Cyber Insurance Market Report

Published Date: 24 January 2026 | Report Code: cyber-insurance

Cyber Insurance Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Cyber Insurance market from 2023 to 2033, covering market size, trends, segmentation, regional insights, and leading players. It aims to highlight the projected growth and challenges in the industry during the forecast period.

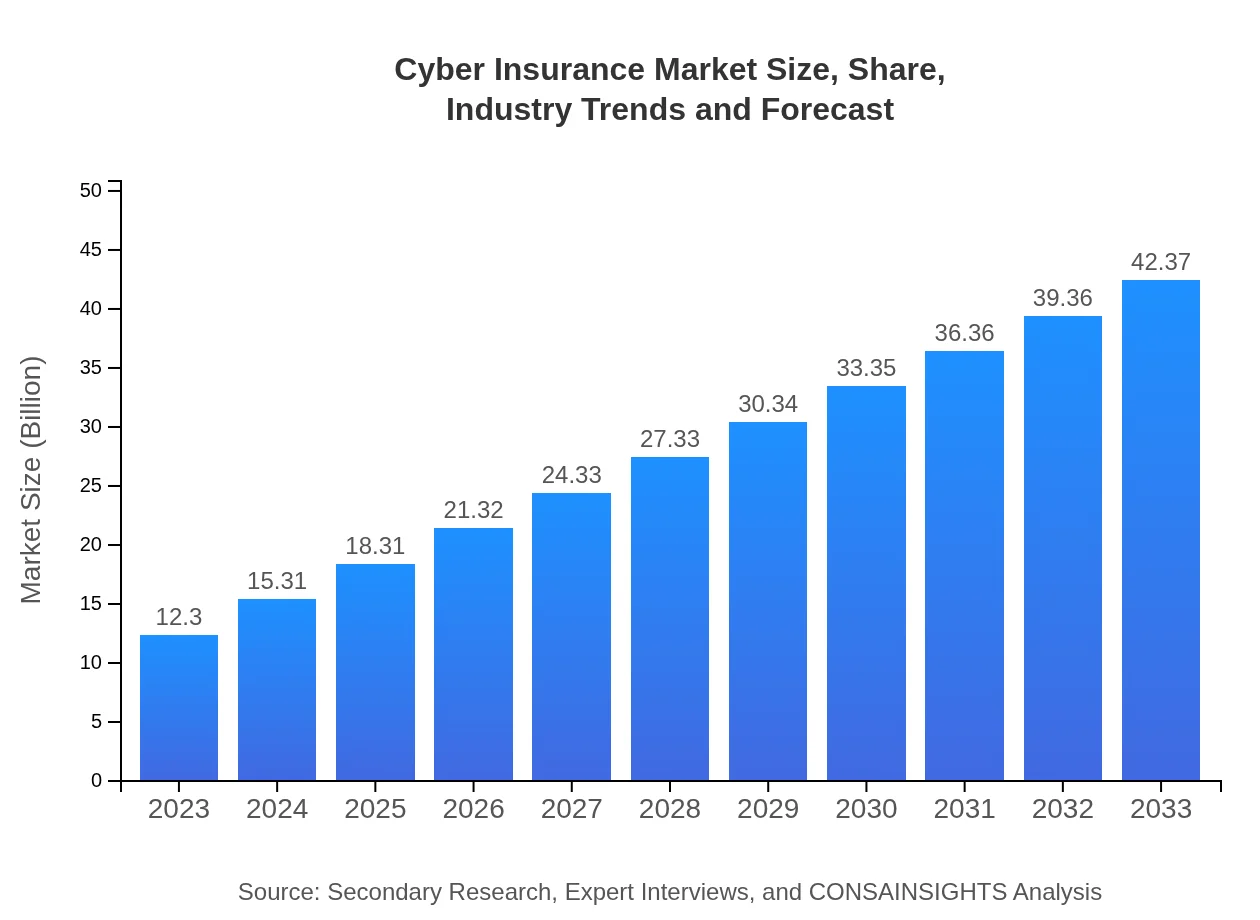

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.30 Billion |

| CAGR (2023-2033) | 12.6% |

| 2033 Market Size | $42.37 Billion |

| Top Companies | AIG, Chubb, AXA, Beazley, Munich Re |

| Last Modified Date | 24 January 2026 |

Cyber Insurance Market Overview

Customize Cyber Insurance Market Report market research report

- ✔ Get in-depth analysis of Cyber Insurance market size, growth, and forecasts.

