Crypto Atm Market Report

Published Date: 24 January 2026 | Report Code: crypto-atm

Crypto Atm Market Size, Share, Industry Trends and Forecast to 2033

This report presents an in-depth analysis of the Crypto ATM market, focusing on trends, growth forecasts, and regional insights from 2023 to 2033. It provides detailed market segments and technological advancements that influence the industry.

| Metric | Value |

|---|---|

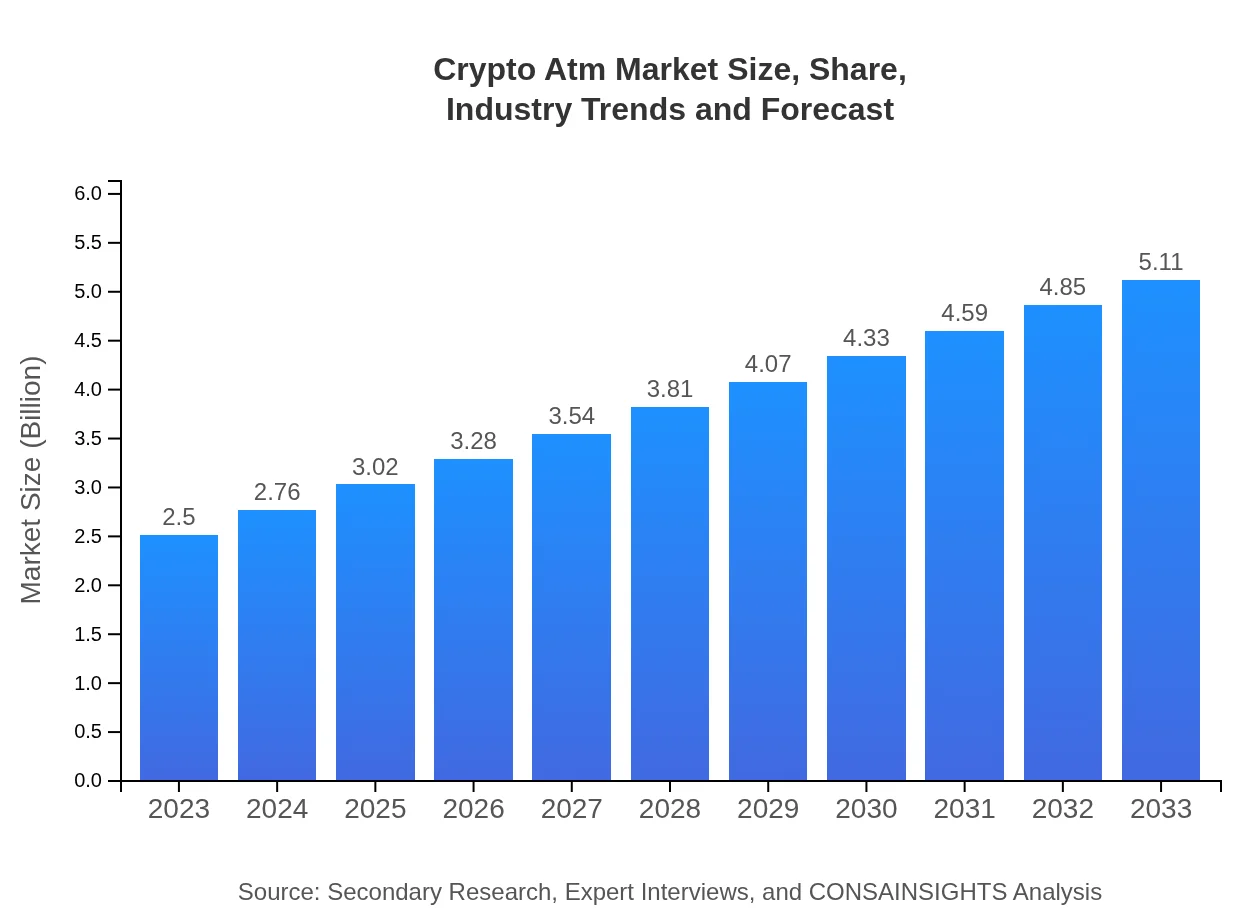

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $5.11 Billion |

| Top Companies | General Bytes, BitAccess, Coinme, Coinsource |

| Last Modified Date | 24 January 2026 |

Crypto ATM Market Overview

Customize Crypto Atm Market Report market research report

- ✔ Get in-depth analysis of Crypto Atm market size, growth, and forecasts.

