Data Center Market Report

Published Date: 31 January 2026 | Report Code: data-center

Data Center Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Data Center market, covering key insights on market trends, forecast data from 2023 to 2033, and regional performances, aimed at helping stakeholders make informed decisions.

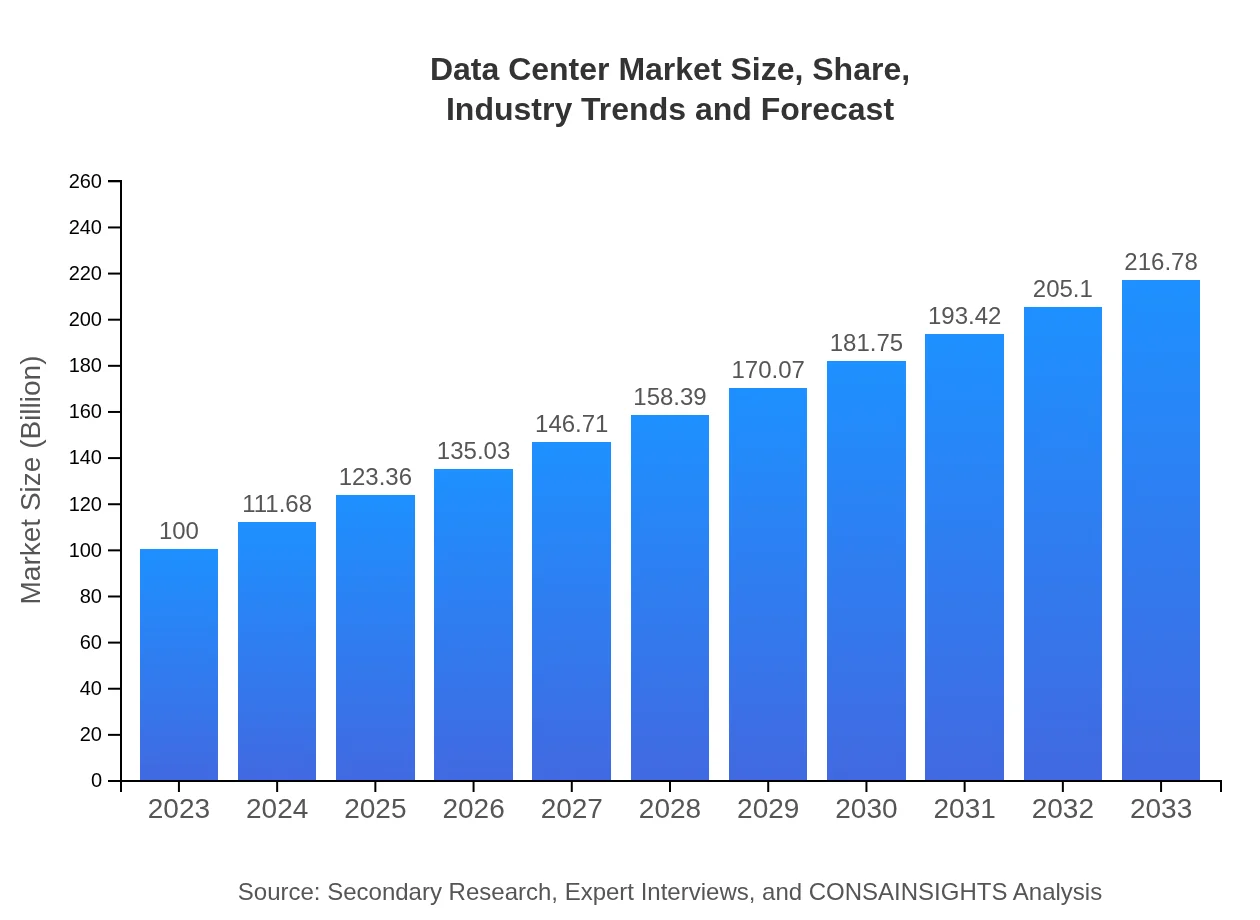

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $216.78 Billion |

| Top Companies | Amazon Web Services (AWS), Microsoft Azure, IBM, Google Cloud Platform, Alibaba Cloud |

| Last Modified Date | 31 January 2026 |

Data Center Market Overview

Customize Data Center Market Report market research report

- ✔ Get in-depth analysis of Data Center market size, growth, and forecasts.

