Cyber Security Insurance Market Report

Published Date: 31 January 2026 | Report Code: cyber-security-insurance

Cyber Security Insurance Market Size, Share, Industry Trends and Forecast to 2033

This report offers an extensive analysis of the Cyber Security Insurance market, sharing insights on market dynamics, growth forecasts from 2023 to 2033, and the influence of regional and technological trends on industry development.

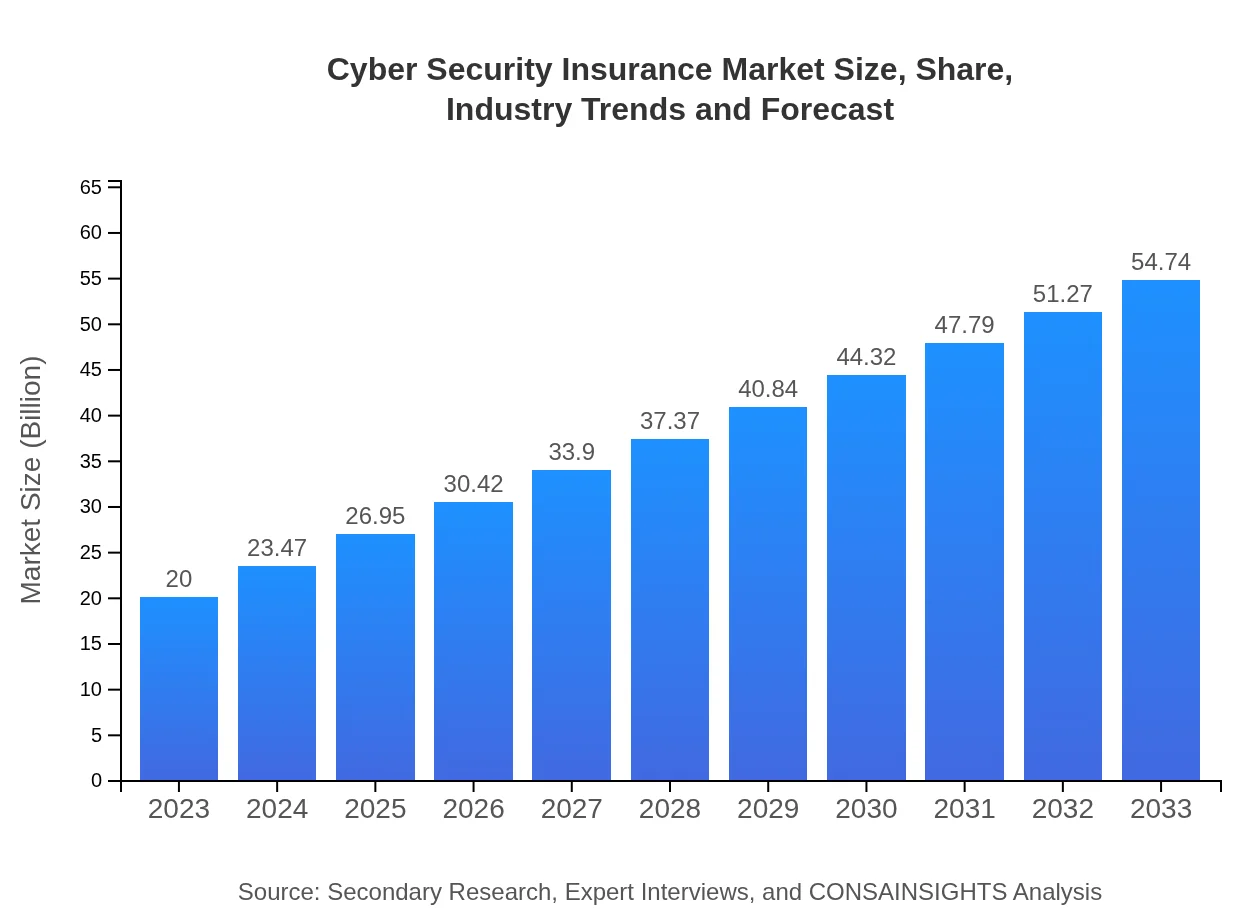

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.00 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $54.74 Billion |

| Top Companies | AIG, Chubb, Travelers, Liberty Mutual, AXA XL |

| Last Modified Date | 31 January 2026 |

Cyber Security Insurance Market Overview

Customize Cyber Security Insurance Market Report market research report

- ✔ Get in-depth analysis of Cyber Security Insurance market size, growth, and forecasts.

