Cutting Tools Market Report

Published Date: 22 January 2026 | Report Code: cutting-tools

Cutting Tools Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a comprehensive analysis of the Cutting Tools sector, examining current trends, market size, and growth forecasts from 2023 to 2033. Key insights into regional performances, segmentation, and leading market players are included to guide stakeholders.

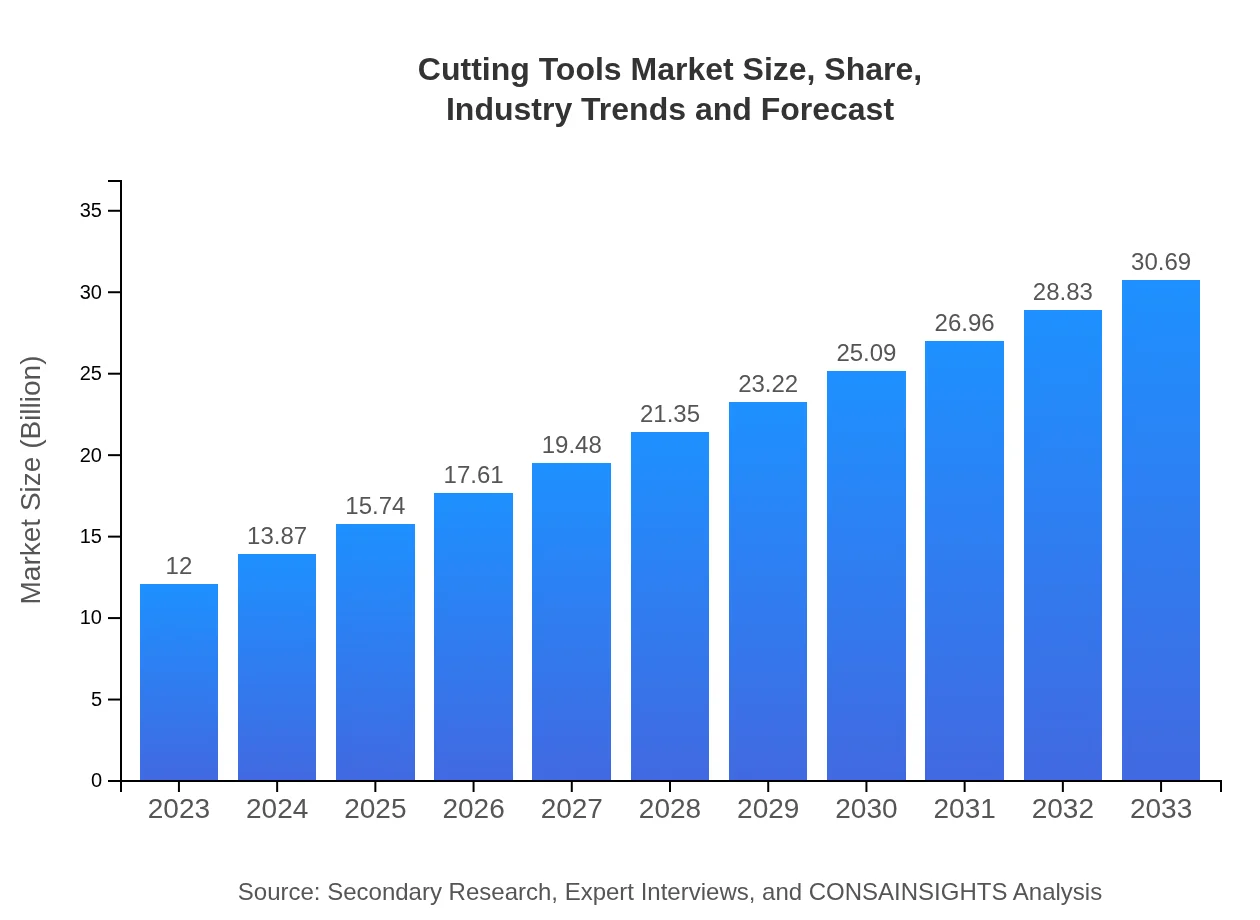

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.00 Billion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $30.69 Billion |

| Top Companies | Kennametal Inc., Sandvik Coromant, Caterpillar Inc., Gühring KG |

| Last Modified Date | 22 January 2026 |

Cutting Tools Market Overview

Customize Cutting Tools Market Report market research report

- ✔ Get in-depth analysis of Cutting Tools market size, growth, and forecasts.

