Data Center Infrastructure Management Dcim Market Report

Published Date: 31 January 2026 | Report Code: data-center-infrastructure-management-dcim

Data Center Infrastructure Management Dcim Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Data Center Infrastructure Management (DCIM) market, highlighting trends, regions, and forecasts from 2023 to 2033, focusing on market size, growth opportunities, and key players in the industry.

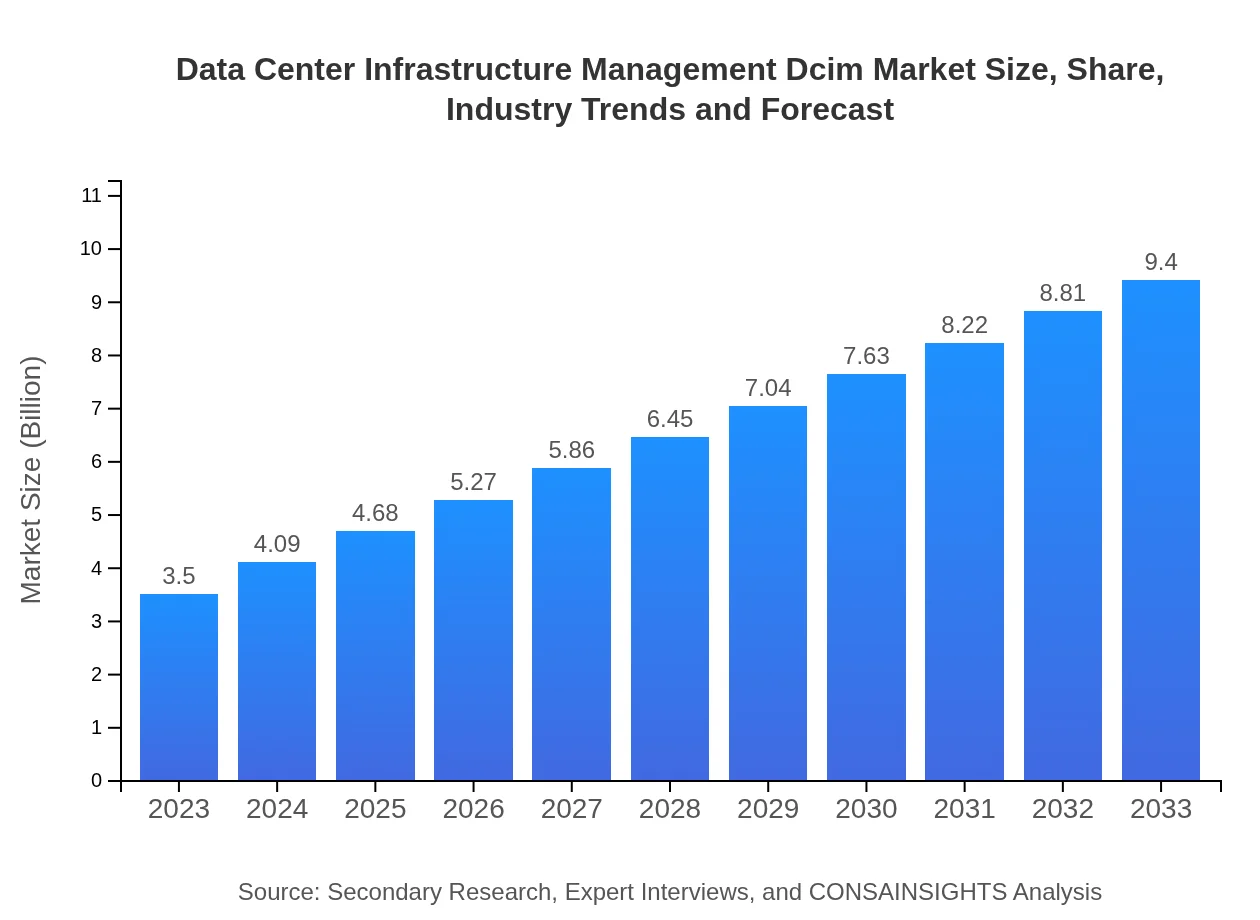

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $9.40 Billion |

| Top Companies | Schneider Electric, Nlyte Software, Commscope |

| Last Modified Date | 31 January 2026 |

Data Center Infrastructure Management DCIM Market Overview

Customize Data Center Infrastructure Management Dcim Market Report market research report

- ✔ Get in-depth analysis of Data Center Infrastructure Management Dcim market size, growth, and forecasts.

