Data Center Cooling Market Report

Published Date: 31 January 2026 | Report Code: data-center-cooling

Data Center Cooling Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Data Center Cooling market from 2023 to 2033. It includes insights on market size, growth rates, segmentation, regional trends, and forecasts, equipping stakeholders with critical data to make informed decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

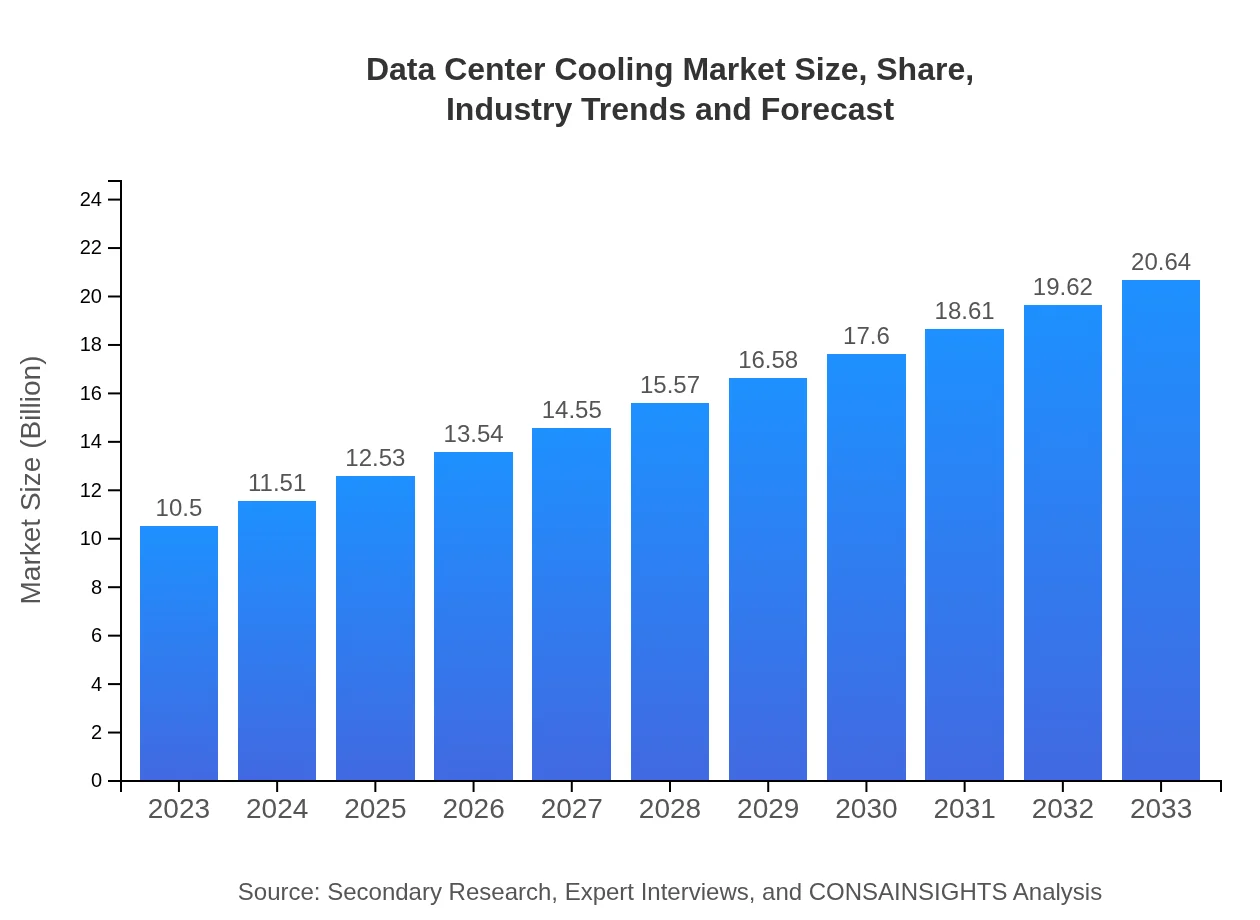

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | Schneider Electric, Vertiv, Stulz, Mitsubishi Electric, Airedale International Air Conditioning |

| Last Modified Date | 31 January 2026 |

Data Center Cooling Market Overview

Customize Data Center Cooling Market Report market research report

- ✔ Get in-depth analysis of Data Center Cooling market size, growth, and forecasts.

