Dairy Cream Market Report

Published Date: 31 January 2026 | Report Code: dairy-cream

Dairy Cream Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Dairy Cream market, focusing on market dynamics, trends, and forecasts from 2023 to 2033. It includes insights on market size, segmentation, regional performance, leading companies, and future growth opportunities in the industry.

| Metric | Value |

|---|---|

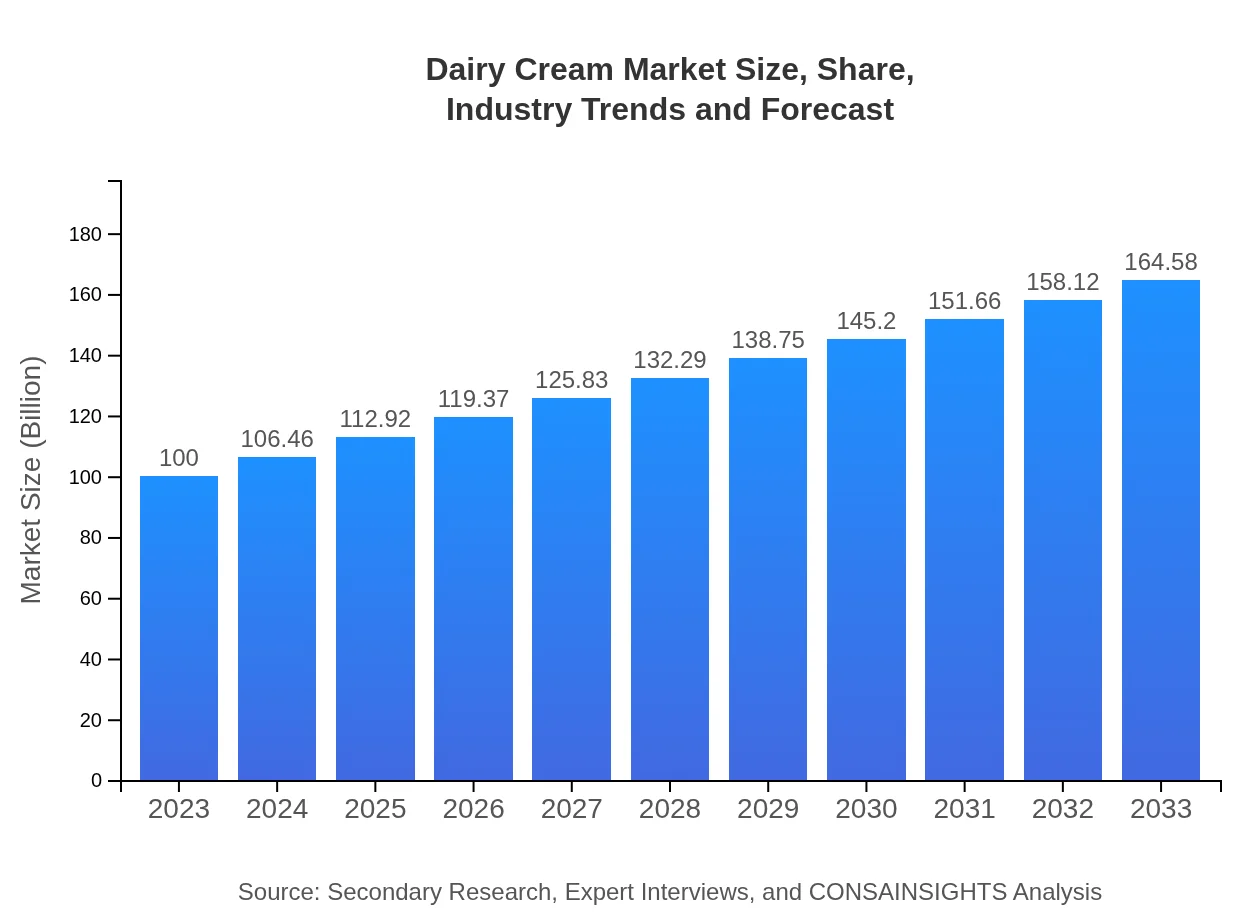

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Nestlé S.A., Fonterra Co-operative Group Ltd., Lactalis Group, Danone S.A. |

| Last Modified Date | 31 January 2026 |

Dairy Cream Market Overview

Customize Dairy Cream Market Report market research report

- ✔ Get in-depth analysis of Dairy Cream market size, growth, and forecasts.

