Cryptocurrency Market Report

Published Date: 31 January 2026 | Report Code: cryptocurrency

Cryptocurrency Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the cryptocurrency market from 2023 to 2033, including market size, growth trends, regional insights, and detailed segment performance.

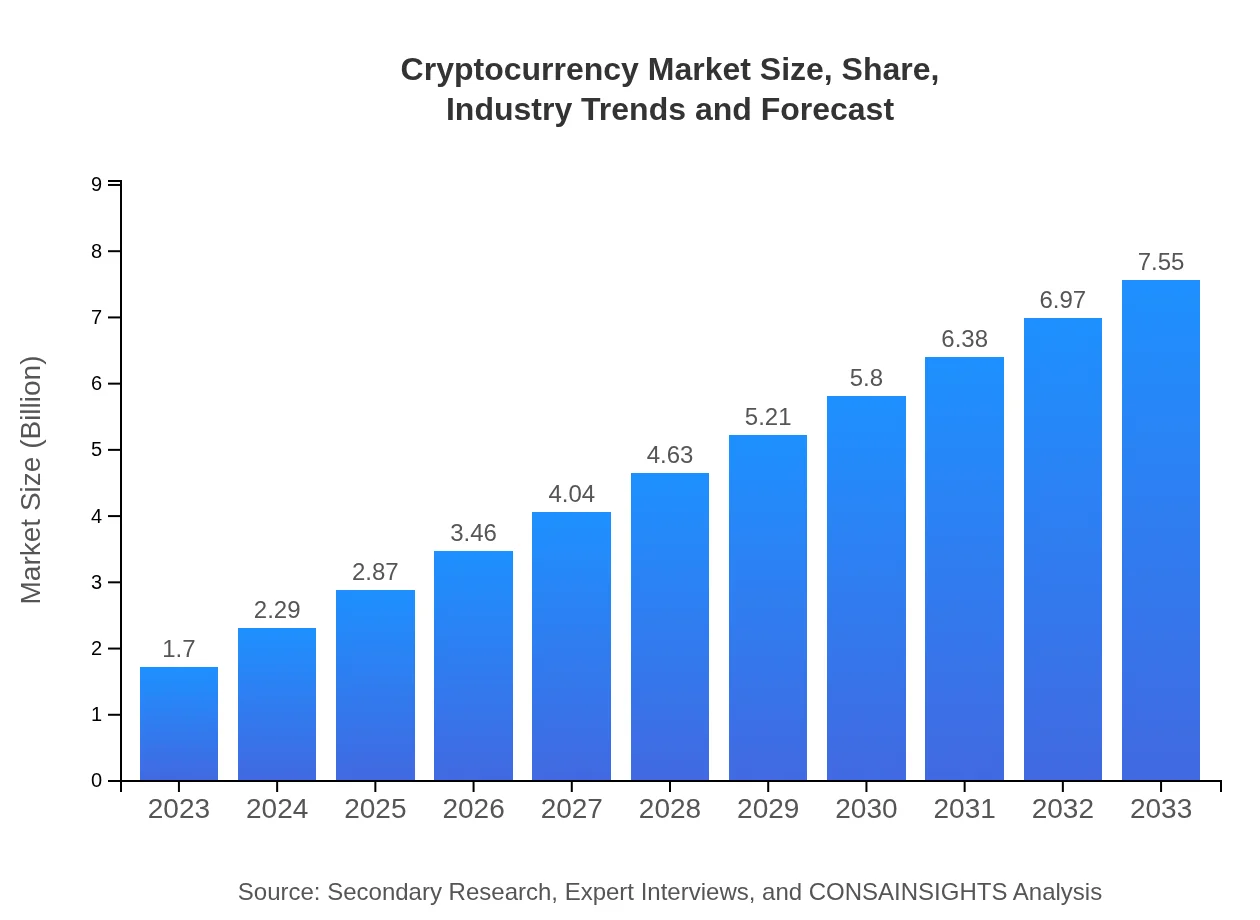

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.70 Billion |

| CAGR (2023-2033) | 15.3% |

| 2033 Market Size | $7.55 Billion |

| Top Companies | Coinbase , Binance, Ripple, Ethereum Foundation |

| Last Modified Date | 31 January 2026 |

Cryptocurrency Market Overview

Customize Cryptocurrency Market Report market research report

- ✔ Get in-depth analysis of Cryptocurrency market size, growth, and forecasts.

