Data Center Logical Security Market Report

Published Date: 31 January 2026 | Report Code: data-center-logical-security

Data Center Logical Security Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Data Center Logical Security market, detailing market trends, insights, and future forecasts from 2023 to 2033, including growth factors, regional dynamics, and industry segmentation.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

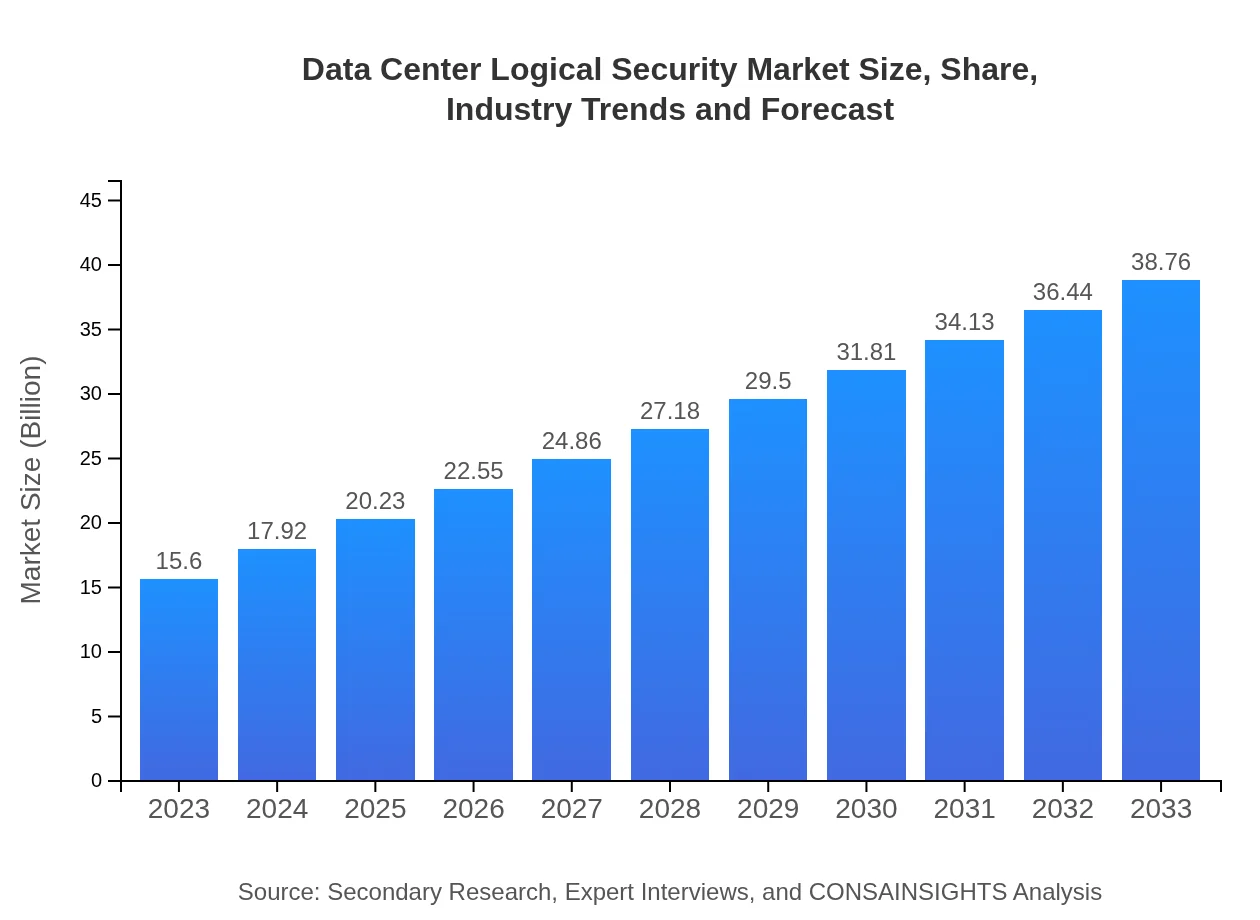

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $38.76 Billion |

| Top Companies | Cisco Systems, Inc., Palo Alto Networks, Inc., Fortinet, Inc., IBM Corporation, Check Point Software Technologies Ltd. |

| Last Modified Date | 31 January 2026 |

Data Center Logical Security Market Overview

Customize Data Center Logical Security Market Report market research report

- ✔ Get in-depth analysis of Data Center Logical Security market size, growth, and forecasts.