- ✔ Understand Crypto Atm's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Crypto Atm

What is the Market Size & CAGR of Crypto ATM market in 2023 and 2033?

Crypto ATM Industry Analysis

Crypto ATM Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Crypto ATM Market Analysis Report by Region

Europe Crypto Atm Market Report:

The European market is also significant, with a market value of $0.80 billion in 2023 expected to grow to $1.64 billion by 2033. Countries like Spain, Switzerland, and the U.K. are embracing Crypto ATMs, fueled by a combination of innovation and consumer acceptance of cryptocurrencies as legitimate payment methods.Asia Pacific Crypto Atm Market Report:

In the Asia Pacific region, the market value was approximately $0.45 billion in 2023 and is projected to double to $0.92 billion by 2033. Rapid urbanization, high smartphone penetration, and increasing interest in cryptocurrency investments are driving this growth. Countries like Japan, South Korea, and Australia are at the forefront of adopting Crypto ATMs.North America Crypto Atm Market Report:

North America remains a dominant force in the Crypto ATM market, with a projected increase from $0.94 billion in 2023 to $1.92 billion in 2033. The U.S. hosts the largest share of Crypto ATMs globally, bolstered by a supportive regulatory environment and increasing institutional adoption. Major cities are seeing explosive growth in ATM deployments.South America Crypto Atm Market Report:

The South American Crypto ATM market is gaining traction, expected to grow from $0.04 billion in 2023 to $0.09 billion by 2033. Although the market is still in its infancy, rising interest in digital currencies among the youth population shows promise. Brazil and Argentina lead the charge in adoption rates.Middle East & Africa Crypto Atm Market Report:

The Middle East and Africa market value is estimated at $0.27 billion for 2023, projected to reach $0.55 billion by 2033. This region is witnessing nascent growth due to increasing investments in blockchain technology and regulatory acceptance. Countries like South Africa are leading regionally in ATM installations.Tell us your focus area and get a customized research report.

