Dairy Testing Market Report

Published Date: 31 January 2026 | Report Code: dairy-testing

Dairy Testing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Dairy Testing market, covering market size, trends, forecasts, and regional insights from 2023 to 2033, aimed at guiding stakeholders in making informed decisions.

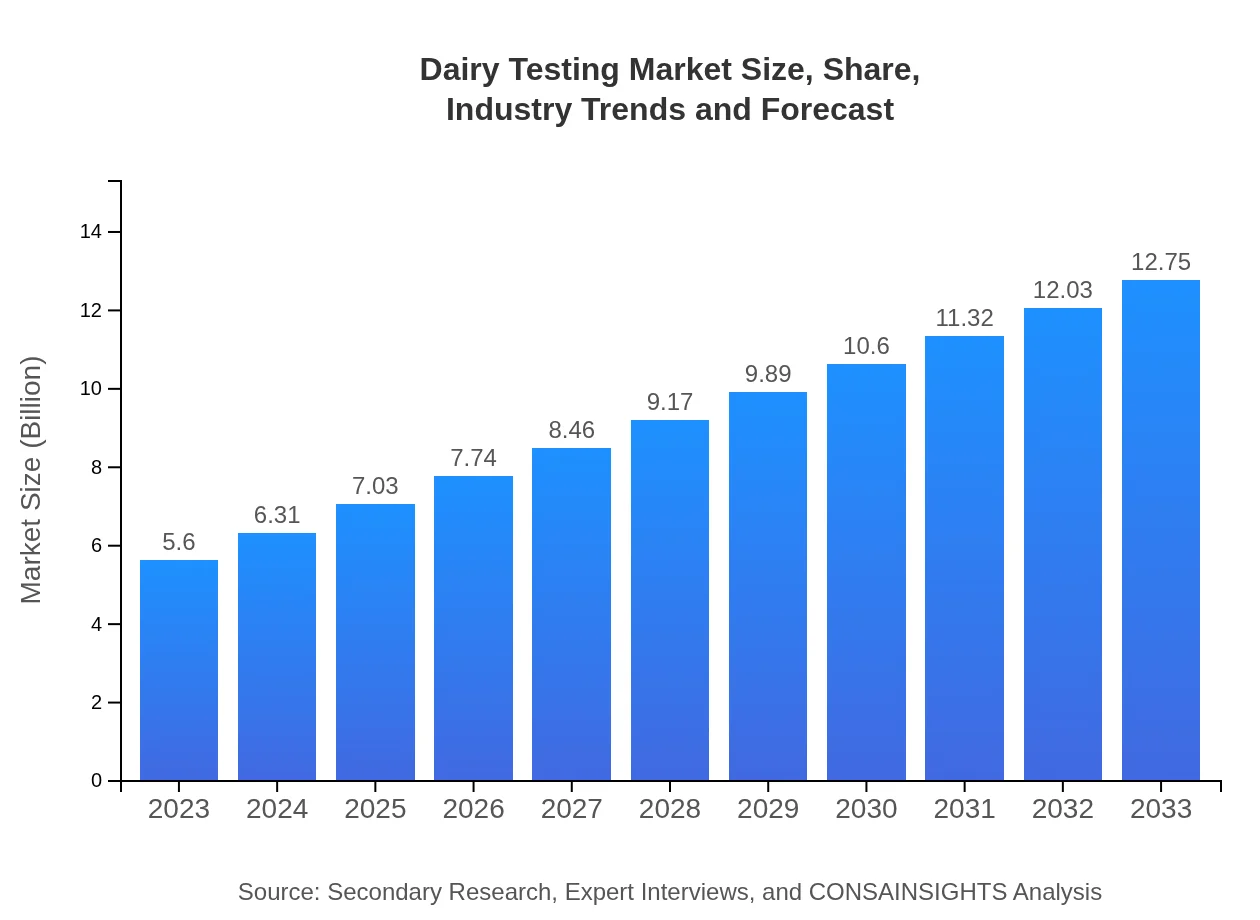

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 8.3% |

| 2033 Market Size | $12.75 Billion |

| Top Companies | Thermo Fisher Scientific, Eurofins Scientific, SGS S.A., Intertek Group plc |

| Last Modified Date | 31 January 2026 |

Dairy Testing Market Overview

Customize Dairy Testing Market Report market research report

- ✔ Get in-depth analysis of Dairy Testing market size, growth, and forecasts.

