Cyber Security In Bfsi Market Report

Published Date: 31 January 2026 | Report Code: cyber-security-in-bfsi

Cyber Security In Bfsi Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Cyber Security market in the Banking, Financial Services, and Insurance (BFSI) sector from 2023 to 2033, including market size, growth forecasts, trends, and key player insights.

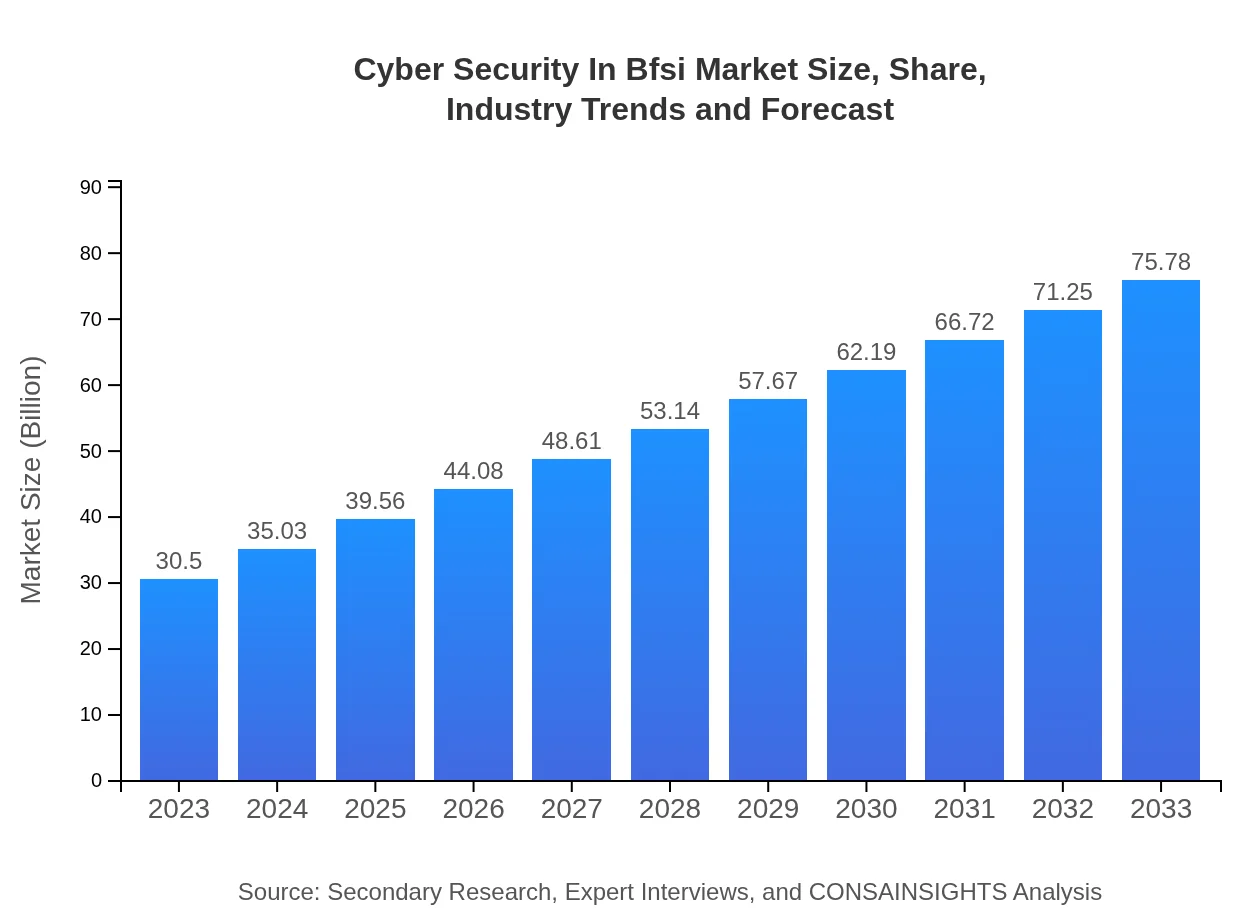

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $30.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $75.78 Billion |

| Top Companies | Cisco Systems, Inc., Palo Alto Networks, Inc., FireEye, Inc., McAfee Corp. |

| Last Modified Date | 31 January 2026 |

Cyber Security In Bfsi Market Overview

Customize Cyber Security In Bfsi Market Report market research report

- ✔ Get in-depth analysis of Cyber Security In Bfsi market size, growth, and forecasts.

