Data Center Generator Market Report

Published Date: 31 January 2026 | Report Code: data-center-generator

Data Center Generator Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Data Center Generator market from 2023 to 2033. It includes insights into market size, segmentation, regional analysis, trends, and forecasts to guide investors and stakeholders.

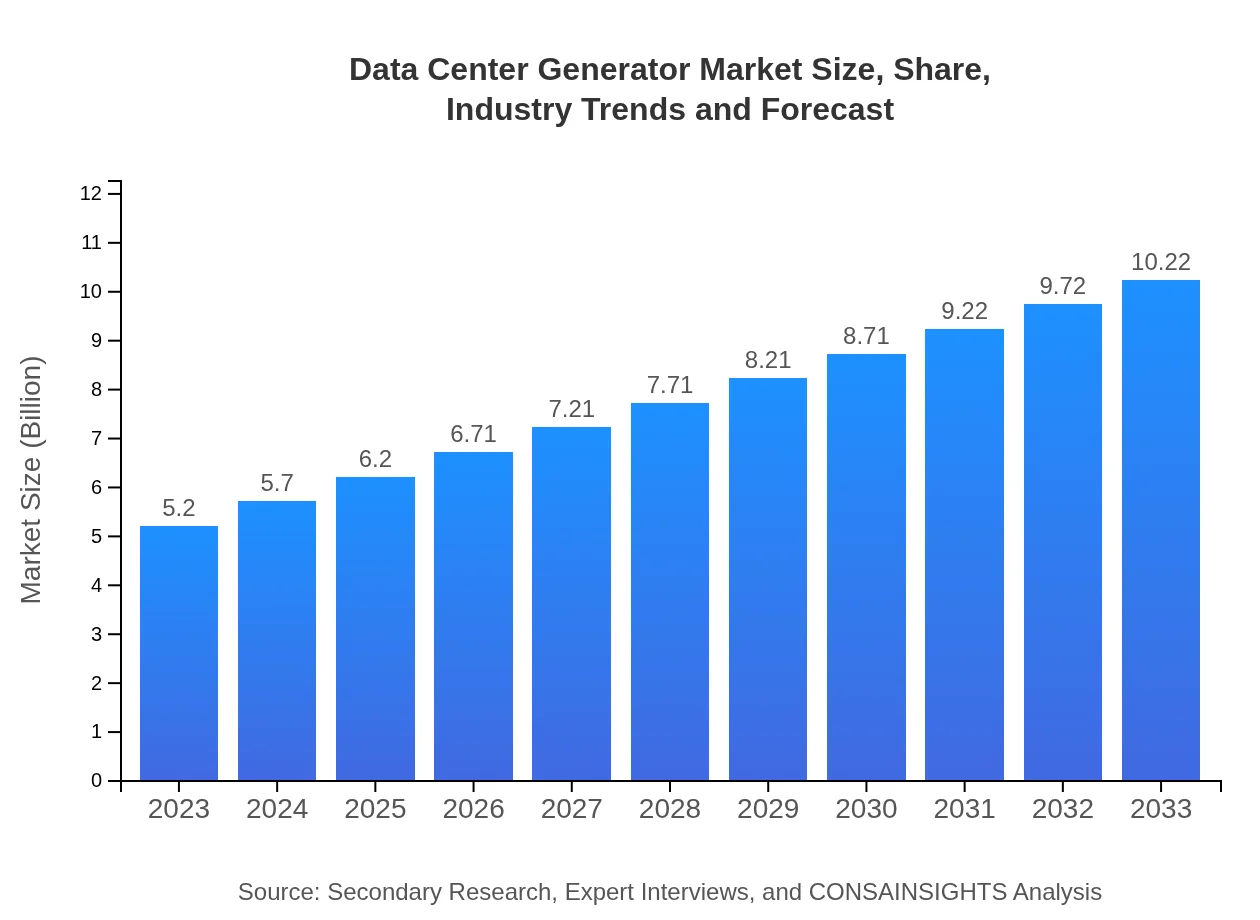

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.22 Billion |

| Top Companies | Caterpillar Inc., Cummins Inc., Generac Holdings Inc., Siemens AG, GE Power |

| Last Modified Date | 31 January 2026 |

Data Center Generator Market Overview

Customize Data Center Generator Market Report market research report

- ✔ Get in-depth analysis of Data Center Generator market size, growth, and forecasts.

