Crop Micronutrient Market Report

Published Date: 02 February 2026 | Report Code: crop-micronutrient

Crop Micronutrient Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Crop Micronutrient market, detailing market size, segmentation, regional insights, and trends from 2023 to 2033 that can impact purchasing decisions and strategic planning.

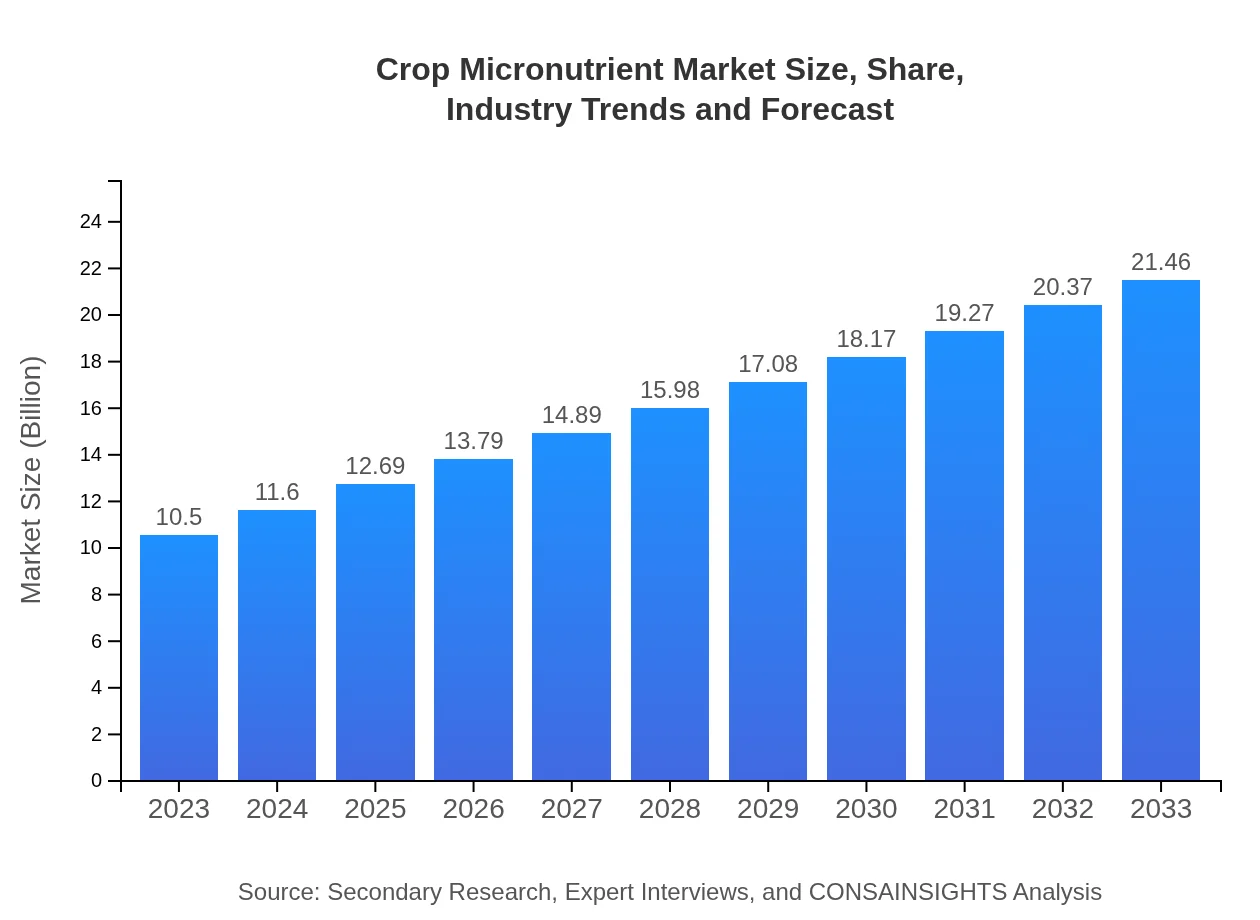

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $21.46 Billion |

| Top Companies | Nutrien Ltd., Yara International, BASF SE, Mosaic Company, Haifa Group |

| Last Modified Date | 02 February 2026 |

Crop Micronutrient Market Overview

Customize Crop Micronutrient Market Report market research report

- ✔ Get in-depth analysis of Crop Micronutrient market size, growth, and forecasts.

