Cyanate Ester Resins Market Report

Published Date: 02 February 2026 | Report Code: cyanate-ester-resins

Cyanate Ester Resins Market Size, Share, Industry Trends and Forecast to 2033

This market report provides an extensive analysis of the Cyanate Ester Resins market, focusing on trends, growth forecasts, and regional insights from 2023 to 2033. It aims to offer stakeholders comprehensive insights into current market conditions, technologies, and market leaders.

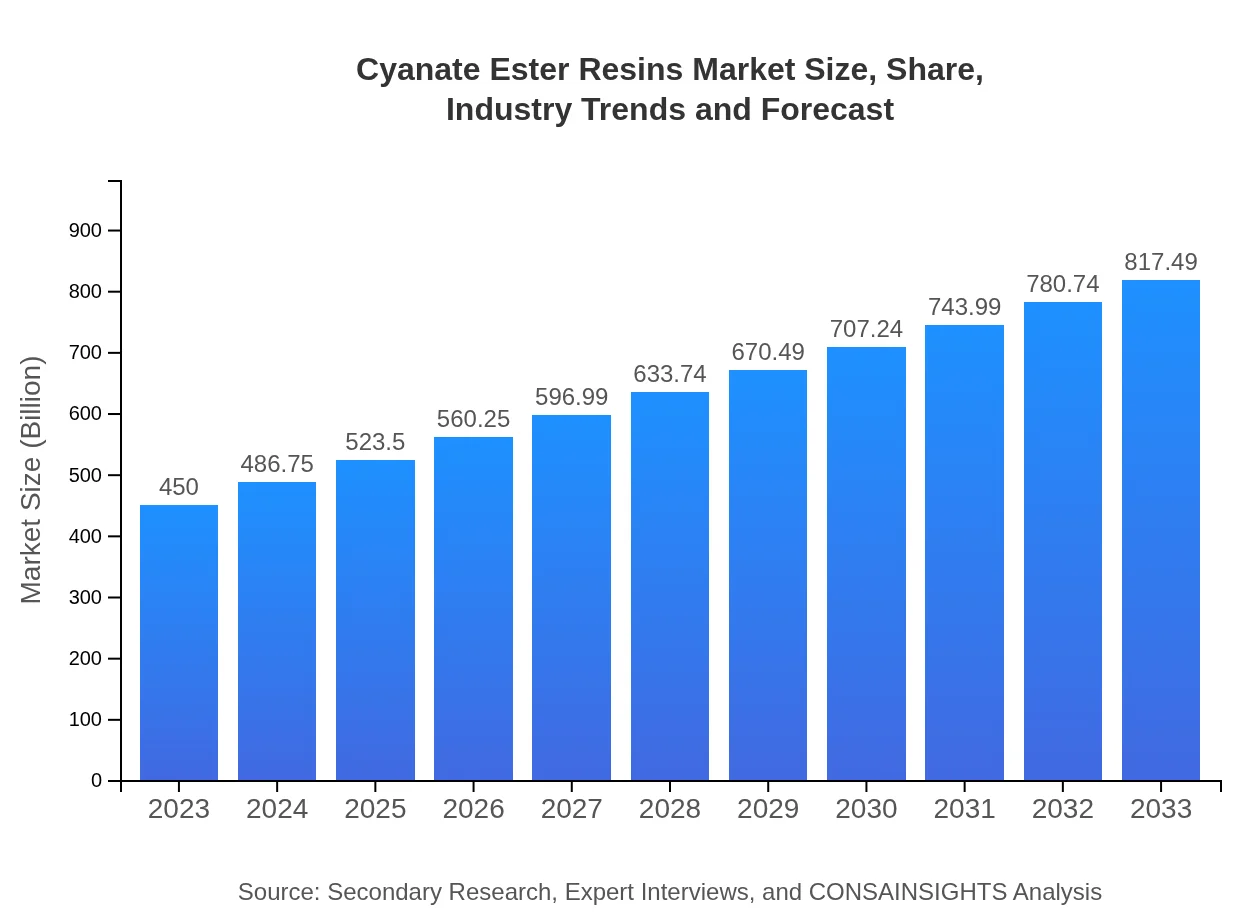

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $450.00 Million |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $817.49 Million |

| Top Companies | Hexion Inc., Cytec Solvay Group, Lonza Group AG, Mankiewicz Gebr. & Co |

| Last Modified Date | 02 February 2026 |

Cyanate Ester Resins Market Overview

Customize Cyanate Ester Resins Market Report market research report

- ✔ Get in-depth analysis of Cyanate Ester Resins market size, growth, and forecasts.