- ✔ Understand Data Center Generator's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Data Center Generator

What is the Market Size & CAGR of Data Center Generator market in 2023?

Data Center Generator Industry Analysis

Data Center Generator Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Data Center Generator Market Analysis Report by Region

Europe Data Center Generator Market Report:

The European Data Center Generator market is expected to grow from $1.26 billion in 2023 to $2.47 billion by 2033. Key trends driving this growth include stringent regulations on data center energy use and increasing investments towards reducing carbon footprints, leading to greater adoption of hybrid and renewable energy generators.Asia Pacific Data Center Generator Market Report:

In 2023, the Asia Pacific Data Center Generator market is valued at approximately $1.01 billion and is expected to grow to $1.98 billion by 2033. The rapid growth of the IT and telecommunications sector in countries like China and India, along with increasing investment in smart city projects and cloud infrastructure, drives demand for reliable power solutions. The region's focus on technological advancements and energy efficiency further boosts market potential.North America Data Center Generator Market Report:

North America leads the market with a size of $1.73 billion in 2023, projected to grow to $3.40 billion by 2033. The region's high density of data centers and advancements in cloud computing solutions contribute significantly to market demand. Furthermore, the push towards sustainability has accelerated the adoption of renewable energy generators and hybrid solutions.South America Data Center Generator Market Report:

The South American market is projected to experience steady growth with a market size of $0.49 billion in 2023, reaching approximately $0.96 billion by 2033. Key growth factors include increased digitization and investment in data processing capabilities in Brazil and Argentina, alongside the development of energy infrastructure to support emerging technologies.Middle East & Africa Data Center Generator Market Report:

The Middle East and Africa Data Center Generator market is anticipated to grow from $0.72 billion in 2023 to $1.41 billion by 2033. The region's expanding investments in technology infrastructure and increasing deployment of data centers driven by burgeoning internet consumption are significant contributors to this growth.Tell us your focus area and get a customized research report.

