Crop Monitoring Market Report

Published Date: 02 February 2026 | Report Code: crop-monitoring

Crop Monitoring Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Crop Monitoring market, encompassing market size, growth trends, regional insights, and future growth forecasts for the period 2023 to 2033.

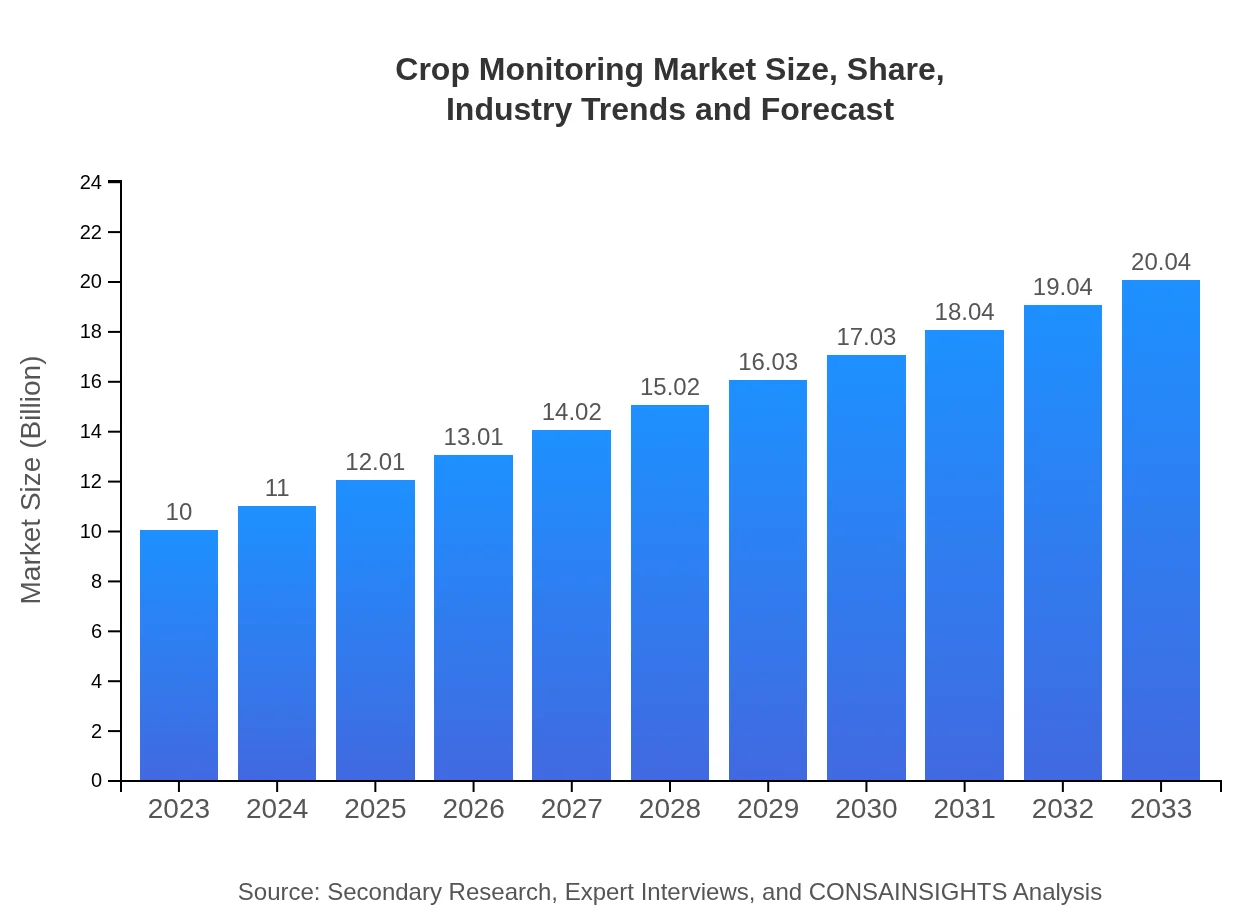

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 7% |

| 2033 Market Size | $20.04 Billion |

| Top Companies | Trimble Inc., John Deere, AG Leader Technology, Bayer Crop Science, Monsanto |

| Last Modified Date | 02 February 2026 |

Crop Monitoring Market Overview

Customize Crop Monitoring Market Report market research report

- ✔ Get in-depth analysis of Crop Monitoring market size, growth, and forecasts.

