Dairy Market Report

Published Date: 31 January 2026 | Report Code: dairy

Dairy Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the dairy market, examining the current state, trends, and forecasts from 2023 to 2033. Insights include market size, segmentation, regional analysis, and key players, along with anticipated market growth and challenges.

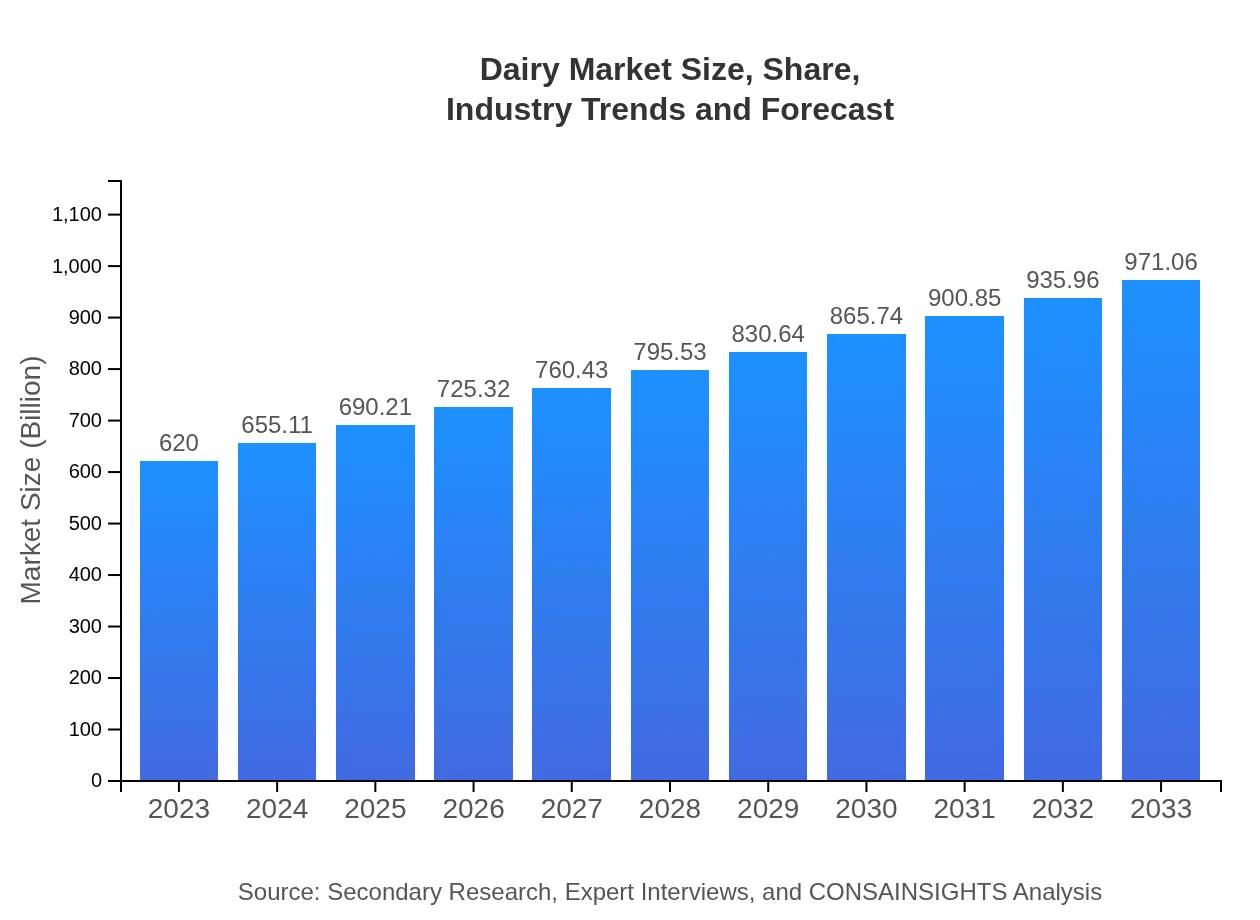

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $620.00 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $971.06 Billion |

| Top Companies | Nestlé, Danone, Lactalis, FrieslandCampina, Fonterra |

| Last Modified Date | 31 January 2026 |

Dairy Market Overview

Customize Dairy Market Report market research report

- ✔ Get in-depth analysis of Dairy market size, growth, and forecasts.