- ✔ Understand Cyanate Ester Resins's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cyanate Ester Resins

What is the Market Size & CAGR of Cyanate Ester Resins market in 2023?

Cyanate Ester Resins Industry Analysis

Cyanate Ester Resins Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cyanate Ester Resins Market Analysis Report by Region

Europe Cyanate Ester Resins Market Report:

In Europe, the market size is projected to increase from $152.50 million in 2023 to $277.05 million by 2033. Enhanced regulations regarding fuel efficiency and carbon emissions are leading to increased utilization of cyanate ester resins in the automotive and aerospace industries.Asia Pacific Cyanate Ester Resins Market Report:

The Asia Pacific region is projected to witness significant growth, with the market estimated to reach $142.90 million by 2033, increasing from $78.66 million in 2023. The rise is fueled by growing industrialization, particularly in aerospace and electronics manufacturing in countries like China and India.North America Cyanate Ester Resins Market Report:

The North American market is anticipated to expand from $159.34 million in 2023 to $289.47 million by 2033. The USA, being a key player in aerospace manufacturing, significantly contributes to this growth due to high demand for lightweight materials.South America Cyanate Ester Resins Market Report:

In South America, the Cyanate Ester Resins market is expected to grow from $40.37 million in 2023 to $73.33 million by 2033, driven by increasing investments in aerospace and renewable energy sectors, providing a conducive environment for the use of advanced materials.Middle East & Africa Cyanate Ester Resins Market Report:

Middle East and Africa markets are expected to grow from $19.13 million in 2023 to $34.74 million by 2033. The region's investment in infrastructural and aerospace projects is likely to propel demand for high-performance materials.Tell us your focus area and get a customized research report.

