Crypto Asset Management Market Report

Published Date: 24 January 2026 | Report Code: crypto-asset-management

Crypto Asset Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Crypto Asset Management market from 2023 to 2033, covering market trends, size, segmentation, and forecasts to facilitate strategic decision-making for stakeholders in the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Coinbase , Fidelity Digital Assets, Kraken, BlockFi, Gemini |

| Last Modified Date | 24 January 2026 |

Crypto Asset Management Market Overview

Customize Crypto Asset Management Market Report market research report

- ✔ Get in-depth analysis of Crypto Asset Management market size, growth, and forecasts.

- ✔ Understand Crypto Asset Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Crypto Asset Management

What is the Market Size & CAGR of Crypto Asset Management market in 2023?

Crypto Asset Management Industry Analysis

Crypto Asset Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Crypto Asset Management Market Analysis Report by Region

Europe Crypto Asset Management Market Report:

The European market for crypto asset management is projected to grow from $0.38 billion in 2023 to $0.71 billion in 2033. Driven by regulatory clarity and advancements in financial technologies, European countries are positioning themselves as leaders in crypto innovations.Asia Pacific Crypto Asset Management Market Report:

The Asia Pacific region's crypto asset management market is anticipated to grow from $0.30 billion in 2023 to $0.55 billion in 2033, driven by increased blockchain adoption, favorable regulations in countries like Singapore, and a tech-savvy population. The presence of numerous start-ups in the region is also catalyzing growth.North America Crypto Asset Management Market Report:

North America currently dominates the Crypto Asset Management market, projected to increase from $0.58 billion in 2023 to $1.08 billion by 2033. This growth is fueled by a robust financial ecosystem, significant venture capital investments in crypto companies, and increasing cryptocurrency adoption by institutional investors.South America Crypto Asset Management Market Report:

In South America, the market is expected to expand from $0.06 billion in 2023 to $0.12 billion by 2033. The growing acceptance of cryptocurrencies as an alternative investment asset class and rising fintech initiatives throughout the region are expected to foster market growth.Middle East & Africa Crypto Asset Management Market Report:

The Middle East and Africa (MEA) market is expected to increase from $0.17 billion in 2023 to $0.32 billion by 2033. Rising awareness about cryptocurrencies along with developing financial infrastructures are likely supporting factors for market expansion in this region.Tell us your focus area and get a customized research report.

