Crowdfunding Market Report

Published Date: 31 January 2026 | Report Code: crowdfunding

Crowdfunding Market Size, Share, Industry Trends and Forecast to 2033

The Crowdfunding Market Report analyzes the current landscape of the crowdfunding industry, encompassing market size, trends, and projections from 2023 to 2033. It provides valuable insights into segmentation, regional performance, and key players impacting the market.

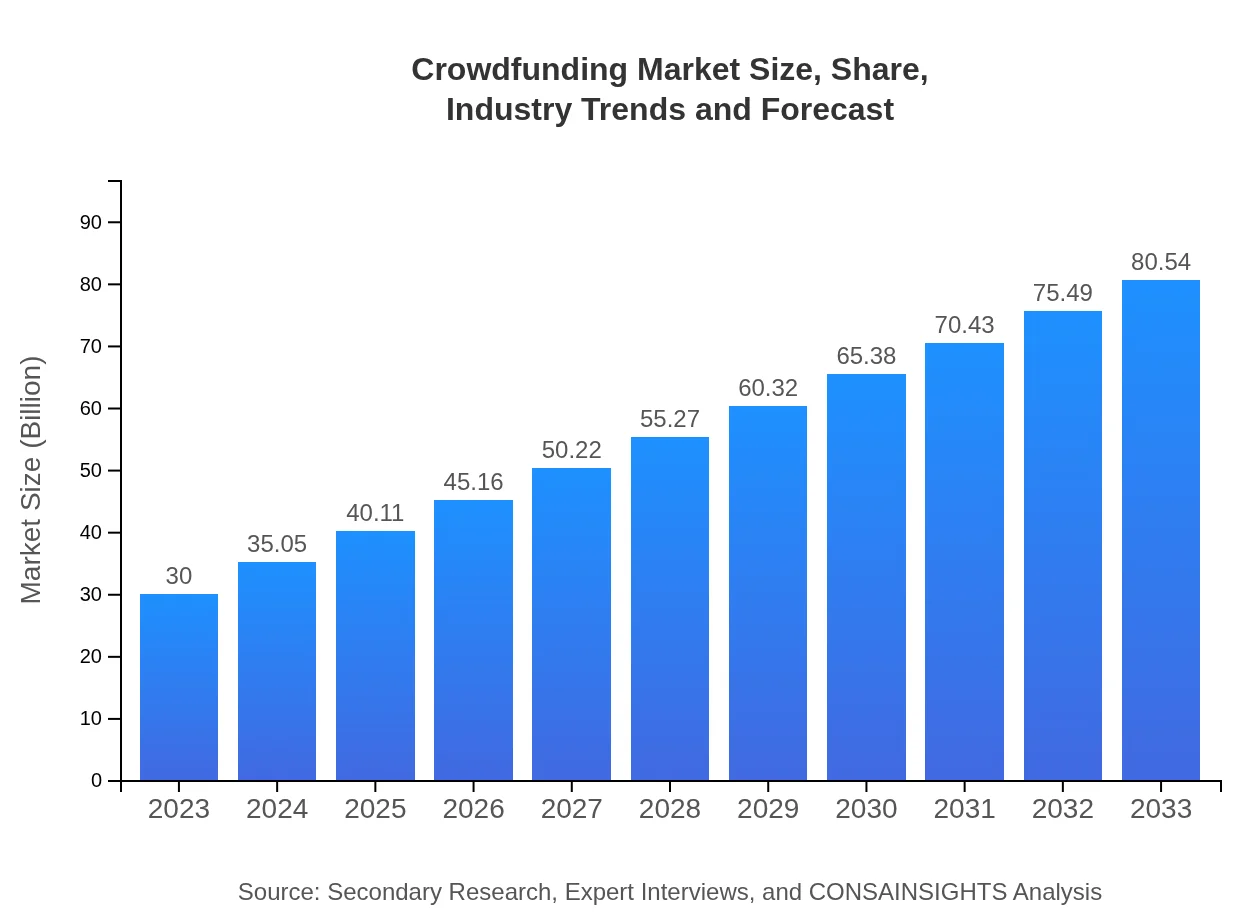

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $30.00 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $80.54 Billion |

| Top Companies | Kickstarter, Indiegogo, GoFundMe, SeedInvest |

| Last Modified Date | 31 January 2026 |

Crowdfunding Market Overview

Customize Crowdfunding Market Report market research report

- ✔ Get in-depth analysis of Crowdfunding market size, growth, and forecasts.