- ✔ Understand Crop Monitoring's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Crop Monitoring

What is the Market Size & CAGR of Crop Monitoring market in 2023?

Crop Monitoring Industry Analysis

Crop Monitoring Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Crop Monitoring Market Analysis Report by Region

Europe Crop Monitoring Market Report:

The European market is poised to grow from $2.78 billion in 2023 to $5.57 billion by 2033. Enhanced awareness of environmentally sustainable practices and strict regulations governing agricultural productivity are some of the key growth drivers, with countries like Germany and the Netherlands leading the charge.Asia Pacific Crop Monitoring Market Report:

Asia Pacific holds a significant share in the Crop Monitoring market, valued at $2.14 billion in 2023, and expected to grow to $4.28 billion by 2033. The adoption of agricultural technology is rising, particularly in countries like India and China due to the need for enhanced food production capabilities amidst a growing population. Government initiatives to promote smart farming further drive growth.North America Crop Monitoring Market Report:

North America currently leads the market with a valuation of $3.35 billion in 2023, expected to reach $6.71 billion by 2033. The region's strong emphasis on advanced farming practices, substantial investments in agricultural technology, and the presence of major tech firms contribute to its dominance in the sector.South America Crop Monitoring Market Report:

In South America, the market is valued at $0.53 billion in 2023, doubling to $1.06 billion by 2033. The region's agricultural landscape is increasingly adopting technological innovations to address challenges like fluctuating climate conditions and to improve crop performance, particularly in larger agricultural countries such as Brazil and Argentina.Middle East & Africa Crop Monitoring Market Report:

The Middle East and Africa market, valued at $1.21 billion in 2023, is projected to double to approximately $2.42 billion by 2033. Factors driving this growth include increasing investment in agricultural technologies to ensure food security in arid climates and innovative solutions tailored to local farming challenges.Tell us your focus area and get a customized research report.