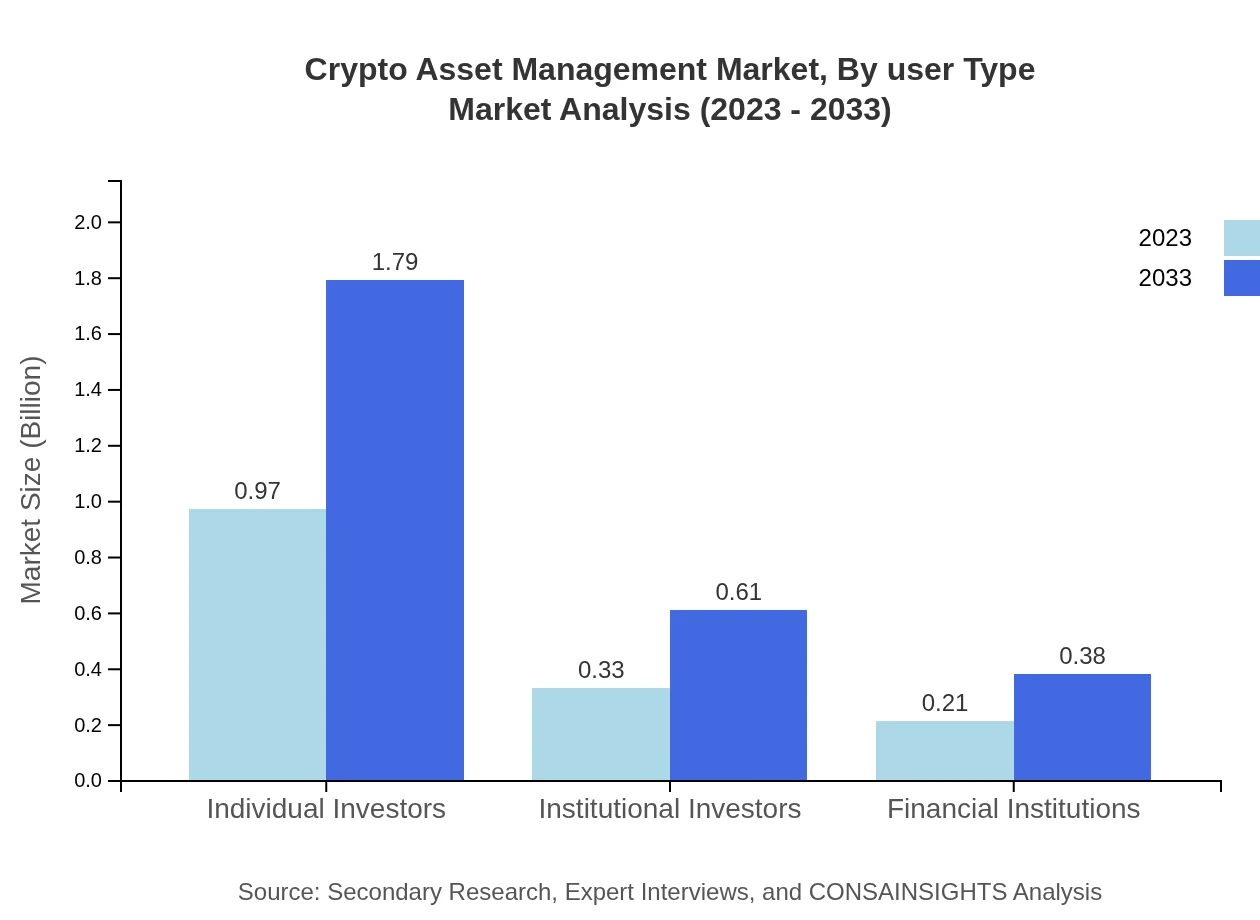

Crypto Asset Management Market Analysis By User Type

The market is primarily driven by individual and institutional investors. For individual investors, the size grows from $0.97 billion in 2023 to $1.79 billion in 2033, representing a share of 64.37% in both years. In contrast, institutional investors’ market size is predicted to reach $0.61 billion by 2033 from $0.33 billion in 2023, maintaining a market share of 21.81%.