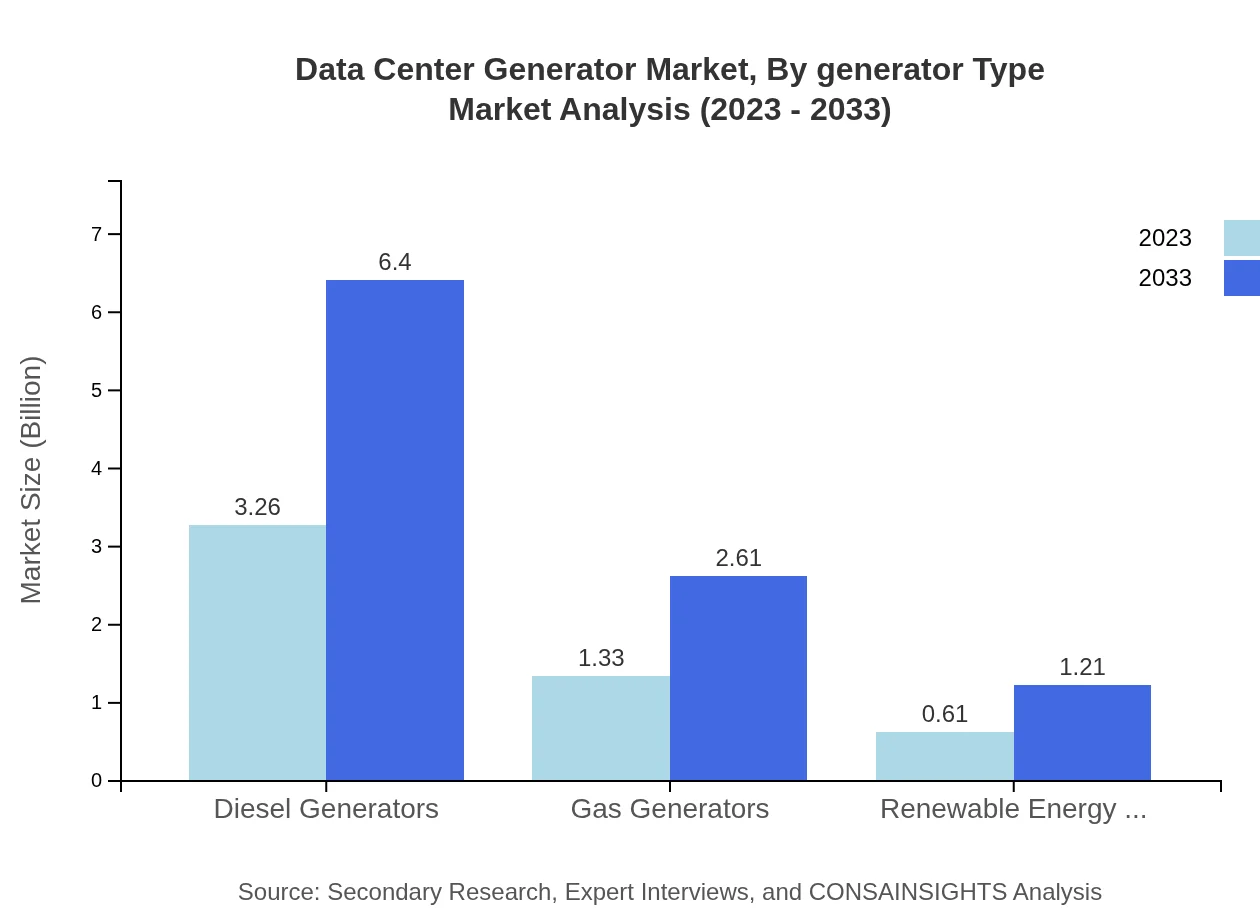

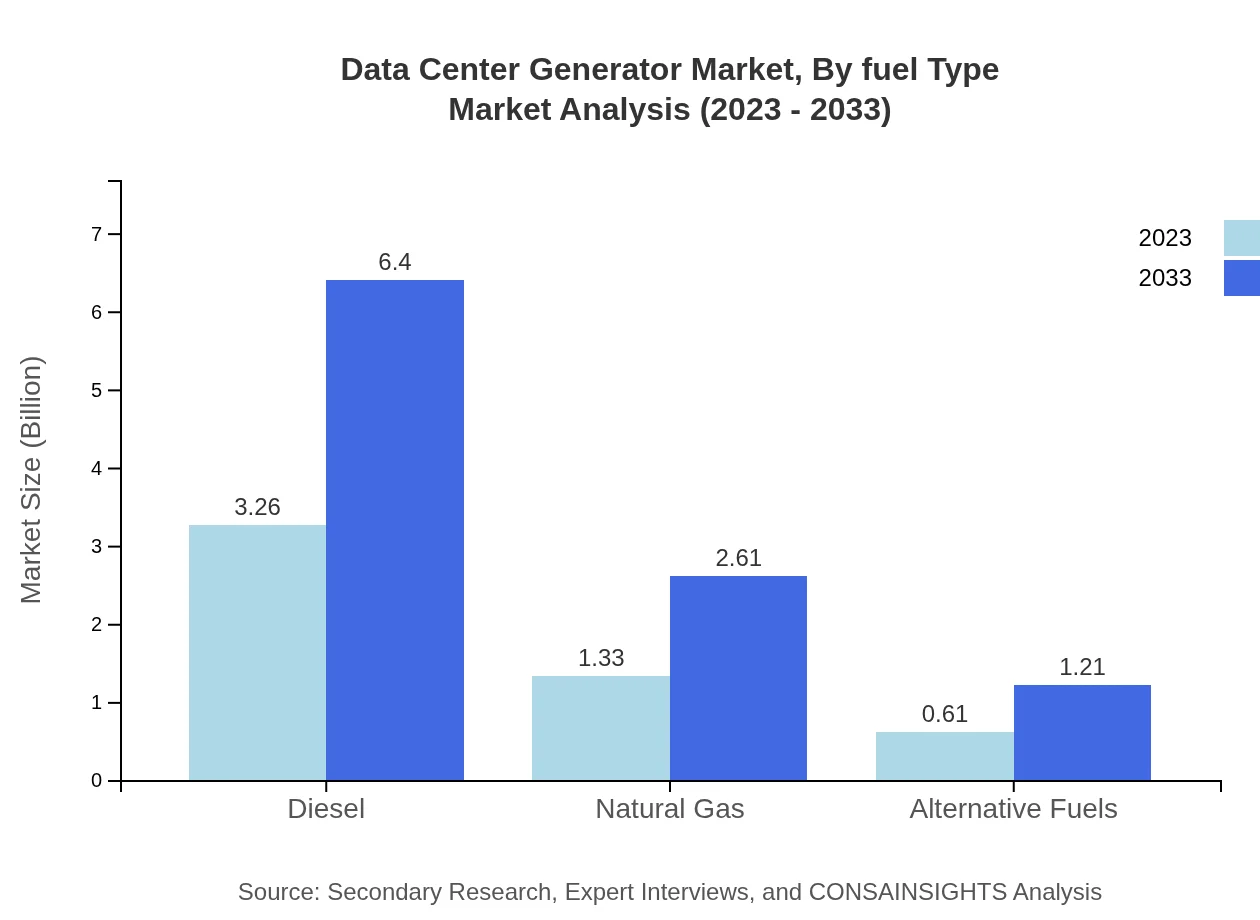

Data Center Generator Market Analysis By Generator Type

The market for Data Center Generators is segmented into Diesel Generators, Gas Generators, and Renewable Energy Generators. Diesel Generators dominate the market, expected to account for 62.64% share in 2023 with a size of $3.26 billion, growing to $6.40 billion by 2033. Gas Generators hold a market share of 25.56% in 2023, growing from $1.33 billion to $2.61 billion by 2033. Renewable Energy Generators, while having a smaller share at 11.8%, are projected to grow from $0.61 billion to $1.21 billion during the same period, reflecting the shift towards sustainable solutions.