- ✔ Understand Data Center Cooling's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Data Center Cooling

What is the Market Size & CAGR of the Data Center Cooling market in 2023?

Data Center Cooling Industry Analysis

Data Center Cooling Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Data Center Cooling Market Analysis Report by Region

Europe Data Center Cooling Market Report:

Europe’s market is expected to grow from $3.29 billion in 2023 to $6.47 billion by 2033, with a strong emphasis on sustainability and regulations aimed at improving energy efficiency in data centers.Asia Pacific Data Center Cooling Market Report:

The Asia Pacific region is expected to experience significant market growth, with a projected market size of $1.89 billion in 2023 and $3.72 billion by 2033, driven by increasing digitalization and cloud adoption.North America Data Center Cooling Market Report:

North America remains the largest market for Data Center Cooling, with a projected size of $3.88 billion in 2023, growing to $7.63 billion by 2033, primarily due to technological innovations and high data consumption rates.South America Data Center Cooling Market Report:

South America is anticipated to witness steady growth, reaching $0.49 billion in 2023 and $0.97 billion by 2033, fueled by the expansion of the telecom sector and rising internet penetration.Middle East & Africa Data Center Cooling Market Report:

The Middle East and Africa are set to develop their data center cooling market from $0.94 billion in 2023 to $1.85 billion by 2033, spurred by oil revenues funneled into digital infrastructure and data center development.Tell us your focus area and get a customized research report.