- ✔ Understand Cyber Security Insurance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cyber Security Insurance

What is the Market Size & CAGR of Cyber Security Insurance market in 2023?

Cyber Security Insurance Industry Analysis

Cyber Security Insurance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cyber Security Insurance Market Analysis Report by Region

Europe Cyber Security Insurance Market Report:

The Cyber Security Insurance market in Europe is set to grow from USD 4.95 billion in 2023 to USD 13.55 billion by 2033. With companies increasingly adopting digital systems and European regulations tightening around data protection, businesses are compelled to seek coverage.Asia Pacific Cyber Security Insurance Market Report:

The Asia Pacific region is witnessing rapid growth in Cyber Security Insurance, projected to reach USD 11.89 billion by 2033 from USD 4.34 billion in 2023. Key factors include increased internet penetration and mandatory compliance regulations, fostering a heightened awareness of cyber risks among businesses in emerging markets.North America Cyber Security Insurance Market Report:

North America remains the largest market for Cyber Security Insurance, with projections indicating growth from USD 7.60 billion in 2023 to USD 20.81 billion by 2033. Increased investment in cybersecurity infrastructure and regulatory mandates in sectors such as healthcare and finance drive the demand for insurance solutions.South America Cyber Security Insurance Market Report:

The Cyber Security Insurance market in South America is estimated to grow from USD 1.54 billion in 2023 to USD 4.22 billion by 2033. As regional companies fortify their cyber defenses against rising threats, adoption of cyber insurance coverage is expected to increase significantly.Middle East & Africa Cyber Security Insurance Market Report:

The Middle East and Africa market for Cyber Security Insurance is projected to rise from USD 1.56 billion in 2023 to USD 4.27 billion by 2033. With increases in cyber threats targeting critical infrastructure, governmental and corporate entities are realizing the need for comprehensive insurance policies to safeguard against financial loss.Tell us your focus area and get a customized research report.