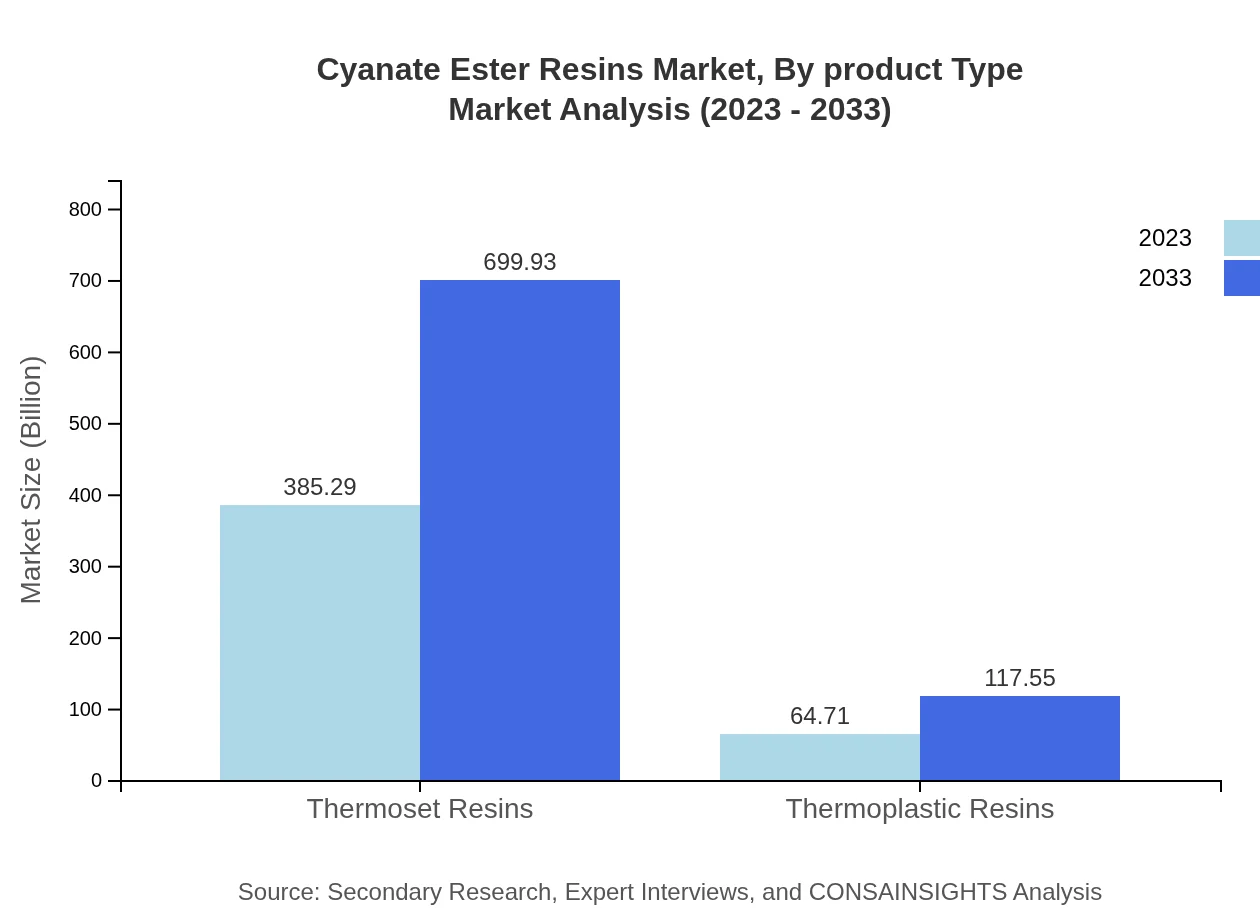

Cyanate Ester Resins Market Analysis By Product Type

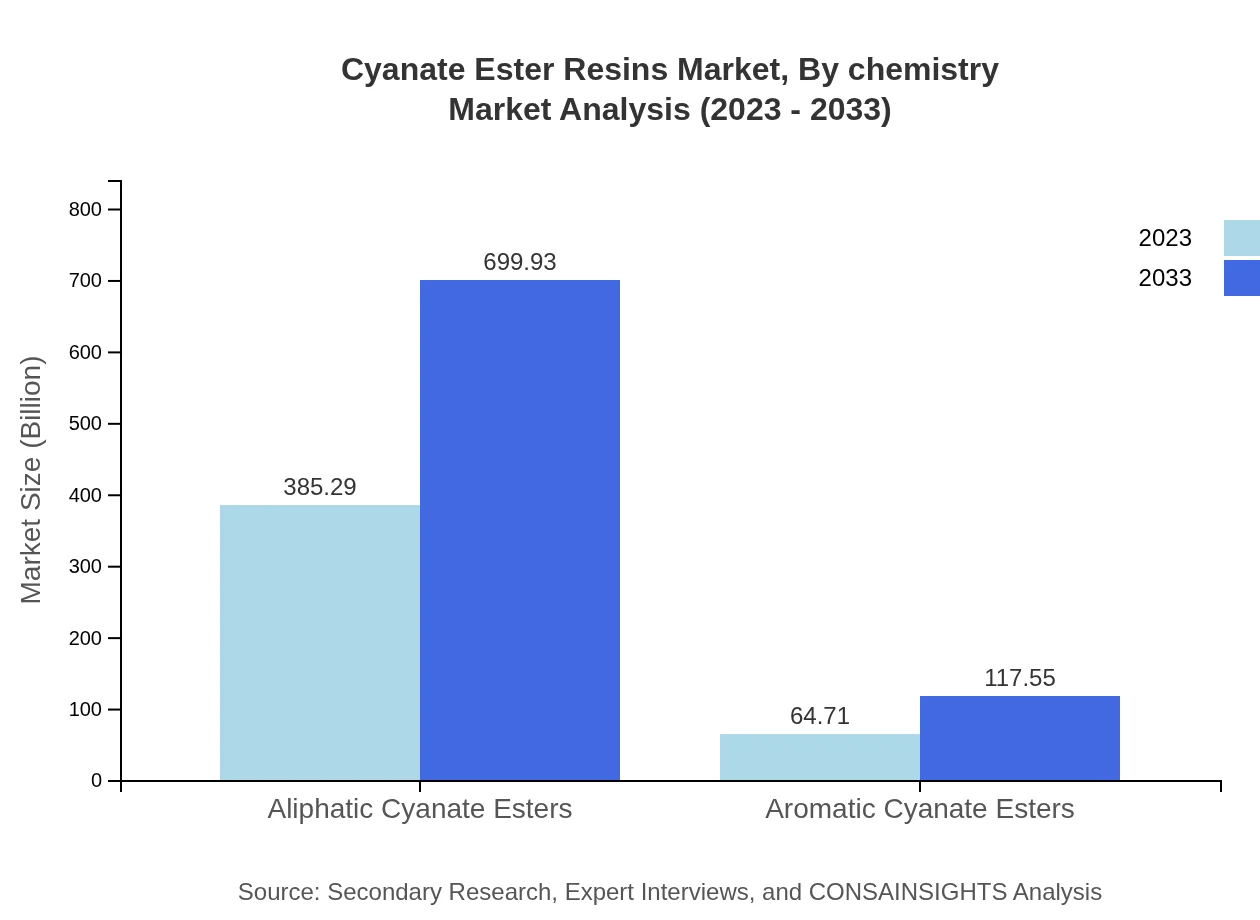

The market is primarily segmented into two product types: Aliphatic and Aromatic Cyanate Esters. Aliphatic Cyanate Esters dominate the market, projected to grow from $385.29 million in 2023 to $699.93 million by 2033, holding an 85.62% market share. Aromatic Cyanate Esters, while smaller, show growth from $64.71 million in 2023 to $117.55 million by 2033, capturing a 14.38% market share.