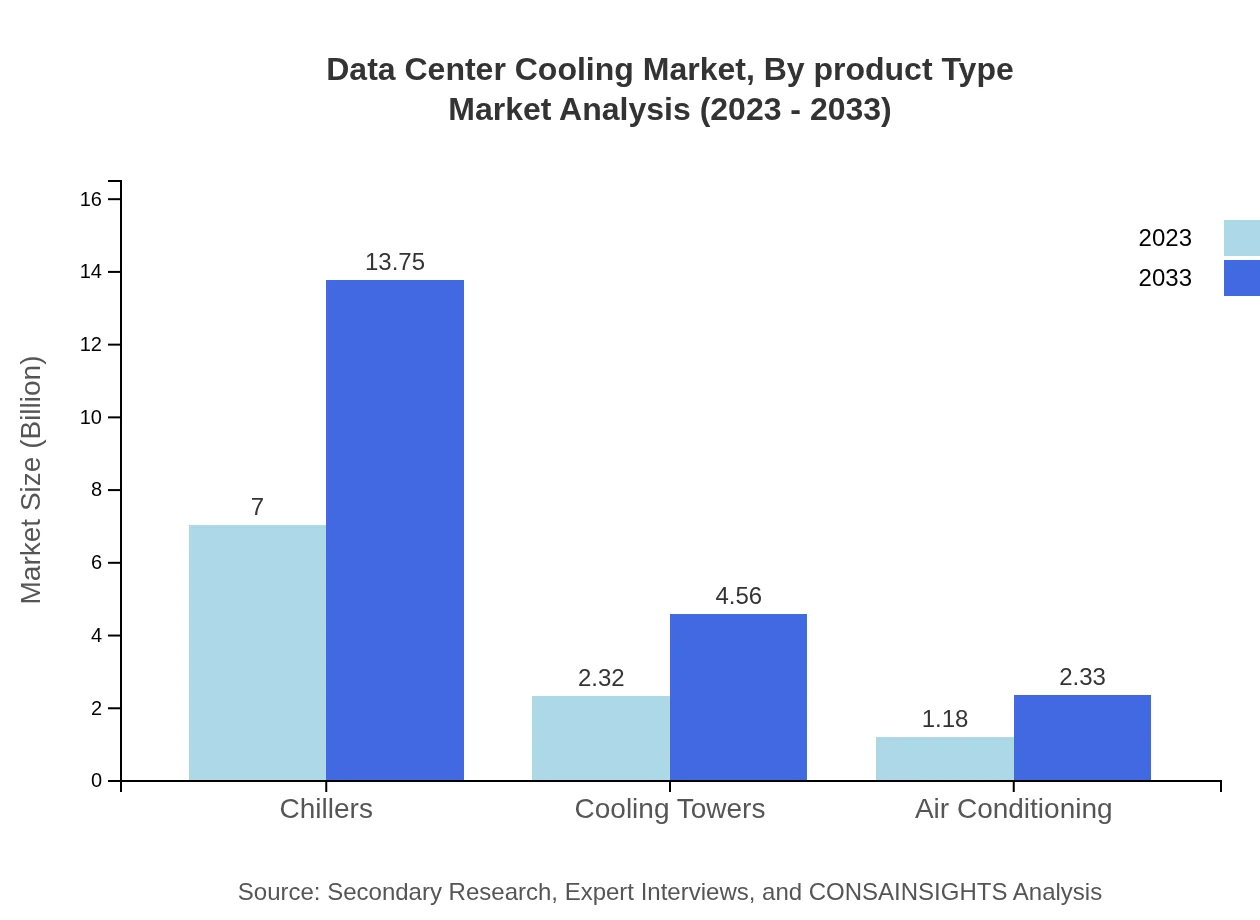

Data Center Cooling Market Analysis By Product Type

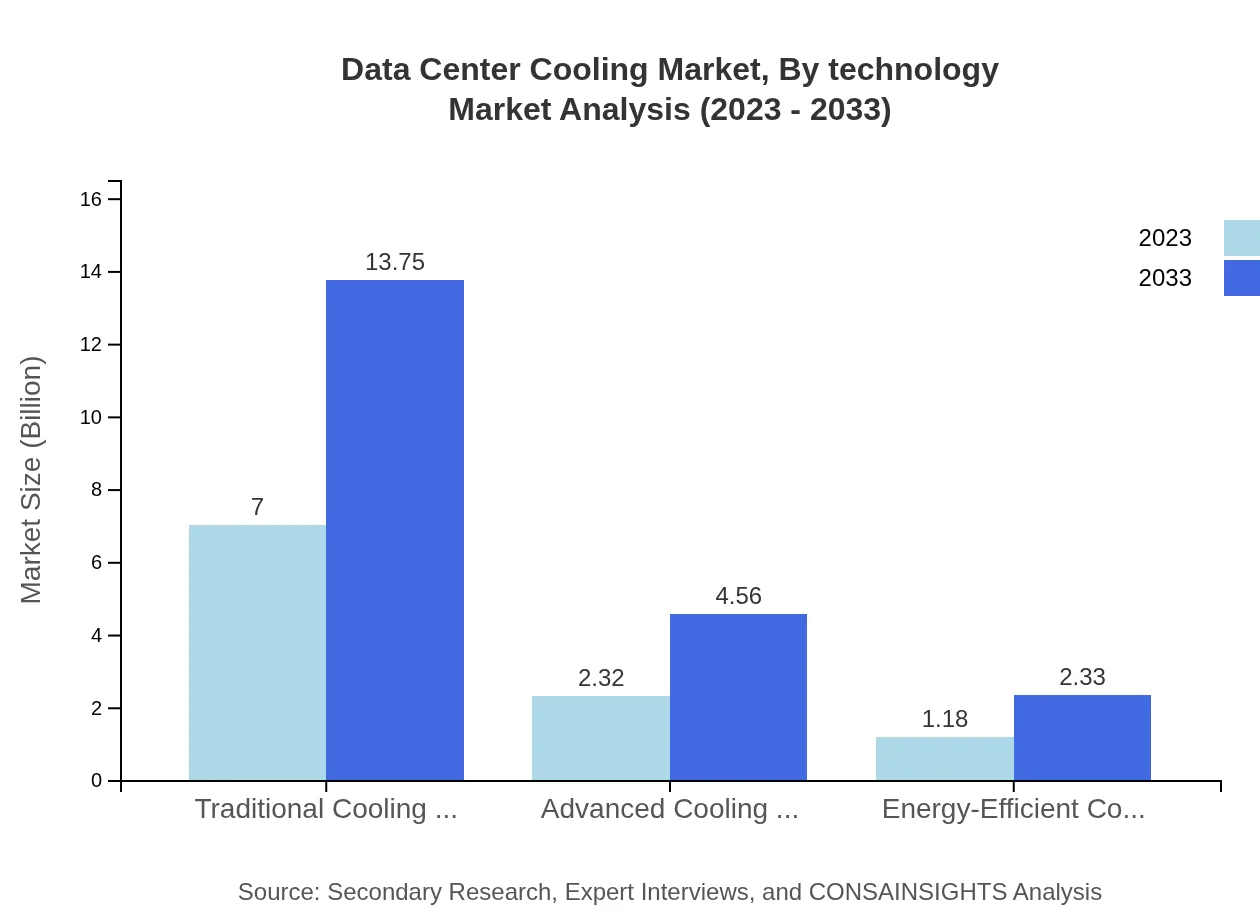

In 2023, traditional cooling systems dominate the market with a size of $7.00 billion (66.65% share), while advanced cooling solutions and energy-efficient technologies contribute $2.32 billion (22.08% share) and $1.18 billion (11.27% share) respectively. By 2033, these figures are expected to rise significantly. With advancements in thermal performance, alternative cooling methods will rapidly gain popularity, driven by sustainability initiatives.

