Dairy Processing Equipment Market Report

Published Date: 22 January 2026 | Report Code: dairy-processing-equipment

Dairy Processing Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Dairy Processing Equipment market, covering trends, forecasts, and comprehensive insights from 2023 to 2033, enabling a better understanding of the industry's dynamics and growth potential.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

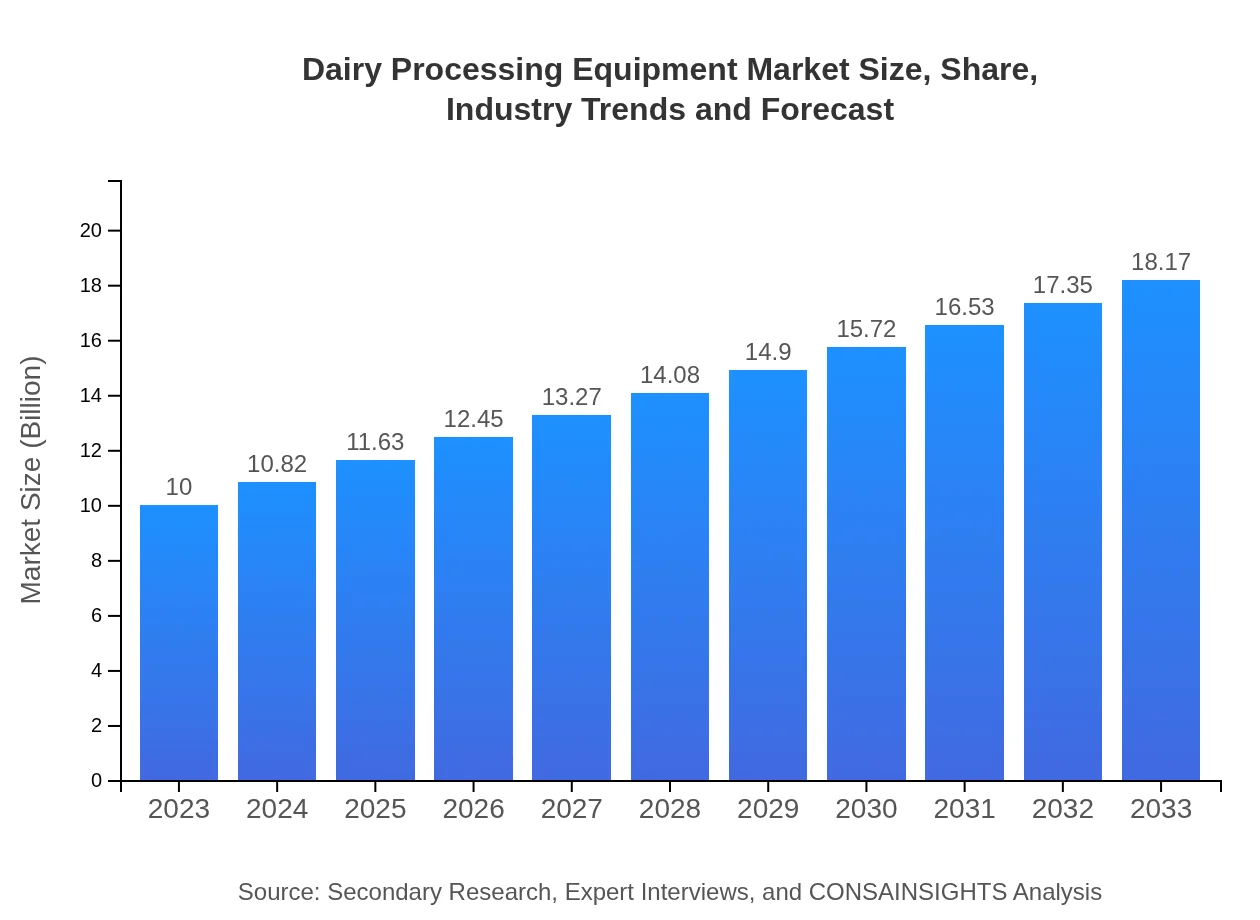

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $18.17 Billion |

| Top Companies | Tetra Pak, Alfa Laval, SPX Flow, GEA Group |

| Last Modified Date | 22 January 2026 |

Dairy Processing Equipment Market Overview

Customize Dairy Processing Equipment Market Report market research report

- ✔ Get in-depth analysis of Dairy Processing Equipment market size, growth, and forecasts.