- ✔ Understand Cryptocurrency's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cryptocurrency

What is the Market Size & CAGR of Cryptocurrency market in 2023?

Cryptocurrency Industry Analysis

Cryptocurrency Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cryptocurrency Market Analysis Report by Region

Europe Cryptocurrency Market Report:

Europe's cryptocurrency market is also on an upward trajectory, projected to grow from $0.46 trillion in 2023 to $2.03 trillion by 2033. The regulatory framework in the EU is becoming more defined, allowing for greater security and investor confidence, thus fostering innovation within the region.Asia Pacific Cryptocurrency Market Report:

The Asia Pacific region is witnessing a robust increase in cryptocurrency adoption, with the market size growing from $0.33 trillion in 2023 to an anticipated $1.46 trillion by 2033. Countries like China, Japan, and India are at the forefront of innovative blockchain applications, further fueled by a tech-savvy population and increasing investment in fintech.North America Cryptocurrency Market Report:

North America, particularly the United States, is a significant player in the cryptocurrency market, experiencing growth from $0.64 trillion in 2023 to $2.85 trillion by 2033. Regulations are evolving favorably, and institutional investment continues to increase, making it one of the most developed cryptocurrency markets globally.South America Cryptocurrency Market Report:

In South America, the cryptocurrency market is expected to expand from $0.10 trillion in 2023 to $0.45 trillion by 2033. This growth is driven by the increasing need for financial inclusion and the utilization of cryptocurrencies as a hedge against inflation in countries like Argentina and Venezuela.Middle East & Africa Cryptocurrency Market Report:

The Middle East and Africa are showing gradual growth in the cryptocurrency sector, increasing from $0.17 trillion in 2023 to an estimated $0.76 trillion by 2033. Factors such as technological advancements, increased internet penetration, and remittance needs are driving this growth, though regulatory barriers remain a challenge.Tell us your focus area and get a customized research report.