- ✔ Understand Crop Micronutrient's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Crop Micronutrient

What is the Market Size & CAGR of Crop Micronutrient market in 2023?

Crop Micronutrient Industry Analysis

Crop Micronutrient Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Crop Micronutrient Market Analysis Report by Region

Europe Crop Micronutrient Market Report:

In Europe, the crop micronutrient market is estimated to be USD 3.41 billion in 2023, expected to increase to USD 6.98 billion by 2033, driven by stringent regulations endorsing sustainable farming and increasing consumer awareness.Asia Pacific Crop Micronutrient Market Report:

In 2023, the Asia Pacific region is projected to have a market size of USD 1.65 billion, expected to grow to USD 3.38 billion by 2033, fueled by increasing agricultural activities and government support in countries like India and China.North America Crop Micronutrient Market Report:

North America's market size was USD 3.92 billion in 2023, projected to grow to USD 8.02 billion by 2033. The region's advanced agricultural practices and technology adoption play a crucial role in this growth trajectory.South America Crop Micronutrient Market Report:

South America shows a modest market size of USD 0.78 billion in 2023, anticipated to reach USD 1.60 billion by 2033. This growth is driven by the expansion of cash crops and a rising focus on sustainable farming.Middle East & Africa Crop Micronutrient Market Report:

The Middle East and Africa region is expected to grow from USD 0.72 billion in 2023 to USD 1.48 billion by 2033, as agricultural modernization efforts expand in these regions.Tell us your focus area and get a customized research report.