- ✔ Understand Dairy Cream's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dairy Cream

What is the Market Size & CAGR of Dairy Cream market in 2023?

Dairy Cream Industry Analysis

Dairy Cream Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dairy Cream Market Analysis Report by Region

Europe Dairy Cream Market Report:

Europe's dairy cream market is projected to grow from USD 26.16 billion in 2023 to USD 43.05 billion by 2033. The region values premium dairy products, and consumer preferences are shifting towards organic and health-focused options.Asia Pacific Dairy Cream Market Report:

In 2023, the Asia-Pacific region's dairy cream market is valued at approximately USD 20.25 billion, with a projected increase to USD 33.33 billion by 2033. Growing urban populations and an increase in the consumption of Western-style foods are major factors propelling market growth in countries like China and India.North America Dairy Cream Market Report:

North America, particularly the US, dominates the dairy cream market with a size of USD 34.44 billion in 2023, expected to reach USD 56.68 billion by 2033. The region benefits from advanced food processing technologies and a strong trend towards gourmet culinary experiences.South America Dairy Cream Market Report:

The South American dairy cream market is expected to grow from USD 8.08 billion in 2023 to USD 13.30 billion by 2033. Increased agricultural productivity and changing lifestyles have led to greater demand for cream-related products in this region, particularly in Brazil and Argentina.Middle East & Africa Dairy Cream Market Report:

In the Middle East and Africa, the dairy cream market is expected to increase from USD 11.07 billion in 2023 to USD 18.22 billion by 2033. Economic growth and a rise in the middle-class population are contributing to increased consumption of dairy products.Tell us your focus area and get a customized research report.