- ✔ Understand Cyber Security In Bfsi's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cyber Security In Bfsi

What is the Market Size & CAGR of Cyber Security In Bfsi market in 2023?

Cyber Security In Bfsi Industry Analysis

Cyber Security In Bfsi Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cyber Security In Bfsi Market Analysis Report by Region

Europe Cyber Security In Bfsi Market Report:

In Europe, the market starts at $9.66 billion in 2023, with projections up to $24.01 billion by 2033. The stringent GDPR regulations have prompted financial firms to adopt advanced cybersecurity solutions, increasing overall market size.Asia Pacific Cyber Security In Bfsi Market Report:

In 2023, the Cyber Security market in the Asia Pacific region is valued at $5.86 billion, expected to reach $14.55 billion by 2033. Rapid digital transformation in nations like China and India, coupled with increasing government focus on data protection, drives market demand.North America Cyber Security In Bfsi Market Report:

The North American Cyber Security market for BFSI is forecast to grow from $10.32 billion in 2023 to $25.65 billion by 2033. The presence of major financial institutions and the increasing frequency of cyberattacks necessitates heightened security measures.South America Cyber Security In Bfsi Market Report:

For South America, the market is estimated at $2.54 billion in 2023, growing to $6.31 billion by 2033. Investments in cybersecurity have surged as organizations seek to comply with international standards and protect against fraud.Middle East & Africa Cyber Security In Bfsi Market Report:

The Cyber Security market in the Middle East and Africa is anticipated to rise from $2.12 billion in 2023 to $5.26 billion by 2033. Growing concerns related to data protection and national security issues are fostering a security-driven environment.Tell us your focus area and get a customized research report.

