Cro Services Market Report

Published Date: 31 January 2026 | Report Code: cro-services

Cro Services Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Cro Services market from 2023 to 2033, providing critical insights, data analysis, and growth forecasts. It covers market size, segmentation, regional dynamics, and leading companies within the industry, equipping stakeholders with the knowledge to make informed decisions.

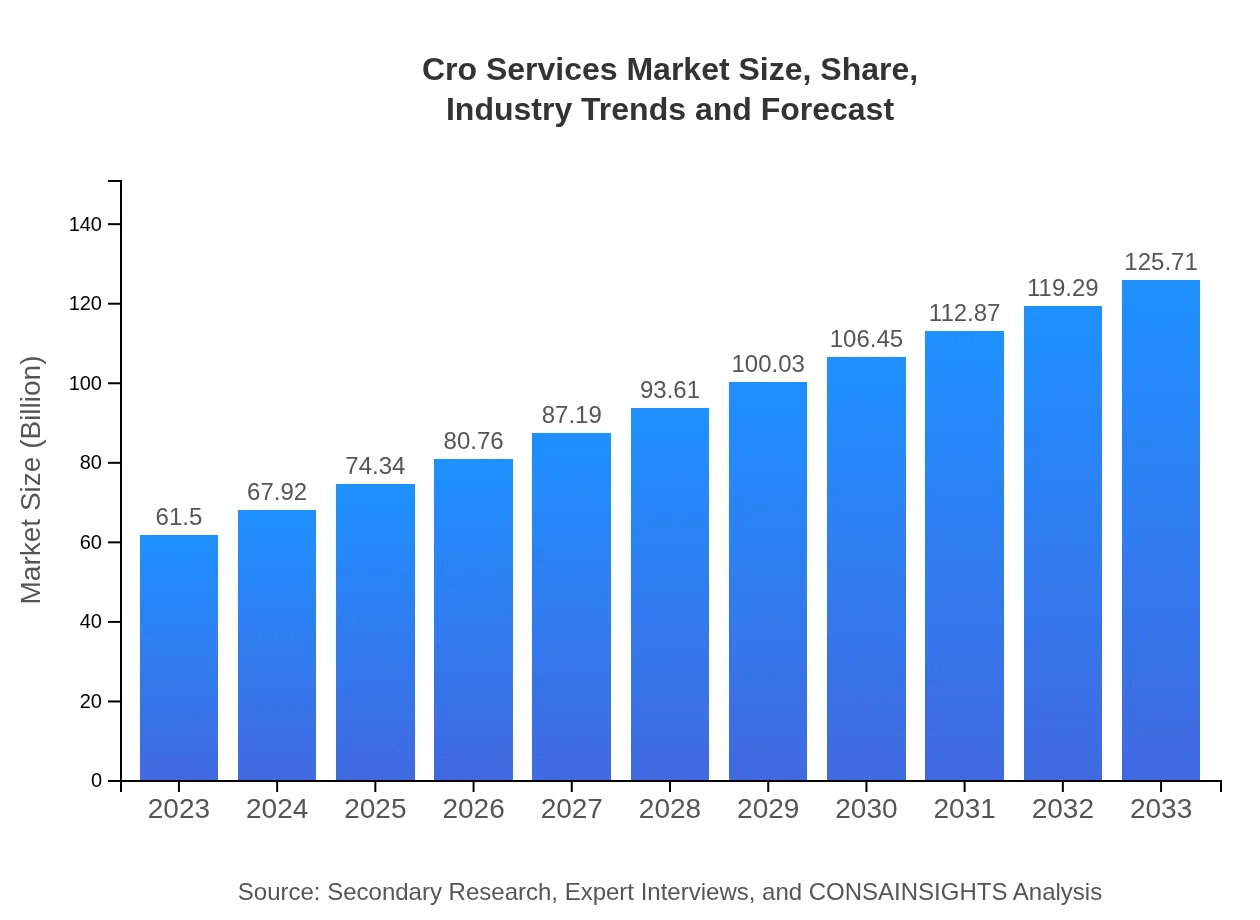

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $61.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $125.71 Billion |

| Top Companies | Covance, IQVIA , PAREXEL, PPD, Charles River Labs |

| Last Modified Date | 31 January 2026 |

Cro Services Market Overview

Customize Cro Services Market Report market research report

- ✔ Get in-depth analysis of Cro Services market size, growth, and forecasts.

