Data Center Blade Server Market Report

Published Date: 31 January 2026 | Report Code: data-center-blade-server

Data Center Blade Server Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Data Center Blade Server market from 2023 to 2033, covering insights into market dynamics, segmentation, technological advancements, and regional performances to forecast trends.

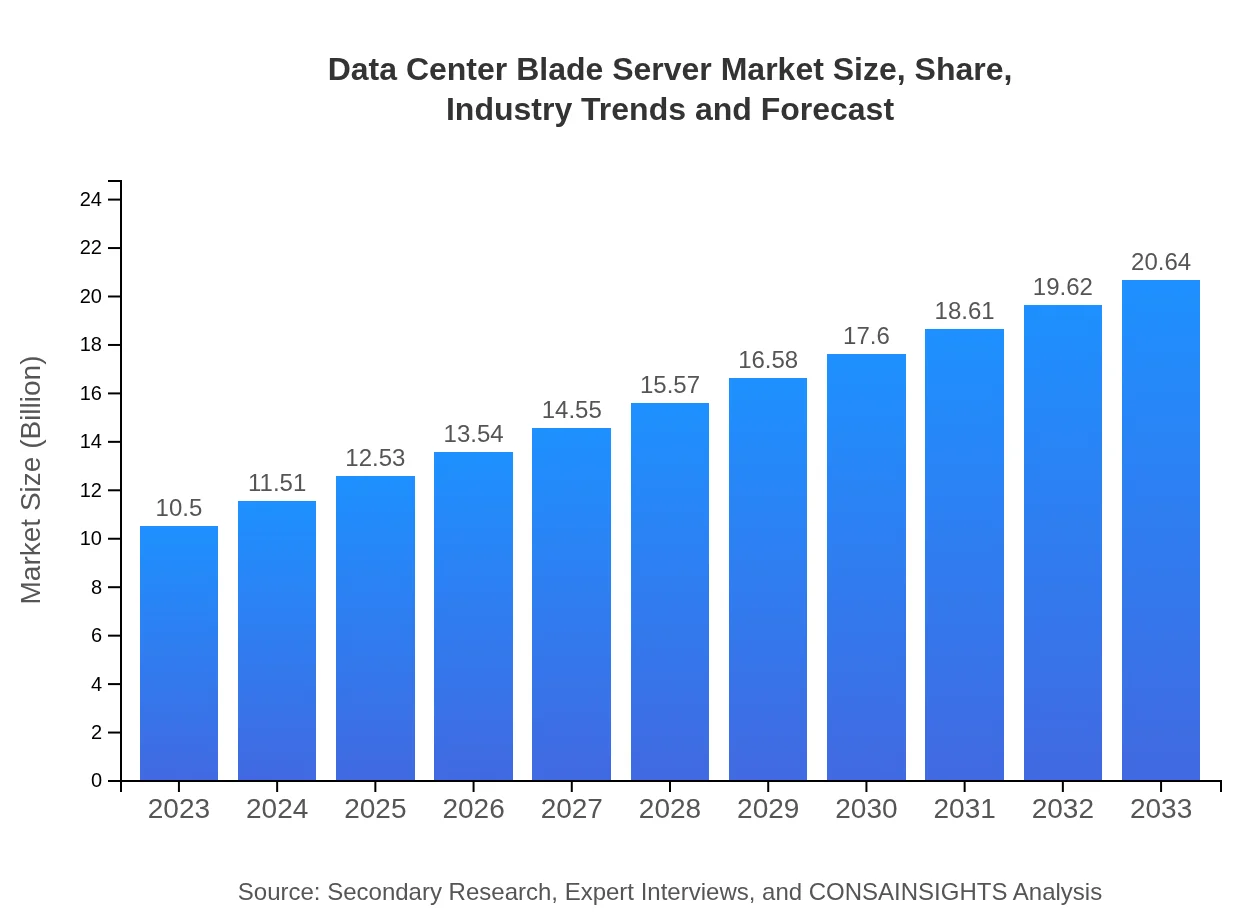

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | IBM, Hewlett Packard Enterprise (HPE), Dell Technologies, Cisco, Lenovo |

| Last Modified Date | 31 January 2026 |

Data Center Blade Server Market Overview

Customize Data Center Blade Server Market Report market research report

- ✔ Get in-depth analysis of Data Center Blade Server market size, growth, and forecasts.