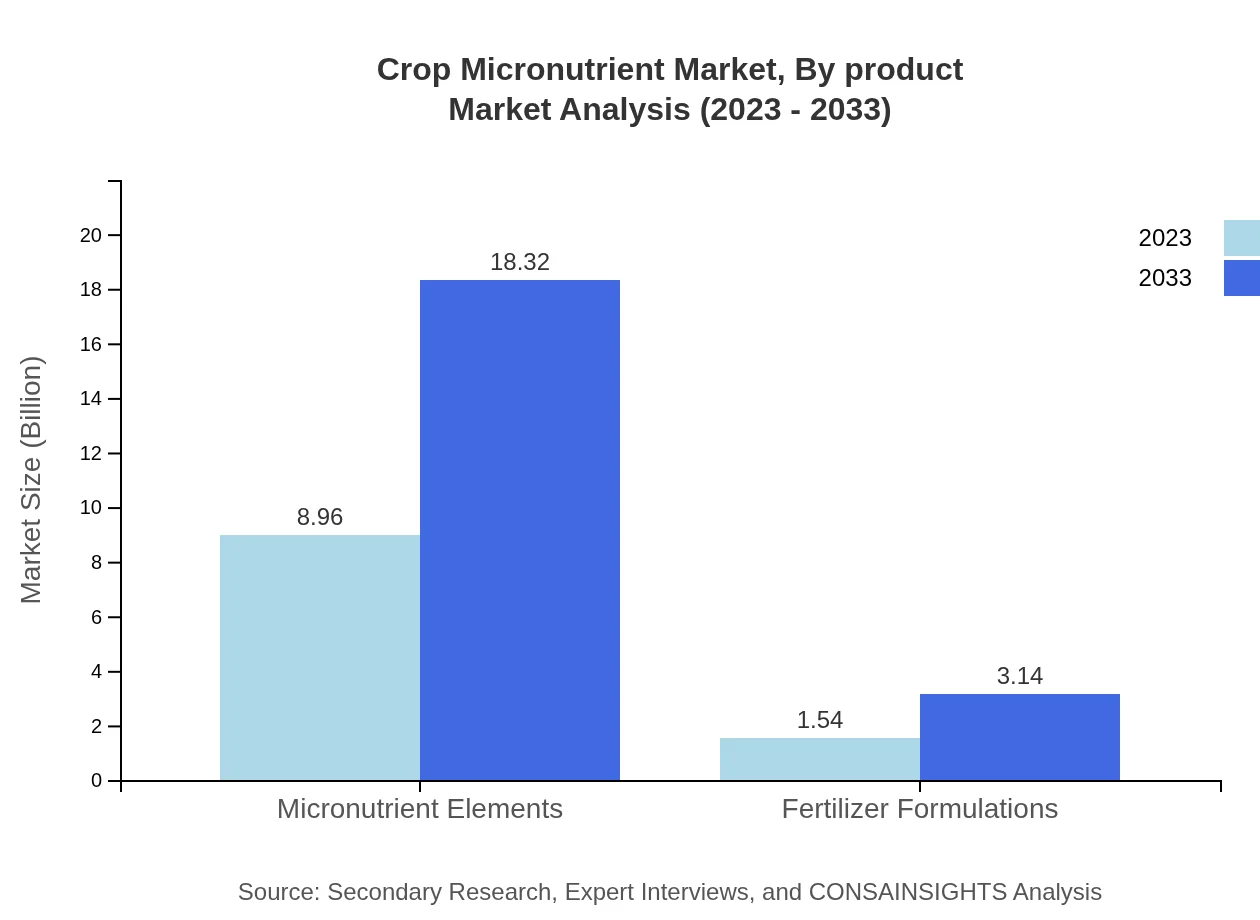

Crop Micronutrient Market Analysis By Product

The market is primarily driven by micronutrient elements, accounting for USD 8.96 billion in 2023 and projected to reach USD 18.32 billion by 2033. These elements play a critical role in boosting crop productivity and resilience against environmental stressors.