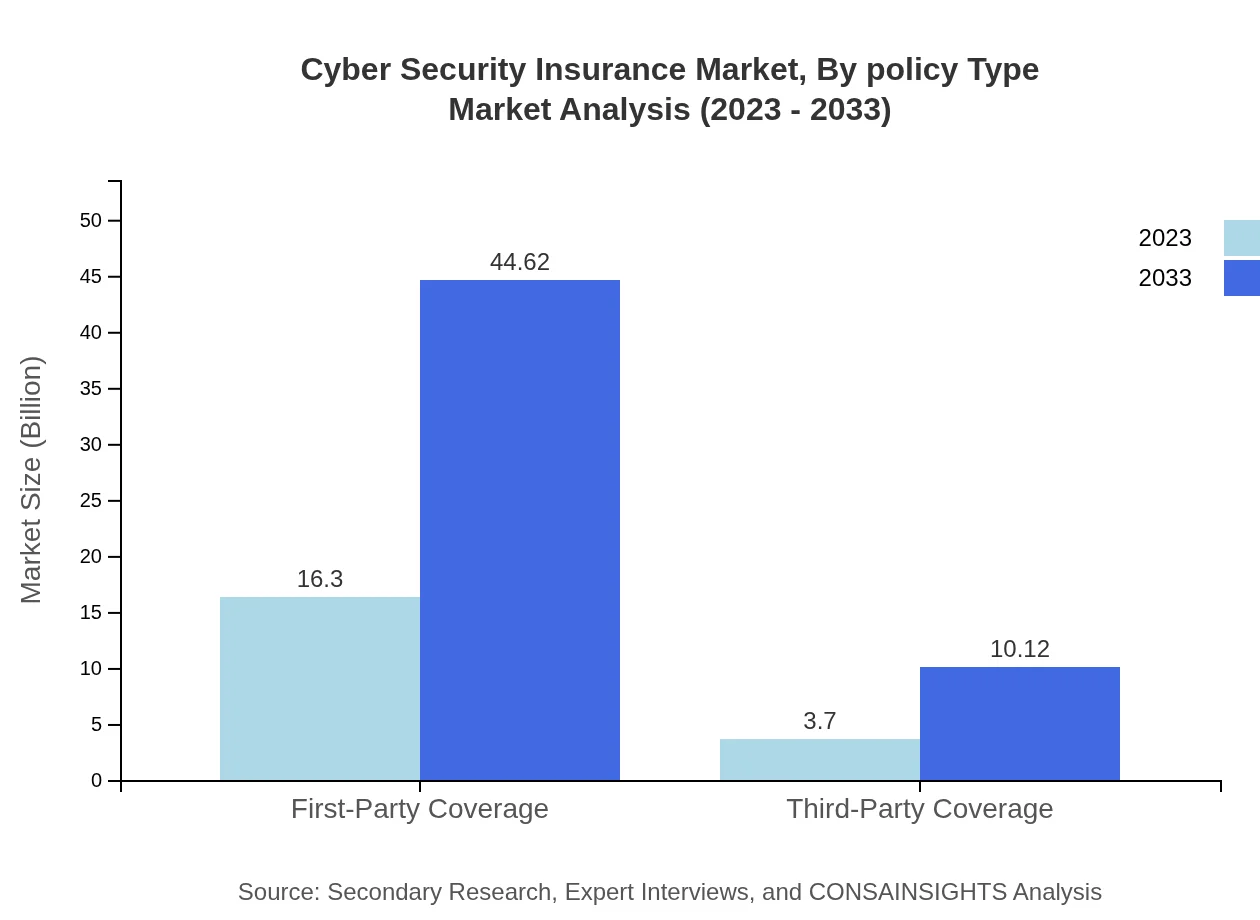

Cyber Security Insurance Market Analysis By Policy Type

The Cyber Security Insurance market by policy type indicates a significant share for first-party coverage, accounting for 81.52% of the market in 2023. This segment is expected to maintain its dominance as organizations prioritize protection against internal data breaches, with the market forecasted to grow from USD 16.30 billion in 2023 to USD 44.62 billion by 2033. Third-party coverage, while smaller (18.48% share in 2023), is also critical for protecting businesses against claims made by affected clients, expected to grow to USD 10.12 billion by 2033.

