Cyclosporine Drugs Market Report

Published Date: 31 January 2026 | Report Code: cyclosporine-drugs

Cyclosporine Drugs Market Size, Share, Industry Trends and Forecast to 2033

This report delivers a comprehensive analysis of the Cyclosporine Drugs market, covering key trends, market size, segmentation, and forecasts for the period 2023-2033. It aims to provide insights into growth factors, challenges, and the competitive landscape of this vital segment in the pharmaceutical industry.

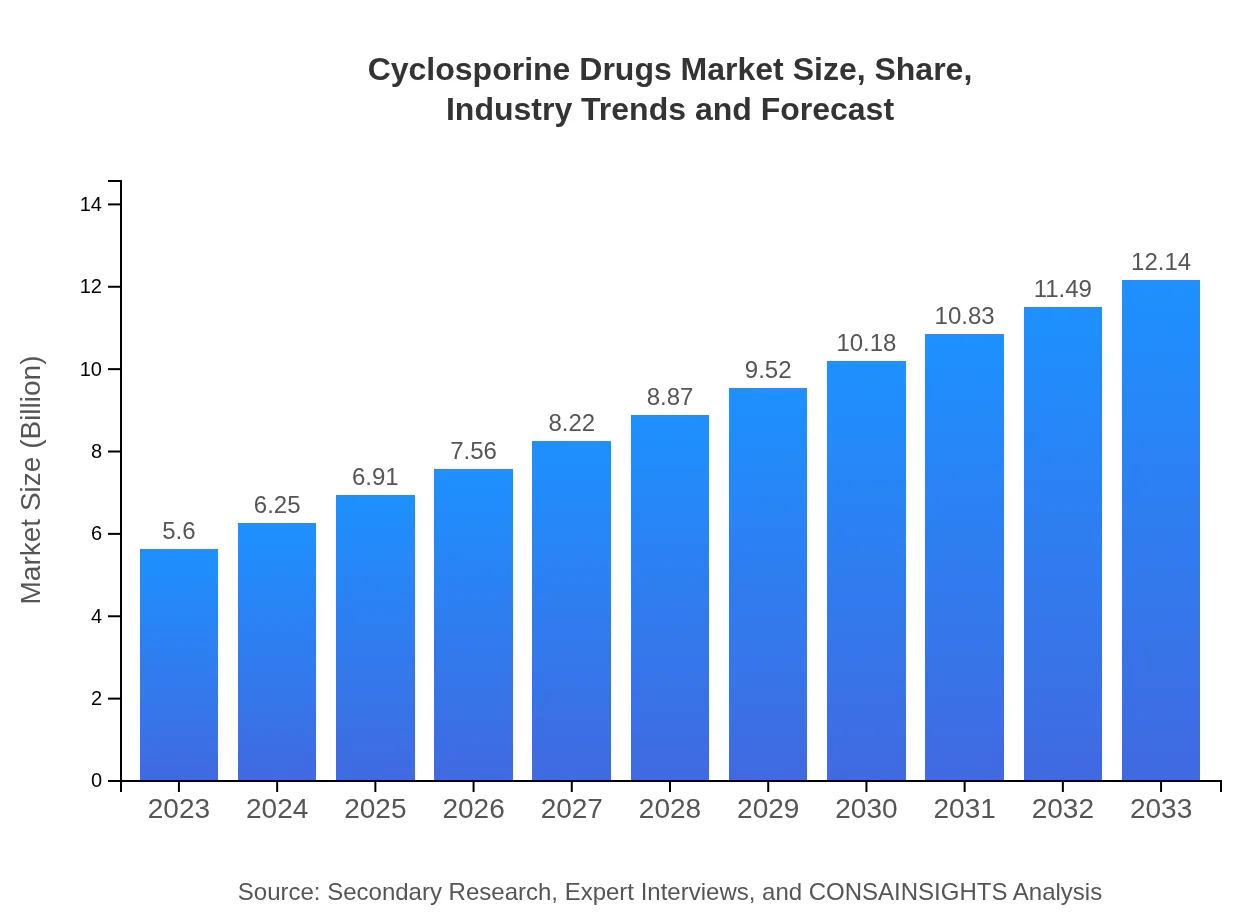

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $12.14 Billion |

| Top Companies | Novartis, Roche, Teva Pharmaceuticals |

| Last Modified Date | 31 January 2026 |

Cyclosporine Drugs Market Overview

Customize Cyclosporine Drugs Market Report market research report

- ✔ Get in-depth analysis of Cyclosporine Drugs market size, growth, and forecasts.