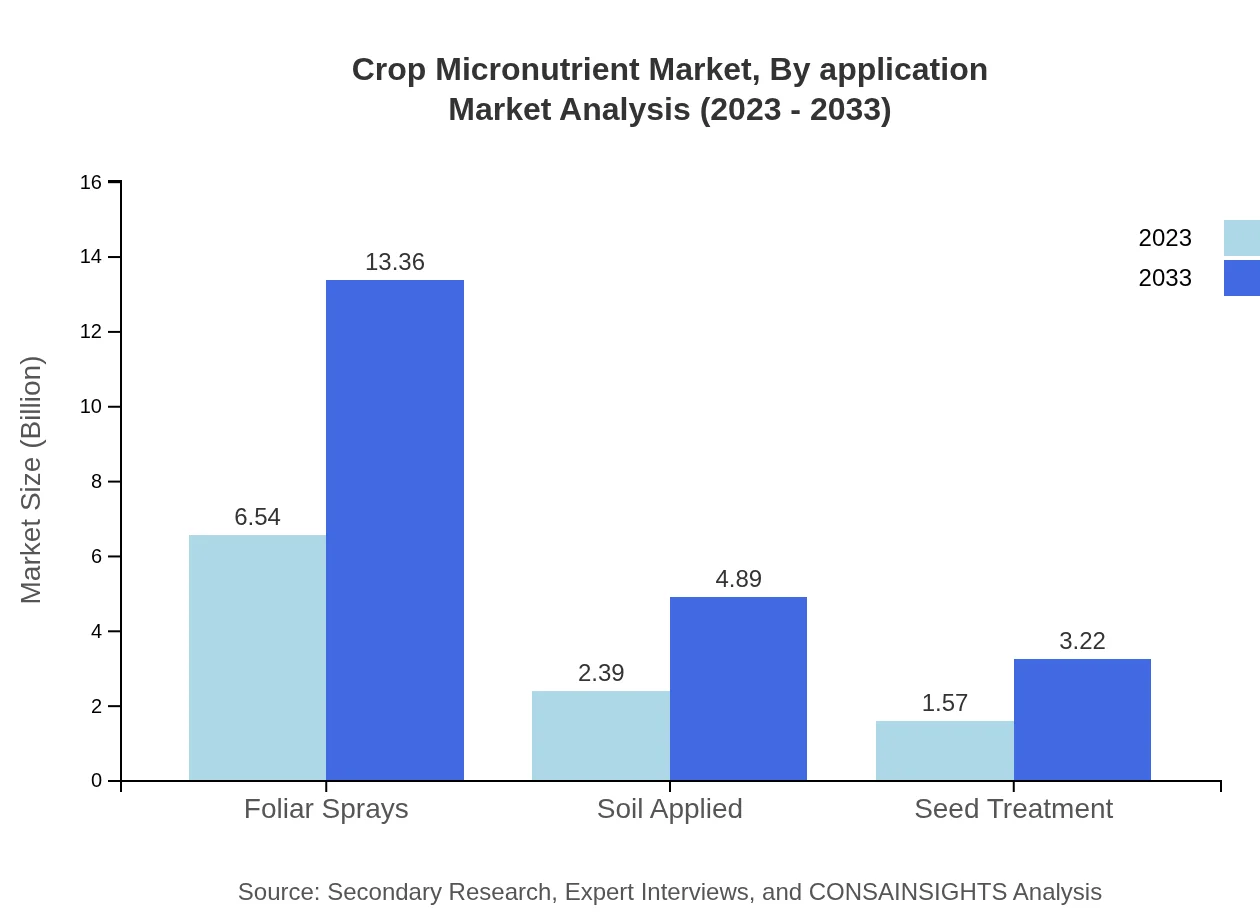

Crop Micronutrient Market Analysis By Application

Targeted agricultural production is the major application segment with agricultural producers generating revenue of USD 6.54 billion in 2023, which will grow to USD 13.36 billion by 2033. This segment highlights the importance of nutrient application in crop vitality.