- ✔ Understand Cyber Insurance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cyber Insurance

What is the Market Size & CAGR of Cyber Insurance market in 2023?

Cyber Insurance Industry Analysis

Cyber Insurance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cyber Insurance Market Analysis Report by Region

Europe Cyber Insurance Market Report:

In Europe, the market size for Cyber Insurance was around $3.38 billion in 2023 and is anticipated to reach $11.63 billion by 2033. The implementation of GDPR and other strict regulations is driving companies to acquire insurance policies, making it a priority for many organizations to safeguard their sensitive data.Asia Pacific Cyber Insurance Market Report:

The Asia Pacific region is witnessing substantial growth in Cyber Insurance, with a market size expected to reach $8.58 billion by 2033, up from $2.49 billion in 2023. The rise in digital adoption among businesses, coupled with increasing cyber threats, is driving demand for insurance solutions. Countries like Japan, Australia, and India are leading the market due to their robust digital infrastructures.North America Cyber Insurance Market Report:

North America holds a significant share of the Cyber Insurance market, with an estimated value of $3.95 billion in 2023, expected to surge to $13.60 billion by 2033. The region is known for its advanced digital landscape and the prevalence of cyber threats, prompting businesses to invest heavily in Cyber Insurance for protection against potential losses.South America Cyber Insurance Market Report:

South America’s Cyber Insurance market is projected to grow from $0.90 billion in 2023 to $3.10 billion by 2033. The growing internet penetration and digital transformation initiatives across countries like Brazil and Argentina are contributing to this growth. Despite economic challenges, awareness of cyber risks is prompting organizations to seek insurance coverage.Middle East & Africa Cyber Insurance Market Report:

The Cyber Insurance market in the Middle East and Africa is expected to grow from $1.58 billion in 2023 to $5.46 billion by 2033. The increasing adoption of digital technologies and mobile applications, along with growing concerns about cyber threats, is fueling demand for Cyber Insurance in this region. Countries like the UAE and South Africa are becoming proactive in implementing Cyber Insurance policies.Tell us your focus area and get a customized research report.