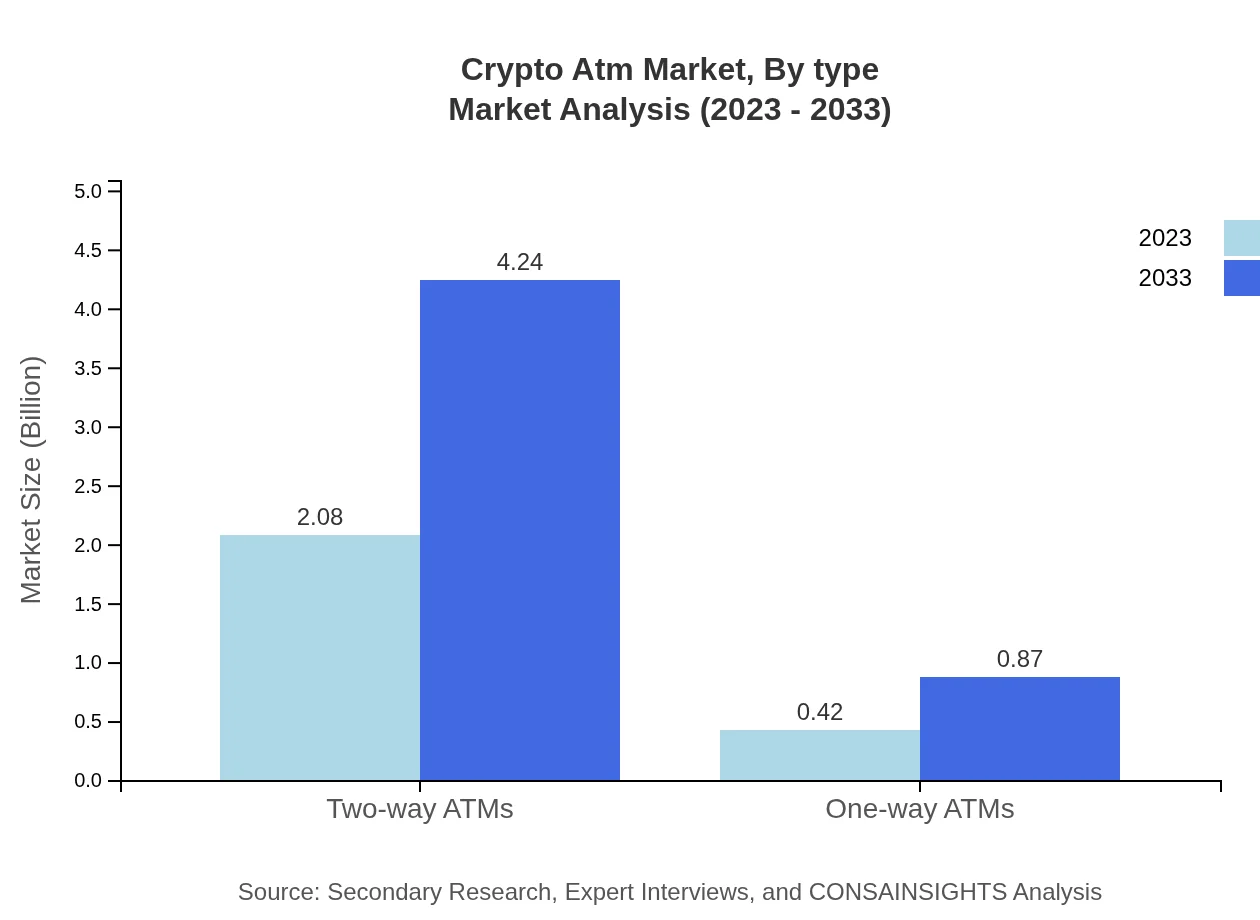

Crypto Atm Market Analysis By Type

Two-way ATMs dominate the market, valued at $2.08 billion in 2023, expected to double to $4.24 billion by 2033, capturing 83.04% market share. One-way ATMs, while growing, only accounted for 16.96% market share, representing $0.42 billion in 2023 and reaching $0.87 billion by 2033.