- ✔ Understand Cro Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cro Services

What is the Market Size & CAGR of Cro Services market in 2023?

Cro Services Industry Analysis

Cro Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cro Services Market Analysis Report by Region

Europe Cro Services Market Report:

Europe’s CRO market is poised to grow from $17.10 billion in 2023 to $34.95 billion by 2033, driven by stringent regulatory demands, the need for advanced clinical research, and a strong focus on patient-centered drug development approaches.Asia Pacific Cro Services Market Report:

The Asia Pacific region is expected to experience significant growth, with the market size anticipated to increase from $12.56 billion in 2023 to $25.68 billion by 2033. This growth is fueled by a burgeoning pharmaceutical sector, supportive regulatory environments, and an increase in clinical trials due to diverse patient populations available.North America Cro Services Market Report:

North America remains the largest market for CRO services, with size estimates of $21.97 billion in 2023 increasing to $44.92 billion by 2033. This market dominance is bolstered by the presence of major pharmaceutical companies, innovation in clinical trial designs, and high R&D expenditure.South America Cro Services Market Report:

In South America, the market is projected to grow from $3.30 billion in 2023 to $6.74 billion by 2033. Factors driving this growth include increasing healthcare investments, a focus on drug development, and rising confectionery collaborations between local and international CROs.Middle East & Africa Cro Services Market Report:

The Middle East and Africa are expected to see gradual growth in the CRO landscape, rising from $6.57 billion in 2023 to $13.43 billion by 2033. This region benefits from increased clinical trials and partnerships to enhance healthcare research capabilities.Tell us your focus area and get a customized research report.