- ✔ Understand Data Center's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Data Center

What is the Market Size & CAGR of Data Center market in 2023 and 2033?

Data Center Industry Analysis

Data Center Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Data Center Market Analysis Report by Region

Europe Data Center Market Report:

In Europe, the market is anticipated to grow from $28.65 billion in 2023 to $62.11 billion in 2033. The region's focus on digital transformation and regulatory compliance ensures that data centers are integral to business operations. Significant initiatives toward increasing energy efficiency and sustainability are also prominent drivers in this region.Asia Pacific Data Center Market Report:

The Asia Pacific region is projected to grow from $19.73 billion in 2023 to $42.77 billion by 2033. The rise of emerging economies and increasing internet penetration rates are contributing to this rapid growth. Countries such as China, India, and Japan are investing heavily in data center expansions and cloud services, which are vital for sustaining regional competitiveness.North America Data Center Market Report:

North America remains a dominant player, with market values increasing from $35.67 billion in 2023 to a projected $77.33 billion by 2033. The presence of major data center operators in the USA, alongside significant investments in cloud infrastructure and advanced technologies, have solidified the region's leading position.South America Data Center Market Report:

In South America, the Data Center market is expected to increase from $5.84 billion in 2023 to $12.66 billion by 2033. Factors influencing this growth include a rising demand for data management solutions and cloud services, driven mainly by the expanding digital economy and increasing internet service accessibility across the region.Middle East & Africa Data Center Market Report:

The Middle East and Africa will witness growth from $10.11 billion in 2023 to $21.92 billion by 2033. Investment in data center infrastructure in various countries, driven by regional governments promoting technology initiatives and digitization, is enhancing the economic outlook in this sector.Tell us your focus area and get a customized research report.