- ✔ Understand Cyclosporine Drugs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cyclosporine Drugs

What is the Market Size & CAGR of Cyclosporine Drugs market in 2023?

Cyclosporine Drugs Industry Analysis

Cyclosporine Drugs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cyclosporine Drugs Market Analysis Report by Region

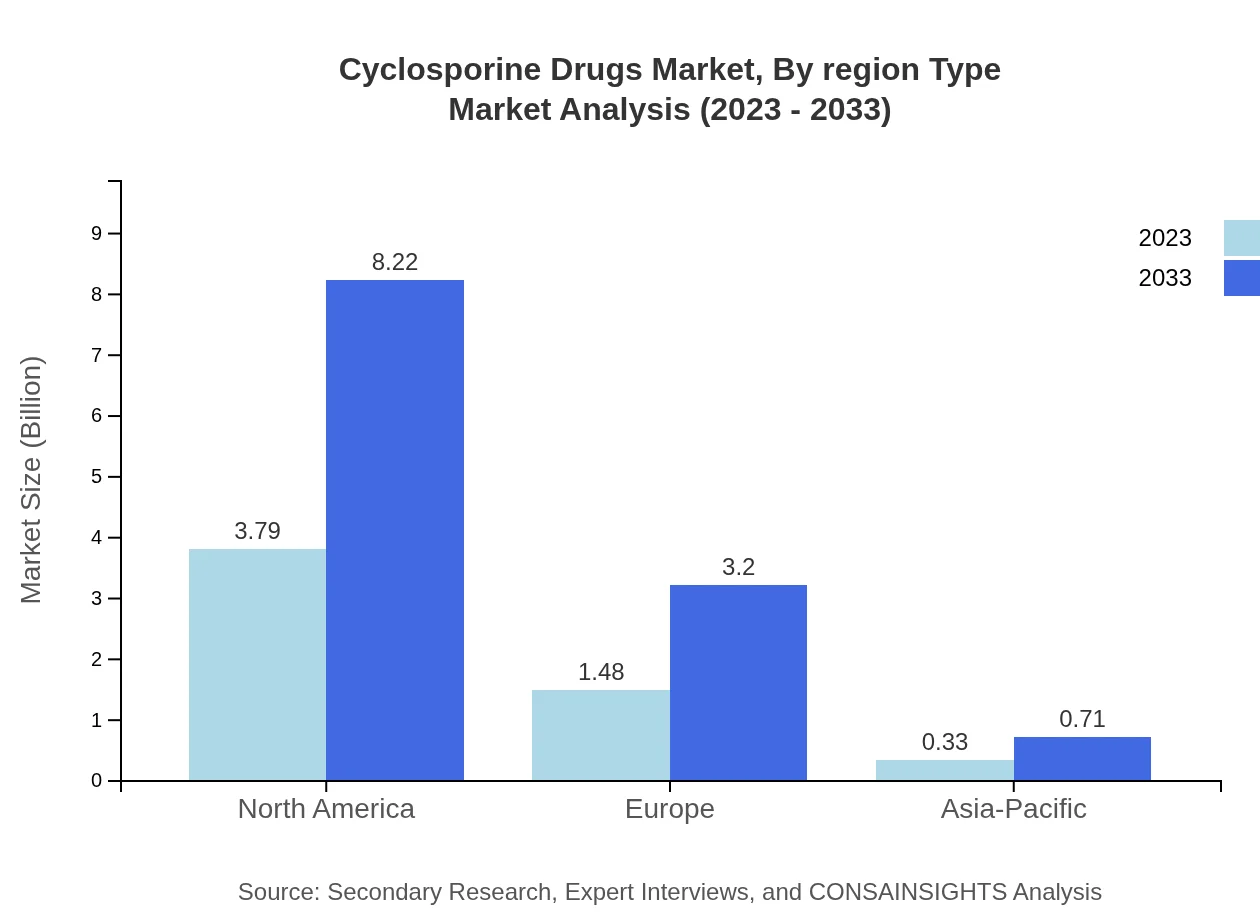

Europe Cyclosporine Drugs Market Report:

Europe’s market is anticipated to grow robustly, increasing from $1.61 billion in 2023 to $3.49 billion by 2033. The region's established healthcare infrastructure and high patient awareness contribute significantly to market growth.Asia Pacific Cyclosporine Drugs Market Report:

The Asia Pacific region is expected to witness significant growth, with market size forecasted to rise from $1.02 billion in 2023 to $2.22 billion by 2033. Factors driving this growth include increasing healthcare access, a growing elderly population, and rising chronic disease prevalence.North America Cyclosporine Drugs Market Report:

In North America, the market for Cyclosporine Drugs is expected to expand from $2.16 billion in 2023 to $4.68 billion by 2033, driven largely by advancements in transplant technology and supportive government policies promoting organ donation.South America Cyclosporine Drugs Market Report:

South America, while having a smaller market size, presents growth opportunities, projected to grow from $0.22 billion in 2023 to $0.47 billion by 2033. Increased investment in healthcare and rising awareness about treatment options are key factors.Middle East & Africa Cyclosporine Drugs Market Report:

The Middle East and Africa market is expected to increase from $0.59 billion in 2023 to $1.28 billion by 2033. This growth is attributed to improving healthcare systems and rising investments in pharmaceuticals.Tell us your focus area and get a customized research report.

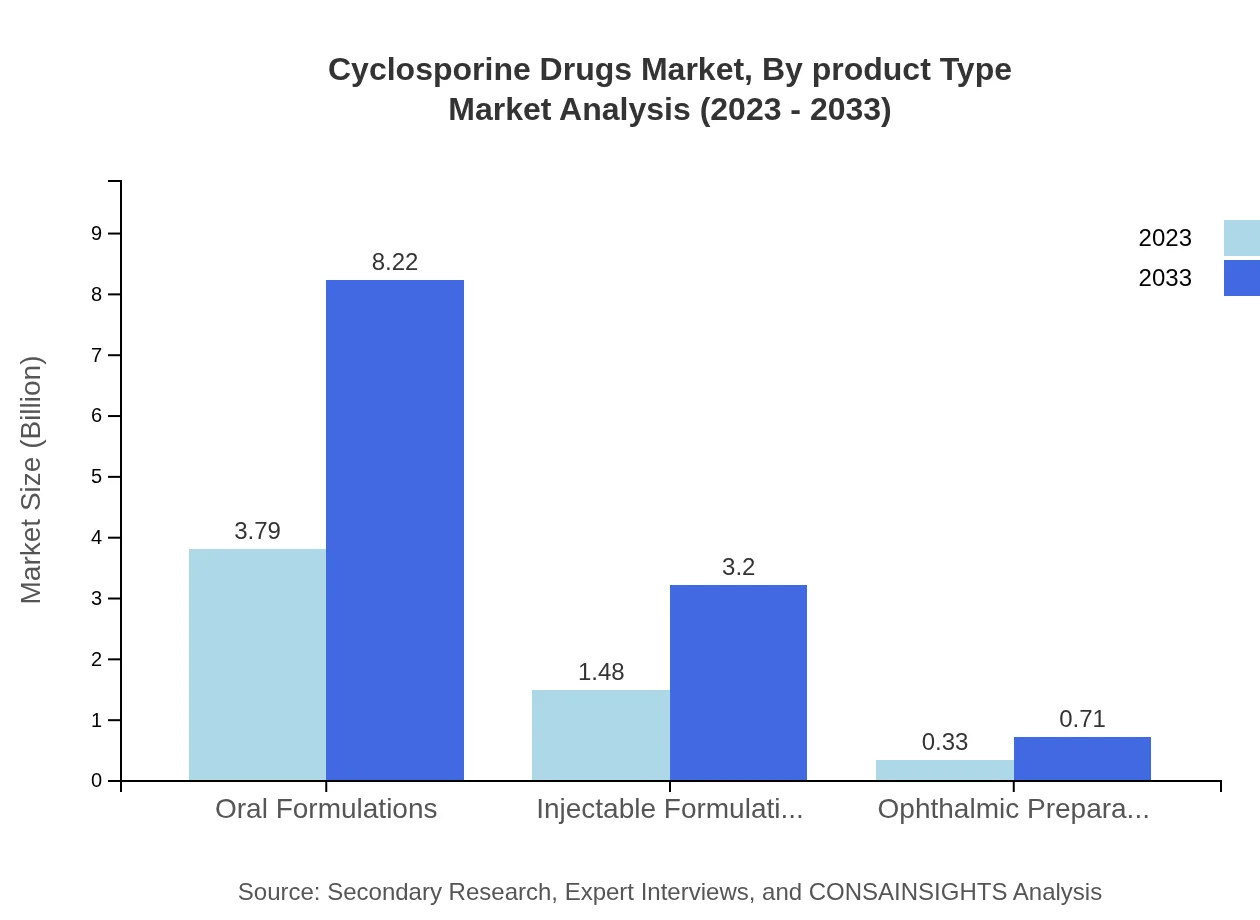

Cyclosporine Drugs Market Analysis By Product Type

Among product types, oral formulations dominate the market, expected to sustain its leading position, increasing from $3.79 billion in 2023 to $8.22 billion by 2033. Injectable formulations follow, growing from $1.48 billion to $3.20 billion. Ophthalmic preparations, though smaller, are projected to rise from $0.33 billion to $0.71 billion during the same period.

