Currency Exchange Software Market Report

Published Date: 31 January 2026 | Report Code: currency-exchange-software

Currency Exchange Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Currency Exchange Software market from 2023 to 2033, highlighting key metrics such as market size, growth potential, technological advances, and regional dynamics.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

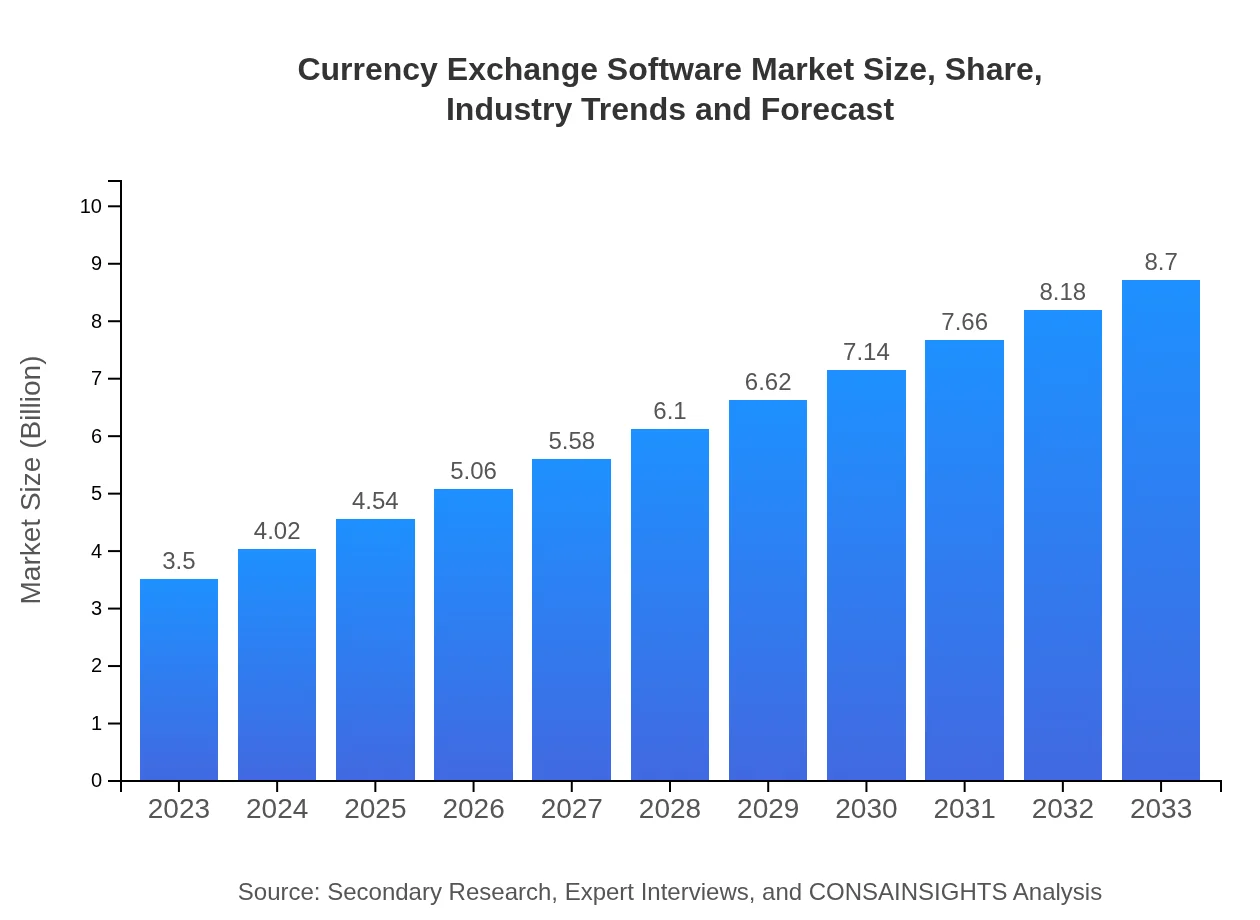

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $8.70 Billion |

| Top Companies | MetaTrader, OANDA Corporation, TransferWise (now Wise), Revolut, PayPal |

| Last Modified Date | 31 January 2026 |

Currency Exchange Software Market Overview

Customize Currency Exchange Software Market Report market research report

- ✔ Get in-depth analysis of Currency Exchange Software market size, growth, and forecasts.

