Dark Analytics Market Report

Published Date: 31 January 2026 | Report Code: dark-analytics

Dark Analytics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Dark Analytics market, outlining key trends, insights, and financial forecasts from 2023 to 2033.

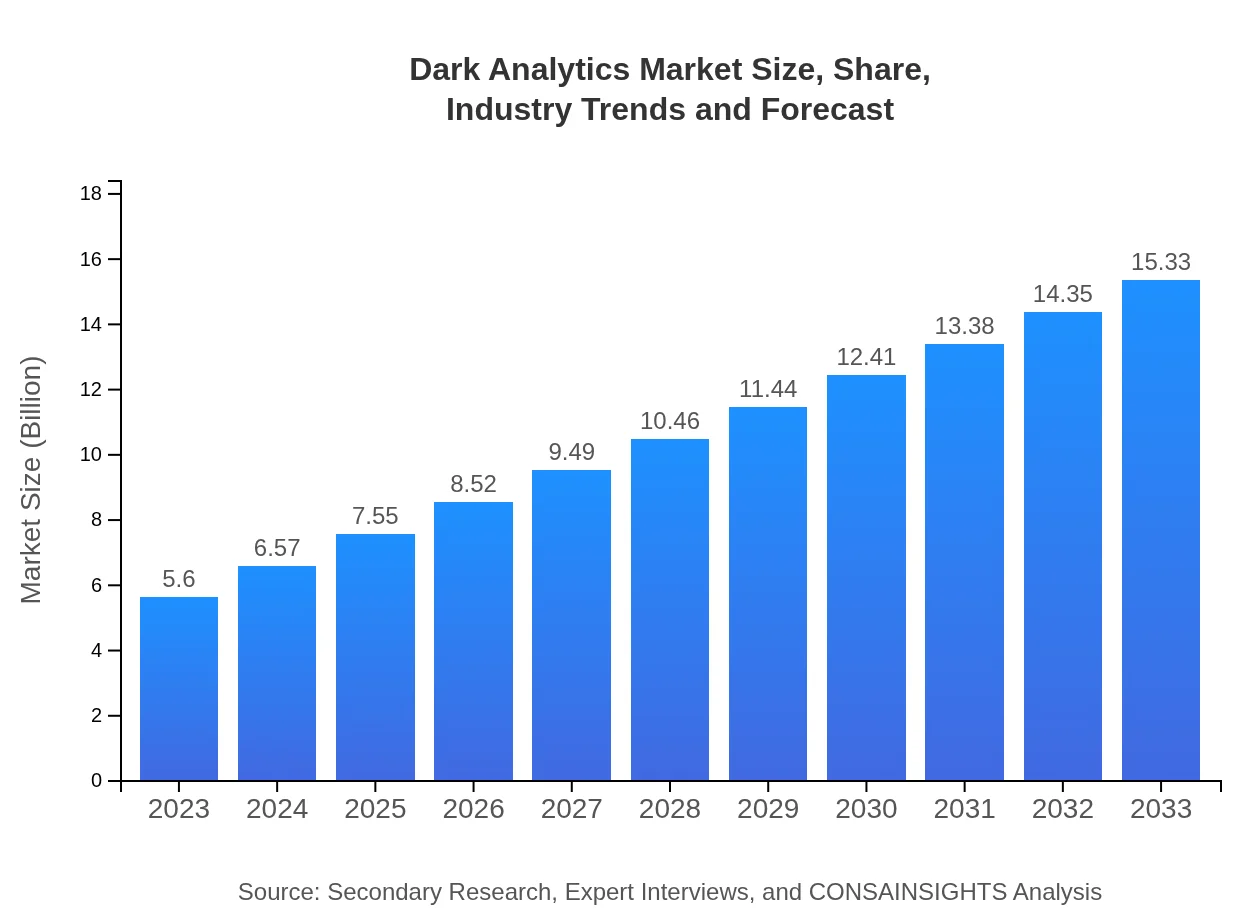

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $15.33 Billion |

| Top Companies | IBM, Microsoft, SAS Institute, Oracle, Tableau |

| Last Modified Date | 31 January 2026 |

Dark Analytics Market Overview

Customize Dark Analytics Market Report market research report

- ✔ Get in-depth analysis of Dark Analytics market size, growth, and forecasts.

