Data Center Liquid Cooling Market Report

Published Date: 31 January 2026 | Report Code: data-center-liquid-cooling

Data Center Liquid Cooling Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Data Center Liquid Cooling market, examining market dynamics from 2023 to 2033. It includes insights on market size, industry trends, regional analysis, technology advancements, and profiles of key players in the industry.

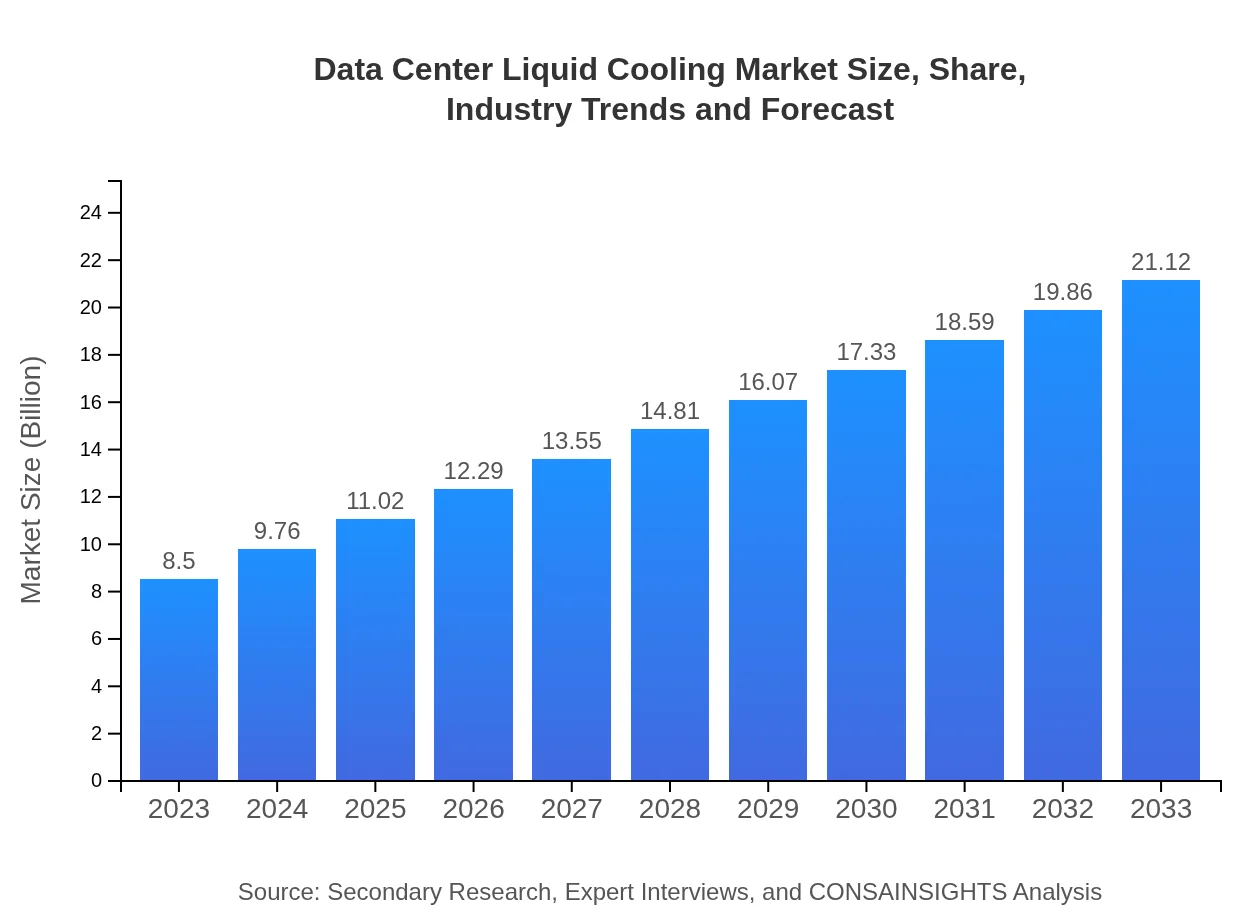

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $21.12 Billion |

| Top Companies | CoolIT Systems, Asetek, Schneider Electric, Vertiv, NLYTE Software |

| Last Modified Date | 31 January 2026 |

Data Center Liquid Cooling Market Overview

Customize Data Center Liquid Cooling Market Report market research report

- ✔ Get in-depth analysis of Data Center Liquid Cooling market size, growth, and forecasts.