- ✔ Understand Dairy's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dairy

What is the Market Size & CAGR of Dairy market in 2023?

Dairy Industry Analysis

Dairy Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dairy Market Analysis Report by Region

Europe Dairy Market Report:

The European dairy market, estimated at USD 180.23 billion in 2023, is expected to reach USD 282.29 billion by 2033. This growth is fueled by strong consumer preferences for organic and sustainably sourced dairy products. Countries like France, Germany, and the UK are leading markets driven by health trends and dairy consumption.Asia Pacific Dairy Market Report:

The Asia Pacific region is witnessing rapid growth in dairy consumption due to increasing population and urbanization. The market size is projected to grow from USD 113.65 billion in 2023 to USD 178.00 billion by 2033, showcasing significant demand for both traditional and plant-based dairy products. Key markets in this region include India and China, where a growing middle class is driving new consumption patterns.North America Dairy Market Report:

North America remains a key player in the global dairy market, valued at USD 241.18 billion in 2023 and projected to grow to USD 377.74 billion by 2033. The US market particularly favors premium and organic dairy products, with consumers willing to spend more on high-quality offerings. Technological advancements and innovations are also enhancing production efficiency in this region.South America Dairy Market Report:

In South America, the dairy market, valued at USD 23.87 billion in 2023, is expected to expand to USD 37.39 billion by 2033. The growth in this region is attributed to the rising demand for cheese and yogurt, alongside an increase in health awareness among consumers which drives the preference for nutritional dairy options.Middle East & Africa Dairy Market Report:

The dairy market in the Middle East and Africa, valued at USD 61.07 billion in 2023, is projected to grow to USD 95.65 billion by 2033. The increasing population, urbanization, and changing dietary habits are contributing to the rise in dairy consumption, particularly in countries like South Africa and the UAE.Tell us your focus area and get a customized research report.

