Data Center Networking Market Report

Published Date: 31 January 2026 | Report Code: data-center-networking

Data Center Networking Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Data Center Networking market, including market trends, size, segmentation, industry analysis, and regional insights, covering the forecast period from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

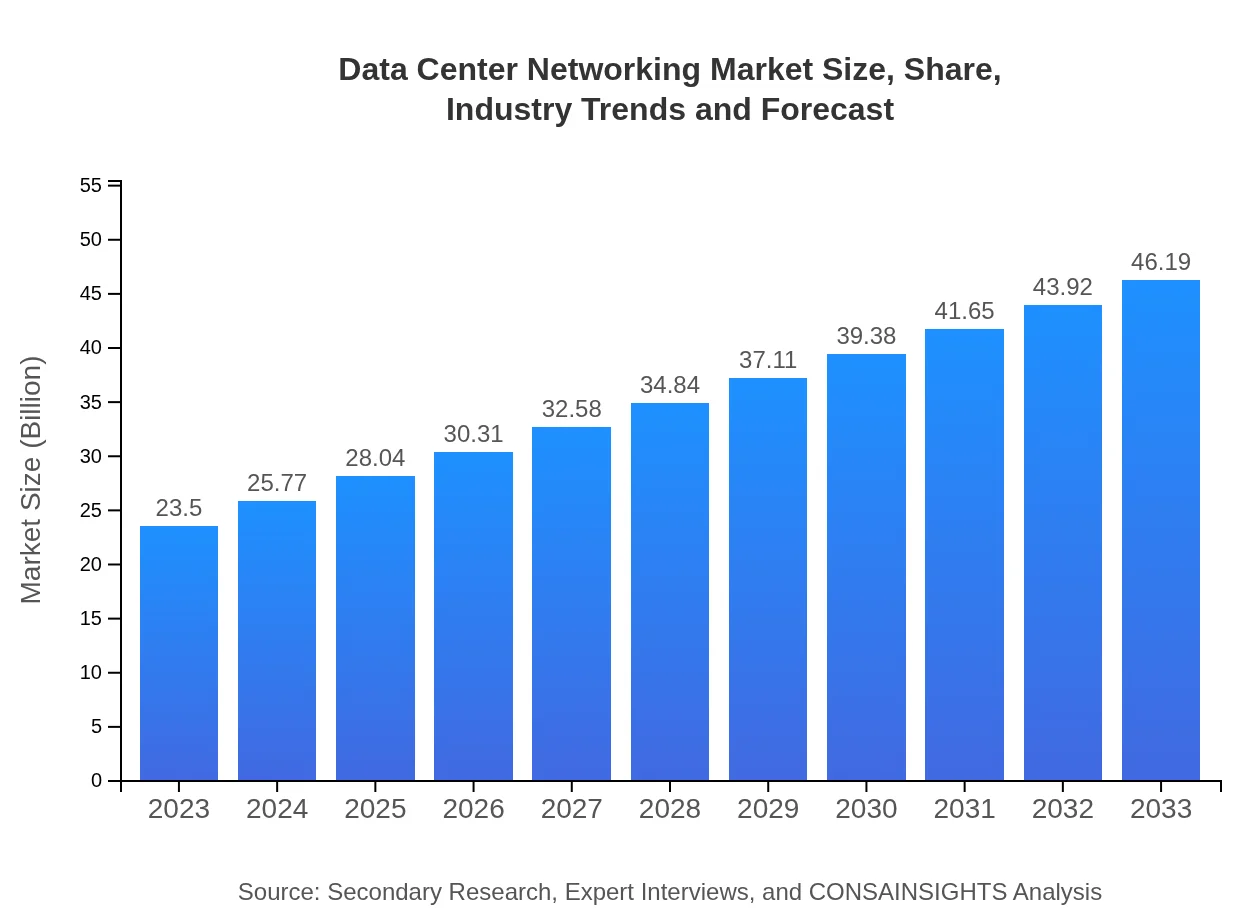

| 2023 Market Size | $23.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $46.19 Billion |

| Top Companies | Cisco Systems, Inc., Arista Networks, Inc., Juniper Networks, Inc. |

| Last Modified Date | 31 January 2026 |

Data Center Networking Market Overview

Customize Data Center Networking Market Report market research report

- ✔ Get in-depth analysis of Data Center Networking market size, growth, and forecasts.