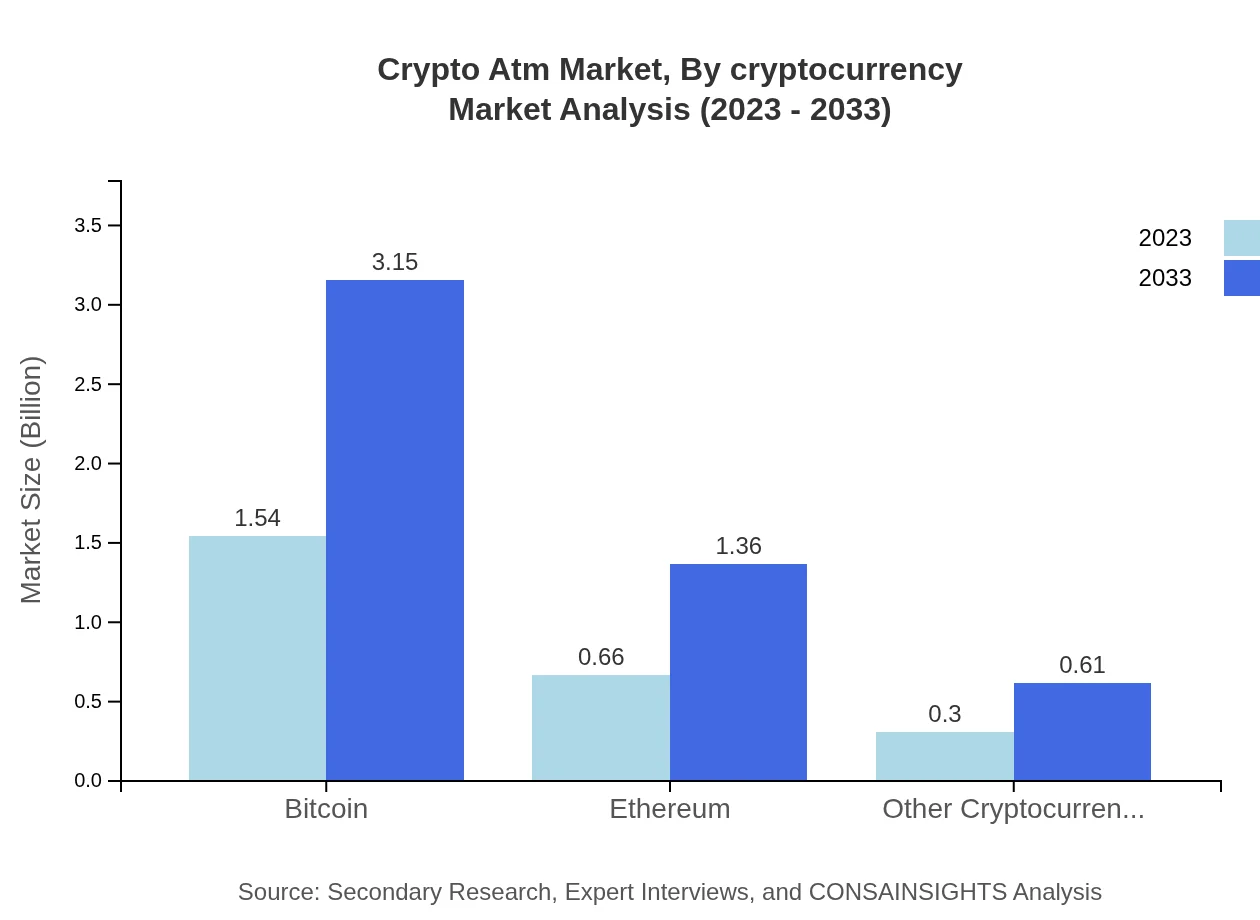

Crypto Atm Market Analysis By Cryptocurrency

Bitcoin remains the most popular cryptocurrency supported by ATMs, accounting for $1.54 billion in 2023, expected to grow to $3.15 billion by 2033, holding 61.57% market share. Ethereum follows with $0.66 billion in 2023, rising to $1.36 billion by 2033 at 26.55%; other cryptocurrencies are seen but at a smaller scale.