- ✔ Understand Currency Exchange Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Currency Exchange Software

What is the Market Size & CAGR of Currency Exchange Software market in 2023?

Currency Exchange Software Industry Analysis

Currency Exchange Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Currency Exchange Software Market Analysis Report by Region

Europe Currency Exchange Software Market Report:

Europe's market will expand from $1.02 billion in 2023 to $2.54 billion by 2033. Increased regulatory scrutiny and investments in secure, compliant financial technologies will propel acceptance and integration of Currency Exchange Software in the region.Asia Pacific Currency Exchange Software Market Report:

In the Asia Pacific region, the market is projected to grow from $0.77 billion in 2023 to $1.91 billion by 2033. The rapid growth of fintech and e-commerce sectors in countries like China and India drives this expansion, enabling more businesses and consumers to access digital currency solutions.North America Currency Exchange Software Market Report:

North America leads the market with a projected growth from $1.16 billion in 2023 to $2.88 billion in 2033. The presence of key market players, increasing mobile payment usage, and demand for robust financial solutions contribute significantly to the region's growth.South America Currency Exchange Software Market Report:

The South American market is expected to increase from $0.09 billion in 2023 to $0.21 billion by 2033. Economic recovery and financial inclusion initiatives across the region will enhance the adoption of Currency Exchange Software among businesses and individuals.Middle East & Africa Currency Exchange Software Market Report:

The Middle East and Africa market is anticipated to grow from $0.47 billion in 2023 to $1.16 billion by 2033. Factors such as rising foreign investment, increased remittances, and expanding economic activities will enhance demand for advanced currency exchange solutions.Tell us your focus area and get a customized research report.