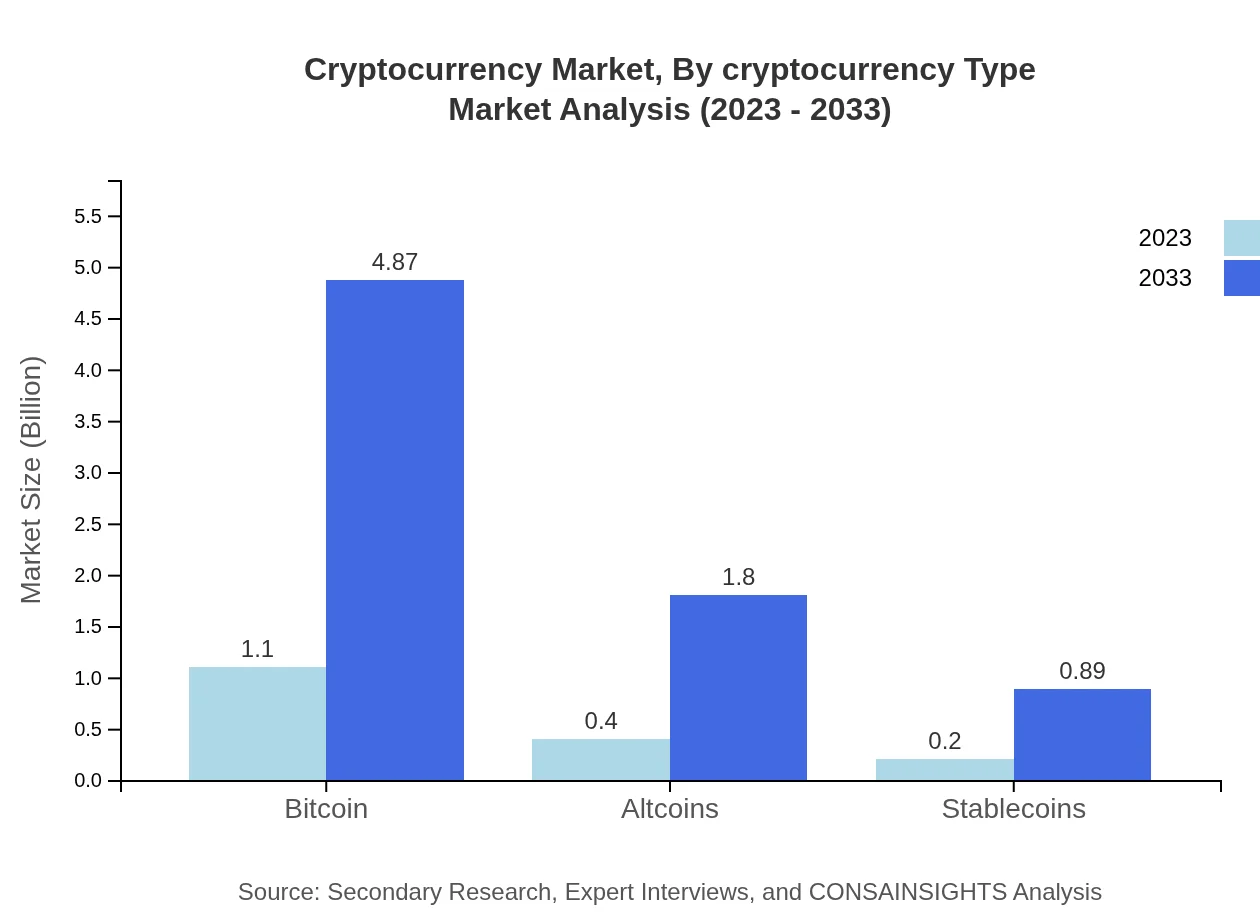

Cryptocurrency Market Analysis By Cryptocurrency Type

The market by cryptocurrency type is segmented into Bitcoin, Altcoins, and Stablecoins. Bitcoin leads with a market size growing from $1.10 trillion in 2023 to $4.87 trillion by 2033, capturing 64.47% share. Altcoins are expected to rise from $0.40 trillion to $1.80 trillion (23.8% share). Stablecoins' performance will advance from $0.20 trillion to $0.89 trillion (11.73% share).