- ✔ Understand Dairy Testing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dairy Testing

What is the Market Size & CAGR of Dairy Testing market in 2033?

Dairy Testing Industry Analysis

Dairy Testing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dairy Testing Market Analysis Report by Region

Europe Dairy Testing Market Report:

Europe's Dairy Testing market is expected to grow from $1.87 billion in 2023 to $4.27 billion by 2033. This region has stringent food safety regulations and high standards of dairy product quality, which drive the demand for comprehensive testing services. Countries like Germany, France, and the UK are at the forefront of this growth.Asia Pacific Dairy Testing Market Report:

In the Asia Pacific region, the Dairy Testing market is projected to grow from $1.07 billion in 2023 to $2.44 billion by 2033. The growth is driven by rising dairy consumption, increasing investments in testing technologies, and regulatory frameworks aimed at ensuring food safety. Countries like India and China are leading this expansion due to their substantial dairy production and consumption.North America Dairy Testing Market Report:

North America, particularly the United States and Canada, is a significant market for Dairy Testing, projected to grow from $1.81 billion in 2023 to $4.11 billion by 2033. This growth is attributed to strict regulatory mandates and a strong emphasis on food quality and safety. The region's advanced laboratory infrastructure supports innovation in dairy testing methodologies.South America Dairy Testing Market Report:

The South America Dairy Testing market is estimated to reach $0.37 billion by 2033, growing from $0.16 billion in 2023. The region's market growth is aided by increasing awareness of food safety standards and improving dairy industry infrastructure. Brazil and Argentina are the key market players, focused on enhancing testing capabilities.Middle East & Africa Dairy Testing Market Report:

The Middle East and Africa Dairy Testing market is projected to experience significant growth, increasing from $0.69 billion in 2023 to $1.56 billion by 2033. The growth is driven by rising imports of dairy products and increasing regulatory scrutiny over food safety. Investments in laboratory infrastructure are expected to enhance testing capabilities across the region.Tell us your focus area and get a customized research report.

