Dairy Ingredients Market Report

Published Date: 31 January 2026 | Report Code: dairy-ingredients

Dairy Ingredients Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Dairy Ingredients market, analyzing trends, growth drivers, and forecasts from 2023 to 2033. It encompasses market size, segment analysis, regional insights, and key players contributing to this evolving sector.

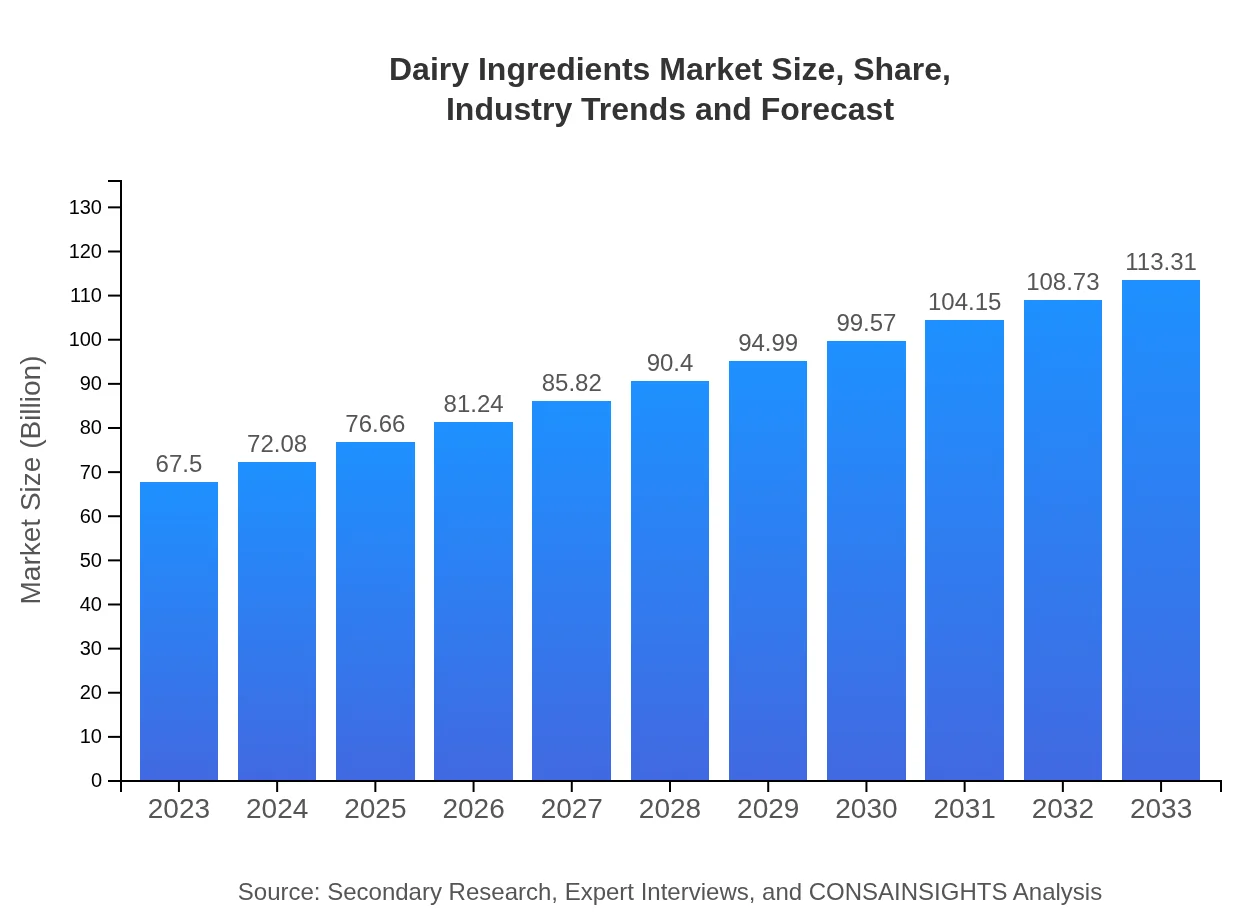

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $67.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $113.31 Billion |

| Top Companies | Dairy Farmers of America, Nestlé S.A., Fonterra Co-operative Group Limited, Danone S.A., Lactalis Group |

| Last Modified Date | 31 January 2026 |

Dairy Ingredients Market Overview

Customize Dairy Ingredients Market Report market research report

- ✔ Get in-depth analysis of Dairy Ingredients market size, growth, and forecasts.