- ✔ Understand Data Center Logical Security's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Data Center Logical Security

What is the Market Size & CAGR of Data Center Logical Security market in 2023?

Data Center Logical Security Industry Analysis

Data Center Logical Security Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Data Center Logical Security Market Analysis Report by Region

Europe Data Center Logical Security Market Report:

Europe's market size for Data Center Logical Security was around $3.84 billion in 2023, with expectations of reaching $9.55 billion by 2033. European compliance regulations such as GDPR are pushing organizations to enhance their data protection strategies, thus fueling market growth.Asia Pacific Data Center Logical Security Market Report:

In 2023, the Asia Pacific market for Data Center Logical Security is valued at approximately $3.01 billion and is expected to grow to $7.49 billion by 2033, showcasing strong adoption driven by increasing digitalization. The proliferation of mobile devices and internet penetration are also propelling the demand for robust security measures in the region.North America Data Center Logical Security Market Report:

In North America, the Data Center Logical Security market reached $5.49 billion in 2023, projected to expand to $13.64 billion by 2033. The region hosts numerous cybersecurity firms and is witnessing significant investment in advanced security technologies to tackle increasingly sophisticated cyber threats.South America Data Center Logical Security Market Report:

The South American market stood at $1.32 billion in 2023, with a forecasted rise to $3.28 billion by 2033. The region’s emphasis on improving cybersecurity frameworks to combat rising cyber threats is contributing to this growth, as governments and institutions prioritize securing their data.Middle East & Africa Data Center Logical Security Market Report:

The Middle East and Africa market is anticipated to grow from $1.93 billion in 2023 to $4.80 billion by 2033, driven by heightened awareness around data privacy and security needs as organizations digitalize their operations and navigate complex regulatory environments.Tell us your focus area and get a customized research report.