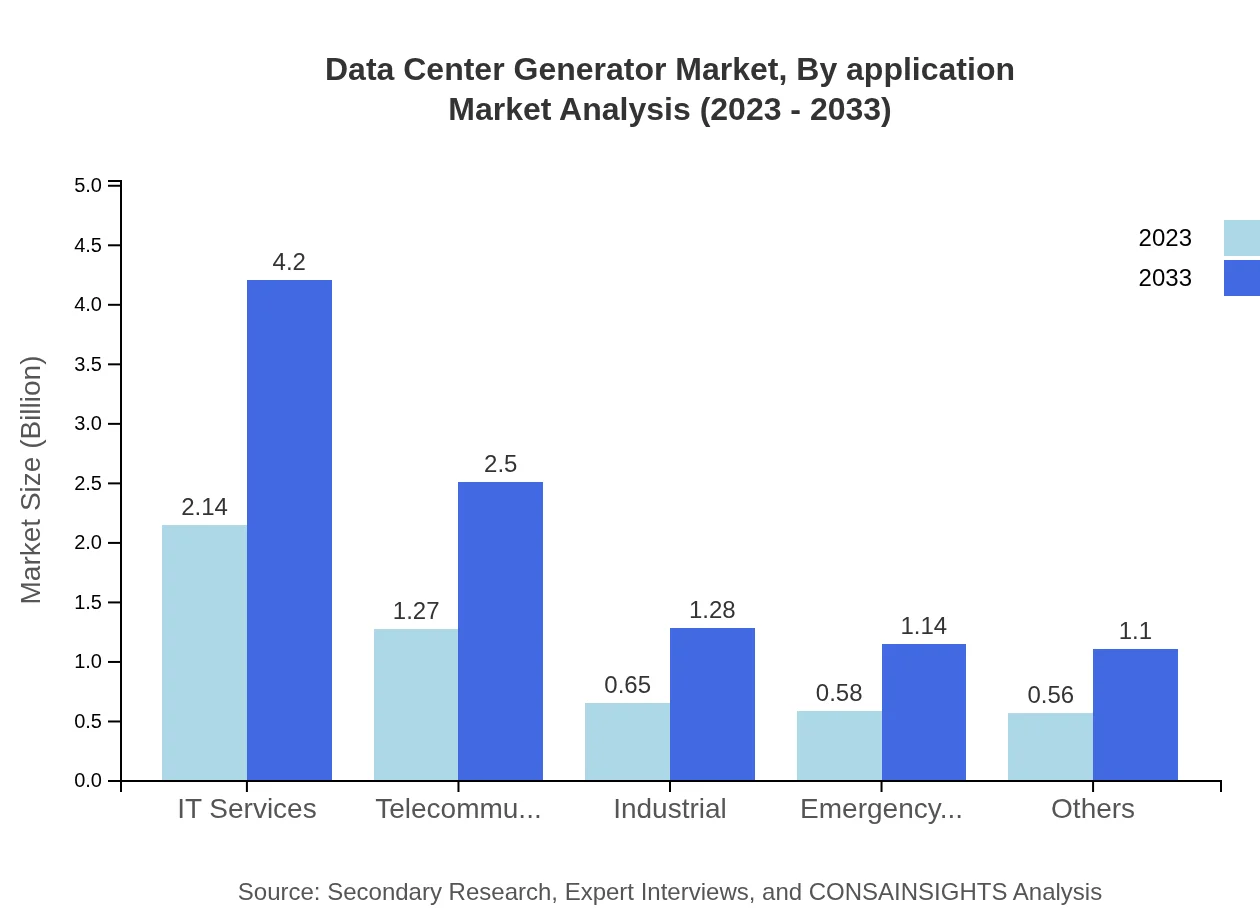

Data Center Generator Market Analysis By Application

The application segments of the Data Center Generator market include IT Services, Telecommunications, Emergency Backup, and more. IT Services are expected to represent 41.09% of the market share in 2023, growing from $2.14 billion to $4.20 billion by 2033. Telecommunications will hold a 24.44% share, growing from $1.27 billion to $2.50 billion. Emergency Backup applications represent a crucial segment with growth from $0.58 billion to $1.14 billion, indicating the critical reliance on uninterrupted power supply.