- ✔ Understand Dairy Processing Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dairy Processing Equipment

What is the Market Size & CAGR of Dairy Processing Equipment market in 2023?

Dairy Processing Equipment Industry Analysis

Dairy Processing Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dairy Processing Equipment Market Analysis Report by Region

Europe Dairy Processing Equipment Market Report:

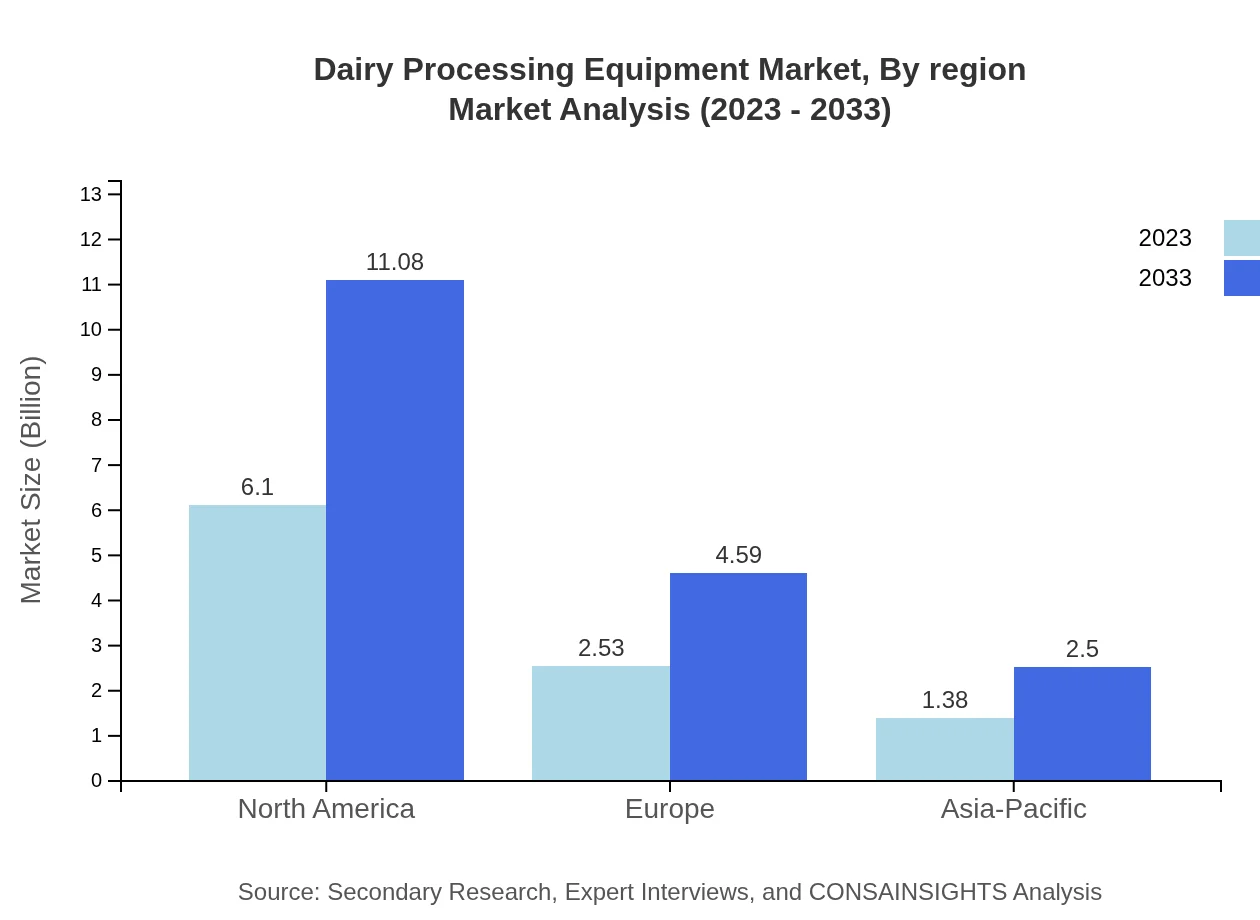

Europe represents a robust market for dairy processing equipment, projected to expand from USD 2.93 billion in 2023 to USD 5.32 billion in 2033. Key drivers include the region's strong focus on dairy innovation, sustainability, and compliance with stringent food safety regulations impacting process improvements.Asia Pacific Dairy Processing Equipment Market Report:

In the Asia Pacific region, the Dairy Processing Equipment market is expected to grow from USD 2.03 billion in 2023 to USD 3.70 billion by 2033. The region exhibits a strong increase in dairy consumption, particularly in countries like India and China, where rising populations and incomes are driving demand for processed dairy products.North America Dairy Processing Equipment Market Report:

North America's Dairy Processing Equipment market is set to rise notably from USD 3.43 billion in 2023 to USD 6.22 billion by 2033. The region benefits from a well-established dairy industry, advanced processing technologies, and a high per capita consumption of dairy products.South America Dairy Processing Equipment Market Report:

The South American dairy processing equipment market is projected to increase from USD 0.36 billion in 2023 to USD 0.66 billion by 2033. This growth is propelled by improved dairy farming practices and the expansion of the dairy processing sector in countries like Brazil and Argentina.Middle East & Africa Dairy Processing Equipment Market Report:

The Middle East and Africa market is expected to grow from USD 1.25 billion in 2023 to USD 2.27 billion by 2033, supported by increasing investment in enhances dairy facilities and growth in demand for processed dairy products in urban areas.Tell us your focus area and get a customized research report.

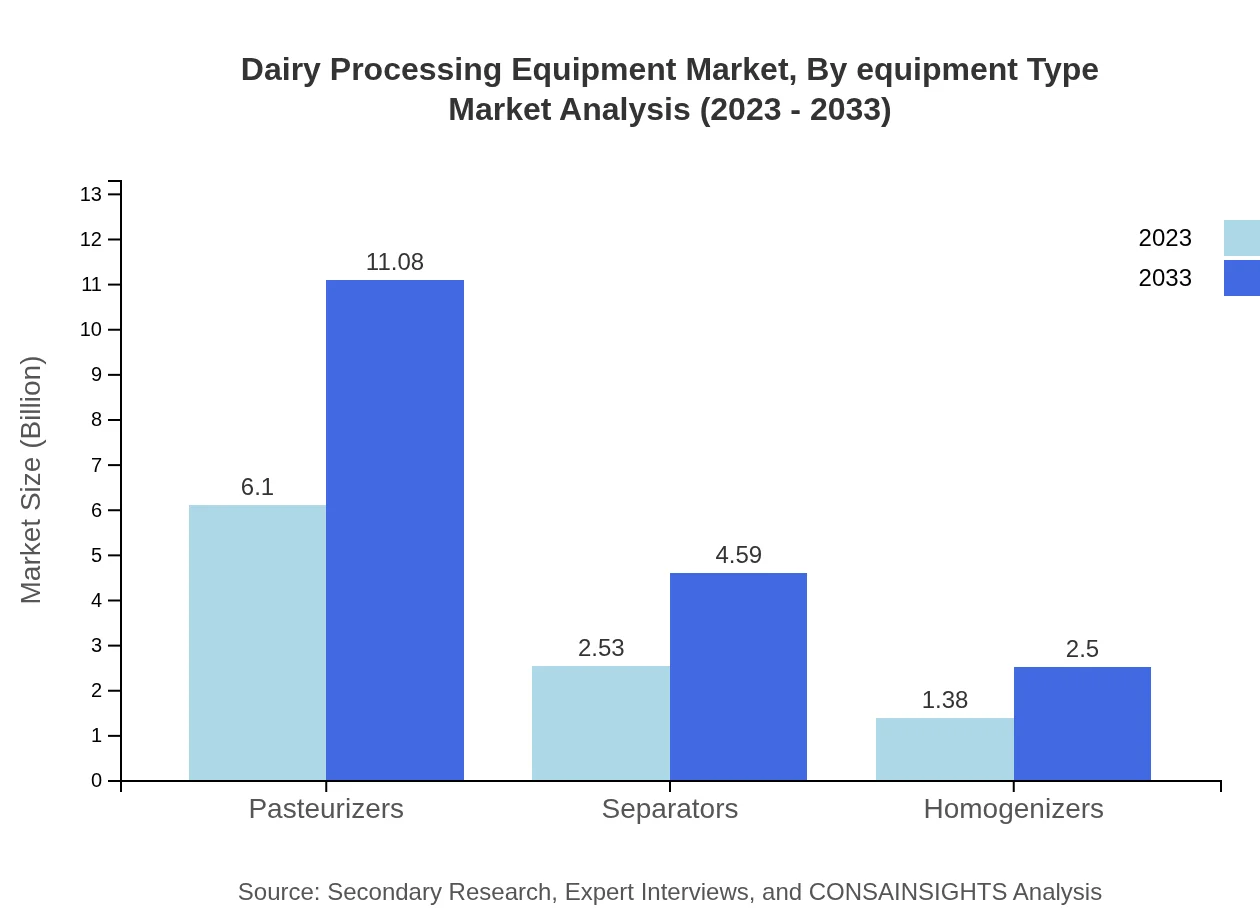

Dairy Processing Equipment Market Analysis By Equipment Type

The analysis of equipment types shows that pasteurizers dominate the market, valued at USD 6.10 billion in 2023, and expected to reach USD 11.08 billion by 2033. They hold a substantial share of 60.98%. Separators and homogenizers also emerge as significant segments, collectively contributing large values to the total market.