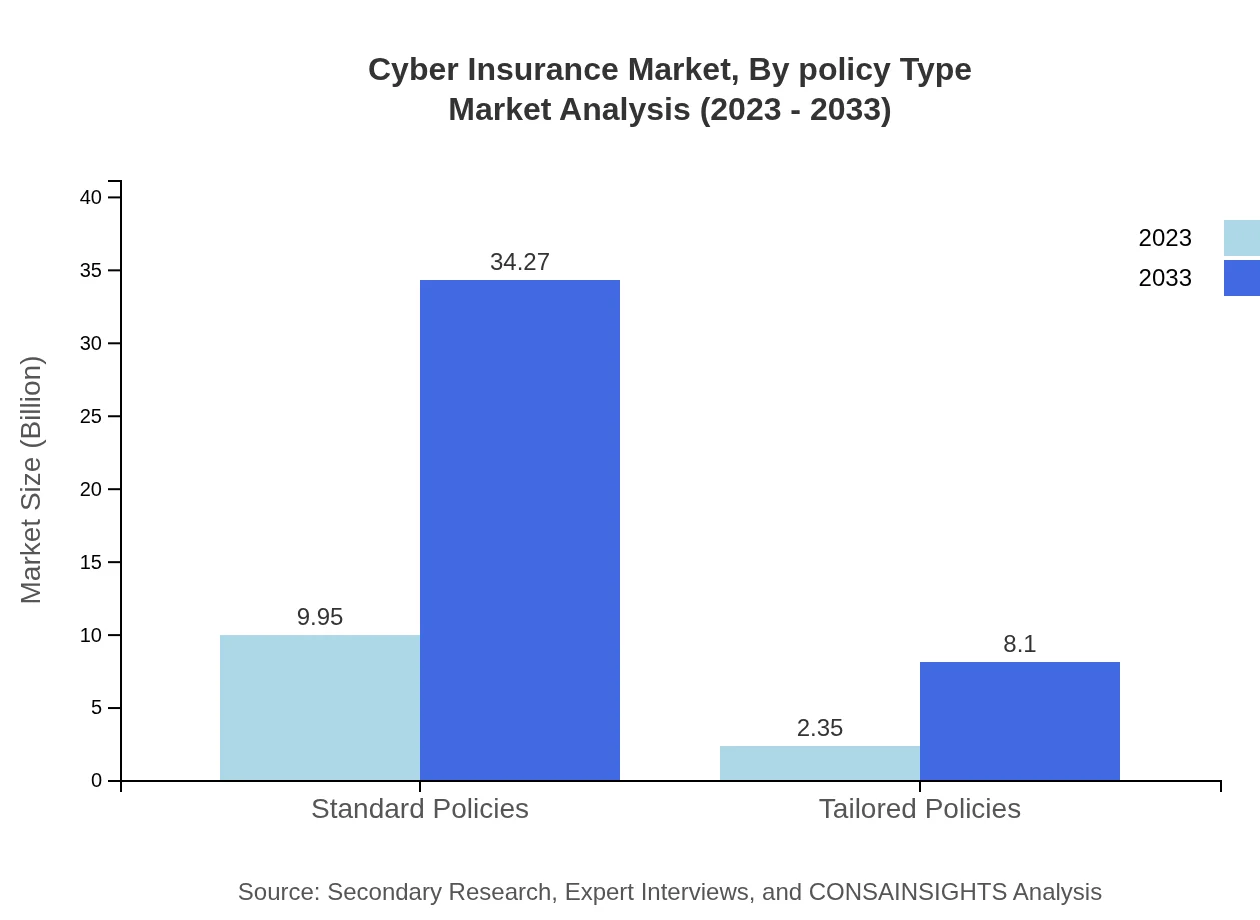

Cyber Insurance Market Analysis By Product Type

The Cyber Insurance market, segmented by product type, includes standard and tailored policies. Standard policies dominated the market in 2023 with a size of $9.95 billion and are projected to grow to $34.27 billion by 2033, representing 80.89% of the market share. Tailored policies, which are designed to meet the specific needs of businesses, held a market size of $2.35 billion in 2023, expected to rise to $8.10 billion by 2033, capturing 19.11% of the market.