- ✔ Understand Data Center Liquid Cooling's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Data Center Liquid Cooling

What is the Market Size & CAGR of the Data Center Liquid Cooling market?

Data Center Liquid Cooling Industry Analysis

Data Center Liquid Cooling Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Data Center Liquid Cooling Market Analysis Report by Region

Europe Data Center Liquid Cooling Market Report:

In Europe, the Data Center Liquid Cooling market reflects significant potential, with a market value of USD 2.37 billion in 2023, forecasted to grow to USD 5.88 billion by 2033. Robust regulations focused on sustainability and energy efficiency are driving the adoption of advanced cooling solutions across the region.Asia Pacific Data Center Liquid Cooling Market Report:

The Asia Pacific region holds a significant share of the Data Center Liquid Cooling market, valued at approximately USD 1.62 billion in 2023, expected to grow to USD 4.03 billion by 2033. The growth is driven by increasing data consumption, a rise in cloud service adoption, and high demand for efficient cooling solutions in densely populated urban areas.North America Data Center Liquid Cooling Market Report:

North America is poised to dominate the Data Center Liquid Cooling market, valued at USD 3.24 billion in 2023 and forecasted to reach USD 8.04 billion in 2033. The region is a hub for technological advancement and cloud services, with a high concentration of data centers leading to strong market growth.South America Data Center Liquid Cooling Market Report:

In South America, the Data Center Liquid Cooling market is valued at around USD 0.53 billion in 2023 and is projected to increase to USD 1.31 billion by 2033. Expansion in telecommunications and the growing e-commerce sector in the region are notable drivers of this growth.Middle East & Africa Data Center Liquid Cooling Market Report:

The Middle East and Africa market for Data Center Liquid Cooling stood at USD 0.75 billion in 2023, projected to grow to USD 1.86 billion by 2033. The rising number of data centers driven by increased demand for digital solutions is a significant growth factor in this region.Tell us your focus area and get a customized research report.