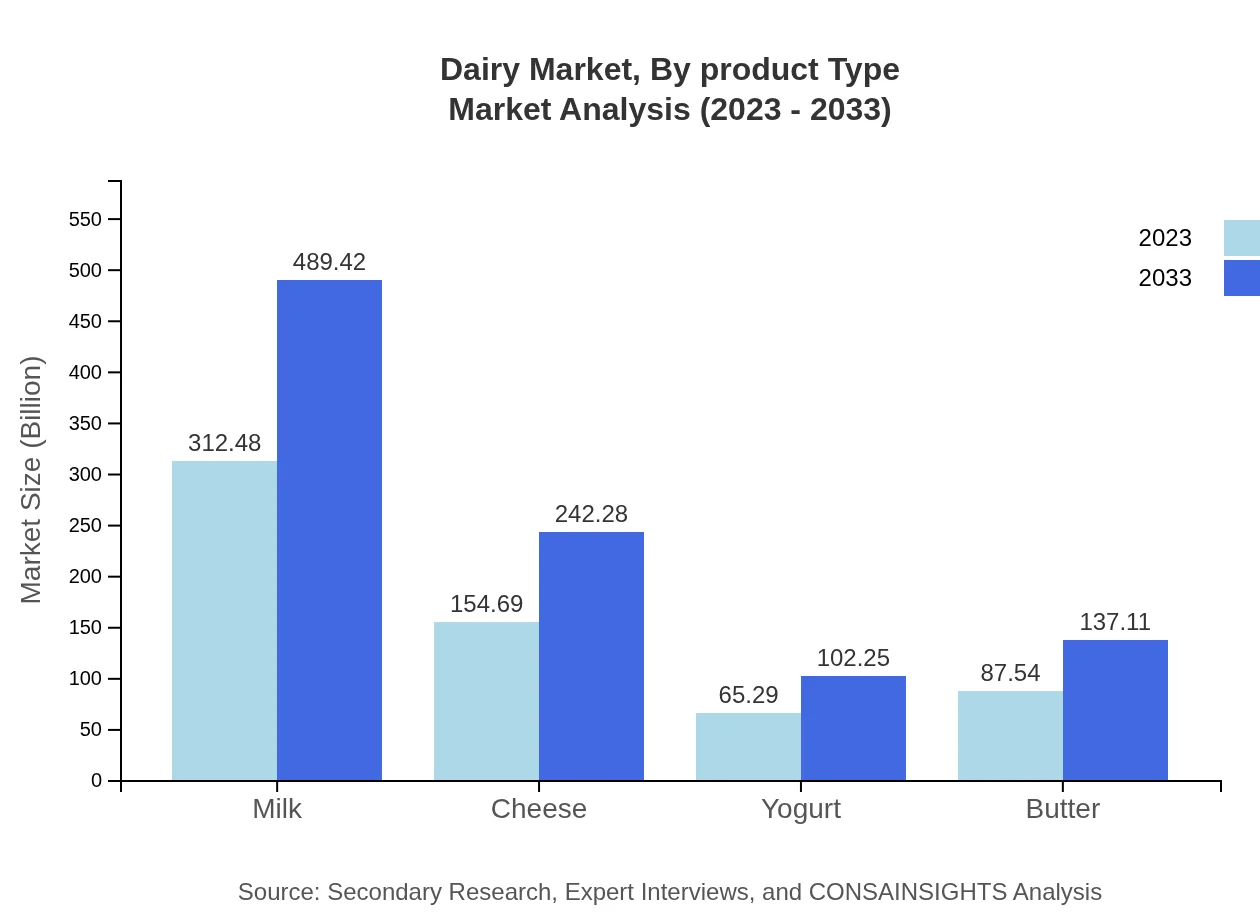

Dairy Market Analysis By Product Type

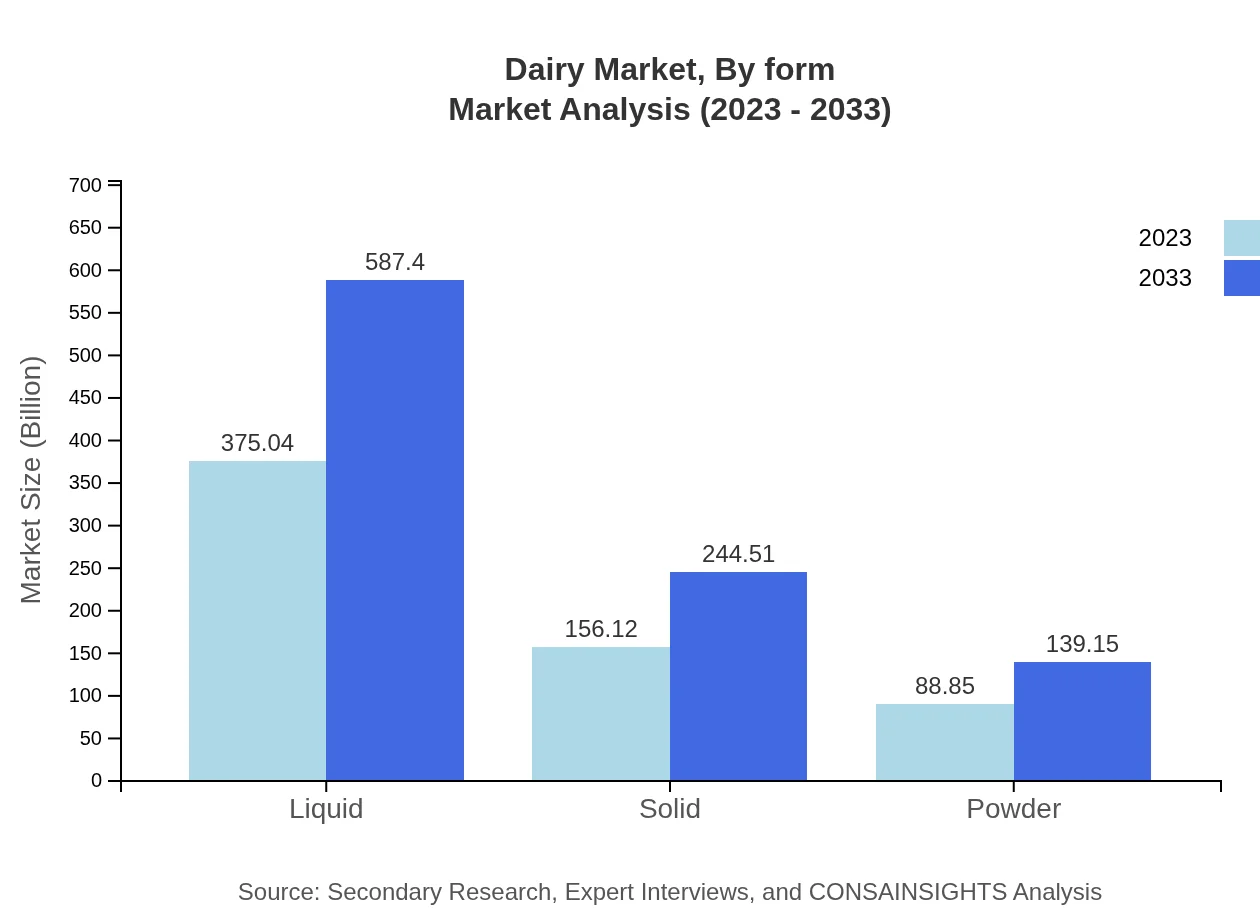

In the segment of product types, liquid dairy dominates the market with a valuation of USD 375.04 billion in 2023, expected to rise to USD 587.40 billion by 2033. Solid dairy products such as cheese and butter are also significant, projected to grow from USD 156.12 billion to USD 244.51 billion over the same period. Powdered dairy products contribute USD 88.85 billion in 2023, expected to reach USD 139.15 billion by 2033, driven by the demand for convenience and extended shelf life.