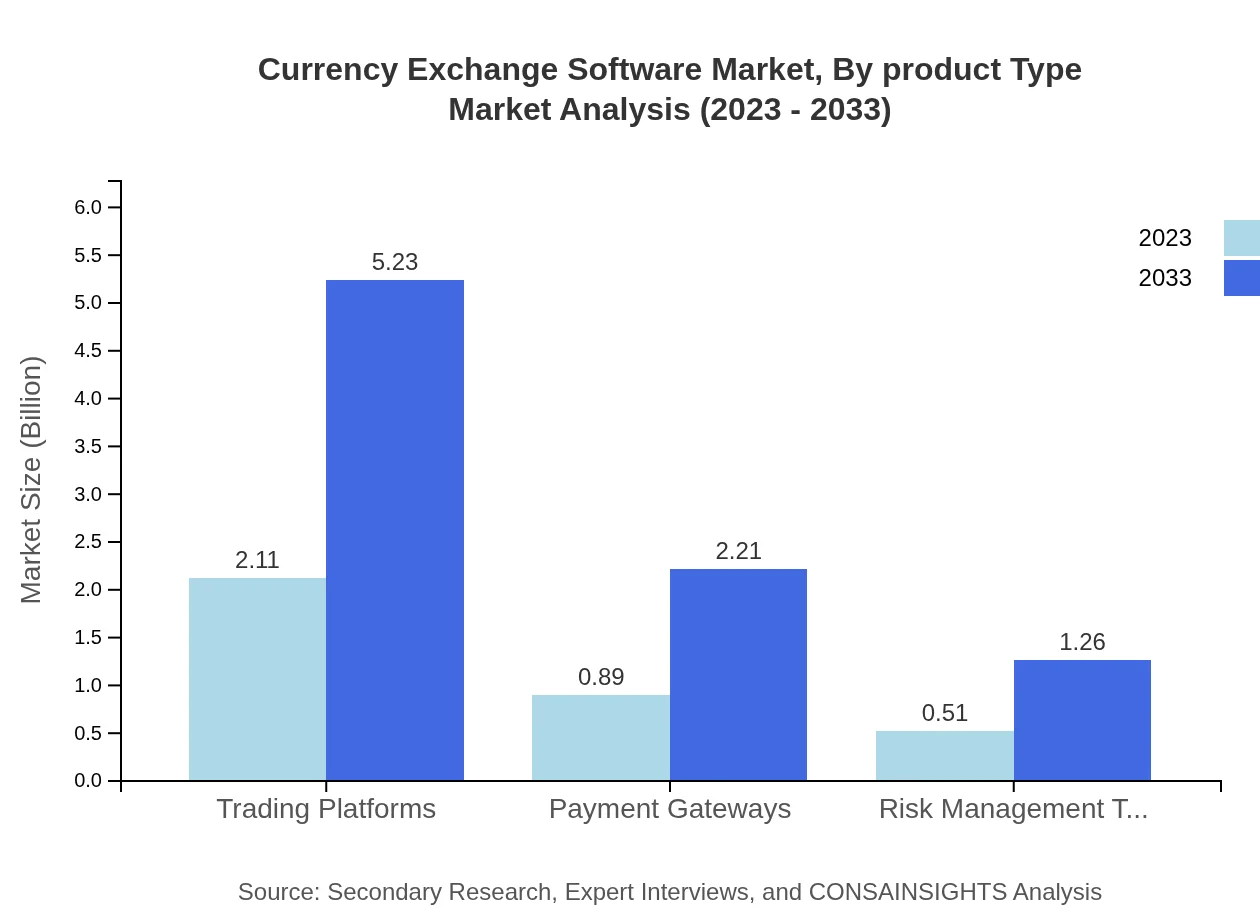

Currency Exchange Software Market Analysis By Product Type

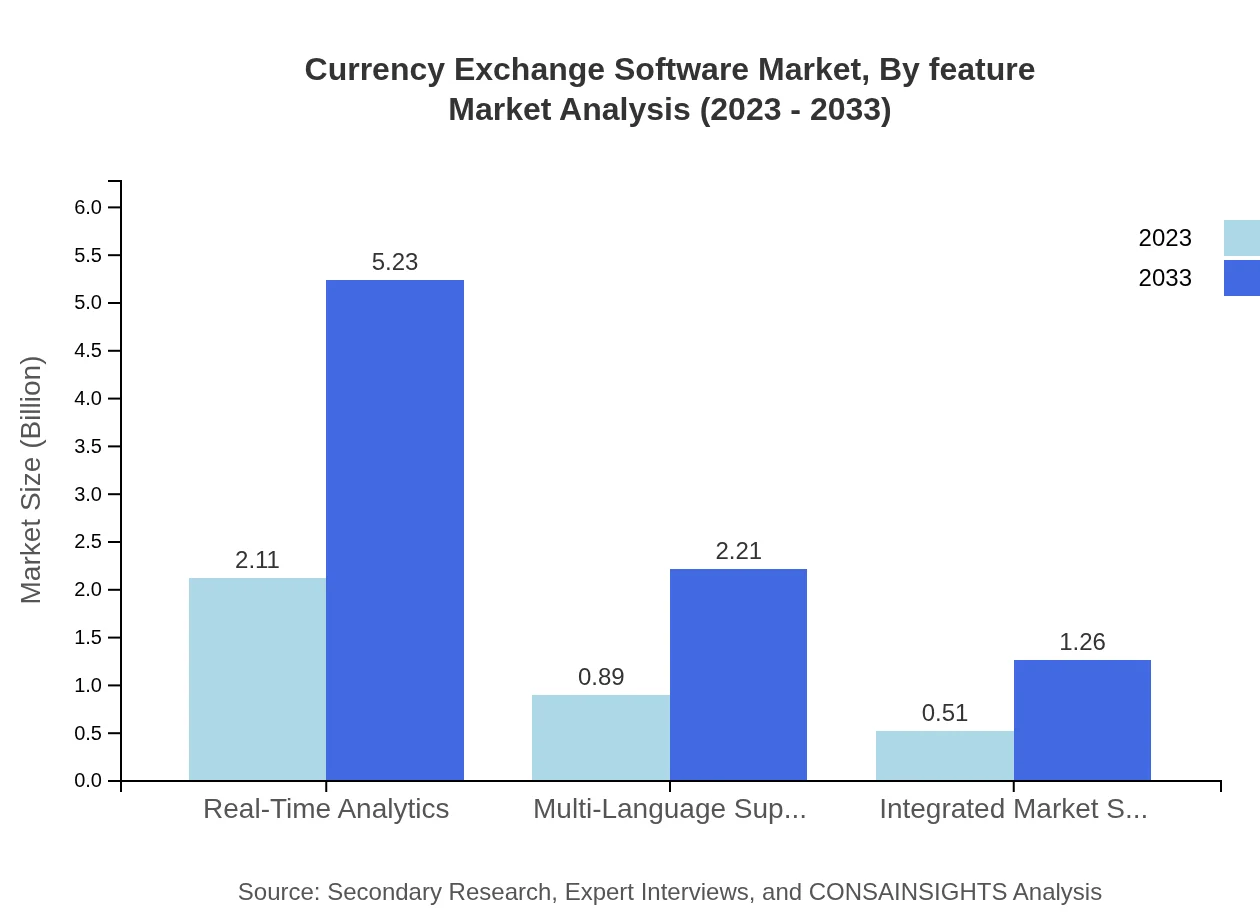

The Currency Exchange Software market by product type showcases diverse solutions: Real-Time Analytics, valued at $2.11 billion in 2023 (60.18% share) and projected to reach $5.23 billion by 2033; Multi-Language Support, growing from $0.89 billion (25.36%) in 2023 to $2.21 billion; and Integrated Market Surveillance from $0.51 billion (14.46%) to $1.26 billion. Each product type addresses specific user demands, reflecting trends toward comprehensive financial management tools.