- ✔ Understand Data Center Infrastructure Management Dcim's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Data Center Infrastructure Management Dcim

What is the Market Size & CAGR of Data Center Infrastructure Management DCIM market in 2023?

Data Center Infrastructure Management DCIM Industry Analysis

Data Center Infrastructure Management DCIM Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Data Center Infrastructure Management DCIM Market Analysis Report by Region

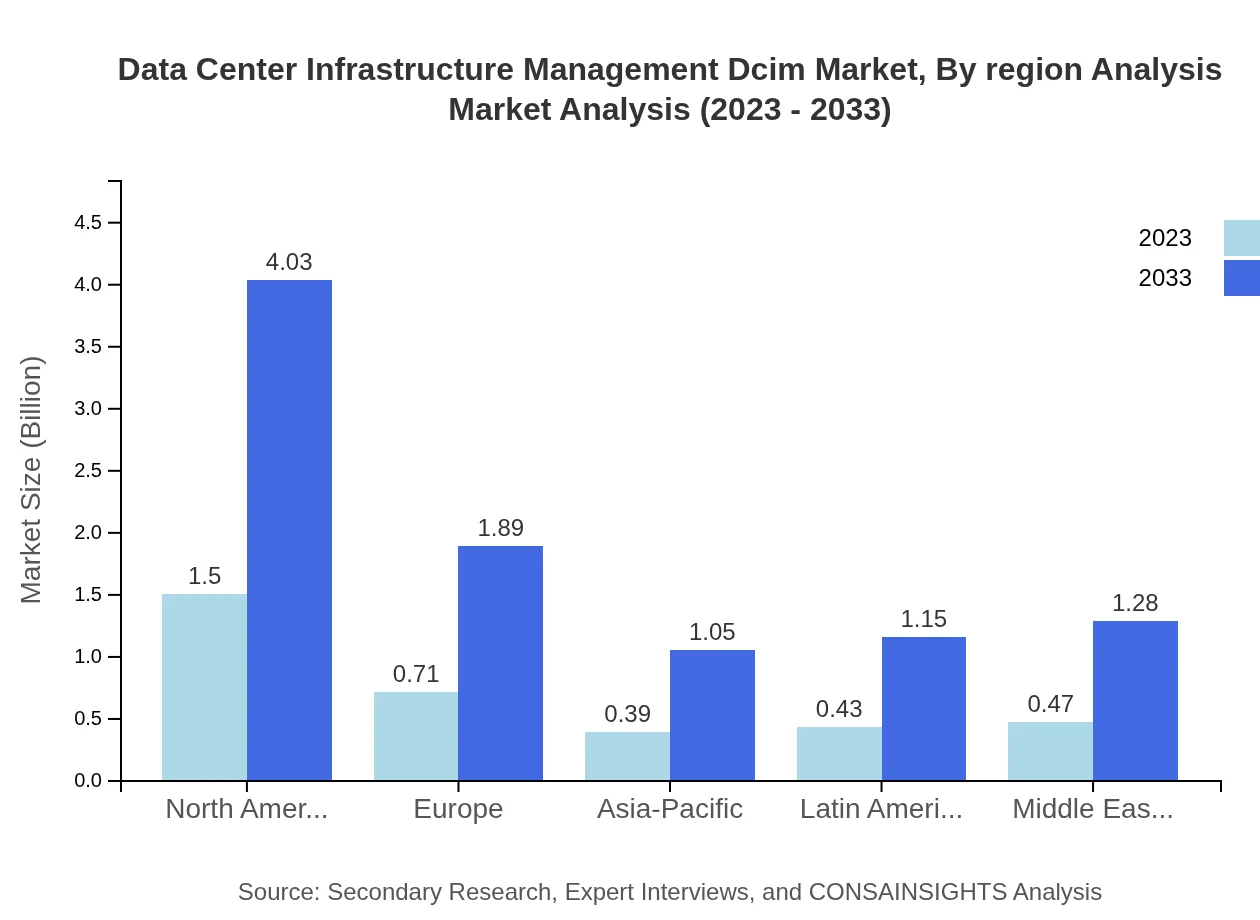

Europe Data Center Infrastructure Management Dcim Market Report:

The European DCIM market is anticipated to grow from $1.11 billion in 2023 to $2.98 billion in 2033. The region is characterized by stringent regulatory requirements pushing organizations to adopt efficient and compliant data center management practices.Asia Pacific Data Center Infrastructure Management Dcim Market Report:

In the Asia Pacific region, the DCIM market is projected to grow from $0.63 billion in 2023 to $1.70 billion in 2033. This growth is driven by increasing investments in data center infrastructure and cloud technologies in countries like China and India, coupled with the rising need for energy-efficient data management.North America Data Center Infrastructure Management Dcim Market Report:

North America remains the largest market for DCIM, with an estimated growth from $1.26 billion in 2023 to $3.38 billion in 2033. The region benefits from advanced technological adoption, extensive cloud deployments, and high data consumption rates, boosting demand for comprehensive DCIM solutions.South America Data Center Infrastructure Management Dcim Market Report:

The South American DCIM market is expected to experience growth from $0.24 billion in 2023 to $0.65 billion in 2033. Governments in this region are focusing on enhancing their digital infrastructure, which includes the adoption of smart technologies in data center management.Middle East & Africa Data Center Infrastructure Management Dcim Market Report:

The Middle East and Africa DCIM market is projected to rise from $0.25 billion in 2023 to $0.68 billion in 2033. Increasing investments in IT infrastructure, driven by digital transformation initiatives, are fueling market growth in this region.Tell us your focus area and get a customized research report.