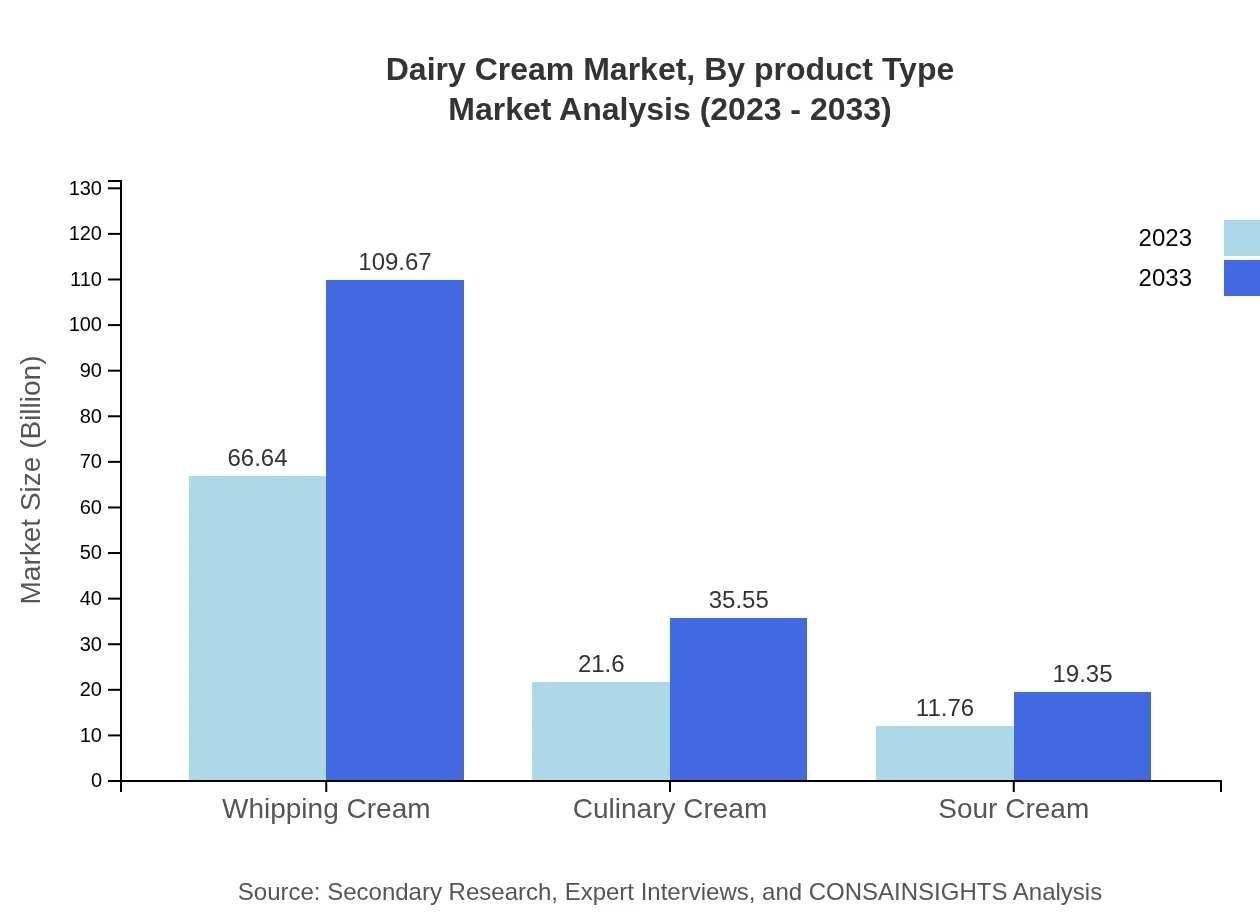

Dairy Cream Market Analysis By Product Type

Dairy cream includes various products such as whipping cream, culinary cream, sour cream, and others, each catering to different culinary needs. Whipping cream holds the largest market share due to its versatility in cooking and baking, while culinary cream is gaining traction for its use in sauces and dressings.