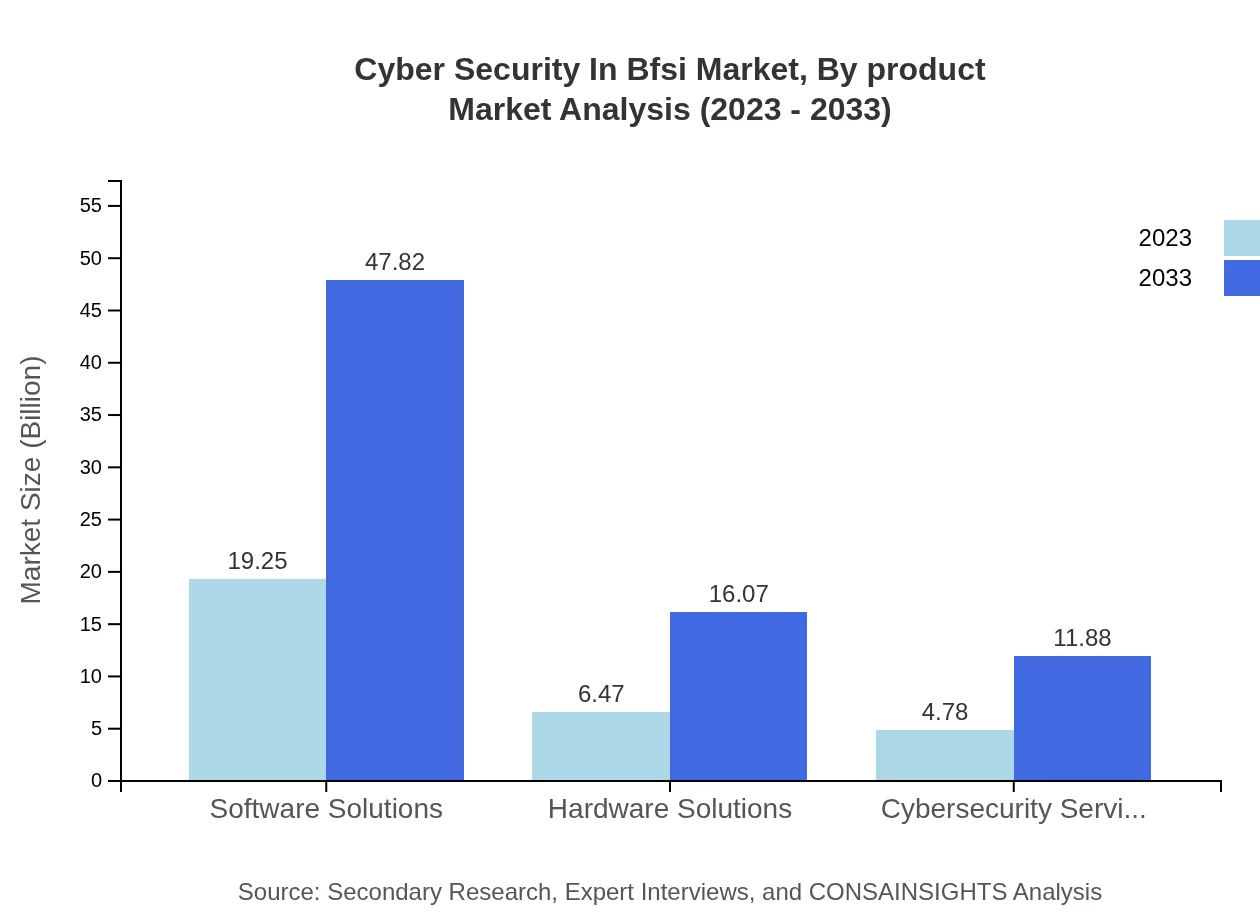

Cyber Security In Bfsi Market Analysis By Product

The product segment analysis indicates that Software Solutions dominate the market, valued at $19.25 billion in 2023 and projected to rise to $47.82 billion by 2033, accounting for a 63.11% market share throughout this period. Hardware Solutions and Cybersecurity Services contribute significantly as well, with Hardware Solutions predicted to grow from $6.47 billion to $16.07 billion, representing 21.21% of the market.