- ✔ Understand Dark Analytics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dark Analytics

What is the Market Size & CAGR of Dark Analytics market in 2023?

Dark Analytics Industry Analysis

Dark Analytics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dark Analytics Market Analysis Report by Region

Europe Dark Analytics Market Report:

The Dark Analytics market in Europe is poised to increase from $1.47 billion in 2023 to $4.03 billion by 2033. The growth can be attributed to stringent data regulations and heightened awareness among companies about the value of unstructured data.Asia Pacific Dark Analytics Market Report:

The Asia Pacific region is witnessing rapid adoption of Dark Analytics solutions, propelled by growing digitalization and a rising emphasis on leveraging big data. The market is expected to expand from $1.10 billion in 2023 to $3.02 billion by 2033, reflecting a robust CAGR fueled by increasing investment in technology across developing economies.North America Dark Analytics Market Report:

North America is the largest market for Dark Analytics, projected to grow from $1.98 billion in 2023 to $5.43 billion by 2033. The region benefits from a robust technology ecosystem and high penetration of digital transformation initiatives in enterprises across key sectors.South America Dark Analytics Market Report:

South America's Dark Analytics market, though smaller, is on an upward trajectory, expected to grow from $0.28 billion in 2023 to $0.78 billion by 2033. This growth is driven by the increasing adoption of digital technologies and data analytics solutions by local businesses.Middle East & Africa Dark Analytics Market Report:

The Middle East and Africa are experiencing significant developments in the Dark Analytics landscape, with market growth from $0.76 billion in 2023 to $2.07 billion by 2033, driven by efforts to modernize infrastructure and integrate innovative data solutions.Tell us your focus area and get a customized research report.