Data Center Logical Security Market Analysis By Product Type

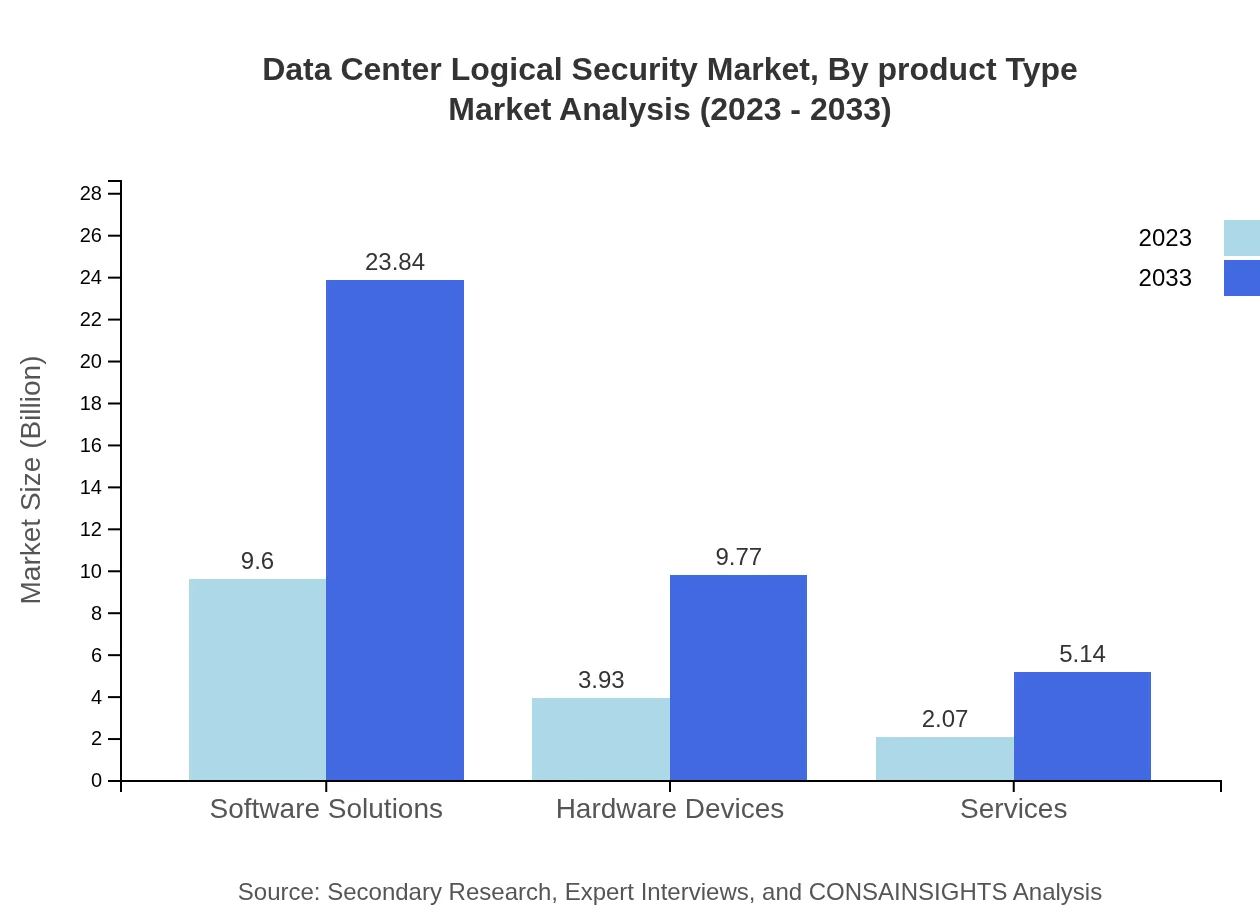

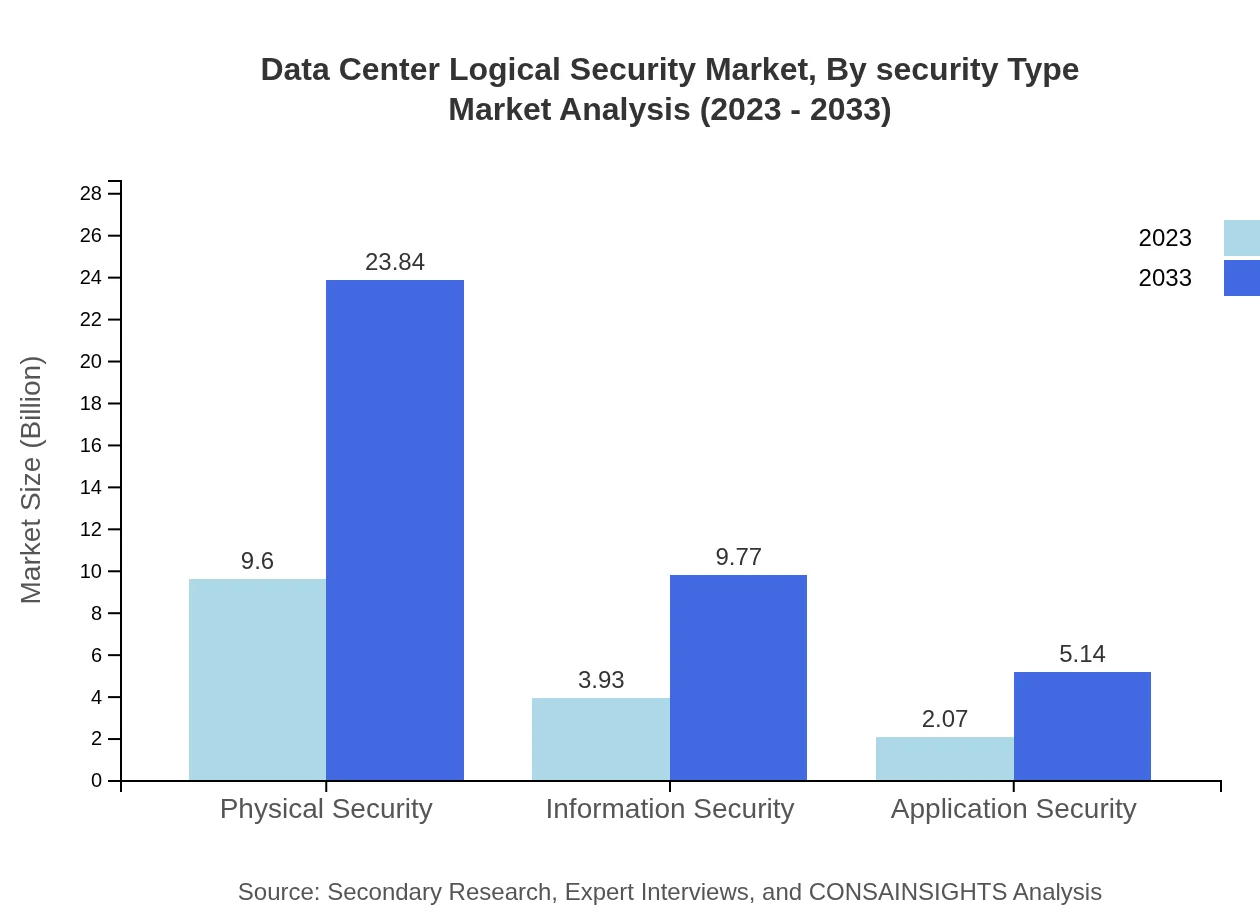

The Data Center Logical Security market, categorized by product type, highlights the prominence of Software Solutions, which accounted for $9.60 billion (61.52% share) in 2023 and is expected to reach $23.84 billion by 2033. Physical Security is another significant sector, currently at $9.60 billion, with a similar growth trajectory. Other key segments include Hardware Devices and Services, reflecting diverse needs for comprehensive security solutions.

