Dairy Products Market Report

Published Date: 31 January 2026 | Report Code: dairy-products

Dairy Products Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Dairy Products market, focusing on market size, growth forecasts, segmentation, and regional insights from 2023 to 2033. It highlights key trends, technologies, and major players influencing the industry landscape.

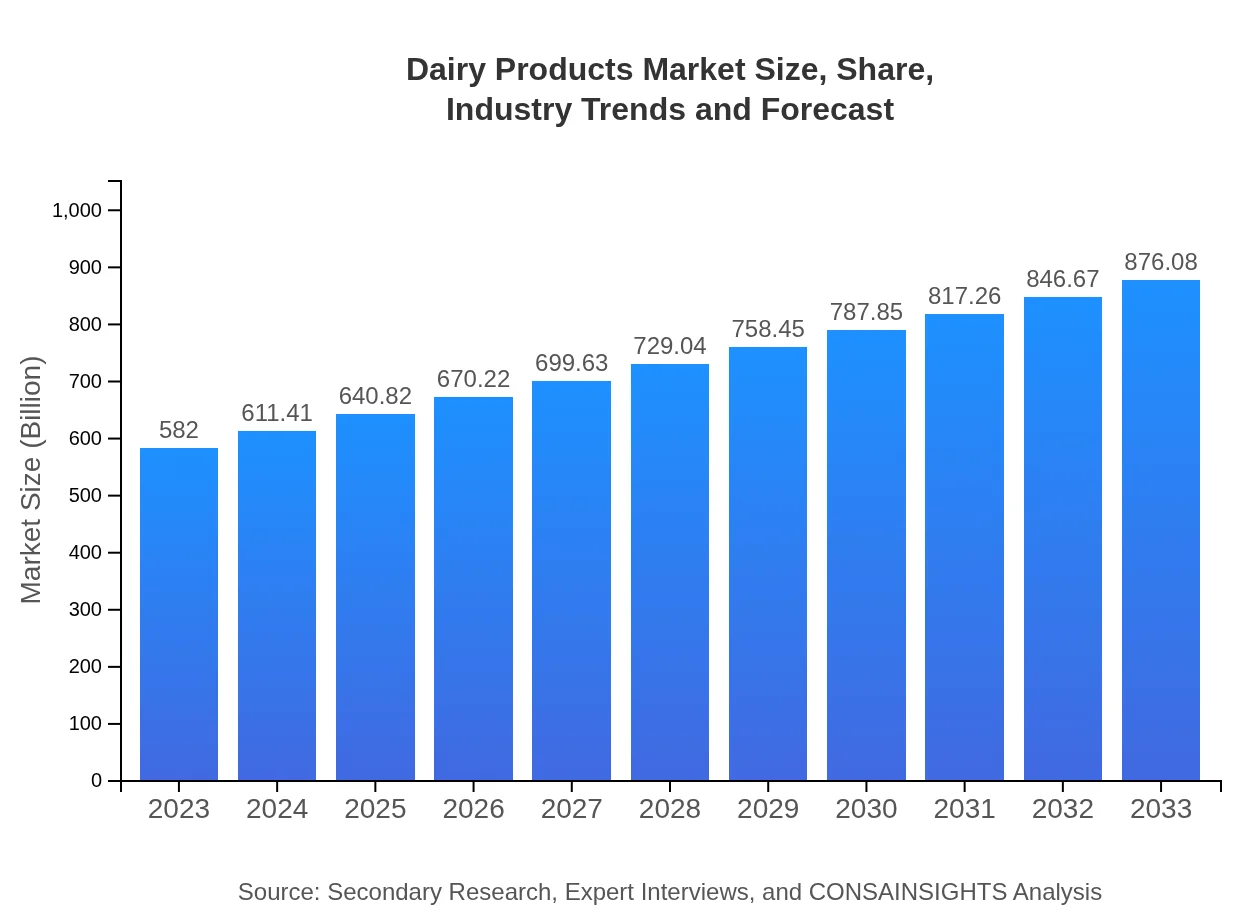

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $582.00 Billion |

| CAGR (2023-2033) | 4.1% |

| 2033 Market Size | $876.08 Billion |

| Top Companies | Nestle S.A., Lactalis Group, Danone S.A., Fonterra Co-operative Group Limited |

| Last Modified Date | 31 January 2026 |

Dairy Products Market Overview

Customize Dairy Products Market Report market research report

- ✔ Get in-depth analysis of Dairy Products market size, growth, and forecasts.

