Data Catalog Market Report

Published Date: 31 January 2026 | Report Code: data-catalog

Data Catalog Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a comprehensive analysis of the Data Catalog industry, detailing market size, growth forecasts from 2023 to 2033, and key insights into market trends, segmentation, and regional performance.

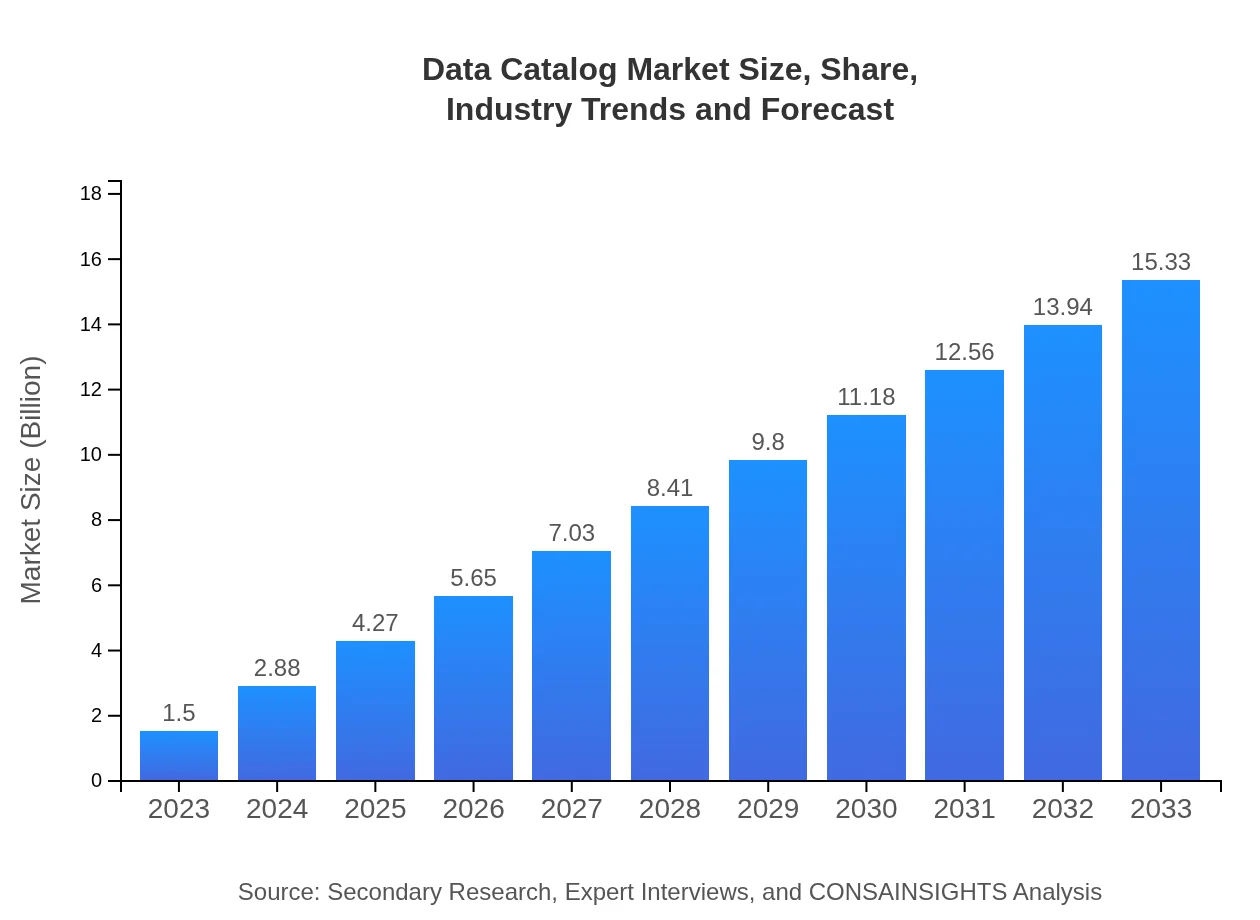

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 24.5% |

| 2033 Market Size | $15.33 Billion |

| Top Companies | Alation, Informatica, Collibra, AWS Glue, Google Cloud Data Catalog |

| Last Modified Date | 31 January 2026 |

Data Catalog Market Overview

Customize Data Catalog Market Report market research report

- ✔ Get in-depth analysis of Data Catalog market size, growth, and forecasts.