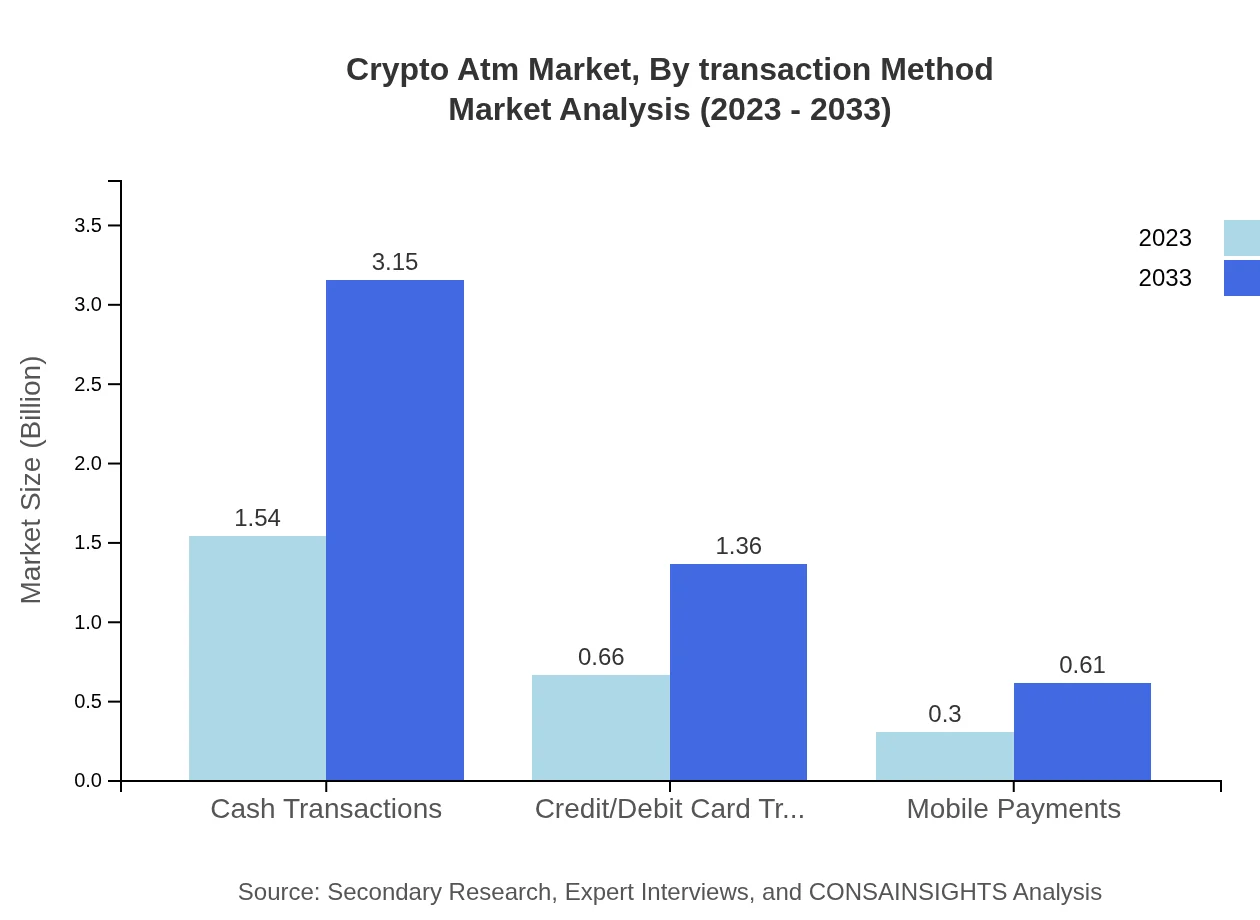

Crypto Atm Market Analysis By Transaction Method

Cash transactions lead at $1.54 billion in 2023, with an anticipated growth to $3.15 billion by 2033, holding a significant 61.57% market share. Credit/debit card transactions and mobile payments are also gaining traction, accounting for $0.66 billion and $0.30 billion respectively in 2023.