- ✔ Understand Dairy Ingredients's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dairy Ingredients

What is the Market Size & CAGR of Dairy Ingredients market in 2023?

Dairy Ingredients Industry Analysis

Dairy Ingredients Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dairy Ingredients Market Analysis Report by Region

Europe Dairy Ingredients Market Report:

The European Dairy Ingredients market claims the largest share, estimated at $25.17 billion in 2023, extending to $42.25 billion by 2033. This is buoyed by strong consumer preferences for organic and functional dairy products, alongside stringent regulations ensuring quality and safety, fostering innovation in sustainable practices.Asia Pacific Dairy Ingredients Market Report:

In the Asia Pacific region, the Dairy Ingredients market is estimated at $11.64 billion in 2023, projected to grow to $19.55 billion by 2033. The rising population and urbanization are leading to increased demand for dairy products, alongside a growing trend of western dietary habits influencing consumption patterns. Investments in dairy infrastructure and production technologies are also vital to growth.North America Dairy Ingredients Market Report:

In North America, the market size for Dairy Ingredients is anticipated to rise from $21.74 billion in 2023 to $36.50 billion by 2033. Increased health awareness, demand for convenience food items, and growth in the protein supplement market drive this region, presenting substantial opportunities for dairy product manufacturers.South America Dairy Ingredients Market Report:

The South American market for Dairy Ingredients is expected to grow from $5.70 billion in 2023 to $9.57 billion in 2033. A surge in interest in dairy nutrition, particularly in Brazil and Argentina, alongside innovations in dairy processing and distribution channels are key growth drivers enhancing market potential.Middle East & Africa Dairy Ingredients Market Report:

The Dairy Ingredients market in the Middle East and Africa is projected to grow from $3.24 billion in 2023 to $5.44 billion by 2033. Factors such as increasing urbanization, a growing food and beverage sector, and rising disposable incomes will support this growth, despite existing challenges in dairy farming and supply chain logistics.Tell us your focus area and get a customized research report.