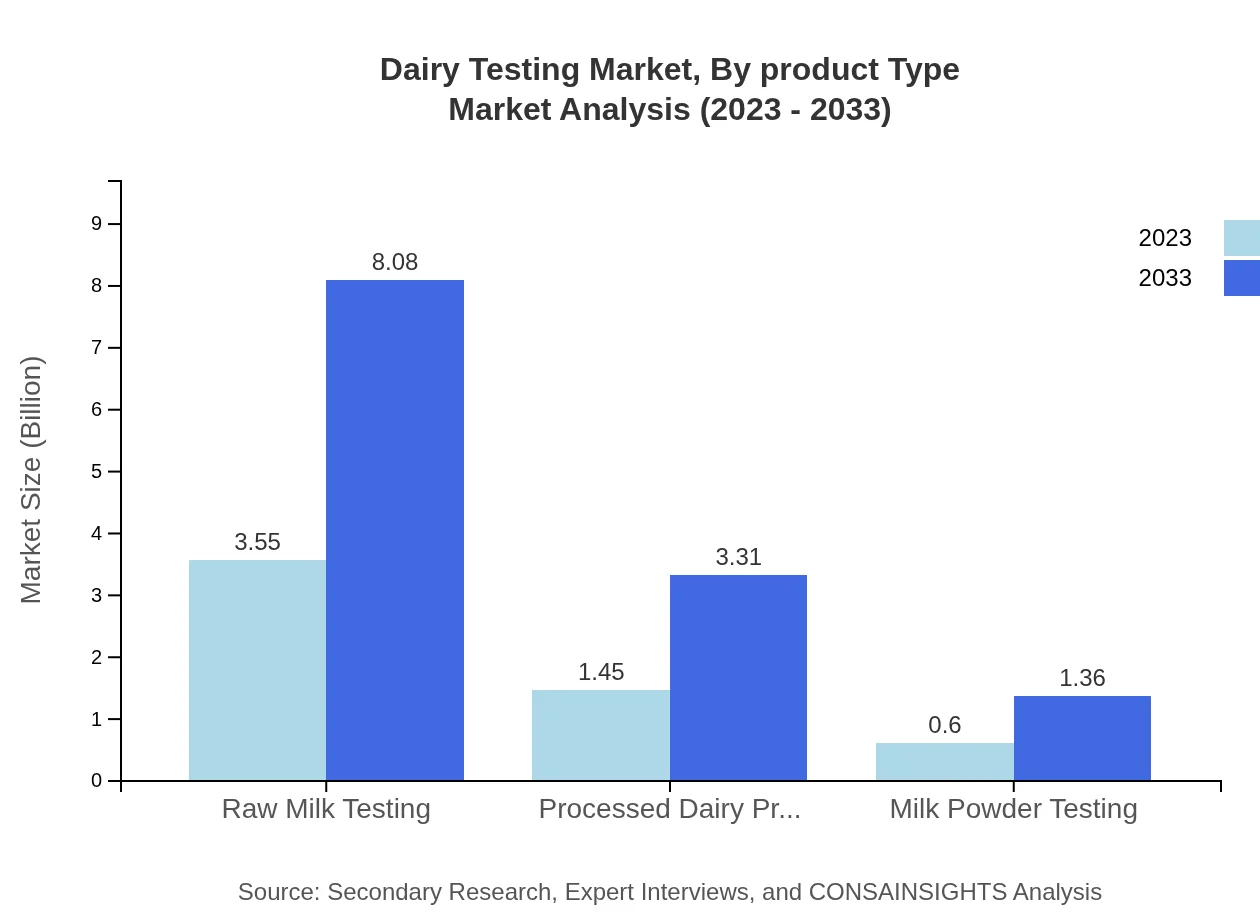

Dairy Testing Market Analysis By Product Type

The Dairy Testing market comprises multiple product types, each contributing significantly to market growth. Raw Milk Testing leads the market, projected to grow from $3.55 billion in 2023 to $8.08 billion by 2033, holding a share of 63.35%. Processed Dairy Products Testing comes next, growing from $1.45 billion to $3.31 billion, and Milk Powder Testing represents a market size of $0.60 billion increasing to $1.36 billion over the same period.