- ✔ Understand Data Center Networking's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Data Center Networking

What is the Market Size & CAGR of the Data Center Networking market in 2023 and 2033?

Data Center Networking Industry Analysis

Data Center Networking Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Data Center Networking Market Analysis Report by Region

Europe Data Center Networking Market Report:

The European Data Center Networking market recorded a size of $5.74 billion in 2023, anticipated to reach $11.28 billion by 2033. Factors driving this growth include increasing demand for data security regulations and the rise in cloud service providers.Asia Pacific Data Center Networking Market Report:

In 2023, the Asia Pacific Data Center Networking market was valued at $4.70 billion and is projected to grow to approximately $9.23 billion by 2033. This region's growth is fueled by rising data center investments, increased adoption of cloud computing, and the expansion of telecommunication networks.North America Data Center Networking Market Report:

North America houses the largest data center networking market, valued at $8.30 billion in 2023 and predicted to grow to $16.31 billion by 2033. The region is a leader in cloud adoption and digital innovation, significantly impacting the demand for advanced networking solutions.South America Data Center Networking Market Report:

The South American market, valued at $2.26 billion in 2023, is expected to reach $4.45 billion by 2033. Growth is driven by digital transformation initiatives among enterprises and escalating demands for enhanced connectivity.Middle East & Africa Data Center Networking Market Report:

In the Middle East and Africa, the market stood at $2.50 billion in 2023 and is expected to grow to $4.91 billion by 2033. Growth is attributed to rising internet penetration and investments in digital infrastructure.Tell us your focus area and get a customized research report.