- ✔ Understand Data Catalog's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Data Catalog

What is the Market Size & CAGR of Data Catalog market in 2023 and 2033?

Data Catalog Industry Analysis

Data Catalog Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Data Catalog Market Analysis Report by Region

Europe Data Catalog Market Report:

Europe’s Data Catalog market is projected to expand from $0.44 billion in 2023 to $4.48 billion by 2033. The region emphasizes strict data governance regulations, prompting businesses to streamline their data processes. Moreover, increasing digital transformation initiatives support the demand for efficient data management solutions across various industries.Asia Pacific Data Catalog Market Report:

The Asia Pacific region is witnessing robust market growth, with a projected increase from $0.26 billion in 2023 to $2.66 billion by 2033. Countries like China and India are leading advancements in data management technologies, spurred by rising internet penetration and increasing investment in data centers. The rising number of startups and SMEs in the region emphasizes the need for efficient data governance solutions.North America Data Catalog Market Report:

North America holds a significant share of the Data Catalog market, with expected growth from $0.58 billion in 2023 to $5.98 billion by 2033. The high adoption rates of advanced technologies and data analytics among enterprises are attributed to this growth. Additionally, a supportive technological infrastructure and substantial R&D investments by leading firms fuel the regional market expansion.South America Data Catalog Market Report:

In South America, the Data Catalog market is anticipated to grow from $0.07 billion in 2023 to $0.75 billion by 2033. Increasing awareness regarding data compliance and governance among businesses is facilitating a gradual shift toward more organized data management practices. Countries like Brazil and Argentina are emerging as key players in this transformation.Middle East & Africa Data Catalog Market Report:

The Middle East and Africa market is expected to grow from $0.14 billion in 2023 to $1.47 billion by 2033. There is a notable increase in cloud adoption and data-centric strategies among businesses in this region. The need for effective data management tools is heightened by the unique challenges posed by diverse regulatory requirements across different countries.Tell us your focus area and get a customized research report.