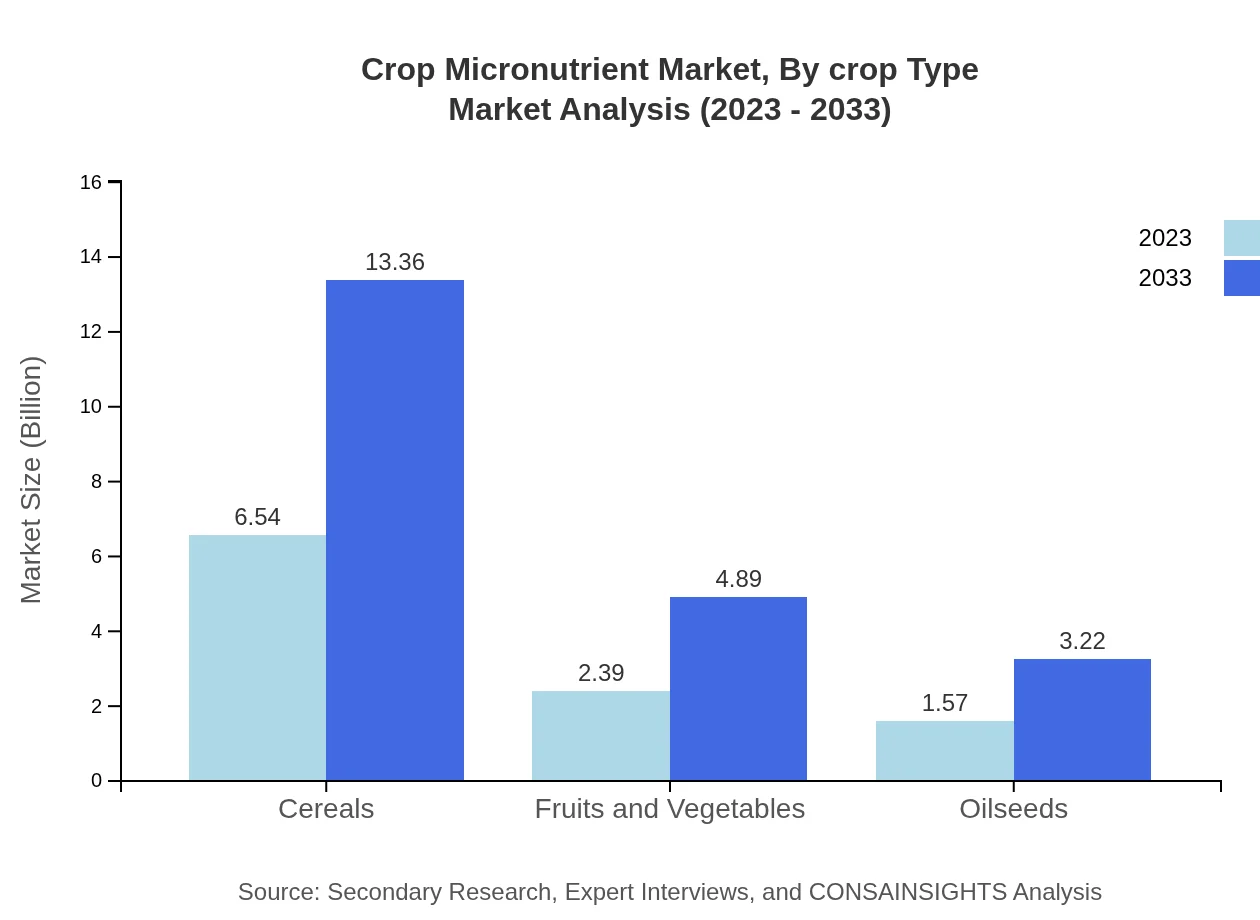

Crop Micronutrient Market Analysis By Crop Type

Cereals represent the largest segment, with a market size of USD 6.54 billion in 2023, projected to reach USD 13.36 billion by 2033. Increasing global demand for cereals drives continuous investment in micronutrient applications.