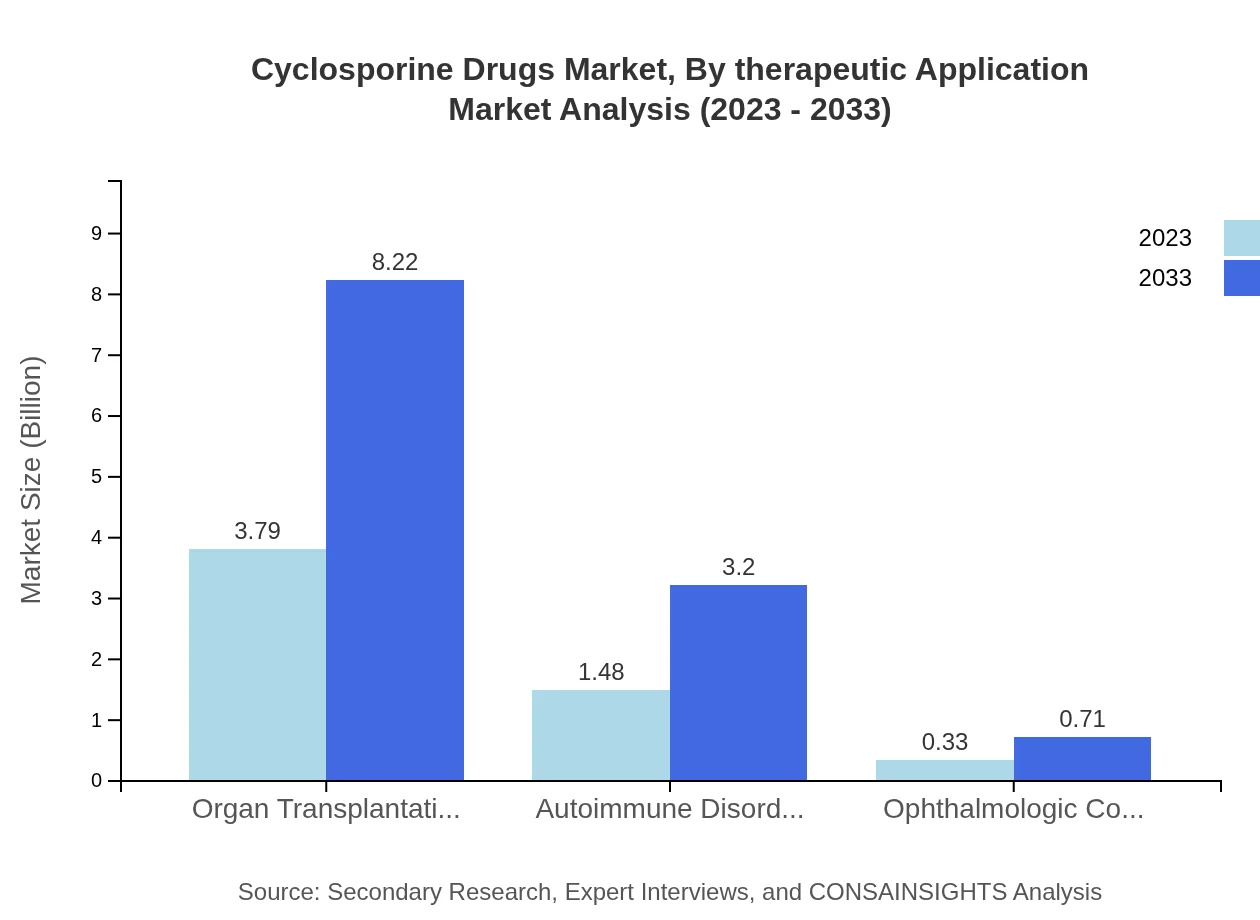

Cyclosporine Drugs Market Analysis By Therapeutic Application

Organ transplantation is the largest therapeutic application segment, expanding from $3.79 billion in 2023 to $8.22 billion by 2033. Autoimmune disorders account for significant market share as well, growing from $1.48 billion to $3.20 billion. Ophthalmologic conditions, while smaller, also show potential for growth.