- ✔ Understand Cutting Tools's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cutting Tools

What is the Market Size & CAGR of Cutting Tools market in 2023?

Cutting Tools Industry Analysis

Cutting Tools Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cutting Tools Market Analysis Report by Region

Europe Cutting Tools Market Report:

The European Cutting Tools market is expected to expand from $3.67 billion in 2023 to $9.39 billion by 2033. The region is known for its advanced manufacturing technologies and robust automotive industry, which contribute to rising demand for precision cutting tools.Asia Pacific Cutting Tools Market Report:

In the Asia Pacific region, the Cutting Tools market is projected to grow from $2.09 billion in 2023 to $5.35 billion by 2033. This growth is driven by rapid industrialization, especially in countries like China and India, and an increasing focus on energy-efficient manufacturing practices.North America Cutting Tools Market Report:

North America, with a market size of $4.45 billion in 2023, is projected to grow to $11.39 billion by 2033. The region benefits from a well-established manufacturing base and significant investment in technological innovations, particularly in the automotive and aerospace sectors.South America Cutting Tools Market Report:

The South American market for Cutting Tools, valued at $0.19 billion in 2023, is expected to increase to $0.50 billion by 2033. This growth is supported by the expansion of mining and agricultural machinery, which drives demand for efficient cutting solutions.Middle East & Africa Cutting Tools Market Report:

In the Middle East and Africa, the Cutting Tools market is anticipated to grow from $1.59 billion in 2023 to $4.06 billion by 2033. The growth is bolstered by the expansion of the oil and gas sector and infrastructure development projects across the region.Tell us your focus area and get a customized research report.