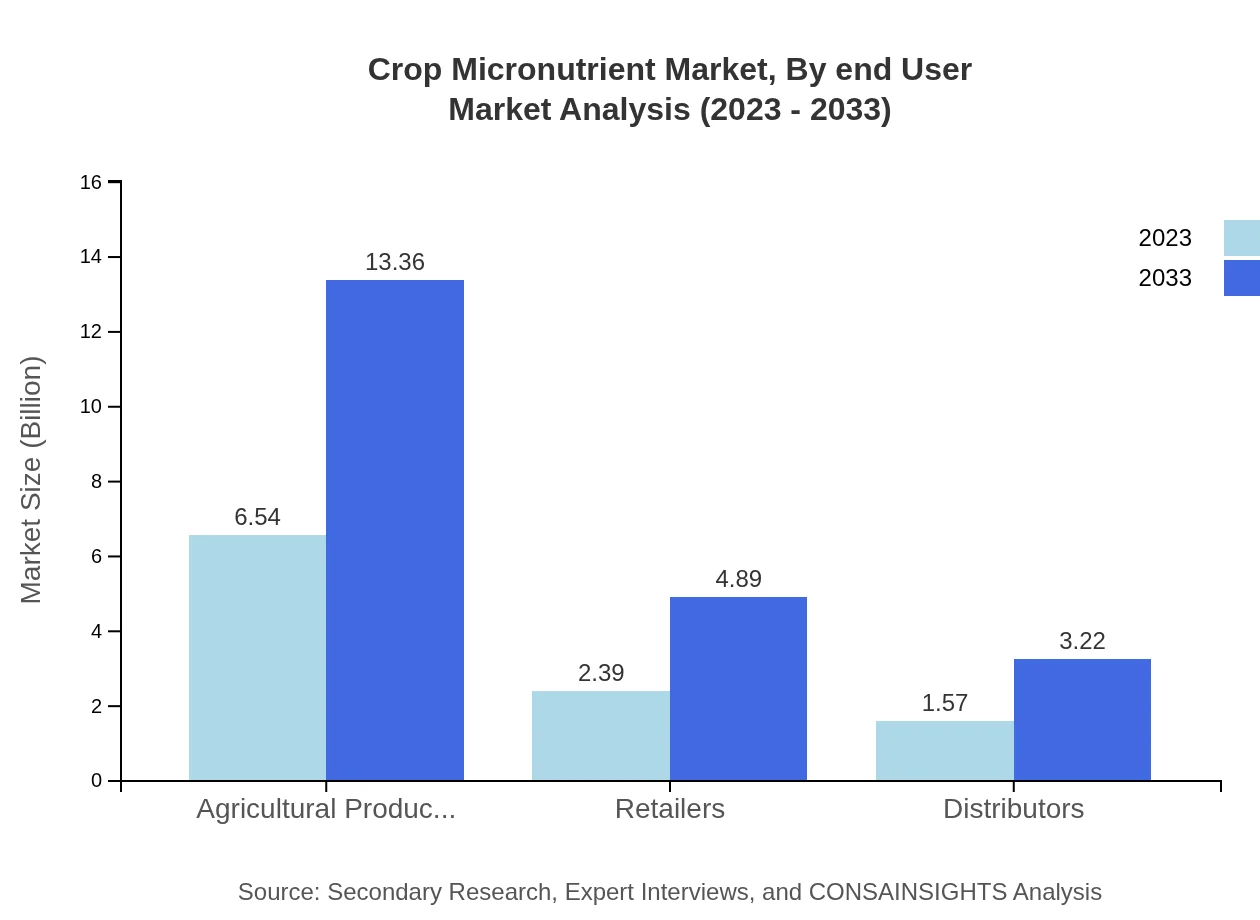

Crop Micronutrient Market Analysis By End User

Retailers play a significant role, with a projected market size of USD 2.39 billion in 2023, expected to reach USD 4.89 billion by 2033, emphasizing the point of sale dynamics for micronutrient products.