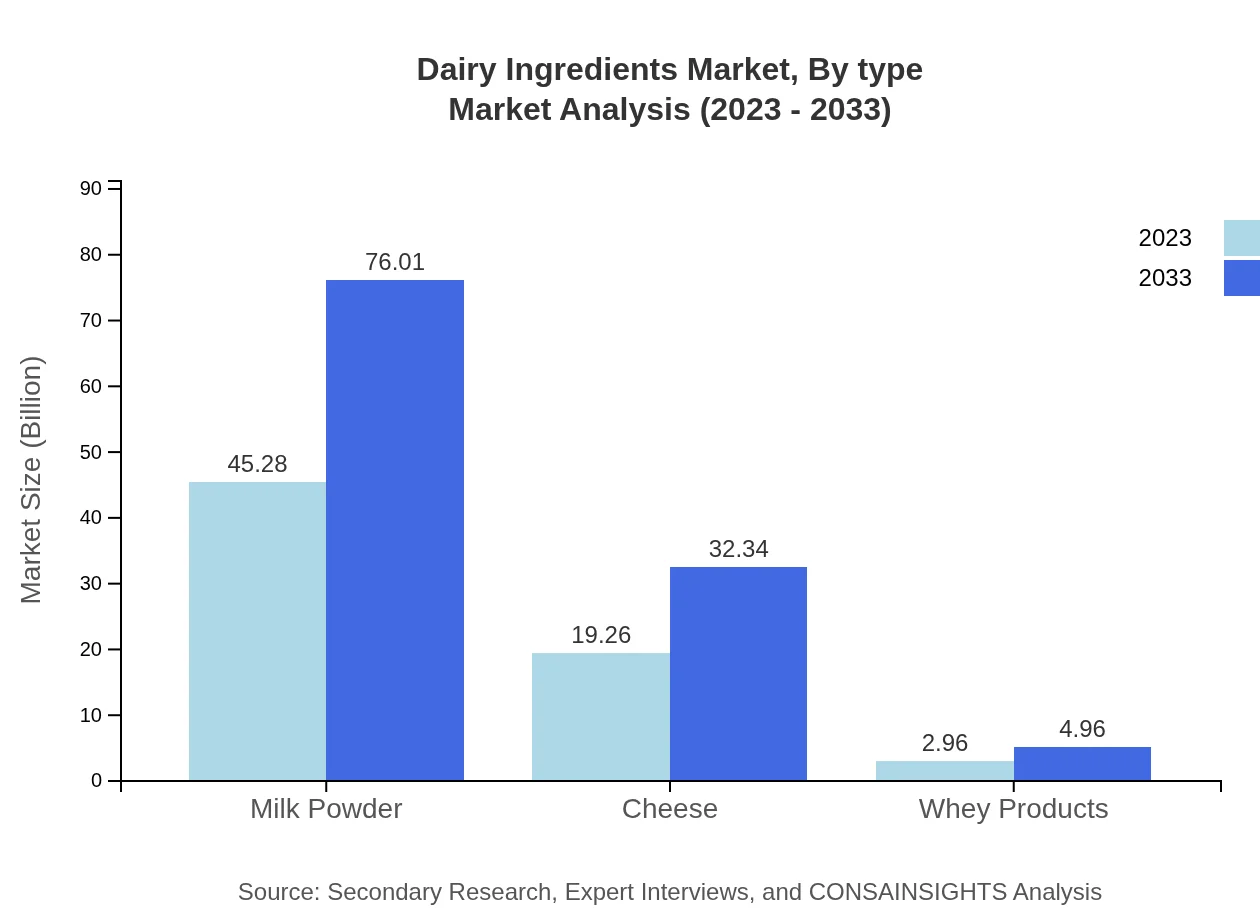

Dairy Ingredients Market Analysis By Type

Liquid dairy products hold the largest market share, comprising $45.28 billion in 2023, projected to reach $76.01 billion in 2033. Powdered dairy products are also significant, with a market size of $19.26 billion in 2023, growing to $32.34 billion in 2033. Solid forms, while smaller, are expected to increase from $2.96 billion to $4.96 billion during the same period.