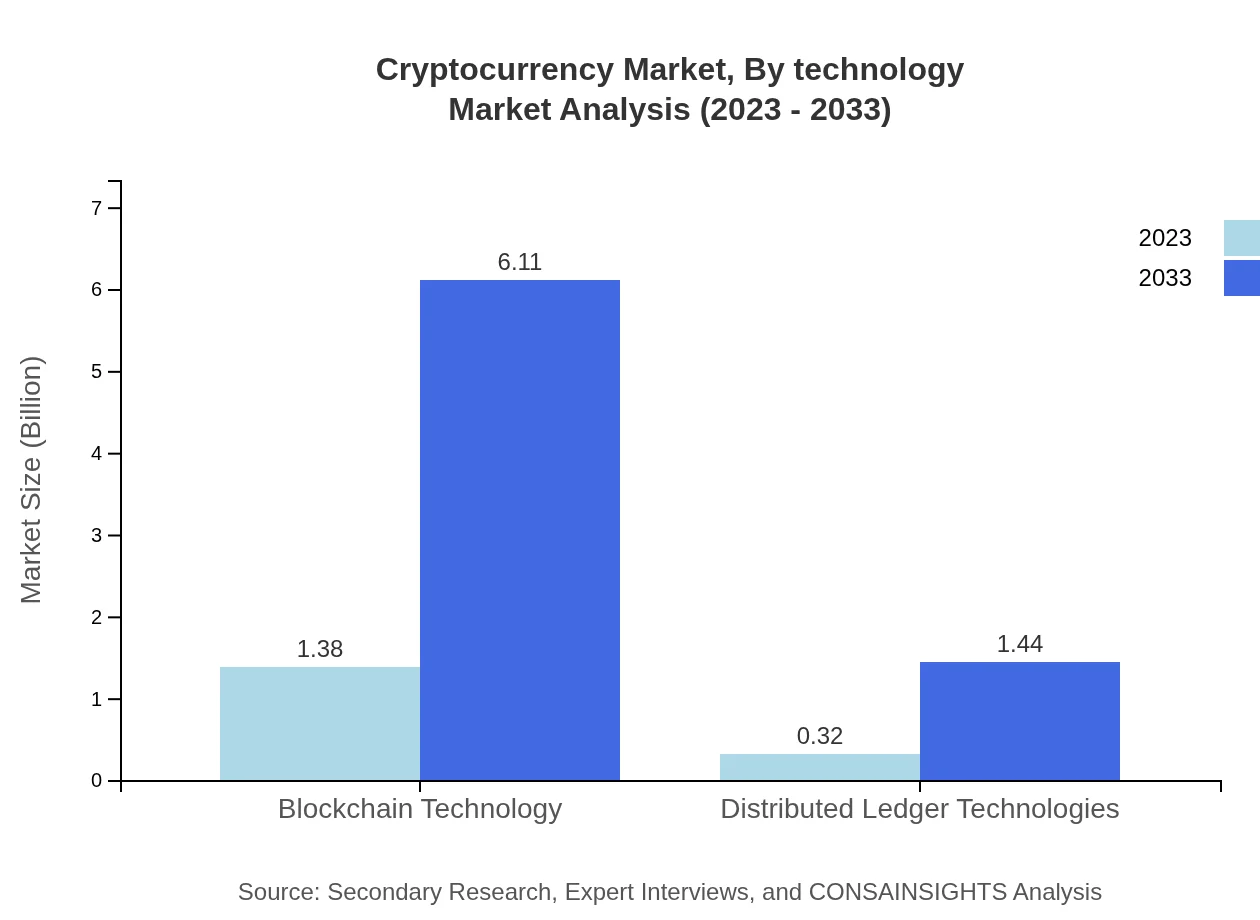

Cryptocurrency Market Analysis By Technology

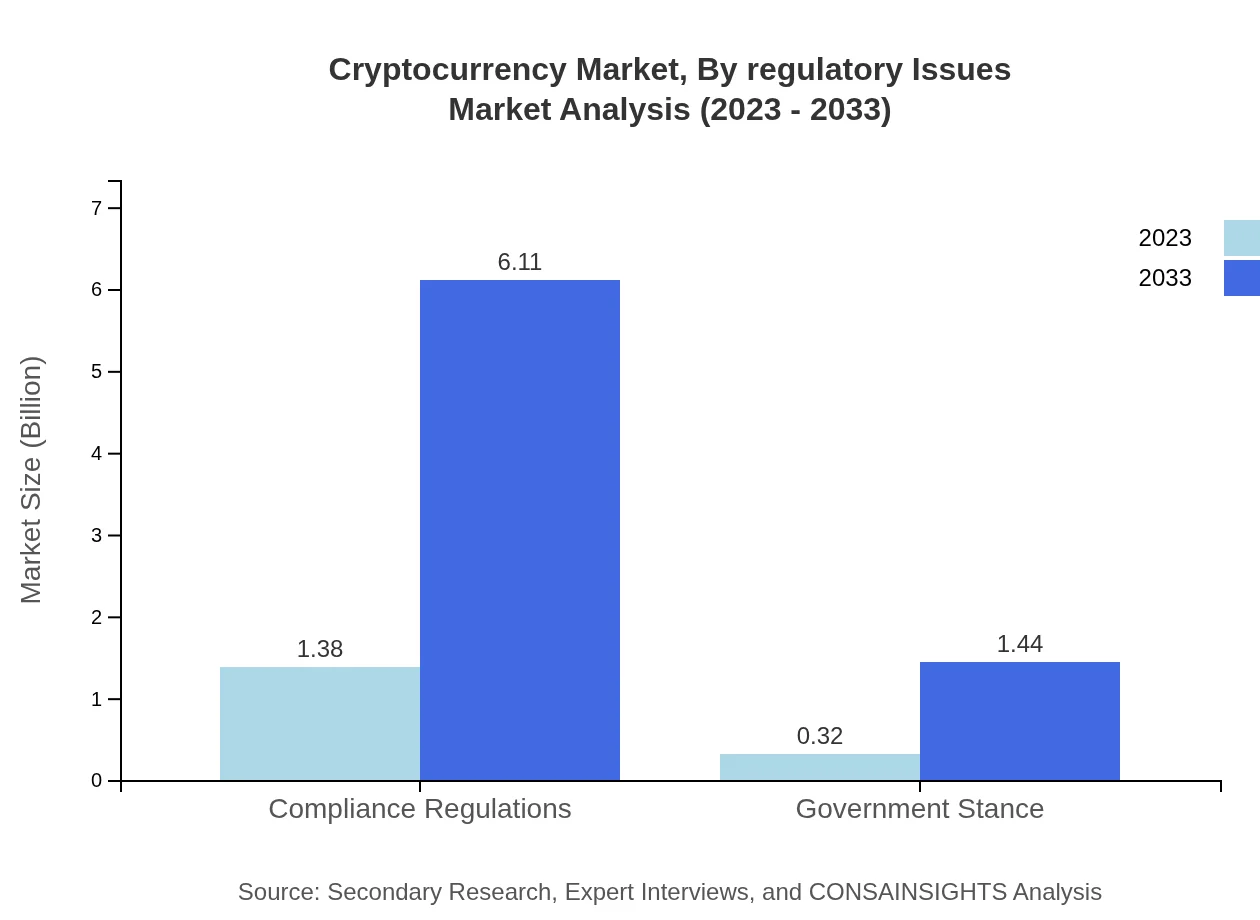

This segment includes blockchain technology, compliance regulations, and distributed ledger technologies, with blockchain leading at $1.38 trillion projected growth to $6.11 trillion by 2033 (80.9% market share). Compliance regulations similarly hold significant importance with a matching growth trajectory, while distributed ledger technologies are set to increase slowly but steadily.