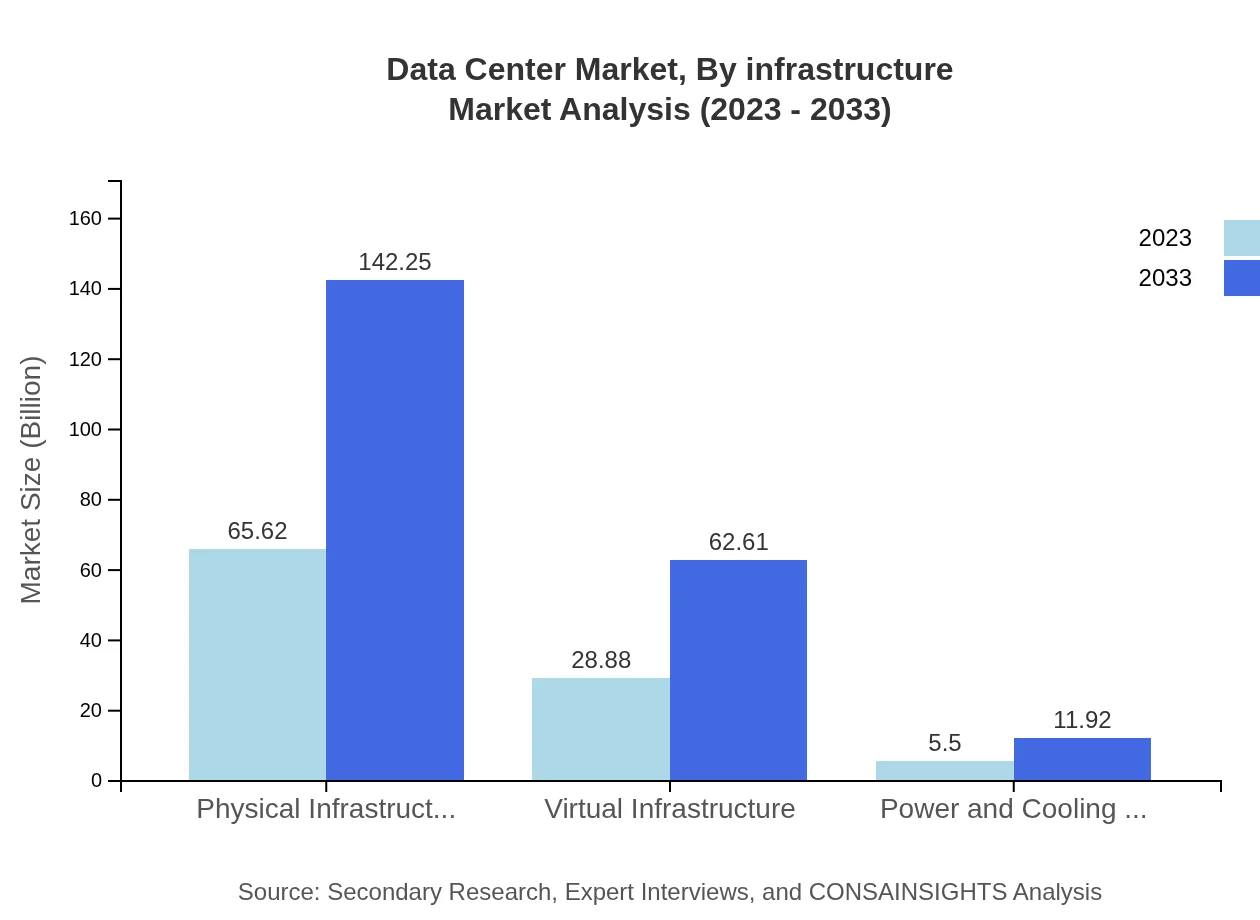

Data Center Market Analysis By Infrastructure

In 2023, the infrastructure segment is valued at $65.62 billion and is forecasted to reach $142.25 billion by 2033. This segment includes physical and virtual infrastructure, indicating the foundational role of hardware and software in maintaining operational capabilities.