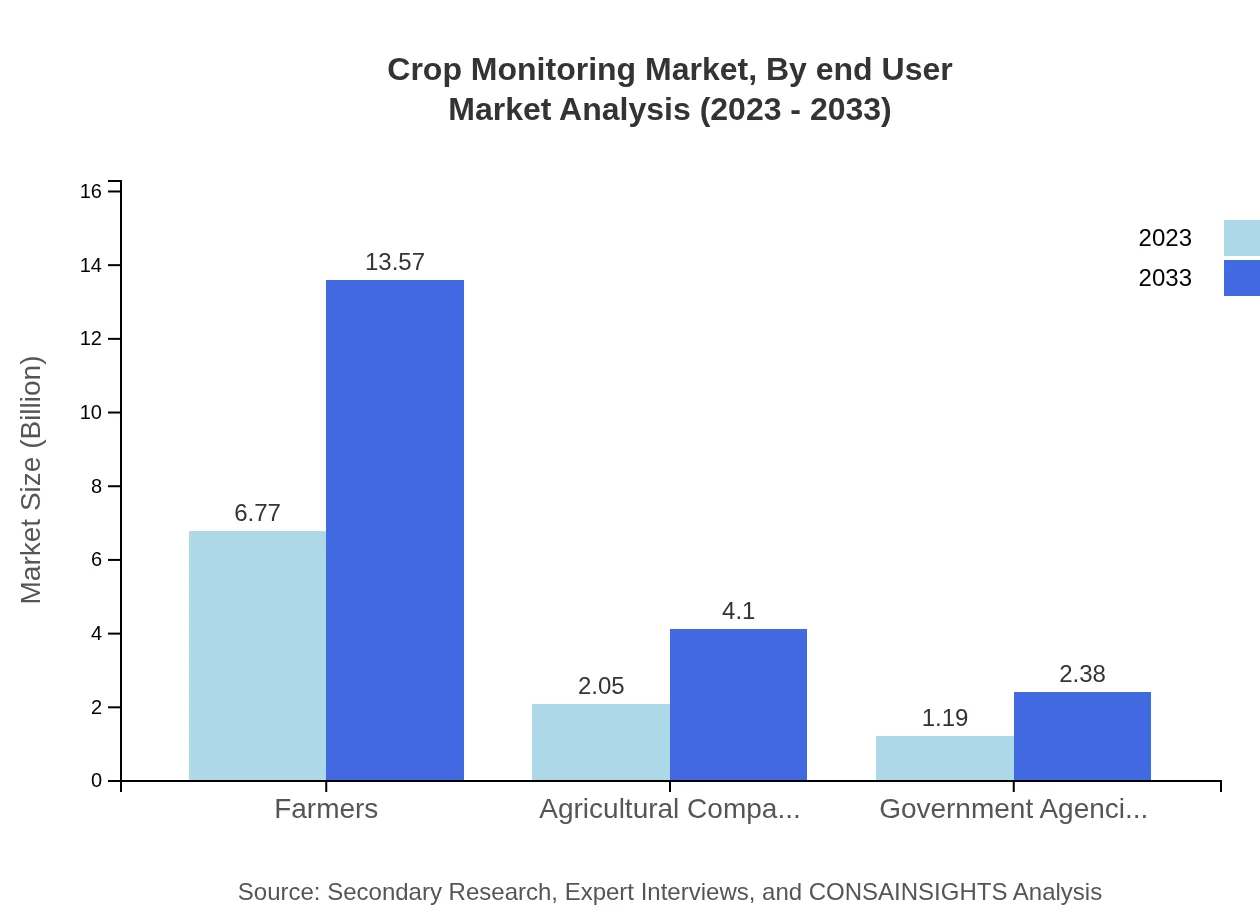

Crop Monitoring Market Analysis By End User

The Crop Monitoring market is significantly driven by the involvement of farmers, agricultural companies, and government agencies. Farmers dominate the market share at 67.68% in 2023 with a market size of $6.77 billion, expected to expand to $13.57 billion by 2033. Agricultural companies contribute 20.47% of the market share, with growth from $2.05 billion to $4.10 billion in the same period. Government agencies account for 11.85%, rising from $1.19 billion to $2.38 billion.