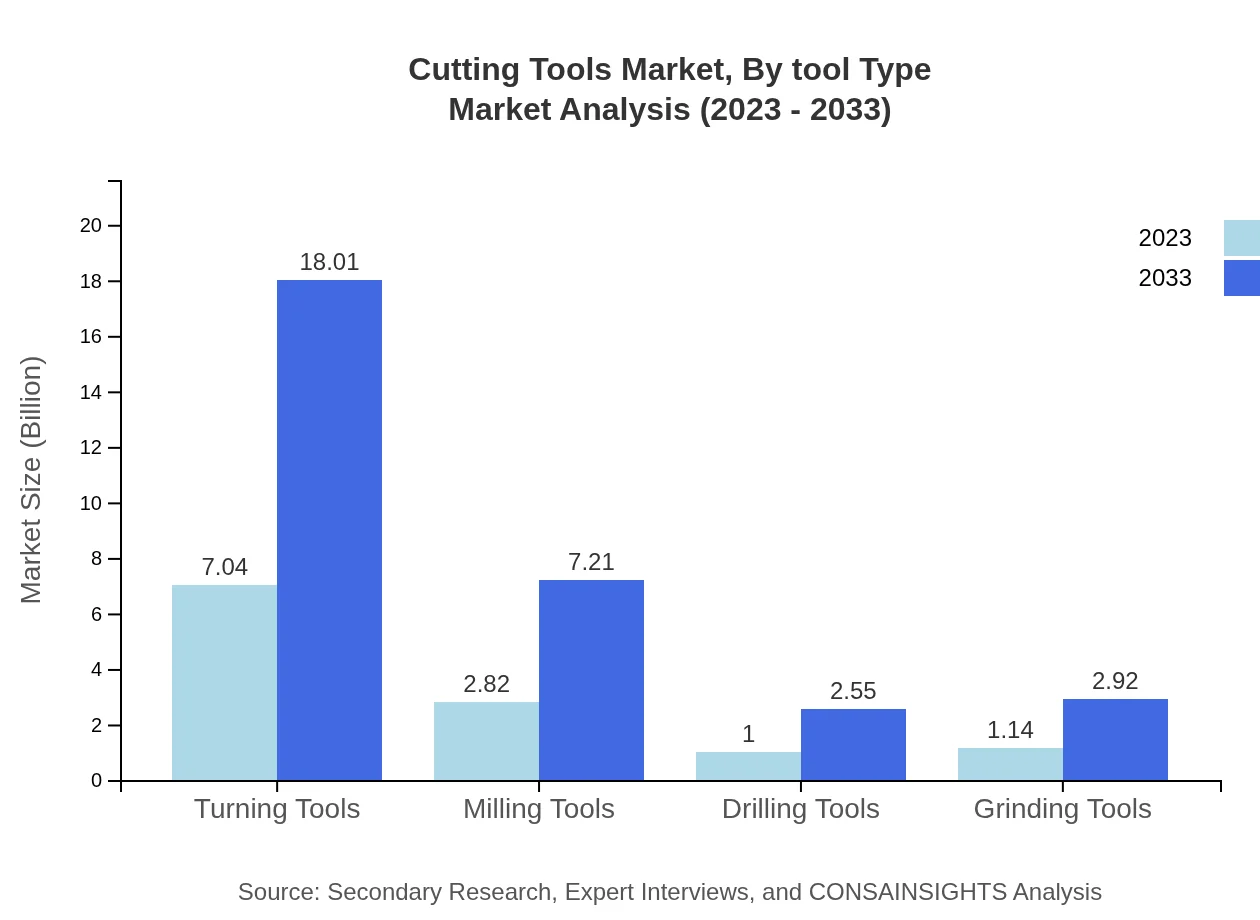

Cutting Tools Market Analysis By Tool Type

Turning tools currently hold a significant market share at 58.69% and are valued at $7.04 billion in 2023, expected to grow to $18.01 billion by 2033. Milling tools account for 23.49% of the market share, with revenues of $2.82 billion in 2023, predicted to rise to $7.21 billion by 2033. Drilling and grinding tools, while smaller segments, show anticipated growth, emphasizing the diversity in cutting tool functions and applications.