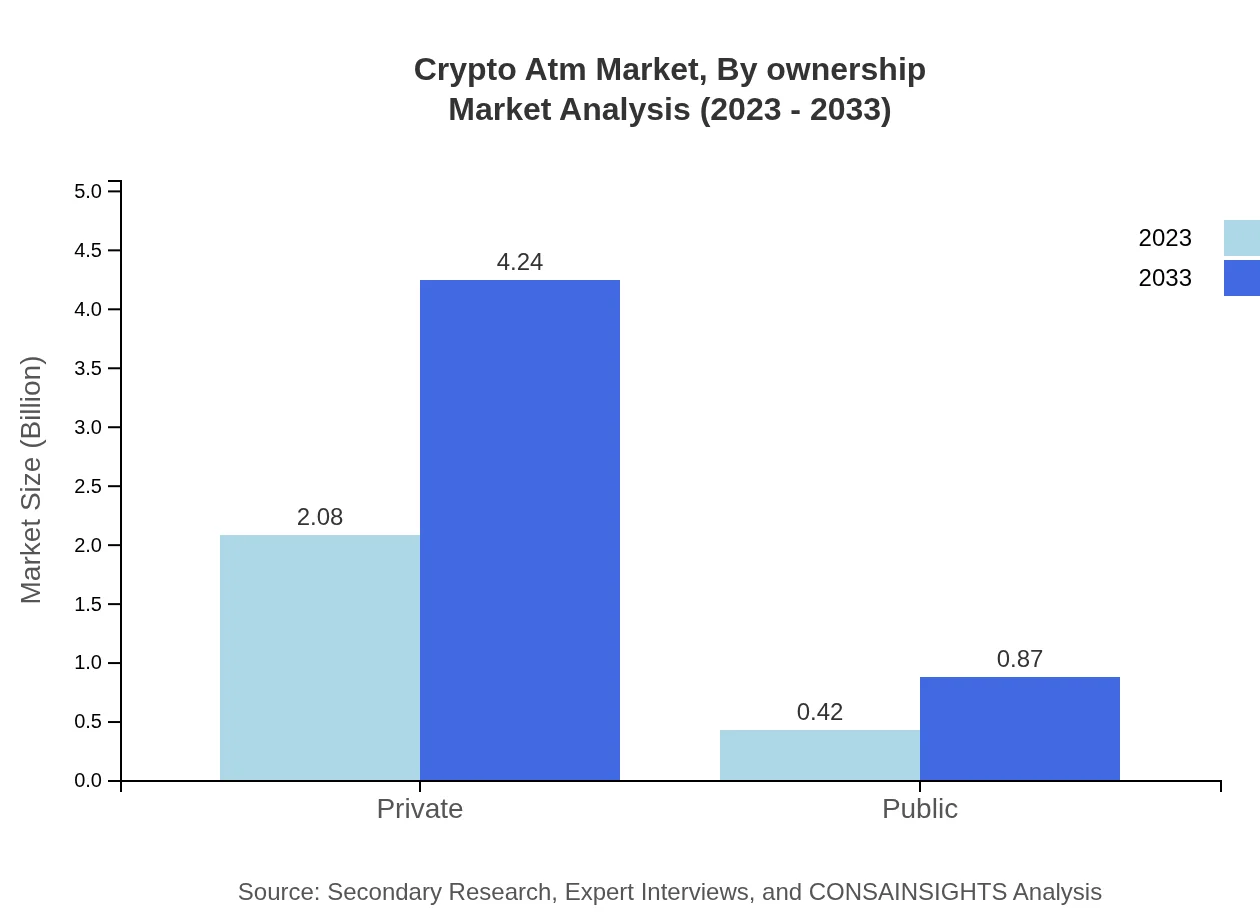

Crypto Atm Market Analysis By Ownership

The market is largely dominated by private ownership models, representing a substantial $2.08 billion in 2023 and expected to double by 2033. Public ATMs, while slowly growing, only reach $0.42 billion in 2023, capturing 16.96% market share.