- ✔ Understand Crowdfunding's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Crowdfunding

What is the Market Size & CAGR of Crowdfunding market in 2023?

Crowdfunding Industry Analysis

Crowdfunding Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Crowdfunding Market Analysis Report by Region

Europe Crowdfunding Market Report:

In Europe, the crowdfunding market is projected to grow from $8.62 billion in 2023 to $23.13 billion by 2033. This growth is spurred by increasing recognition of crowdfunding as a legitimate funding source for startups and social initiatives, complemented by supportive regulatory frameworks across several nations.Asia Pacific Crowdfunding Market Report:

In the Asia Pacific region, the crowdfunding market is projected to grow from $5.69 billion in 2023 to $15.27 billion by 2033. Countries like China and India are leading this surge, driven by increasing internet penetration and a burgeoning startup ecosystem. Local platforms are adapting to cultural nuances by catering to community and social projects, enhancing their appeal.North America Crowdfunding Market Report:

North America remains the largest market for crowdfunding, with a market size of $11.26 billion in 2023, expected to reach $30.22 billion by 2033. The region benefits from a well-established regulatory framework, advanced technological infrastructure, and a strong entrepreneurial spirit, which collectively foster a robust funding environment.South America Crowdfunding Market Report:

The South American crowdfunding market is anticipated to rise from $0.81 billion in 2023 to $2.17 billion in 2033. The increasing affinity for alternative financing solutions among entrepreneurs, alongside growing digital literacy, is propelling market growth while platforms are now focusing on local projects that resonate with community needs.Middle East & Africa Crowdfunding Market Report:

In the Middle East and Africa, the crowdfunding market is expected to expand from $3.63 billion in 2023 to $9.75 billion by 2033. Predominantly fueled by awareness and acceptance of alternative financing, the region is witnessing an increase in platforms that cater to both local startups and social impact initiatives.Tell us your focus area and get a customized research report.