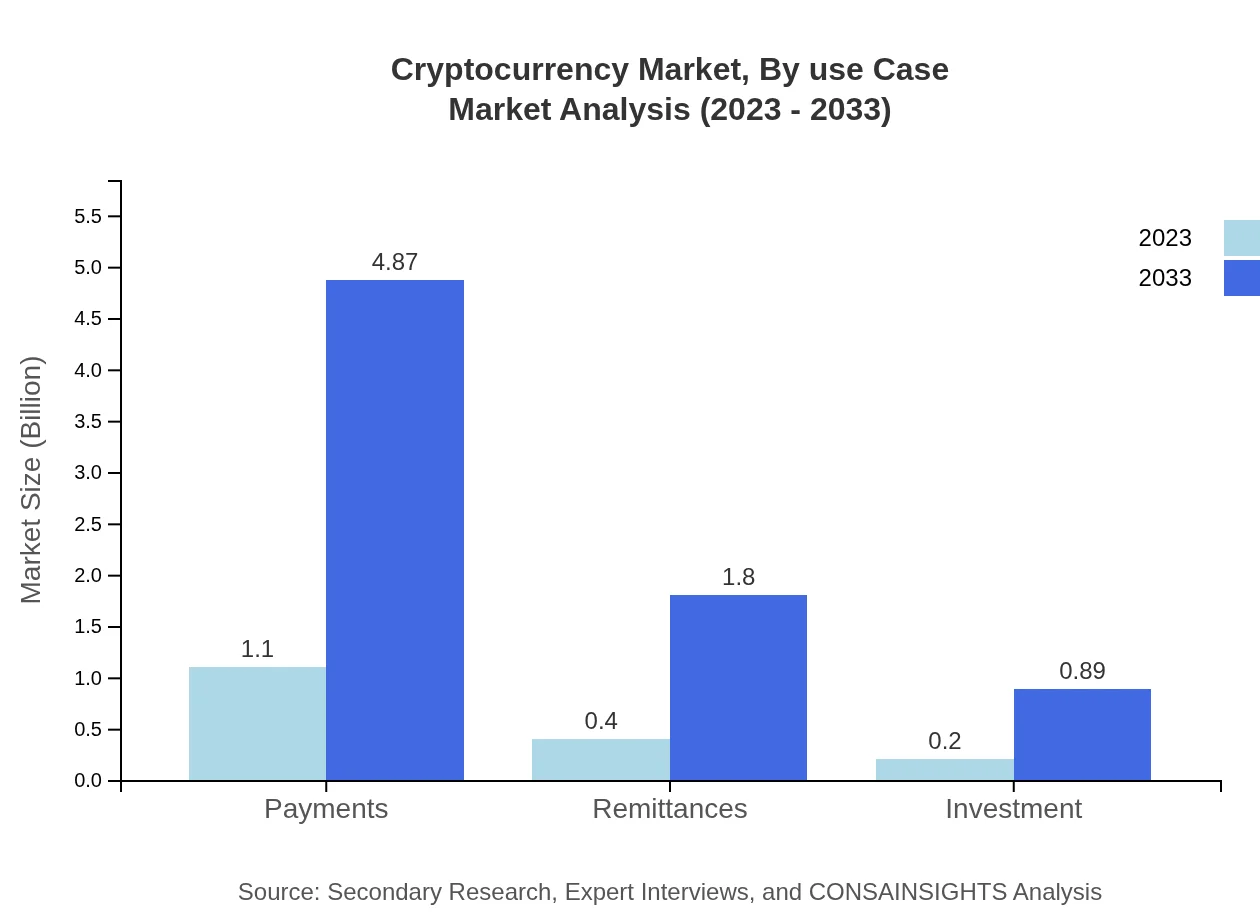

Cryptocurrency Market Analysis By Use Case

In terms of use cases, the payments segment dominates, increasing from $1.10 trillion in 2023 to $4.87 trillion by 2033 (64.47% share). Remittances will follow with a significant increase from $0.40 trillion to $1.80 trillion (23.8% share). Investment vehicles show growth potential as well, from $0.20 trillion to $0.89 trillion (11.73% share).