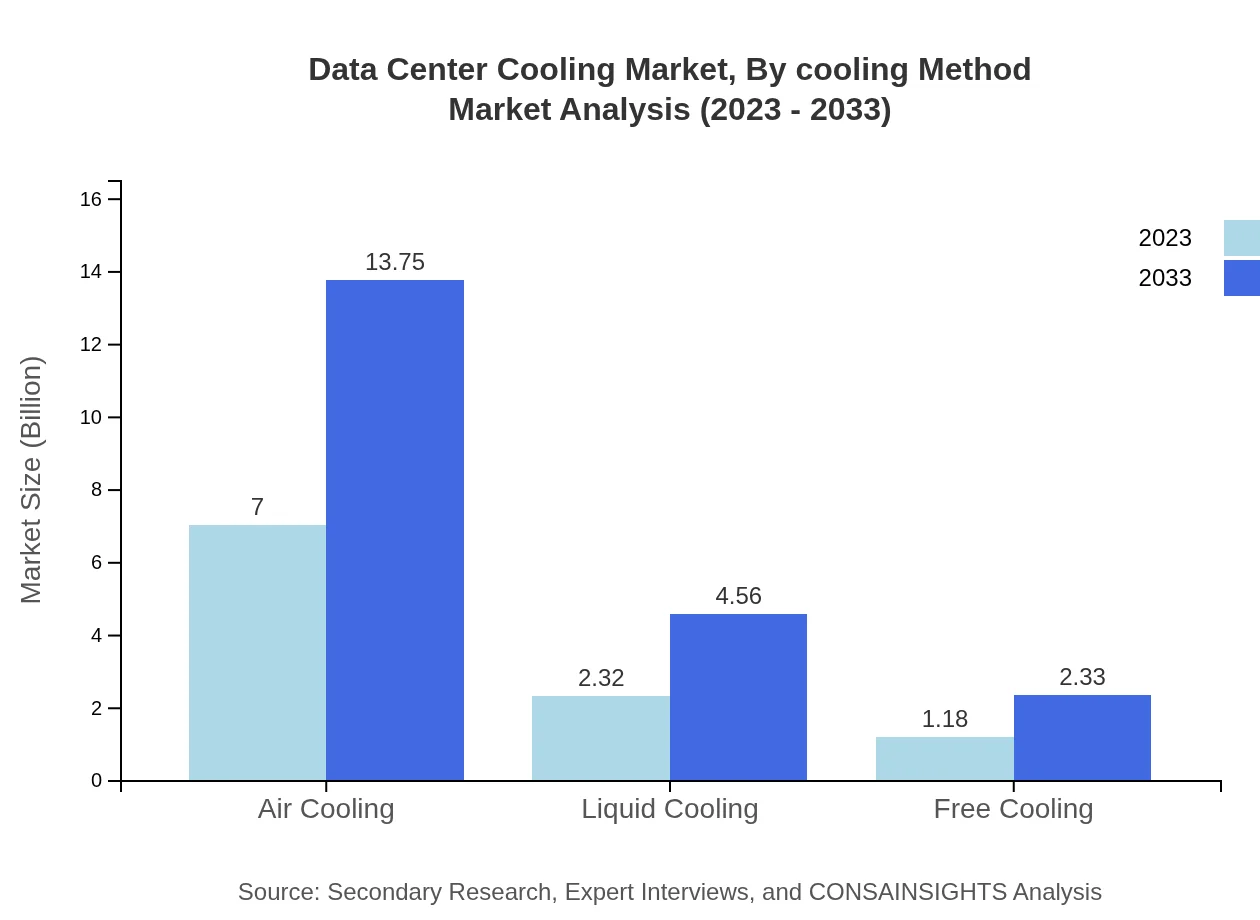

Data Center Cooling Market Analysis By Cooling Method

Chillers are projected to hold a predominant market size of $7.00 billion in 2023, remaining significant due to reliability and efficiency. In contrast, cooling towers, air conditioning systems, liquid cooling, and free cooling each contribute to the growing shift towards integrated cooling solutions tailored to data center designs.