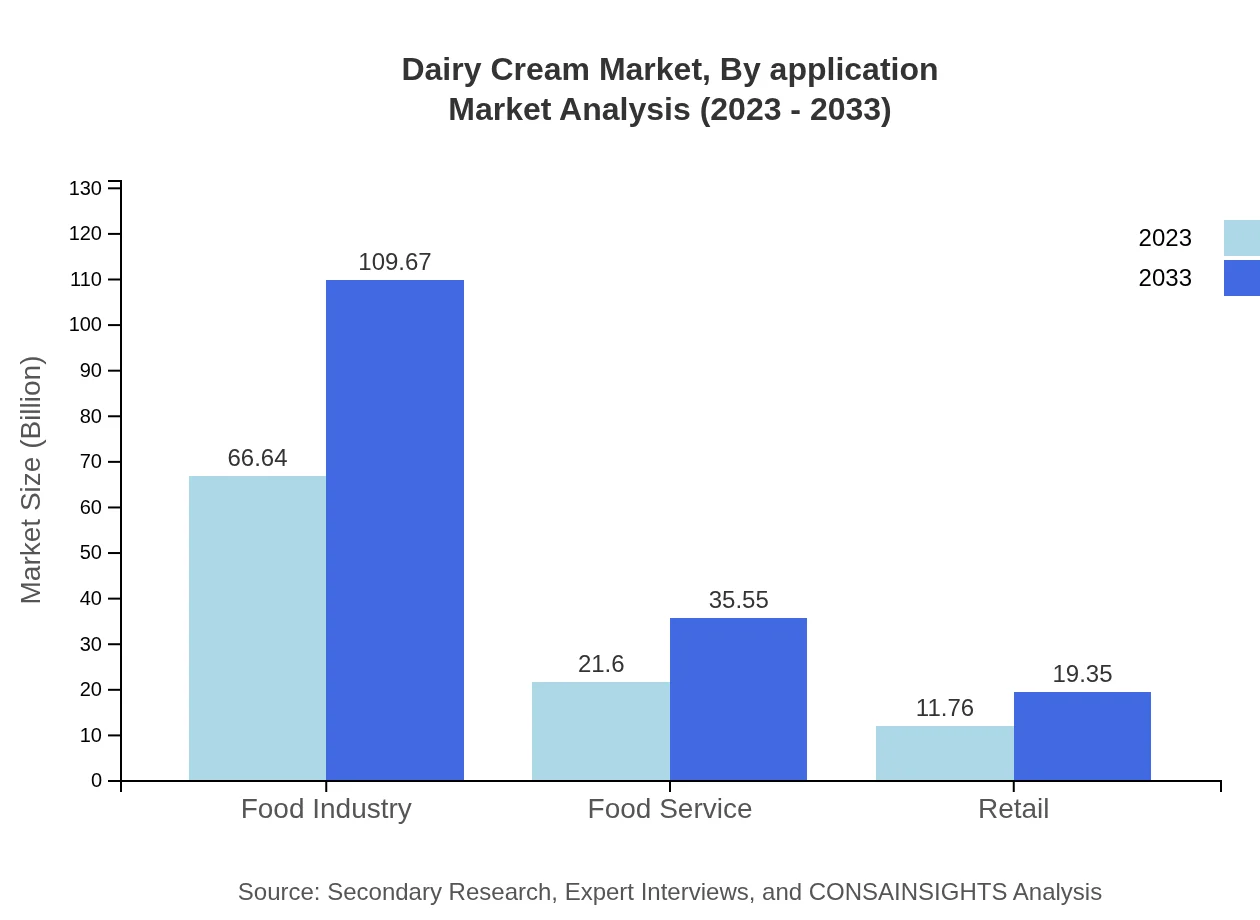

Dairy Cream Market Analysis By Application

The major applications of dairy cream include the food industry, food service, retail, and households. The food industry is the leading application segment, owing to the increasing use of cream in processed food products. The food service sector is also expanding rapidly, driven by the rise in dining out and gourmet meals.