Data Center Logical Security Market Analysis By Technology

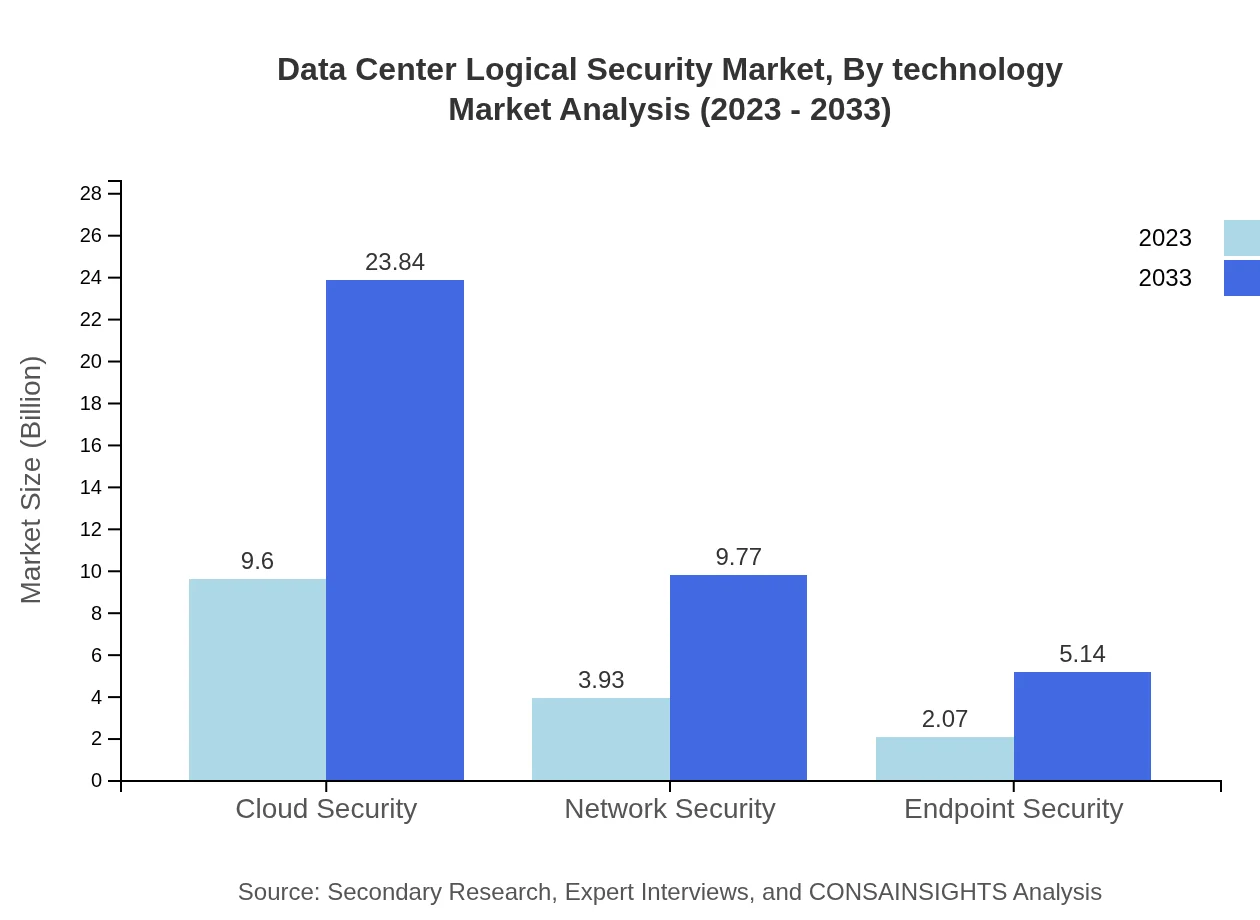

Technologically, the Data Center Logical Security market is significantly influenced by advancements in AI and machine learning. These technologies enhance threat detection and preemptive measures. Additionally, the increasing implementation of identity and access management solutions is reshaping the landscape, with investments directed towards intelligent security protocols capable of evolving with new threat vectors.