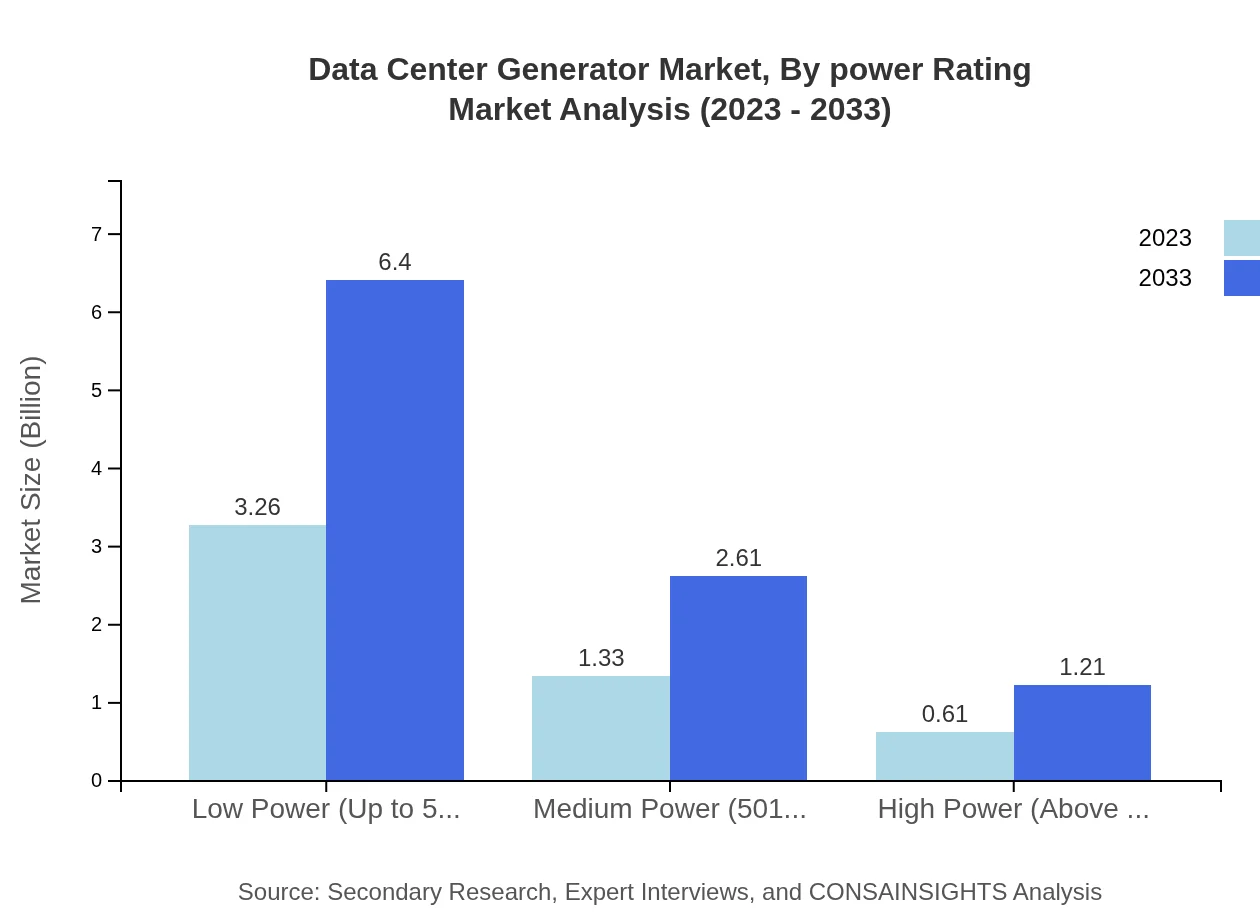

Data Center Generator Market Analysis By Power Rating

Market segmentation by power rating showcases Low Power (up to 500 kVA), Medium Power (501 to 1500 kVA), and High Power (above 1500 kVA). Low Power generators currently hold the largest market share at 62.64%, expected to grow from $3.26 billion to $6.40 billion by 2033. Medium Power ratings represent a 25.56% share, expected to rise from $1.33 billion to $2.61 billion. High Power generators, although smaller in size, are projected to expand, indicating a growing need for large-scale power solutions in extensive data center operations.

Data Center Generator Market Analysis By Fuel Type

By fuel type, Diesel continues to lead with a significant market size of $3.26 billion in 2023, anticipated to reach $6.40 billion by 2033. Natural gas follows, holding a market size of $1.33 billion in 2023, projected to grow to $2.61 billion. Alternative fuels are gaining traction, albeit smaller, with a size expected to increase from $0.61 billion to $1.21 billion, reflecting a growing awareness for sustainable energy solutions in the data center sector.

