Data Center Interconnect Market Report

Published Date: 31 January 2026 | Report Code: data-center-interconnect

Data Center Interconnect Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Data Center Interconnect (DCI) market, highlighting key insights on market trends, forecasts from 2023 to 2033, and detailed regional and segment analyses, guiding stakeholders in making informed decisions.

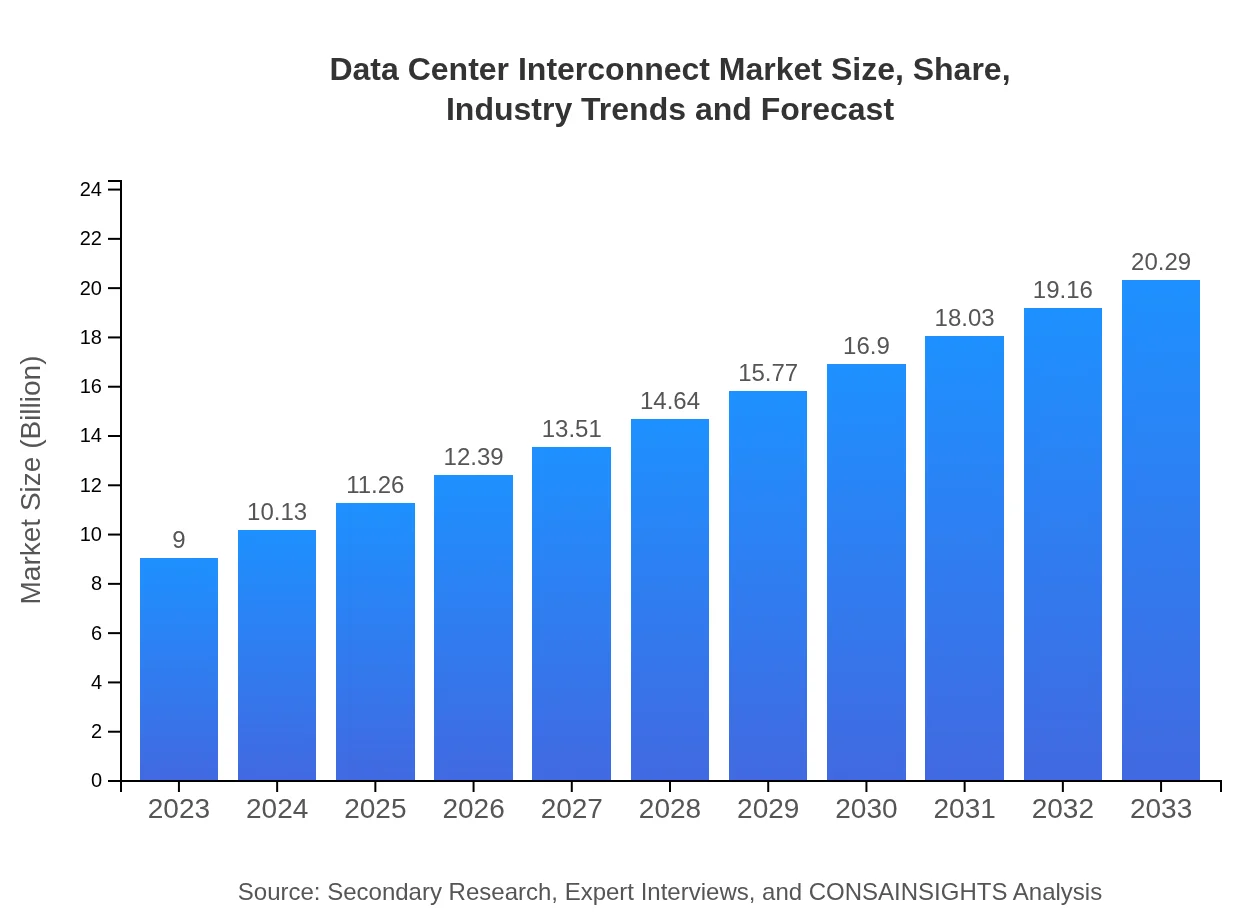

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $9.00 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $20.29 Billion |

| Top Companies | Cisco Systems, Inc., Juniper Networks, Inc., Arista Networks, Inc., Ciena Corporation |

| Last Modified Date | 31 January 2026 |

Data Center Interconnect Market Overview

Customize Data Center Interconnect Market Report market research report

- ✔ Get in-depth analysis of Data Center Interconnect market size, growth, and forecasts.