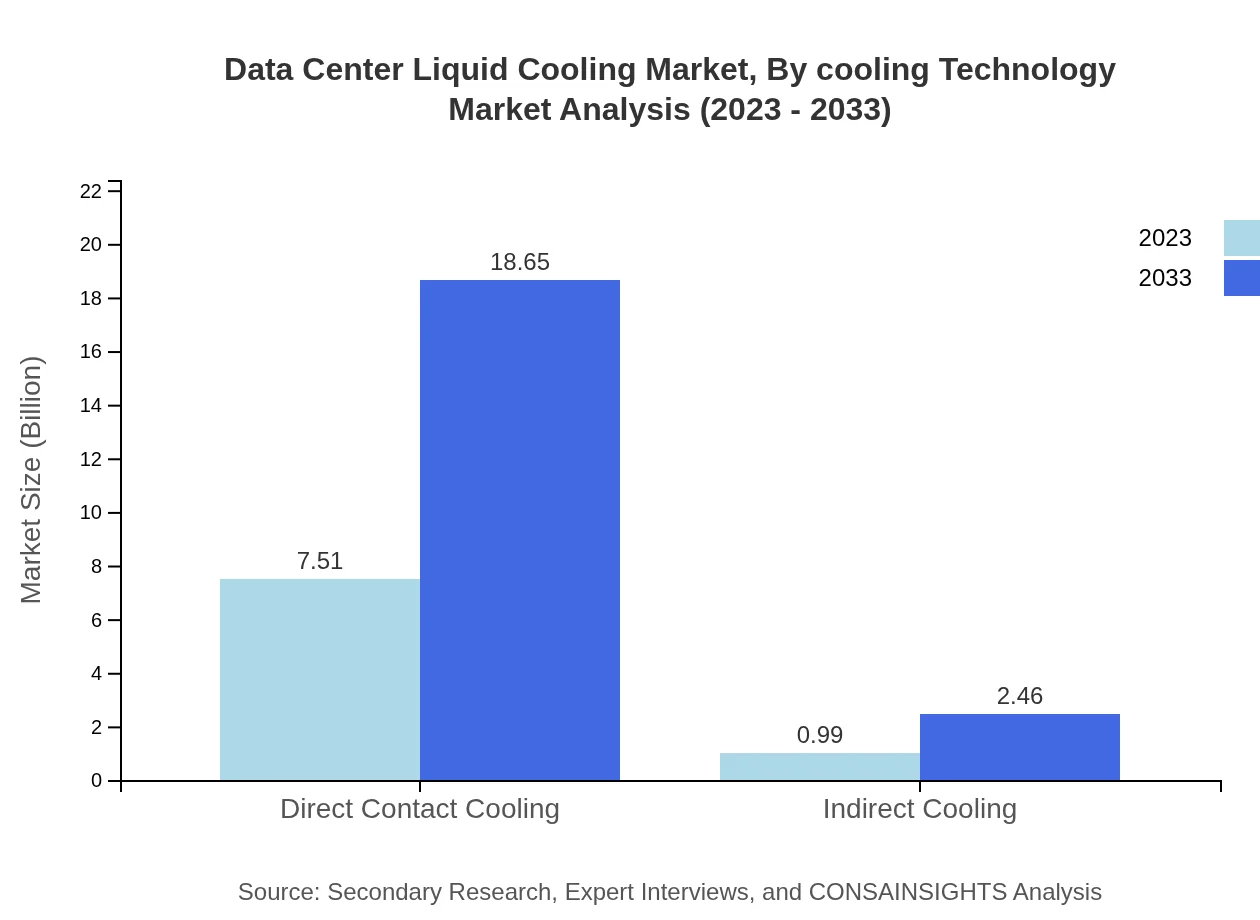

Data Center Liquid Cooling Market Analysis By Cooling Technology

The cooling technology segment is divided mainly into direct contact cooling and indirect cooling. Direct contact cooling, with a market size of USD 7.51 billion in 2023, is expected to maintain a significant share due to its efficiency in transferring heat away. Indirect cooling technologies are also gaining traction, targeting specific cooling challenges within data centers.