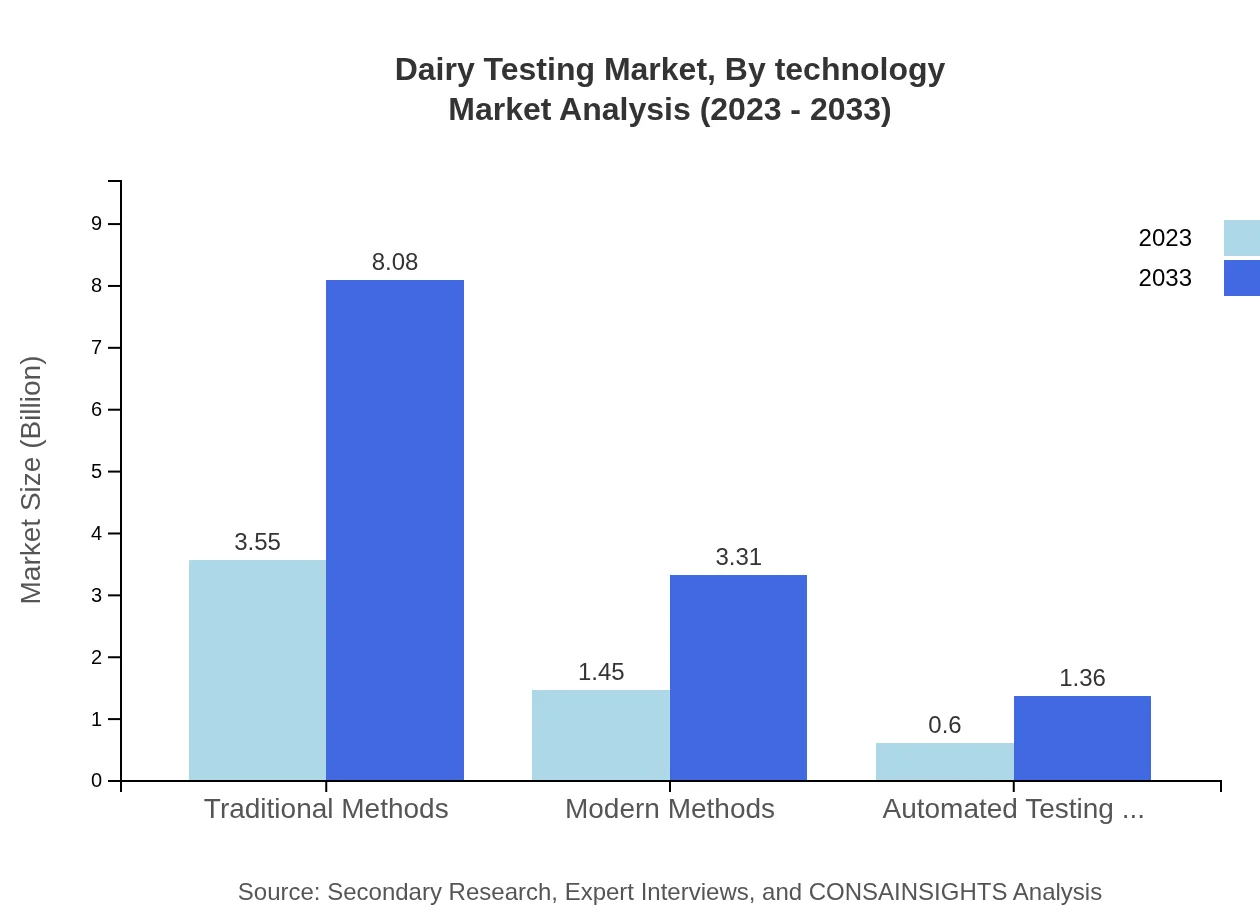

Dairy Testing Market Analysis By Technology

Technology plays a crucial role in Dairy Testing. Traditional Methods dominate the segment, accounting for 63.35% of the market share with a size of $3.55 billion in 2023, expected to reach $8.08 billion by 2033. Modern Methods are gaining traction, projected to grow significantly, while Automated Testing Systems are on the rise, expected to provide more efficiency in testing procedures.