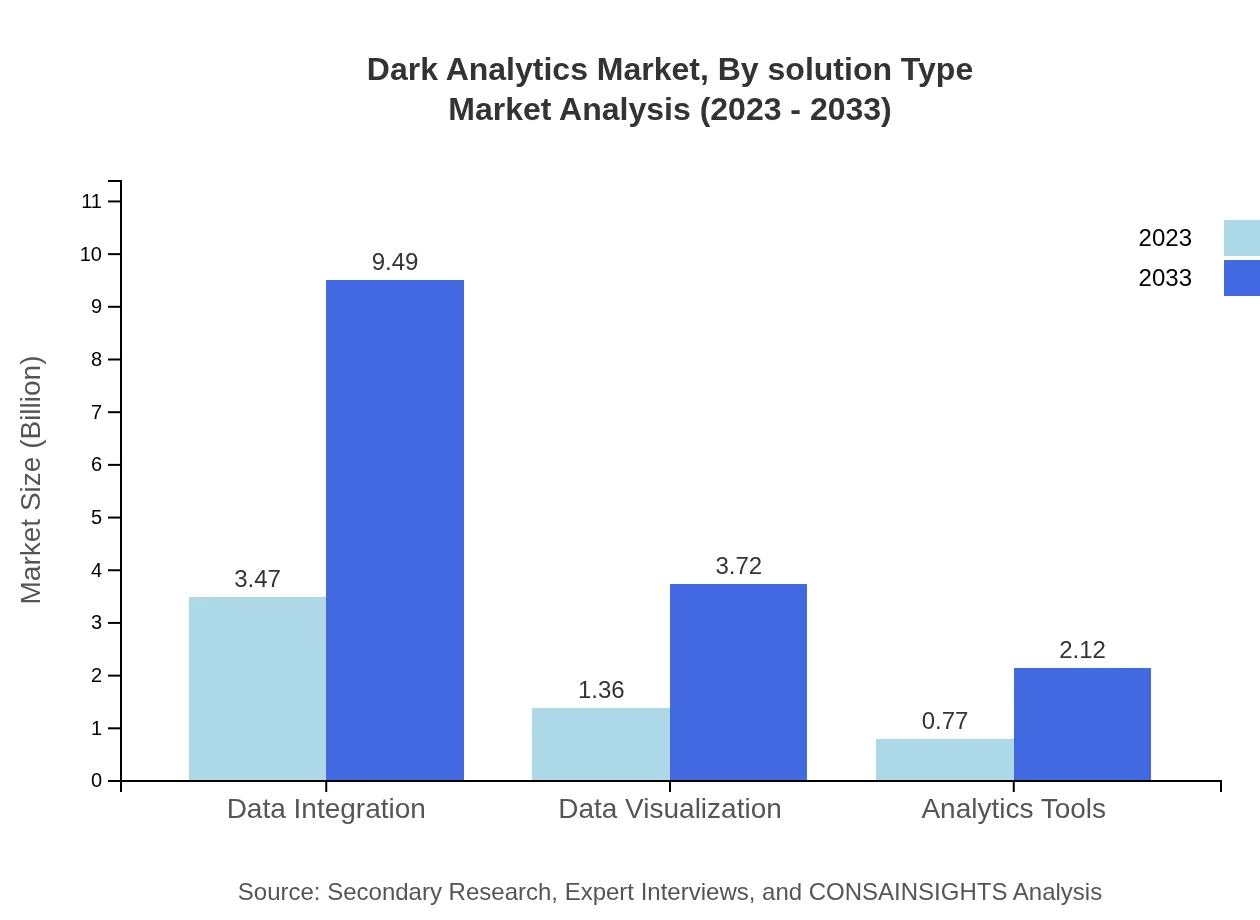

Dark Analytics Market Analysis By Solution Type

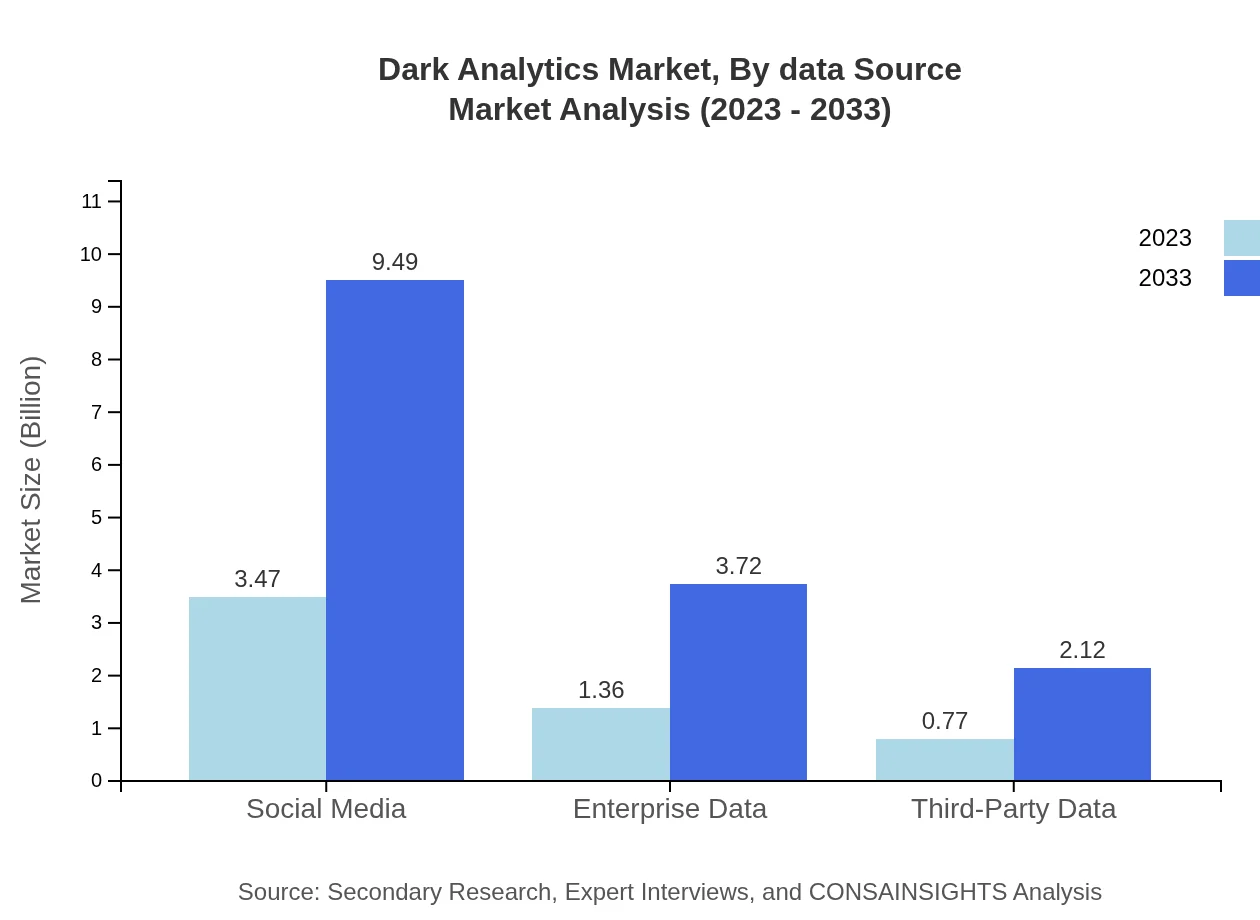

Dark Analytics solutions are primarily classified into several categories. In 2023, Data Integration leads with a market size of $3.47 billion, expected to grow to $9.49 billion by 2033, reflecting the critical nature of integrating disparate data sources. Analytics Tools and Data Visualization are also essential offerings, showcasing similar growth patterns.