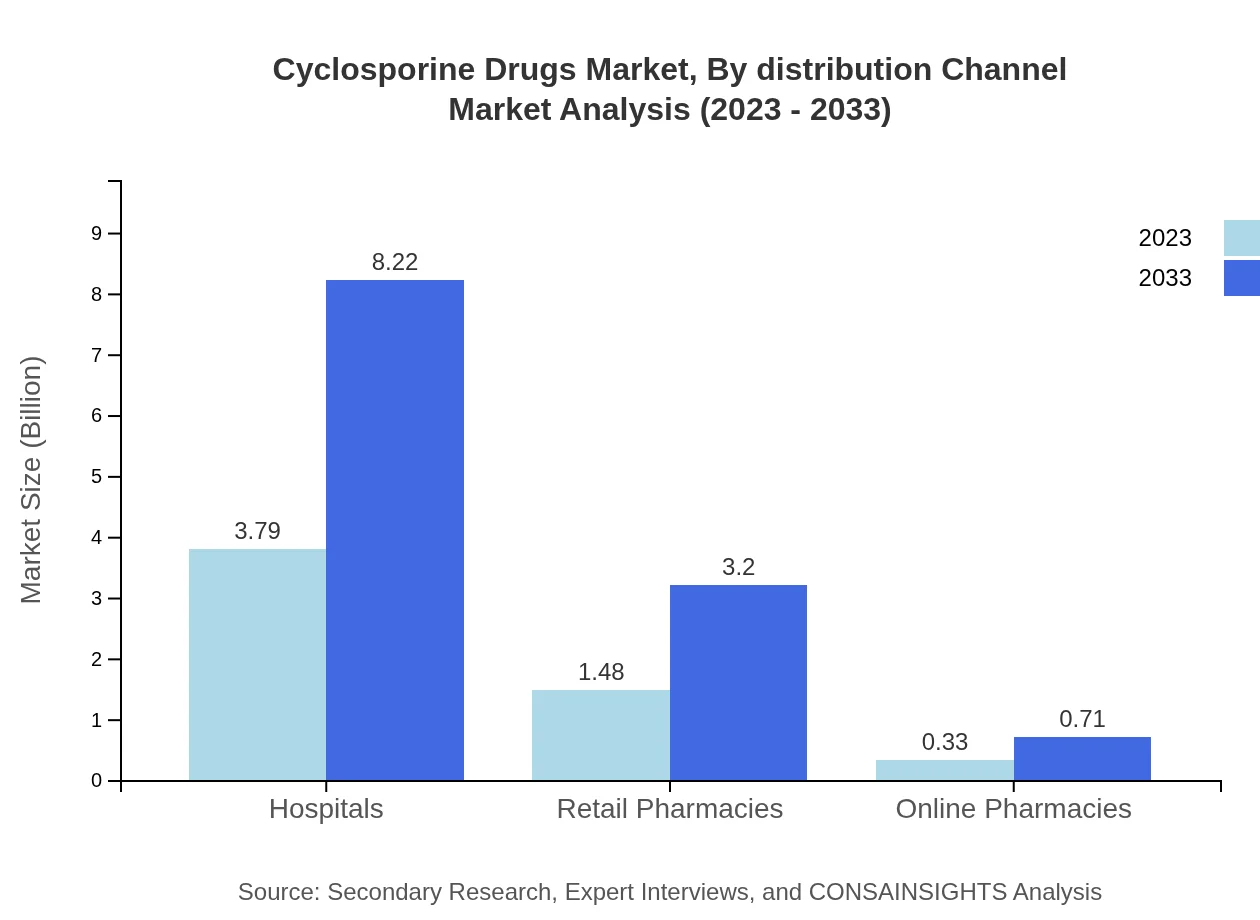

Cyclosporine Drugs Market Analysis By Distribution Channel

Hospitals and clinics are the primary distribution channels for Cyclosporine Drugs, expected to grow from $3.79 billion in 2023 to $8.22 billion by 2033, holding 67.73% of market share throughout the forecast period. Retail and online pharmacies are also important, with projected growth reflecting the increasing preference for home-based healthcare.