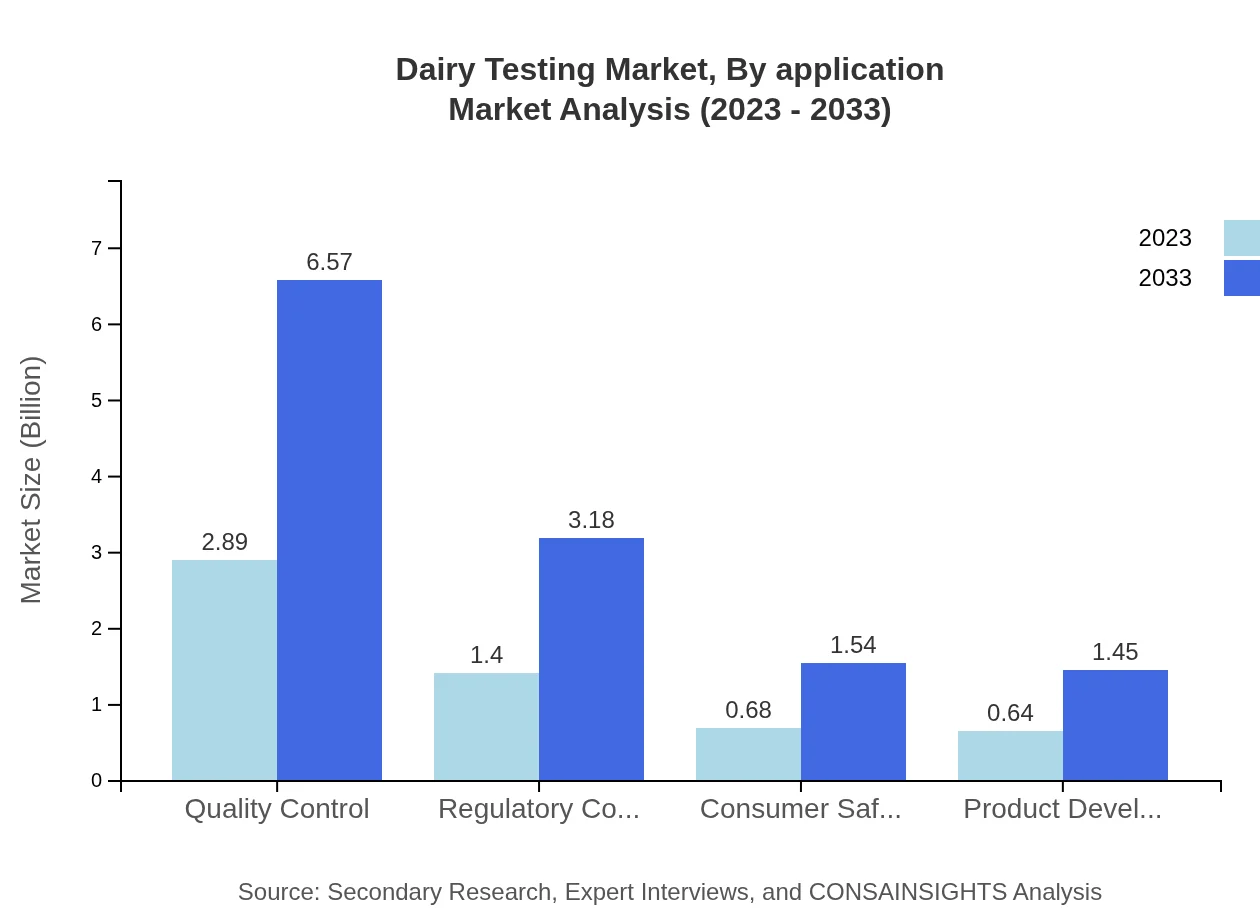

Dairy Testing Market Analysis By Application

The Dairy Testing market is segmented into various applications, including quality control, regulatory compliance, consumer safety, product development, and industrial use. Quality Control is the largest segment, constituting 51.53% of the market with a size of $2.89 billion expected to grow to $6.57 billion by 2033. Regulatory compliance and consumer safety also play vital roles in market dynamics.