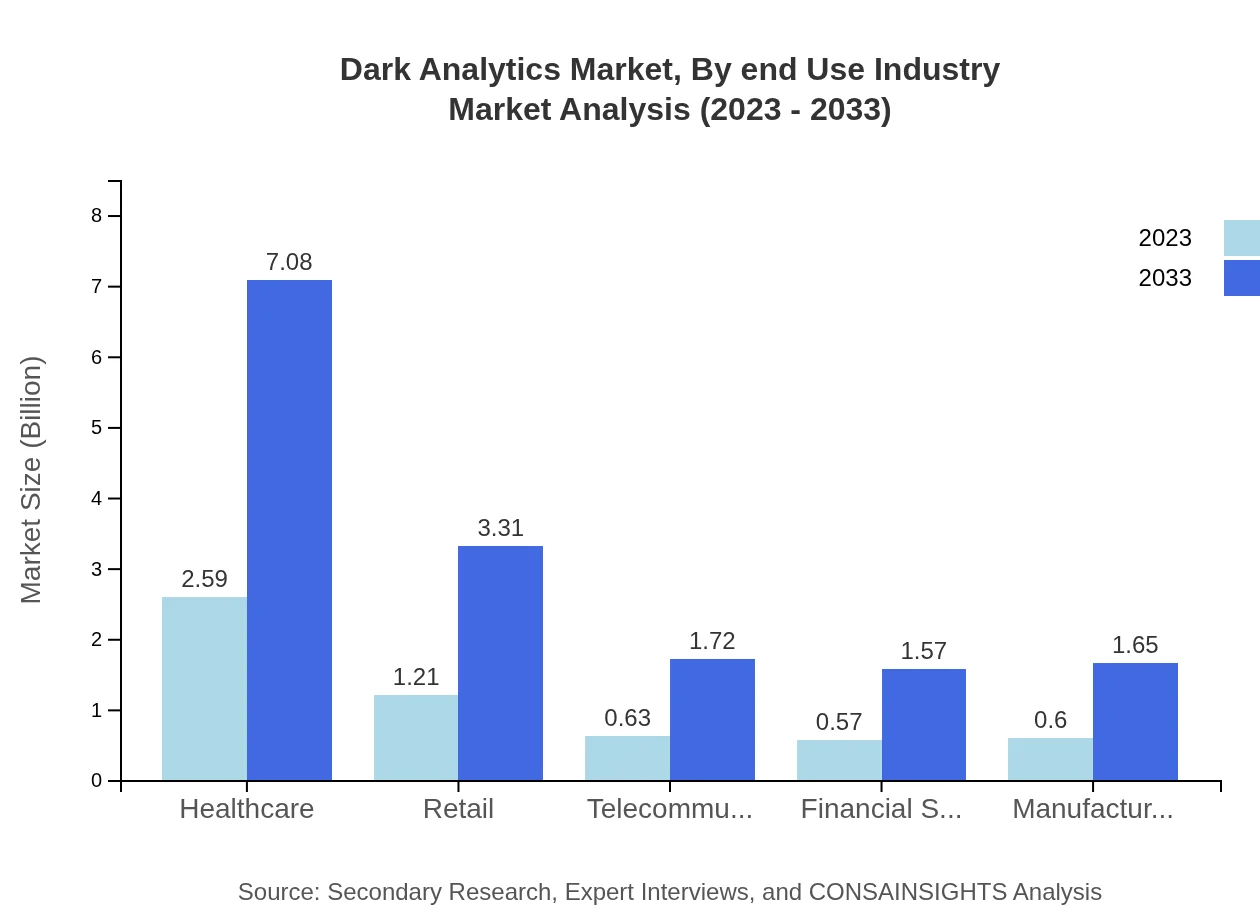

Dark Analytics Market Analysis By End Use Industry

In 2023, the healthcare sector emerges as a key player with a market share of $2.59 billion, projected to reach $7.08 billion by 2033. The financial services and retail industries follow closely, indicating broad applicability of Dark Analytics across varied sectors.