- ✔ Understand Dairy Products's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dairy Products

What is the Market Size & CAGR of Dairy Products market in 2023?

Dairy Products Industry Analysis

Dairy Products Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dairy Products Market Analysis Report by Region

Europe Dairy Products Market Report:

In Europe, the Dairy Products market size was approximately USD 150.27 billion in 2023, anticipated to grow to USD 226.20 billion by 2033. The region is characterized by a strong dairy tradition and high consumer acceptance of lactose-free and specialty dairy products.Asia Pacific Dairy Products Market Report:

In the Asia Pacific region, the Dairy Products market was valued at USD 117.39 billion in 2023 and is projected to reach USD 176.70 billion by 2033. The growth is driven by rising urbanization, increased health awareness, and changing dietary habits. Countries like India and China are leading the way in consumption.North America Dairy Products Market Report:

North America represented a significant market, valued at USD 204.92 billion in 2023, expected to reach USD 308.47 billion by 2033. The increase is supported by high per capita income, strong demand for organic dairy, and robust dairy farming practices.South America Dairy Products Market Report:

South America’s Dairy Products market had an estimated value of USD 48.02 billion in 2023, forecasted to rise to USD 72.28 billion by 2033. This increase is fueled by the growing demand for dairy nutrition among the expanding population and the rise of dairy-based products in the food sector.Middle East & Africa Dairy Products Market Report:

The market in the Middle East and Africa is estimated at USD 61.40 billion in 2023, with a projected increase to USD 92.43 billion by 2033. Growth in this region is driven by rapid urbanization, increased nutritional awareness, and population growth.Tell us your focus area and get a customized research report.