- ✔ Understand Data Center Blade Server's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Data Center Blade Server

What is the Market Size & CAGR of Data Center Blade Server market in 2023?

Data Center Blade Server Industry Analysis

Data Center Blade Server Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Data Center Blade Server Market Analysis Report by Region

Europe Data Center Blade Server Market Report:

The European market is also set to grow, with expectations of reaching 6.35 billion USD by 2033 from 3.23 billion USD in 2023. Factors such as increased compliance regulations and sustainability concerns are driving investments in data center technologies.Asia Pacific Data Center Blade Server Market Report:

The Asia Pacific region is projected to grow significantly, reaching a market value of 4.05 billion USD by 2033, up from 2.06 billion USD in 2023. The rise of data centers and investments in digital infrastructure from countries like China and India are propelling this growth.North America Data Center Blade Server Market Report:

North America dominated the market with a size of 3.41 billion USD in 2023, projected to increase to 6.69 billion USD by 2033. The presence of major technology companies and a strong focus on advanced data processing solutions contribute to this growth.South America Data Center Blade Server Market Report:

In South America, the market is expected to witness steady growth, increasing from 0.62 billion USD in 2023 to 1.21 billion USD by 2033. Growing adoption of cloud services and internet access expansion are the main drivers in this region.Middle East & Africa Data Center Blade Server Market Report:

In the Middle East and Africa, the market will grow from 1.19 billion USD in 2023 to approximately 2.34 billion USD in 2033. Growing investments in digital transformation projects and increased reliance on data analytics will facilitate this expansion.Tell us your focus area and get a customized research report.