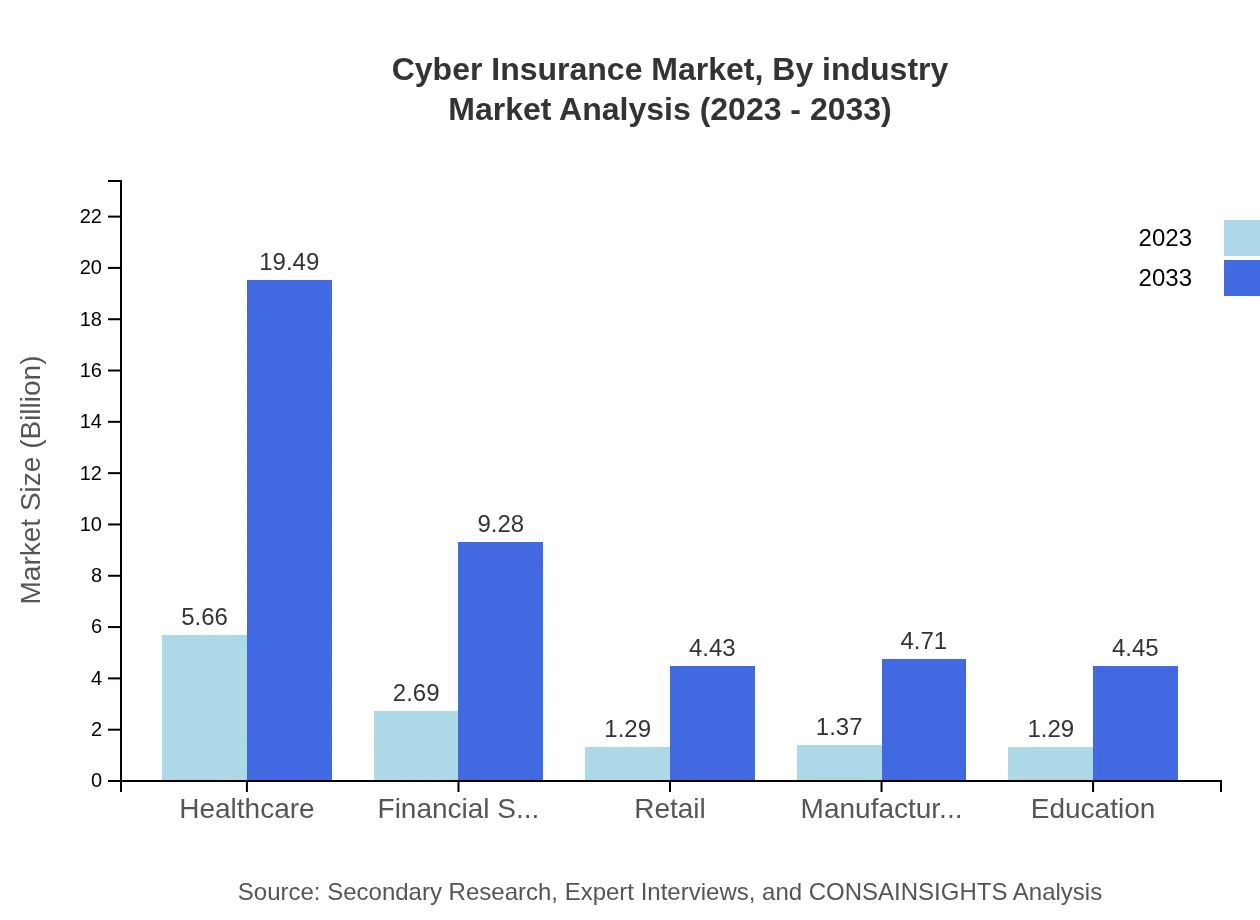

Cyber Insurance Market Analysis By Industry

The industry segment encompasses several sectors, with healthcare leading the market. In 2023, the healthcare segment size was $5.66 billion, and it is forecasted to reach $19.49 billion by 2033, maintaining a 46.01% market share. Financial services followed with a market size of $2.69 billion in 2023, expected to grow to $9.28 billion by 2033. Retail, manufacturing, and education also represent significant segments in the Cyber Insurance market.