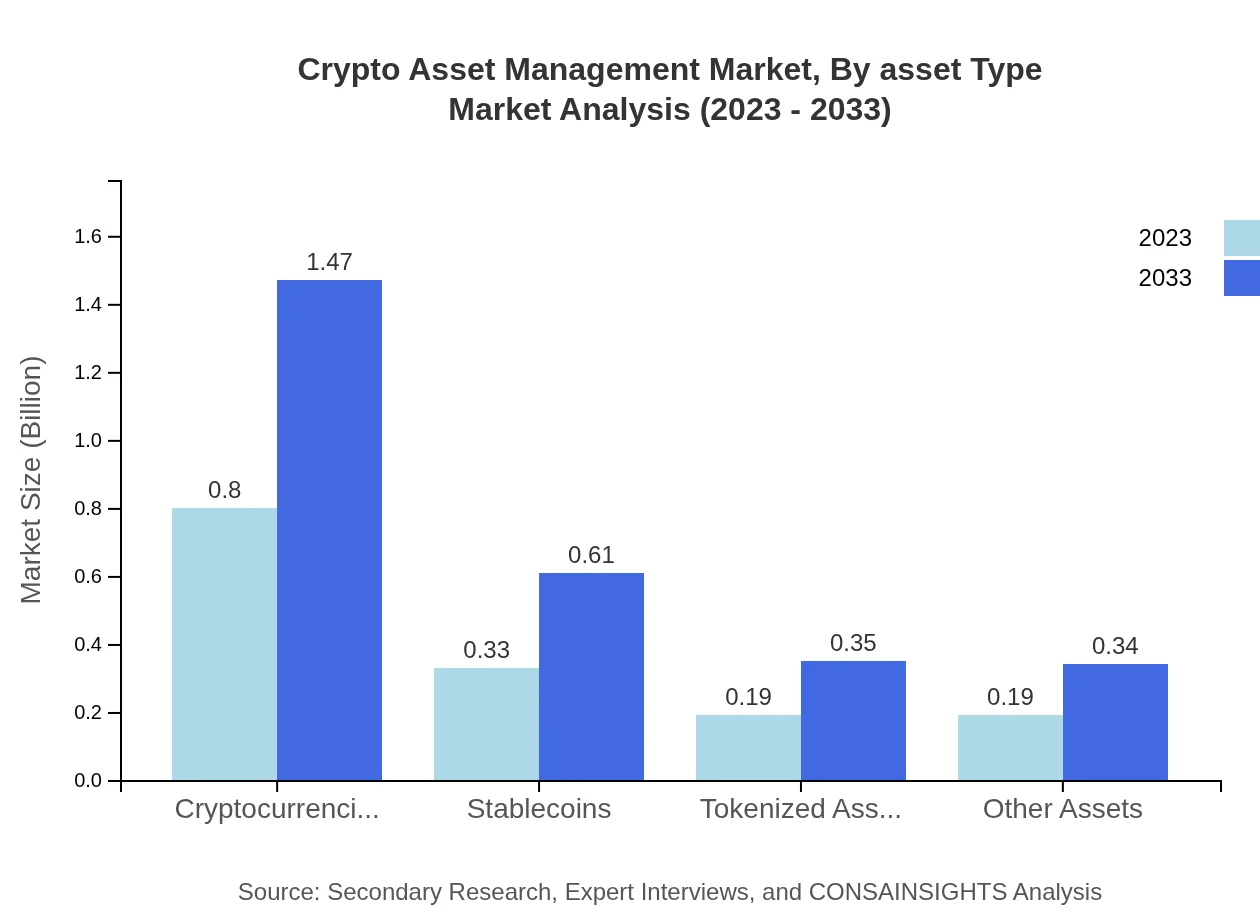

Crypto Asset Management Market Analysis By Asset Type

In terms of asset types, cryptocurrencies will see growth from $0.80 billion (53.02% share) in 2023 to $1.47 billion by 2033. Stablecoins and tokenized assets follow, increasing from $0.33 billion to $0.61 billion (22.05% share) and $0.19 billion to $0.35 billion (12.55% share) respectively.