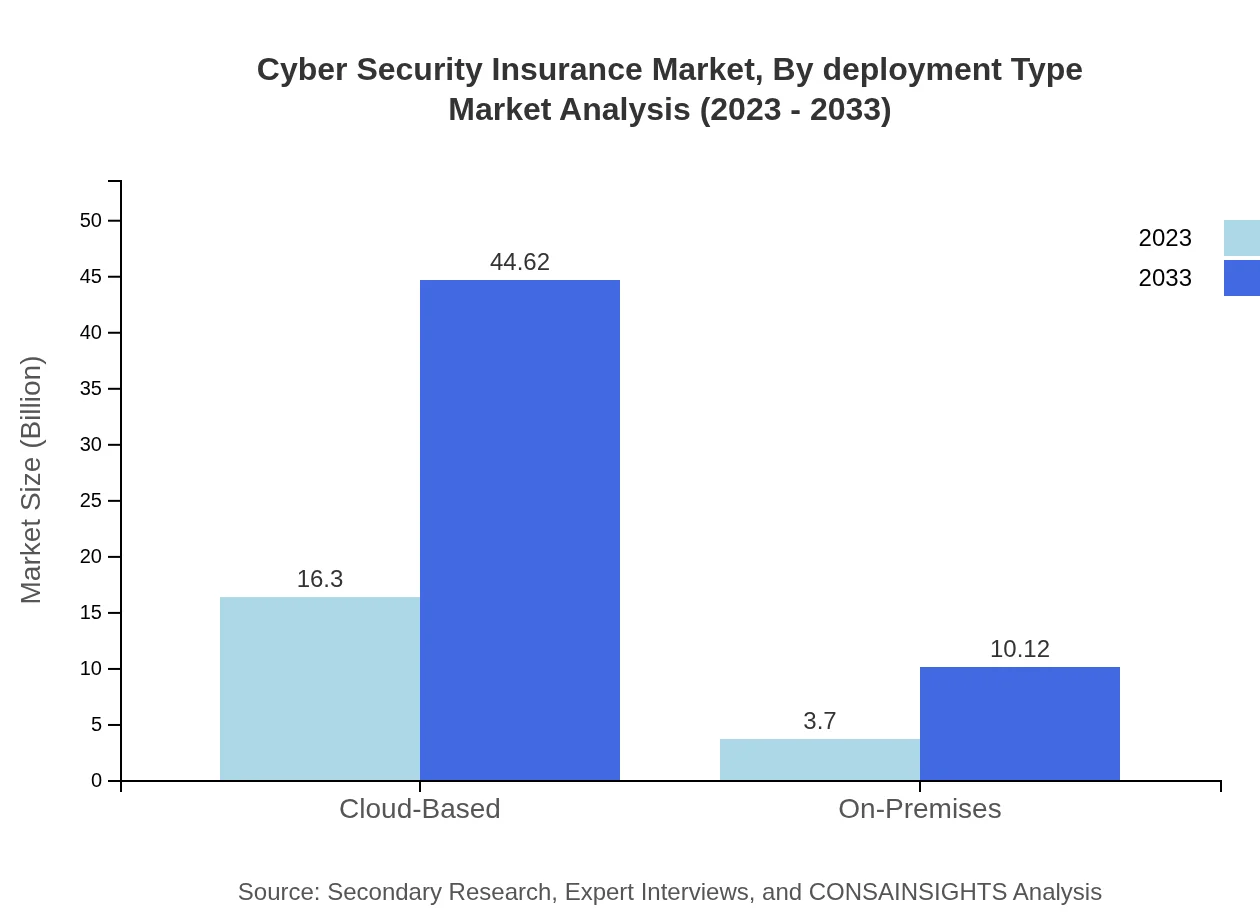

Cyber Security Insurance Market Analysis By Deployment Type

In deployment types, cloud-based solutions dominate, constituting 81.52% of the market in 2023 with a forecasted growth from USD 16.30 billion to USD 44.62 billion by 2033. This growth is attributed to the increased shift to cloud technologies. In contrast, on-premises deployment accounts for 18.48% of the market and is projected to reach USD 10.12 billion by 2033 as businesses maintain some traditional infrastructures.