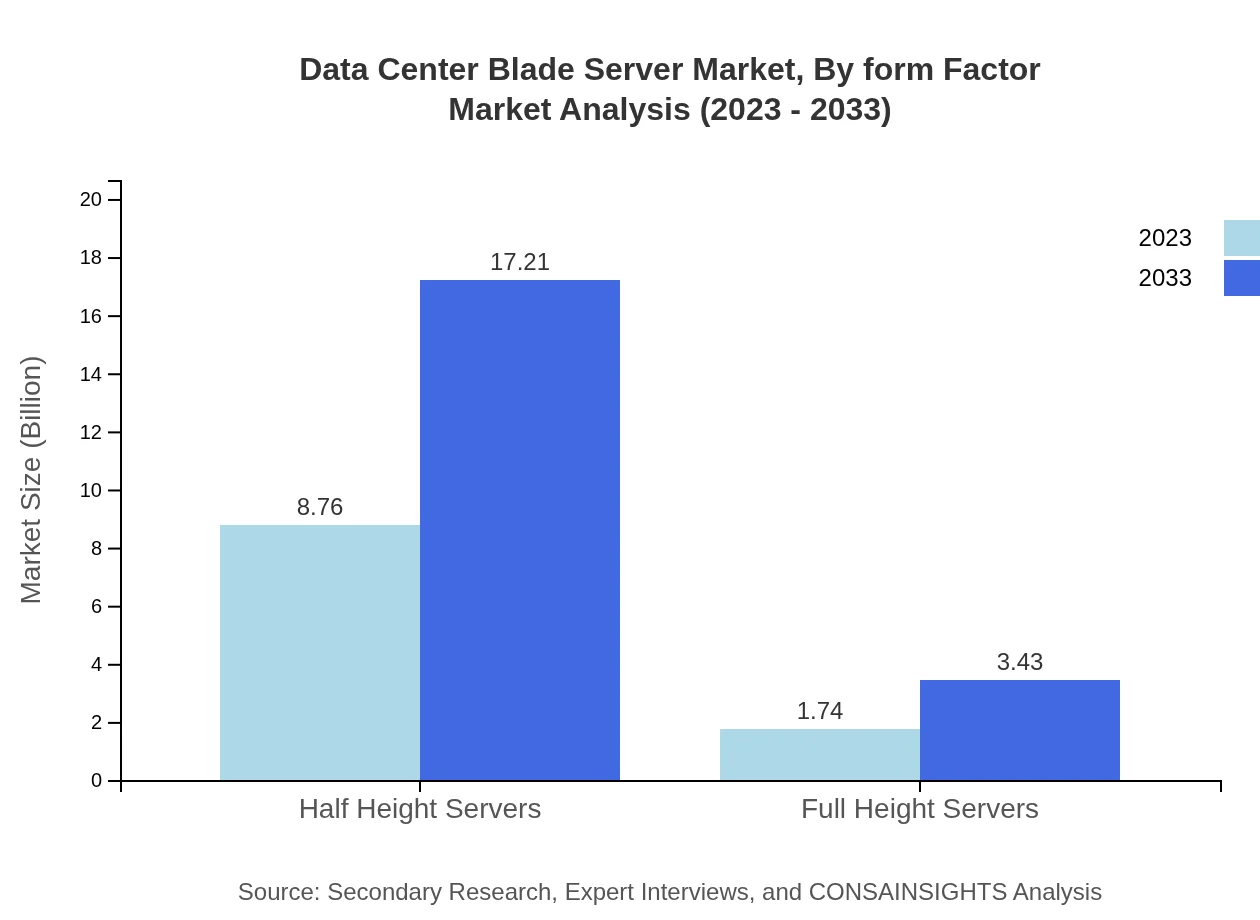

Data Center Blade Server Market Analysis By Form Factor

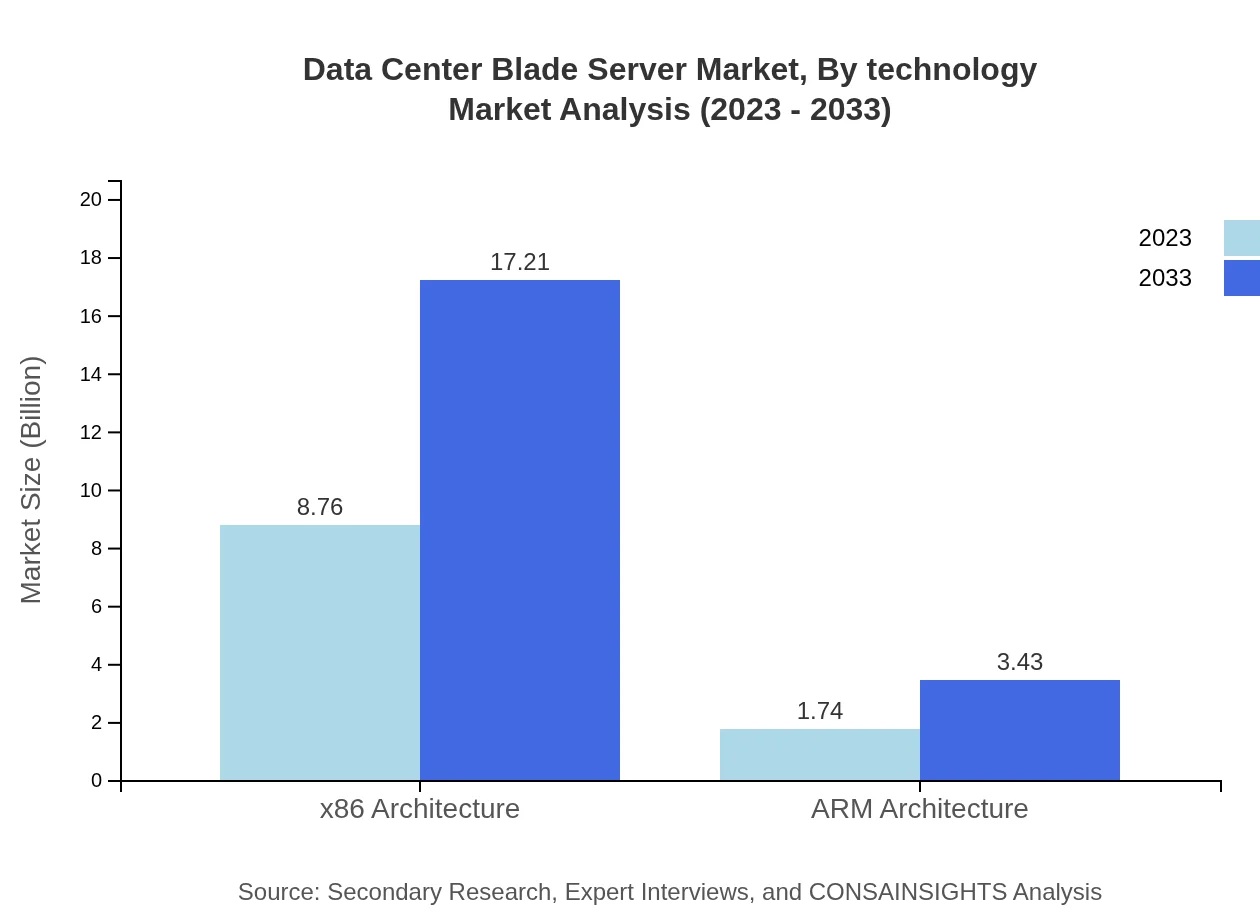

The Data Center Blade Server market by form factor is predominantly influenced by x86 architecture, accounting for 83.4% of the market in 2023. Blade servers in the x86 category are preferred due to their compatibility with existing applications and infrastructure. ARM architecture is also gaining traction, projected to grow from 1.74 billion USD in 2023 to 3.43 billion USD by 2033.