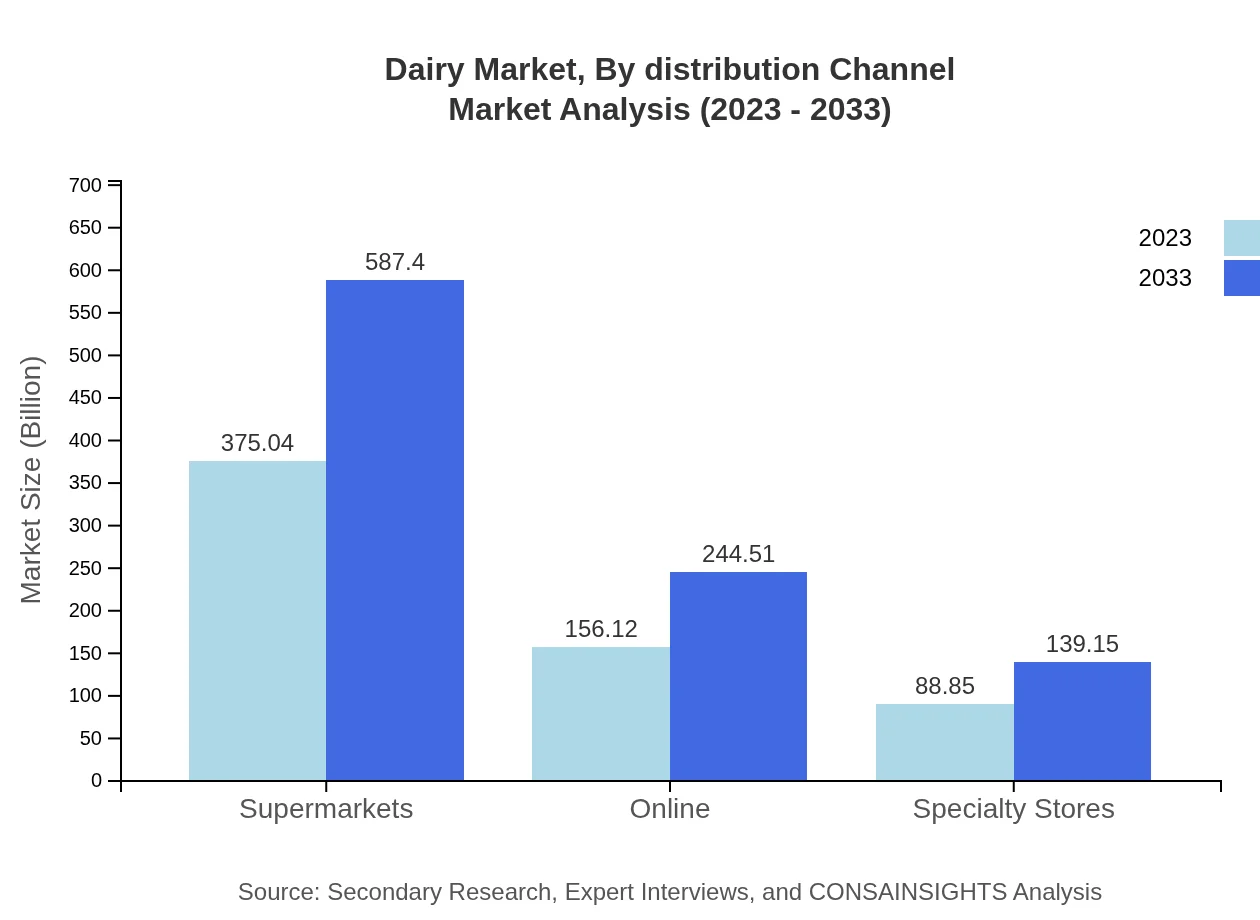

Dairy Market Analysis By Distribution Channel

The dairy market distribution channels include supermarkets, online platforms, and specialty stores. Supermarkets hold a substantial market share, expected to grow from USD 375.04 billion in 2023 to USD 587.40 billion by 2033. Online channels are also gaining traction, with sales projected to rise from USD 156.12 billion to USD 244.51 billion, as consumers increasingly prefer shopping online for convenience.

Dairy Market Analysis By Form

In terms of form, the dairy market includes liquid, solid, and powdered formats. The liquid form, especially milk, remains the largest segment, expected to see robust growth from USD 375.04 billion to USD 587.40 billion between 2023 and 2033. Solid formats, primarily cheese, are also key, projected to rise from USD 156.12 billion to USD 244.51 billion.