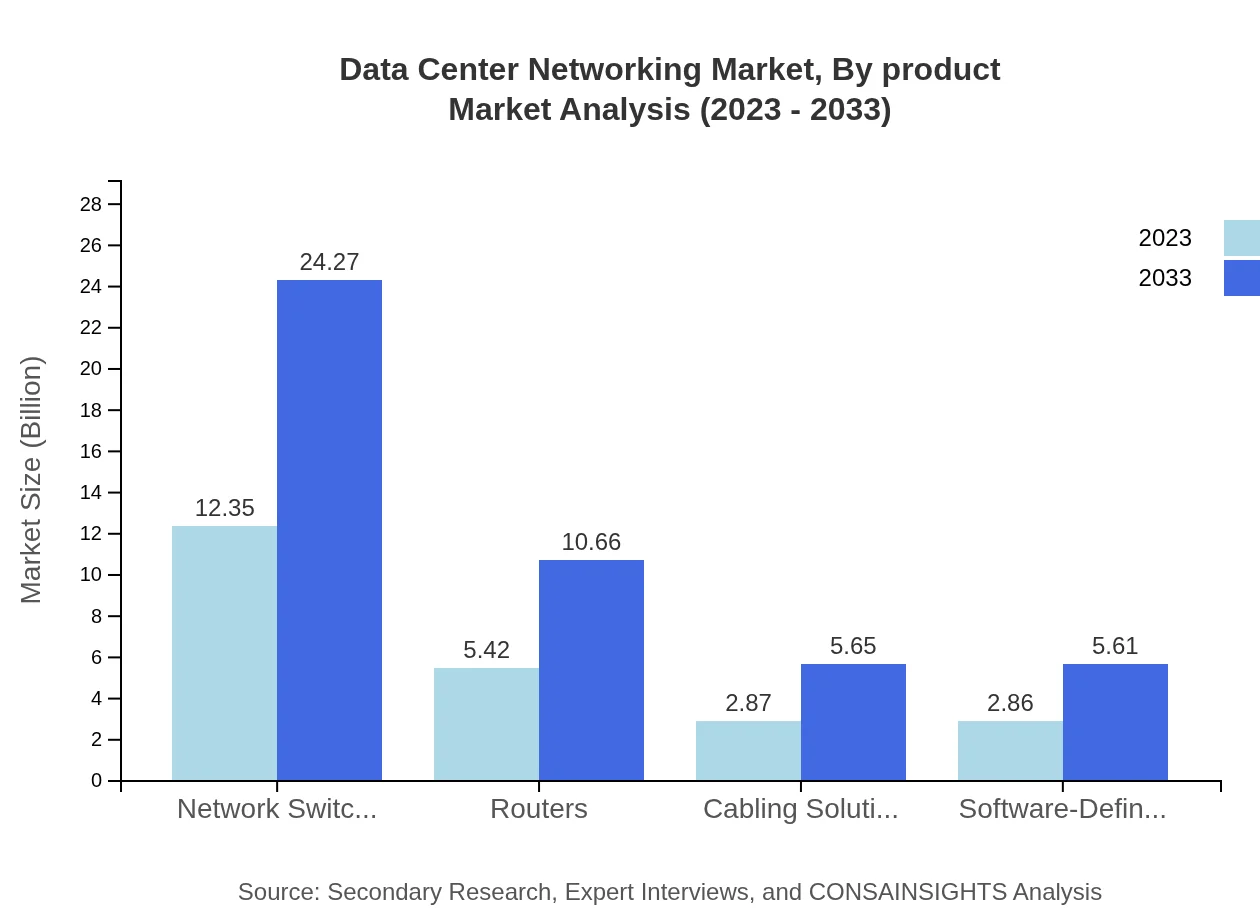

Data Center Networking Market Analysis By Product

In 2023, network switches dominated the market with a valuation of $12.35 billion, projected to reach $24.27 billion by 2033, maintaining a market share of 52.54%. Routers followed with $5.42 billion and are expected to grow to $10.66 billion at a 23.08% share. Cabling solutions and Software-Defined Networking (SDN) also represent significant product categories, indicating a strong market diversification.