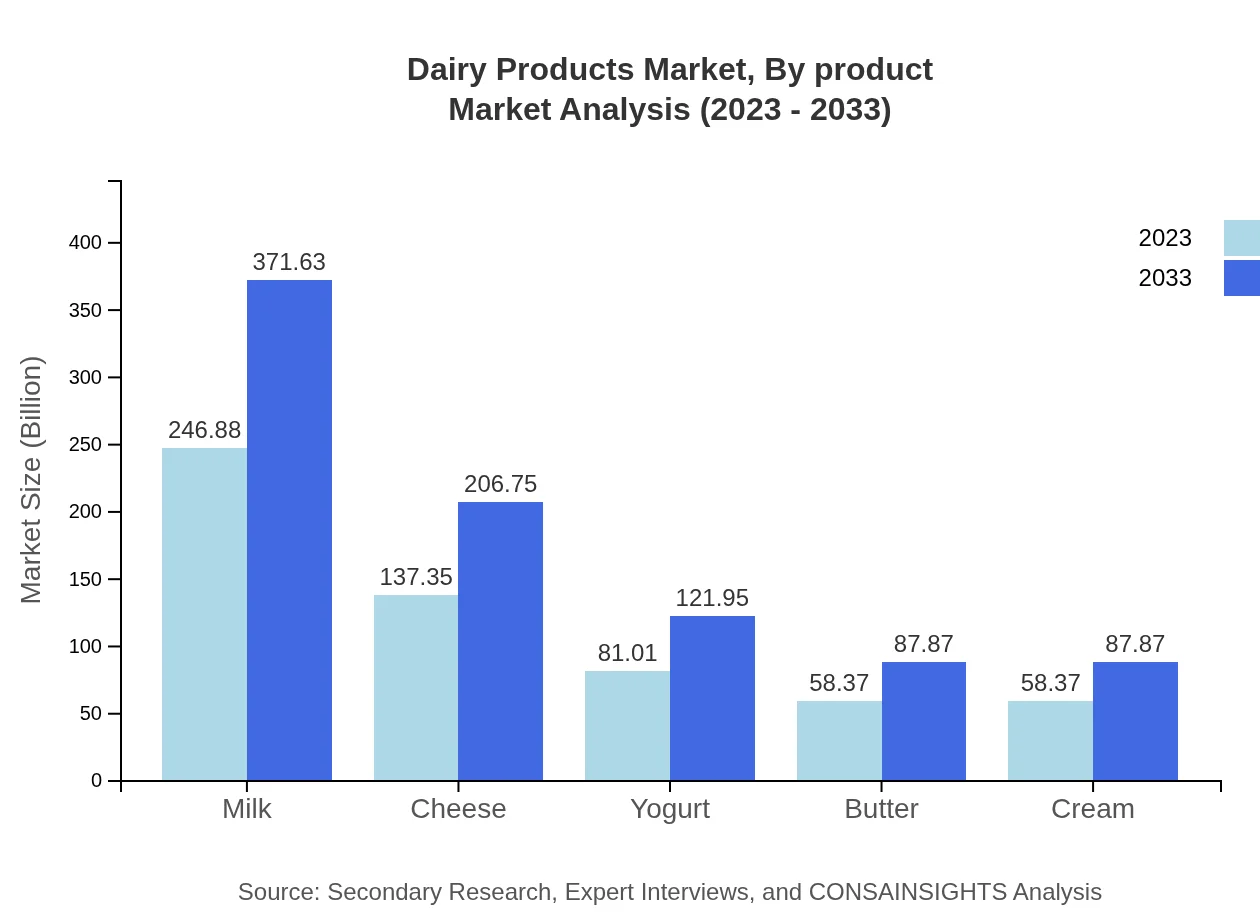

Dairy Products Market Analysis By Product

The Dairy Products market, categorized by product type, includes: - Milk: 2023 market size is USD 246.88 billion; projected to grow to USD 371.63 billion by 2033. Represents 42.42% of market share. - Cheese: 2023 market size is USD 137.35 billion; expected to rise to USD 206.75 billion by 2033, holding 23.6% market share. - Yogurt: 2023 market size is USD 81.01 billion, with a projected 2033 size of USD 121.95 billion, comprising 13.92% of market share. - Butter and Cream, both currently valued at USD 58.37 billion, are projected to grow to USD 87.87 billion by 2033, representing 10.03% market share each.