Currency Exchange Software Market Analysis By Application

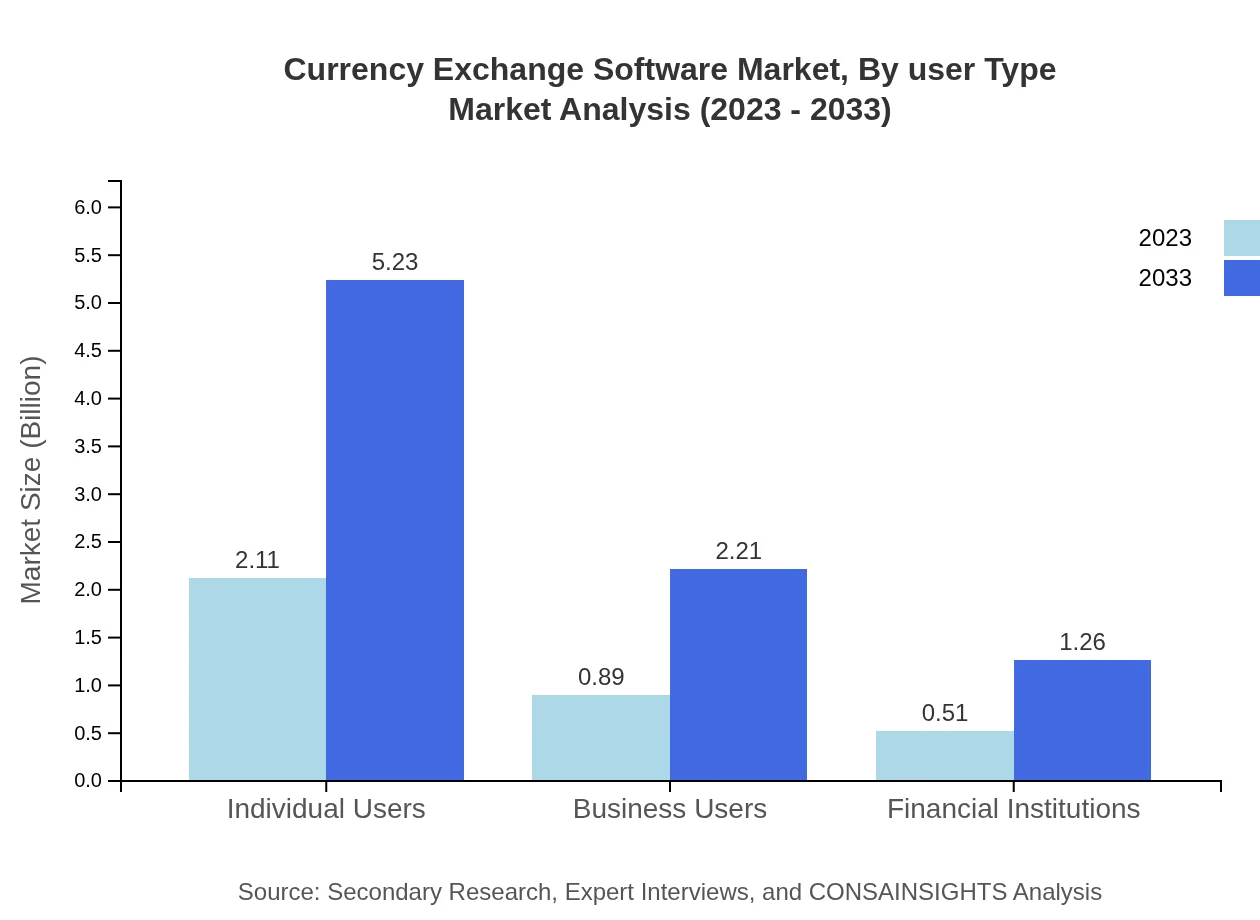

In the application segment, Individual Users dominate the market with a size of $2.11 billion (60.18%) in 2023, growing to $5.23 billion by 2033. Business Users represent a market of $0.89 billion (25.36%), with forecasts indicating an increase to $2.21 billion. Financial Institutions contribute $0.51 billion (14.46%), expected to grow to $1.26 billion. Each segment reflects evolving financial needs, particularly among individual traders and corporate entities.