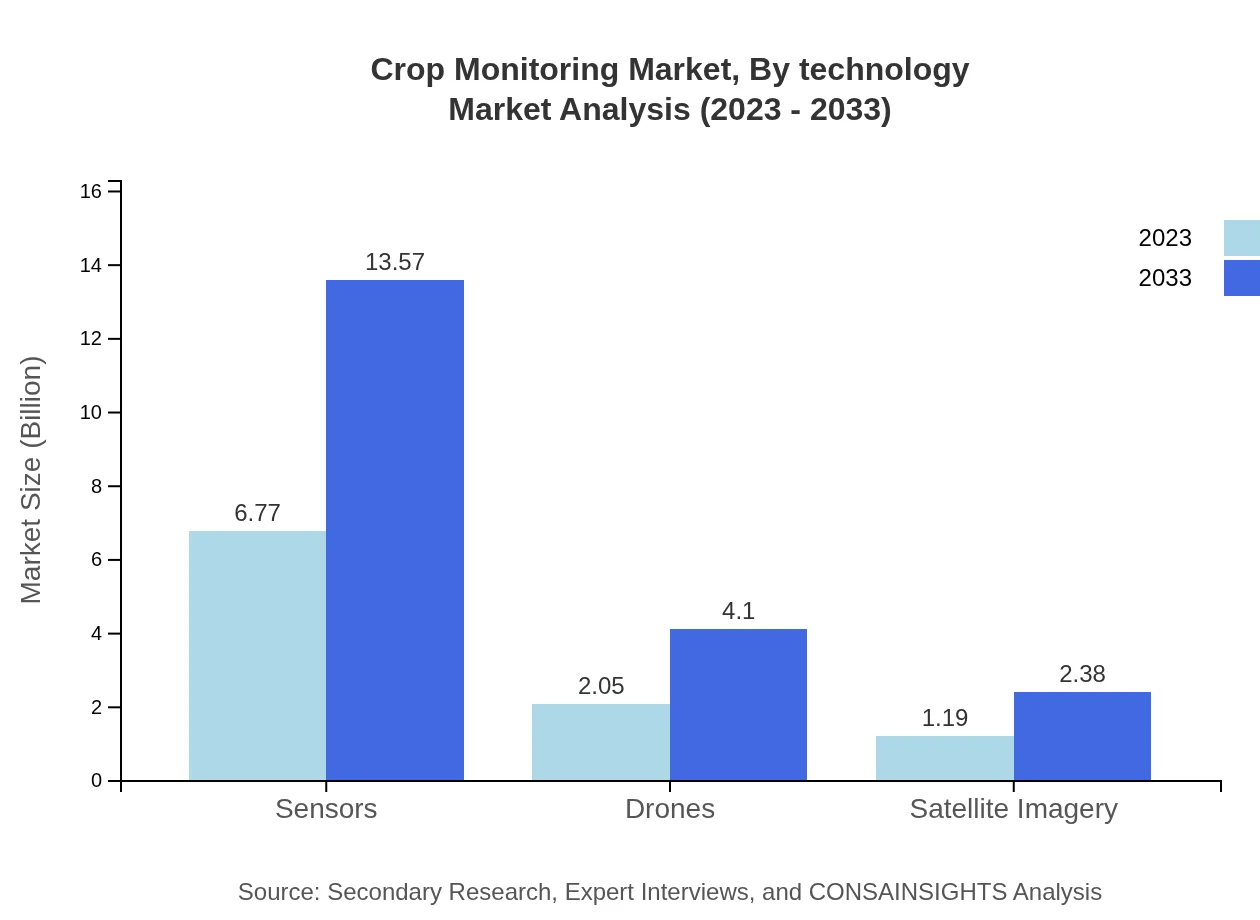

Crop Monitoring Market Analysis By Technology

The Crop Monitoring market based on technology features sensors, drones, and satellite imagery as the primary segments. Sensors account for a significant 67.68% market share, valued at $6.77 billion in 2023 and expected to grow to $13.57 billion by 2033. Drones hold a 20.47% share, with valuations growing from $2.05 billion to $4.10 billion, while satellite imagery represents 11.85%, projected to increase from $1.19 billion to $2.38 billion.

