Crop Monitoring Technology In Precision Farming Market Report

Published Date: 31 January 2026 | Report Code: crop-monitoring-technology-in-precision-farming

Crop Monitoring Technology In Precision Farming Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Crop Monitoring Technology market in precision farming, detailing market size, trends, and forecasts from 2023 to 2033. It offers insights into key segments, regional dynamics, and competitive landscape, aimed at stakeholders seeking to understand market opportunities and growth trajectories.

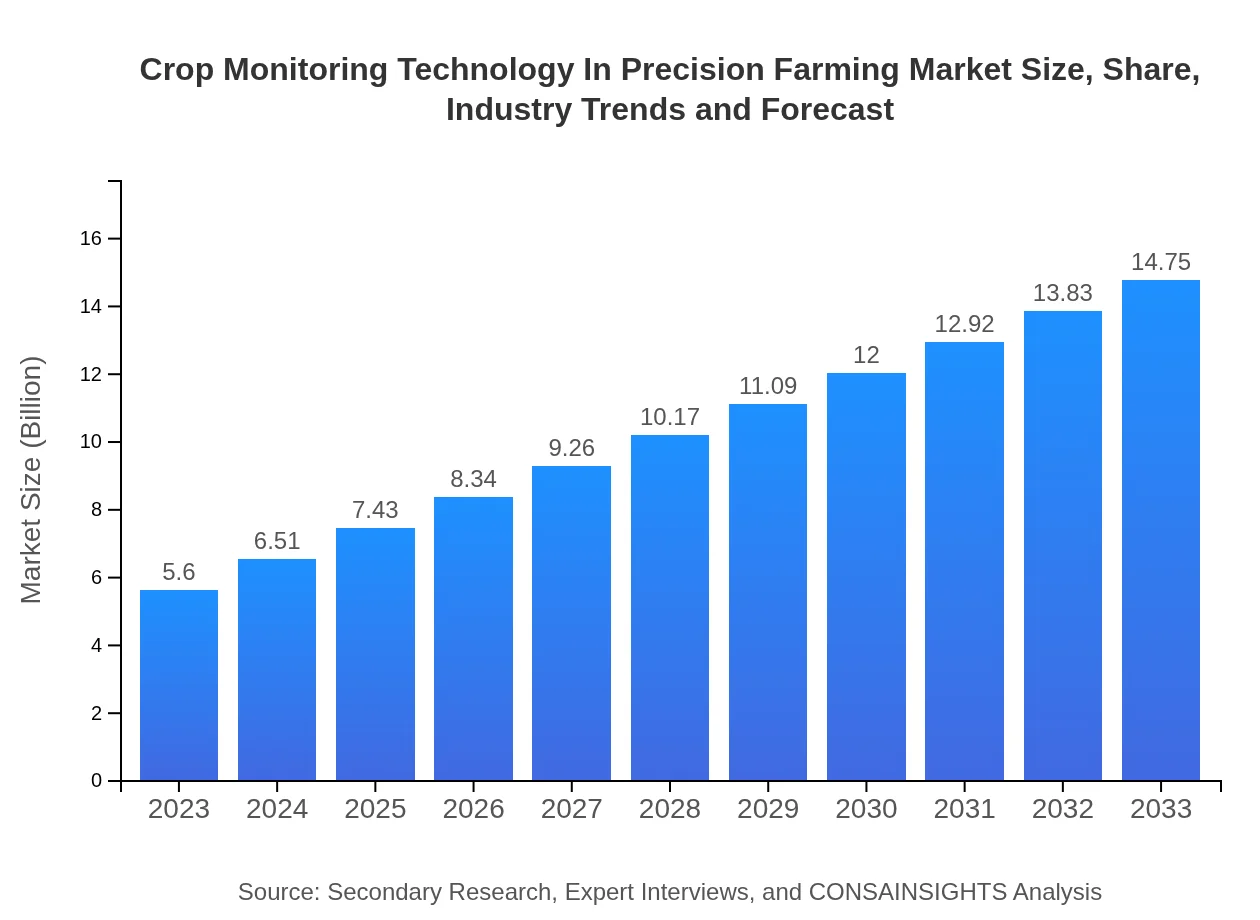

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $14.75 Billion |

| Top Companies | Trimble Inc., John Deere, Monsanto (now part of Bayer), Ag Leader Technology, Sentera |

| Last Modified Date | 31 January 2026 |

Crop Monitoring Technology In Precision Farming Market Overview

Customize Crop Monitoring Technology In Precision Farming Market Report market research report

- ✔ Get in-depth analysis of Crop Monitoring Technology In Precision Farming market size, growth, and forecasts.