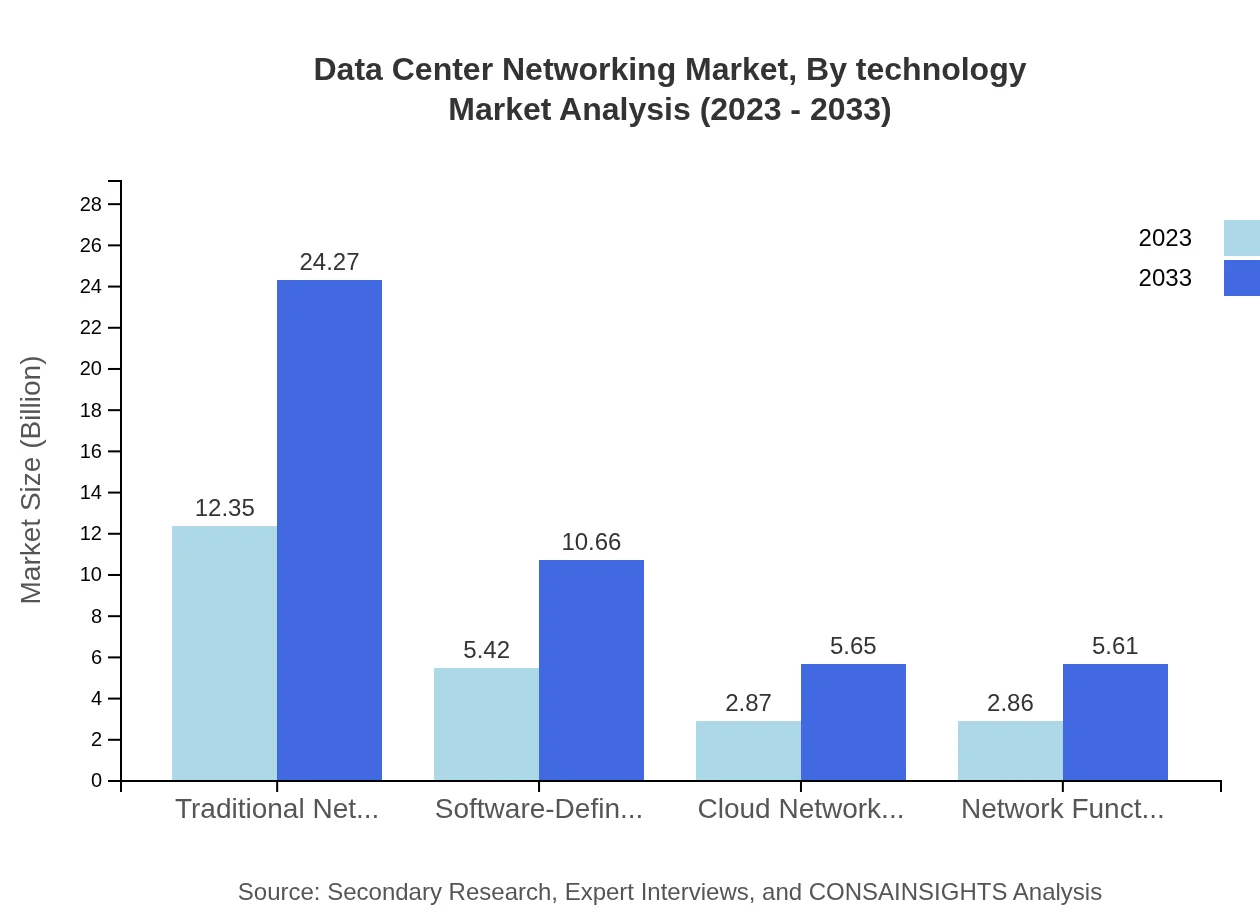

Data Center Networking Market Analysis By Technology

Technological advancements, especially in SDN and NFV, are reshaping the Data Center Networking landscape. SDN is expected to grow from $2.86 billion in 2023 to $5.61 billion by 2033, representing an essential shift toward more programmable networks. Similarly, Cloud Networking and Network Functions Virtualization are gaining traction as businesses seek improved efficiency and scalability.