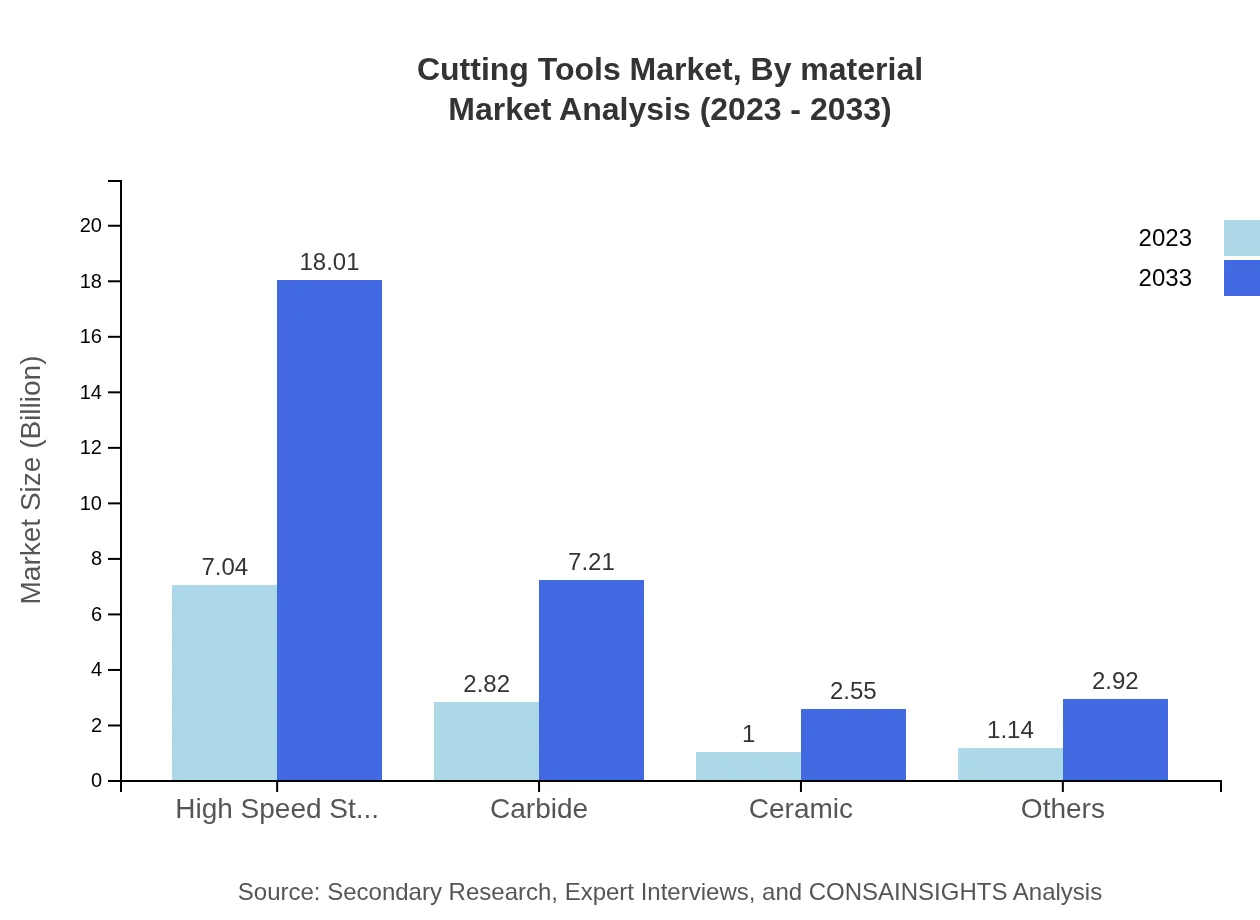

Cutting Tools Market Analysis By Material

High-Speed Steel (HSS) dominates the market with a size of $7.04 billion in 2023, expected to reach $18.01 billion by 2033. This material accounts for 58.69% of the market share. Carbide cutting tools, valued at $2.82 billion in 2023, will grow to $7.21 billion, reflecting 23.49% of the market share. Ceramic and other materials also play critical roles, especially in contexts demanding high heat resistance and durability.