- ✔ Understand Data Center Interconnect's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Data Center Interconnect

What is the Market Size & CAGR of Data Center Interconnect market in 2023 and 2033?

Data Center Interconnect Industry Analysis

Data Center Interconnect Market Segmentation and Scope

Tell us your focus area and get a customized research report.

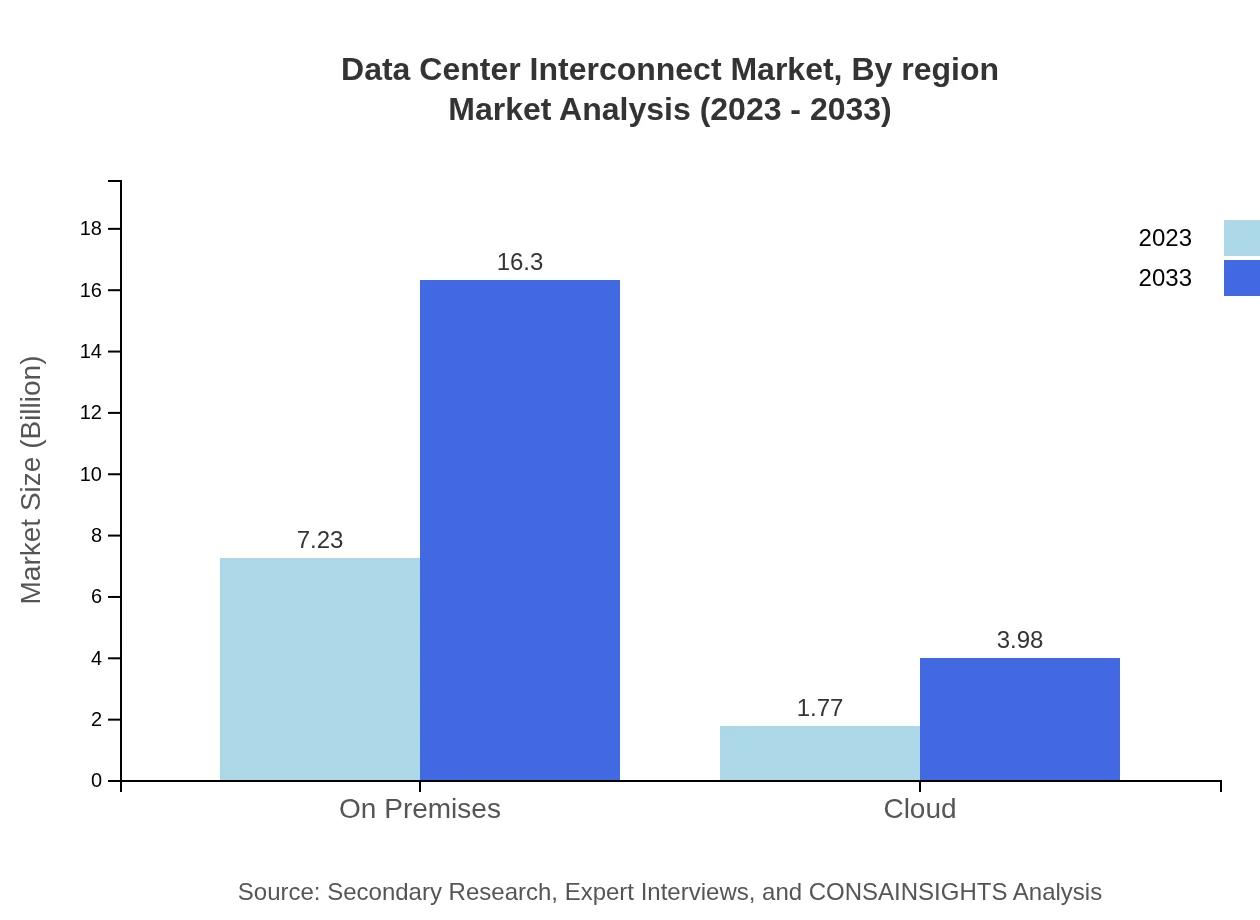

Data Center Interconnect Market Analysis Report by Region

Europe Data Center Interconnect Market Report:

Europe's DCI market is estimated to grow from USD 2.31 billion in 2023 to USD 5.22 billion by 2033. Factors such as stringent data privacy regulations, increased demand for business continuity, and rising investments in digital infrastructure are propelling this growth. Countries like Germany and the UK are key players in this expansion.Asia Pacific Data Center Interconnect Market Report:

In the Asia-Pacific region, the Data Center Interconnect market is anticipated to grow from USD 1.78 billion in 2023 to USD 4.01 billion by 2033, driven by rapid urbanization, the proliferation of smart technologies, and extensive investments in data center infrastructure. Countries like China, India, and Japan are spearheading this growth with their robust digital transformation initiatives.North America Data Center Interconnect Market Report:

With a market size of USD 3.34 billion in 2023, North America leads the DCI market and is projected to reach USD 7.53 billion by 2033, supported by higher data consumption rates, significant technological investments, and the presence of major cloud service providers. The U.S. continues to dominate the landscape with its advanced DCI infrastructure.South America Data Center Interconnect Market Report:

The South American market is projected to expand from USD 0.85 billion in 2023 to USD 1.92 billion by 2033. Strengthened demand for internet connectivity and cloud services, particularly amid the region's increased mobile internet penetration, is expected to drive DCI growth in countries like Brazil and Argentina.Middle East & Africa Data Center Interconnect Market Report:

The Middle East and Africa DCI market is set to progress from USD 0.71 billion in 2023 to USD 1.61 billion by 2033. Emerging economies in this region are increasingly prioritizing digital infrastructure development, and the rise of smart city projects is further driving investments in DCI solutions.Tell us your focus area and get a customized research report.

