Data Center Power Market Report

Published Date: 31 January 2026 | Report Code: data-center-power

Data Center Power Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Data Center Power market from 2023 to 2033, offering insights into market trends, sizes, segmentations, and regional dynamics that shape this fast-evolving industry.

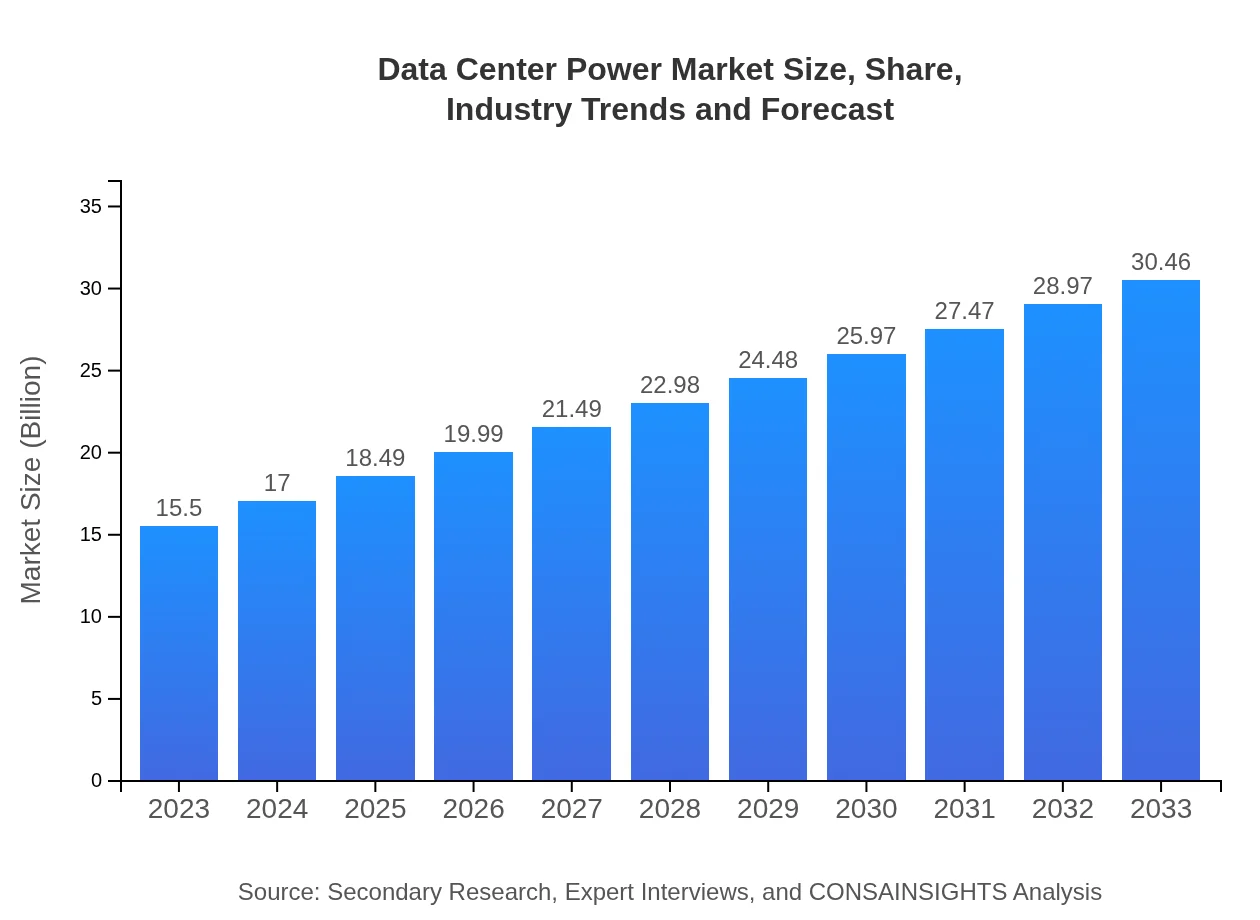

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $30.46 Billion |

| Top Companies | Schneider Electric, Eaton Corporation, Vertiv Holdings, Siemens AG |

| Last Modified Date | 31 January 2026 |

Data Center Power Market Overview

Customize Data Center Power Market Report market research report

- ✔ Get in-depth analysis of Data Center Power market size, growth, and forecasts.

- ✔ Understand Data Center Power's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Data Center Power

What is the Market Size & CAGR of Data Center Power market in 2023?