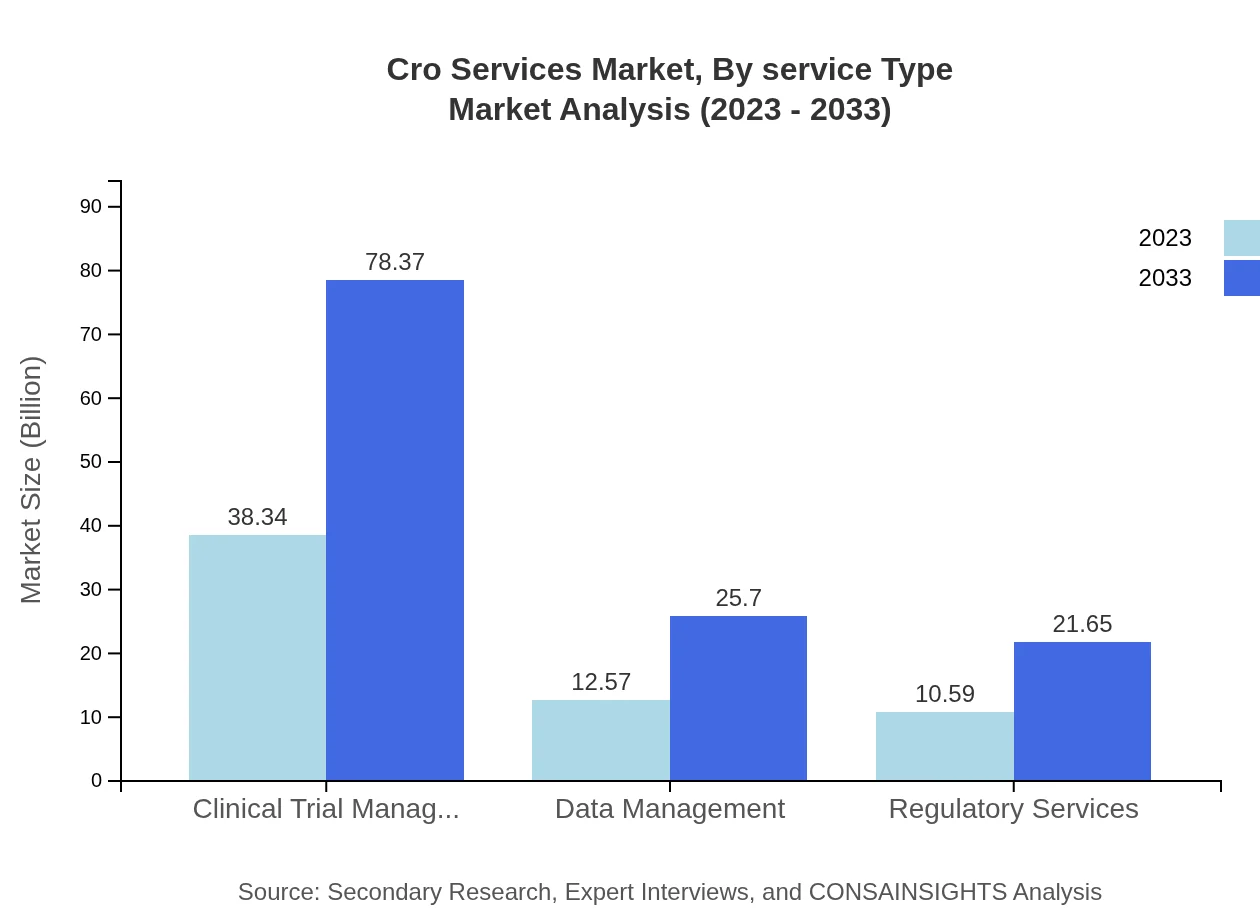

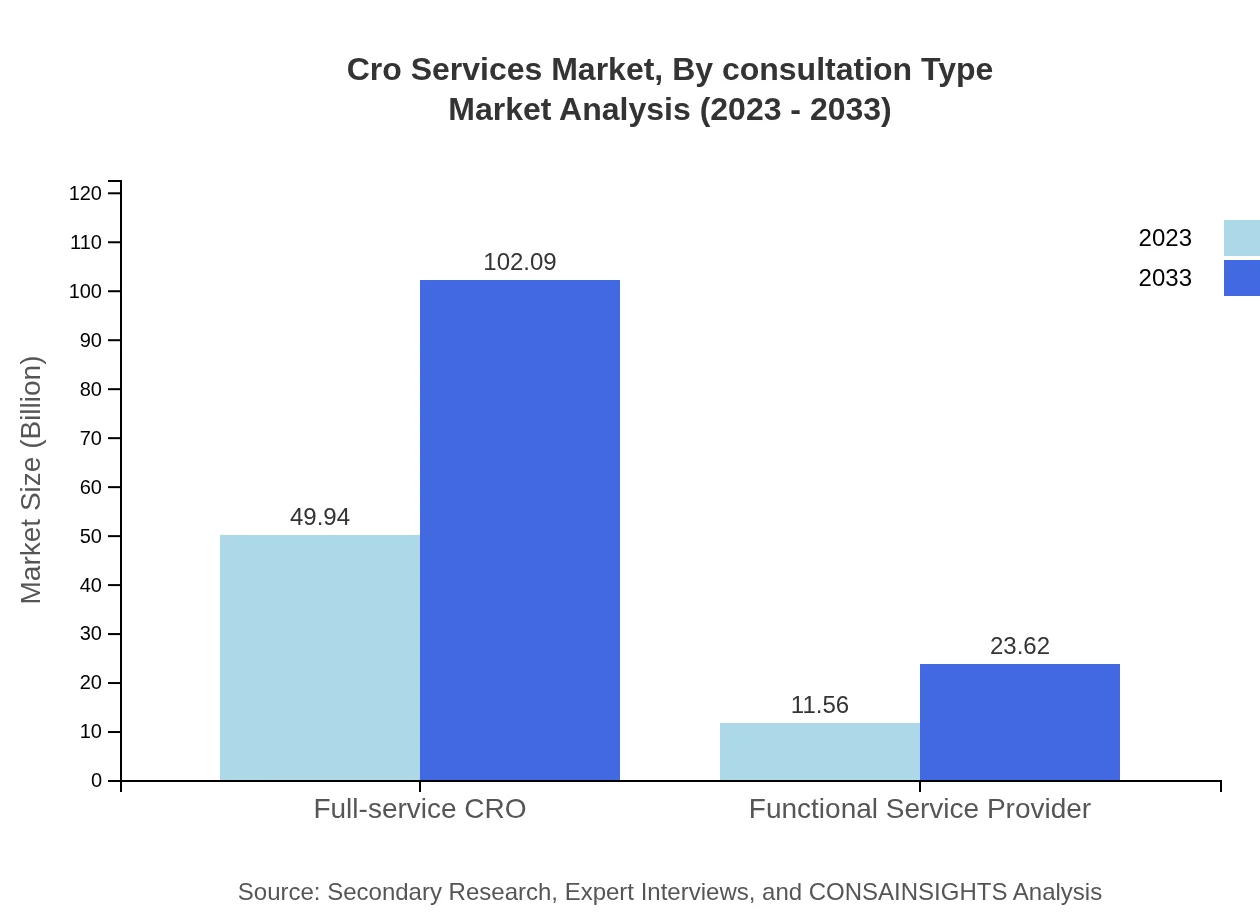

Cro Services Market Analysis By Service Type

The CRO services market, segmented by service type, reveals that full-service CROs dominate the industry, valued at $49.94 billion in 2023 and projected to reach $102.09 billion by 2033. Functional service providers also play a significant role, with a market size starting at $11.56 billion and expected to rise to $23.62 billion during the same period. Clinical trial management services constitute a crucial segment, valued at $38.34 billion in 2023, enhancing client operations significantly.