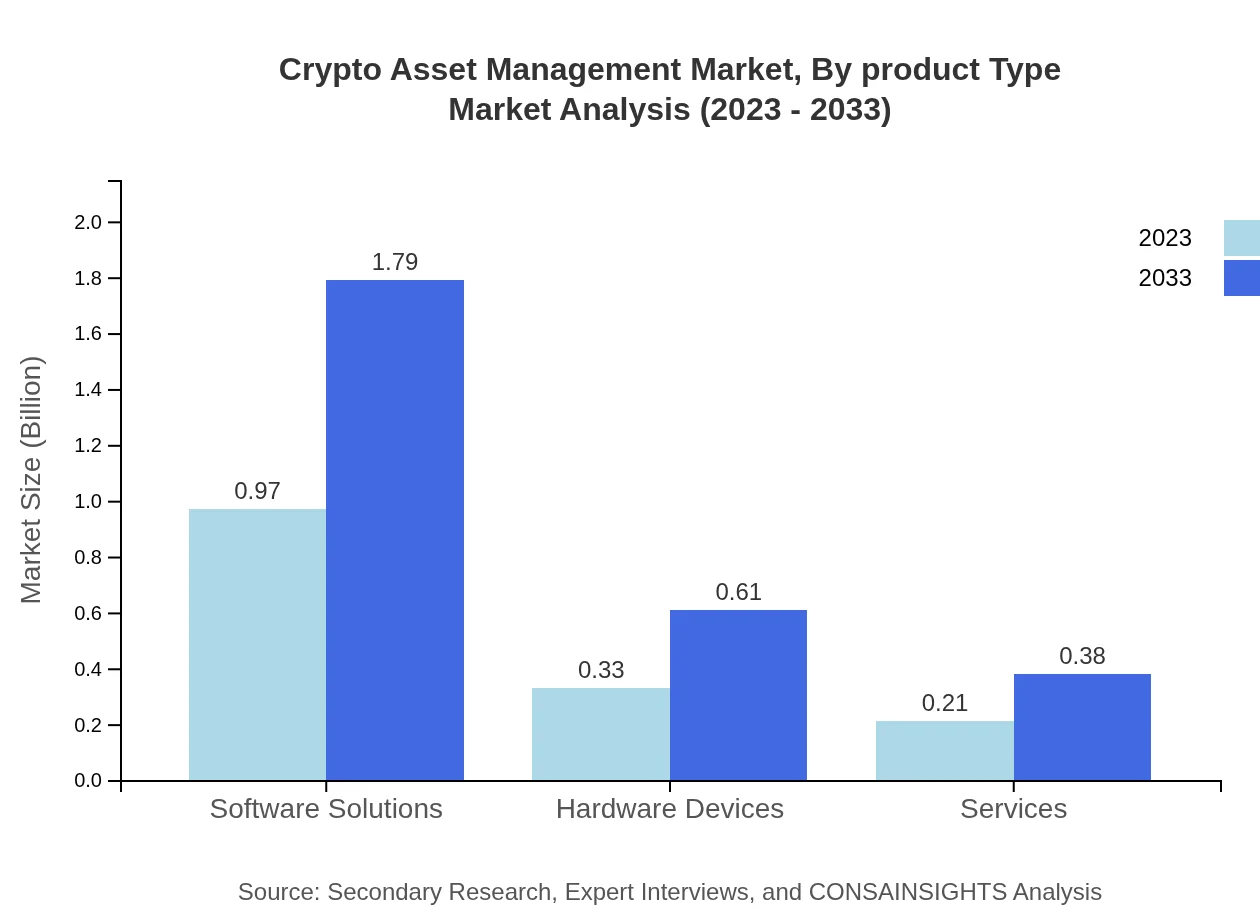

Crypto Asset Management Market Analysis By Product Type

Software solutions dominate the product type segment, expected to grow from $0.97 billion (64.37% share) in 2023 to $1.79 billion by 2033. Hardware devices and services also contribute significantly, with sizes of $0.33 billion and $0.21 billion expected to grow accordingly.