Data Center Power Industry Analysis

Data Center Power Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Data Center Power Market Analysis Report by Region

Europe Data Center Power Market Report:

In Europe, the market is anticipated to grow from $4.70 billion in 2023 to $9.24 billion by 2033. Stringent regulations regarding energy efficiency and sustainability drive investments in advanced power management solutions across leading economies such as Germany, France, and the UK.Asia Pacific Data Center Power Market Report:

In 2023, the Data Center Power market in Asia Pacific is valued at $2.86 billion and is projected to reach $5.63 billion by 2033. Rapid digital transformation, increased internet penetration, and expanding cloud services contribute to this growth. Major countries leading the market include China and India, focusing on enhancing their data center capabilities.North America Data Center Power Market Report:

North America holds a significant share of the Data Center Power market, with a valuation of $5.62 billion in 2023, projected to reach $11.05 billion by 2033. The region is home to major tech giants and leading data center operators, boosting demand for enhanced power solutions.South America Data Center Power Market Report:

The South American Data Center Power market is valued at approximately $1.35 billion in 2023 and is expected to reach $2.66 billion by 2033. Growth is driven by increasing IT investments and expanding digital services, particularly in Brazil and Argentina, where data centers are rapidly increasing.Middle East & Africa Data Center Power Market Report:

The Middle East and Africa Data Center Power market stands at $0.96 billion in 2023, potentially reaching $1.89 billion by 2033. The region is progressively improving its data infrastructure capabilities, with substantial investments in technology and energy-efficient systems.Tell us your focus area and get a customized research report.