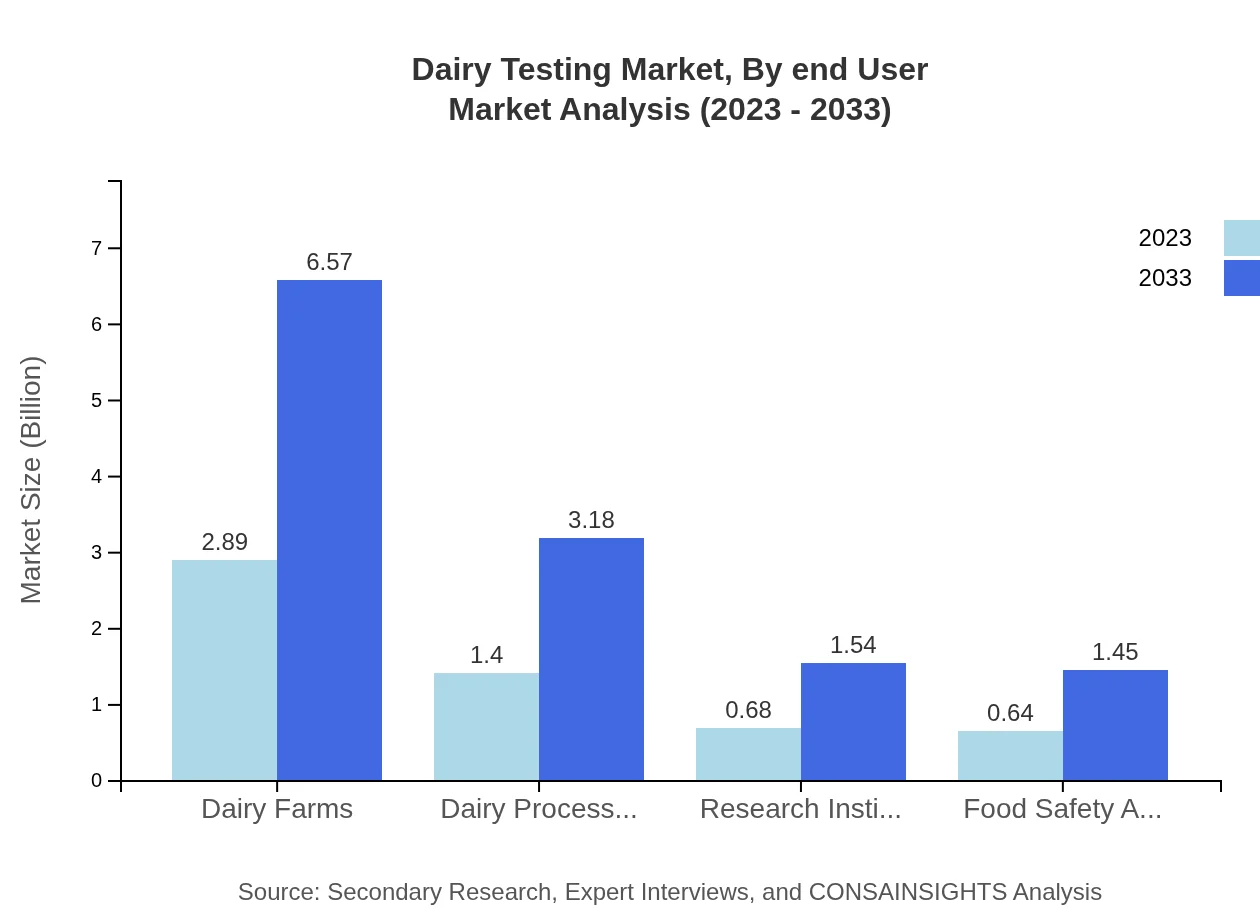

Dairy Testing Market Analysis By End User

The Dairy Testing market serves several end-users, with Dairy Farms being the primary market holder, expected to grow from $2.89 billion in 2023 to $6.57 billion by 2033, capturing 51.53% of the market. Dairy Processors and Research Institutes follow, highlighting the diverse applications of dairy testing across different sectors within the dairy industry.