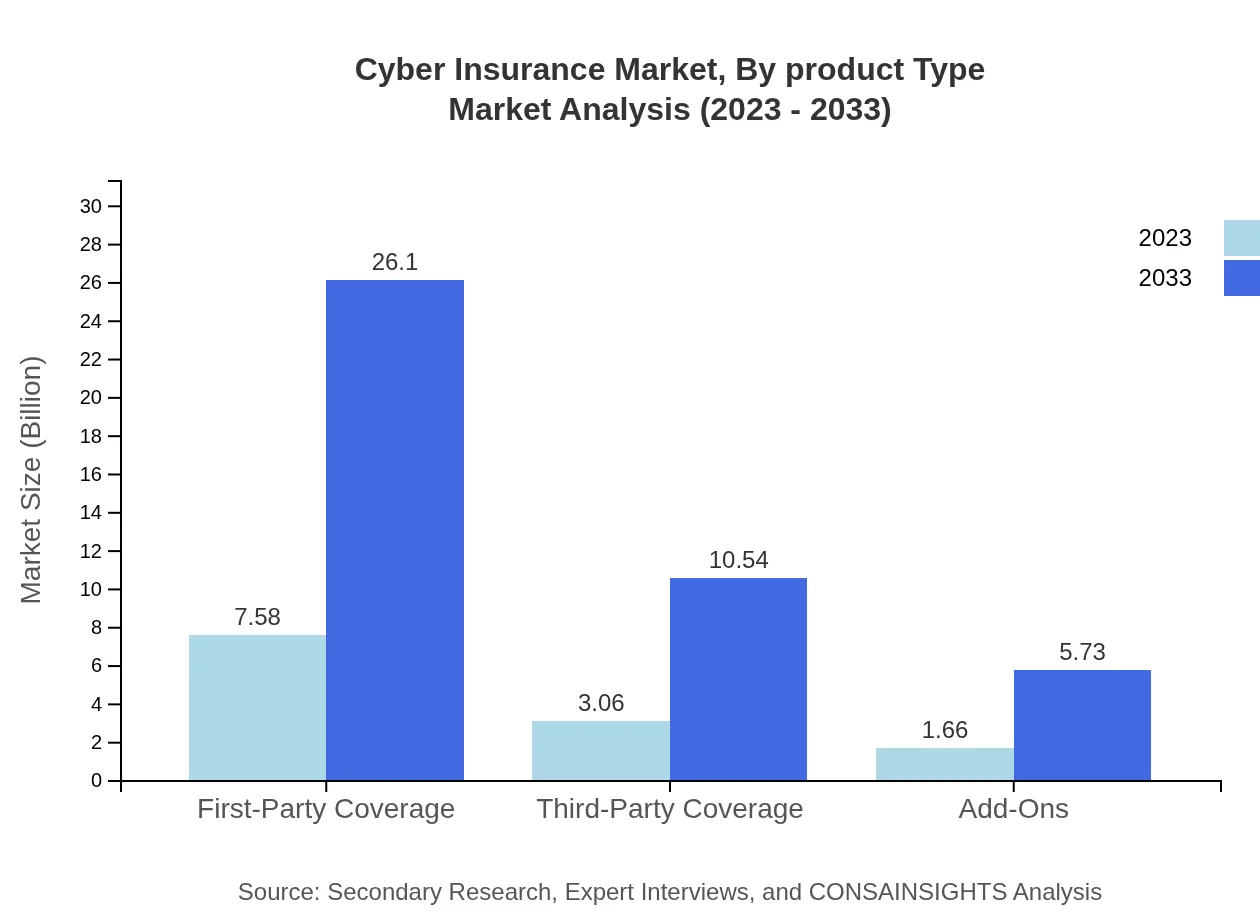

Cyber Insurance Market Analysis By Policy Type

Cyber Insurance products are classified by policy type into first-party and third-party coverage. First-party coverage is the larger segment, with a size of $7.58 billion in 2023, projected to grow to $26.10 billion by 2033 while holding a market share of 61.6%. Third-party coverage, focused on liabilities towards external stakeholders, was valued at $3.06 billion in 2023, expected to increase to $10.54 billion by 2033, maintaining a stable share of 24.88%.