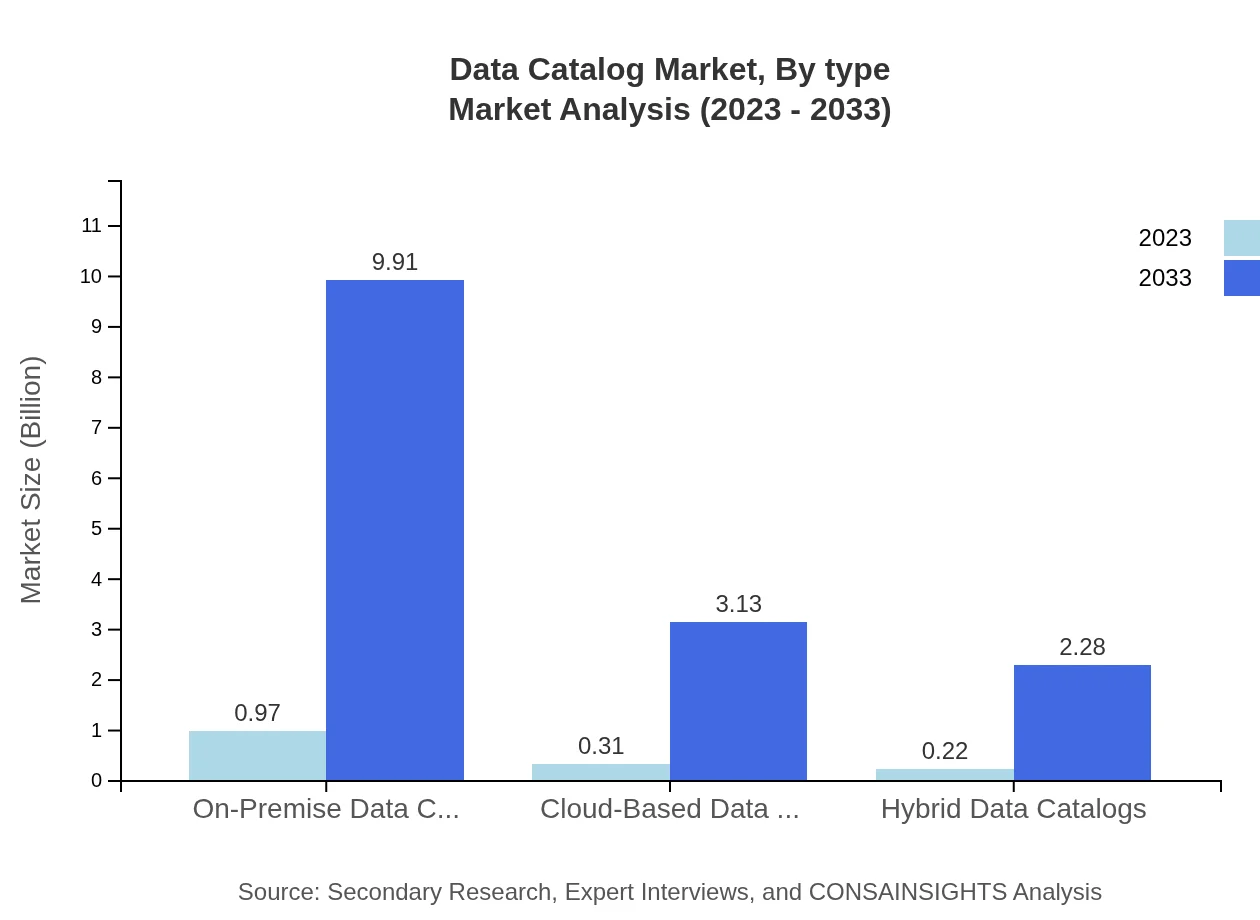

Data Catalog Market Analysis By Type

The Data Catalog market is primarily segmented into On-Premise, Cloud-Based, and Hybrid models. On-premise data catalogs are predicted to dominate the market size in 2023 with $0.97 billion, growing significantly to $9.91 billion by 2033, holding a market share of 64.69%. Cloud-based catalogs show a growing trend from $0.31 billion to $3.13 billion, accounting for 20.41% market share, demonstrating increasing preference for cloud solutions due to scalability and reduced infrastructure costs. Hybrid solutions are also gaining traction, growing from $0.22 billion to $2.28 billion, with a secure position in 14.90% of the market.