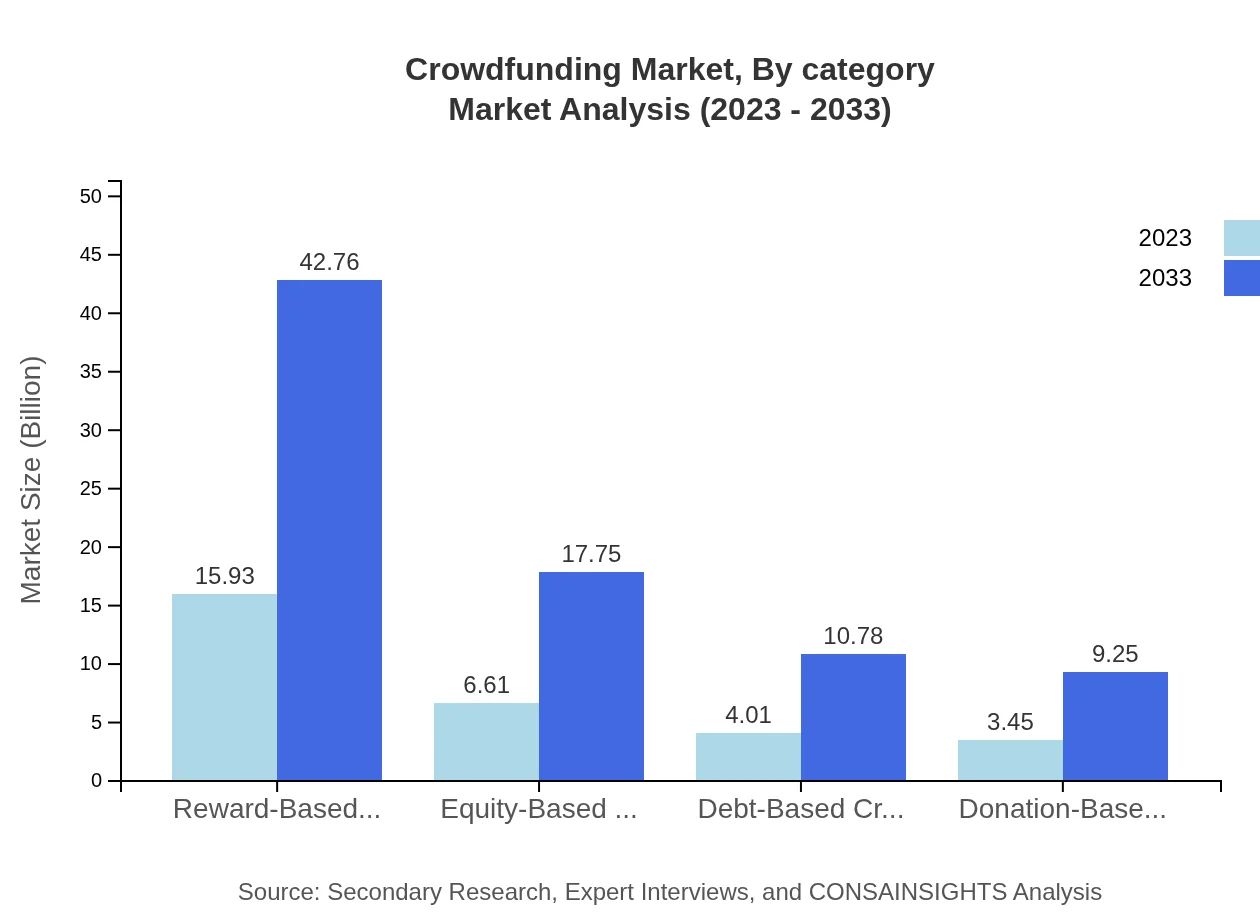

Crowdfunding Market Analysis By Category

The crowdfunding market, segmented by category, highlights reward-based crowdfunding as the largest segment, valued at $15.93 billion in 2023 and projected to reach $42.76 billion by 2033. Equity-based crowdfunding follows, with a market size of $6.61 billion in 2023, projected to grow to $17.75 billion by 2033. Debt-based crowdfunding and donation-based crowdfunding also show promising growth trajectories, indicating diverse opportunities across the sector.