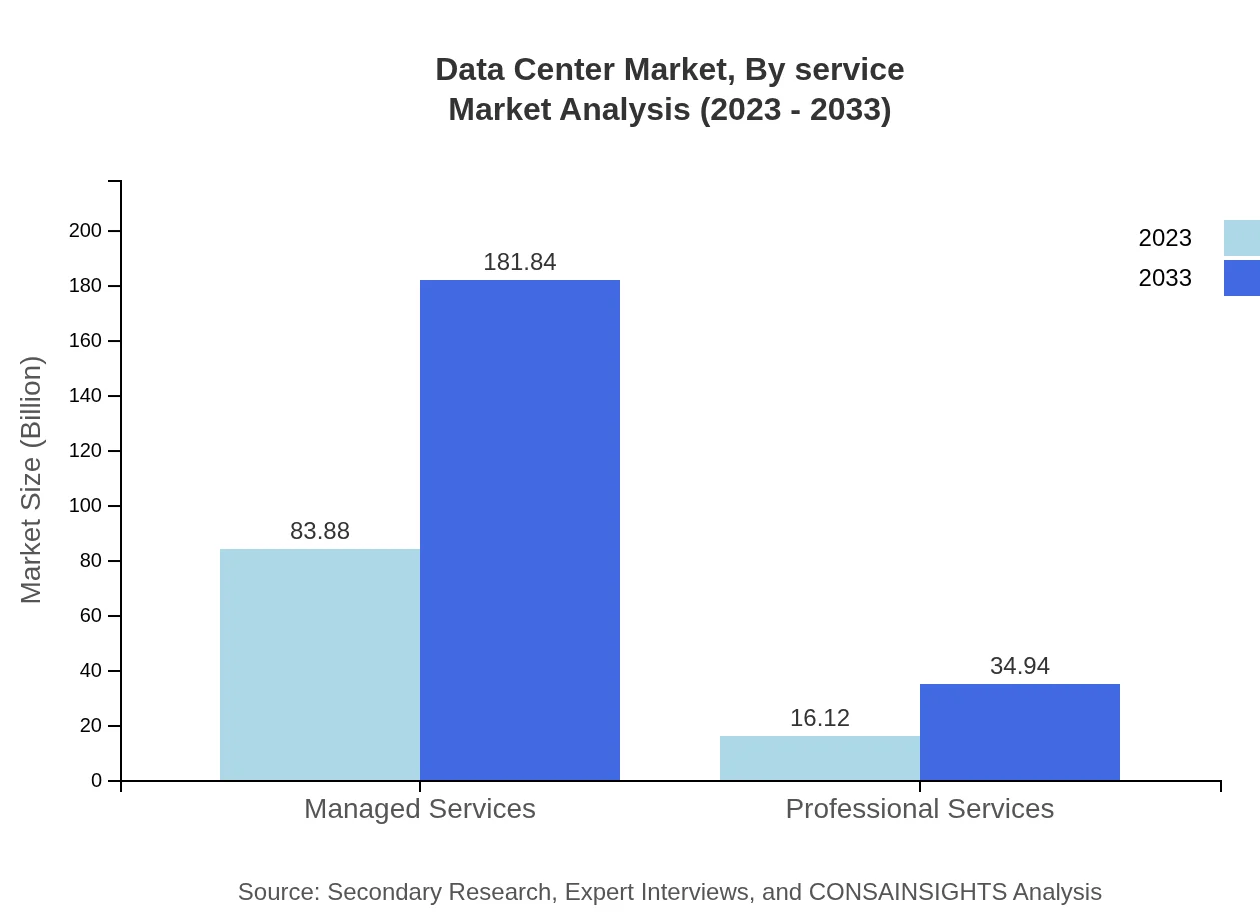

Data Center Market Analysis By Service

Managed services, with an initial market size of $83.88 billion in 2023, are projected to nearly double by 2033, reflecting the rising emphasis on outsourcing data center management to address complex IT requirements and compliance needs.