Currency Exchange Software Market Analysis By Deployment Model

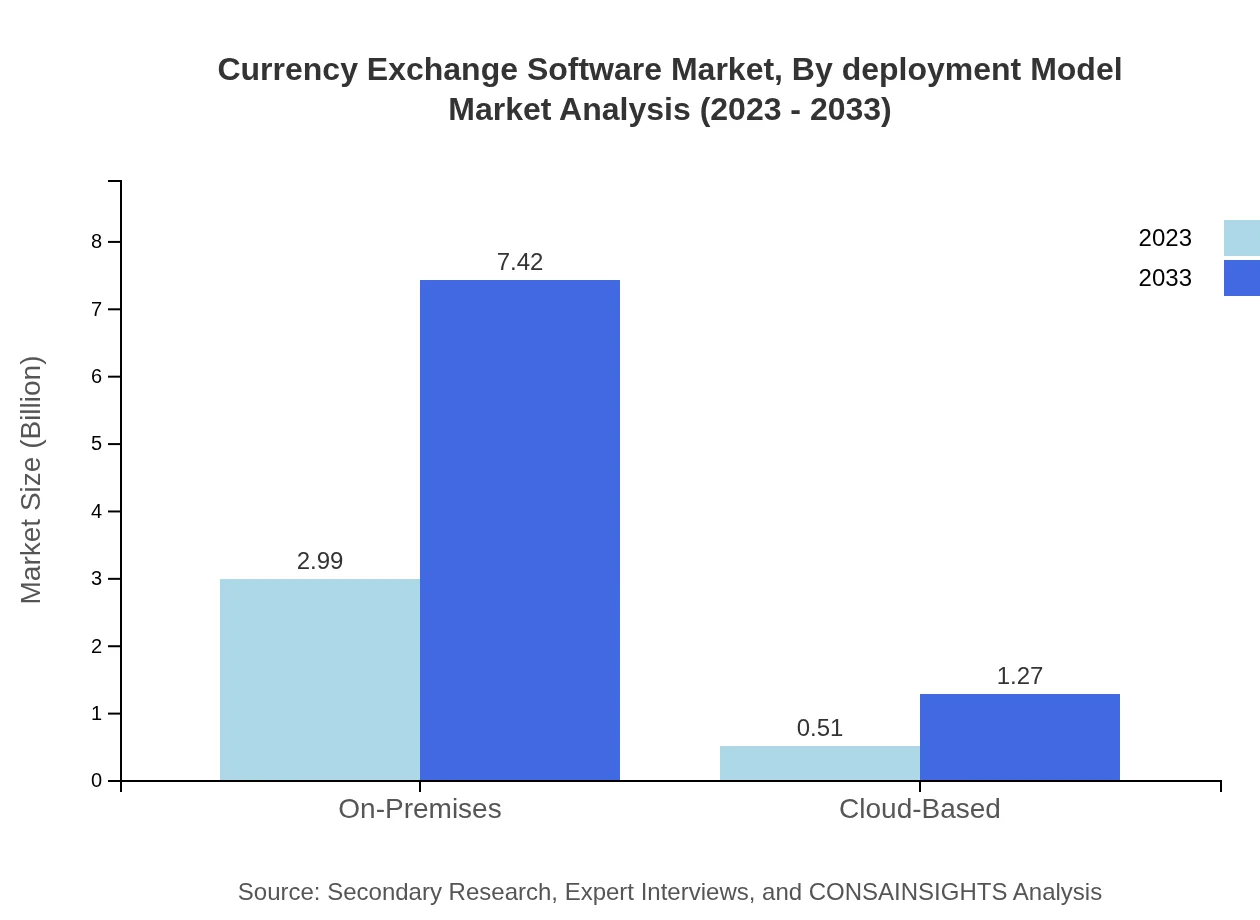

The deployment model analysis reveals that On-Premises solutions lead with a substantial share of $2.99 billion (85.35%) in 2023, expected to rise to $7.42 billion. Conversely, Cloud-Based solutions, having $0.51 billion (14.65%) in 2023, will grow to $1.27 billion. The strong preference for On-Premises software indicates high security and control, while increasing cloud adoption reflects convenience and scalability needs.