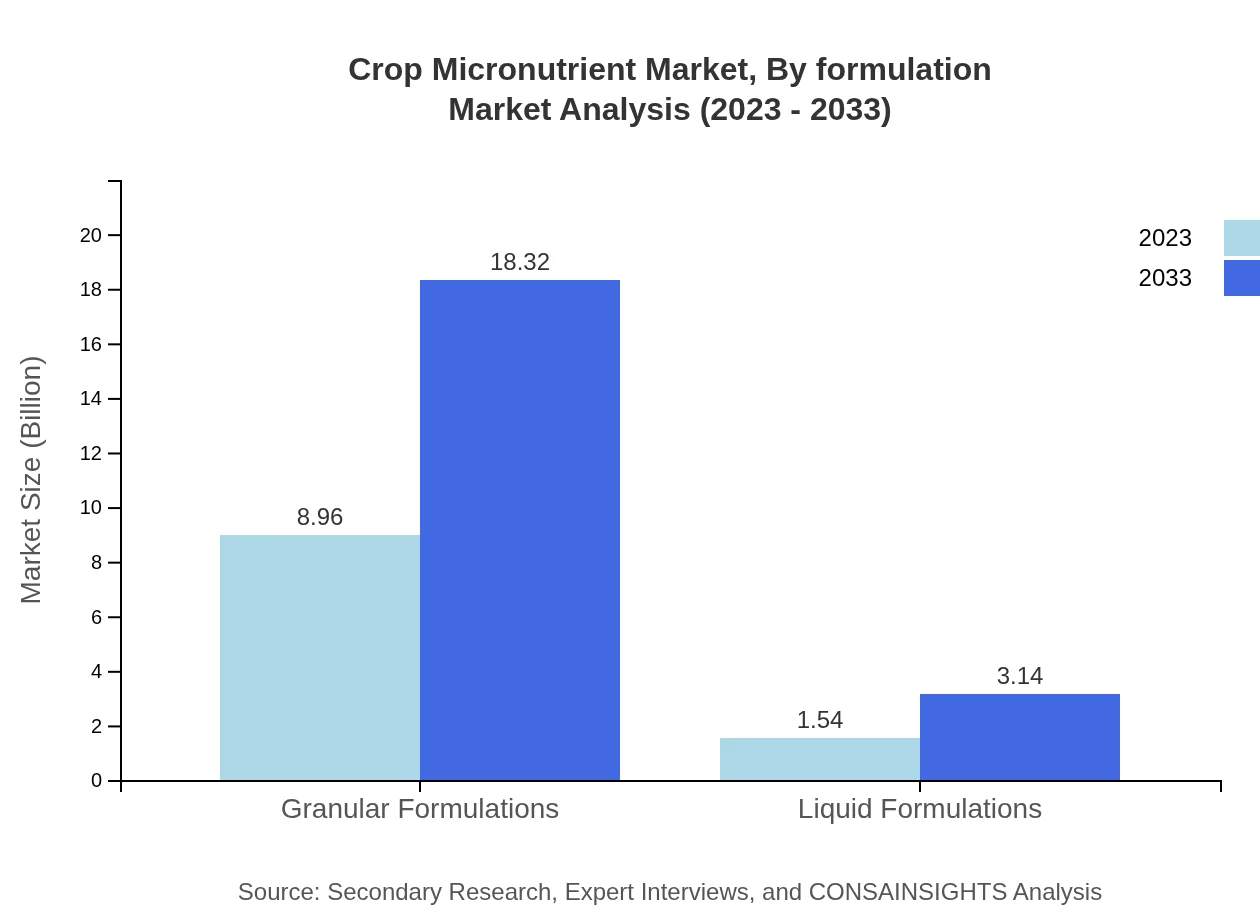

Crop Micronutrient Market Analysis By Formulation

Granular formulations dominate the market with a size of USD 8.96 billion in 2023, expected to grow to USD 18.32 billion by 2033, driven by ease of application and extended nutrient release times.

Crop Micronutrient Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Crop Micronutrient Industry

Nutrien Ltd.:

One of the world's largest providers of crop inputs and services, offering a broad portfolio of micronutrients and innovative agricultural solutions.Yara International:

Specializes in crop nutrition and offers high-quality micronutrient products that enhance crop yield and resistance.BASF SE:

A leading chemical company known for its advanced crop protection and micronutrient solutions, supporting sustainable agricultural practices across the globe.Mosaic Company:

Provides concentrated phosphate and potash crop nutrients and is heavily involved in the development of micronutrient solutions.Haifa Group:

Offers a range of fertilizers including specialty micronutrients for agriculture, focusing on innovative and sustainable practices.We're grateful to work with incredible clients.

FAQs

What is the market size of crop micronutrient?

The crop micronutrient market is valued at approximately $10.5 billion in 2023, with a predicted CAGR of 7.2% over the next decade, projected to reach substantial growth by 2033.

What are the key market players or companies in the crop micronutrient industry?

Key players in the crop micronutrient market include major companies focusing on agricultural fertilizers, biotech firms, and nutrient suppliers that innovate within the agricultural sector, ensuring high yield and effective soil nutrition.

What are the primary factors driving the growth in the crop micronutrient industry?

Growth drivers include increasing global food demand, advancements in agricultural technology, growing awareness of micronutrient deficiencies in crops, and regulatory support favoring sustainable farming practices that enhance soil nutrient quality.

Which region is the fastest Growing in the crop micronutrient market?

North America is the fastest-growing region in the crop micronutrient market, anticipated to grow from $3.92 billion in 2023 to $8.02 billion by 2033, highlighting strong agricultural practices and extensive use of micronutrients.

Does ConsaInsights provide customized market report data for the crop micronutrient industry?

Yes, ConsaInsights offers customized market report data tailored to specific inquiries in the crop micronutrient industry, ensuring relevant insights based on client requirements and market dynamics.

What deliverables can I expect from this crop micronutrient market research project?

Expected deliverables include comprehensive market analysis, detailed segmentation reports, competitor profiling, trend analysis, forecasts, and actionable insights that guide strategy formulation in the crop micronutrient sector.

What are the market trends of crop micronutrient?

Market trends indicate a shift towards organic farming practices, increased deployment of granular formulations, a focus on sustainable nutrient solutions, and rising investments in research for enhancing crop nutrition efficiency.