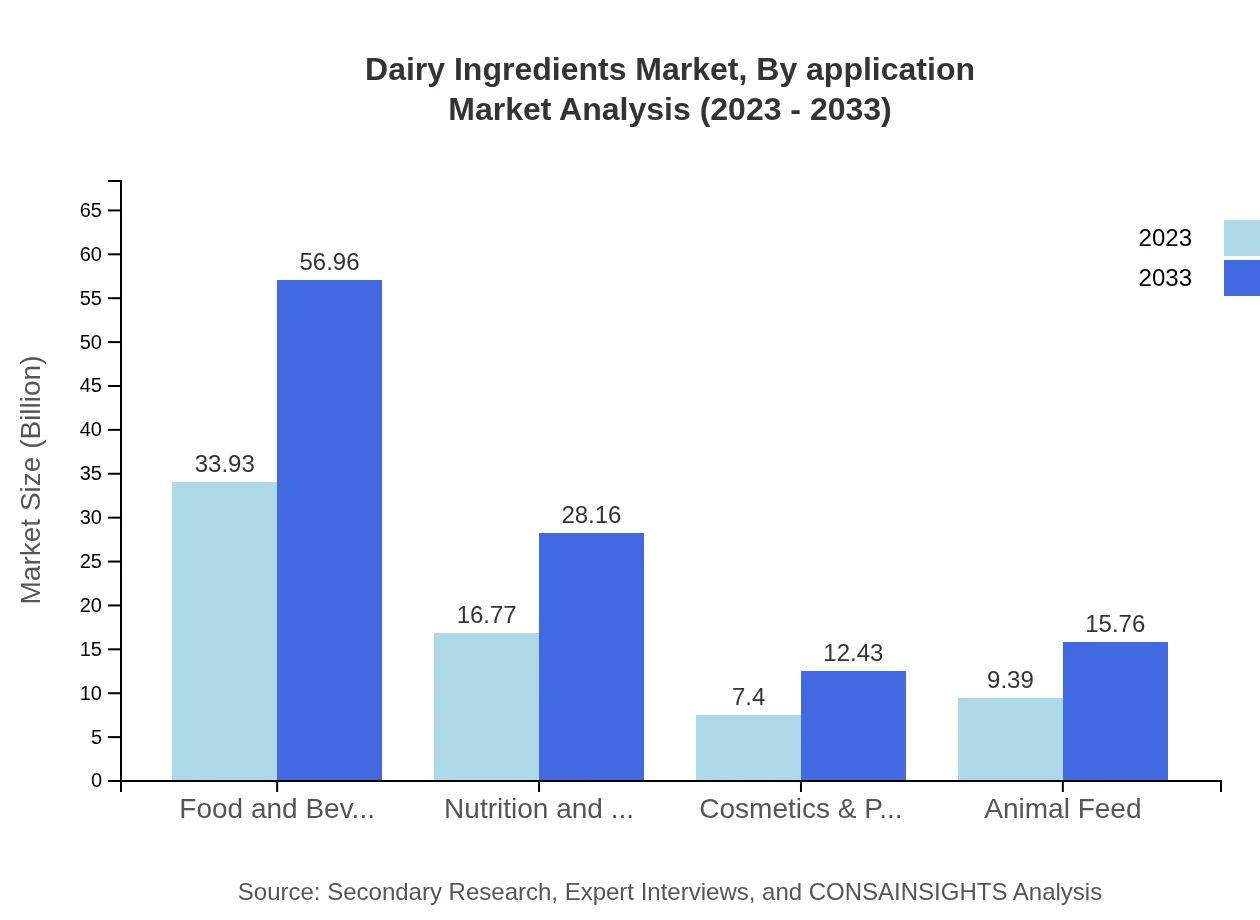

Dairy Ingredients Market Analysis By Application

Dairy ingredients find extensive application across various sectors, including Food and Beverages (estimated at $33.93 billion in 2023, growing to $56.96 billion by 2033), Nutrition and Health (from $16.77 billion to $28.16 billion), and Animal Feed (from $9.39 billion to $15.76 billion). The importance of dairy ingredients in enhancing nutritional value drives these figures.