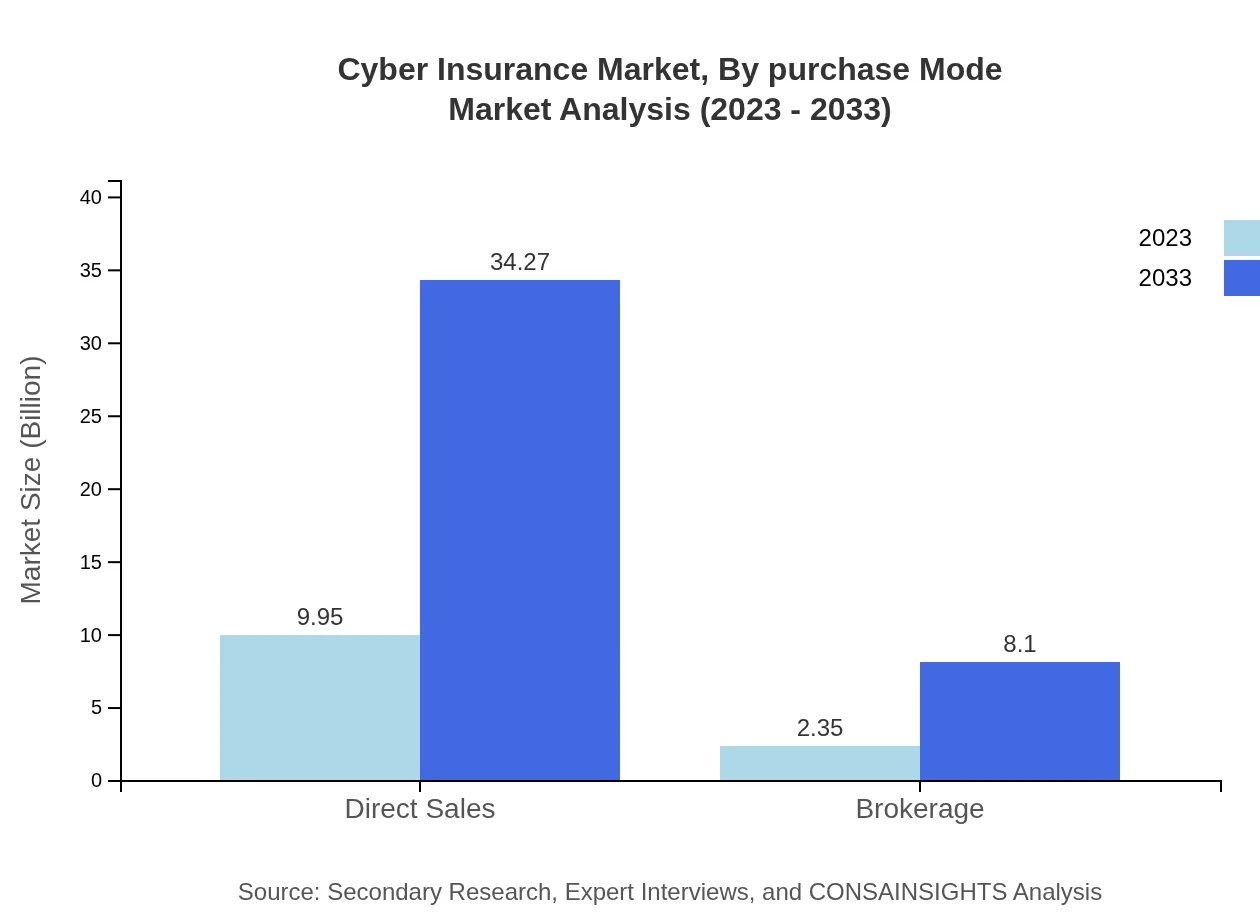

Cyber Insurance Market Analysis By Purchase Mode

The Cyber Insurance market can be segmented based on the purchase mode into direct sales and brokerage. Direct sales accounted for $9.95 billion in 2023, indicating significant consumer preference for this channel, with forecasts suggesting a rise to $34.27 billion by 2033. The brokerage segment, while smaller at a market size of $2.35 billion in 2023, is expected to reach $8.10 billion by 2033, showcasing 19.11% market share.