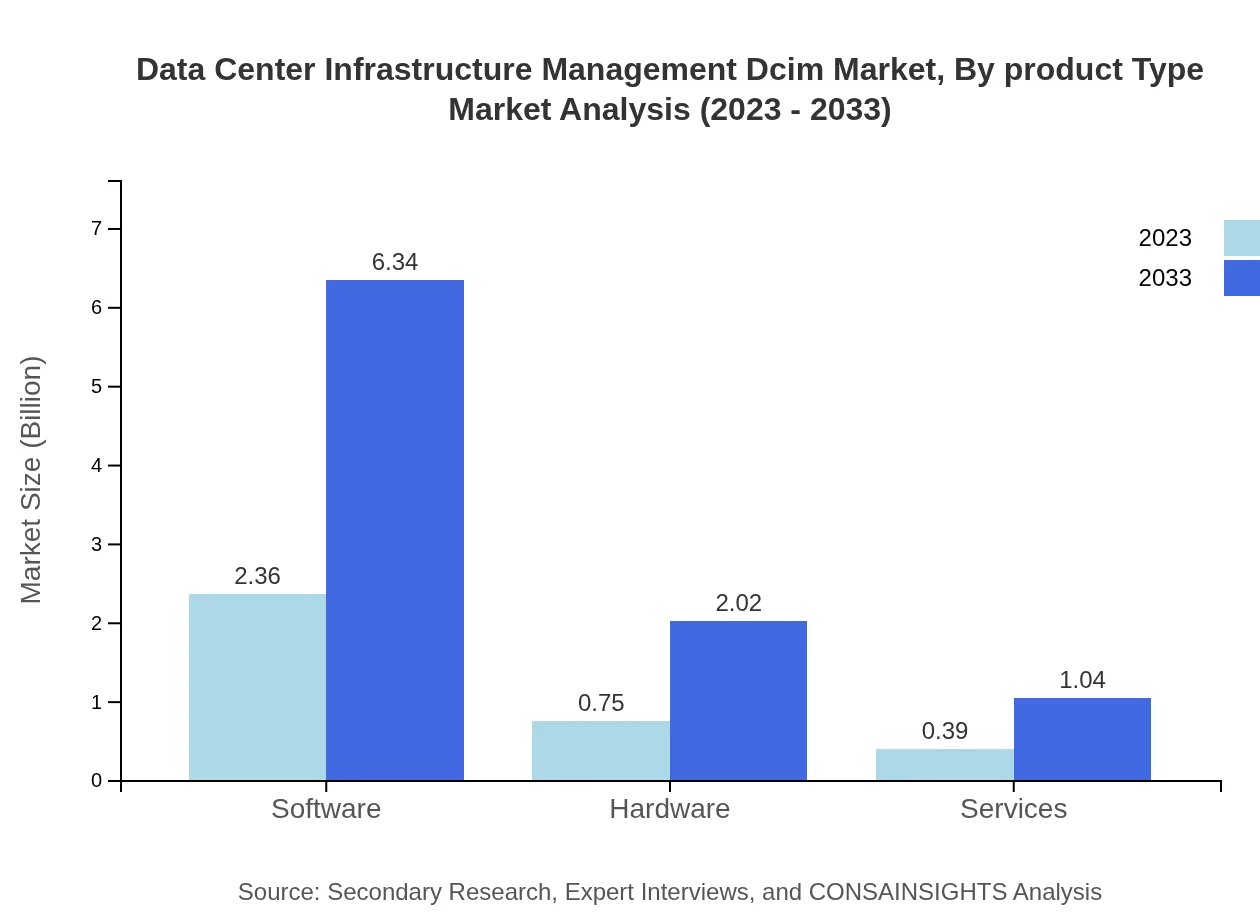

Data Center Infrastructure Management Dcim Market Analysis By Product Type

The breakdown of the DCIM market reveals a strong inclination towards software solutions, which accounted for $2.36 billion in 2023 and is expected to grow to $6.34 billion by 2033. Hardware systems make up a significant portion as well, with key players developing integrated solutions for operational efficiency.