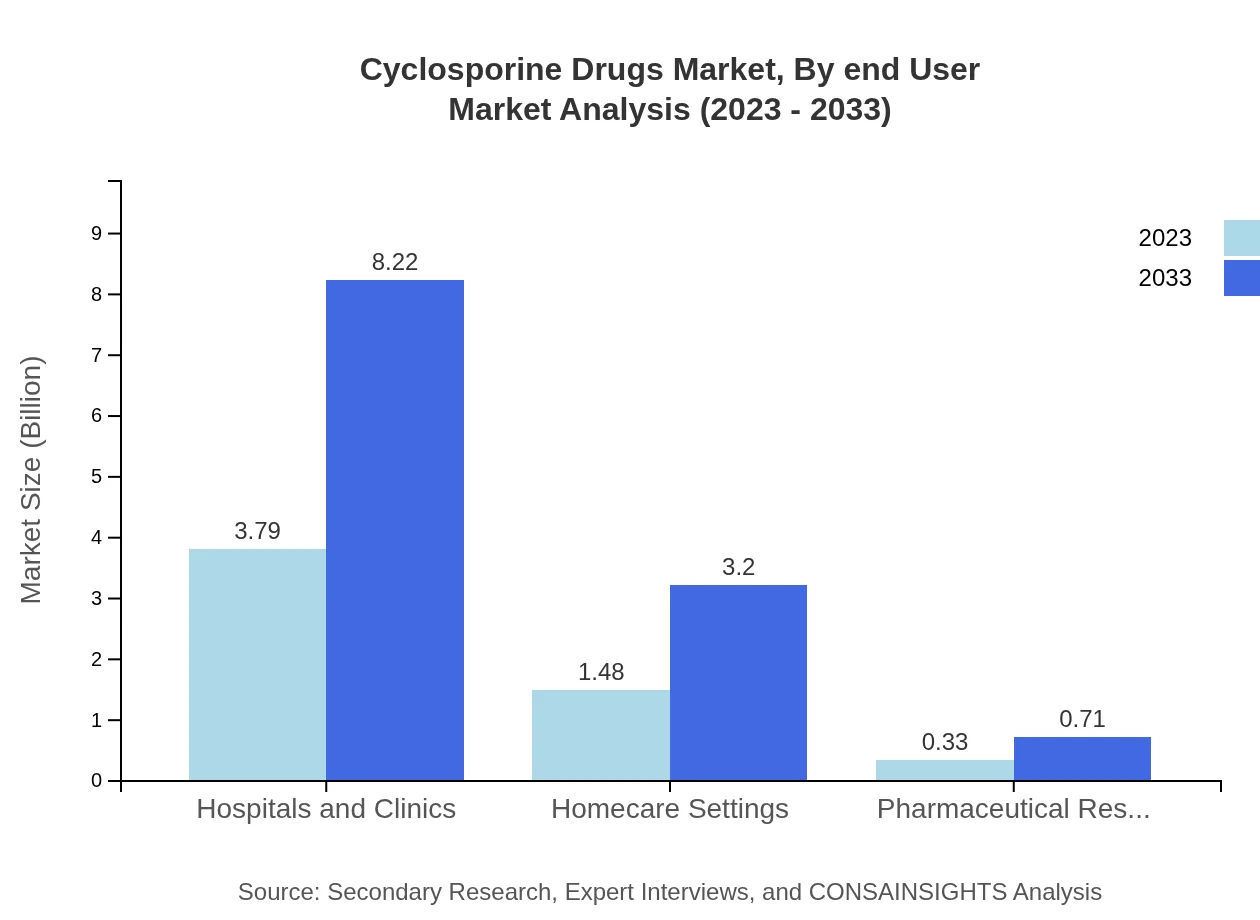

Cyclosporine Drugs Market Analysis By End User

In terms of end-users, hospitals dominate the market, with sizes expanding as organ transplants increase. Homecare settings are also significant, particularly for autoimmune disorder treatments, reflecting a shift toward outpatient care models alongside traditional settings.

Cyclosporine Drugs Market Analysis By Region Type

Regional analysis shows that North America leads in both market size and growth rates, followed by Europe and Asia Pacific. Each region's healthcare policies, patient demographics, and investment levels play vital roles in shaping their respective market landscapes.

Cyclosporine Drugs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cyclosporine Drugs Industry

Novartis:

Novartis is a leading pharmaceutical company known for its innovative therapies, including high-quality Cyclosporine formulations that serve both brand and generic markets.Roche:

Roche specializes in biotechnology and diagnostics and is heavily involved in the Cyclosporine market, driving advancements in treatment options and drug delivery systems.Teva Pharmaceuticals:

Teva is a prominent generic pharmaceutical manufacturer that plays a significant role in the Cyclosporine Drugs market by providing cost-effective alternatives to branded therapies.We're grateful to work with incredible clients.

FAQs

What is the market size of cyclosporine Drugs?

The global market size for cyclosporine drugs is projected to reach approximately $5.6 billion by 2033, growing at a CAGR of 7.8% from 2023. This growth is bolstered by advancements in pharmaceutical formulations and rising prevalence of autoimmune disorders and transplant procedures.

What are the key market players or companies in the cyclosporine Drugs industry?