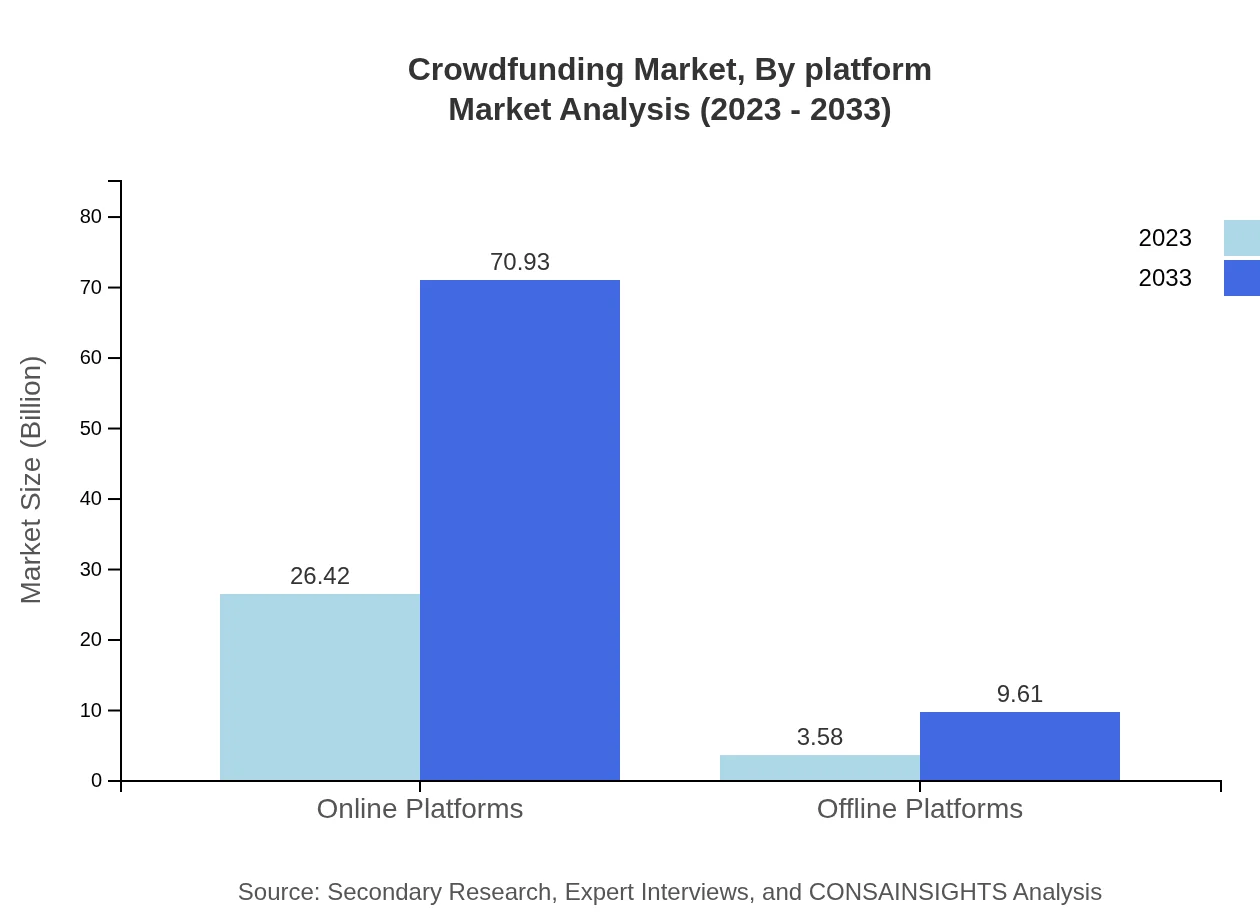

Crowdfunding Market Analysis By Platform

Online platforms dominate the crowdfunding landscape, representing a market size of $26.42 billion in 2023, expanding to $70.93 billion by 2033. The rise of mobile applications has further bolstered this segment's growth, while offline platforms remain modest, currently valued at $3.58 billion, showing an increase to $9.61 billion by 2033.