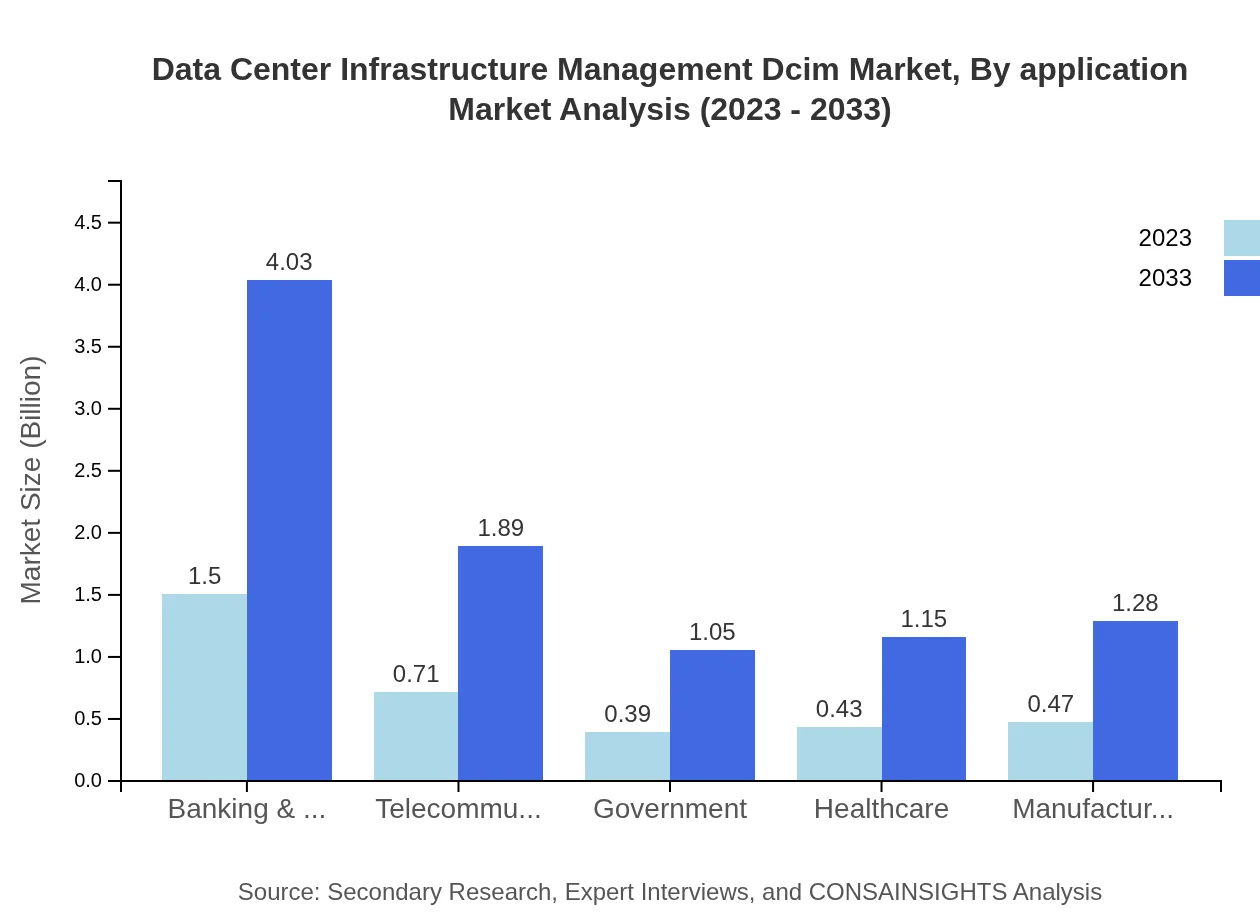

Data Center Infrastructure Management Dcim Market Analysis By Application

The banking and finance sector is the largest application area for DCIM, with a market share of approximately 42.91% in 2023. Telecommunications and government sectors follow closely, utilizing DCIM for enhanced data management and operational integrity.