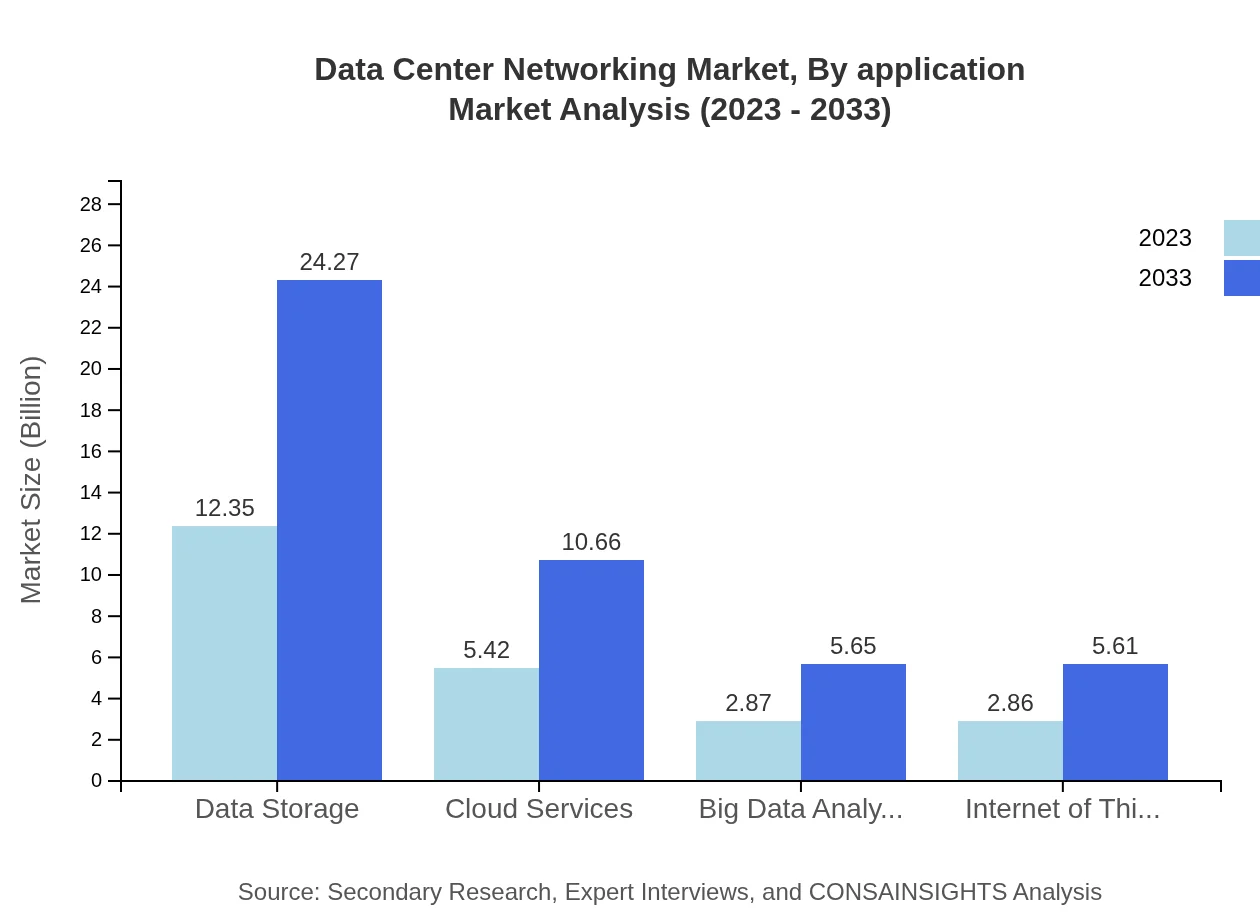

Data Center Networking Market Analysis By Application

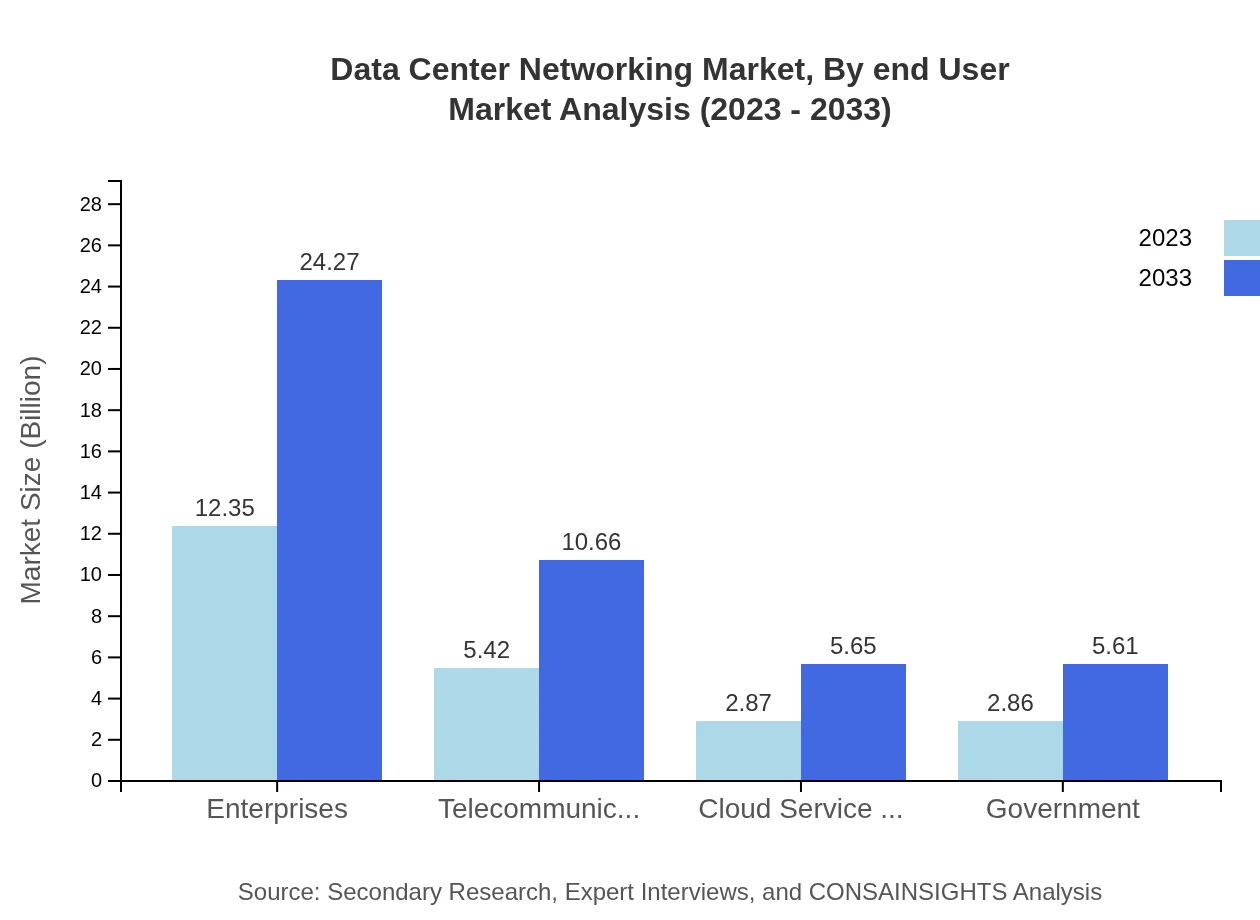

The enterprise segment is crucial, projected to dominate with a market size of $12.35 billion in 2023 and a growth to $24.27 billion by 2033. Telecommunications companies also play a vital role, valued at $5.42 billion, highlighting the widespread application of data networking across various sectors.

Data Center Networking Market Analysis By End User

The enterprise sector, encompassing both small and large organizations, represents a considerable market share in Data Center Networking, while government institutions increasingly utilize advanced networking solutions for enhanced security and data management.