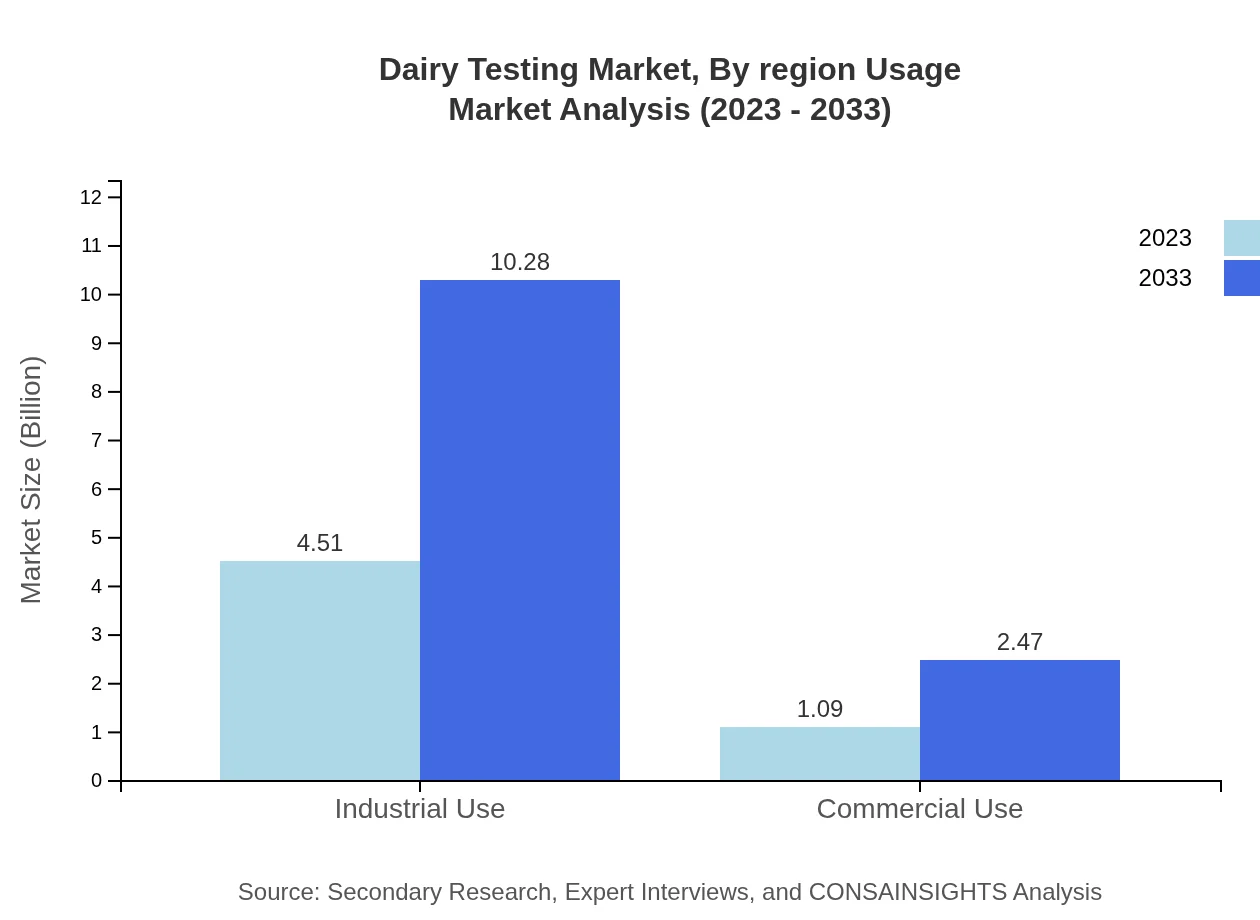

Dairy Testing Market Analysis By Region Usage

The Dairy Testing market's usage spans across industrial and commercial applications. Industrial use holds a significant share, with $4.51 billion expected to rise to $10.28 billion by 2033. In contrast, commercial use remains a smaller segment, projected to grow from $1.09 billion to $2.47 billion, reflecting the emphasis on enhanced testing solutions in industrial dairy production.

Dairy Testing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dairy Testing Industry

Thermo Fisher Scientific:

A leading provider of laboratory services and products, Thermo Fisher Scientific offers innovative testing solutions to ensure quality in dairy products, contributing extensively to food safety.Eurofins Scientific:

Eurofins is a global group of laboratories providing high-quality testing services, including dairy product analysis, with numerous accreditations from regulatory bodies worldwide.SGS S.A.:

SGS provides comprehensive laboratory testing services, ensuring compliance with international food safety standards, including those applicable to the Dairy Testing market.Intertek Group plc:

Intertek delivers quality assurance services, including dairy testing, with focus on compliance and reducing risks associated with food safety.We're grateful to work with incredible clients.

FAQs

What is the market size of dairy testing?

The global dairy testing market is valued at $5.6 billion in 2023 with a projected CAGR of 8.3%. It is expected to significantly expand by 2033 as food safety concerns increase.

What are the key market players or companies in this dairy testing industry?

Key players in the dairy testing market include major corporations that specialize in food safety, testing technology, and quality assurance. Companies like Eurofins, SGS, and Intertek lead this dynamic industry, focusing on innovative testing methodologies.

What are the primary factors driving the growth in the dairy testing industry?

Key growth drivers in the dairy testing industry include increasing health consciousness, stringent food safety regulations, and technological advancements in testing methods. The rising demand for quality assurance in dairy products also plays a crucial role.

Which region is the fastest Growing in the dairy testing?

The fastest-growing region in the dairy testing market is Europe, projected to grow from $1.87 billion in 2023 to $4.27 billion by 2033, fueled by regulatory demands and consumer trends favoring quality assurance.

Does ConsaInsights provide customized market report data for the dairy testing industry?

Yes, ConsaInsights offers customized market report data tailored specifically to client needs in the dairy testing sector, ensuring relevant, actionable insights for informed decision-making.

What deliverables can I expect from this dairy testing market research project?

Deliverables from the dairy testing market research project include comprehensive market size analyses, growth projections, segmentation insights, and regional performance data, along with strategic recommendations for market entry or expansion.

What are the market trends of dairy testing?

Current trends in the dairy testing market include a shift towards automated testing systems, increased focus on consumer safety, and the adoption of modern testing methods over traditional practices, reflecting evolving industry standards.