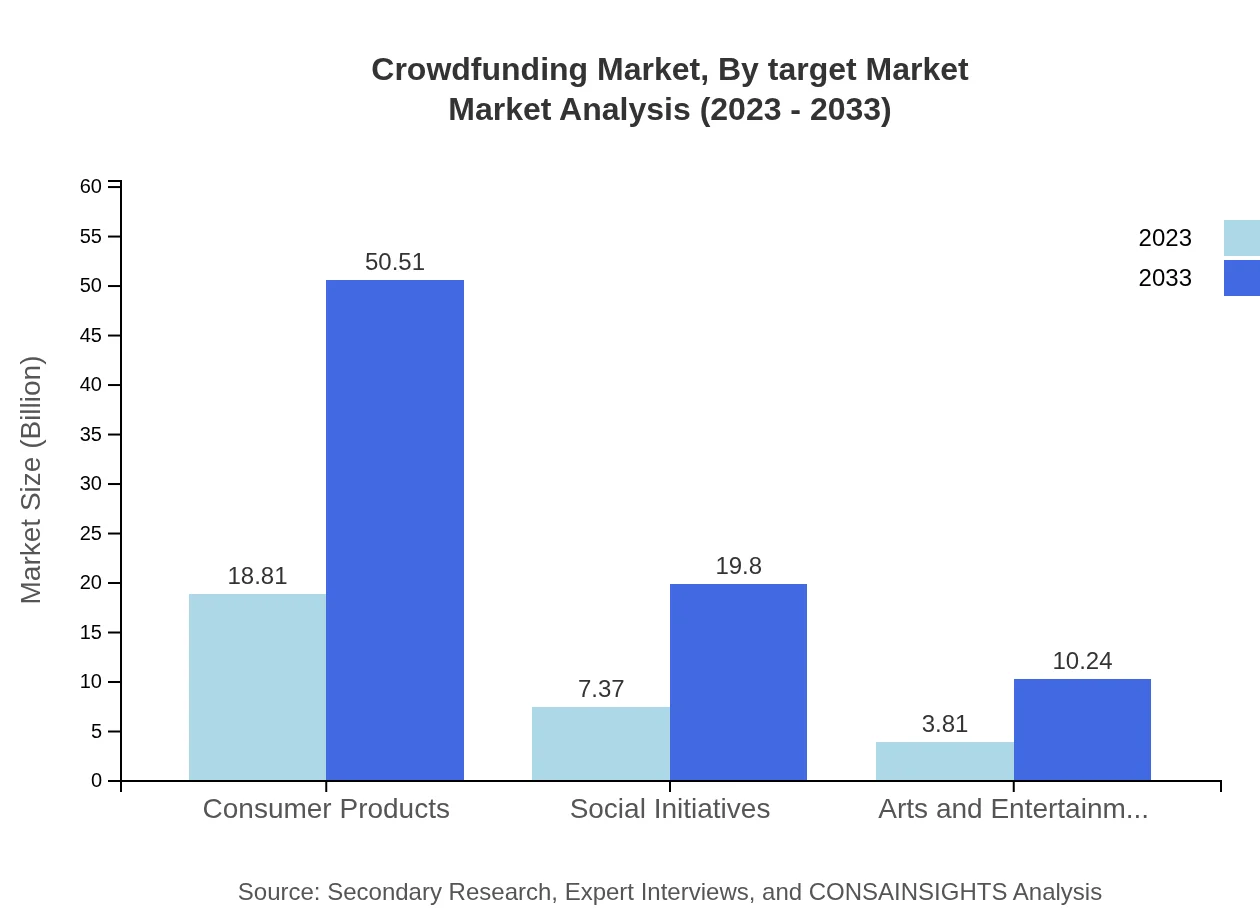

Crowdfunding Market Analysis By Target Market

The crowdfunding market segment, by target market, encompasses consumer products with significant growth, from $18.81 billion in 2023 to $50.51 billion by 2033. Notably, social initiatives also exhibit strong presence and growth, indicating a heightened interest in funding projects that tackle social issues.