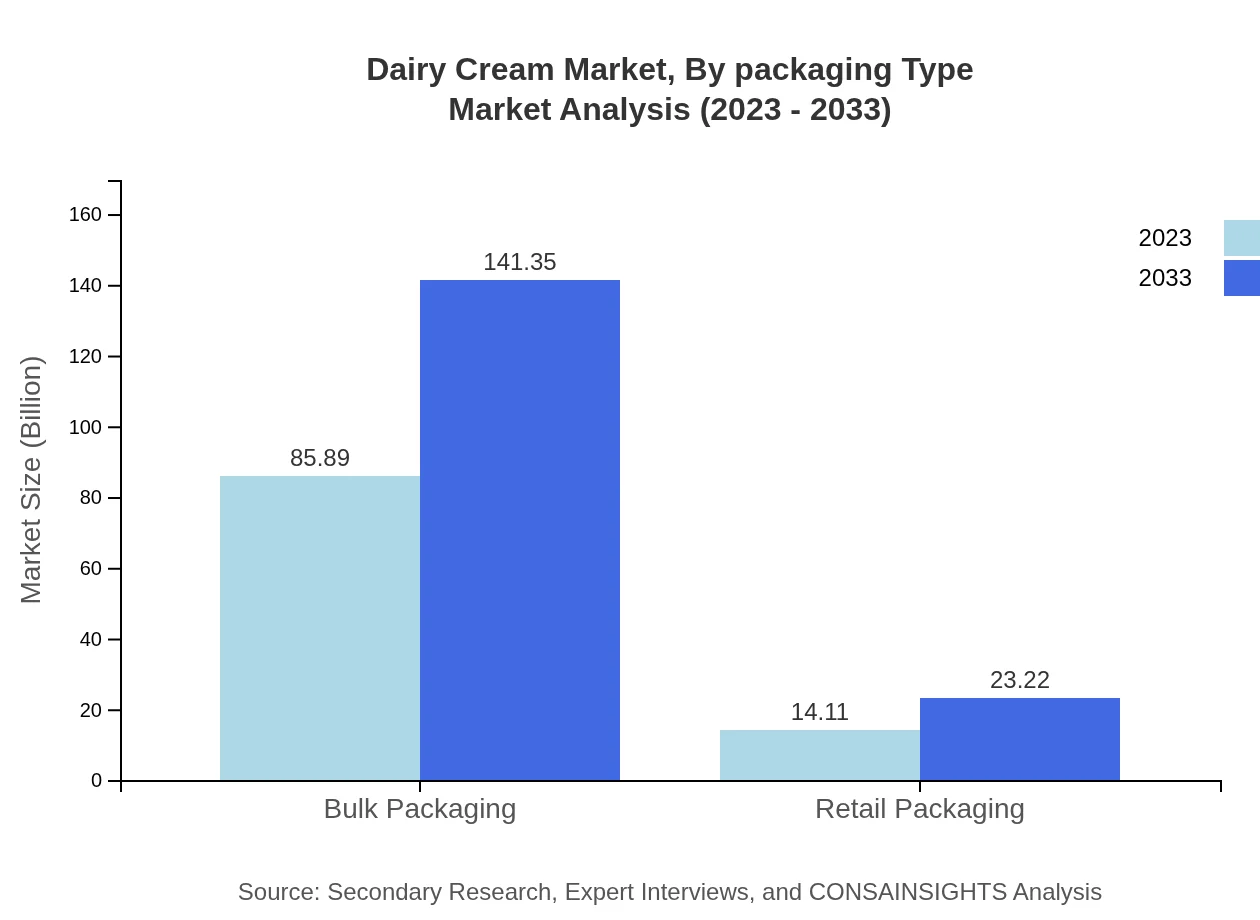

Dairy Cream Market Analysis By Packaging Type

The market is divided into bulk packaging and retail packaging. Bulk packaging dominates due to its suitability for commercial use, while retail packaging caters to household consumers looking for convenience and single-use options.