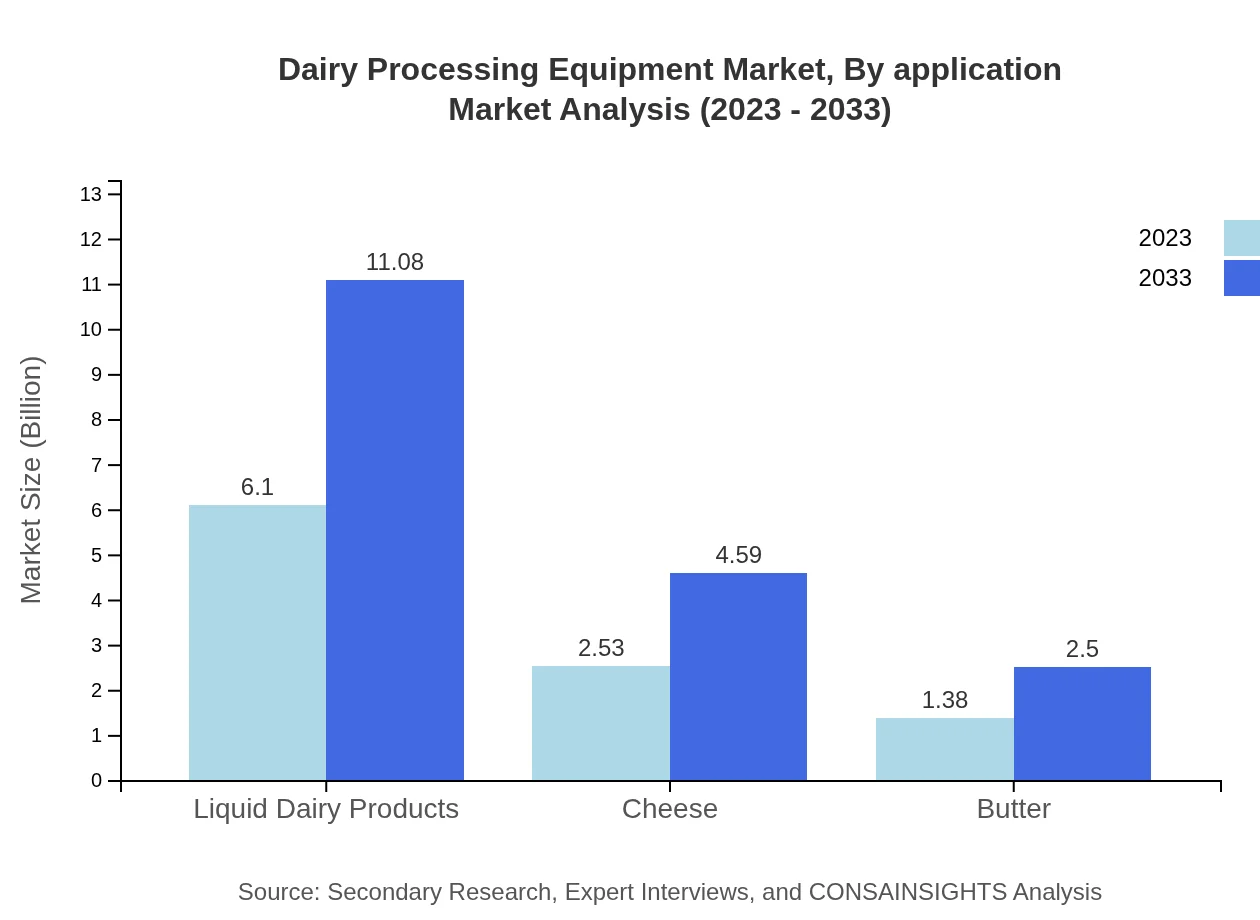

Dairy Processing Equipment Market Analysis By Application

In terms of applications, liquid dairy products, cheese, and butter are the primary contributors to the market. Liquid dairy products lead with a size of USD 6.10 billion in 2023 and projected to grow significantly over the forecast period, while cheese processing contributes considerable revenues due to its global popularity.