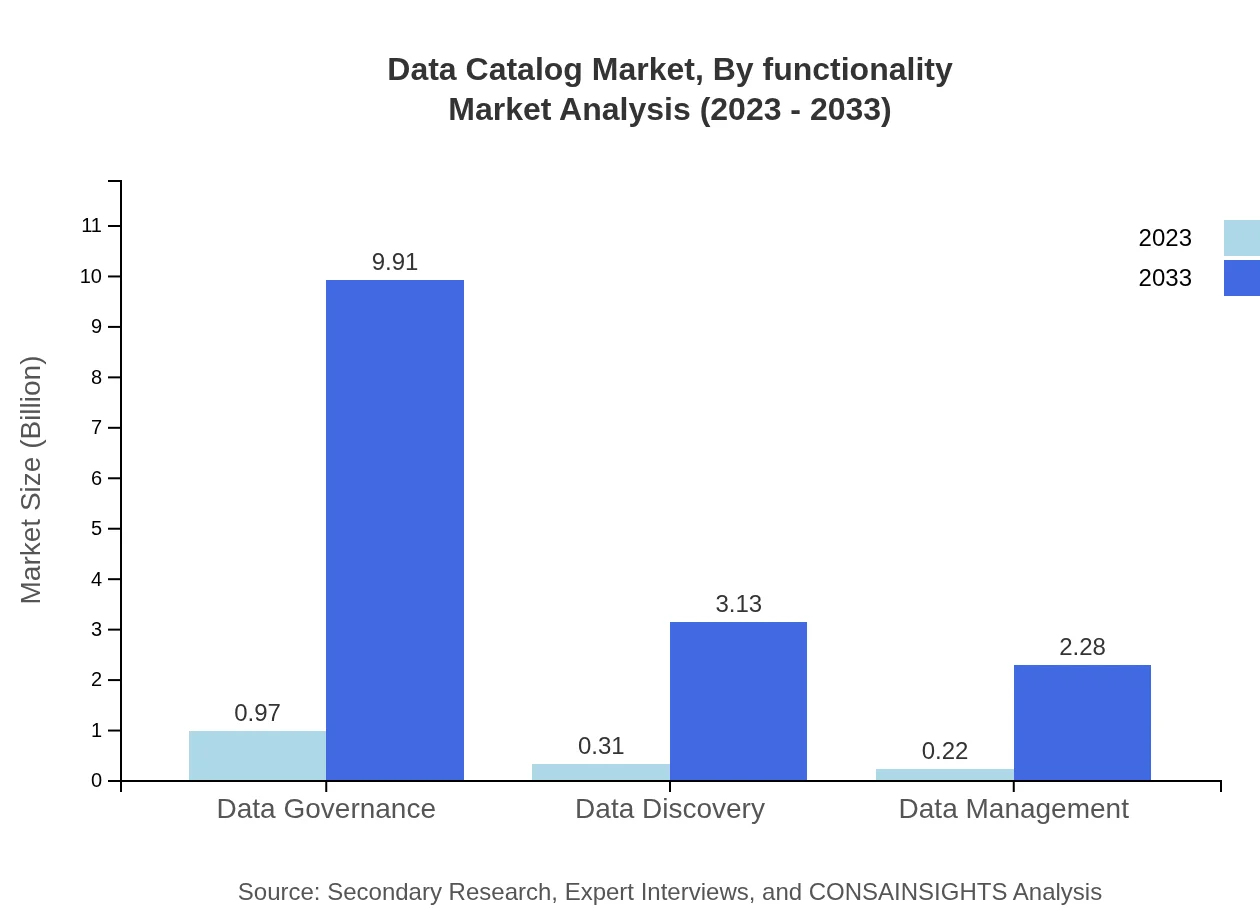

Data Catalog Market Analysis By Functionality

Segmented by functionality, the Data Catalog caters to various sectors including Data Discovery, Data Governance, and Data Management. Data Discovery solutions are projected to grow from $0.31 billion to $3.13 billion, while Data Governance commands a significant market share with expected growth from $0.97 billion to $9.91 billion, highlighting the importance of compliance in data handling. Meanwhile, Data Management is also on the rise, increasing from $0.22 billion to $2.28 billion as businesses invest more heavily in effective data management strategies.