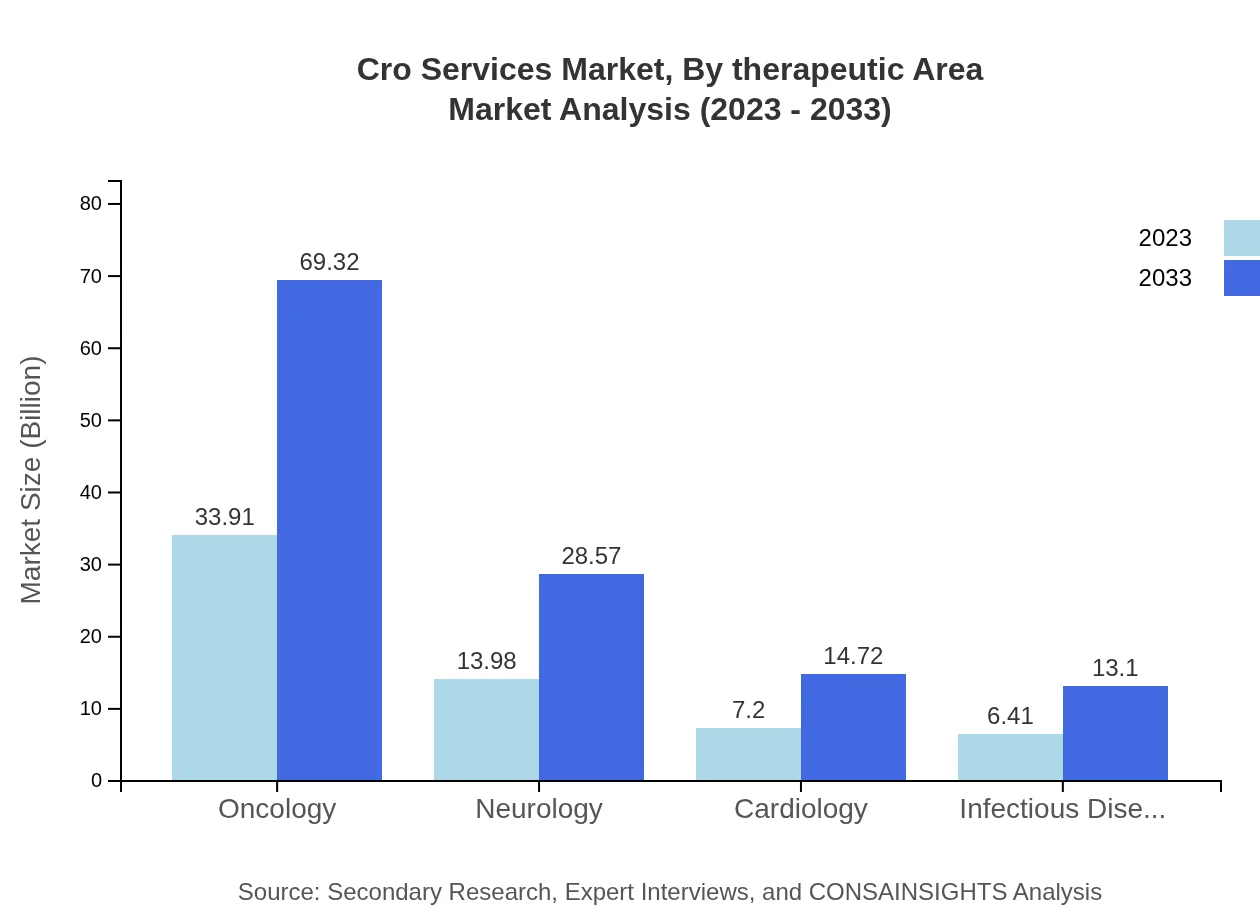

Cro Services Market Analysis By Therapeutic Area

Oncology leads the therapeutic area segment, generating a market size of $33.91 billion in 2023, expected to reach $69.32 billion by 2033. Other notable areas include neurology, valued at $13.98 billion in 2023, and cardiology, estimated at $7.20 billion. The increasing prevalence of chronic diseases significantly drives the need for extensive clinical trials in these areas.