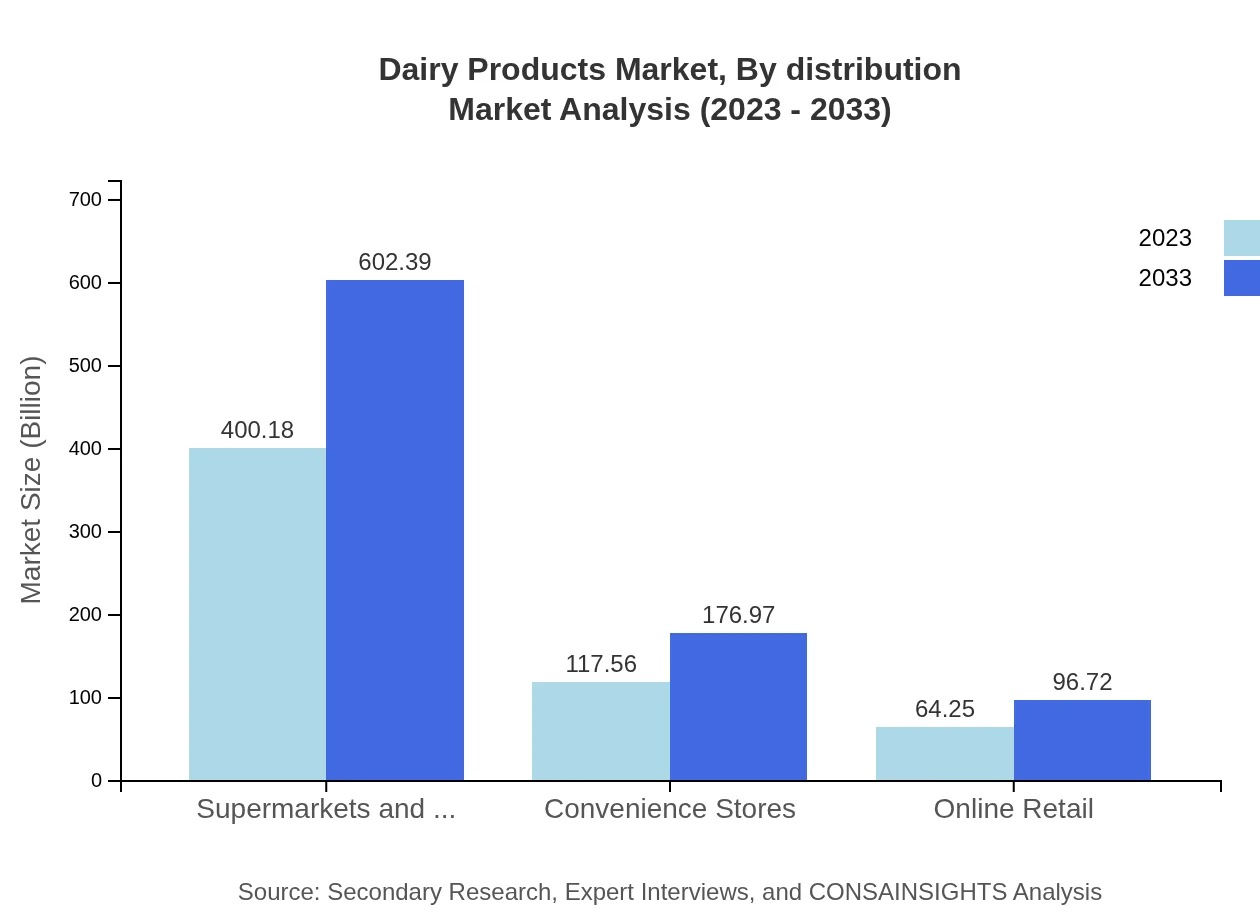

Dairy Products Market Analysis By Distribution

The Dairy Products market, segmented by distribution channels, includes: - Supermarkets and Hypermarkets: Dominating with USD 400.18 billion in 2023, expected to reach USD 602.39 billion by 2033, accounting for 68.76% growth share. - Convenience Stores: Currently USD 117.56 billion, projected to hit USD 176.97 billion by 2033, representing 20.2% share. - Online Retail: Expected to grow from USD 64.25 billion in 2023 to USD 96.72 billion by 2033, with a share of 11.04%.