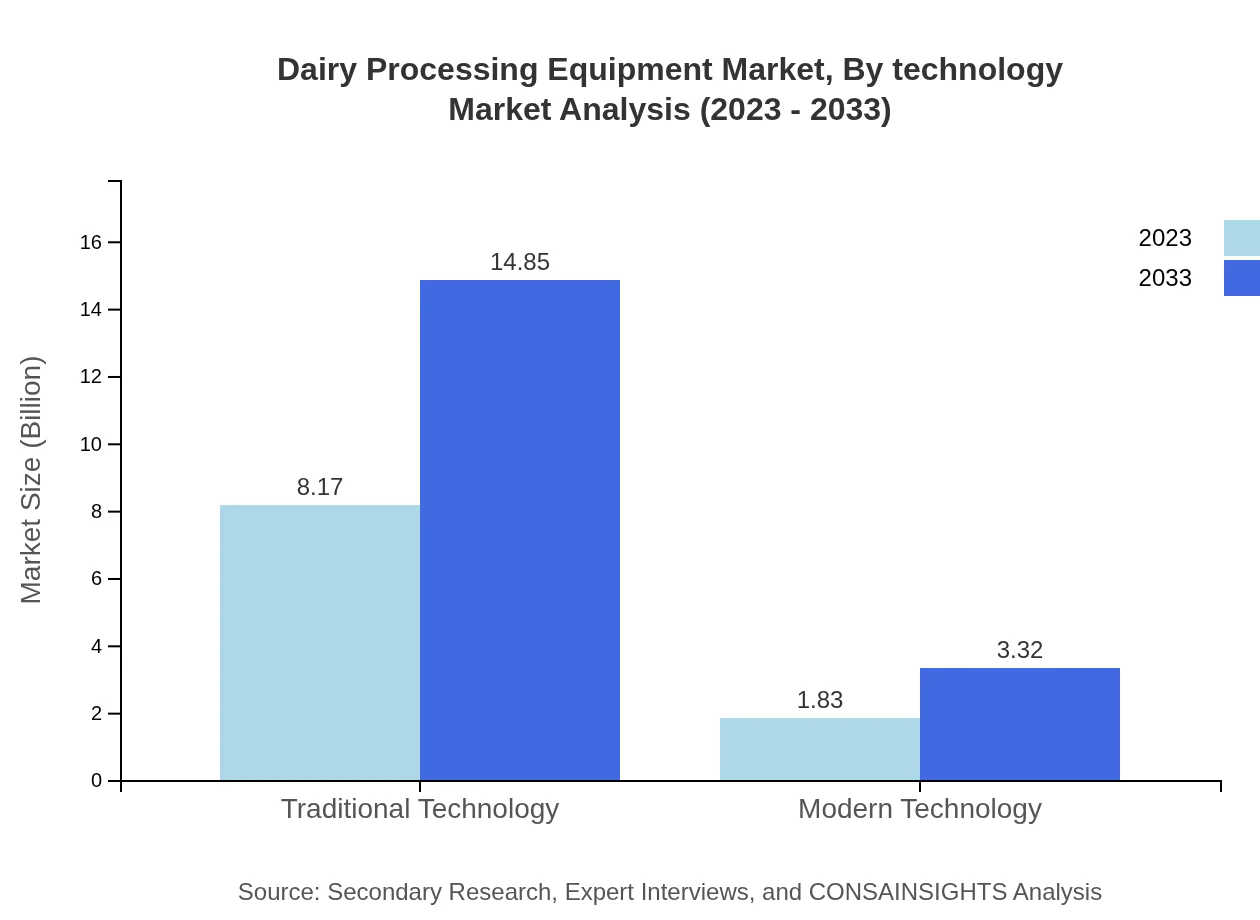

Dairy Processing Equipment Market Analysis By Technology

The market is also analyzed based on technology, with traditional technology holding a substantial market share of 81.73%. However, modern technology is gaining traction, aiming for more efficient processing and adherence to sustainability practices, expected to grow from USD 1.83 billion in 2023 to USD 3.32 billion by 2033.