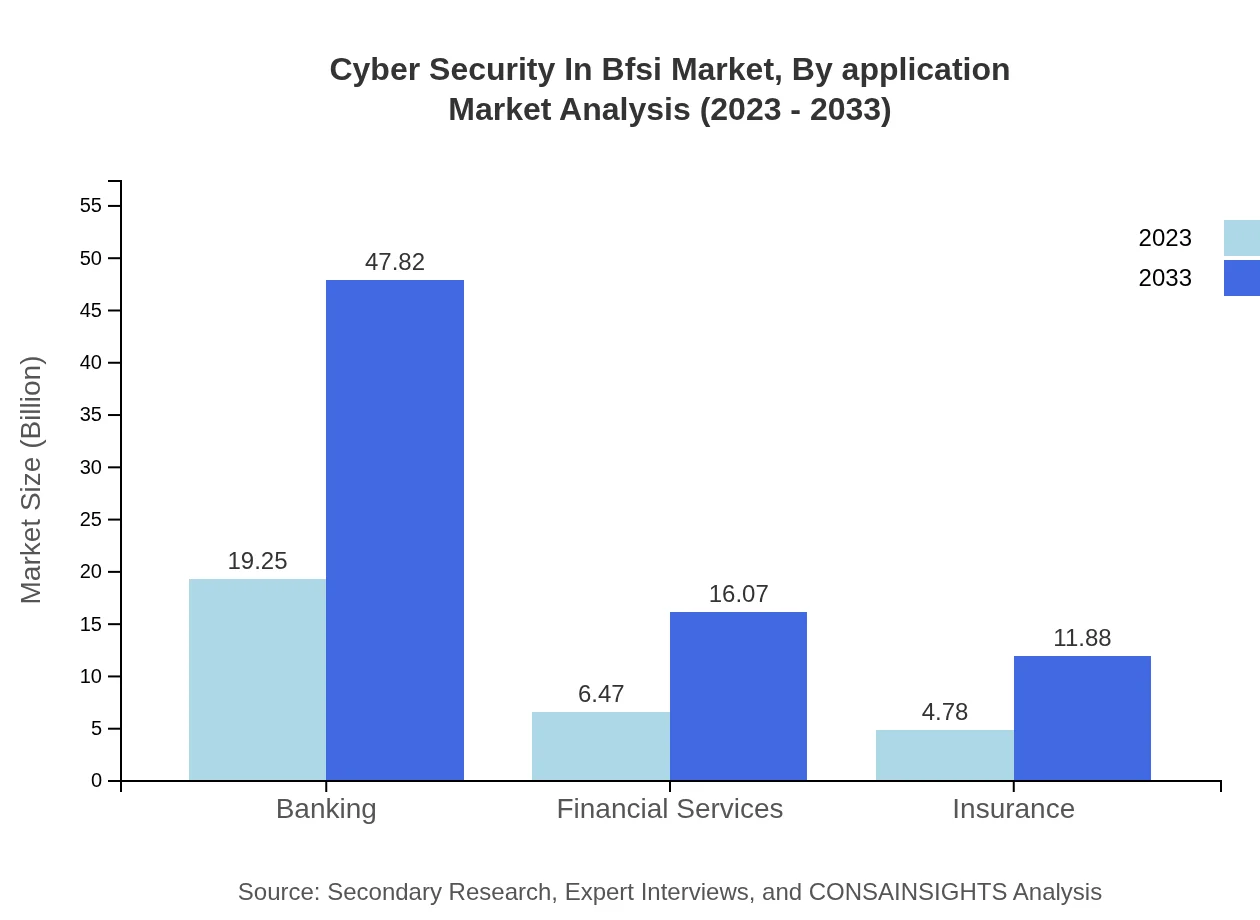

Cyber Security In Bfsi Market Analysis By Application

Application segmentation illustrates that Banking sector applications hold the largest market share, estimated at $19.25 billion in 2023, expected to reach $47.82 billion by 2033. Insurance and Financial Services applications follow closely, with respective growth projections leading to heightened investments in Cybersecurity solutions.