- ✔ Understand Crop Monitoring Technology In Precision Farming's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Crop Monitoring Technology In Precision Farming

What is the Market Size & CAGR of Crop Monitoring Technology In Precision Farming market in 2033?

Crop Monitoring Technology In Precision Farming Industry Analysis

Crop Monitoring Technology In Precision Farming Market Segmentation and Scope

Tell us your focus area and get a customized research report.

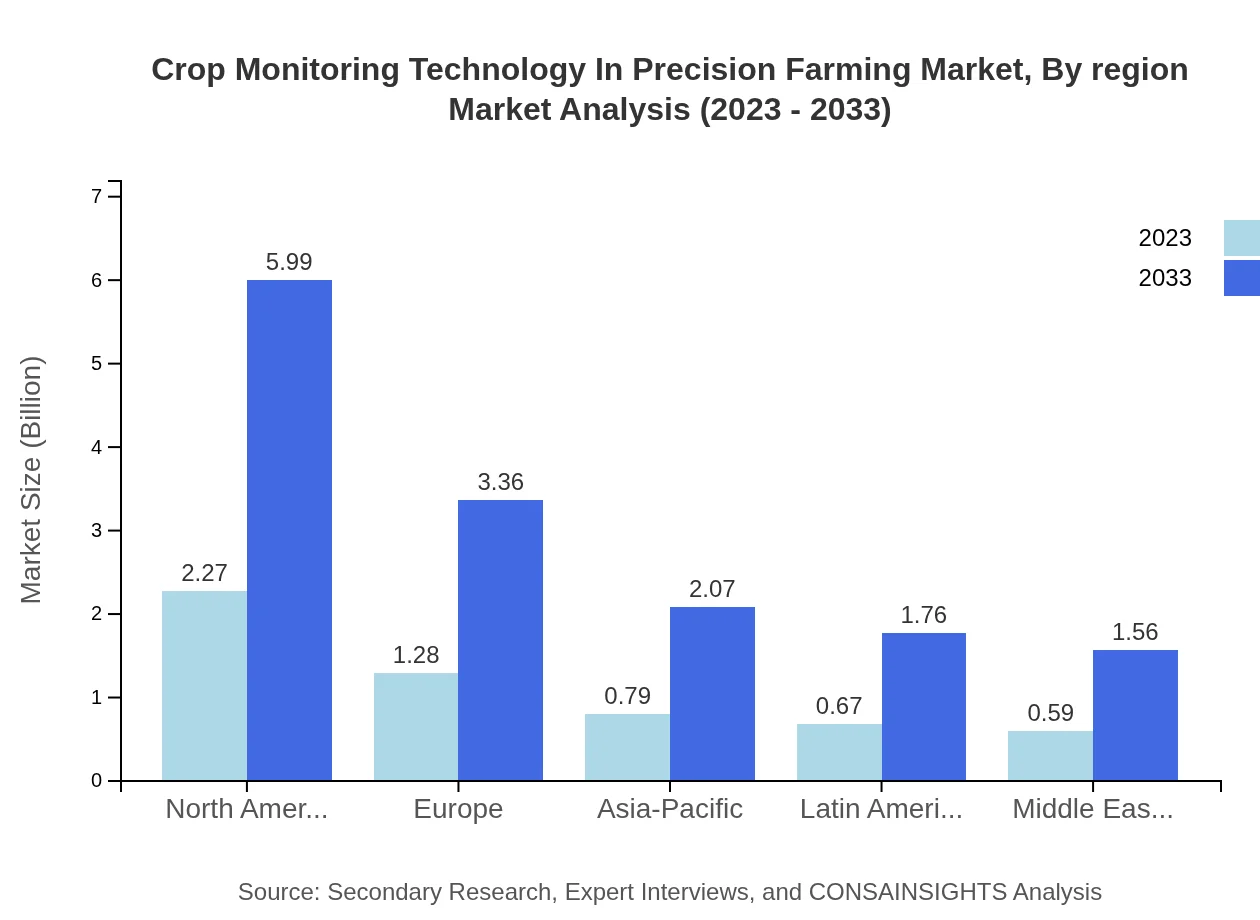

Crop Monitoring Technology In Precision Farming Market Analysis Report by Region

Europe Crop Monitoring Technology In Precision Farming Market Report:

Europe, with a market size of $2.00 billion in 2023, is projected to grow to $5.26 billion by 2033. The region is leading in the adoption of precision agriculture due to stringent regulations on environmental sustainability and the focus on improving farm productivity. Increased utilization of data-driven farming practices is expected to further bolster market growth.Asia Pacific Crop Monitoring Technology In Precision Farming Market Report:

In 2023, the Asia Pacific market for Crop Monitoring Technology is valued at $0.99 billion, with projections to reach $2.60 billion by 2033. The region's growth is fueled by initiatives aimed at enhancing agricultural productivity and addressing food security concerns in densely populated areas. Increasing investment in smart agriculture technologies is also expected to drive market expansion.North America Crop Monitoring Technology In Precision Farming Market Report:

North America registers a robust market, valued at $1.88 billion in 2023, with an estimated growth to $4.96 billion by 2033. The dominance is attributed to advanced agricultural practices, significant investment by farmers in precision farming technologies, and sustainable agriculture initiatives supported by government policies.South America Crop Monitoring Technology In Precision Farming Market Report:

The South American market is relatively small, starting at $0.01 billion in 2023 and anticipated to grow to $0.03 billion by 2033. While the growth rate is modest, the region possesses significant agricultural land that may benefit from technology adoption, particularly in optimizing crop yields and resource management.Middle East & Africa Crop Monitoring Technology In Precision Farming Market Report:

The Middle East and Africa market, estimated at $0.72 billion in 2023, is expected to grow to $1.90 billion by 2033. Efforts to enhance water management and improve crop resilience in arid climates drive the demand for crop monitoring technologies in this region, despite existing infrastructural challenges.Tell us your focus area and get a customized research report.