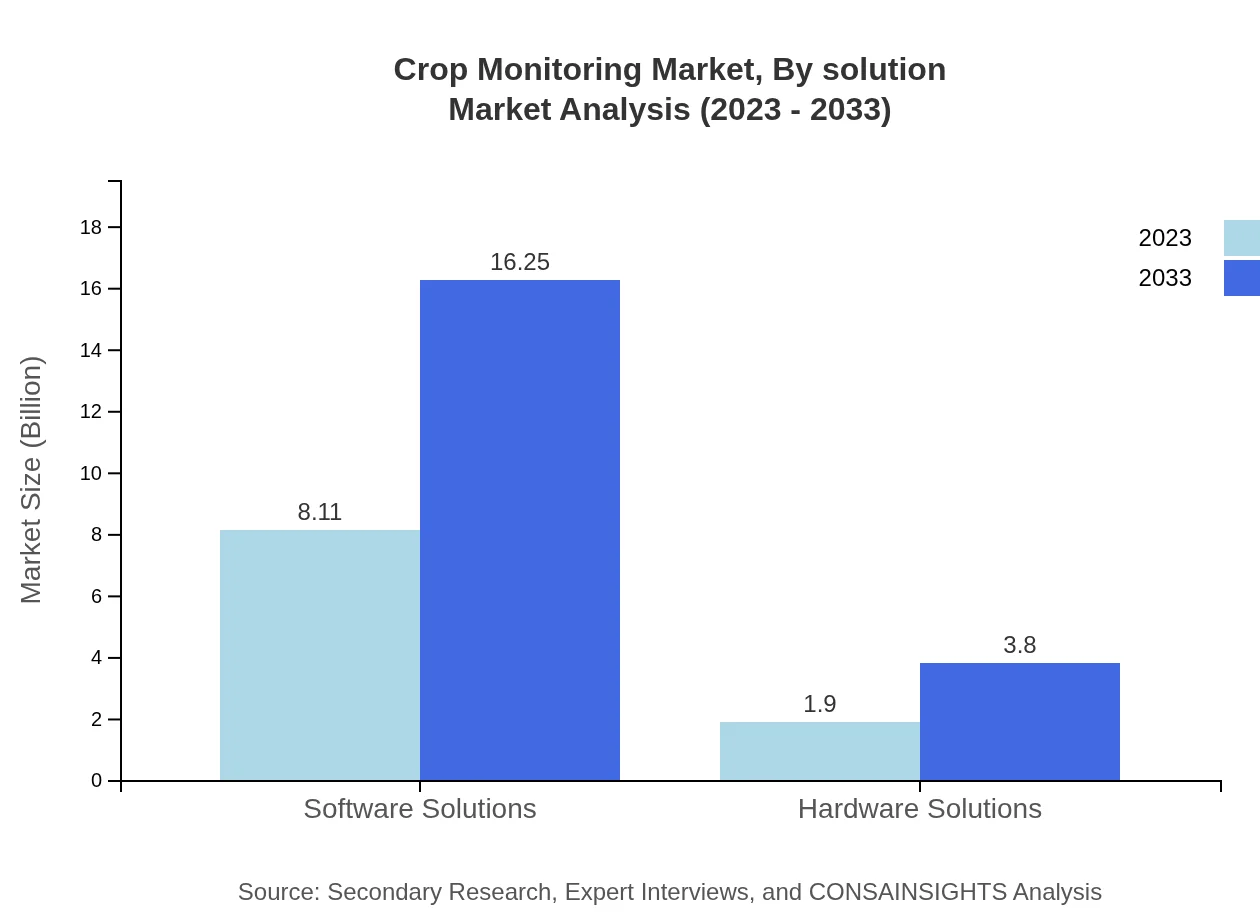

Crop Monitoring Market Analysis By Solution

The Crop Monitoring market divides into hardware and software solutions. Software solutions dominate the market with an 81.05% share, valued at $8.11 billion in 2023, anticipated to grow to $16.25 billion by 2033. Hardware solutions represent 18.95%, increasing from $1.90 billion to $3.80 billion.