Data Center Logical Security Market Analysis By Deployment Model

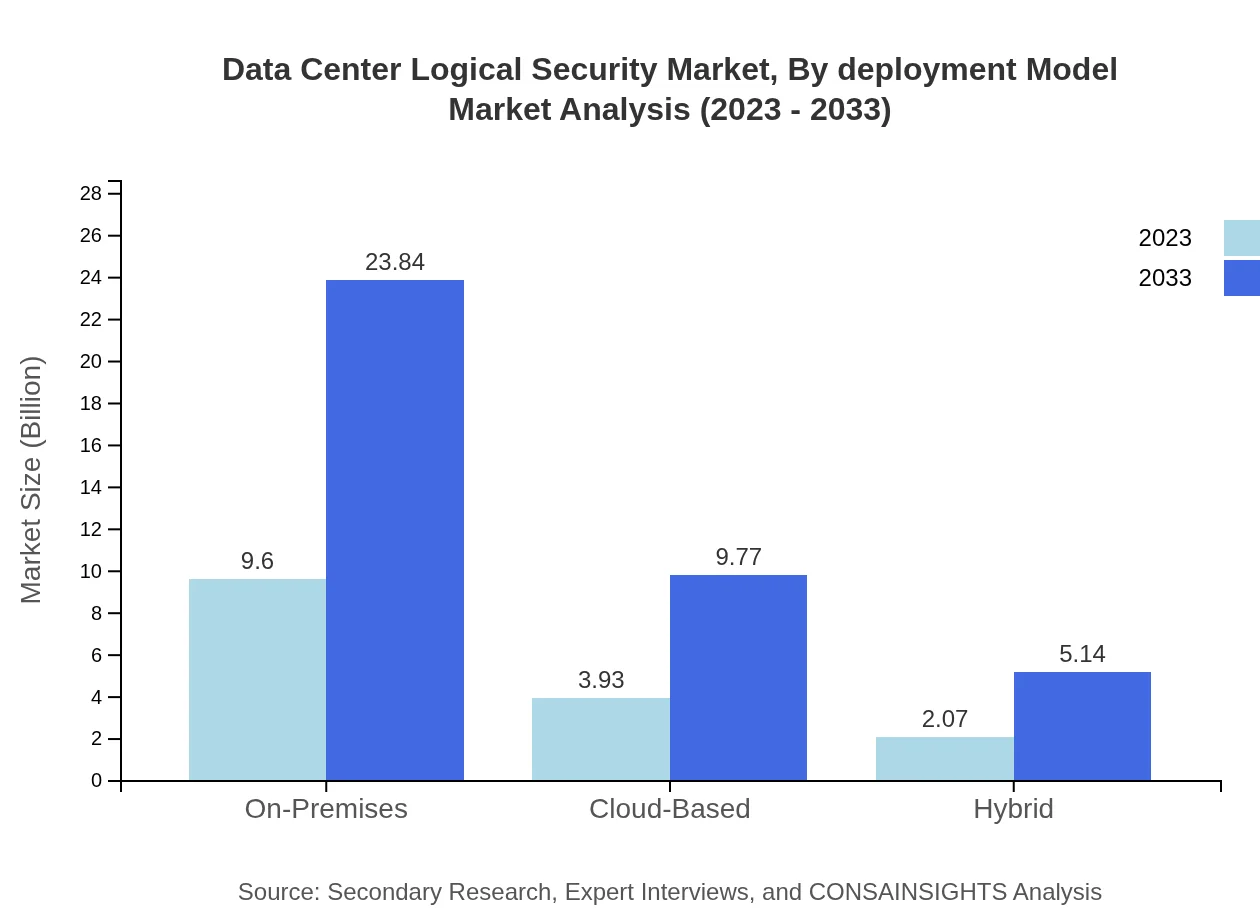

When categorized by deployment model, On-Premises solutions occupy a significant market share, yet Cloud-Based security is rapidly gaining traction due to the rise of remote architectures. The Hybrid deployment model is also becoming more appealing to organizations aiming for flexible solutions that incorporate both on-premises and cloud technologies.