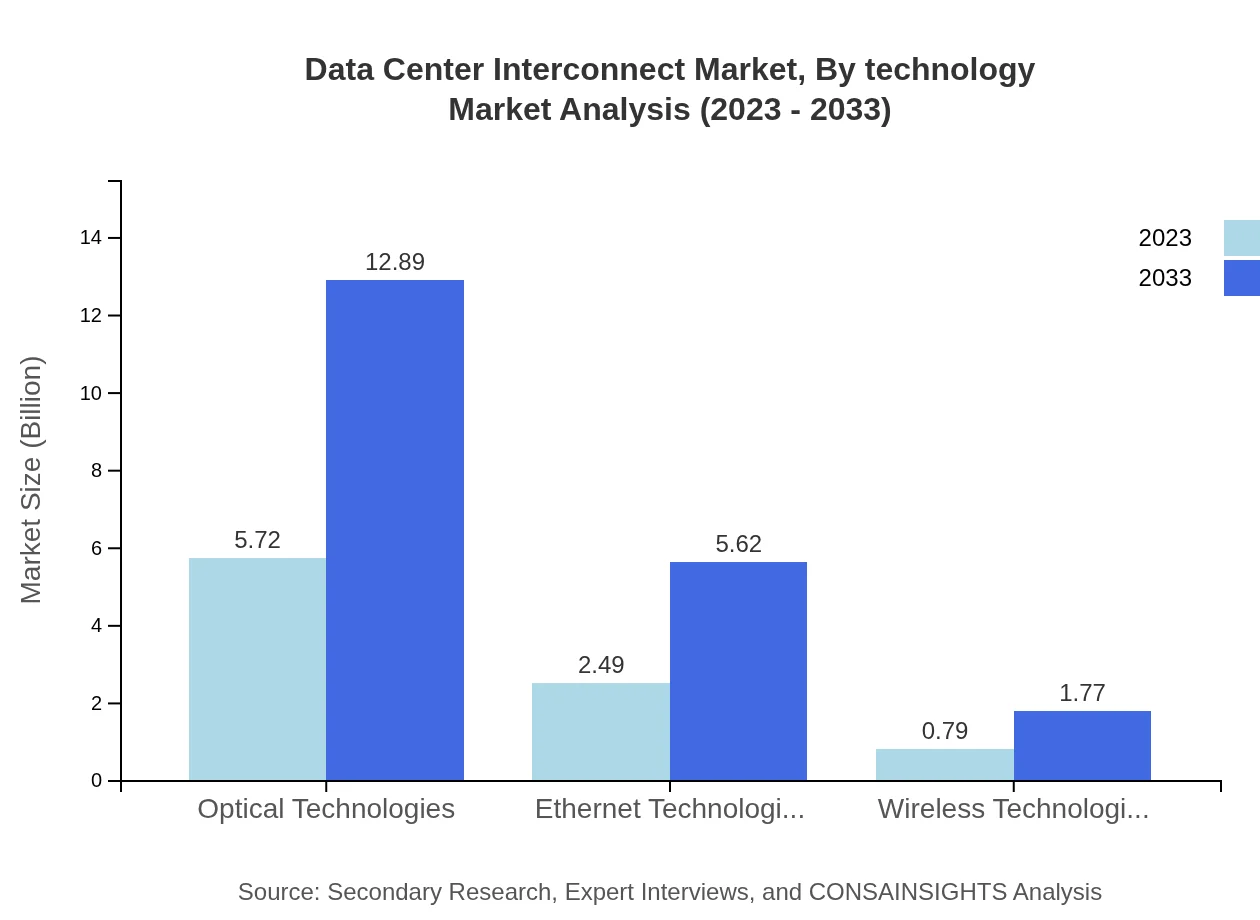

Data Center Interconnect Market Analysis By Technology

The Data Center Interconnect market is significantly influenced by technological advancements. As of 2023, the optical technologies segment dominates the market with a size of USD 5.72 billion and is expected to grow to USD 12.89 billion by 2033, capturing around 63.55% market share. Ethernet technologies follow closely, with a 2023 market size of USD 2.49 billion (27.71% share) projected to rise to USD 5.62 billion by 2033. New innovations in wireless technologies, however, are also garnering attention with a size of USD 0.79 billion in 2023, anticipated to reach USD 1.77 billion by 2033.