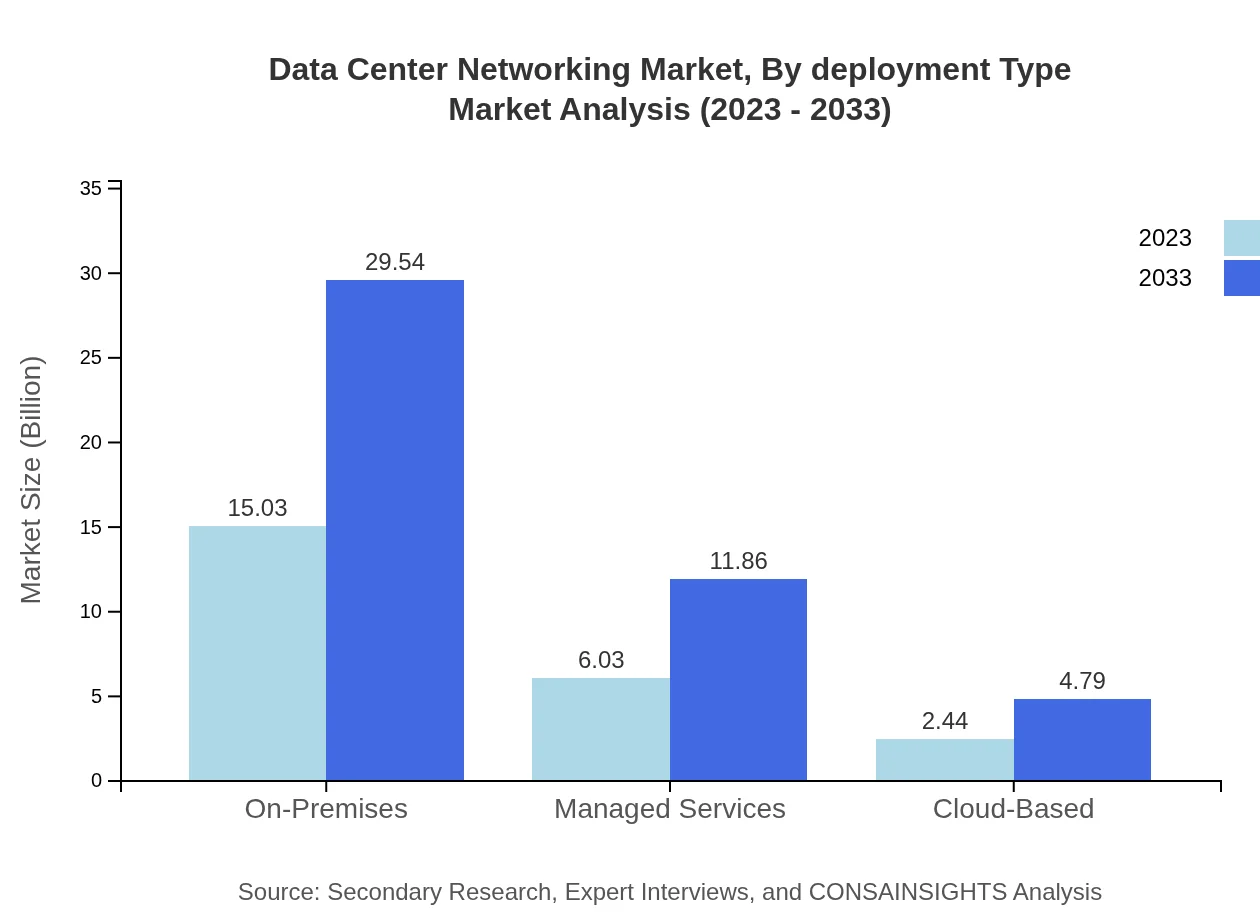

Data Center Networking Market Analysis By Deployment Type

On-premises solutions continue to be favored, capturing a significant market share with $15.03 billion in 2023, expected to rise to $29.54 billion by 2033. However, cloud-based and managed services are rapidly growing segments, reflecting the shift toward flexible and scalable networking solutions.

Data Center Networking Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in the Data Center Networking Industry

Cisco Systems, Inc.:

A global leader in networking solutions, Cisco designs, manufactures, and sells networking hardware, software, and telecommunications equipment.Arista Networks, Inc.:

Specializes in developing cloud networking solutions and is known for its high-performance networking products essential to data centers.Juniper Networks, Inc.:

Provides high-performance networking and cybersecurity solutions, helping organizations connect, secure, and automate their data networks.We're grateful to work with incredible clients.

FAQs

What is the market size of data Center Networking?

The global data-center-networking market is expected to grow from $23.5 billion in 2023 at a CAGR of 6.8%. By 2033, the market size is projected to significantly increase, reflecting ongoing advancements and adoption in networking technologies.

What are the key market players or companies in this data Center Networking industry?

Key players in the data-center-networking industry include Cisco Systems, Arista Networks, Juniper Networks, and Hewlett Packard Enterprise. These companies contribute to a robust competitive landscape, driving innovation and shaping market trends.

What are the primary factors driving the growth in the data Center Networking industry?

Driving factors include the increasing demand for cloud services and data storage solutions, the rise of IoT devices, and the need for enhanced network performance and security. These trends spur businesses to invest heavily in cutting-edge networking solutions.

Which region is the fastest Growing in the data Center Networking?

North America stands out as the fastest-growing region, with market projections of $8.30 billion in 2023, expected to rise to $16.31 billion by 2033. Europe and Asia-Pacific also show significant growth, indicating regional investment in networking technologies.

Does ConsaInsights provide customized market report data for the data Center Networking industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the data-center-networking industry. This service allows clients to obtain insights that align strategically with their unique operational objectives.

What deliverables can I expect from this data Center Networking market research project?

Deliverables include comprehensive market analysis reports, trend insights, competitive landscape assessments, and regional forecasts. Each report is structured to provide actionable insights that support strategic decision-making for stakeholders.

What are the market trends of data Center Networking?

Current market trends include a shift towards software-defined networking (SDN), an increasing adoption of cloud services, and innovations in network virtualization. These trends are reshaping traditional networking to optimize performance and scalability.