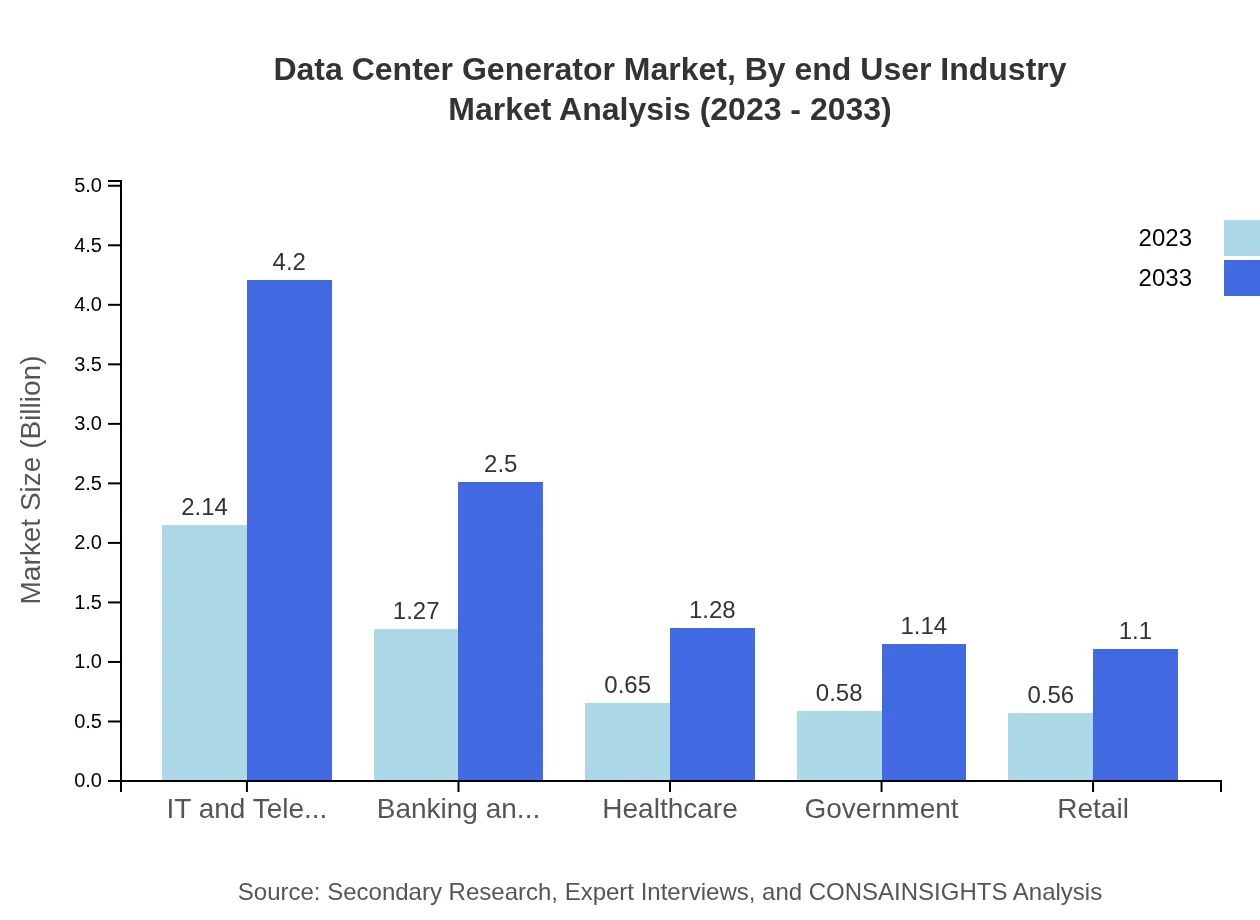

Data Center Generator Market Analysis By End User Industry

Segments by end-user industry include IT and Telecom, Banking and Finance, Healthcare, and Government. IT and Telecom lead the market significantly with $2.14 billion in 2023, expected to grow to $4.20 billion. Banking and Finance follow closely at $1.27 billion, expected to rise to $2.50 billion. Healthcare and Government sectors are also crucial segments, with growth driven by the critical need for uninterrupted power to support operations and enhance service delivery.

Data Center Generator Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Data Center Generator Industry

Caterpillar Inc.:

A leading manufacturer of diesel and gas engines, Caterpillar Inc. offers a wide range of backup and primary power solutions, including reliable generators for data centers.Cummins Inc.:

Cummins specializes in power generation equipment, providing innovative solutions tailored for data centers, focusing on performance efficiency and sustainability.Generac Holdings Inc.:

Generac remains a strong player in the generator market, known for its modular backup power systems suitable for various data center environments.Siemens AG:

Siemens provides comprehensive energy solutions, including advanced generator technologies aimed at reducing carbon footprints and improving operational efficiency.GE Power:

General Electric’s power division offers state-of-the-art gas generators and hybrid systems that cater to the specific needs of data centers in a rapidly digitalizing world.We're grateful to work with incredible clients.

FAQs

What is the market size of data Center Generator?

The global data center generator market is currently valued at approximately $5.2 billion, projected to grow at a CAGR of 6.8% from 2023 to 2033, showcasing significant expansion in the upcoming decade.

What are the key market players or companies in the data Center Generator industry?

Key players in the data center generator market include major manufacturers and suppliers providing innovative solutions, focusing on sustainability and efficiency in power generation.

What are the primary factors driving the growth in the data Center Generator industry?

The growth in the data center generator industry is driven by rising energy demands, increased data security standards, and the proliferation of cloud computing services necessitating reliable power solutions.

Which region is the fastest Growing in the data Center Generator?

North America is the fastest-growing region in the data center generator market, with a projected increase from $1.73 billion in 2023 to $3.40 billion by 2033, indicating a strong demand for power backup solutions.

Does ConsaInsights provide customized market report data for the data Center Generator industry?

Yes, ConsaInsights offers customized market research reports tailored to specific needs and inquiries related to the data center generator market, ensuring clients receive the most relevant insights.

What deliverables can I expect from this data Center Generator market research project?

Expect comprehensive deliverables including market analysis reports, forecasts, segmented insights, competitive landscape assessments, and strategic recommendations for enhancing market presence.

What are the market trends of data Center Generator?

Current market trends include a shift toward eco-friendly generators, integration of renewable energy sources, and advancements in generator technology to enhance efficiency and reduce carbon footprints.