Currency Exchange Software Market Analysis By User Type

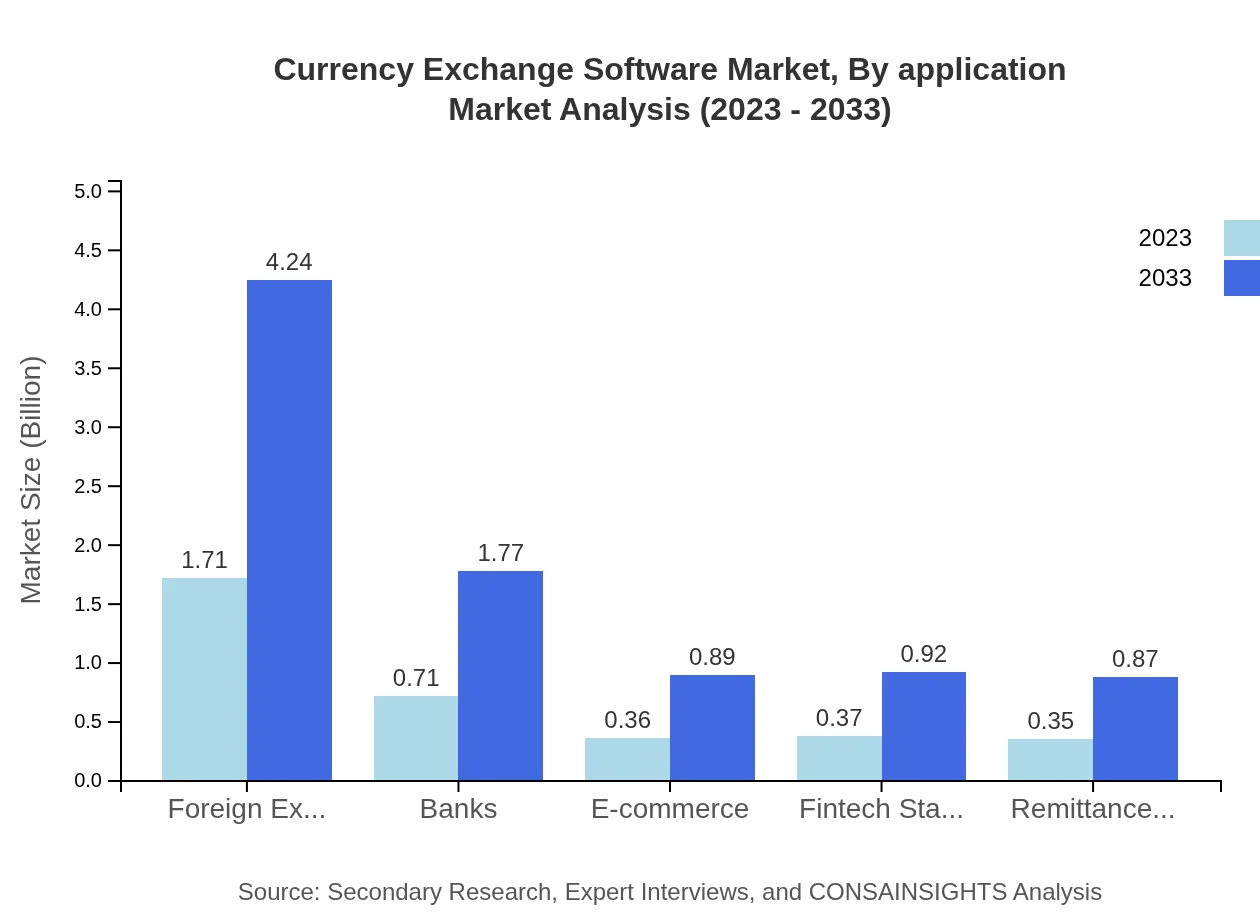

By user type, Foreign Exchange Brokers occupy a significant position with $1.71 billion (48.77%) in 2023, scaling to $4.24 billion by 2033. Traditional Banks currently value at $0.71 billion (20.37%), forecasted to reach $1.77 billion. E-commerce and Fintech start-ups contribute to market diversity, indicating that software solutions cater to multiple user needs for currency management.

Currency Exchange Software Market Analysis By Feature

The market's key features include Risk Management Tools, valued at $0.51 billion (14.46%) in 2023 and projected to grow to $1.26 billion, alongside Trading Platforms with $2.11 billion (60.18%), also forecasted to reach $5.23 billion. Payment Gateways and Multi-Language Support are crucial, reflecting user demand for functional and user-friendly currency exchange technologies.

Currency Exchange Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Currency Exchange Software Industry

MetaTrader:

MetaTrader offers sophisticated trading platforms widely used by Forex traders with powerful analysis tools and real-time execution capabilities.OANDA Corporation:

OANDA provides innovative currency exchange tools and solutions, emphasizing high-quality data processing, compliance and user-friendly interfaces.TransferWise (now Wise):

Wise focuses on transparency and reduced expenses in international transfers, providing consumers with competitive exchange rates.Revolut:

Revolut is a fintech startup known for its multi-currency account services, appealing to users who demand versatility in currency management.PayPal:

PayPal is a leading online payment system that allows users to send and receive money internationally, featuring currency conversion functionalities.We're grateful to work with incredible clients.

FAQs

What is the market size of Currency Exchange Software?

The global market size for Currency Exchange Software reached approximately $3.5 billion in 2023 and is projected to grow at a CAGR of 9.2%, indicating significant expansion opportunities through 2033.

What are the key market players or companies in the Currency Exchange Software industry?

Key players in the Currency Exchange Software market include well-established software providers, fintech startups, and large banks, all of whom are leveraging technology to enhance trading platforms and improve customer experiences.

What are the primary factors driving the growth in the Currency Exchange Software industry?

The growth in the Currency Exchange Software industry is primarily driven by increasing globalization, advancements in payment technologies, the rise in digital transactions, and the demand for real-time analytics and multi-language support.

Which region is the fastest Growing in the Currency Exchange Software?

The fastest-growing region for Currency Exchange Software from 2023 to 2033 is projected to be Europe, with market growth increasing from $1.02 billion to $2.54 billion, showcasing a significant opportunity for technology adoption.

Does ConsaInsights provide customized market report data for the Currency Exchange Software industry?

Yes, ConsaInsights offers customizable market report data for the Currency Exchange Software industry, allowing clients to tailor research data according to specific needs and regional insights.

What deliverables can I expect from this Currency Exchange Software market research project?

Deliverables from the Currency Exchange Software market research project include comprehensive market analysis reports, regional breakdowns, competitive intelligence, and insights on market trends, drivers, and future forecasts.

What are the market trends of Currency Exchange Software?

Current trends in the Currency Exchange Software market include a shift towards cloud-based solutions, an emphasis on integrated market surveillance, and innovations in risk management tools to enhance operational efficiency.