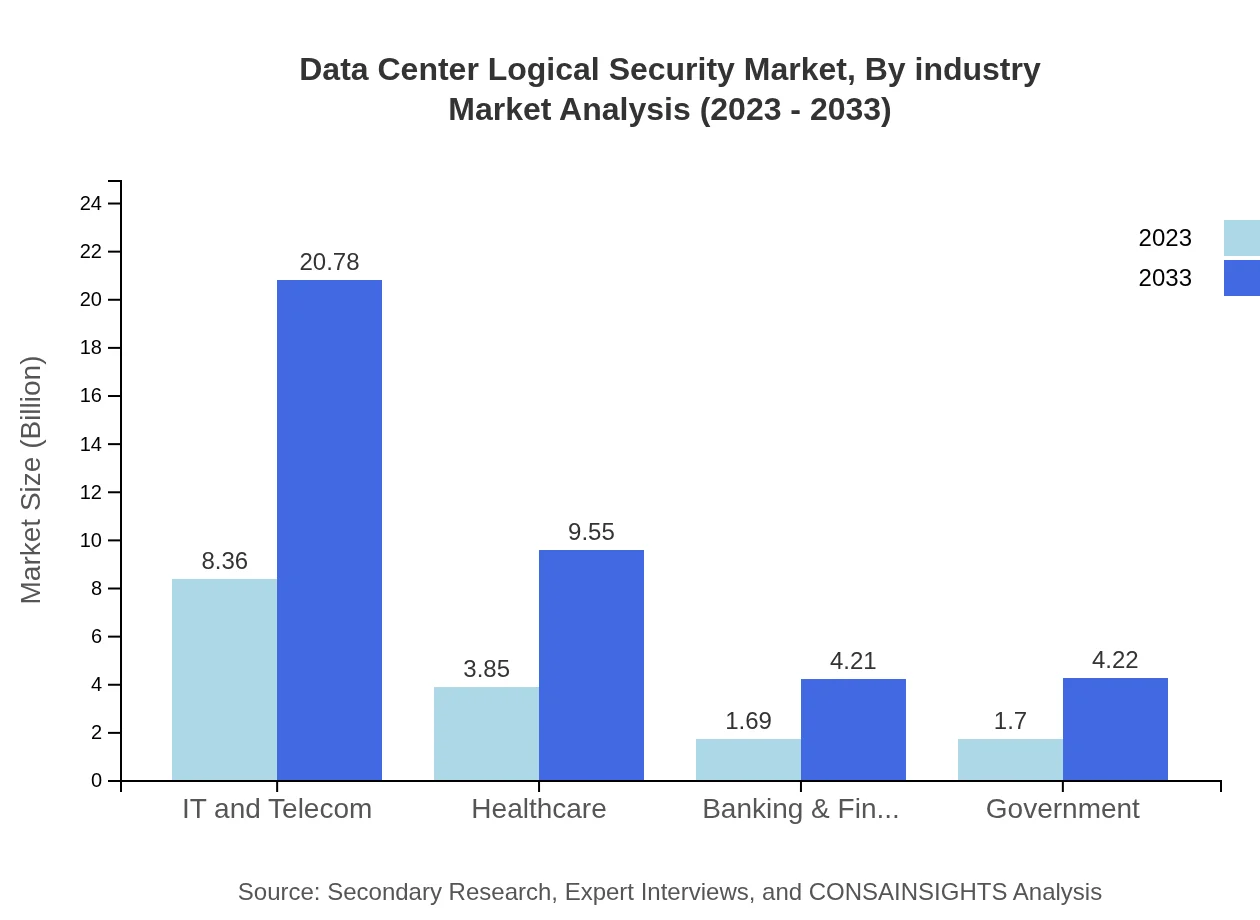

Data Center Logical Security Market Analysis By Industry

Industries such as IT and Telecom lead the market with a size of $8.36 billion (53.61% share) in 2023, projected to reach $20.78 billion by 2033. The Healthcare sector is also noteworthy, with increased investments in security measures due to sensitive data handling, expected to grow from $3.85 billion to $9.55 billion in the same period.

Data Center Logical Security Market Analysis By Security Type

By security type, the market encompasses various domains including Network Security and Endpoint Security. Network Security is projected to grow from $3.93 billion in 2023 to $9.77 billion by 2033, while Endpoint Security is also seeing significant growth, driven by the need for comprehensive protection across all endpoints within an organization.

Data Center Logical Security Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Data Center Logical Security Industry

Cisco Systems, Inc.:

Cisco is a global leader in IT, networking, and cybersecurity solutions, offering comprehensive logical security products tailored for data centers.Palo Alto Networks, Inc.:

A pioneer in Cybersecurity solutions, Palo Alto Networks develops advanced platforms to secure data center environments across industries.Fortinet, Inc.:

Fortinet specializes in network security solutions that protect data integrity in fast-paced digital environments, widely used in data centers.IBM Corporation:

IBM provides extensive security services and solutions, focusing on holistic data protection and compliance in data center infrastructures.Check Point Software Technologies Ltd.:

Check Point emphasizes cybersecurity innovation to protect enterprises with advanced security solutions tailored for data centers.We're grateful to work with incredible clients.

FAQs

What is the market size of Data Center Logical Security?

The Data Center Logical Security market is valued at approximately $15.6 billion in 2023, with an expected compound annual growth rate (CAGR) of 9.2% leading up to 2033.

What are the key market players or companies in the Data Center Logical Security industry?

Key players in the Data Center Logical Security industry include major technology firms specializing in security solutions, including companies such as Cisco, IBM, and Fortinet. These companies are recognized for their advancements in cyber security, particularly in data protection.

What are the primary factors driving the growth in the Data Center Logical Security industry?

Primary growth factors include the rising incidence of cyber threats, increased regulatory compliance requirements, and expanding cloud services adoption. Organizations are prioritizing logical security to safeguarded their data and strengthen their overall security protocols.

Which region is the fastest Growing in the Data Center Logical Security market?

The fastest-growing region in the Data Center Logical Security market is North America, with the market projected to expand from $5.49 billion in 2023 to $13.64 billion by 2033, demonstrating a robust demand for advanced security solutions.

Does ConsaInsights provide customized market report data for the Data Center Logical Security industry?

Yes, ConsaInsights provides customized market report data tailored to specific needs in the Data Center Logical Security industry. Clients can expect granular insights to inform their strategic decisions based on unique market dynamics.

What deliverables can I expect from this Data Center Logical Security market research project?

Deliverables include detailed market analysis reports, segmentation data, forecasts, and insights into competitive landscapes. Customized presentations and consultations can also be expected to aid in decision-making processes.

What are the market trends of Data Center Logical Security?

Current market trends include increased investment in cloud and hybrid security solutions, adoption of AI and machine learning technologies for threat detection, and a growing focus on compliance-driven security measures across various sectors.