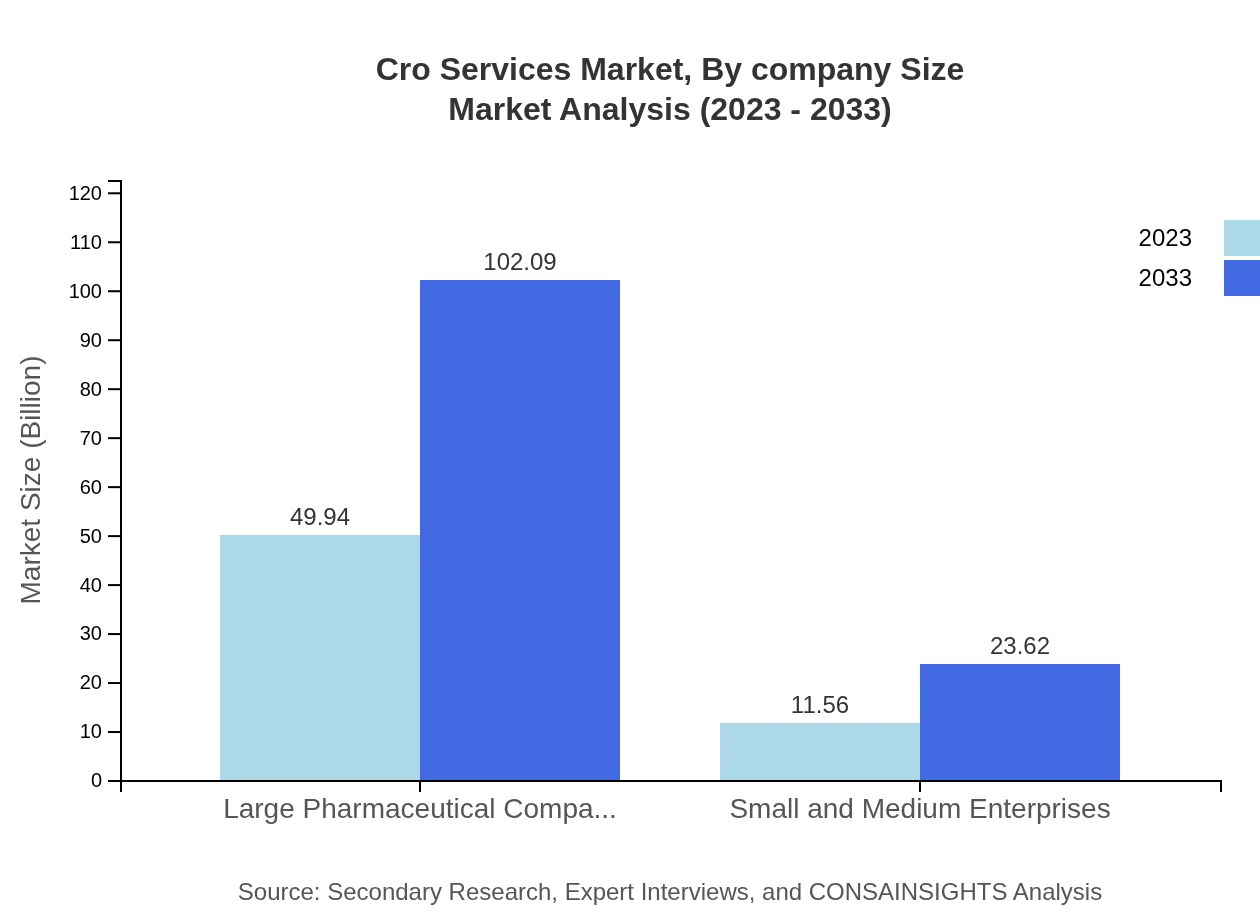

Cro Services Market Analysis By Company Size

Large pharmaceutical companies dominate the CRO services market, with a size estimation of $49.94 billion in 2023 set to grow to nearly $102.09 billion by 2033. Meanwhile, small and medium enterprises hold a smaller but crucial market segment, starting with $11.56 billion and anticipated to grow to $23.62 billion, reflecting their increasing reliance on outsourced services.

Cro Services Market Analysis By Consultation Type

The market segmented by consultation type reveals that project-based services lead with a strong market presence, while advisory and managed service models are gaining traction as organizations seek specialized expertise in navigating complex regulatory frameworks.