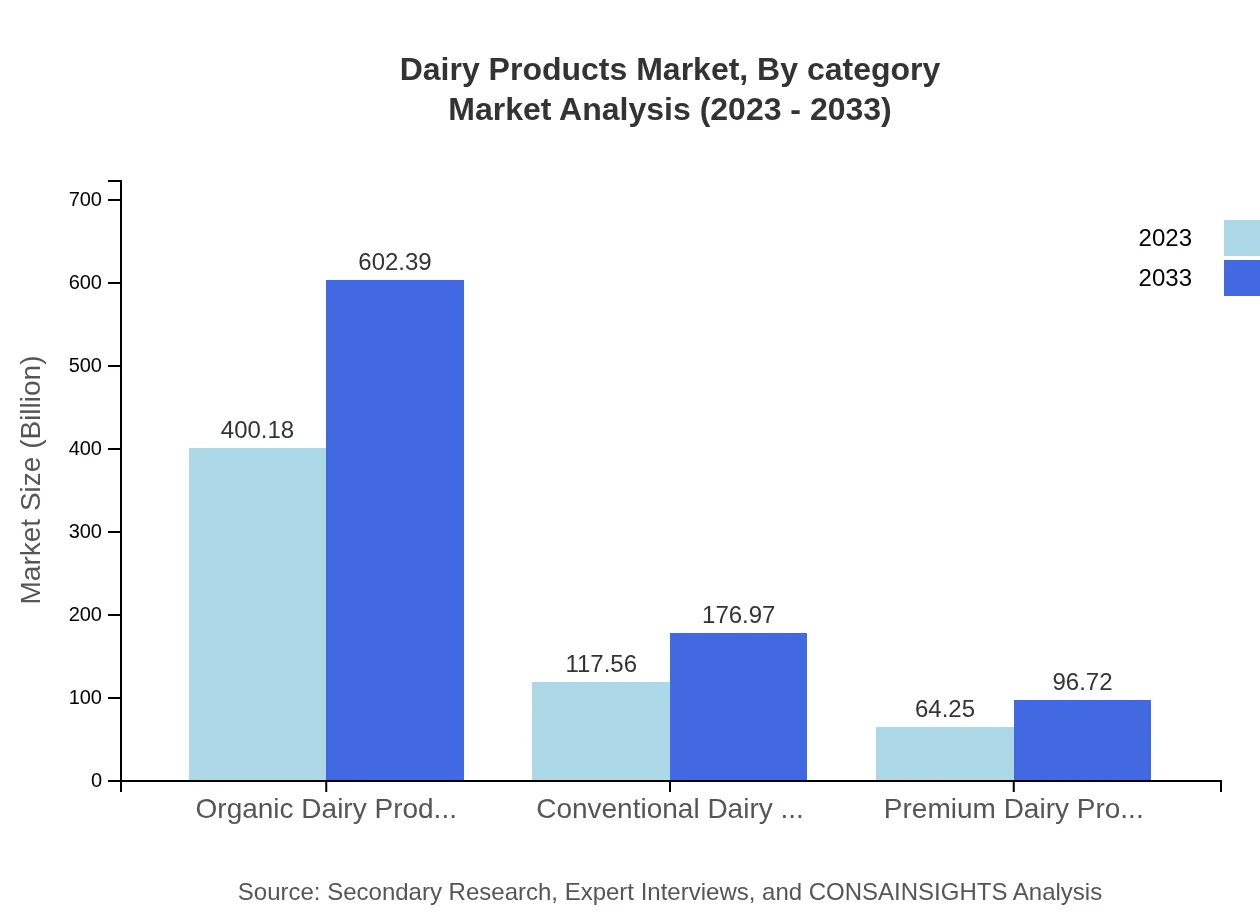

Dairy Products Market Analysis By Category

The Dairy Products market by category includes: - Organic Dairy Products: Market size of USD 400.18 billion in 2023, forecasted to rise to USD 602.39 billion by 2033, sharing 68.76% of the market. - Conventional Dairy Products: Valued at USD 117.56 billion in 2023, expected to grow to USD 176.97 billion by 2033, representing a 20.2% market share.