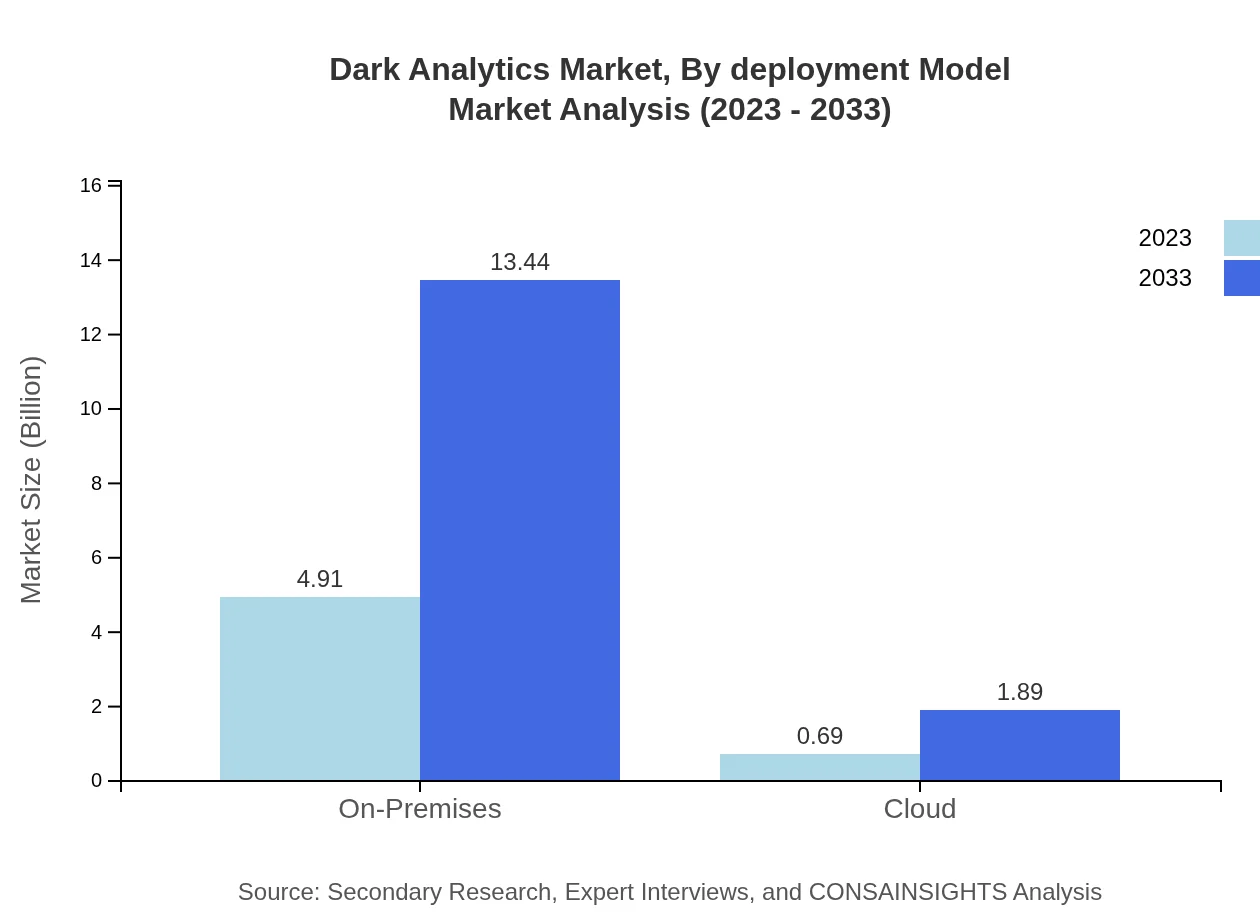

Dark Analytics Market Analysis By Deployment Model

On-Premises solutions dominate the deployment landscape, holding a market size of $4.91 billion in 2023, expected to increase to $13.44 billion by 2033. Cloud solutions, although smaller in share, are expected to grow significantly due to increasing digital adoption rates.