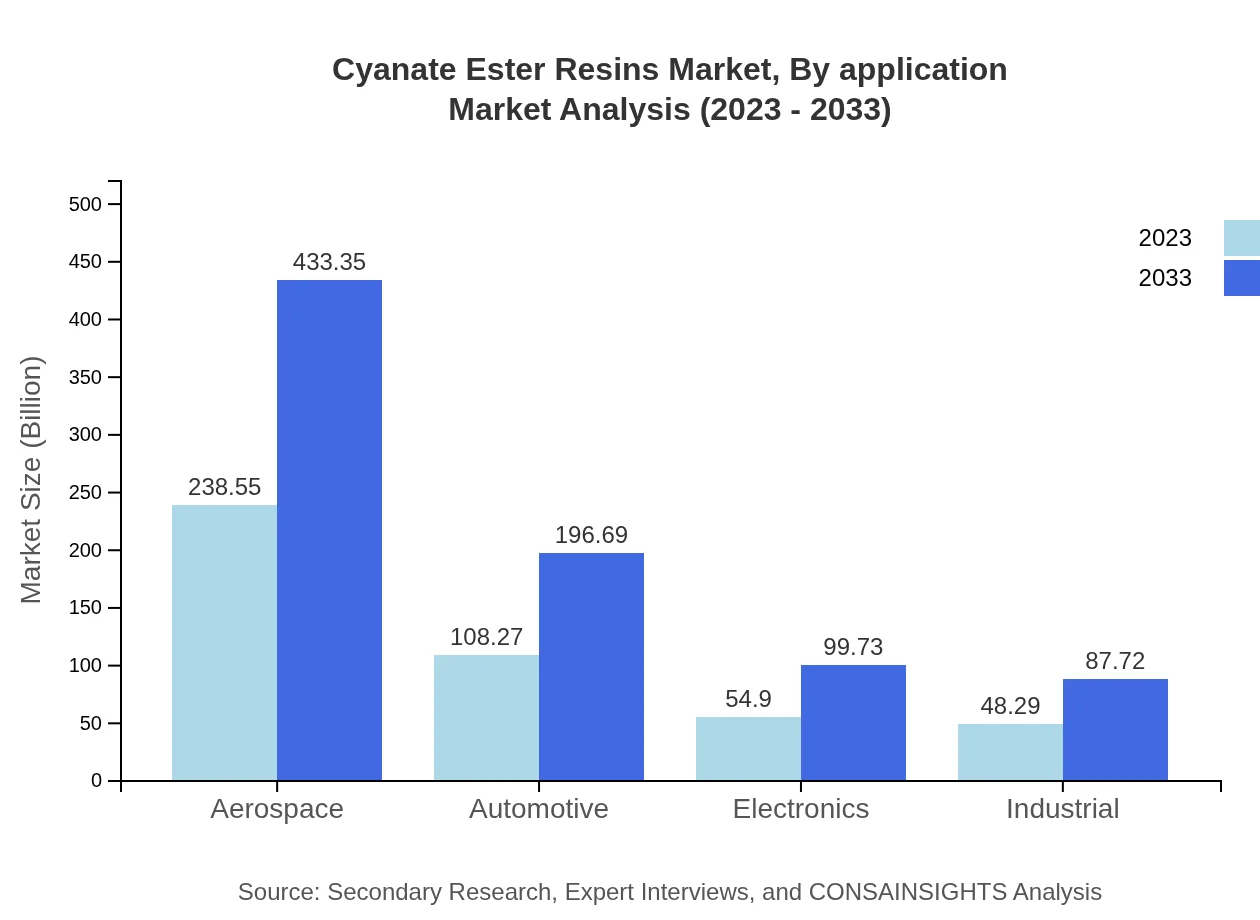

Cyanate Ester Resins Market Analysis By Application

The main applications for Cyanate Ester Resins include Aerospace, Automotive, Electronics, and Industrial uses. The Aerospace sector is the largest segment, with a market size of $238.55 million in 2023 expected to reach $433.35 million by 2033, maintaining a 53.01% market share. The Automotive sector follows with a growth from $108.27 million in 2023 to $196.69 million by 2033.