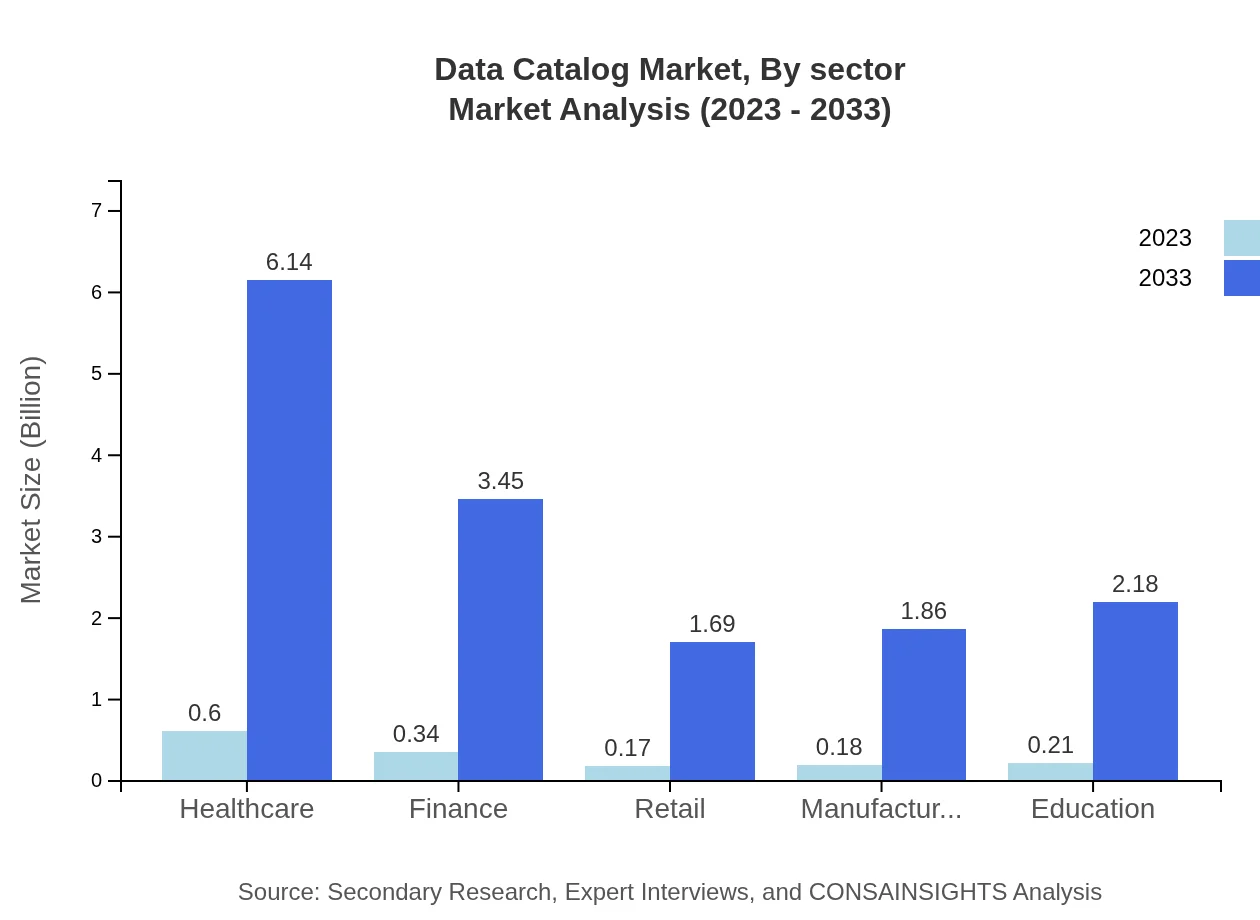

Data Catalog Market Analysis By Sector

The sector analysis highlights that Healthcare leads the market, anticipated to rise from $0.60 billion in 2023 to $6.14 billion by 2033, driven by stringent regulations and the necessity for comprehensive patient data management. The Finance sector also shows strong potential, increasing from $0.34 billion to $3.45 billion. Retail, Education, and Manufacturing sectors contribute further, each demonstrating growth from relatively low bases, emphasizing the increasing recognition of the need for systematic data management.