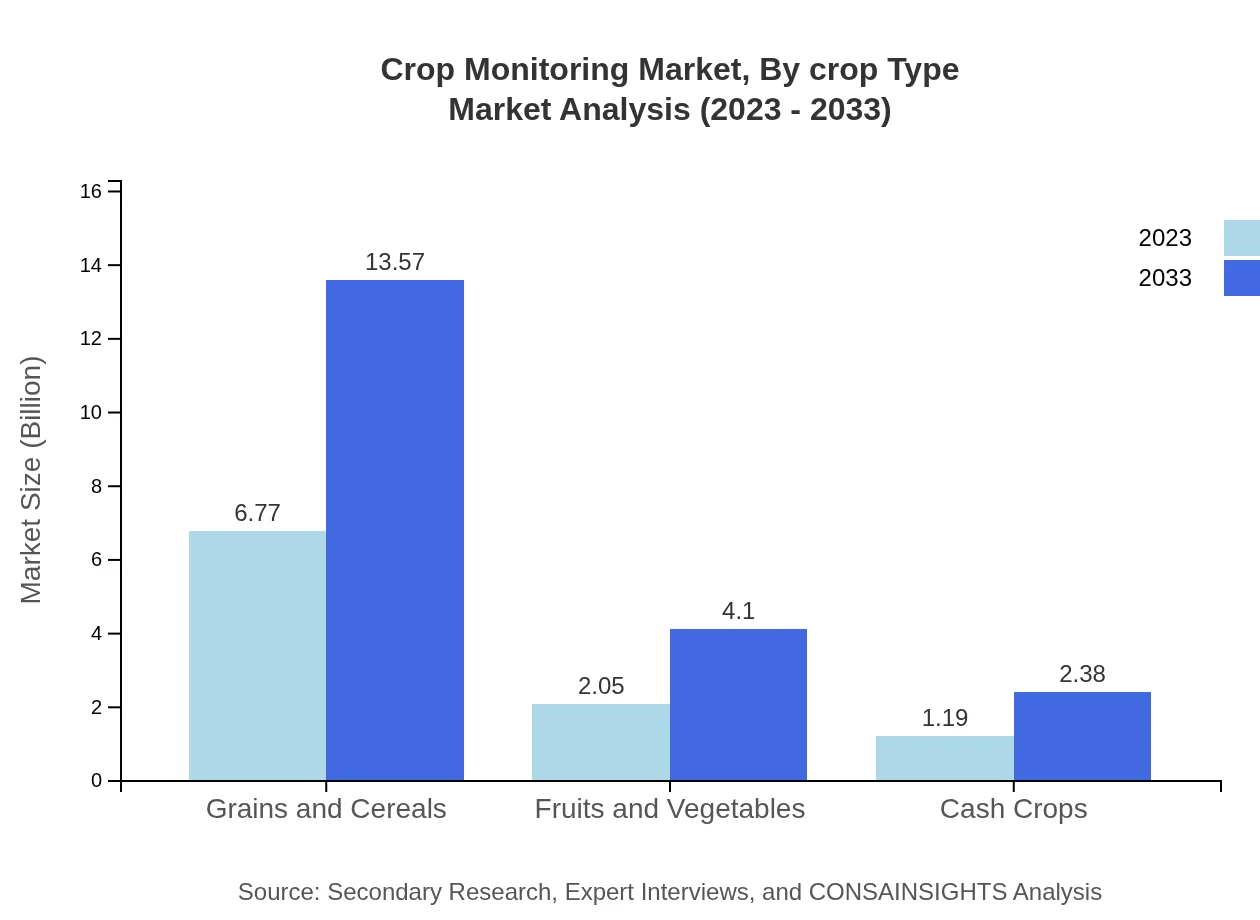

Crop Monitoring Market Analysis By Crop Type

In segmenting by crop type, grains and cereals constitute a substantial 67.68% of the market, growing from $6.77 billion to $13.57 billion. Fruits and vegetables account for 20.47%, rising from $2.05 billion to $4.10 billion, and cash crops represent 11.85%, expanding from $1.19 billion to $2.38 billion.