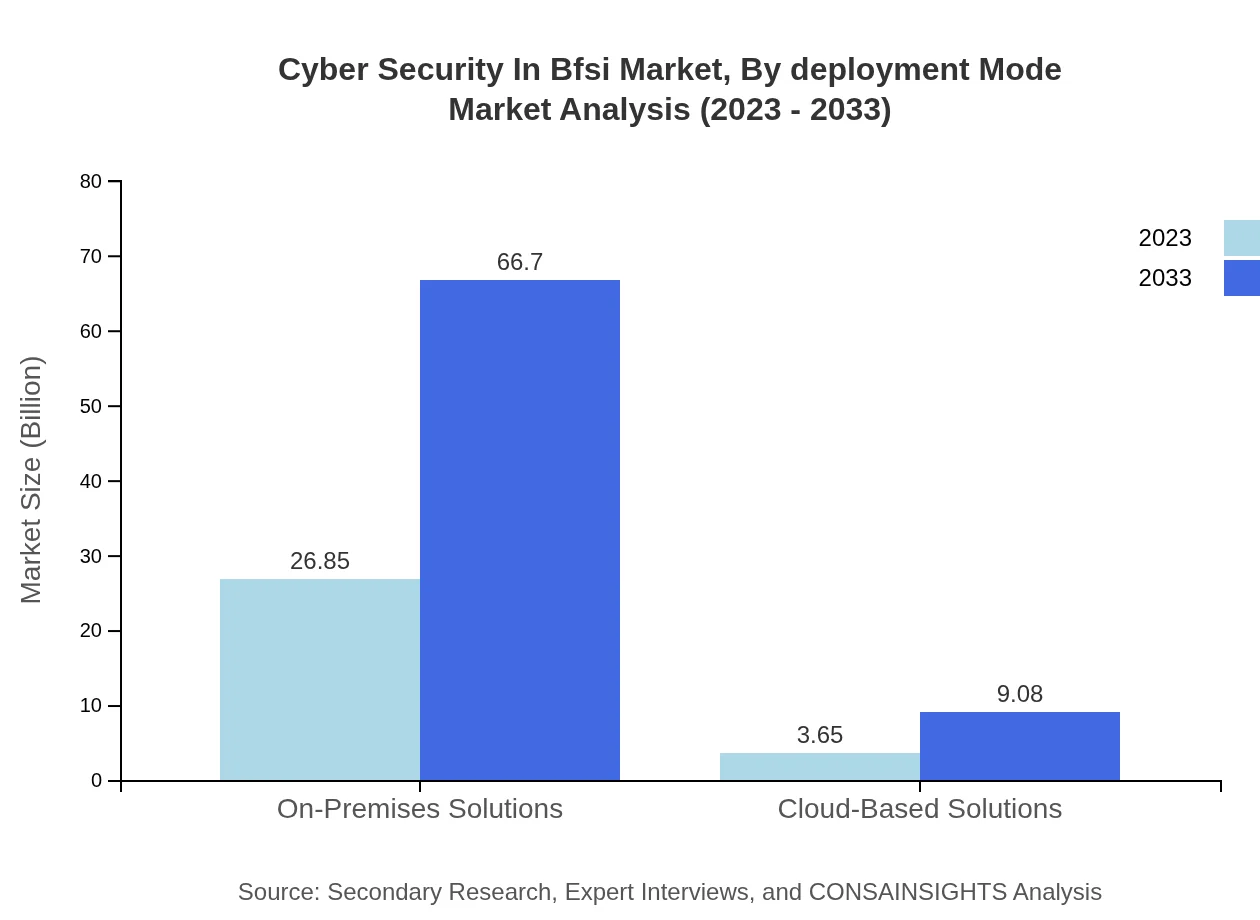

Cyber Security In Bfsi Market Analysis By Deployment Mode

The analysis of deployment mode reveals that On-Premises Solutions represent a substantial share, starting at $26.85 billion in 2023 and anticipated to grow to $66.70 billion by 2033, implying an 88.02% market share. Conversely, Cloud-Based Solutions are gaining traction, moving from $3.65 billion to $9.08 billion as the market adapts to scalable security models.