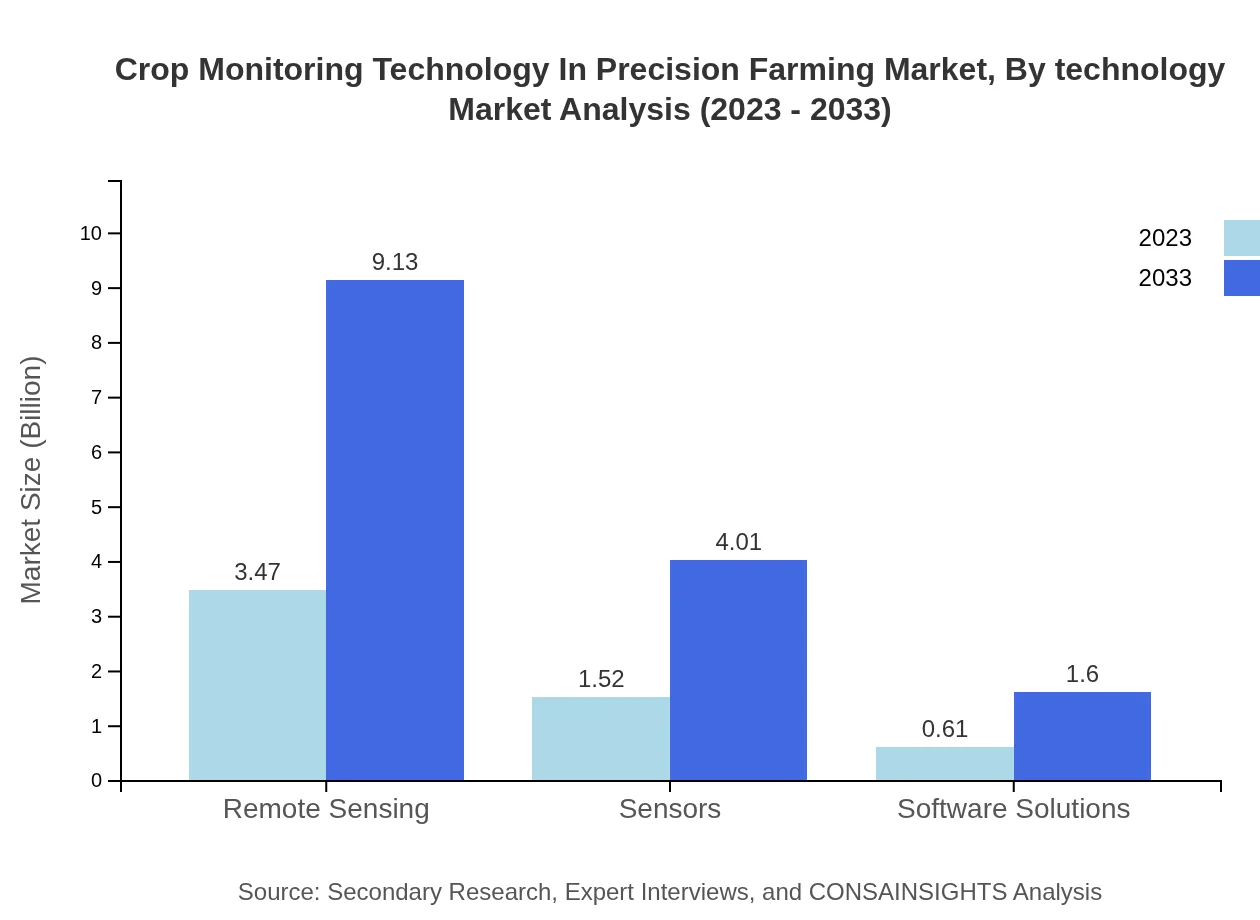

Crop Monitoring Technology In Precision Farming Market Analysis By Technology

The market is characterized by multiple technological offerings. Remote sensing holds the largest market share at 61.92% ($3.47 billion), while sensors account for 27.21% ($1.52 billion) in 2023. Software solutions, although smaller, are critical for analysis, representing 10.87% ($0.61 billion) of the market. This segmentation underscores the essential role of innovative technologies in driving agricultural efficiency and sustainability.