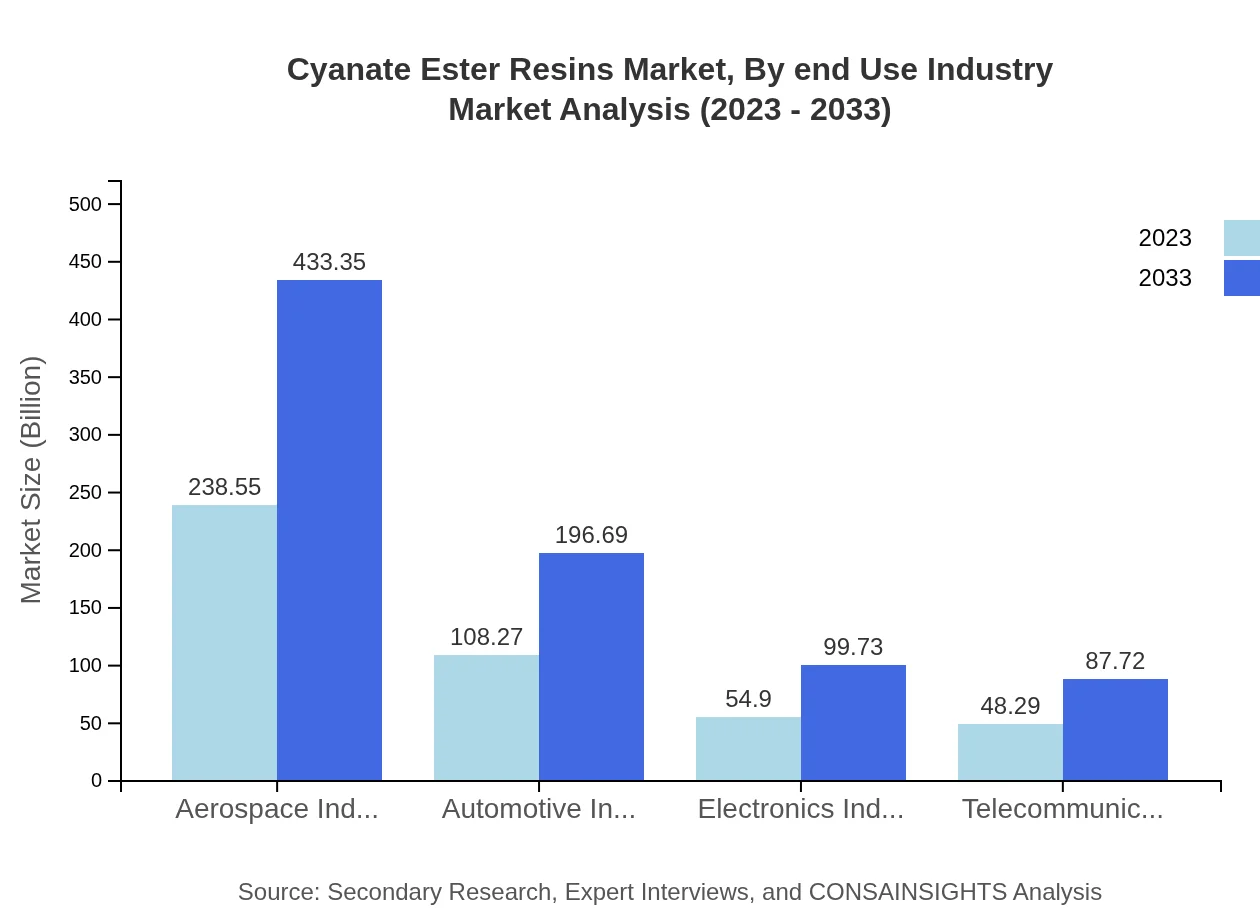

Cyanate Ester Resins Market Analysis By End Use Industry

In terms of end-use, the Aerospace and Electronics industries are leading consumers of cyanate ester resins. The Aerospace industry shows a market size of $238.55 million in 2023, anticipated to grow to $433.35 million by 2033, while the electronics market is expected to climb from $54.90 million to $99.73 million in the same period, reflecting its importance in lightweight and durable materials.