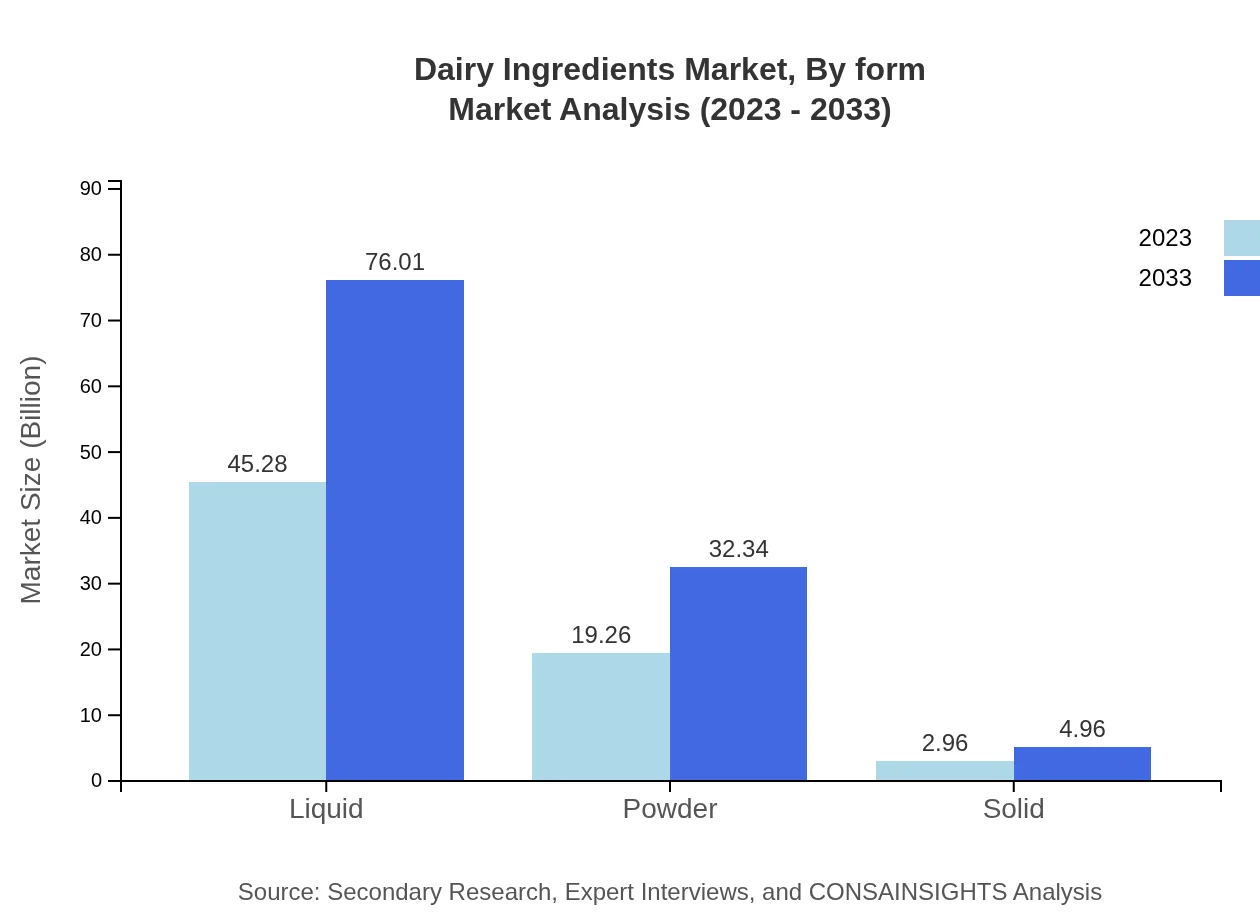

Dairy Ingredients Market Analysis By Form

The dairy ingredients market is categorized by form into liquid, powder, and solid. Each segment plays a crucial role in food processing, with liquid products dominating, followed by powdered and solid variants. The versatility in application drives both consumer and industrial preferences.