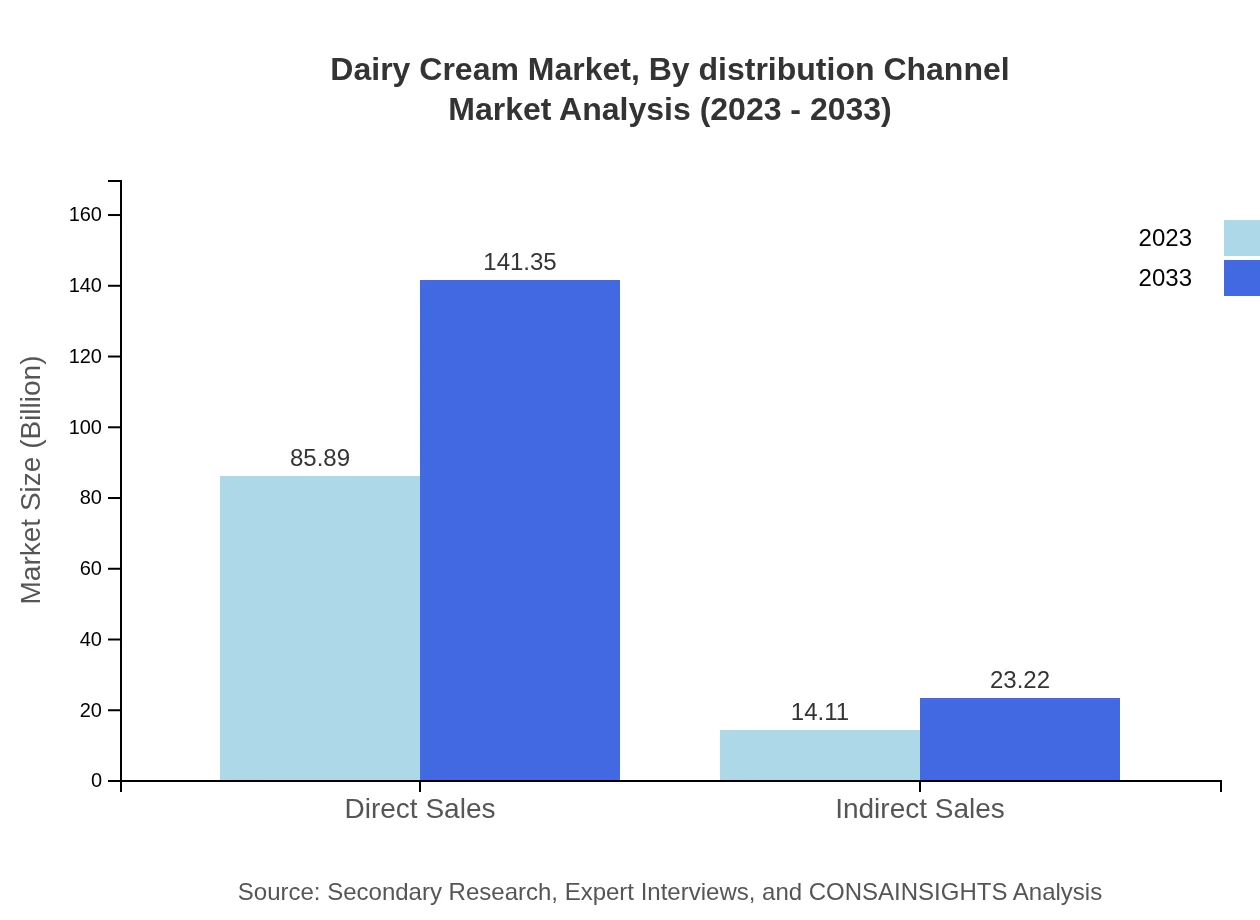

Dairy Cream Market Analysis By Distribution Channel

Products are distributed through direct sales, indirect sales, and e-commerce channels. Direct sales remain significant for bulk buyers in the food industry, while indirect and retail channels are crucial for reaching consumers.