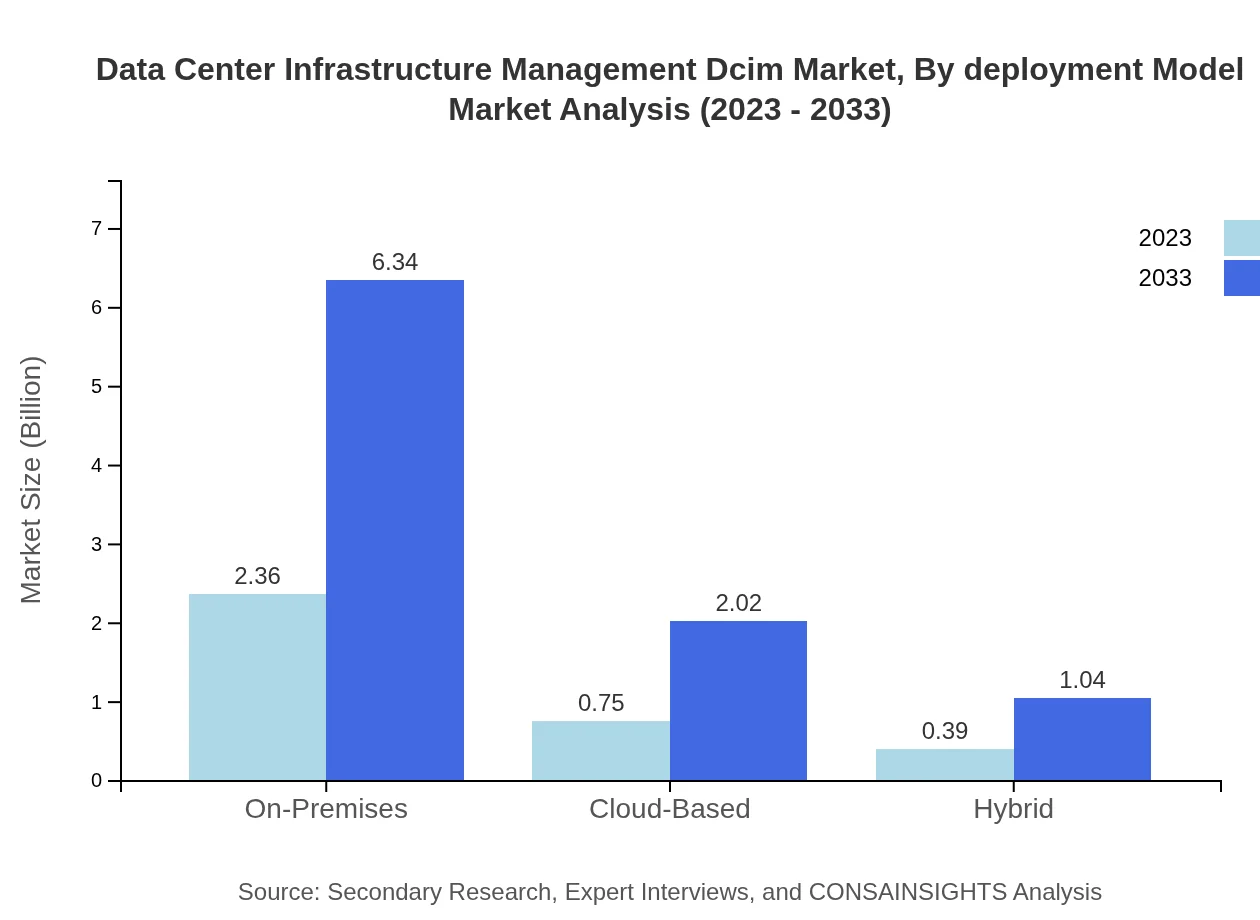

Data Center Infrastructure Management Dcim Market Analysis By Deployment Model

On-premises deployment dominates the DCIM landscape, representing 67.43% of the market share in 2023. However, cloud-based solutions are gaining traction as organizations look for flexible and scalable options, accounting for 21.54% of the market.