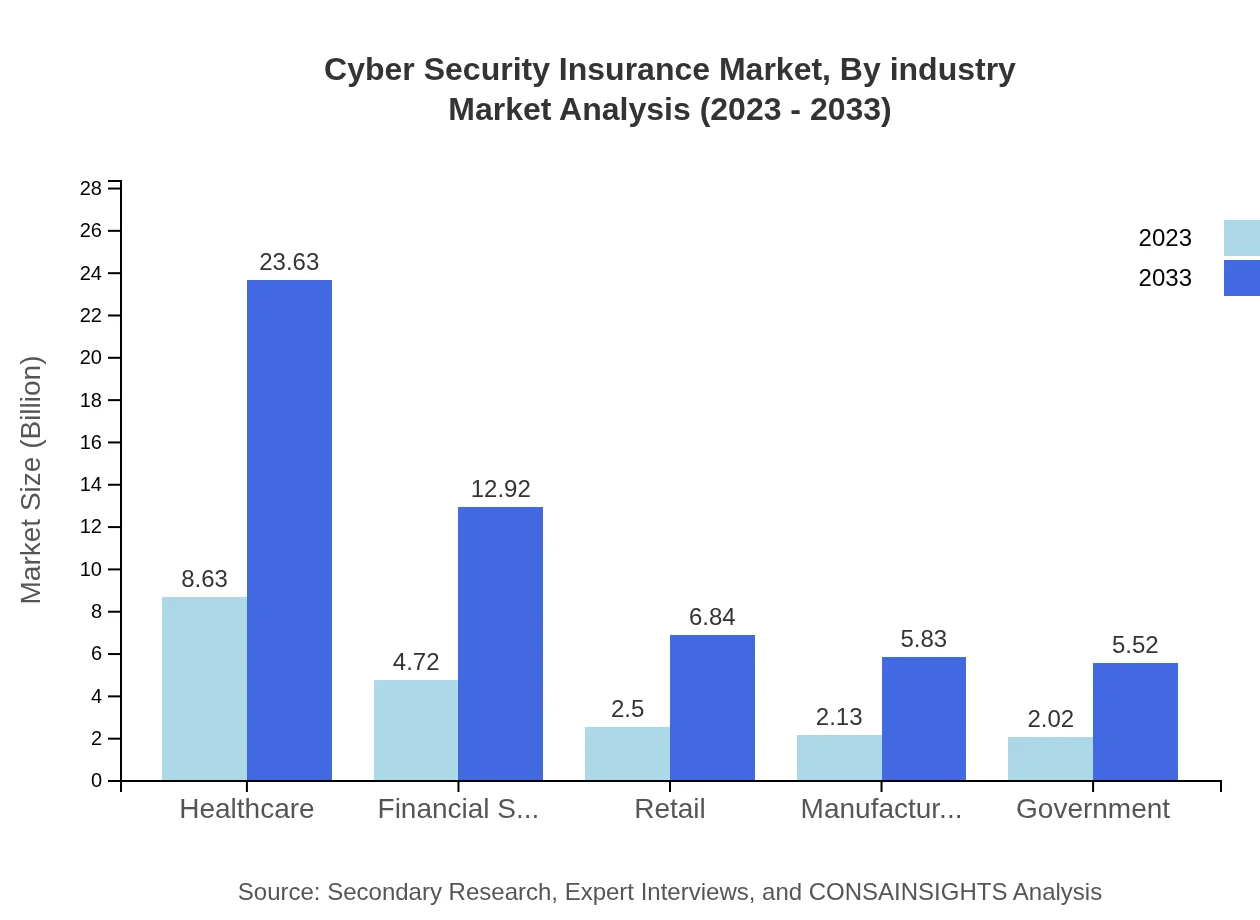

Cyber Security Insurance Market Analysis By Industry

Healthcare is leading the Cyber Security Insurance market by industry, with a market size expected to grow from USD 8.63 billion in 2023 to USD 23.63 billion by 2033, retaining a significant 43.16% market share throughout the forecast period. Other segments like financial services, retail, manufacturing, and government are also critical players, with financial services anticipated to grow from USD 4.72 billion to USD 12.92 billion. Each sector faces unique challenges, compelling them to adopt specialized insurance solutions.