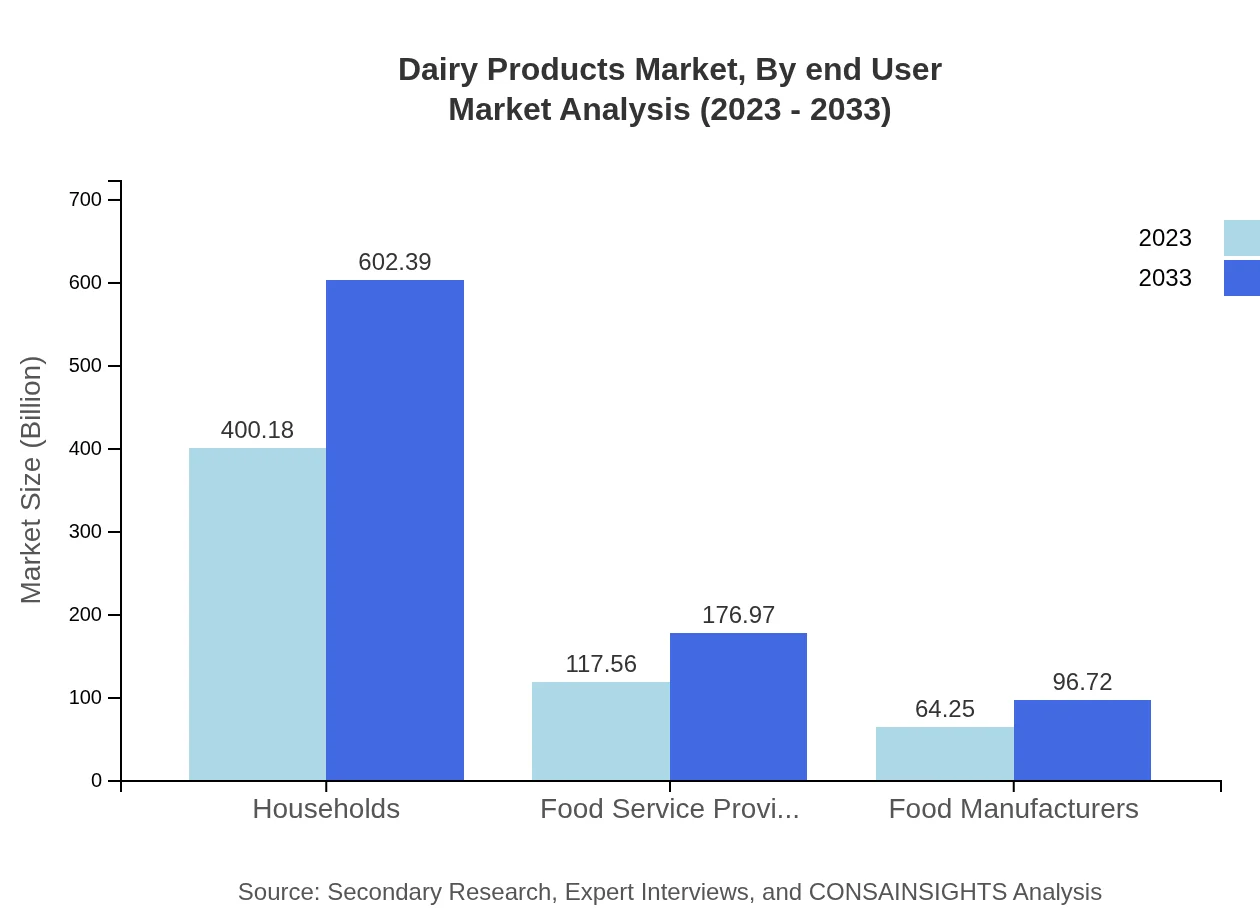

Dairy Products Market Analysis By End User

The Dairy Products market segmented by end-users is determined as follows: - Households: Market size of USD 400.18 billion in 2023, expected to continue expanding to USD 602.39 billion by 2033, holding a share of 68.76%. - Food Service Providers: Valued at USD 117.56 billion in 2023, projected to grow to USD 176.97 billion by 2033, maintaining 20.2% share.