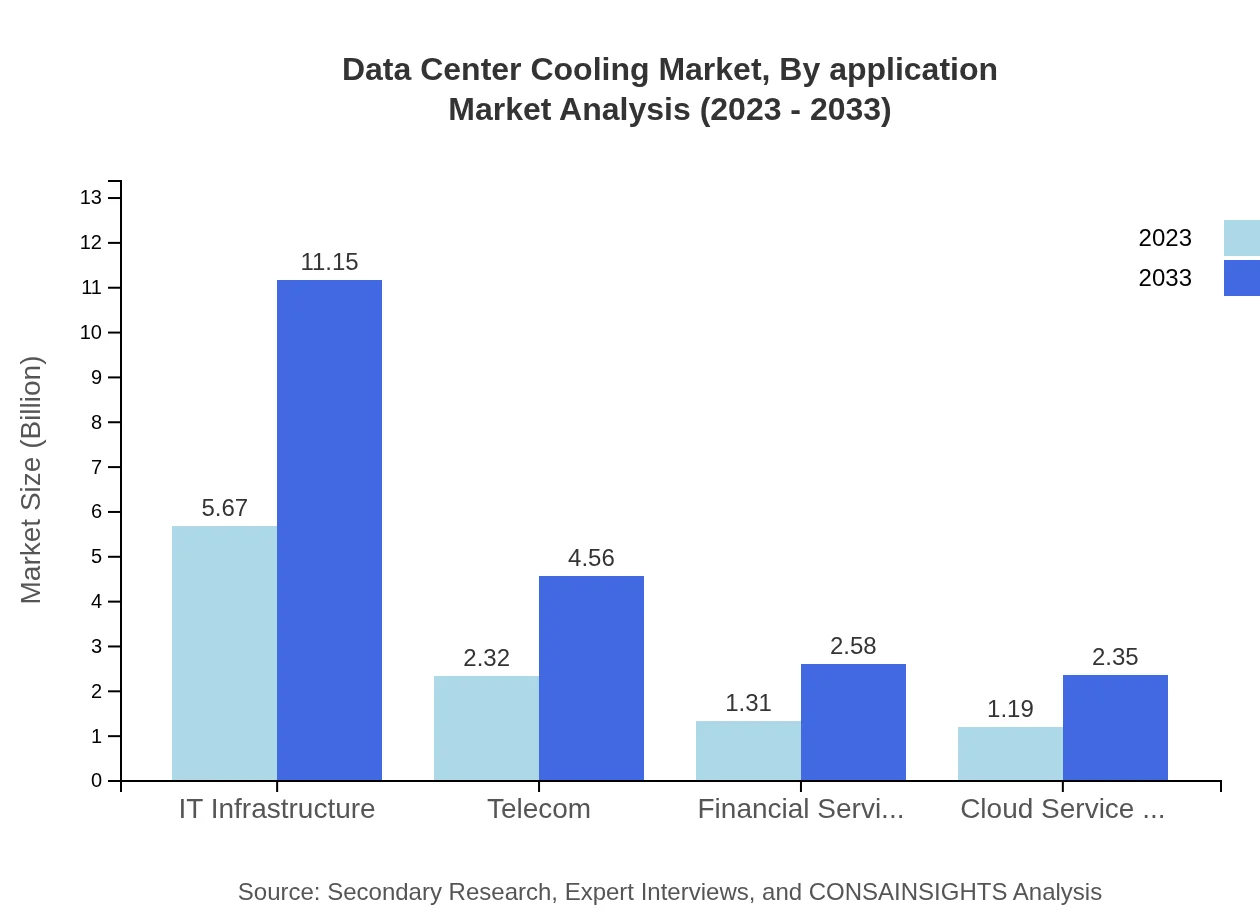

Data Center Cooling Market Analysis By Application

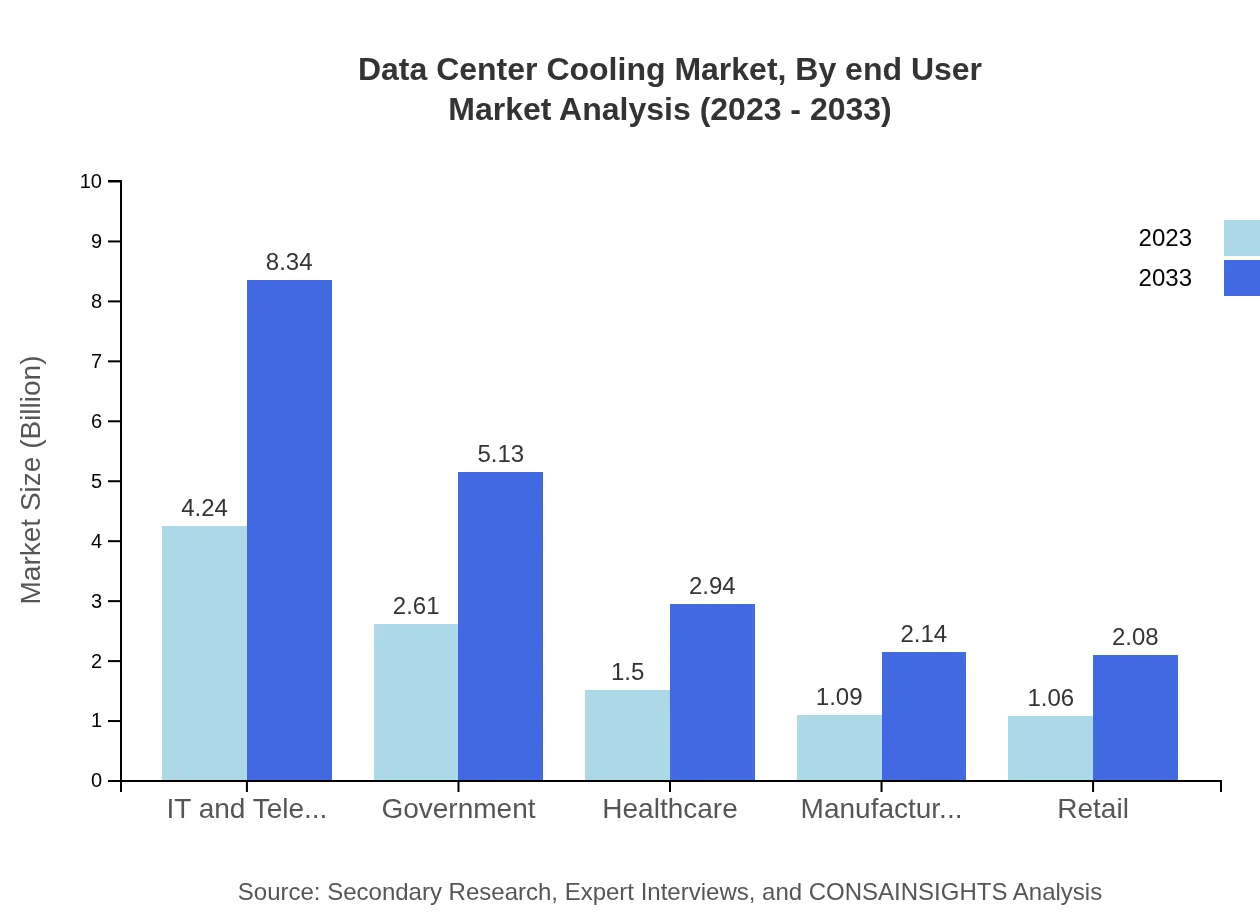

The IT and telecom segments represent the largest share of the market, expected to reach $4.24 billion in 2023. Government and healthcare applications follow, with sizes of $2.61 billion and $1.50 billion respectively, highlighting the diversity of data center applications across different sectors and their unique cooling needs.

Data Center Cooling Market Analysis By End User

With rising data traffic, the IT and telecom sectors are key drivers, holding around 40.4% of the market share by 2033. Other significant contributors include financial services, manufacturing, and retail, underscoring the critical importance of effective cooling solutions in maintaining service quality and operational efficiency.

Data Center Cooling Market Analysis By Technology

Technological advancements such as AI and IoT-driven monitoring systems are enhancing efficiency and operational performance in data center cooling. Energy-efficient cooling technologies are projected to grow substantially as organizations prioritize sustainability and cost reduction.

Data Center Cooling Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in the Data Center Cooling Industry

Schneider Electric:

A global expert in energy management and automation, Schneider Electric offers dc cooling solutions that promote energy efficiency and sustainability across all sectors.Vertiv:

Vertiv provides critical digital infrastructure solutions, including cooling systems, to empower reliable operations for data centers around the globe.Stulz:

Stulz is known for precision cooling solutions and innovative cooling technology, ensuring temperature control across various applications in data centers.Mitsubishi Electric:

A leader in HVAC systems, Mitsubishi Electric focuses on providing advanced cooling solutions tailored for high-performance data centers.Airedale International Air Conditioning:

A highly specialized provider of cooling and ventilation solutions for critical environments, including data centers.We're grateful to work with incredible clients.