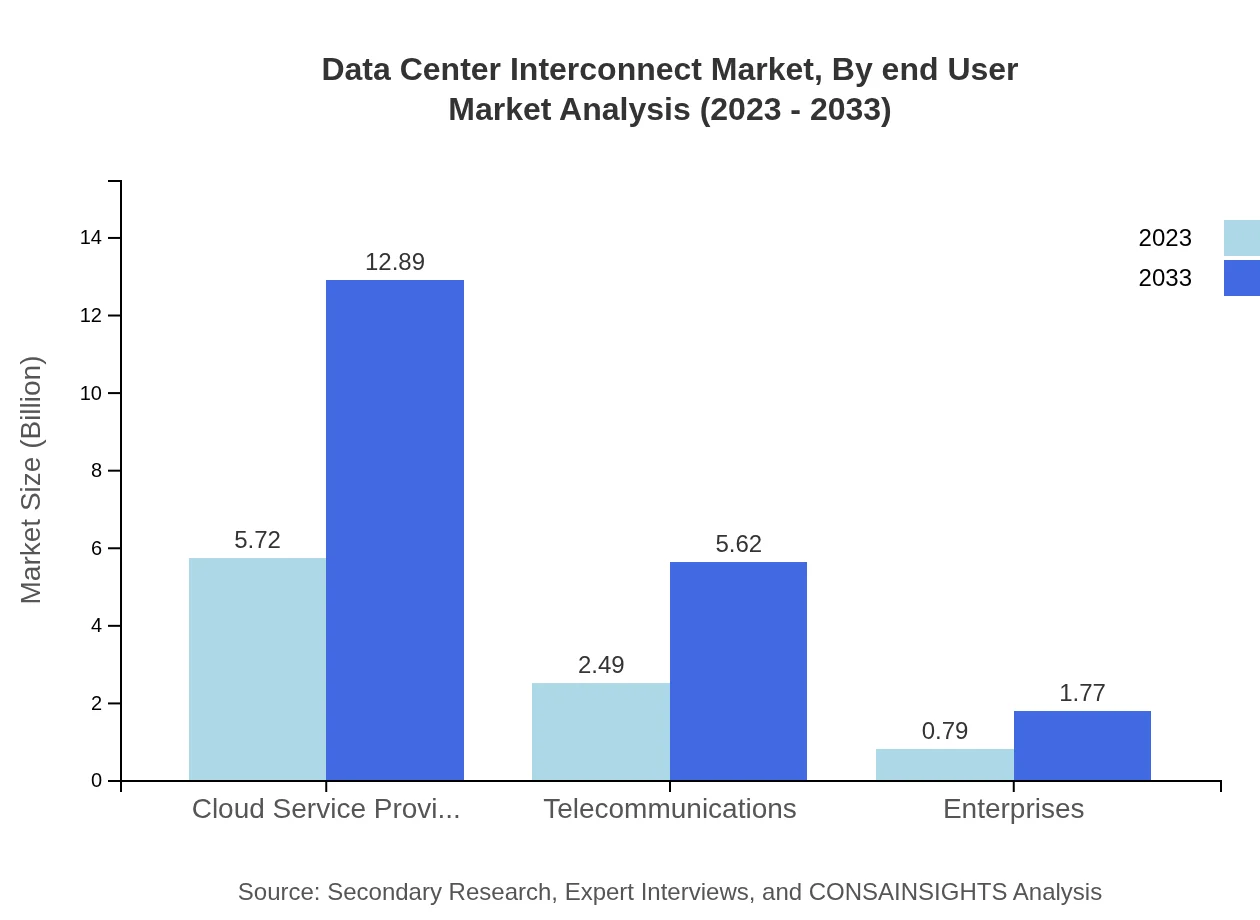

Data Center Interconnect Market Analysis By End User

End-user segmentation showcases that Cloud Service Providers represent the largest share of the Data Center Interconnect market with a projected growth from USD 5.72 billion in 2023 to USD 12.89 billion by 2033, indicating a 63.55% market share. Telecommunications also holds significant sway, with market size growing from USD 2.49 billion in 2023 to USD 5.62 billion by 2033, while enterprises contribute with a smaller segment expected to reach USD 1.77 billion from USD 0.79 billion during the same period.