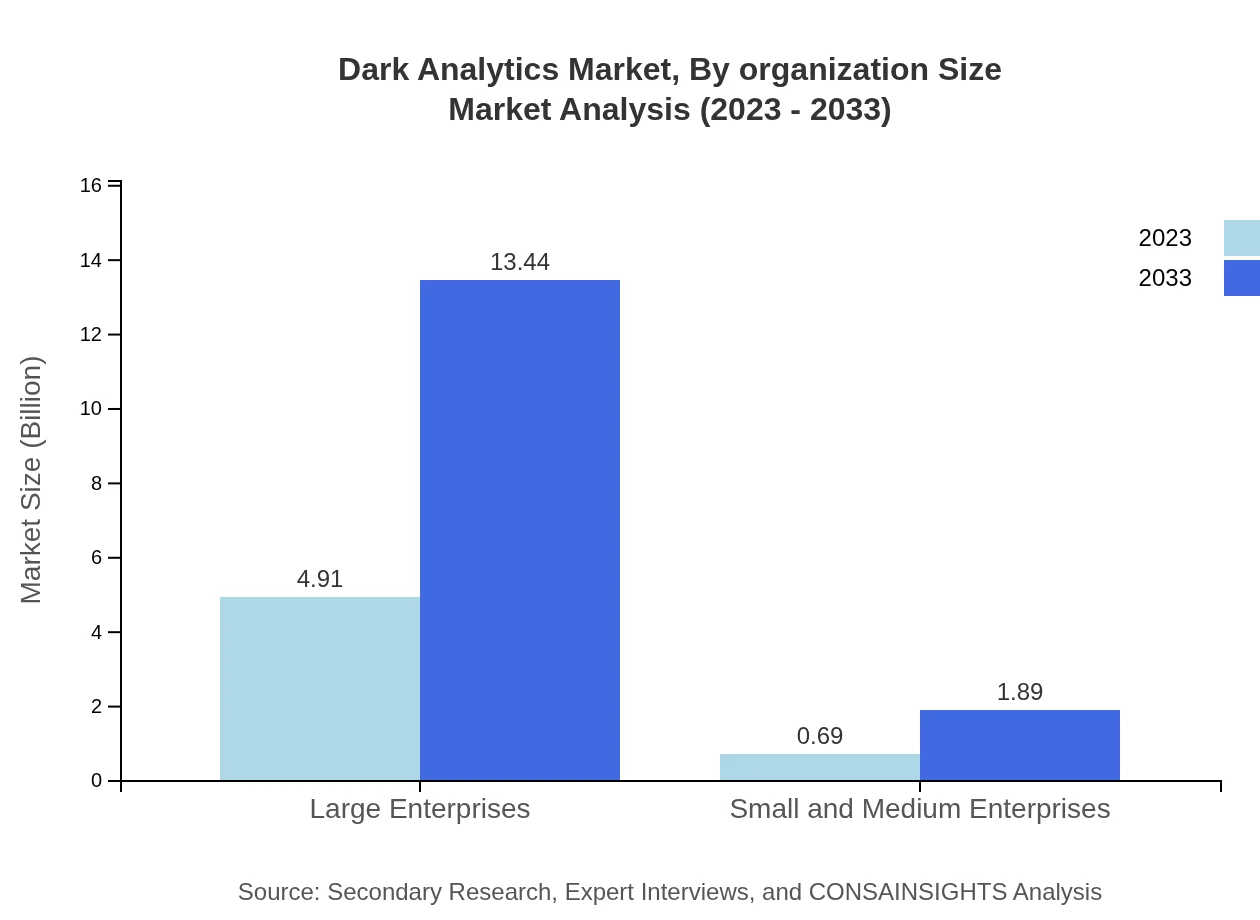

Dark Analytics Market Analysis By Organization Size

Large Enterprises significantly contribute to the Dark Analytics market, with a size of $4.91 billion in 2023, poised to reach $13.44 billion by 2033, indicating a steady interest in sophisticated analytics solutions among larger organizations.

Dark Analytics Market Analysis By Data Source

Data from social media and enterprise sources is critical for analytics, with social media holding a notable market size during this period. The significance of integrating various data sources to leverage insights will continue to shape market dynamics in the coming years.

Dark Analytics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dark Analytics Industry

IBM:

IBM is at the forefront of Dark Analytics, offering solutions that leverage machine learning and AI to extract meaningful insights from dark data.Microsoft:

Microsoft provides comprehensive analytical tools and platforms that empower businesses to harness dark data effectively, enhancing decision-making processes.SAS Institute:

SAS Institute focuses on advanced analytics solutions tailored to capture and analyze unstructured data across various sectors.Oracle:

Oracle offers powerful data processing capabilities, facilitating organizations' abilities to derive insights from dark data sources.Tableau:

Tableau, now a part of Salesforce, enhances data visualization and integration for revealing valuable insights from dark information.We're grateful to work with incredible clients.

FAQs

What is the market size of dark Analytics?

The dark analytics market is valued at approximately $5.6 billion in 2023, with a projected CAGR of 10.2%. This growth signifies expanding interest and investment in this innovative sector, targeting untapped data insights.

What are the key market players or companies in the dark Analytics industry?

Key players in the dark analytics industry include major tech companies providing data solutions, analytics platforms, and consulting firms. They lead in developing innovative analytics tools that utilize dark data for strategic insights.

What are the primary factors driving the growth in the dark Analytics industry?

Growth in the dark analytics industry is driven by increasing data generation, demand for data-driven decision-making, advancements in AI and machine learning, and the necessity to harness underutilized data for competitive advantage.

Which region is the fastest Growing in the dark Analytics?

North America is the fastest-growing region in dark analytics, with its market size expected to expand from $1.98 billion in 2023 to $5.43 billion by 2033, fueled by technological adoption and robust data strategies.

Does ConsaInsights provide customized market report data for the dark Analytics industry?

Yes, ConsaInsights offers tailored market report data for the dark analytics industry. Our customized reports are designed to meet specific client needs, ensuring relevant insights into market dynamics and growth opportunities.

What deliverables can I expect from this dark Analytics market research project?

Deliverables include comprehensive reports with market analysis, segmentation data, competitive landscape overview, regional insights, and forecasts. Clients receive actionable insights to inform strategy and decision-making.

What are the market trends of dark analytics?

Current trends in dark analytics encompass increased focus on AI integration, enhanced data privacy measures, a shift towards real-time analysis, and growing emphasis on actionable insights from unstructured data sources.