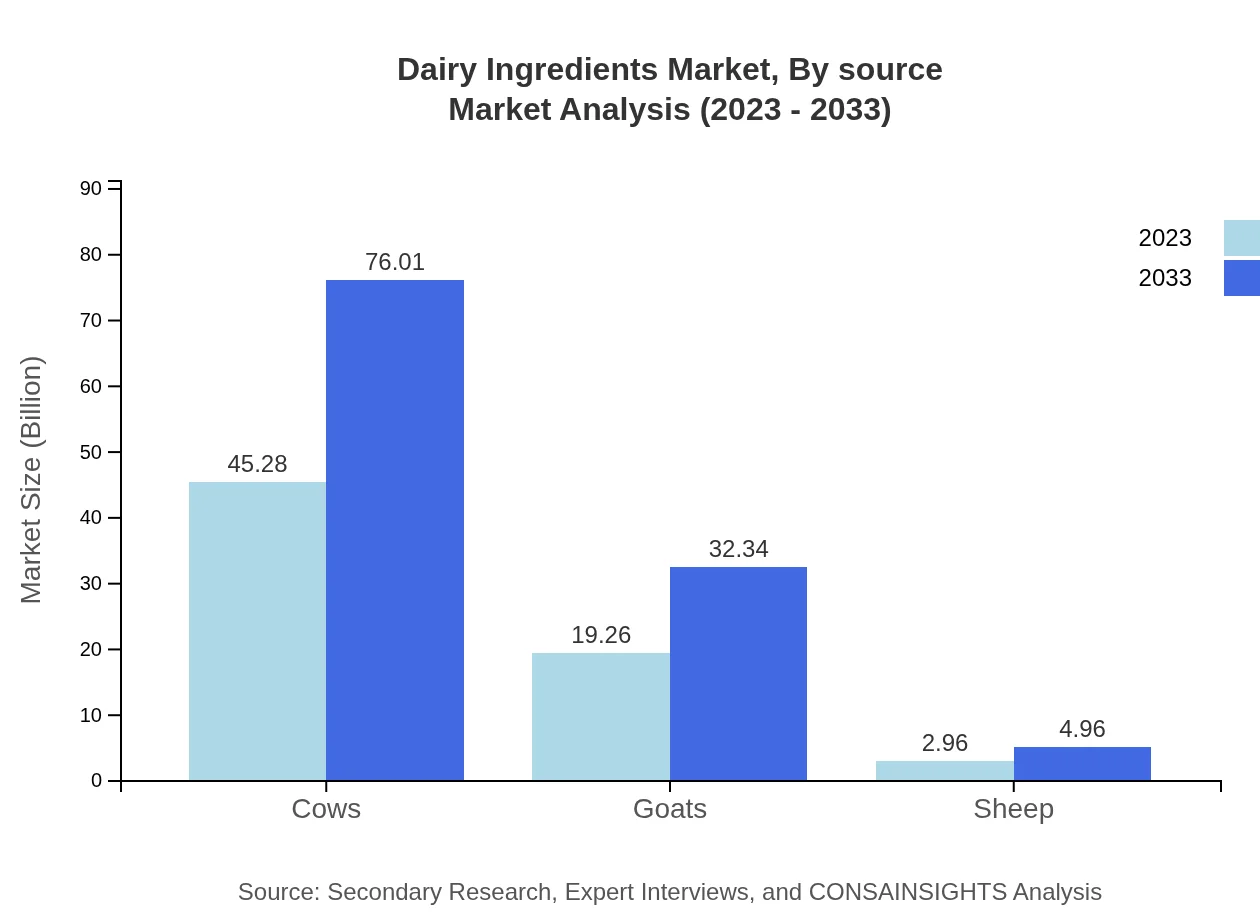

Dairy Ingredients Market Analysis By Source

Key sources include cow, goat, and sheep dairy products. Cow-derived ingredients dominate with a significant market representation, followed by those from goats and sheep. This segmentation provides insights into specific nutritional and sensory attributes appreciated in different regional cuisines.