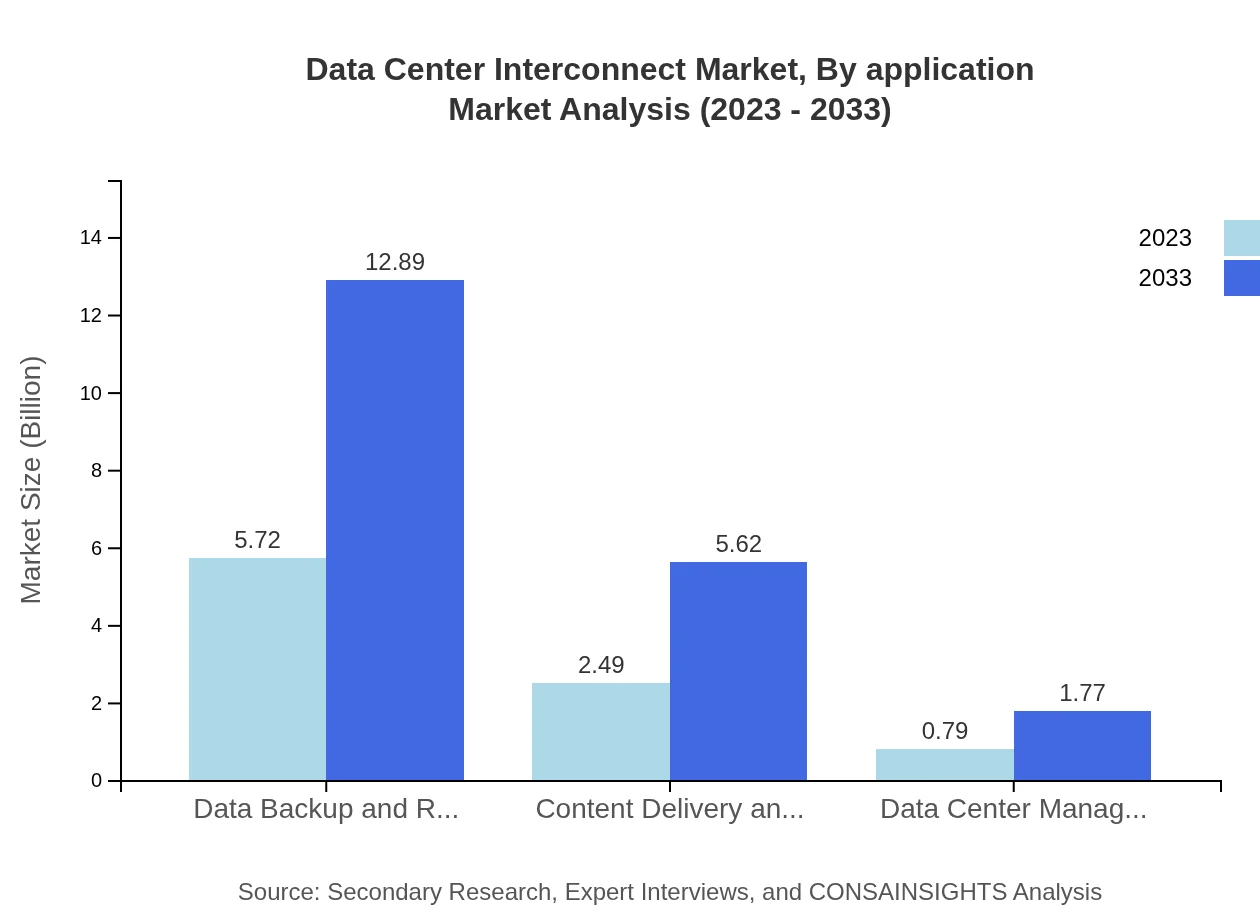

Data Center Interconnect Market Analysis By Application

The application scope highlights a steady demand across several sectors. The Data Backup and Recovery application leads with a size of USD 5.72 billion in 2023, expected to grow to USD 12.89 billion by 2033. Content delivery and streaming platforms are also essential, growing from USD 2.49 billion to USD 5.62 billion, with data center management applications expected to see modest growth from USD 0.79 billion to USD 1.77 billion.

Data Center Interconnect Market Analysis By Region

Regional analysis provides insights indicating North America as the market leader, while the growth rates in the Asia-Pacific and Latin American regions represent emerging opportunities. As cloud adoption accelerates, geographical expansion in services and infrastructure will continue to play a crucial role in shaping the DCI landscape.

Data Center Interconnect Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Data Center Interconnect Industry

Cisco Systems, Inc.:

Cisco is a leader in providing networking solutions, including advanced DCI technologies that ensure high performance and security in data transfers. Their innovative approaches facilitate seamless connectivity in hybrid cloud environments.Juniper Networks, Inc.:

Juniper is known for their high-performance networking products that support data center interconnect solutions. Their software-defined networking capabilities enhance operational efficiency for data center operators.Arista Networks, Inc.:

Arista specializes in cloud networking solutions with a focus on DCI. Their robust Ethernet switch offering targets the growing demand for bandwidth in data centers.Ciena Corporation:

Ciena delivers high-capacity optical networking solutions aimed at improving data center connectivity. They are pivotal in advancing technologies that support efficient data traffic management.We're grateful to work with incredible clients.

FAQs

What is the market size of Data Center Interconnect?

The Data Center Interconnect market is valued at approximately $9 billion in 2023, with an expected CAGR of 8.2% through 2033. Future projections indicate significant growth in market size, underscoring the increasing demand for interconnectivity solutions.

What are the key market players or companies in this Data Center Interconnect industry?

Key players in the Data Center Interconnect industry include giants like Cisco Systems, Juniper Networks, Arista Networks, and Ciena. Their innovations and technology development significantly influence the industry's direction and competitive landscape.

What are the primary factors driving the growth in the Data Center Interconnect industry?

Growth in the Data Center Interconnect industry is primarily driven by the increasing demand for cloud computing, the rise of big data analytics, and the need for enhanced disaster recovery solutions. Additionally, the surge in data transmission requirements is a crucial factor.

Which region is the fastest Growing in the Data Center Interconnect?

The fastest-growing region in the Data Center Interconnect market is North America, poised to grow from $3.34 billion in 2023 to $7.53 billion by 2033, driven by increasing investments in data center infrastructure and advanced technologies.

Does ConsaInsights provide customized market report data for the Data Center Interconnect industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the Data Center Interconnect industry, ensuring clients receive comprehensive insights and analyses relevant to their business challenges and market opportunities.

What deliverables can I expect from this Data Center Interconnect market research project?

From the Data Center Interconnect market research project, you can expect detailed market reports, trend analyses, competitive landscape assessments, and insights into regional growth opportunities, along with tailored recommendations for strategic decision-making.

What are the market trends of Data Center Interconnect?

Current trends in the Data Center Interconnect market include the increased adoption of optical and Ethernet technologies, a shift towards cloud-based solutions, and enhanced focus on cybersecurity measures, reflecting the evolving demands of modern data management.