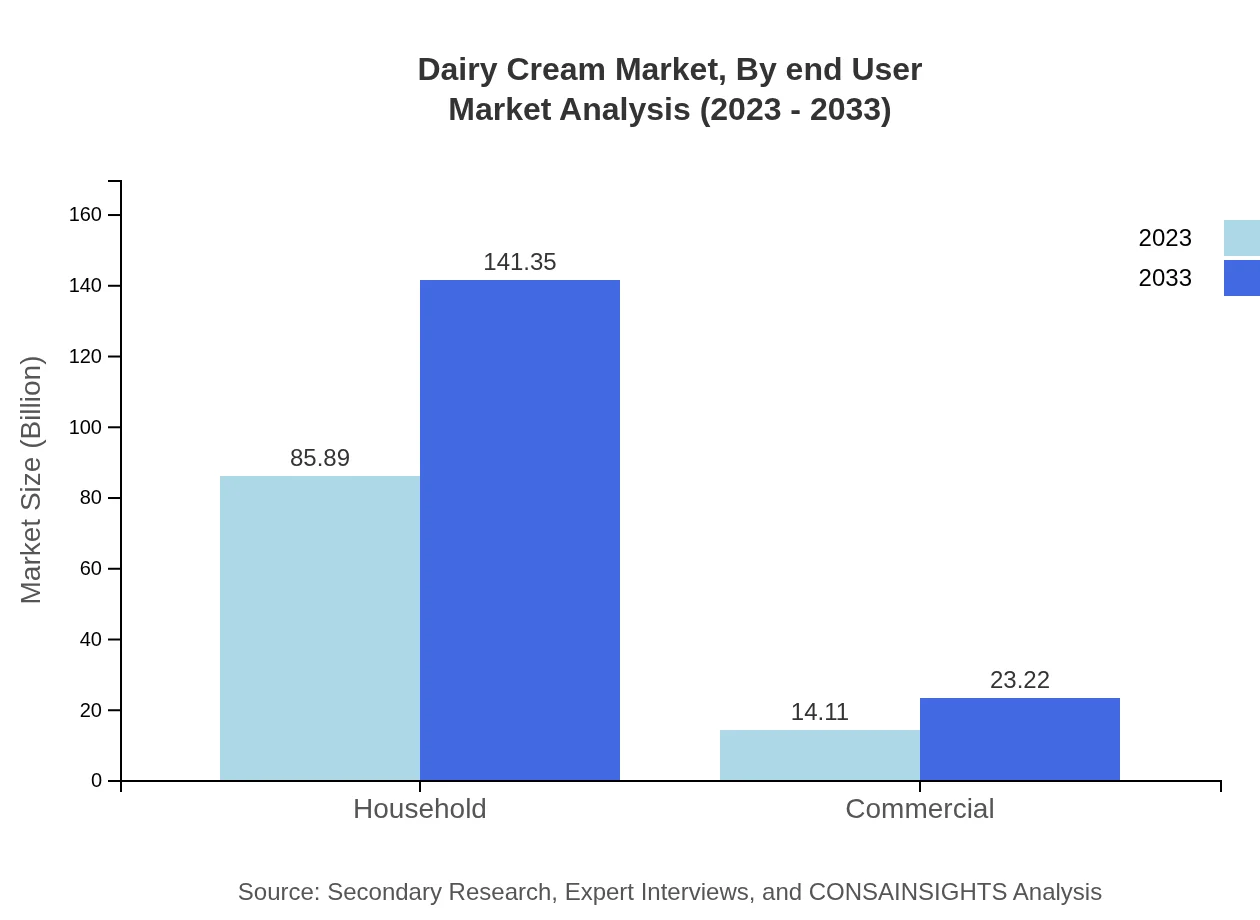

Dairy Cream Market Analysis By End User

The end-users of dairy cream include households, restaurants, cafes, and food processing industries. Households constitute the largest segment, largely due to the consistent use of cream in daily cooking and baking, while commercial establishments leverage cream for value-added products.

Dairy Cream Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dairy Cream Industry

Nestlé S.A.:

A global leader in food and beverage, Nestlé S.A. offers a wide range of dairy cream products, focusing on quality and nutritional excellence.Fonterra Co-operative Group Ltd.:

Based in New Zealand, Fonterra is a major exporter of dairy and a leader in dairy cream innovation, known for its high-quality milk and cream products.Lactalis Group:

Lactalis is one of the largest dairy groups worldwide, providing a diverse range of cream products suited for various culinary applications.Danone S.A.:

Danone is known for its health-focused products and operates in the dairy industry, producing high-quality dairy cream for health-conscious consumers.We're grateful to work with incredible clients.

FAQs

What is the market size of dairy cream?

The dairy cream market is projected to reach approximately USD 100 million by 2033, with a compound annual growth rate (CAGR) of 5%. This growth indicates a steady demand for various types of dairy cream in different sectors.

What are the key market players or companies in this dairy cream industry?

Key players in the dairy cream market include major dairy processors and manufacturers globally. They are actively engaging in product innovation and partnerships to enhance market presence and meet consumer preferences.

What are the primary factors driving the growth in the dairy cream industry?

Factors driving growth include increasing demand for dairy products, expanding food service industry, and rising consumer preference for premium quality cream in culinary applications, contributing to an expanding market size.

Which region is the fastest Growing in the dairy cream market?

North America is currently the fastest-growing region, with the dairy cream market projected to grow from USD 34.44 million in 2023 to USD 56.68 million by 2033, fueled by high consumption rates and food service expansion.

Does ConsaInsights provide customized market report data for the dairy cream industry?

Yes, ConsaInsights offers customized market report data for the dairy cream industry, catering specific insights to meet client needs, including segments, regional performance, and competitive landscape.

What deliverables can I expect from this dairy cream market research project?

Expect comprehensive deliverables including detailed market size data, segment analysis, trend forecasts, competitive landscape assessments, and geographic insights tailored to inform strategic decision-making.

What are the market trends of dairy cream?

Current trends in the dairy cream market include the rise of plant-based alternatives, increasing demand for organic dairy products, and innovations in packaging and distribution, enhancing market accessibility and consumer engagement.