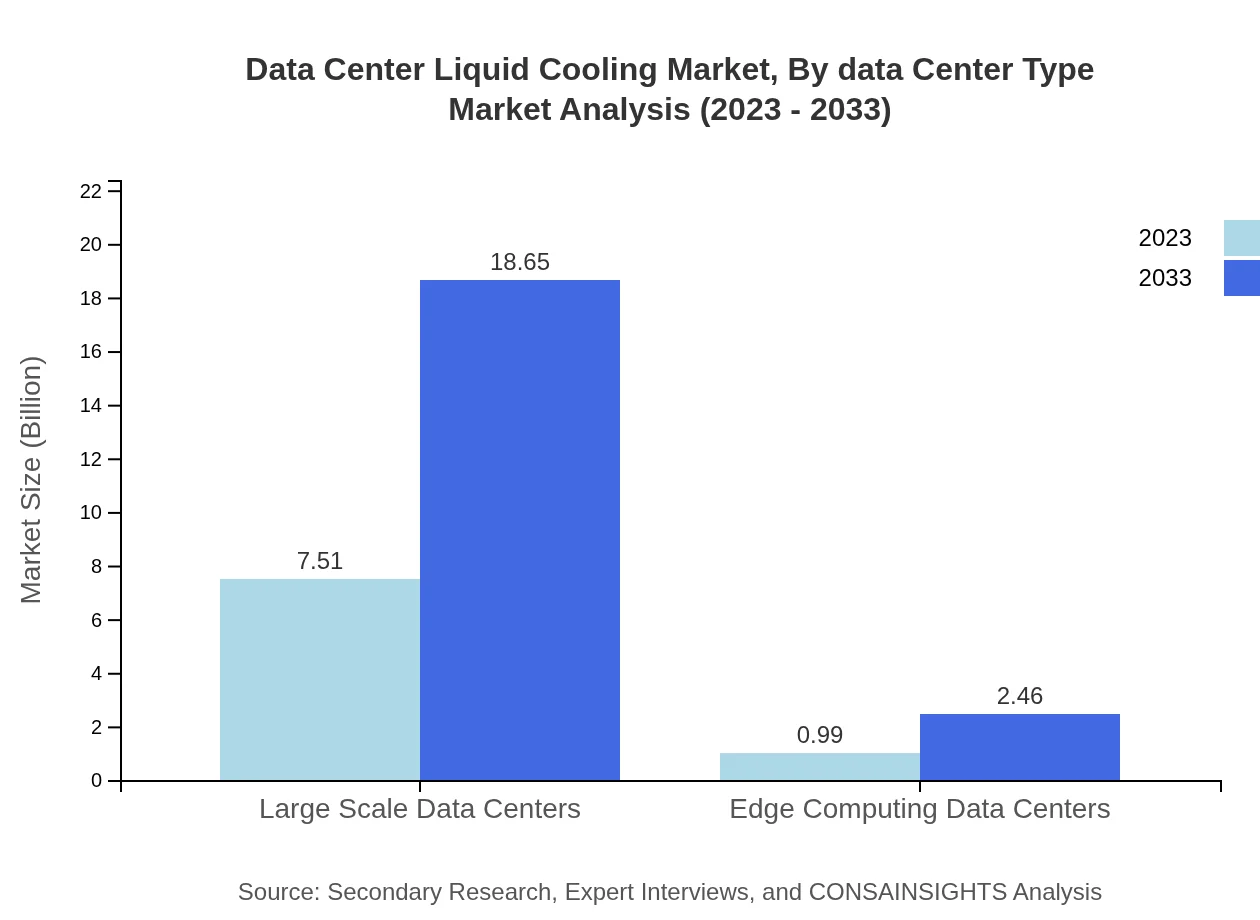

Data Center Liquid Cooling Market Analysis By Data Center Type

The data center types segment includes large-scale data centers and edge computing data centers. Large-scale data centers are the primary consumers of liquid cooling technologies, accounting for a market size of USD 7.51 billion in 2023. Edge computing data centers are emerging with a growing demand, projected to reach USD 2.46 billion by 2033.