Data Center Blade Server Market Analysis By Technology

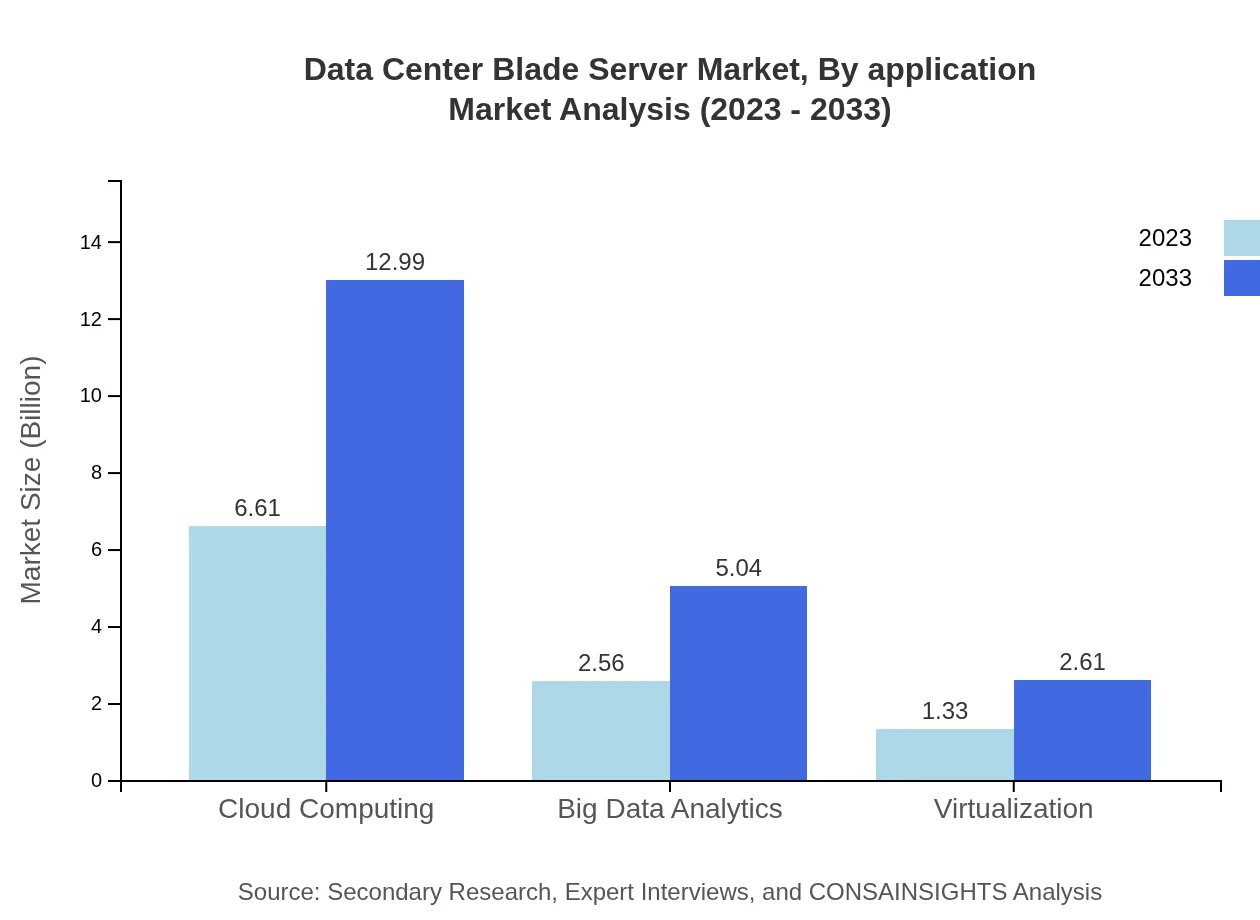

Significant trends in technology include the integration of advanced virtualization tools and cloud computing services. The Cloud Computing segment holds a market share of 62.94% in 2023, reflecting a strong shift towards hybrid data center models that cater to on-demand computing requirements. The adoption of big data analytics and storage management solutions further supports market growth.

Data Center Blade Server Market Analysis By Application

Demand for blade servers in applications such as big data analytics, cloud computing, and virtualization is on the rise. The big data analytics segment is expected to double from 2.56 billion USD in 2023 to 5.04 billion USD by 2033, signifying a pivotal push for more data-centric operations across industries.