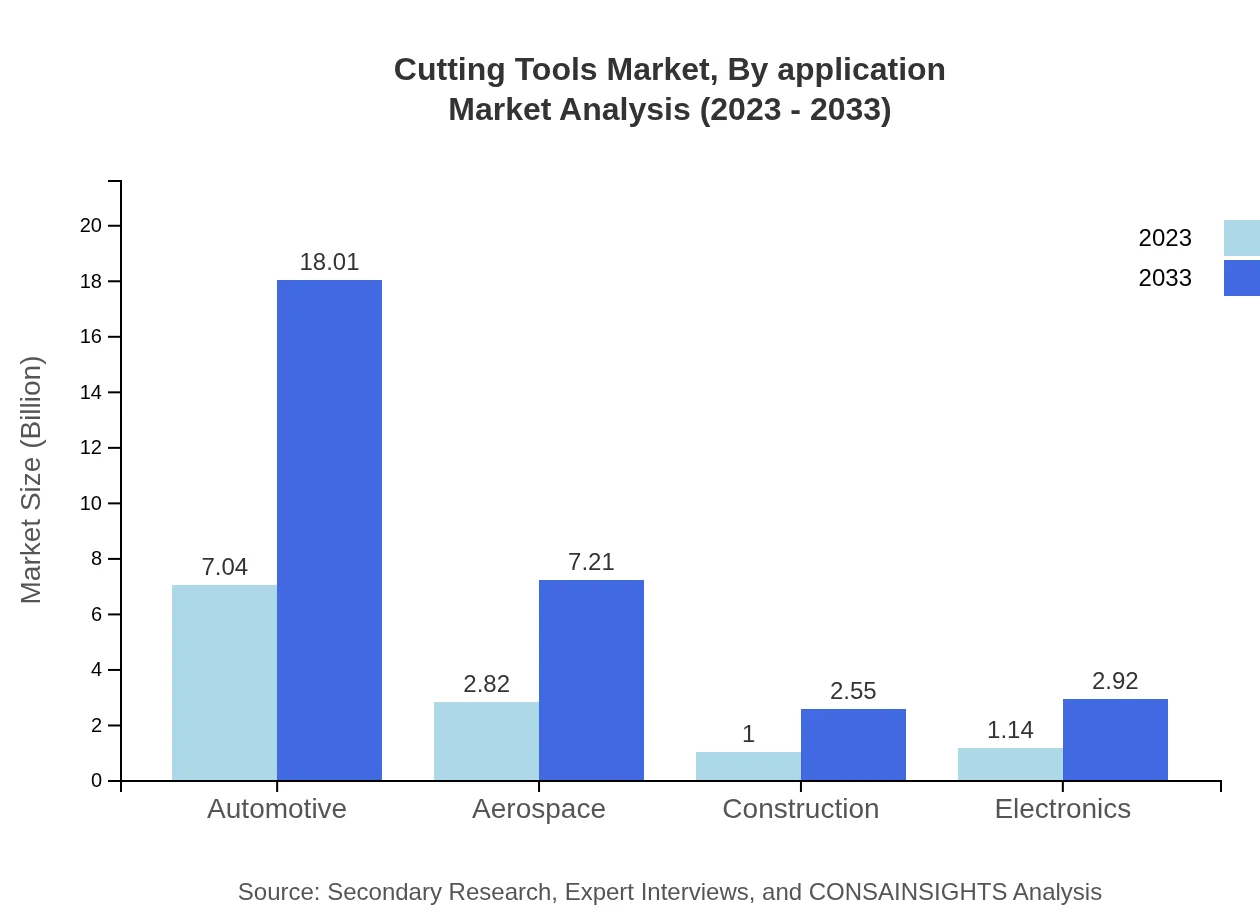

Cutting Tools Market Analysis By Application

The automotive sector leads the Cutting Tools market, holding 58.69% market share, with a value of $7.04 billion in 2023, projected to grow to $18.01 billion by 2033. Aerospace and manufacturing applications are substantial as well, indicating the vital role cutting tools play in various high-precision industries. This segmentation highlights the interdependence of industries on efficient cutting technology.