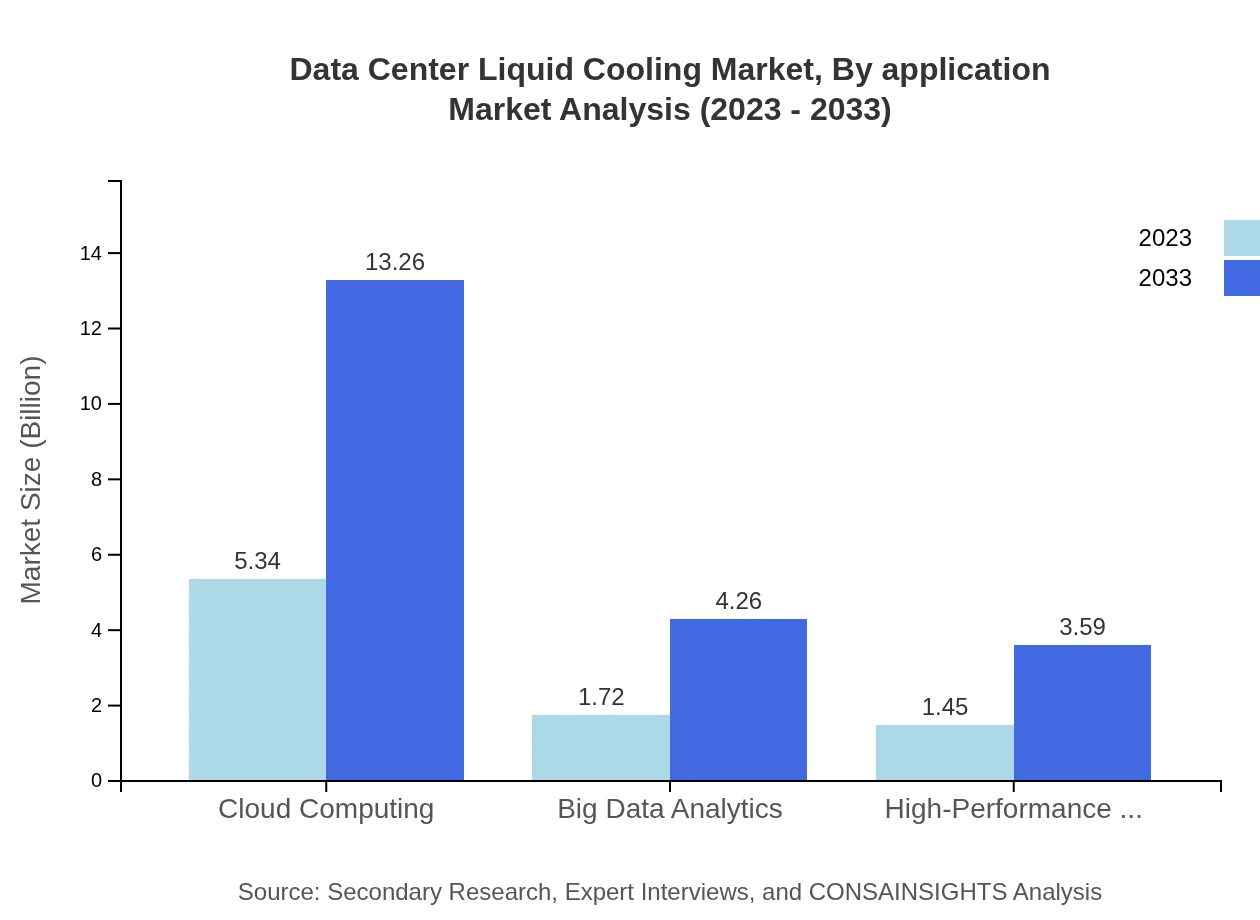

Data Center Liquid Cooling Market Analysis By Application

The market segmented by application, particularly highlights cloud computing with a size of USD 5.34 billion in 2023. High-performance computing follows closely due to its specialized requirements, with a market size of USD 1.45 billion for the same year.