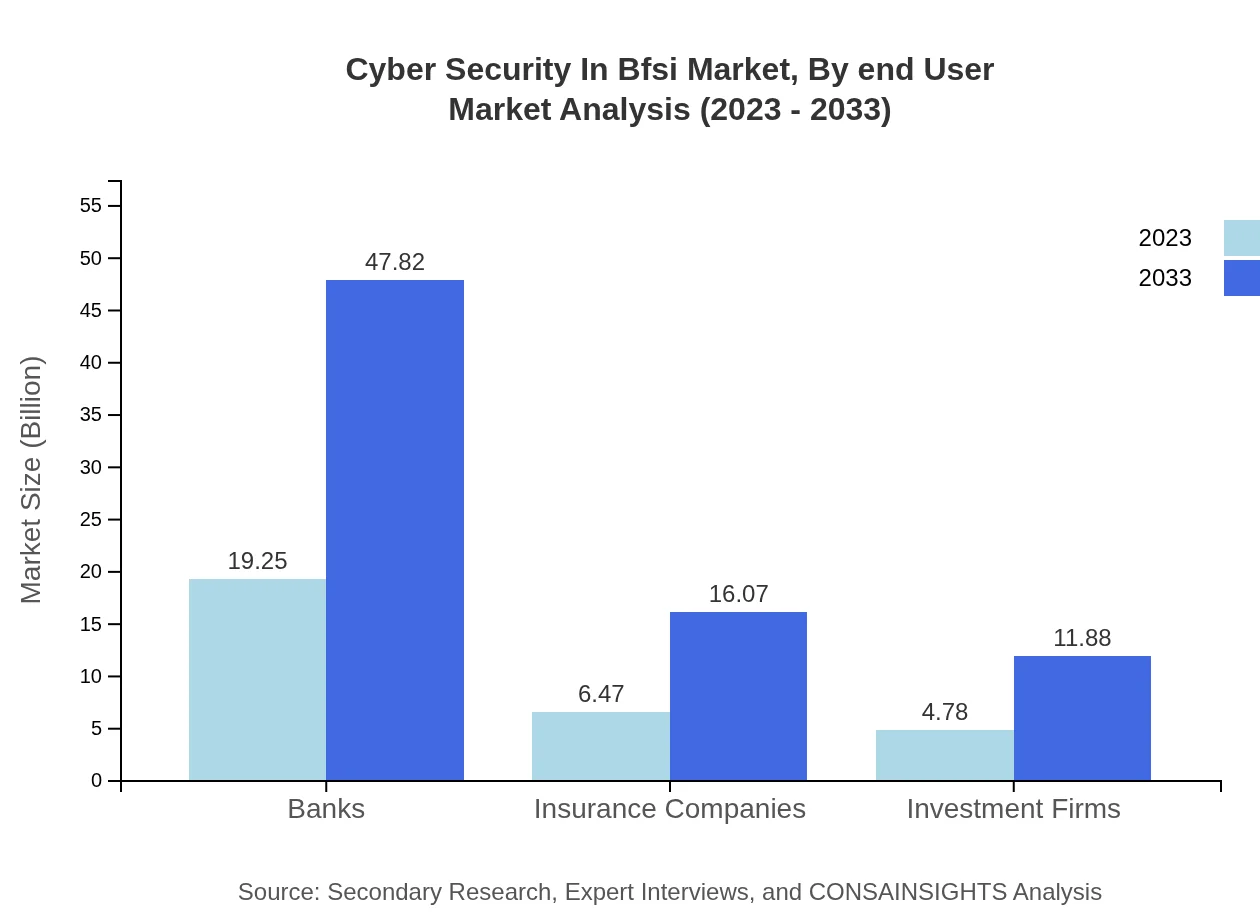

Cyber Security In Bfsi Market Analysis By End User

End-user segmentation indicates Banks as the leading consumers of cybersecurity solutions, starting with a market value of $19.25 billion in 2023 and expected to rise to $47.82 billion by 2033. Insurance Companies and Investment Firms also play crucial roles, investing heavily in cybersecurity measures.