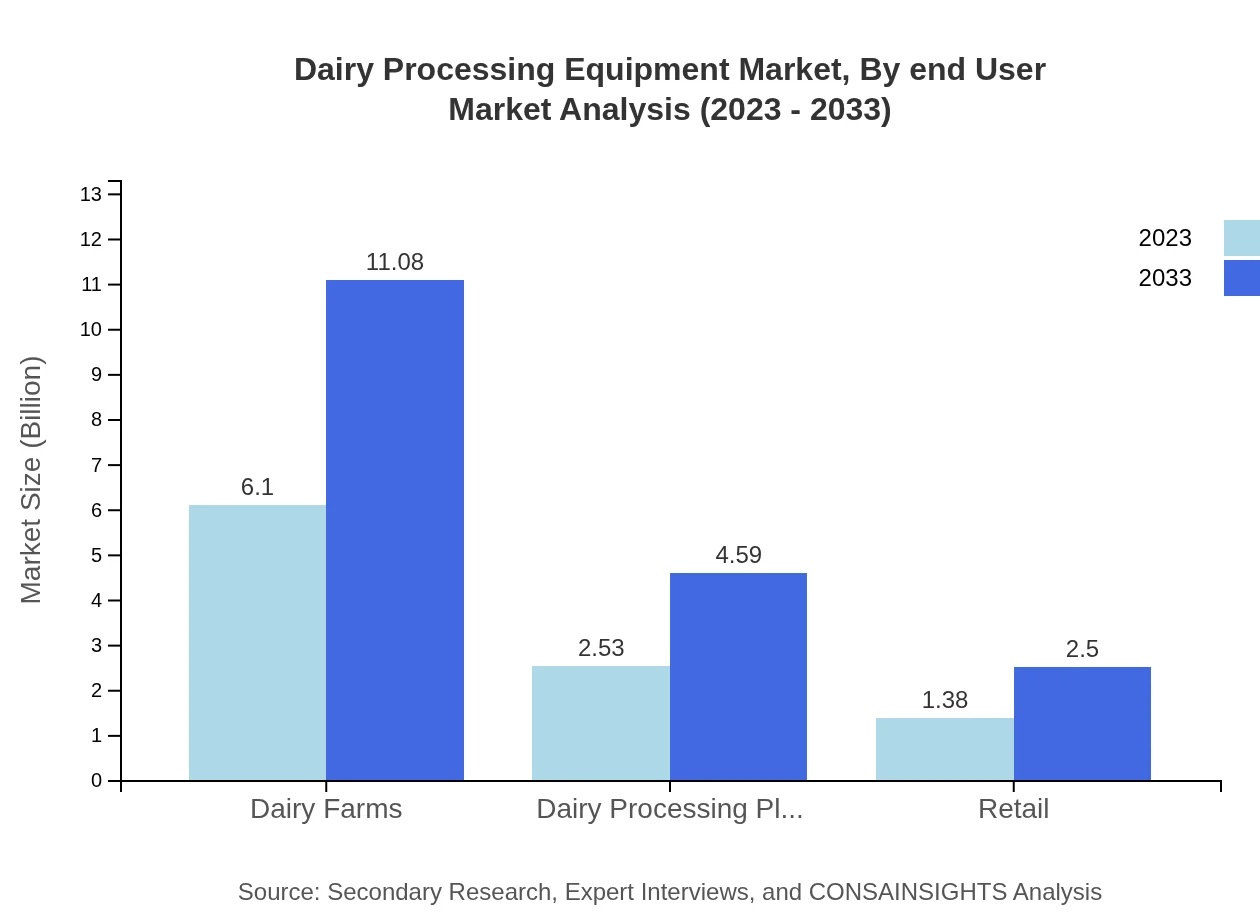

Dairy Processing Equipment Market Analysis By End User

Dairy farms and processing plants form the core of end-users in the industry, with dairy farms comprising a significant market share of approximately 60.98% in 2023, with a corresponding market growth expected over the forecast period as demand for processed dairy rises.

Dairy Processing Equipment Market Analysis By Region

The geographic segmentation demonstrates that North America leads the market, holding a share of 60.98% in 2023 followed by Europe and Asia Pacific, reflecting the diverse needs and advancements in each region's dairy processing sector.

Dairy Processing Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dairy Processing Equipment Industry

Tetra Pak:

Tetra Pak is a leading provider of processing and packaging solutions in the dairy sector, known for its innovation in sustainable dairy processing technologies and commitment to food safety.Alfa Laval:

Alfa Laval specializes in equipment and systems for heat transfer, separation, and fluid handling, catering extensively to the dairy processing industry with an emphasis on enhancing operational efficiency.SPX Flow:

SPX Flow offers processing solutions focusing on improving product quality and operational efficiency in dairy processing, contributing to sustainable practices in the dairy market.GEA Group:

GEA Group is a prominent player in dairy processing equipment manufacturing, providing innovative solutions for the processing of liquid dairy products, cheese, and other dairy items.We're grateful to work with incredible clients.

FAQs

What is the market size of dairy Processing Equipment?

The dairy processing equipment market is estimated to be worth approximately $10 billion in 2023, with a projected compound annual growth rate (CAGR) of 6% from 2023 to 2033, indicating strong growth in demand and market expansion.

What are the key market players or companies in this dairy Processing Equipment industry?