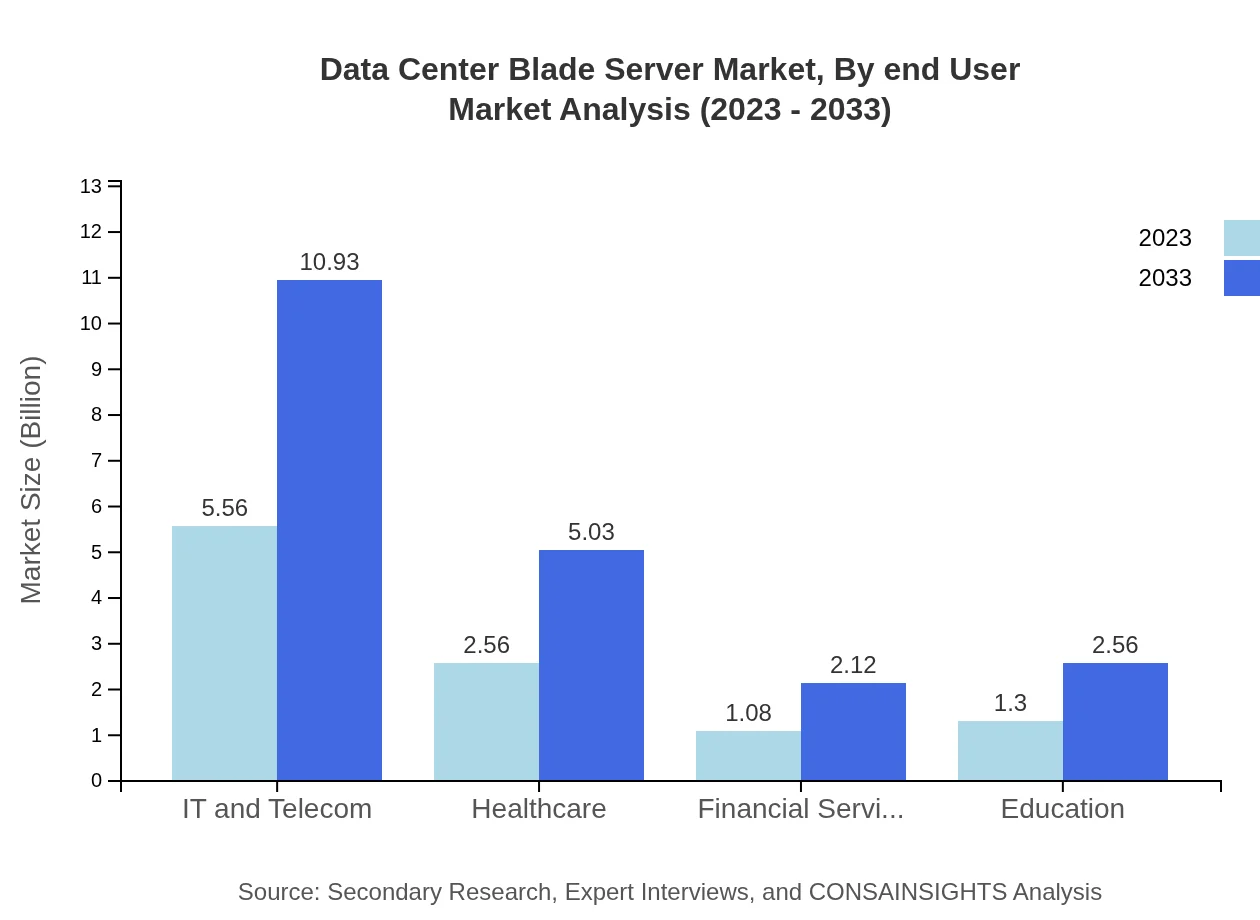

Data Center Blade Server Market Analysis By End User

The IT and telecom sector remains the largest end-user of Data Center Blade Servers, representing 52.96% of the market share in 2023. Sectors like healthcare and financial services are increasingly recognizing the need for efficient computing solutions to manage vast datasets and ensure compliance.