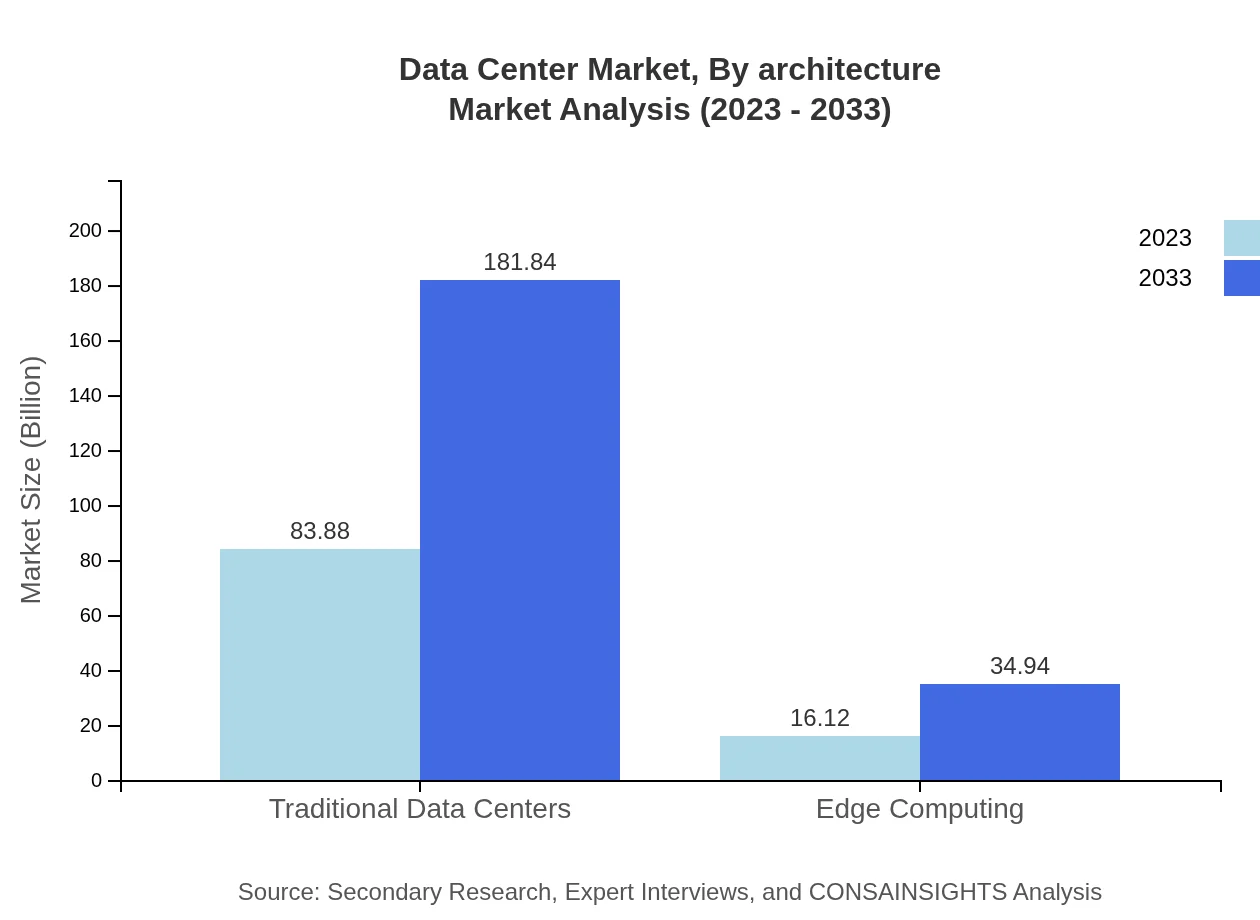

Data Center Market Analysis By Architecture

The architecture segment, inclusive of traditional data centers and edge computing frameworks, shows burgeoning significance. Traditional data centers accounted for $83.88 billion in 2023, while edge computing is also gaining momentum with growth from $16.12 billion to $34.94 billion by 2033.