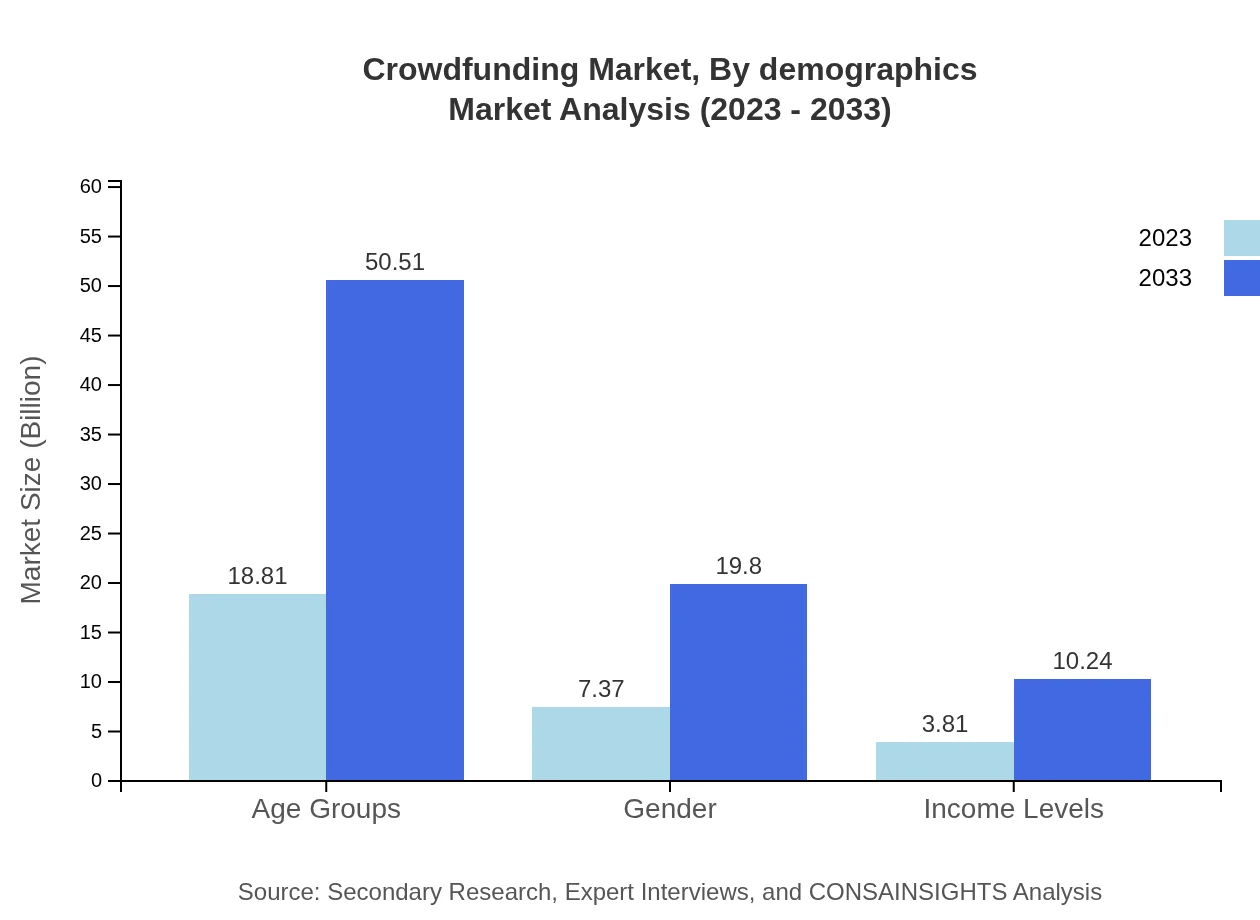

Crowdfunding Market Analysis By Demographics

By demographics, age groups present remarkable potential, expanding from $18.81 billion in 2023 to $50.51 billion by 2033. Gender demographics also reveal substantial engagement, with female-centric campaigns garnering increased attention, alongside various income levels, indicating a broadening appeal to different socioeconomic classes.

Crowdfunding Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Crowdfunding Industry

Kickstarter:

Kickstarter is one of the most popular crowdfunding platforms, focusing primarily on creative projects. It has established a robust community of backers seeking innovative products and artistic endeavors.Indiegogo:

Indiegogo offers a flexible fundraising platform that supports both creative projects and product launches. It provides backers with diverse options, including 'equity' and 'charitable' crowdfunding, thus catering to a wide range of funding needs.GoFundMe:

GoFundMe stands out in the crowdfunding landscape for personal causes and charitable initiatives. Its user-friendly approach and social media integration have made it widely accessible for individuals seeking funding help during emergencies or special campaigns.SeedInvest:

SeedInvest is a leading equity crowdfunding platform that allows accredited investors to access high-quality startup investment opportunities. It focuses on maintaining stringent due diligence processes to ensure investors are matched with credible ventures.We're grateful to work with incredible clients.

FAQs

What is the market size of crowdfunding?

The crowdfunding market is projected to reach approximately $30 billion by 2033, growing at a CAGR of 10%. The market is currently valued at about $30 billion in 2023, showcasing significant growth potential in the coming years.

What are the key market players or companies in this crowdfunding industry?

Key players in the crowdfunding industry include platforms like Kickstarter, Indiegogo, GoFundMe, and Fundable. These companies lead by offering diverse mechanisms for fundraising, catering to various sectors like arts, entrepreneurship, and social initiatives.

What are the primary factors driving the growth in the crowdfunding industry?

Growth in the crowdfunding industry is primarily driven by increasing digital adoption, a growing number of startups needing capital, and a rise in awareness of alternative funding options as compared to traditional financing methods.

Which region is the fastest Growing in crowdfunding?

The fastest-growing region in crowdfunding is North America, showing a market growth from $11.26 billion in 2023 to $30.22 billion by 2033. Asia Pacific follows closely, growing from $5.69 billion to $15.27 billion during the same period.

Does ConsaInsights provide customized market report data for the crowdfunding industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the crowdfunding industry. Clients can request detailed analyses, segmented reports, and insights based on their unique market interests.

What deliverables can I expect from this crowdfunding market research project?

From this crowdfunding market research project, you can expect comprehensive reports, including market size, growth trends, competitive analysis, segment insights, and regional breakdowns, all tailored to inform your strategic planning.

What are the market trends of crowdfunding?

The crowdfunding market is witnessing trends such as an increase in reward-based crowdfunding, with projected growth from $15.93 billion in 2023 to $42.76 billion by 2033, and growing emphasis on equity-based options for startups.