FAQs

What is the market size of data Center Cooling?

The data center cooling market is valued at approximately $10.5 billion in 2023, with a projected growth at a CAGR of 6.8%. This growth indicates increasing demands for efficient cooling solutions as data centers expand.

What are the key market players or companies in the data Center Cooling industry?

Key players in the data center cooling industry include significant companies such as Schneider Electric, Vertiv Holdings, and Mitsubishi Electric, which are recognized for their innovative cooling solutions and extensive market influence.

What are the primary factors driving the growth in the data Center Cooling industry?

Growth in the data center cooling industry is primarily driven by the increasing need for efficiency, rising data center construction, and growing IT infrastructure demands amidst the burgeoning data traffic and cloud computing needs.

Which region is the fastest Growing in the data Center Cooling market?

The Asia-Pacific region is the fastest-growing market for data center cooling, with an anticipated increase from $1.89 billion in 2023 to $3.72 billion by 2033, reflecting its expanding IT and telecom sectors and investment in data centers.

Does ConsaInsights provide customized market report data for the data Center Cooling industry?

Yes, ConsaInsights offers customized market report data for the data center cooling industry, enabling stakeholders to access tailored insights that match their specific market interests and business needs.

What deliverables can I expect from this data Center Cooling market research project?

Deliverables from the data center cooling market research project typically include comprehensive market analyses, segment breakdowns, growth forecasts, and insights into competitive landscapes, tailored to your specific requirements.

What are the market trends of data Center Cooling?

Current trends in the data center cooling market include a shift towards more energy-efficient technologies, increased adoption of advanced cooling solutions, and the growing emphasis on sustainability and climate-conscious operations.