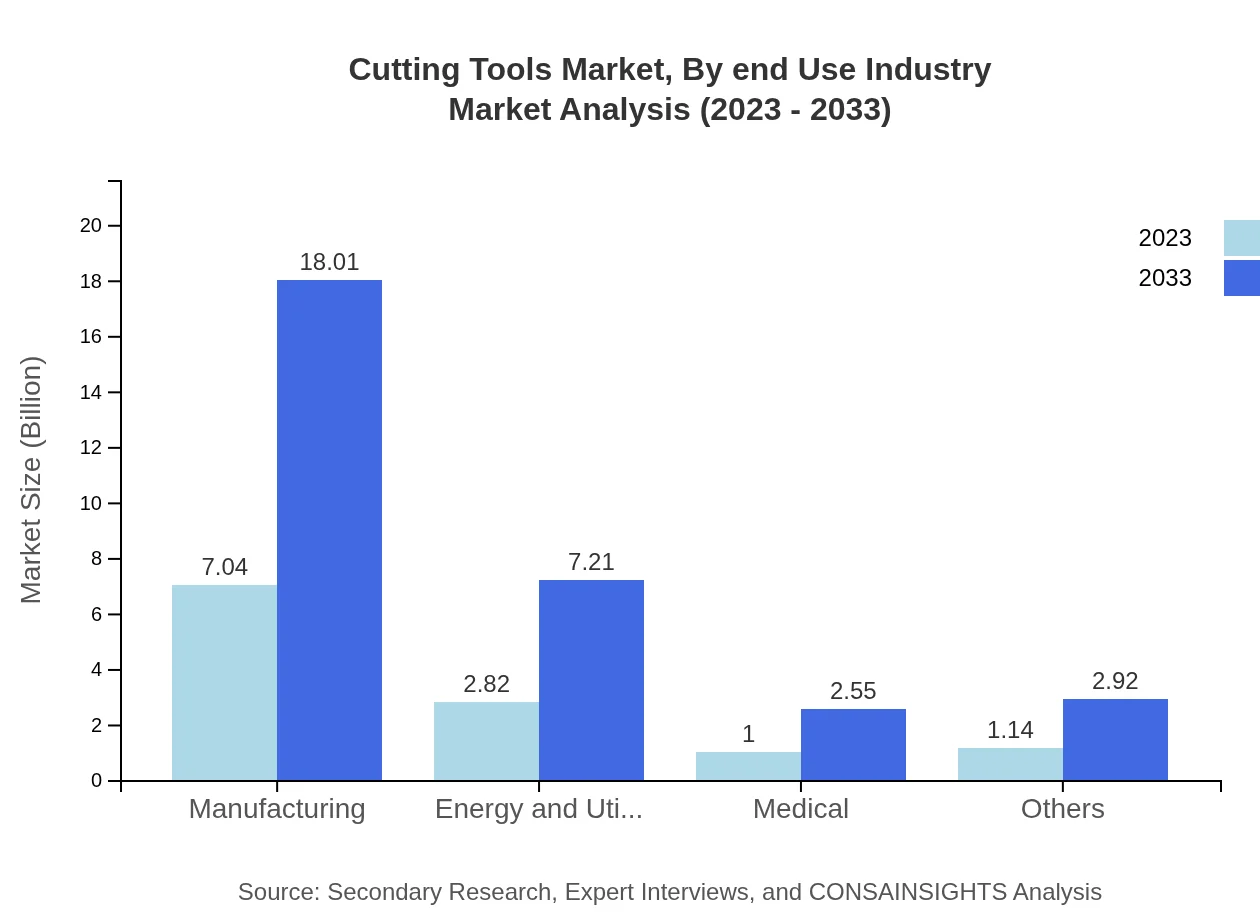

Cutting Tools Market Analysis By End Use Industry

The cutting tools used in energy and utilities are witnessing a growth trajectory, with a projected increase from $2.82 billion in 2023 to $7.21 billion by 2033. Other industries such as electronics, construction, and medical are also significant contributors, showcasing diverse application scopes and the necessity of innovation across sectors.

Cutting Tools Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cutting Tools Industry

Kennametal Inc.:

A leading manufacturer of metalworking tools known for its advanced technology and innovation in cutting tool solutions aimed at improving productivity and efficiency.Sandvik Coromant:

A global leader in metal cutting, Sandvik Coromant provides tools and knowledge that enhance productivity within machining processes worldwide.Caterpillar Inc.:

Caterpillar is not only known for heavy machinery but also provides cutting tools tailored for mining and construction, ensuring high performance in rugged conditions.Gühring KG:

Specializing in cutting tools, Gühring KG promotes innovative custom solutions and is recognized for its precision in the aerospace and automotive industries.We're grateful to work with incredible clients.

FAQs

What is the market size of cutting Tools?

The global cutting-tools market was valued at approximately $12 billion in 2023 and is anticipated to reach significant growth by 2033, with a CAGR of 9.5% over the forecast period.

What are the key market players or companies in the cutting Tools industry?

Key players in the cutting-tools industry include Sandvik, Kennametal, Seco Tools, and Walter AG, which dominate market share through innovation and technology in manufacturing high-quality cutting tools.

What are the primary factors driving the growth in the cutting Tools industry?

The growth in the cutting-tools industry is primarily driven by increasing demand in the automotive and aerospace sectors, advancements in manufacturing technologies, and higher production efficiency requirements.

Which region is the fastest Growing in the cutting Tools market?

The Asia-Pacific region is the fastest-growing market for cutting-tools, projected to grow from $2.09 billion in 2023 to $5.35 billion by 2033, reflecting strong industrial growth in countries like China and India.

Does ConsaInsights provide customized market report data for the cutting Tools industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the cutting-tools industry, allowing clients to gain insights relevant to their business strategies.

What deliverables can I expect from this cutting Tools market research project?

Deliverables from the cutting-tools market research project include comprehensive market analysis reports, segmentation insights, competitive landscape assessments, and forecasts tailored to client specifications.

What are the market trends of cutting Tools?

Current market trends in the cutting-tools sector include a shift towards sustainability, increased automation in manufacturing processes, and the rising use of advanced materials like ceramic and carbide in tool production.