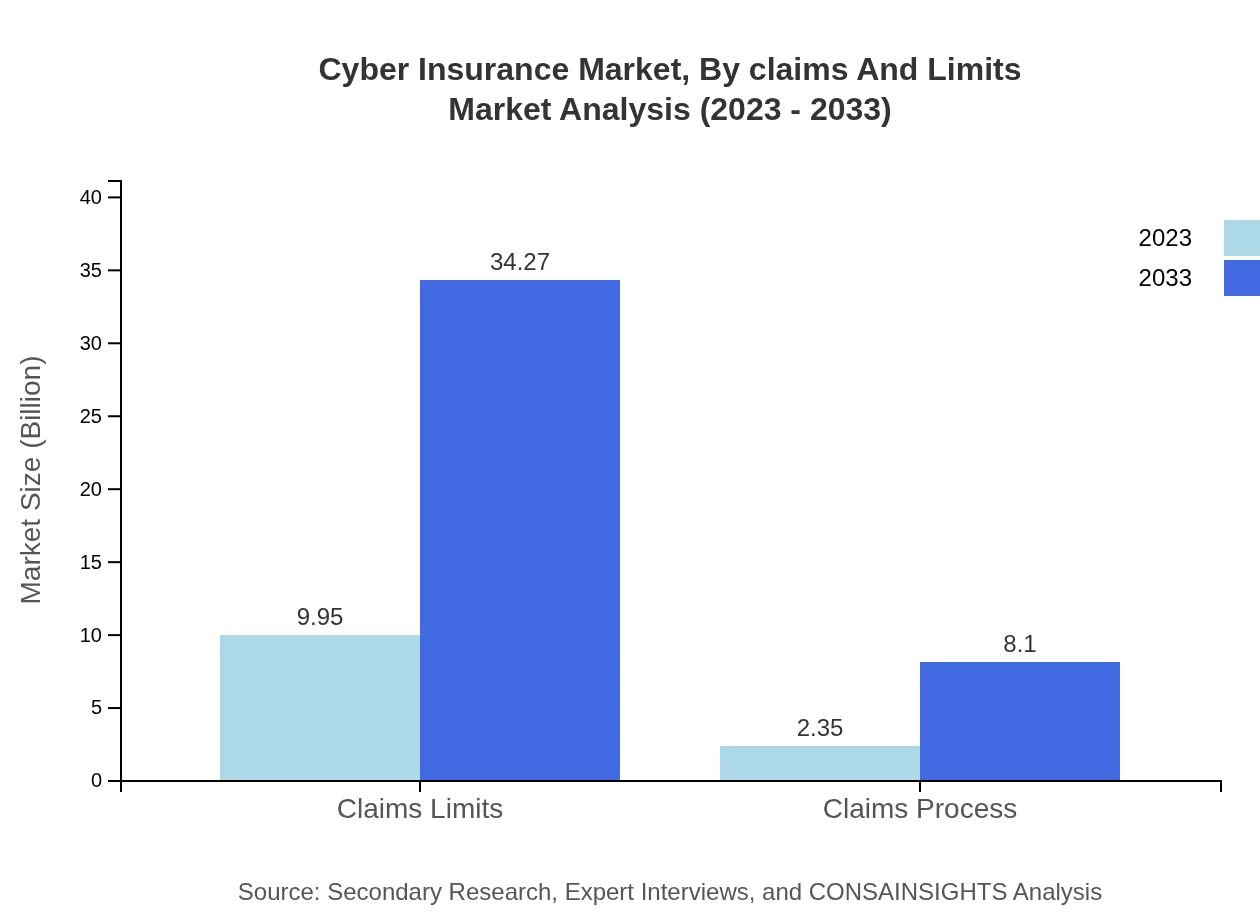

Cyber Insurance Market Analysis By Claims And Limits

In terms of claims and limits, the Cyber Insurance market shows a clear delineation between various coverage amounts. The claims limits segment reached $9.95 billion in 2023, projected to grow to $34.27 billion by 2033, upholding a robust market share of 80.89%. Claims process options, with a smaller market of $2.35 billion in 2023, are expected to increase to $8.10 billion by 2033, securing 19.11% of the market.

Cyber Insurance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cyber Insurance Industry

AIG:

American International Group, Inc. offers a range of Cyber Insurance solutions, addressing both first-party and third-party risks and providing extensive support in case of cyber incidents.Chubb:

Chubb Limited provides tailored Cyber Insurance products focused on risk management and offering coverage for data breaches, ransomware attacks, and business interruptions.AXA:

AXA SA is a leading provider of Cyber Insurance, specializing in comprehensive coverage for various industries and emphasizing the importance of cybersecurity measures.Beazley:

Beazley Group offers specialized Cyber Insurance products focusing on data protection, professional liability, and crisis management services.Munich Re:

Munich Re is a global reinsurer that also provides Cyber Insurance solutions, helping businesses mitigate risks associated with cyber threats and liabilities.We're grateful to work with incredible clients.

FAQs

What is the market size of cyber Insurance?

The global cyber-insurance market was valued at approximately $12.3 billion in 2023 and is projected to achieve a CAGR of 12.6% through 2033. This growth signifies increasing awareness and demand for cybersecurity solutions among businesses.

What are the key market players or companies in the cyber Insurance industry?

Key players in the cyber-insurance market include major insurance firms, cybersecurity solution providers, and technology companies. They play crucial roles in offering innovative policies and comprehensive coverage options tailored to evolving cyber threats.

What are the primary factors driving the growth in the cyber Insurance industry?

The growth of the cyber-insurance market is driven by increasing cyber threats, regulatory compliance requirements, and heightened awareness among companies regarding cybersecurity risks. Additionally, the digital transformation of businesses contributes significantly to this expansion.

Which region is the fastest Growing in the cyber Insurance market?

North America is currently the fastest-growing region in the cyber-insurance market, expected to grow from $3.95 billion in 2023 to $13.60 billion by 2033. This rapid growth aligns with the region's strong focus on cybersecurity.

Does ConsaInsights provide customized market report data for the cyber Insurance industry?

Yes, ConsaInsights offers customized market research reports tailored to specific needs within the cyber-insurance industry, allowing clients to access relevant insights and data that suit their strategic planning and decision-making processes.

What deliverables can I expect from this cyber Insurance market research project?

Expect detailed reports that provide market analysis, trends, forecasts, competitive landscape evaluation, and regional insights in the cyber-insurance industry, along with actionable recommendations to aid your business strategies.

What are the market trends of cyber Insurance?

Current trends in the cyber-insurance market include increased adoption of tailored policies, growth in awareness of cybersecurity threats, and a shift towards more comprehensive coverage options. Companies are increasingly seeking first-party and add-on covers.