Key players in the dairy processing equipment industry include established companies such as Tetra Pak, GEA Group, and Alfa Laval, which dominate the market with their innovative technologies and extensive product offerings tailored for dairy processing.

What are the primary factors driving the growth in the dairy Processing Equipment industry?

Factors driving growth in the dairy processing equipment market include increasing dairy consumption, technological advancements in processing equipment, rising health consciousness among consumers, and the globalization of dairy supply chains enhancing production capabilities.

Which region is the fastest Growing in the dairy Processing Equipment market?

The Asia-Pacific region is poised to be the fastest-growing market for dairy processing equipment, with its market size projected to grow from $2.03 billion in 2023 to $3.70 billion by 2033, reflecting a strong economic growth and demand for dairy products.

Does ConsaInsights provide customized market report data for the dairy Processing Equipment industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the dairy processing equipment industry, ensuring clients receive insights and analyses that cater to their unique business objectives and market conditions.

What deliverables can I expect from this dairy Processing Equipment market research project?

From our dairy processing equipment market research project, clients can expect comprehensive reports including market size, growth forecasts, competitive analysis, regional insights, and detailed segmentation data on various equipment types and dairy products.

What are the market trends of dairy Processing Equipment?

Current trends in the dairy processing equipment market include increased automation, a shift towards sustainable practices, growing demand for high-quality dairy products, and the introduction of advanced technology focusing on efficiency and cost reduction.