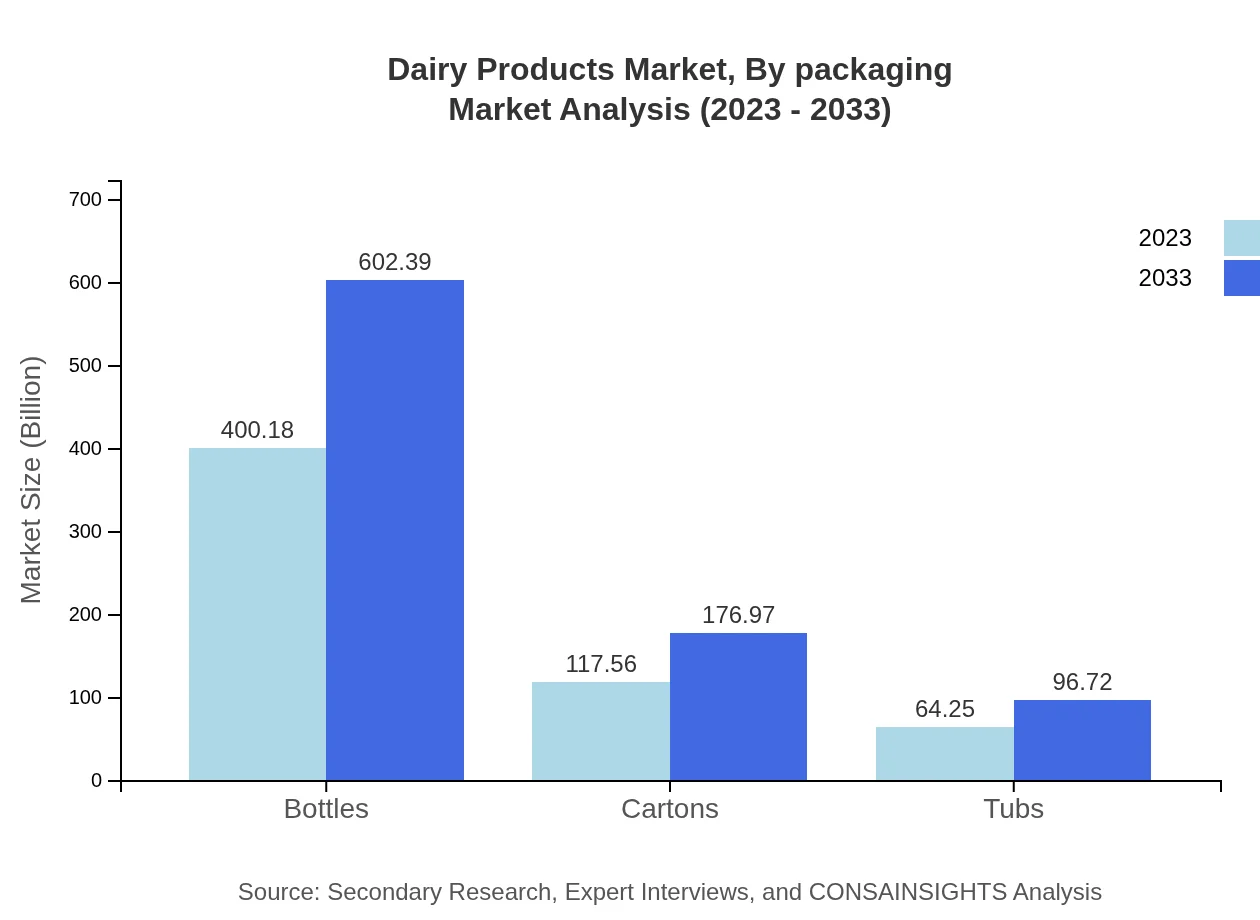

Dairy Products Market Analysis By Packaging

Market analysis by packaging types includes: - Bottles: Anticipated to grow from USD 400.18 billion in 2023 to USD 602.39 billion by 2033, representing 68.76% of market share. - Cartons: Currently at USD 117.56 billion, expected to reach USD 176.97 billion by 2033, accounting for 20.2% share. - Tubs: Starting from USD 64.25 billion in 2023, forecasted to grow to USD 96.72 billion by 2033, sharing 11.04% of the market.

Dairy Products Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dairy Products Industry

Nestle S.A.:

Nestle is a global leader in the food and beverage sector, particularly in dairy products, with a strong portfolio including milk, condensed milk, and dairy-based nutritional products.Lactalis Group:

Lactalis is one of the world's largest dairy product manufacturers, producing a wide range of products, including cheese, milk, and yogurt.Danone S.A.:

Danone specializes in dairy products, particularly yogurt and plant-based alternatives, leveraging health and wellness trends to grow its market share.Fonterra Co-operative Group Limited:

Fonterra is a New Zealand-based cooperative known for its dairy export operations and a wide array of dairy products, emphasizing sustainability.We're grateful to work with incredible clients.

FAQs

What is the market size of dairy Products?

The global dairy products market is projected to reach a size of $582 billion by 2033, with a CAGR of 4.1%. This growth encompasses various segments and reflects an expanding consumer base.

What are the key market players or companies in this dairy products industry?

Key players in the dairy products industry include major companies like Nestlé, Danone, Lactalis, Fonterra, and FrieslandCampina, which dominate the market through innovation and wide distribution channels.

What are the primary factors driving growth in the dairy products industry?

Key drivers of growth in the dairy products sector include rising health consciousness, increasing demand for organic and premium dairy products, and growing urbanization, particularly in emerging markets.

Which region is the fastest Growing in the dairy products market?

The Asia Pacific region is the fastest-growing market for dairy products, expected to expand from $117.39 billion in 2023 to $176.70 billion by 2033, driven by population growth and increasing meat and dairy consumption.

Does ConsInsights provide customized market report data for the dairy products industry?

Yes, ConsInsights offers customized market report data tailored to specific needs in the dairy products industry, allowing businesses to access insights as per their strategic objectives.

What deliverables can I expect from this dairy products market research project?

Deliverables from the dairy products market research project typically include comprehensive reports, market analysis, trend forecasts, and strategic recommendations customized to your specific business needs.

What are the market trends of dairy products?

Emerging trends in the dairy products market include a shift towards organic and premium products, increased plant-based alternatives, and innovations in packaging and distribution to enhance sustainability.