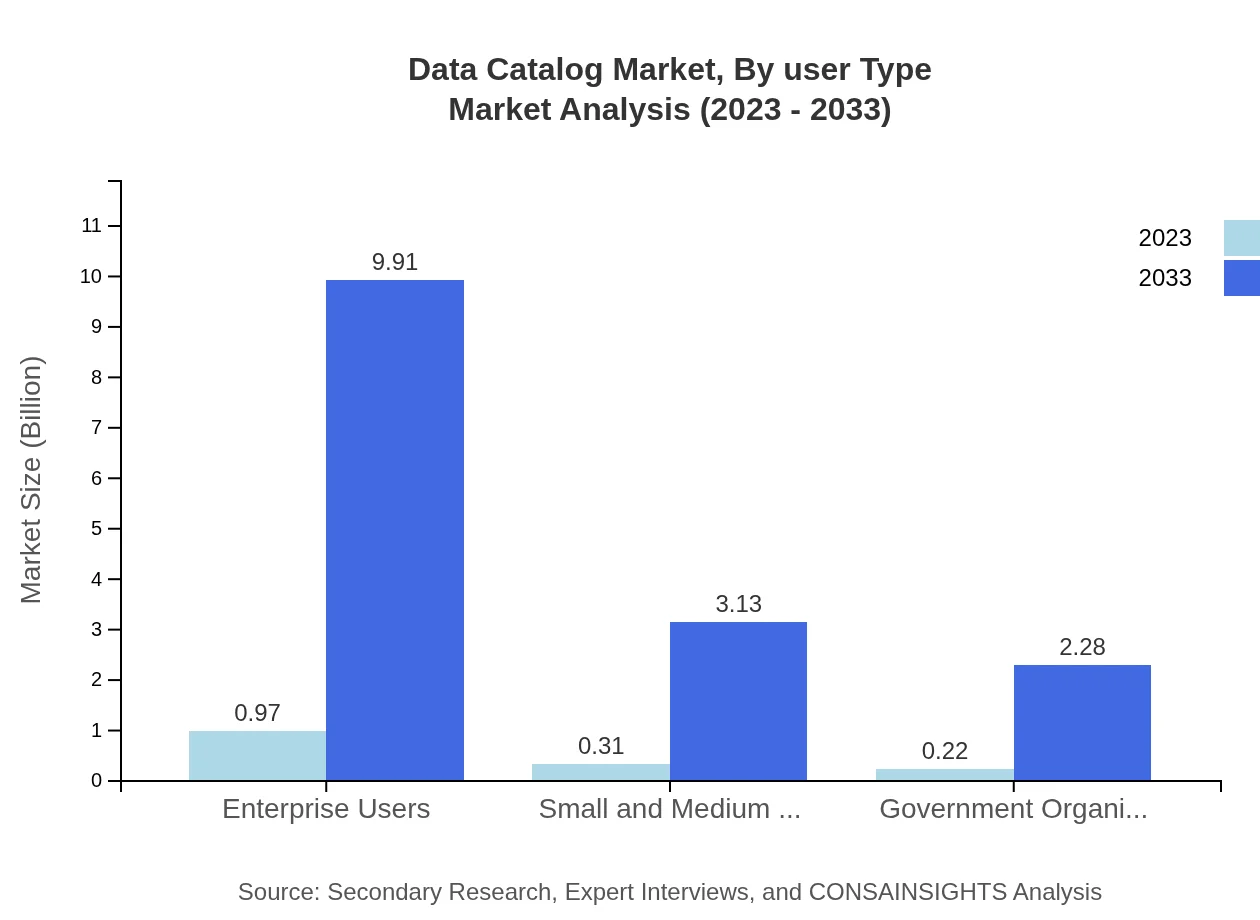

Data Catalog Market Analysis By User Type

User type segmentation reveals that Enterprise Users dominate the market, expected to grow from $0.97 billion to $9.91 billion, retaining a substantial market share of 64.69%. Small and Medium Businesses (SMBs), demonstrating rising data needs, will grow from $0.31 billion to $3.13 billion, capturing 20.41% of the market. Government Organizations and other user types also exhibit increasing traction as public agencies recognize the importance of effective data management for policy-making and public services.

Data Catalog Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Data Catalog Industry

Alation:

Alation provides enterprise data catalog solutions that combine data intelligence with collaborative data stewardship, focused on empowering organizations to manage their data efficiently.Informatica:

Informatica is a leader in cloud data management, offering data catalog solutions known for their powerful data integration and innovative governance features.Collibra:

Collibra specializes in data governance and data cataloging, enabling data professionals to find, understand, and trust their data assets.AWS Glue:

AWS Glue provides a cloud-based data catalog service that makes it easy to discover and search data across various sources while promoting seamless data integration.Google Cloud Data Catalog:

Google Cloud Data Catalog offers enterprise data management solutions, integrating machine learning capabilities that automate data metadata management and enhance data discoverability.We're grateful to work with incredible clients.

FAQs

What is the market size of Data Catalog?

The Data Catalog market is currently valued at approximately $1.5 billion and is projected to grow significantly with a CAGR of 24.5% over the next decade.

What are the key market players or companies in the Data Catalog industry?

Key players in the Data Catalog market include prominent technology firms and specialized data management companies, focusing on innovations and integration within data ecosystems.

What are the primary factors driving the growth in the Data Catalog industry?

The growth in the Data Catalog industry is propelled by increased data generation, demand for data governance, and rising needs for enhanced analytics and data accessibility across sectors.

Which region is the fastest Growing in the Data Catalog?

The fastest-growing region for Data Catalog is North America, anticipating growth from $0.58 billion in 2023 to $5.98 billion by 2033.

Does ConsaInsights provide customized market report data for the Data Catalog industry?

Yes, ConsaInsights offers tailored market report data for the Data Catalog industry to meet specific client needs and insights.

What deliverables can I expect from this Data Catalog market research project?

Deliverables from a Data Catalog market research project include comprehensive market analysis, segment-wise insights, competitive landscape, and growth forecasts.

What are the market trends of Data Catalog?

Market trends in Data Catalog showcase an increasing shift towards cloud-based solutions, rising focus on data governance, and enhanced data analytics for various industry applications.