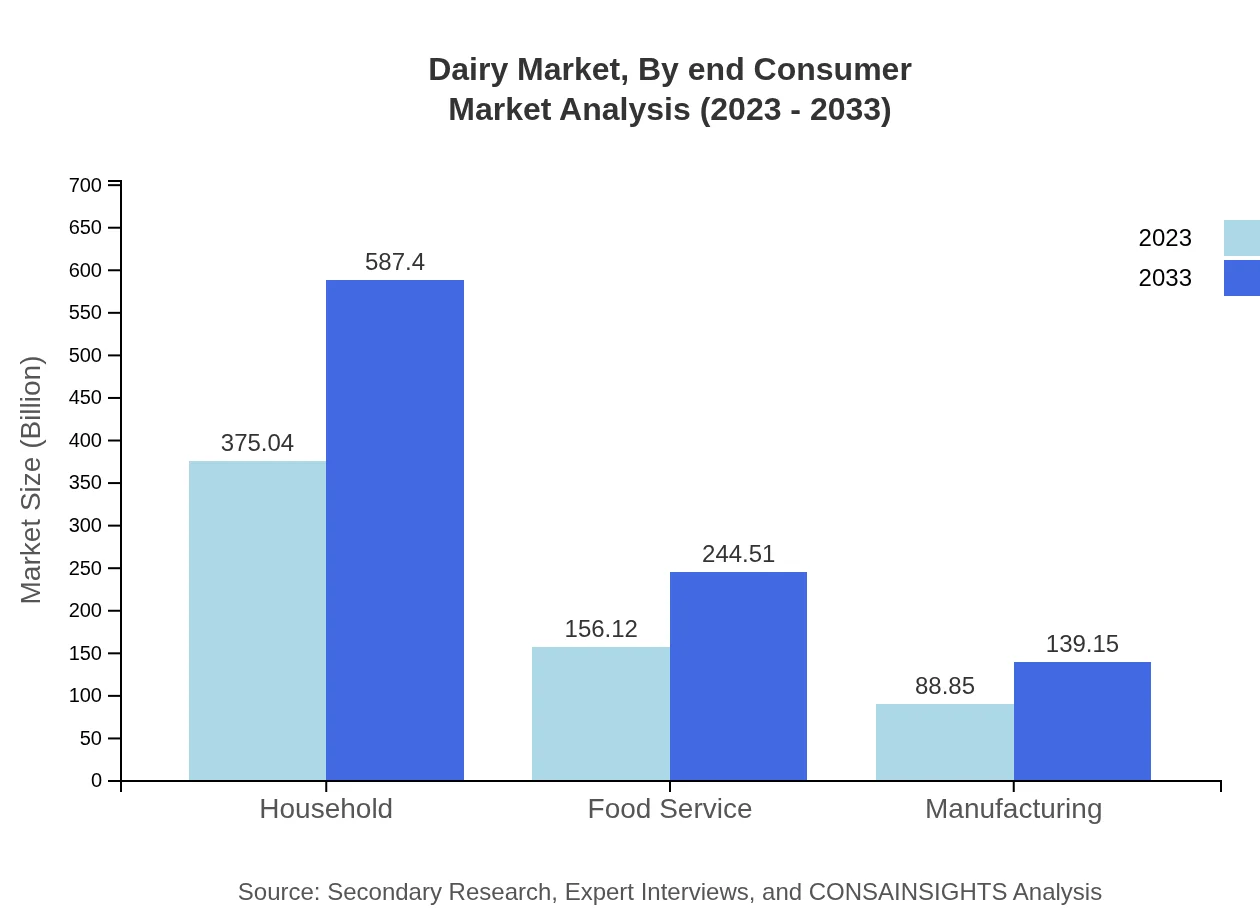

Dairy Market Analysis By End Consumer

For end consumers, the dairy market is segmented into households, food service, and manufacturing sectors. The household sector shows a significant market size valued at USD 375.04 billion in 2023 and anticipated to climb to USD 587.40 billion by 2033. The food service industry, catering to restaurants and cafes, also exhibits strong demand, expected to grow from USD 156.12 billion to USD 244.51 billion.