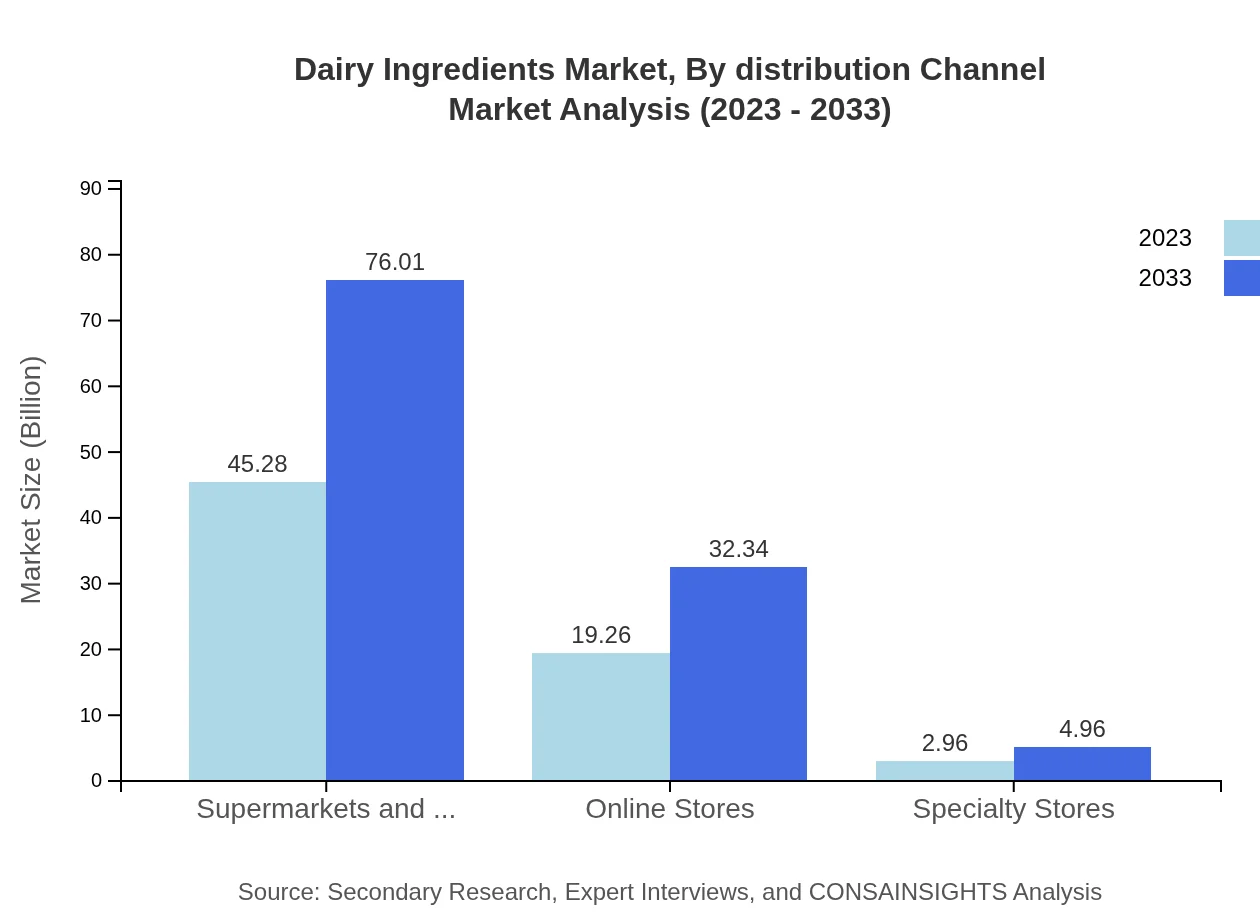

Dairy Ingredients Market Analysis By Distribution Channel

Distribution channels encompass Supermarkets and Hypermarkets, Online Stores, and Specialty Stores. The online sales channel is experiencing significant growth, driven by increased e-commerce penetration and changing consumer shopping behaviors, while traditional retail continues robustly.

Dairy Ingredients Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dairy Ingredients Industry

Dairy Farmers of America:

One of the largest dairy cooperatives in the U.S., known for its extensive range of dairy products, including cheese, fluid milk, and other ingredients.Nestlé S.A.:

A global leader in the food and beverage sector, Nestlé offers a wide variety of dairy ingredients spanning several applications in nutrition and food service.Fonterra Co-operative Group Limited:

A New Zealand-based dairy co-operative, renowned for its focus on sustainability, exporting a range of dairy products including milk powders and cheese.Danone S.A.:

A major multinational food-products corporation that is revolutionizing the dairy sector by emphasizing health-focused dairy beverages and products.Lactalis Group:

One of the world’s top dairy product manufacturers, with a strong portfolio of cheese and dairy ingredients, catering to global markets.We're grateful to work with incredible clients.

FAQs

What is the market size of dairy Ingredients?

The global dairy ingredients market is projected to grow from $67.5 billion in 2023 to a robust size by 2033, with a CAGR of 5.2%. This growth indicates substantial demand and opportunities within the dairy ingredients sector.

What are the key market players or companies in this dairy Ingredients industry?

Key players in the dairy ingredients market include companies like FrieslandCampina, Fonterra Co-Operative Group, Danone, and Saputo. These companies lead in innovation and product development, contributing significantly to market dynamics and trends.

What are the primary factors driving the growth in the dairy ingredients industry?

Factors driving growth in the dairy ingredients market include increasing consumer demand for dairy products, rising health awareness, and the growing popularity of protein-rich diets. Additionally, advancements in food technology further enhance the market's potential.

Which region is the fastest Growing in the dairy ingredients?

The Europe region is currently the fastest-growing market for dairy ingredients, with anticipated growth from $25.17 billion in 2023 to $42.25 billion by 2033. This growth reflects a strong consumer preference for dairy products across the region.

Does ConsaInsights provide customized market report data for the dairy ingredients industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of businesses in the dairy ingredients industry. This customization ensures that clients receive relevant insights and analysis for strategic planning.

What deliverables can I expect from this dairy ingredients market research project?

From the dairy ingredients market research project, you can expect comprehensive reports, insightful market analysis, trend identification, competitive landscape assessments, and customized recommendations based on specific business objectives.

What are the market trends of dairy ingredients?

Current market trends in dairy ingredients show an increasing shift towards plant-based alternatives, innovation in product offerings, and a focus on sustainable sourcing. These trends reflect changing consumer preferences and regulatory pressures for healthier and environmentally friendly products.