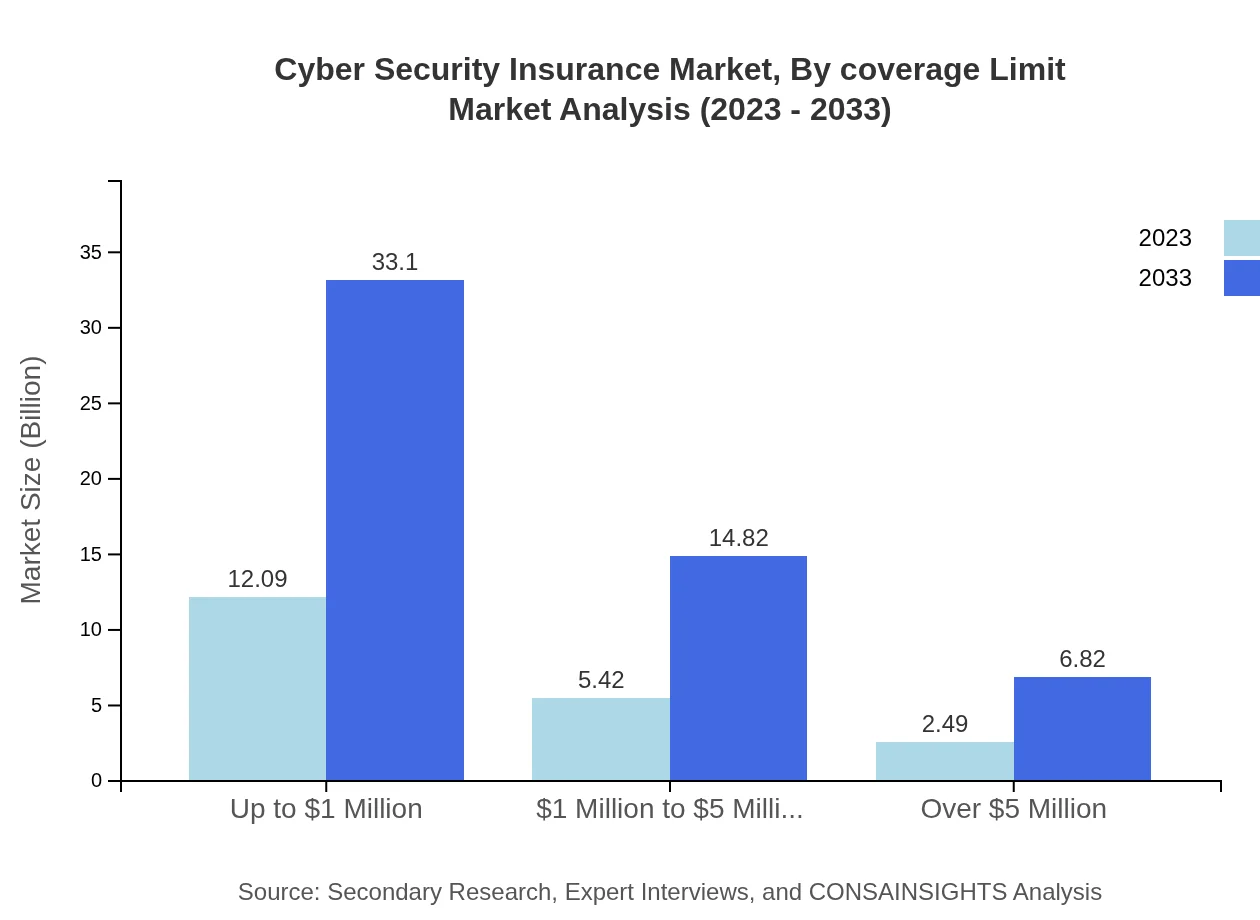

Cyber Security Insurance Market Analysis By Coverage Limit

When analyzing by coverage limits, the segment under USD 1 Million comprises 60.47% of the market, with projections indicating growth from USD 12.09 billion in 2023 to USD 33.10 billion by 2033. This reflects businesses opting for basic coverage. Conversely, segments offering higher coverage limits, particularly over $5 Million, account for a smaller segment of the market but are gaining traction, expected to grow to USD 6.82 billion by 2033 as companies face potential higher damages due to cyber events.

Cyber Security Insurance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cyber Security Insurance Industry

AIG:

Leading provider of cyber insurance solutions, AIG offers comprehensive policies to protect against data breaches and cyber extortion. Their innovative risk assessment tools help clients minimize risks effectively.Chubb:

Chubb is known for their extensive cyber insurance coverage tailored for businesses of all sizes, combined with proactive risk management solutions and cybersecurity expertise.Travelers:

Travelers provides specialized cyber insurance designed to meet the unique needs of various industries, including healthcare and financial services, with a focus on helping businesses recover from incidents.Liberty Mutual:

Liberty Mutual’s cyber insurance policies are designed to protect businesses from the financial impact of cyber risks, emphasizing customer service and risk mitigation planning.AXA XL:

AXA XL has a strong presence in the cyber insurance market, providing robust coverage options that address evolving cyber threats and tailored solutions for large corporations.We're grateful to work with incredible clients.

FAQs

What is the market size of Cyber Security Insurance?

The Cyber Security Insurance market was valued at approximately $20 billion in 2023, with a projected CAGR of 10.2% over the next ten years, indicating significant growth and demand for security coverage against cyber threats.

What are the key market players or companies in the Cyber Security Insurance industry?

Key players in the Cyber Security Insurance market include large insurers and specialized firms that provide tailored coverage solutions. Notable companies often lead in innovation and policy structuring but are not named in the current dataset.

What are the primary factors driving the growth in the Cyber Security Insurance industry?

The growth of the Cyber Security Insurance market is driven by increasing cyber threats, the digital transformation of businesses, regulatory requirements for data protection, and a heightened awareness of cybersecurity risks among companies across sectors.

Which region is the fastest Growing in the Cyber Security Insurance market?

North America leads the Cyber Security Insurance market, growing from $7.60 billion in 2023 to an estimated $20.81 billion by 2033. It is followed by Europe and Asia-Pacific, reflecting increasing investments in cybersecurity across regions.

Does ConsaInsights provide customized market report data for the Cyber Security Insurance industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the Cyber Security Insurance industry, ensuring that stakeholders receive relevant and actionable information.

What deliverables can I expect from this Cyber Security Insurance market research project?

From the Cyber Security Insurance market research project, clients can expect comprehensive reports that include market analyses, forecasts, regional insights, and segmentation data to inform strategic decision-making.

What are the market trends of Cyber Security Insurance?

Current trends in the Cyber Security Insurance market include the growth of cloud-based solutions, increased coverage options tailored for specific industries, and greater emphasis on first-party coverage as companies seek to mitigate risks and losses.