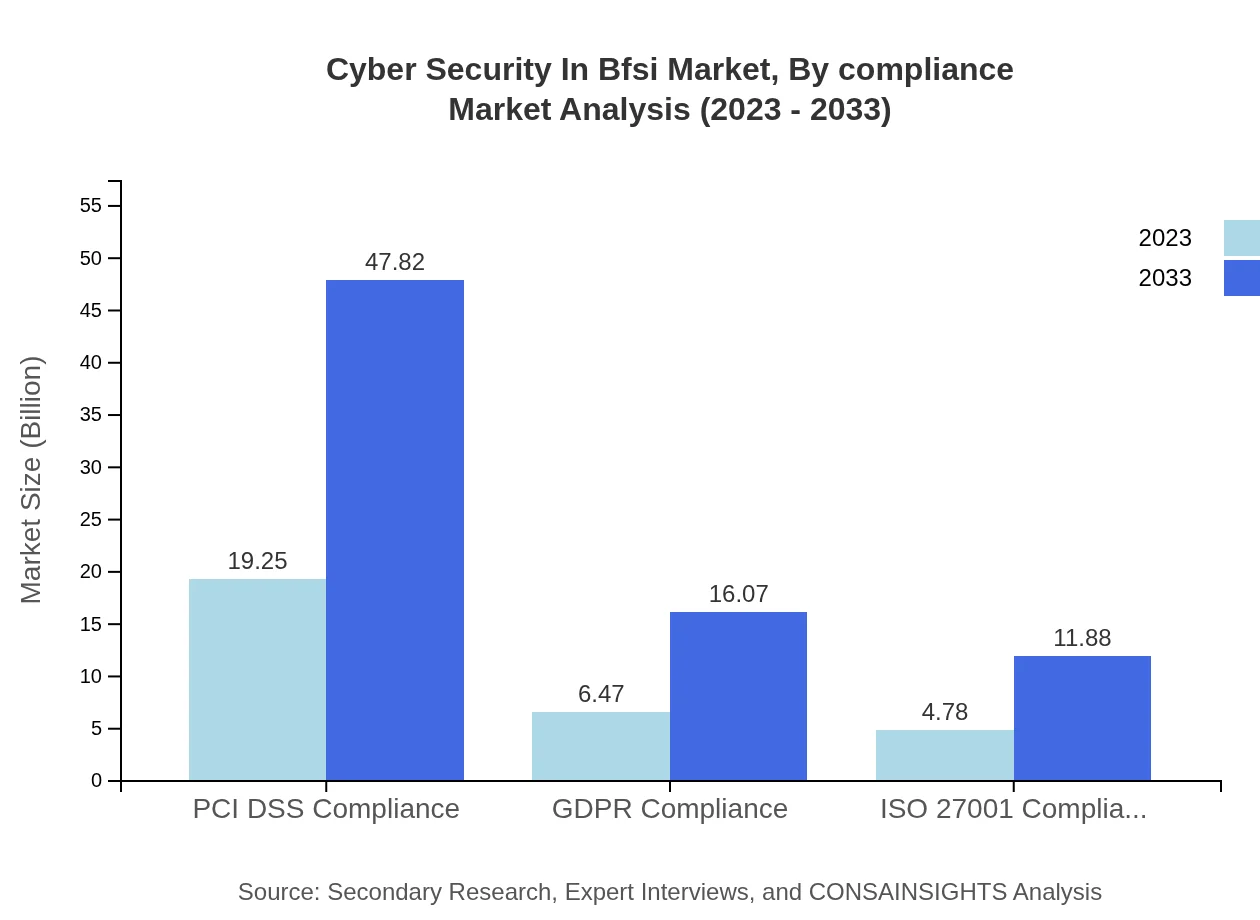

Cyber Security In Bfsi Market Analysis By Compliance

Compliance standards are a critical market driver, particularly PCI DSS, GDPR, and ISO 27001 standards. PCI DSS compliance leads the market with a value of $19.25 billion in 2023 and a projected growth to $47.82 billion by 2033, encapsulating 63.11% of compliance-related investments.

Cyber Security In Bfsi Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cyber Security In Bfsi Industry

Cisco Systems, Inc.:

Cisco provides comprehensive cybersecurity solutions for the BFSI sector, helping institutions secure their networks against cyber threats and ensuring compliance with regulatory requirements.Palo Alto Networks, Inc.:

Palo Alto is recognized for its advanced threat detection capabilities and firewall technology, playing a pivotal role in enabling BFSI companies to enhance their cybersecurity posture.FireEye, Inc.:

FireEye specializes in dynamic security solutions, utilizing innovative technology to protect BFSI organizations against sophisticated cyber threats and breaches.McAfee Corp.:

McAfee provides end-to-end security solutions tailored for the BFSI sector, assisting companies in preserving customer trust and securing financial data.We're grateful to work with incredible clients.

FAQs

What is the market size of cyber Security In Bfsi?

The cyber-security market in BFSI is projected to reach a size of $30.5 billion by 2033, growing at a CAGR of 9.2% from its current value. This growth reflects the increasing demand for advanced security solutions in the financial sector.

What are the key market players or companies in this cyber Security In Bfsi industry?

Key players in the cyber-security BFSI market include multinational companies such as IBM, Cisco, McAfee, and Symantec. They are leading the charge in innovative security solutions tailored for financial institutions, enhancing their cybersecurity frameworks.

What are the primary factors driving the growth in the cyber Security In Bfsi industry?

Growth in the cyber-security BFSI sector is largely driven by the increasing incidence of cyberattacks, regulatory compliance demands, evolving technology landscapes, and a heightened awareness of security among financial institutions, necessitating robust security measures.

Which region is the fastest Growing in the cyber Security In Bfsi?

The Asia-Pacific region is the fastest-growing market for cyber-security in BFSI, with a projected increase from $5.86 billion in 2023 to $14.55 billion by 2033, reflecting heightened digitalization and regulatory pressures.

Does ConsaInsights provide customized market report data for the cyber Security In Bfsi industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the cyber-security BFSI sector, allowing businesses to gain targeted insights and make informed decisions based on market dynamics.

What deliverables can I expect from this cyber Security In Bfsi market research project?

From the cyber-security BFSI market research project, clients can expect comprehensive reports, market analysis, trend forecasts, competitive landscape insights, and tailored recommendations to aid strategic planning and investment decisions.

What are the market trends of cyber Security In Bfsi?

Current trends in the cyber-security BFSI industry include a shift towards cloud-based solutions, increased investment in AI-driven security technologies, and a growing focus on regulatory compliance, shaping future investment strategies.