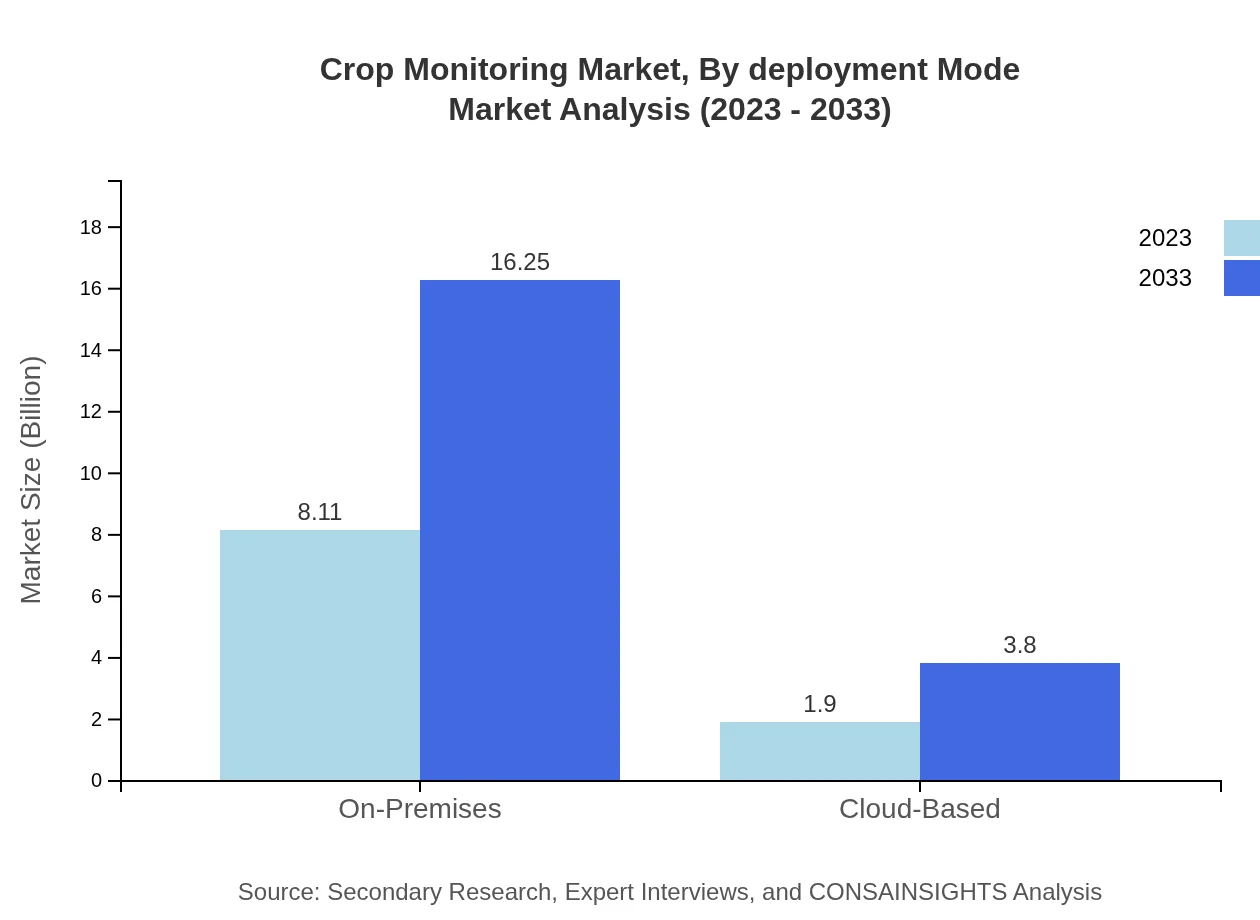

Crop Monitoring Market Analysis By Deployment Mode

The deployment mode segment shows a clear preference for on-premises solutions, which maintain an 81.05% market share and growth from $8.11 billion to $16.25 billion. Cloud-based solutions hold a modest 18.95% share, anticipated to rise from $1.90 billion to $3.80 billion.

Crop Monitoring Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Crop Monitoring Industry

Trimble Inc.:

A leading player in precision agriculture technology, Trimble offers solutions that enhance productivity, reduce environmental impact, and enable farm management through advanced data analytics.John Deere:

An iconic agricultural machinery manufacturer, John Deere’s innovations in advanced crop monitoring solutions integrate seamlessly with their equipment to offer comprehensive agricultural insights.AG Leader Technology:

Focusing on technology solutions for farmers, AG Leader provides precision farming products that enhance decision-making processes using accurate data collection and analytics.Bayer Crop Science:

Bayer is a major player in agribusiness, focusing on innovation in crop monitoring technologies that support sustainable agriculture and crop health management.Monsanto:

Known for its agricultural products, Monsanto incorporates modern data-driven technologies to empower farmers with solutions for crop monitoring and management.We're grateful to work with incredible clients.

FAQs

What is the market size of crop Monitoring?

The crop monitoring market has a current size estimated at $10 billion, with a projected CAGR of 7% from 2023 to 2033. This growth reflects strong advancements and increased investment in agricultural technologies.

What are the key market players or companies in this crop Monitoring industry?

Major players in the crop monitoring sector include key companies engaged in software, hardware, and sensor technologies. These entities contribute significantly to innovation and market expansion, focusing on precision farming and data analytics.

What are the primary factors driving the growth in the crop Monitoring industry?

Growth in the crop monitoring industry is driven by technological advancements, increasing demand for food security, and the need for precise agricultural practices. Additionally, rising awareness about sustainable farming boosts the market further.

Which region is the fastest Growing in the crop Monitoring?

North America is anticipated to be the fastest-growing region in the crop monitoring market, with a projected growth from $3.35 billion in 2023 to $6.71 billion by 2033, reflecting strong adoption of advanced agricultural technologies.

Does ConsaInsights provide customized market report data for the crop Monitoring industry?

Yes, ConsaInsights offers tailored market report data for the crop monitoring industry, allowing stakeholders to access specific insights that cater to their strategic and operational needs.

What deliverables can I expect from this crop Monitoring market research project?

Deliverables from the crop monitoring market research project include detailed market analysis, growth forecasts, segment insights, regional breakdowns, and competitive landscape assessments, providing vital information for informed decision-making.

What are the market trends of crop monitoring?

Key market trends in crop monitoring include the adoption of IoT technology, increasing use of drones and satellite imagery for data collection, and a shift towards cloud-based solutions, enhancing efficiency and productivity in agriculture.