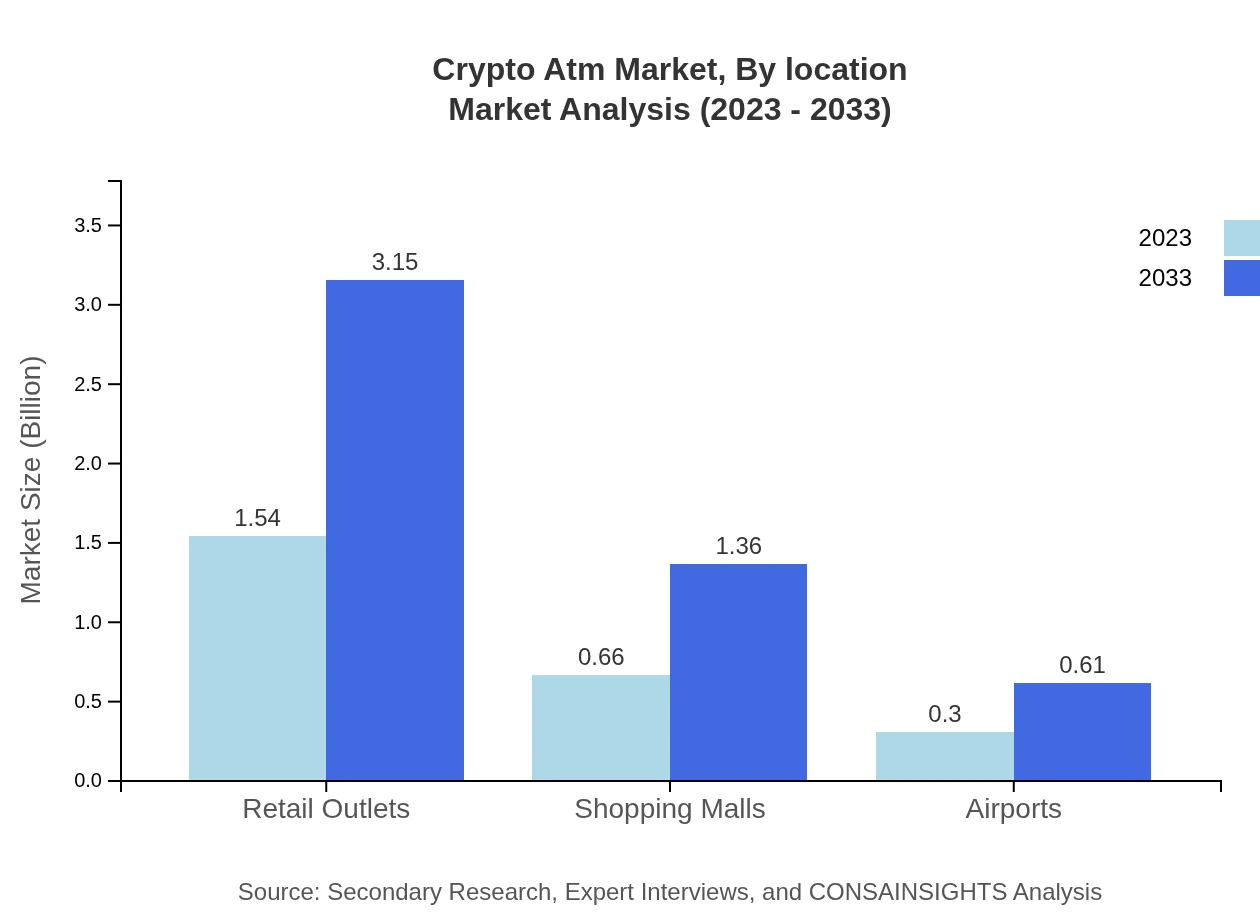

Crypto Atm Market Analysis By Location

Retail outlets represent a lucrative segment at $1.54 billion in 2023, growing to $3.15 billion by 2033. Shopping malls follow with notable growth, registering $0.66 billion in 2023, and expected to reach $1.36 billion by 2033. Airports and other locations are also emerging, albeit at a slower pace.

Crypto ATM Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Crypto ATM Industry

General Bytes:

General Bytes is one of the largest manufacturers of Bitcoin ATMs, providing state-of-the-art kiosks and enhancing customer access around the globe.BitAccess:

BitAccess offers innovative solutions for managing Bitcoin ATMs and provides numerous models to cater to client needs.Coinme:

Specializing in cryptocurrency purchases, Coinme integrates its services in retail stores, expanding ATM footprints across various markets.Coinsource:

Coinsource operates a vast network of Bitcoin ATMs, focusing on accessibility and user-friendly interfaces for customers.We're grateful to work with incredible clients.

FAQs

What is the market size of Crypto ATM?

The global Crypto ATM market is projected to reach $2.5 billion by 2033, with a CAGR of 7.2% from 2023 to 2033. This indicates robust growth driven by the increasing acceptance of cryptocurrencies worldwide.

What are the key market players or companies in the Crypto ATM industry?

Key players in the Crypto ATM industry include CoinCloud, Bitaccess, and Genesis Coin. These companies lead in technology innovation and market penetration, contributing significantly to the expansion of the Crypto ATM market.

What are the primary factors driving the growth in the Crypto ATM industry?

Key growth factors for the Crypto ATM industry include rising cryptocurrency adoption, increased awareness about digital currencies, and the convenience of access to cash-to-crypto transactions facilitated by ATMs.

Which region is the fastest Growing in the Crypto ATM market?

North America is the fastest-growing region in the Crypto ATM market, with substantial growth anticipated from $0.94 billion in 2023 to $1.92 billion by 2033, driven by favorable regulations and high cryptocurrency adoption.

Does ConsaInsights provide customized market report data for the Crypto ATM industry?

Yes, ConsaInsights offers customized market reports for the Crypto ATM industry, tailoring data and insights specific to client needs, ensuring comprehensive understanding and strategic planning.

What deliverables can I expect from this Crypto ATM market research project?

Deliverables from the Crypto ATM market research project include detailed market analysis, segmentation data, regional insights, and competitive landscape information, providing a thorough overview of industry dynamics.

What are the market trends of Crypto ATM?

Current trends in the Crypto ATM market indicate an increase in demand for two-way ATMs, with market share expected to remain at 83.04%. A shift towards more integrated service options is also noticeable.