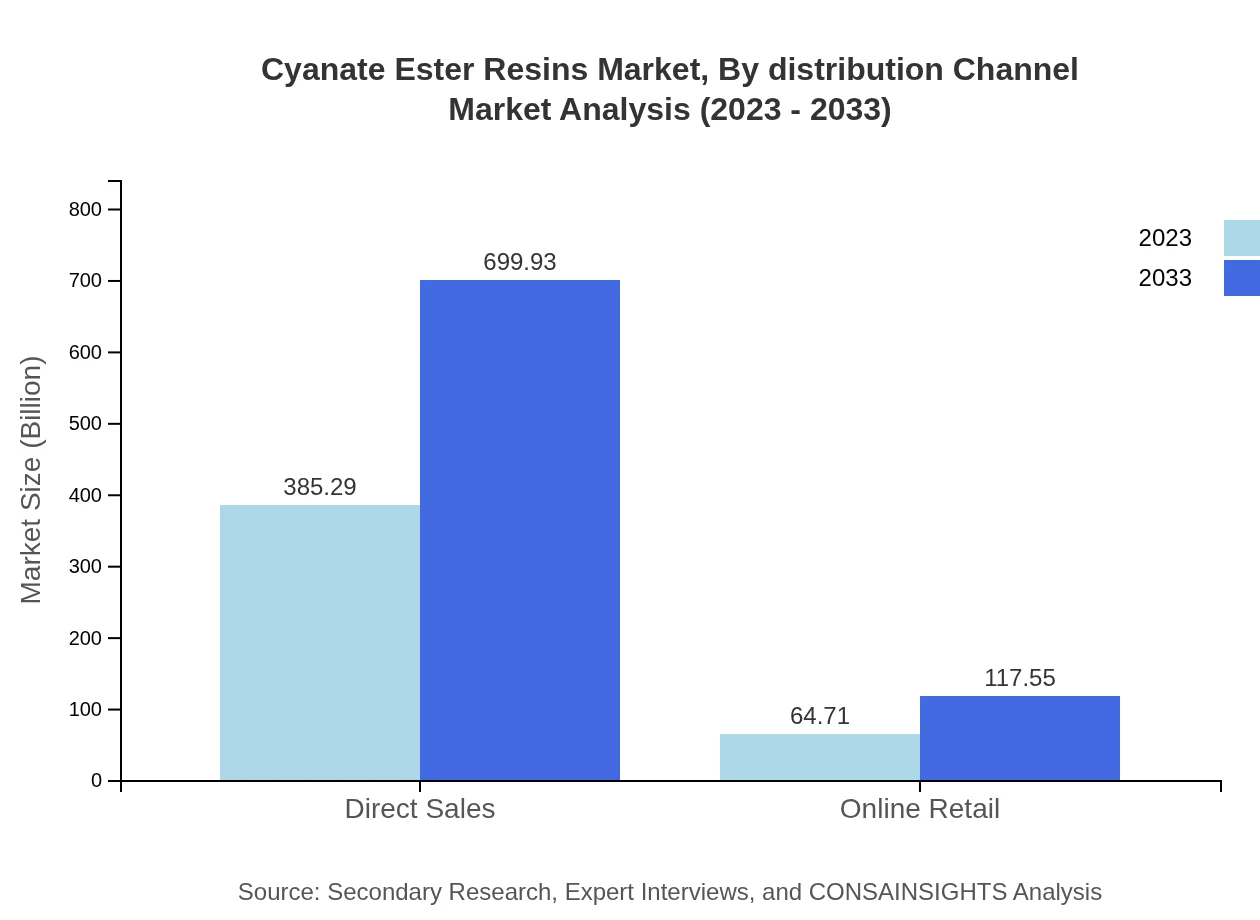

Cyanate Ester Resins Market Analysis By Distribution Channel

Sales channels for Cyanate Ester Resins include Direct Sales and Online Retail. Direct Sales is the primary channel, with a market share of 85.62% in 2023, projected to mirror the same share as it grows from $385.29 million to $699.93 million by 2033. Online Retail is also expanding, increasing from $64.71 million to $117.55 million.

Cyanate Ester Resins Market Analysis By Chemistry

Cyanate Ester Resins can be categorized into Thermoset Resins and Thermoplastic Resins. Thermoset forms the majority of the market with a size of $385.29 million in 2023, expected to rise to $699.93 million by 2033, while Thermoplastic resins make up a smaller segment, anticipated to grow from $64.71 million to $117.55 million.

Cyanate Ester Resins Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cyanate Ester Resins Industry

Hexion Inc.:

Hexion Inc. is a global leader in thermoset resins, supplying high-performance cyanate esters for aerospace and defense applications. They focus heavily on research and development to innovate and improve their products.Cytec Solvay Group:

Cytec Solvay Group specializes in advanced materials, providing a range of cyanate ester resins that meet strict aviation standards, ensuring performance and reliability in critical applications.Lonza Group AG:

Lonza is known for its innovative materials technology, producing cyanate esters that cater to various industries, including electronics, telecommunications, and automotive.Mankiewicz Gebr. & Co:

Mankiewicz focuses on high-quality specialty paints and coatings, having entered the cyanate esters market to enhance their portfolio with advanced materials for the aerospace sector.We're grateful to work with incredible clients.

FAQs

What is the market size of cyanate Ester Resins?

The cyanate-ester resins market is currently valued at approximately $450 million, with a projected CAGR of 6% from 2023 to 2033. This growth indicates a robust demand for these resins across multiple sectors.

What are the key market players or companies in the cyanate Ester Resins industry?

The key players include major resin manufacturers and suppliers that specialize in polymer products, providing a range of cyanate-ester resins for the aerospace, automotive, and electronics industries, ensuring innovation and competitive pricing.

What are the primary factors driving the growth in the cyanate Ester Resins industry?

Key growth drivers include the increasing demand from the aerospace industry for lightweight, durable materials, advances in resin formulation technology, and a surge in applications across automotive and electronics sectors.

Which region is the fastest Growing in the cyanate Ester Resins?

The fastest-growing region for cyanate-ester resins is North America, expected to grow from $159.34 million in 2023 to $289.47 million by 2033, driven by strong aerospace and automotive industries.

Does ConsaInsights provide customized market report data for the cyanate Ester Resins industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs, providing detailed insights and forecasts for the cyanate-ester resins market, ensuring relevant data for strategic decision-making.

What deliverables can I expect from this cyanate Ester Resins market research project?

Expect comprehensive market analysis including size, growth forecasts, segment insights, regional performance, key player profiles, and emerging market trends focused on cyanate-ester resins.

What are the market trends of cyanate Ester Resins?

Current trends include a growing emphasis on eco-friendly resins, advancements in manufacturing techniques, and increased applications in high-performance sectors like aerospace, reflecting innovation and sustainability in materials technology.