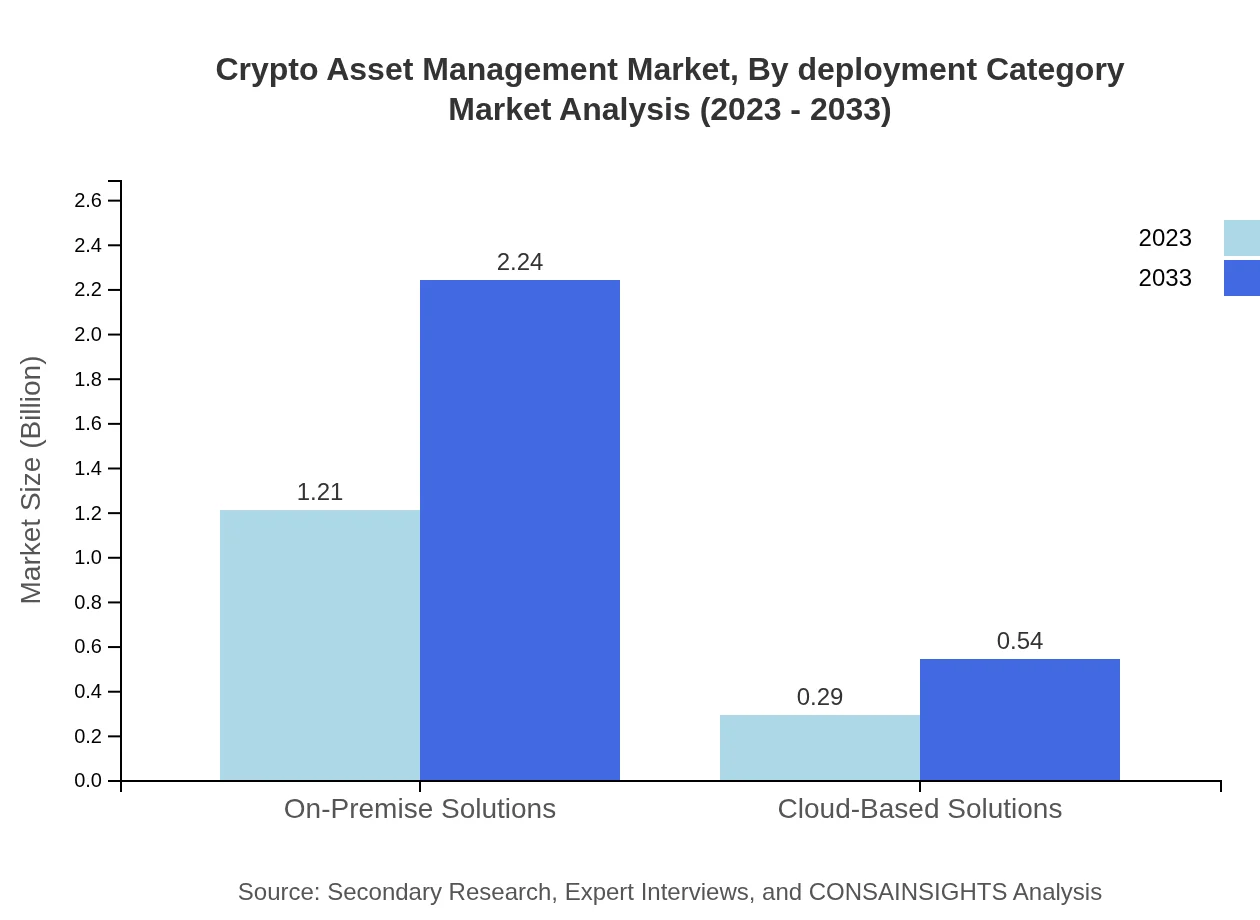

Crypto Asset Management Market Analysis By Deployment Category

On-premise solutions lead with a market size progressing from $1.21 billion (80.48% share) in 2023 to $2.24 billion by 2033 while cloud-based solutions show growth from $0.29 billion (19.52% share) to $0.54 billion.