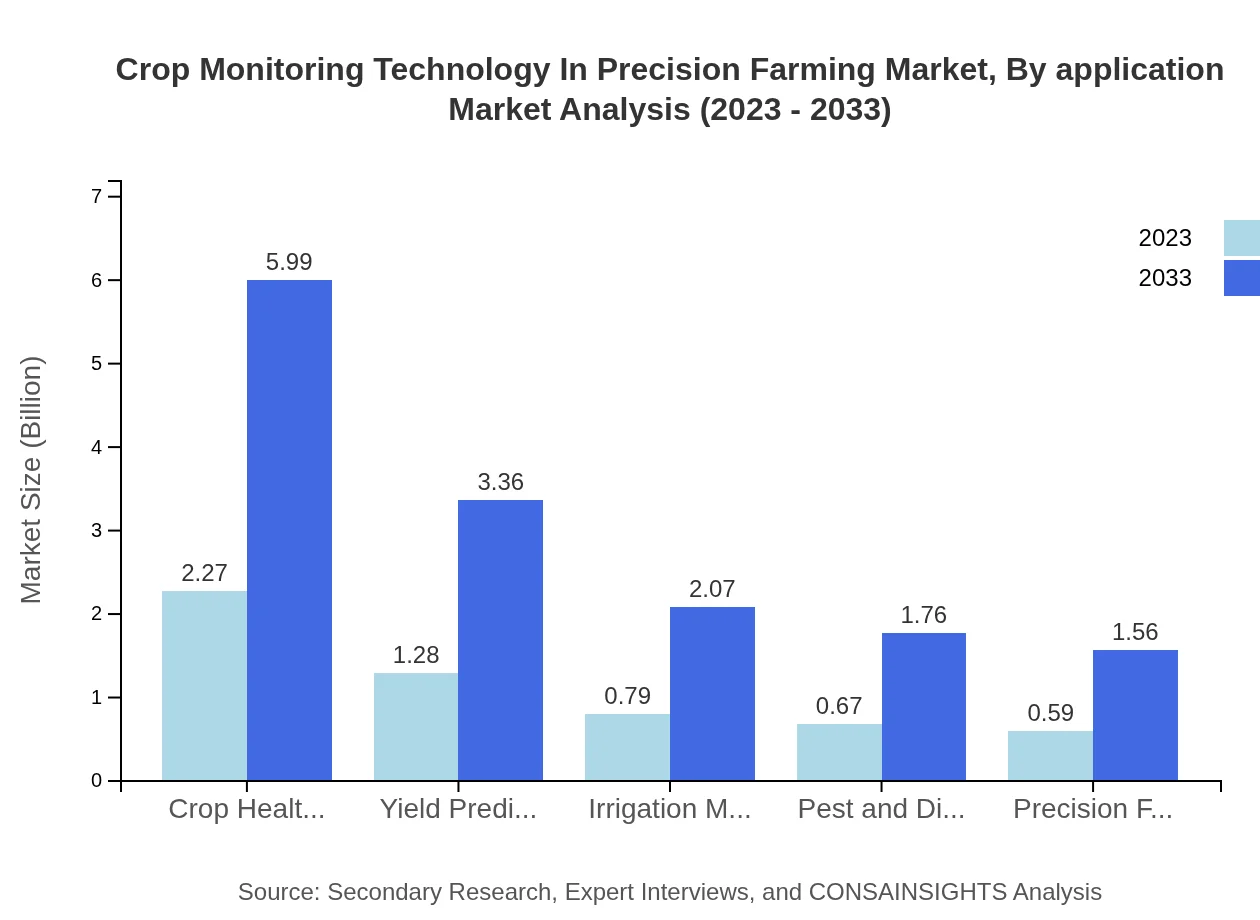

Crop Monitoring Technology In Precision Farming Market Analysis By Application

Key applications such as Crop Health Monitoring and Yield Prediction lead the sector, collectively representing over 60% of market share. Crop Health Monitoring, valued at $2.27 billion (40.62%) in 2023, enables farmers to optimize treatments based on health assessments. Yield Prediction contributes significantly at $1.28 billion (22.81%), facilitating improved resource allocation.