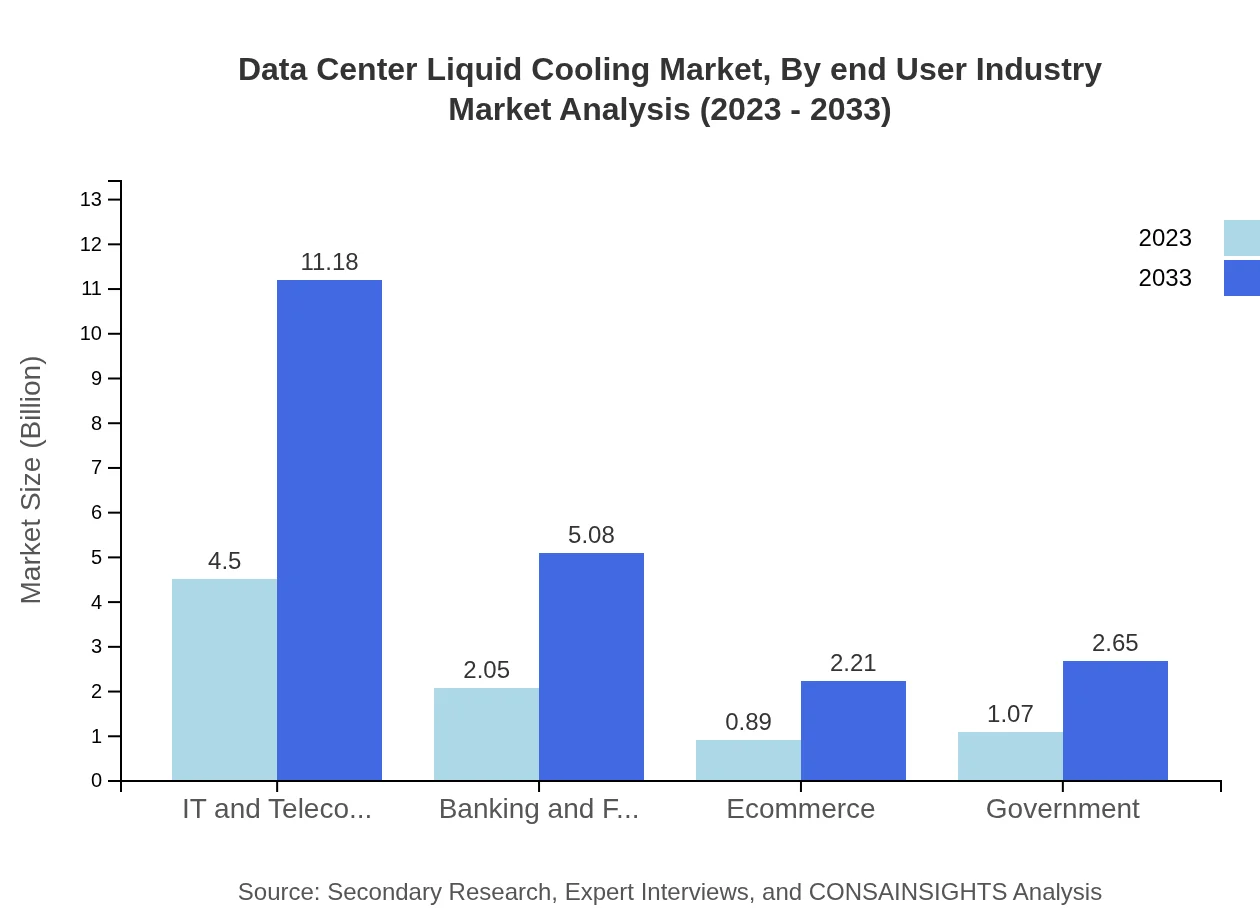

Data Center Liquid Cooling Market Analysis By End User Industry

Key end-user industries such as IT and telecommunications dominate, with a market size of USD 4.50 billion in 2023, followed by banking and financial services at USD 2.05 billion, highlighting the critical role of data centers in these sectors.