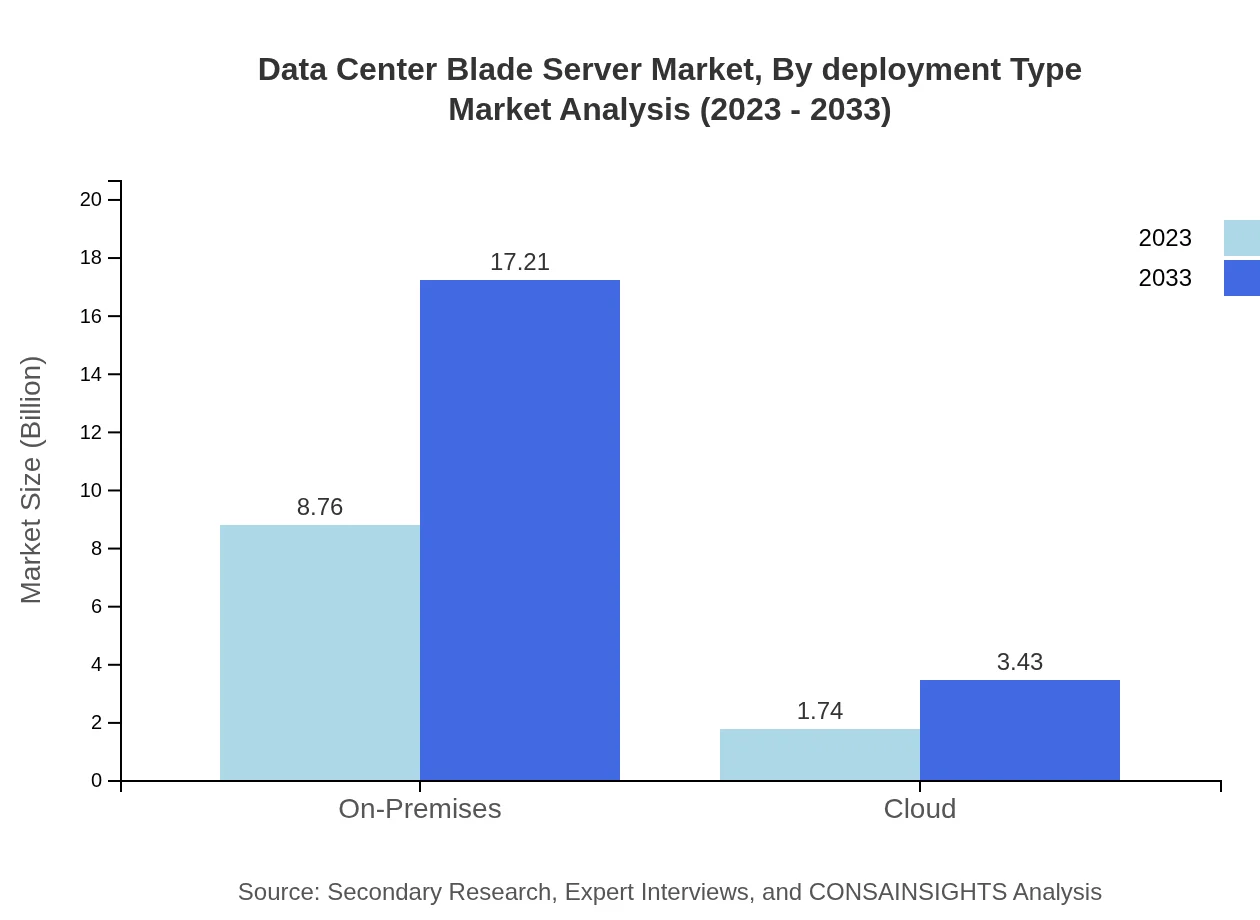

Data Center Blade Server Market Analysis By Deployment Type

Deployment types in the Data Center Blade Server market include on-premises and cloud solutions. On-premises deployments still dominate with an 83.4% share, reflecting certainty in security and control needs of enterprises. Conversely, cloud deployments are forecasted to grow as hybrid models become more commonplace.

Data Center Blade Server Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Data Center Blade Server Industry

IBM:

IBM is a leading manufacturer of blade servers, offering solutions that emphasize security, efficiency, and scalability suitable for enterprise environments.Hewlett Packard Enterprise (HPE):

HPE offers a robust range of blade servers offering integrated systems for enterprises, focusing on improving performance and reducing power consumption through advanced technology.Dell Technologies:

Dell provides versatile blade server solutions with a focus on flexibility and support for various workloads to cater to the evolving needs of businesses.Cisco:

Cisco develops blade servers that are optimized for networking and data-intensive applications, enhancing connectivity and performance for data centers.Lenovo :

Lenovo's blade server offerings prioritize energy efficiency and operational excellence, making them suitable for modern data center architectures.We're grateful to work with incredible clients.

FAQs

What is the market size of Data Center Blade Server?

The Data Center Blade Server market is projected to reach approximately $10.5 billion by 2033, growing at a CAGR of 6.8%. This indicates robust demand and expansion opportunities in the server market over the next decade.

What are the key market players or companies in the Data Center Blade Server industry?

Key players in the Data Center Blade Server market include major technology firms that focus on server innovations, especially in enhancing efficiency, scalability, and cloud applications. These companies are constantly engaging in R&D to meet industry demands.

What are the primary factors driving the growth in the Data Center Blade Server industry?

Growth in the Data Center Blade Server industry is primarily driven by the increasing demand for cloud computing services, the rise of big data analytics, and the need for virtualization in enterprise IT. These elements positively influence market expansion.

Which region is the fastest Growing in the Data Center Blade Server?

The fastest-growing region in the Data Center Blade Server market is projected to be Europe, with an increase from $3.23 billion in 2023 to $6.35 billion by 2033, highlighting significant growth prospects within this geographical area.

Does ConsaInsights provide customized market report data for the Data Center Blade Server industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the Data Center Blade Server industry. This includes detailed market analyses reflecting unique business requirements and strategic objectives.

What deliverables can I expect from this Data Center Blade Server market research project?

Deliverables from the Data Center Blade Server market research project typically include comprehensive reports, analytical data visualizations, competitive landscape assessments, and strategic recommendations designed for decision-making and investment planning.

What are the market trends of Data Center Blade Server?

Current market trends in the Data Center Blade Server industry indicate a shift toward energy-efficient designs, increased adoption of cloud services, and growing integration of AI for data management, all aimed at optimizing operational efficiency.