Key players in the cyclosporine drugs industry include major pharmaceutical companies and biotech firms known for immunosuppressive medications. They drive innovation through research and development, contributing to the market's competitiveness and dynamic growth.

What are the primary factors driving the growth in the cyclosporine Drugs industry?

Growth in the cyclosporine drugs market is driven by increasing incidences of organ transplants and autoimmune diseases, innovations in oral and injectable formulations, and rising healthcare expenditures, leading to improved patient access to these essential medications.

Which region is the fastest Growing in the cyclosporine Drugs market?

The Asia-Pacific region is the fastest-growing market for cyclosporine drugs, with a projected increase from $1.02 billion in 2023 to $2.22 billion by 2033. This growth is fueled by rising healthcare infrastructure and demand for effective treatment options.

Does ConsaInsights provide customized market report data for the cyclosporine Drugs industry?

Yes, ConsaInsights offers tailored market report data for the cyclosporine drugs industry, enabling clients to access in-depth insights and business intelligence to make informed decisions tailored to their specific needs and market strategy.

What deliverables can I expect from this cyclosporine Drugs market research project?

Expect comprehensive deliverables including market size analysis, competitive landscape review, segmentation data, and regional insights, along with strategic recommendations to enhance market positioning, supported by robust data analytics.

What are the market trends of cyclosporine Drugs?

Current trends in the cyclosporine drugs market include enhanced drug formulations, increased focus on personalized medicine, and a shift towards online pharmacies. These trends are shaping the market landscape significantly through improved accessibility and patient engagement.