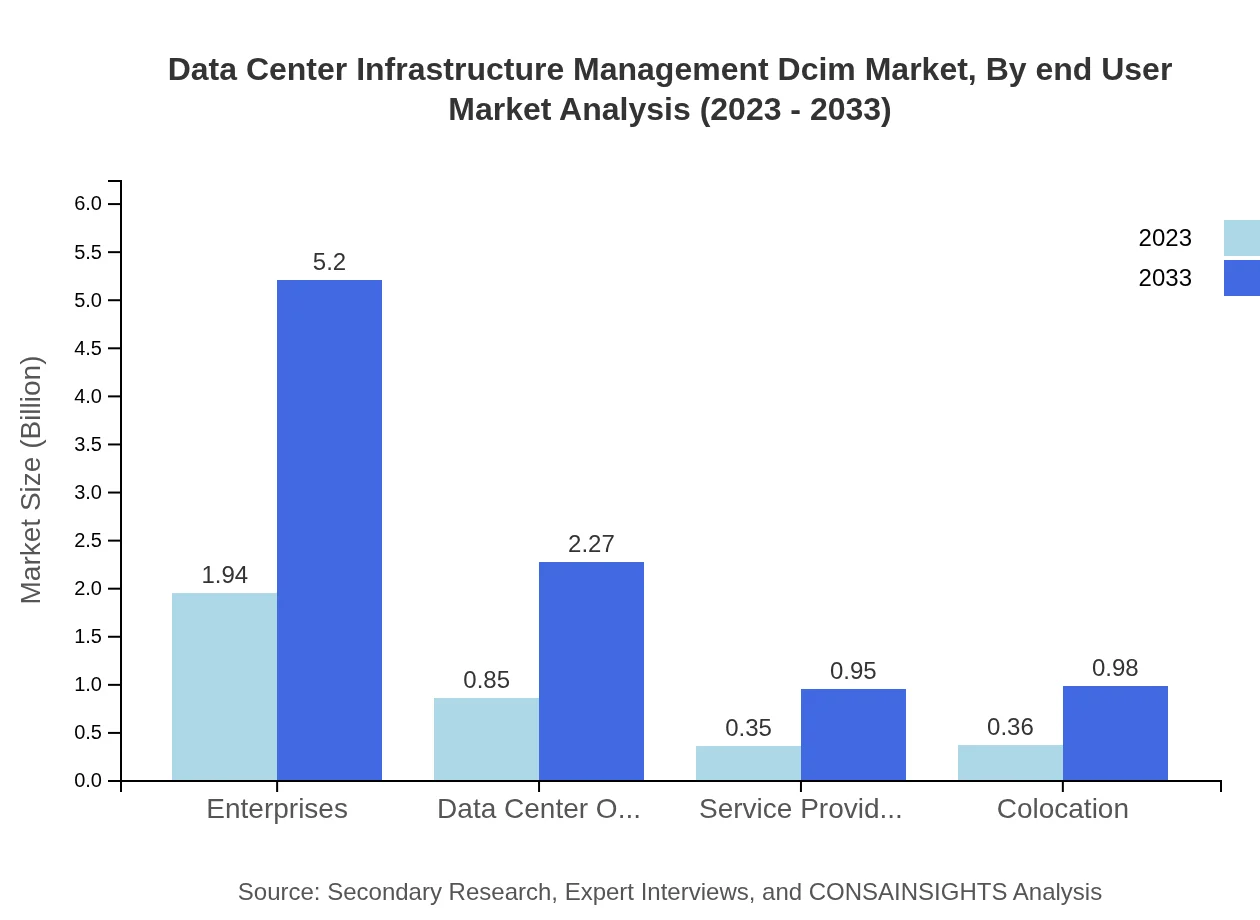

Data Center Infrastructure Management Dcim Market Analysis By End User

Enterprises are the primary end users of DCIM solutions, generating a market value of $1.94 billion in 2023. Data center operators also play a crucial role, with anticipated growth reflecting the increasing need for optimized operations.

Data Center Infrastructure Management Dcim Market Analysis By Region Analysis

Regional analysis indicates that North America leads in both market size and growth, closely followed by Europe. The Asia-Pacific region is emerging as a significant player driven by rapid technology adoption and cloud infrastructure expansion.

Data Center Infrastructure Management DCIM Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Data Center Infrastructure Management DCIM Industry

Schneider Electric:

Schneider Electric is a global leader in energy management and automation solutions, providing advanced DCIM software for effective data center management.Nlyte Software:

Nlyte Software offers a suite of DCIM solutions designed to improve operational efficiency and reduce costs, catering to a wide array of industries globally.Commscope:

Commscope provides innovative solutions for data communication networks, including critical infrastructure monitoring for efficient data center operations.We're grateful to work with incredible clients.

FAQs

What is the market size of Data Center Infrastructure Management (DCIM)?

The Data Center Infrastructure Management (DCIM) market is valued at approximately $3.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 10% from 2023 to 2033, indicating a robust growth trajectory.

What are the key market players or companies in the DCIM industry?

The key players in the DCIM industry include global technology giants and specialized software developers, focusing on enhancing data center efficiency through innovative solutions and comprehensive management tools.

What are the primary factors driving the growth in the DCIM industry?

Key growth drivers in the DCIM industry include the increasing demand for data centers due to rising digitalization, the need for efficient energy management, and advancements in technology that enhance operational insights and improve resource optimization.

Which region is the fastest Growing in the DCIM industry?

North America is the fastest-growing region in the DCIM industry, projected to grow from 1.26 billion in 2023 to 3.38 billion by 2033, driven by high data consumption and the growing number of data centers.

Does ConsaInsights provide customized market report data for the DCIM industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the DCIM industry, focusing on unique market dynamics, regional insights, and segment analysis for informed decision-making.

What deliverables can I expect from this DCIM market research project?

From the DCIM market research project, expect comprehensive reports detailing market size, trends, competitive landscape insights, and forecasts, alongside visual data representations such as charts and graphs for clearer understanding.

What are the market trends of DCIM?

Current market trends in DCIM include the integration of artificial intelligence for predictive analytics, adoption of cloud-based solutions, and a shift towards sustainability, as companies strive to reduce carbon footprints and enhance energy efficiency.