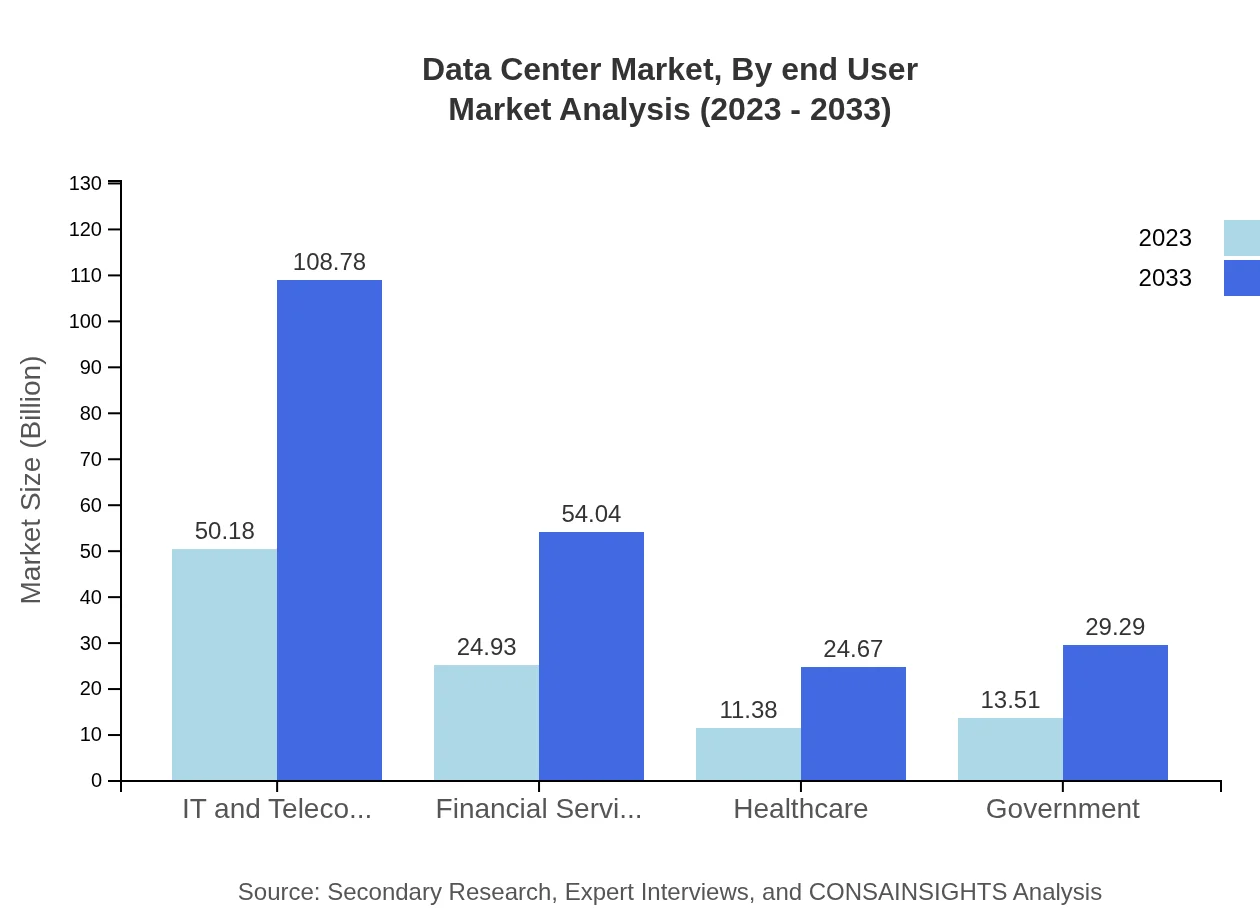

Data Center Market Analysis By End User

The financial services sector leads with a market size of $24.93 billion in 2023, expected to grow to $54.04 billion by 2033. This trend underscores the critical nature of data security and management in financial transactions.

Data Center Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Data Center Industry

Amazon Web Services (AWS):

AWS is a pioneer in cloud services, offering vast data storage solutions and computing power alongside an extensive network of data centers globally.Microsoft Azure:

Microsoft Azure provides a comprehensive cloud computing service, with a vast footprint of data centers ensuring high performance and scalability for enterprise solutions.IBM:

IBM provides integrated data center services, focusing on innovative technology and cloud solutions to drive business efficiency and agility.Google Cloud Platform:

Google Cloud delivers cutting-edge data center technology, specializing in advanced analytics, machine learning, and high-performance computing.Alibaba Cloud:

Alibaba Cloud serves a robust market in Asia, offering diverse data center infrastructure and services to support digital transformation across industries.We're grateful to work with incredible clients.

FAQs

What is the market size of Data Center?

The global data center market is valued at approximately $100 billion in 2023, with a projected CAGR of 7.8% from 2023 to 2033, indicating significant growth in the industry over the next decade.

What are the key market players or companies in this data center industry?

Key market players include companies like Amazon Web Services, Microsoft Azure, Google Cloud, IBM, and Alibaba Cloud, which dominate the cloud services segment and significantly influence data center infrastructure development.

What are the primary factors driving the growth in the data center industry?

Key growth drivers include increased data consumption, the rise of cloud computing, the need for data storage and processing, the expansion of IoT, and the increasing focus on energy-efficient technologies.

Which region is the fastest Growing in the data center?

North America is witnessing rapid growth, with market expansion from $35.67 billion in 2023 to $77.33 billion by 2033, driven by technology advancements and demand for cloud solutions.

Does ConsaInsights provide customized market report data for the data center industry?

Yes, ConsaInsights offers tailored market research reports designed to meet specific client needs, providing in-depth analysis and insights relevant to the data center industry.

What deliverables can I expect from this data center market research project?

Deliverables typically include comprehensive reports, market forecasts, segmentation analysis, competitor insights, and strategic recommendations to inform business decision-making in the data center sector.

What are the market trends of data center?

Trends include the shift towards edge computing, increased investment in energy-efficient data centers, growth in managed services, and the adoption of advanced cooling technologies for optimal performance.