Cro Services Market Analysis By Delivery Mode

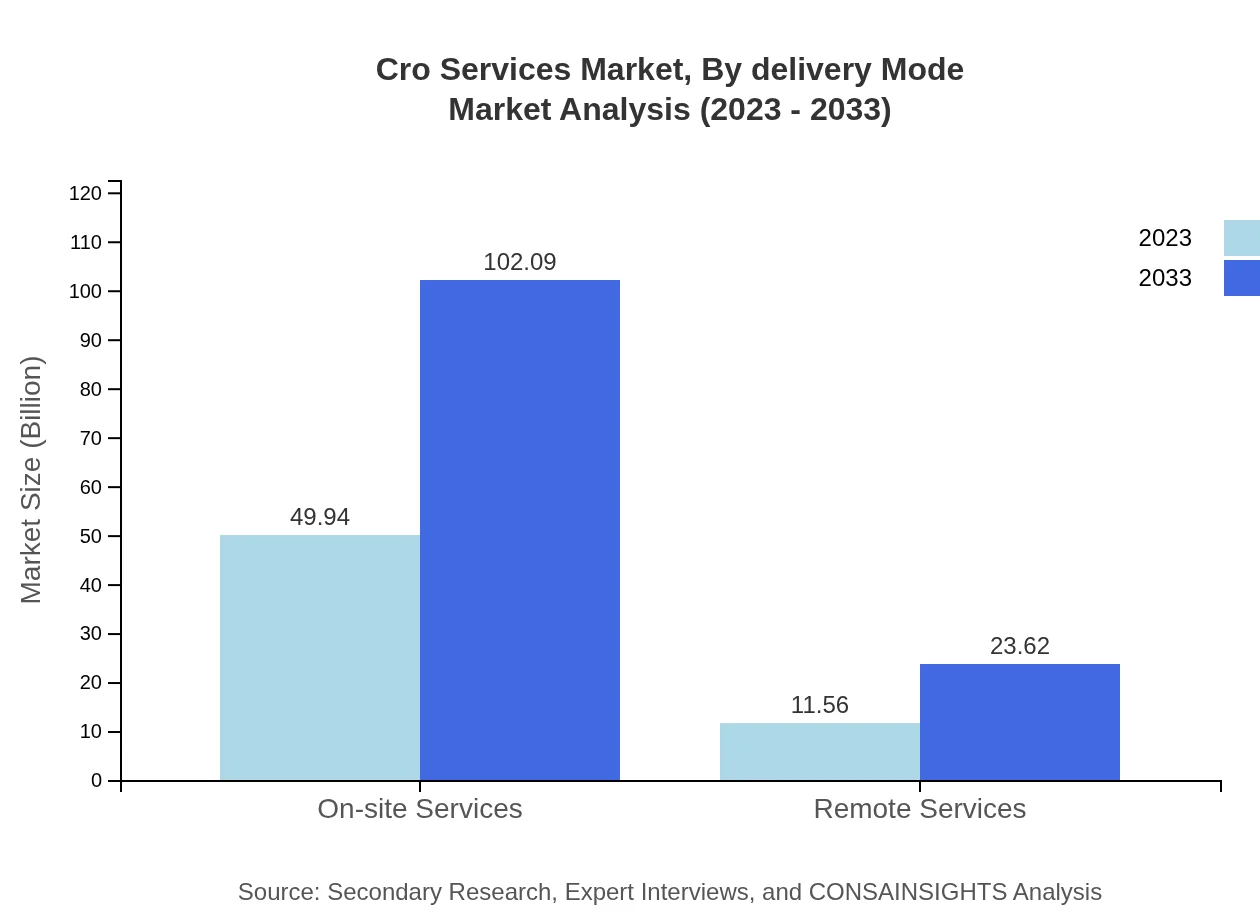

On-site services dominate the delivery mode with a market value of $49.94 billion in 2023, anticipated to maintain the same growth and reach $102.09 billion by 2033. Remote services are also gaining ground, showcasing growth potential as technology enables more flexible clinical research environments.

Cro Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cro Services Industry

Covance:

Covance is a global leader in drug development and commercialization services. They offer comprehensive CRO services that support the entire drug development process, emphasizing quality and efficiency.IQVIA :

IQVIA specializes in advanced analytics, technology solutions, and contract research services. Their extensive database and deep industry insights allow for accelerated drug development and a superior understanding of market dynamics.PAREXEL:

PAREXEL provides a wide range of clinical research services through its global team of experts, helping clients navigate complex regulatory environments and expedite the approval process.PPD:

PPD offers comprehensive drug development and lifecycle management services, focusing on tailored solutions that enhance the efficiency of clinical trials and improve outcomes.Charles River Labs:

Charles River Labs is a global provider of early-stage contract research services that expedite the discovery and development of new drugs, providing essential support throughout the drug lifecycle.We're grateful to work with incredible clients.

FAQs

What is the market size of CRO Services?

The global market size for CRO services is valued at $61.5 billion in 2023, with a projected CAGR of 7.2%, indicating substantial growth potential through 2033.

What are the key market players or companies in the CRO Services industry?

Key players in the CRO services market include large pharmaceutical companies that dominate the market share, alongside emerging small and medium enterprises that contribute to innovation and flexibility within the industry.

What are the primary factors driving the growth in the CRO Services industry?

Primary growth drivers include an increase in clinical trials, advancements in technology, outsourcing trends in pharmaceutical research, and a rising demand for efficient data management and regulatory compliance in drug development.

Which region is the fastest Growing in the CRO Services market?

The fastest-growing region in the CRO services market is North America, expected to grow from $21.97 billion in 2023 to $44.92 billion by 2033, driven by high investment in research and development.

Does ConsaInsights provide customized market report data for the CRO Services industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs, ensuring detailed insights into market trends, projections, and competitive dynamics in the CRO services industry.

What deliverables can I expect from this CRO Services market research project?

Deliverables include comprehensive market analysis reports, segmentation insights, growth forecasts, competitive landscape evaluations, and strategic recommendations tailored to the CRO services market.

What are the market trends of CRO Services?

Current trends in the CRO services market include an increase in the adoption of digital health technologies, a focus on personalized medicine, expansion in Asia-Pacific, and heightened regulatory scrutiny impacting service demand.