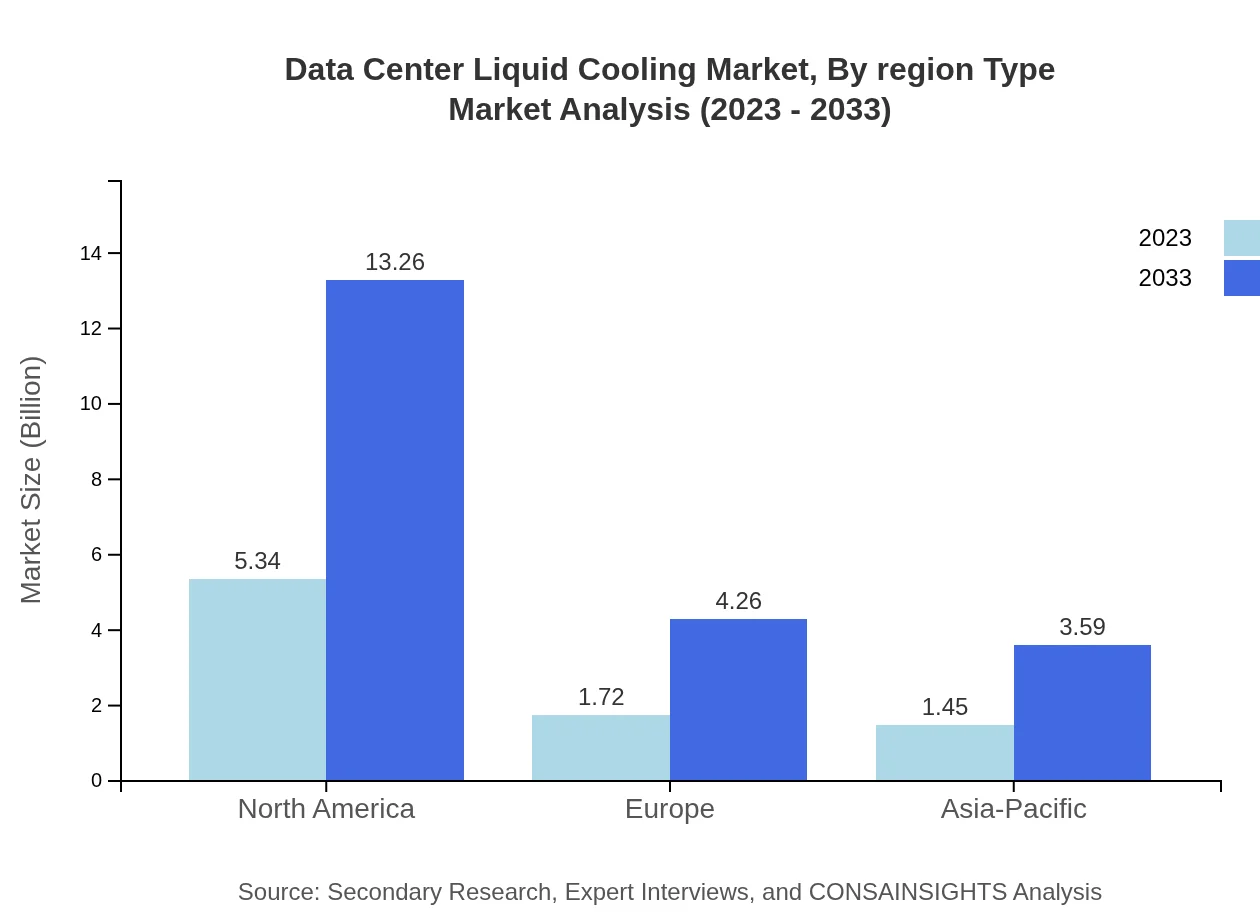

Data Center Liquid Cooling Market Analysis By Region Type

Regional analysis indicates considerable growth potential across North America and Europe, supported by regulatory frameworks promoting energy efficiency and the increasing establishment of data centers to support tech-driven economies.

Data Center Liquid Cooling Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Data Center Liquid Cooling Industry

CoolIT Systems:

CoolIT Systems specializes in liquid cooling solutions for data centers, offering advanced thermal management technology that enhances data center efficiency.Asetek:

Asetek is a leading provider of liquid cooling solutions known for innovative products that optimize cooling in high-density computing environments.Schneider Electric:

Schneider Electric is a key player in energy management and automation solutions, providing a range of cooling products and services tailored for data centers.Vertiv:

Vertiv focuses on critical digital infrastructure and continuity solutions, prominently offering intelligent cooling systems.NLYTE Software:

NLYTE Software provides data center optimization solutions, including tools for managing cooling systems effectively.We're grateful to work with incredible clients.

FAQs

What is the market size of data Center Liquid Cooling?

The global Data Center Liquid Cooling market is valued at approximately $8.5 billion in 2023, with a projected CAGR of 9.2% leading to substantial growth over the next decade.

What are the key market players or companies in the data Center Liquid Cooling industry?

Key players in the Data Center Liquid Cooling industry include major corporations such as Asetek, CommScope, and Schneider Electric, which are pioneering innovative liquid cooling solutions to meet increasing demand for energy efficiency.

What are the primary factors driving the growth in the data Center Liquid Cooling industry?

Factors driving growth in the Data Center Liquid Cooling industry include the rising need for energy-efficient cooling technologies, increased data center capacities, and the surge in cloud computing and big data analytics services.

Which region is the fastest Growing in the data Center Liquid Cooling?

North America is the fastest-growing region in the Data Center Liquid Cooling market, expected to grow from $3.24 billion in 2023 to $8.04 billion by 2033, driven by high data center investments.

Does ConsaInsights provide customized market report data for the data Center Liquid Cooling industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the Data Center Liquid Cooling industry, allowing businesses to gather focused insights for strategic decision-making.

What deliverables can I expect from this data Center Liquid Cooling market research project?

Deliverables from the Data Center Liquid Cooling market research project include comprehensive market analysis, industry insights, competitive landscape, and tailored recommendations for market entry strategies.

What are the market trends of data Center Liquid Cooling?

Current trends in the Data Center Liquid Cooling market include increasing adoption of direct contact cooling solutions, a shift towards sustainability, and growing integration of advanced cooling technologies to optimize performance.