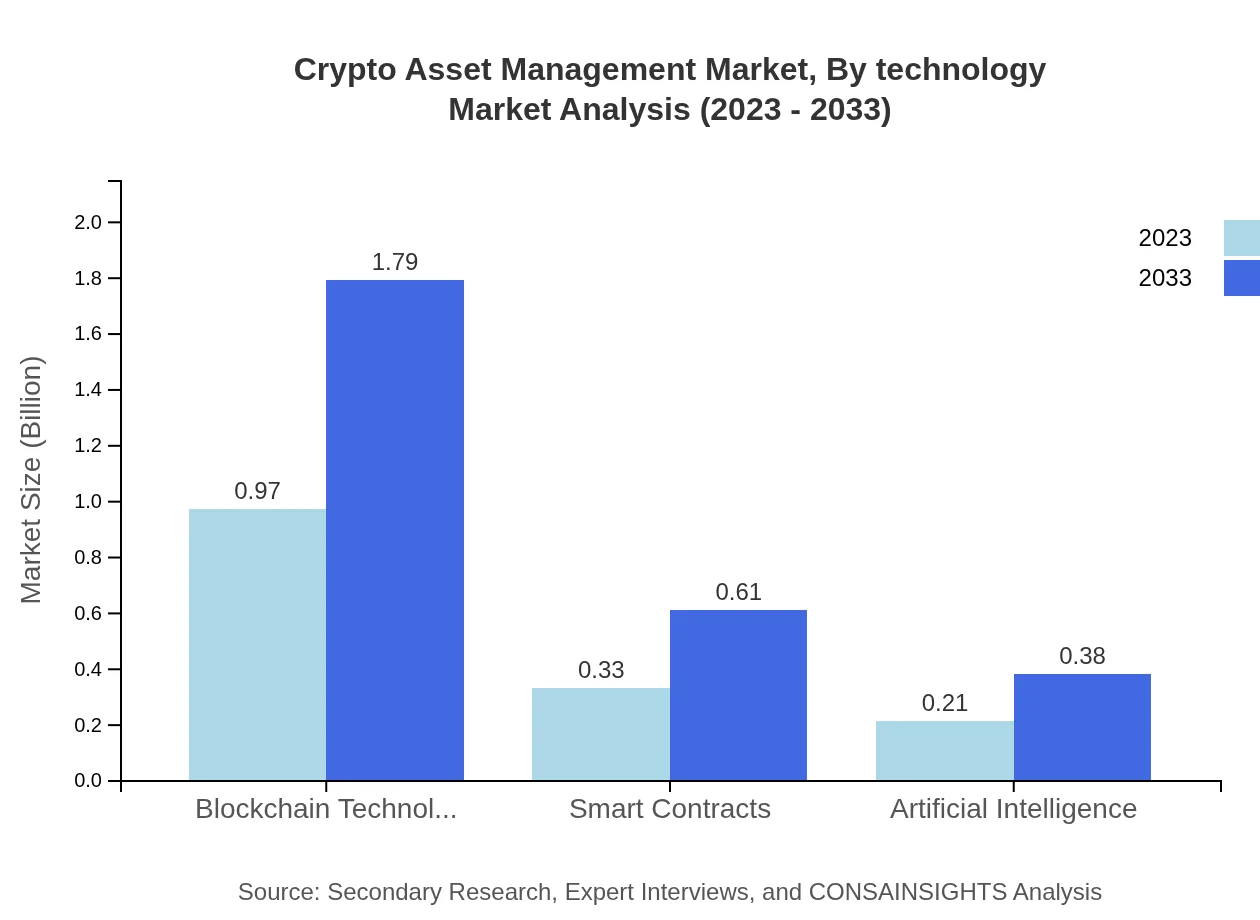

Crypto Asset Management Market Analysis By Technology

Technological advancements such as blockchain, AI, and smart contracts are crucial. Blockchain technology grows from $0.97 billion (64.37% share) in 2023 to $1.79 billion by 2033. AI and smart contracts also demonstrate growth, emphasizing their integral roles in the future of asset management.

Crypto Asset Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Crypto Asset Management Industry

Coinbase :

As one of the largest cryptocurrency exchanges globally, Coinbase offers a user-friendly platform for managing and trading diverse cryptocurrencies.Fidelity Digital Assets:

Fidelity provides institutional-grade digital asset solutions, enabling clients to securely store and manage their cryptocurrencies.Kraken:

A well-known cryptocurrency exchange that also offers crypto asset management services for both retail and professional investors.BlockFi:

Focusing on interest-bearing accounts and loans, BlockFi allows users to manage their crypto assets efficiently while generating returns.Gemini:

Operated by the Winklevoss twins, Gemini offers a secure and compliant platform for digital asset management services.We're grateful to work with incredible clients.

FAQs

What is the market size of crypto Asset Management?

The crypto-asset-management market is currently valued at $1.5 billion and is projected to grow at a CAGR of 6.2%. This growth reflects the rising adoption of digital assets and management solutions within the finance sector.

Who are the key market players or companies in the crypto Asset Management industry?

Key players in crypto-asset-management include established financial institutions, tech companies focusing on blockchain, and specialized digital asset platforms. These entities are pivotal in shaping service offerings and innovations in the rapidly evolving crypto environment.

What are the primary factors driving the growth in the crypto Asset Management industry?

Major growth drivers for the crypto-asset-management sector include increased institutional investment, technological advancements, regulatory clarity, and heightened demand for diversified investment portfolios featuring digital assets among both individual and institutional investors.

Which region is the fastest Growing in the crypto Asset Management market?

North America is currently the fastest-growing region in the crypto-asset-management market, with projections estimating a rise from $0.58 billion in 2023 to $1.08 billion by 2033, fueled by innovation and increased market participation in digital currencies.

Does ConsInsights provide customized market report data for the crypto Asset Management industry?

Yes, ConsInsights offers customized market report data tailored to the specific needs of clients in the crypto-asset-management industry, ensuring that businesses can access relevant insights that align with their strategic goals and market interests.

What deliverables can I expect from this crypto Asset Management market research project?

Clients can expect comprehensive reports including market size data, growth trend analysis, competitive landscape, regional insights, and segmentation data, all tailored to support informed decision-making within the crypto-asset-management landscape.

What are the market trends of crypto Asset Management?

Market trends in crypto-asset-management include a shifting focus towards institutional adoption of digital assets, increasing use of AI for asset management, and a growing interest in stablecoins and tokenized assets, reflecting innovation and diversification in investment strategies.