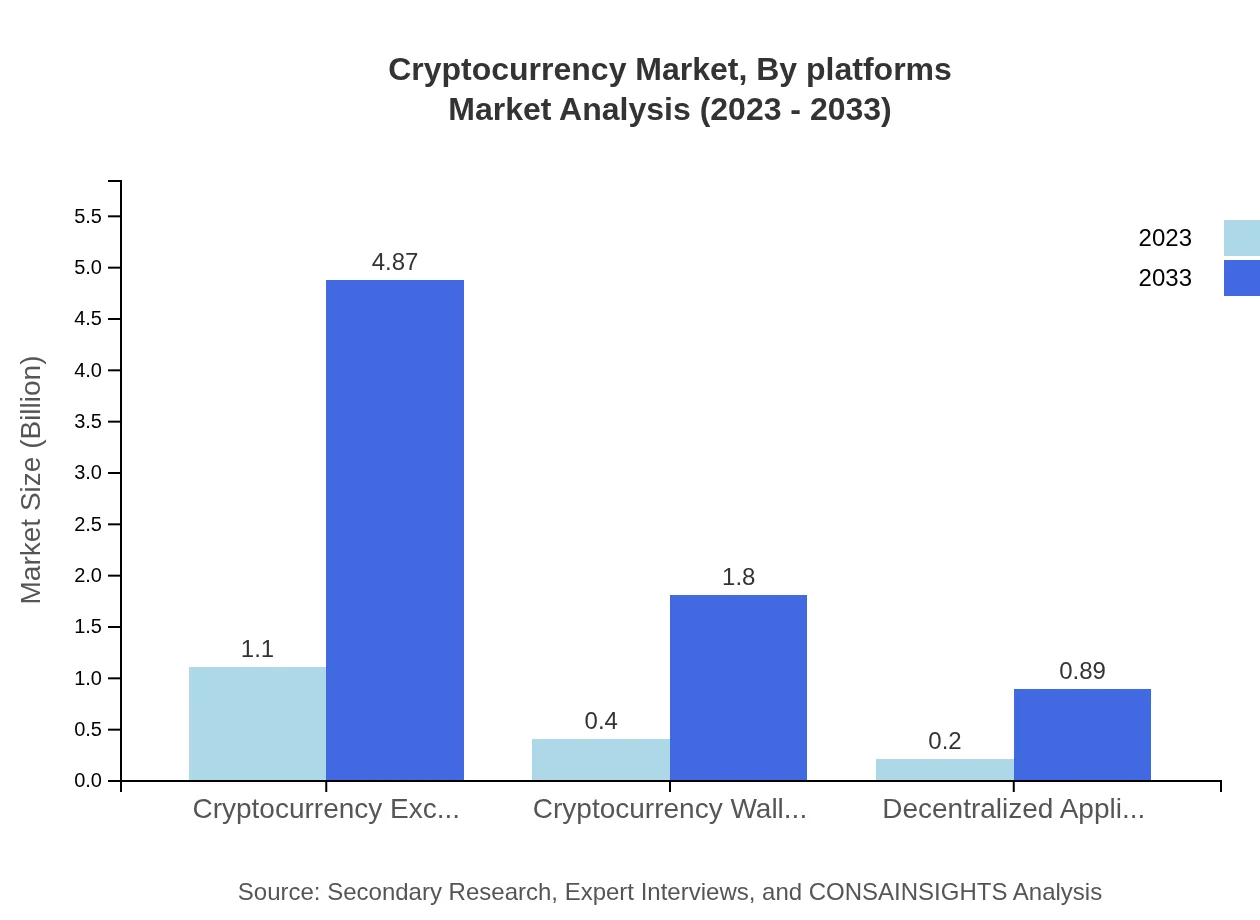

Cryptocurrency Market Analysis By Platforms

This section addresses cryptocurrency exchanges, wallets, and decentralized applications. Exchanges see a dominant role with anticipatory growth from $1.10 trillion to $4.87 trillion (64.47% share), while wallets and dApps are set for significant growth, indicating the increasing diversity in cryptocurrency utilization.

Cryptocurrency Market Analysis By Regulatory Issues

Regulatory frameworks are evolving to provide clarity in the cryptocurrency space. This aspect plays a critical role in shaping market dynamics and investor confidence. The regulatory landscape's response to concerns over security and compliance will substantially impact the growth trajectory of various segments within the cryptocurrency market.

Cryptocurrency Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cryptocurrency Industry

Coinbase :

Coinbase is one of the largest cryptocurrency exchanges in the United States, providing a platform for buying, selling, and storing various cryptocurrencies. It has played a crucial role in mainstreaming digital assets.Binance:

Binance is a leading global cryptocurrency exchange known for its extensive range of available cryptocurrencies and trading pairs. The platform's focus on innovation and user experience has secured its market dominance.Ripple:

Ripple is notable for its unique technology that facilitates cross-border payments through its digital currency, XRP. It aims to provide faster transaction speeds and lower fees compared to traditional banking systems.Ethereum Foundation:

The Ethereum Foundation supports the Ethereum network, a leading platform for decentralized applications and smart contracts. Ethereum has significantly influenced the growth of DeFi and NFTs.We're grateful to work with incredible clients.

FAQs

What is the market size of Cryptocurrency?

The cryptocurrency market was valued at approximately $1.7 billion in 2023 and is expected to grow significantly, with a projected CAGR of 15.3%, reaching an estimated size by 2033 that underscores its expanding influence.

What are the key market players or companies in the Cryptocurrency industry?

Key players in the cryptocurrency market include notable exchanges such as Binance and Coinbase, along with blockchain solutions providers like IBM and Consensys, which drive innovation and shape competitive dynamics.

What are the primary factors driving the growth in the Cryptocurrency industry?

Factors driving growth include increasing adoption of blockchain technology, rising consumer awareness, expanding retail investments, and the demand for decentralized finance solutions, all contributing to market expansion and innovation.

Which region is the fastest Growing in the Cryptocurrency market?

Asia Pacific is projected to be the fastest-growing region, with its market size expected to rise from $0.33 billion in 2023 to $1.46 billion by 2033, highlighting the region's increasing engagement in digital currencies.

Does ConsInsights provide customized market report data for the Cryptocurrency industry?

Yes, ConsInsights offers tailored market reports for the cryptocurrency industry, allowing clients to obtain specific insights that align with their strategic objectives and market understanding.

What deliverables can I expect from this Cryptocurrency market research project?

Clients can expect comprehensive reports, detailed market analysis, segmentation data, competitive landscape assessments, and future trends, ensuring a thorough understanding of the cryptocurrency market dynamics.

What are the market trends of Cryptocurrency?

Current trends include the rise of decentralized finance (DeFi), increased investments in blockchain technology, regulatory developments affecting market structures, and the growing popularity of stablecoins among investors.