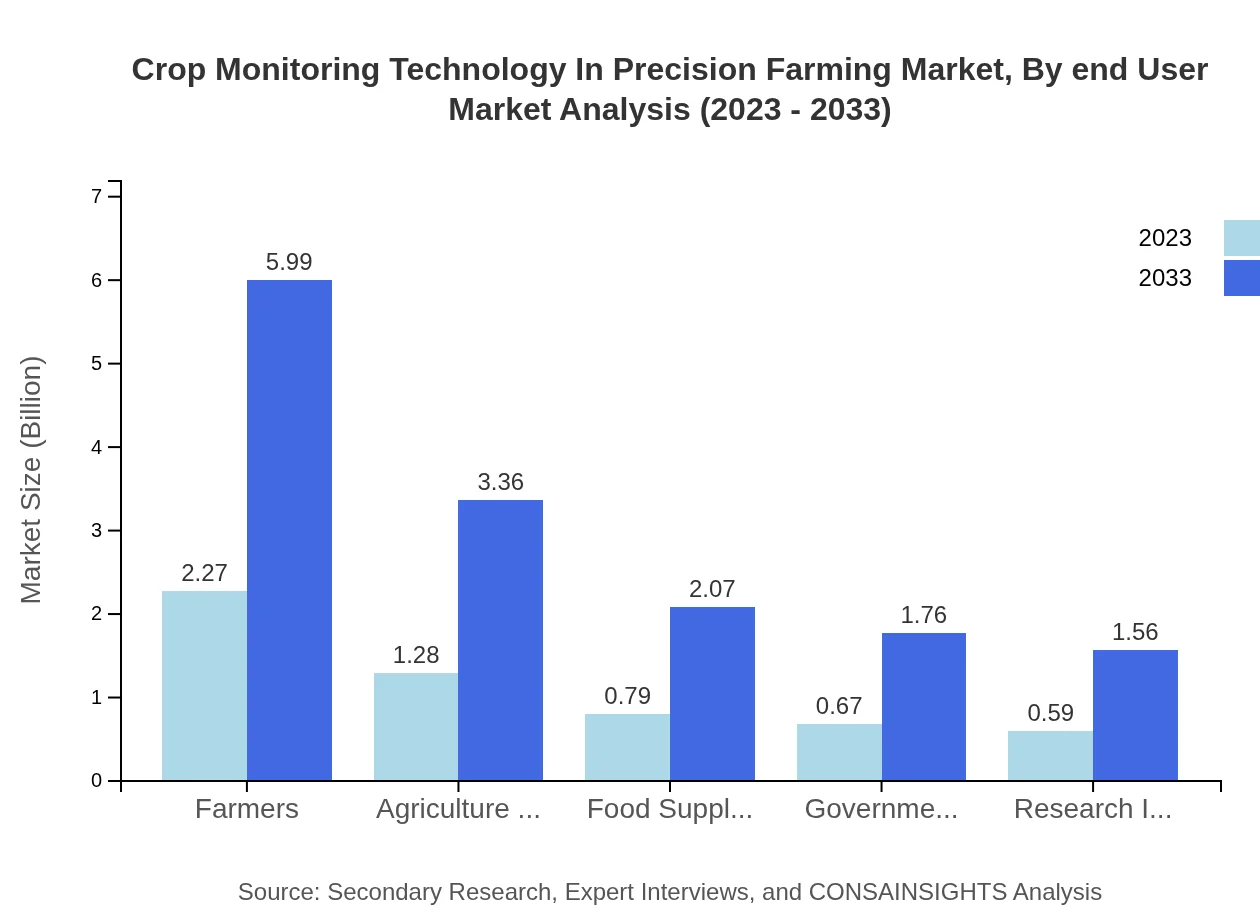

Crop Monitoring Technology In Precision Farming Market Analysis By End User

Farmers are the primary end-users, holding a significant share at 40.62% ($2.27 billion) in 2023. Agriculture service providers (22.81%), food suppliers (14.02%), government agencies (11.94%), and research institutions (10.61%) also represent crucial segments that drive technology adoption across different agricultural sectors.

Crop Monitoring Technology In Precision Farming Market Analysis By Region

Regionally, North America dominates the market, expecting to maintain a consistent market share of around 40.62% throughout the forecast. Europe follows closely with a share of 22.81%, highlighting its role in adopting advanced agricultural technologies. The Asia-Pacific region, albeit smaller, is evolving rapidly, showcasing a potential share of 14.02% as it enhances farming practices.

Crop Monitoring Technology In Precision Farming Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Crop Monitoring Technology In Precision Farming Industry

Trimble Inc.:

A leader in precision agriculture technology, Trimble provides integrated solutions that enhance farming productivity through technologies like GPS and data analytics.John Deere:

Renowned for its agricultural machinery, John Deere also leads in precision farming technologies, offering solutions for crop monitoring and management.Monsanto (now part of Bayer):

A major player in agriculture, Monsanto has invested in biotechnology and data analytics, enhancing crop productivity through innovative monitoring solutions.Ag Leader Technology:

Specialized in precision farming systems, Ag Leader offers a range of monitoring solutions focused on optimizing agricultural outputs.Sentera:

Sentera focuses on drone technology and remote sensing to enable farmers to monitor crops and health with precision, enhancing proactive decision-making.We're grateful to work with incredible clients.

FAQs

What is the market size of crop Monitoring Technology In Precision Farming?

The global crop monitoring technology market in precision farming was valued at $5.6 billion in 2023 and is projected to grow at a CAGR of 9.8%, reaching significant milestones by 2033.

What are the key market players or companies in this crop Monitoring Technology In Precision Farming industry?

Key players in the crop monitoring technology market include top agricultural service providers, technology firms specializing in remote sensing, and software solution developers, enhancing efficiency and sustainability in farming.

What are the primary factors driving the growth in the crop Monitoring Technology In Precision Farming industry?

Factors such as the increasing demand for efficient agriculture, technological advancements in sensors and data analytics, and the necessity for sustainable farming practices are driving market growth significantly.

Which region is the fastest Growing in the crop Monitoring Technology In Precision Farming?

Asia Pacific is the fastest-growing region in crop monitoring technology, projected to expand from $0.99 billion in 2023 to $2.60 billion by 2033, showcasing significant growth potential.

Does ConsaInsights provide customized market report data for the crop Monitoring Technology In Precision Farming industry?

Yes, ConsaInsights offers customized market research reports tailored to specific client needs, providing detailed insights and analysis for the crop monitoring technology sector.

What deliverables can I expect from this crop Monitoring Technology In Precision Farming market research project?

Clients can expect comprehensive reports featuring market size data, trend analysis, competition landscape, regional insights, and growth forecasts tailored to individual requirements.

What are the market trends of crop Monitoring Technology In Precision Farming?

Current trends include the adoption of IoT devices, AI-driven analytics for precision agriculture, emphasis on sustainability, and the integration of advanced remote sensing technologies to enhance crop management.