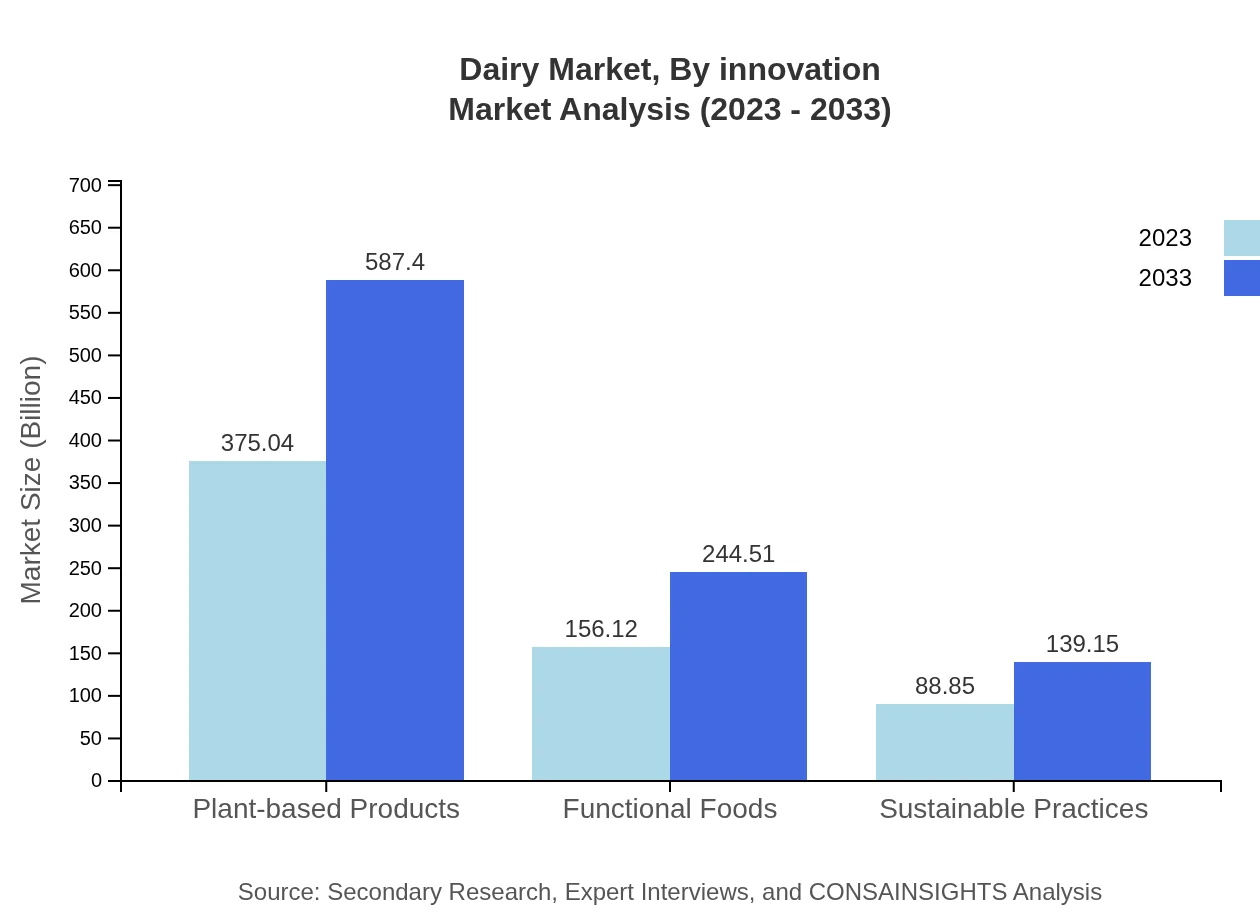

Dairy Market Analysis By Innovation

Innovations in dairy products, particularly in plant-based options, are gaining popularity. The market for innovative dairy such as fortified products and non-dairy alternatives is projected to grow from USD 375.04 billion in 2023 to USD 587.40 billion in 2033. This trend is driven by consumer interest in healthier and environmentally friendly choices.

Dairy Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dairy Industry

Nestlé:

A multinational conglomerate known for its extensive dairy product range, including milk, cheese, and infant formula, leading the innovation in health-focused dairy solutions.Danone:

Recognized for its dairy products and plant-based alternatives, Danone emphasizes nutrition and sustainability in its product offerings.Lactalis:

A global leader in the dairy market, Lactalis is well-known for its cheese, milk, and butter products, advocating for quality and regional specialties.FrieslandCampina:

A major dairy cooperative providing a wide range of products from milk to cheese and yogurt, FrieslandCampina focuses on sustainability and customer needs.Fonterra:

Based in New Zealand, Fonterra is one of the world's largest dairy exporters, delivering high-quality milk and dairy products worldwide.We're grateful to work with incredible clients.

FAQs

What is the market size of dairy?

The global dairy market is valued at approximately $620 billion in 2023, with a projected growth at a CAGR of 4.5% through 2033. This indicates significant expansion in consumption and production across the sector.

What are the key market players or companies in this dairy industry?

Key players in the dairy industry include Nestlé, Lactalis, Danone, Fonterra, and Coca-Cola, each contributing significantly to global dairy production and innovation, establishing strong market presence.

What are the primary factors driving the growth in the dairy industry?

Key growth factors include rising consumption of dairy products, increasing health consciousness, expansion of the functional foods market, and innovation in dairy processing and product offerings, appealing to health-savvy consumers.

Which region is the fastest Growing in the dairy market?

The fastest-growing region in the dairy market is expected to be Asia Pacific, with market growth projected from $113.65 billion in 2023 to $178.00 billion by 2033, driven by increasing demand and local production capabilities.

Does ConsaInsights provide customized market report data for the dairy industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the dairy industry, ensuring comprehensive insights and analysis to aid strategic decision-making.

What deliverables can I expect from this dairy market research project?

Deliverables will typically include detailed market analysis reports, market size data, competitive landscape insights, growth forecasts, and tailored recommendations to support business strategies and investments.

What are the market trends of dairy?

Market trends in dairy include a shift towards plant-based products, increasing demand for organic and functional foods, sustainable farming practices, and innovations in dairy processing to enhance product offerings.