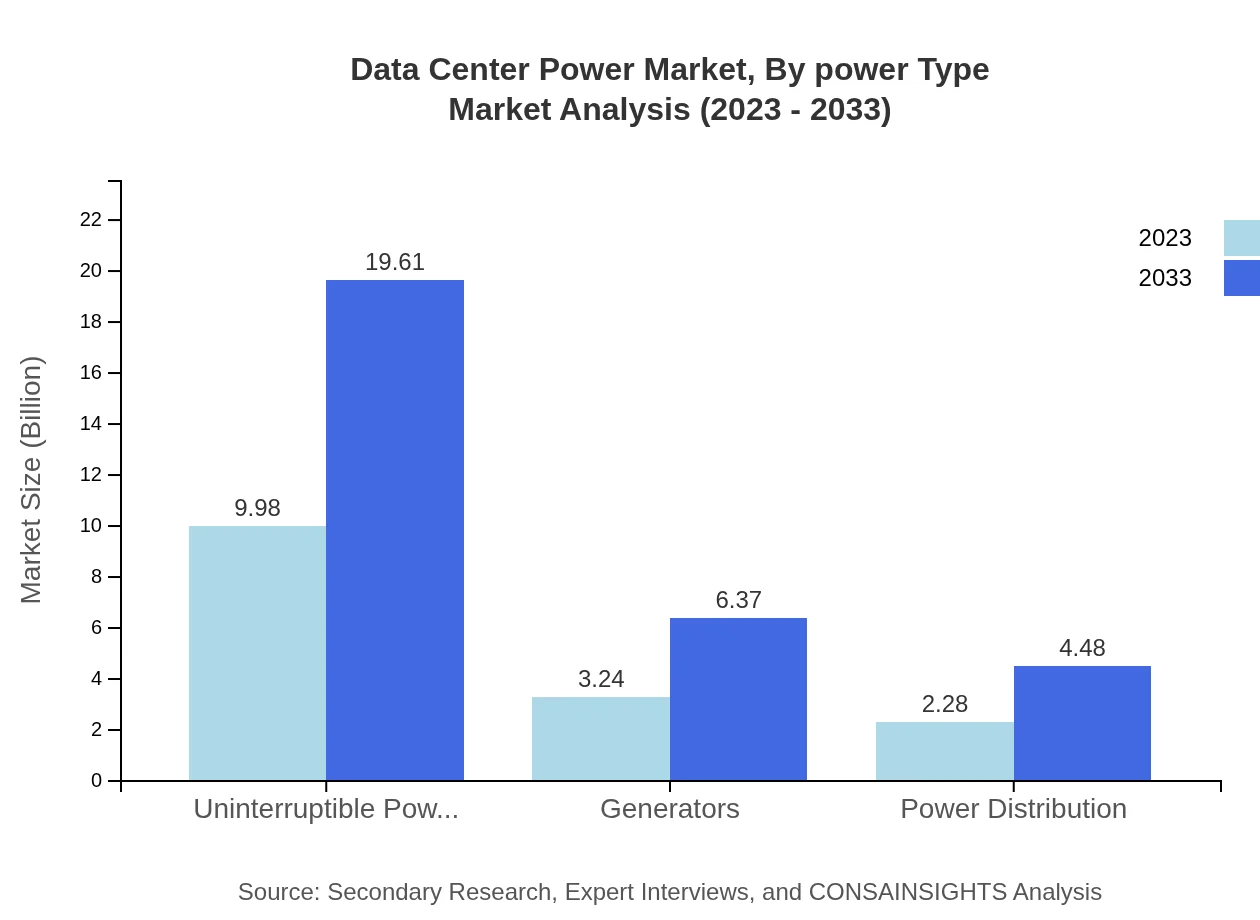

Data Center Power Market Analysis By Power Type

The Data Center Power Market, by power type, comprises DC Power Solutions, which is valued at about $9.98 billion in 2023 and is projected to grow to $19.61 billion by 2033, capturing a significant market share. AC Power Solutions follow with a size of $3.24 billion, expected to rise to $6.37 billion, while Smart Grid Technologies are valued at $2.28 billion and will reach $4.48 billion, reflecting growing integration in power management.

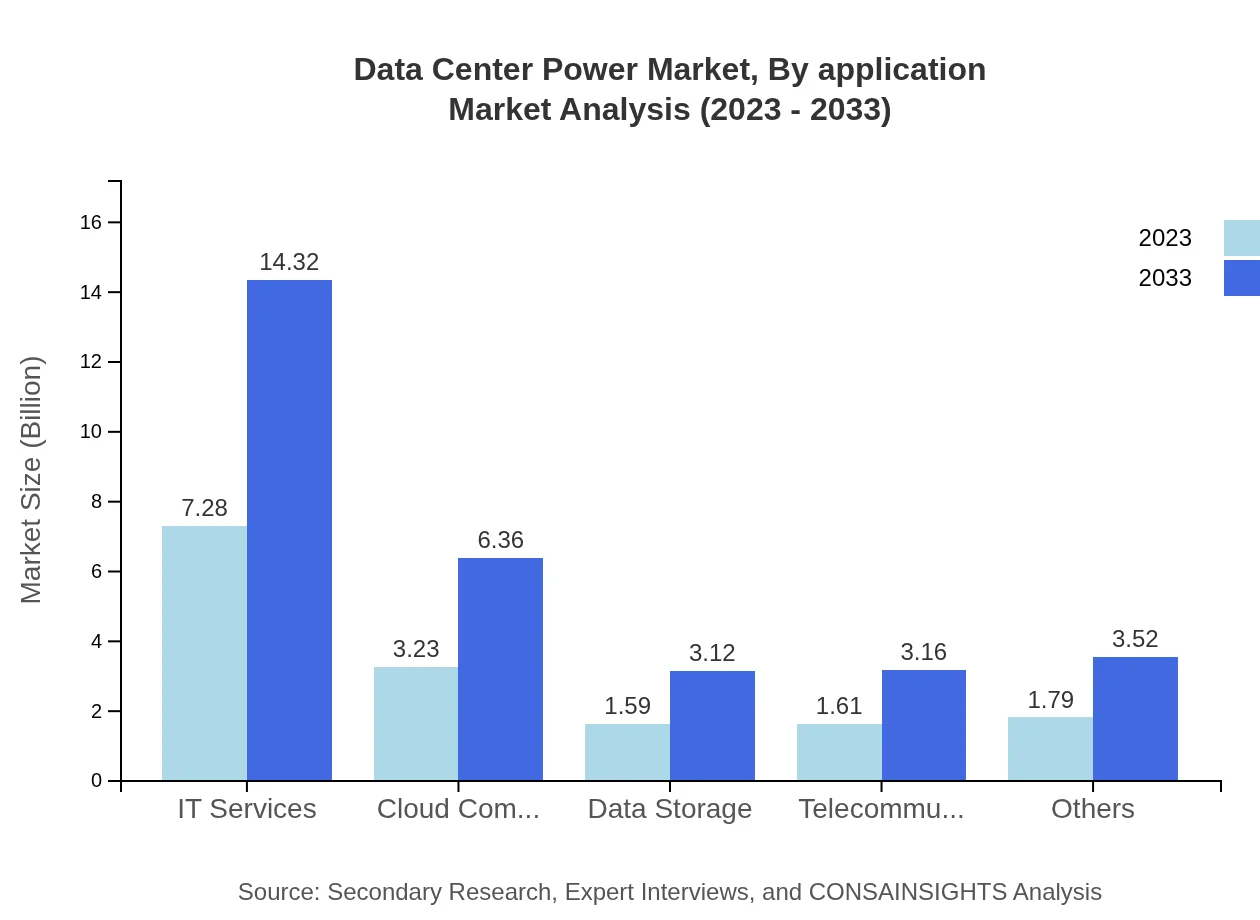

Data Center Power Market Analysis By Application

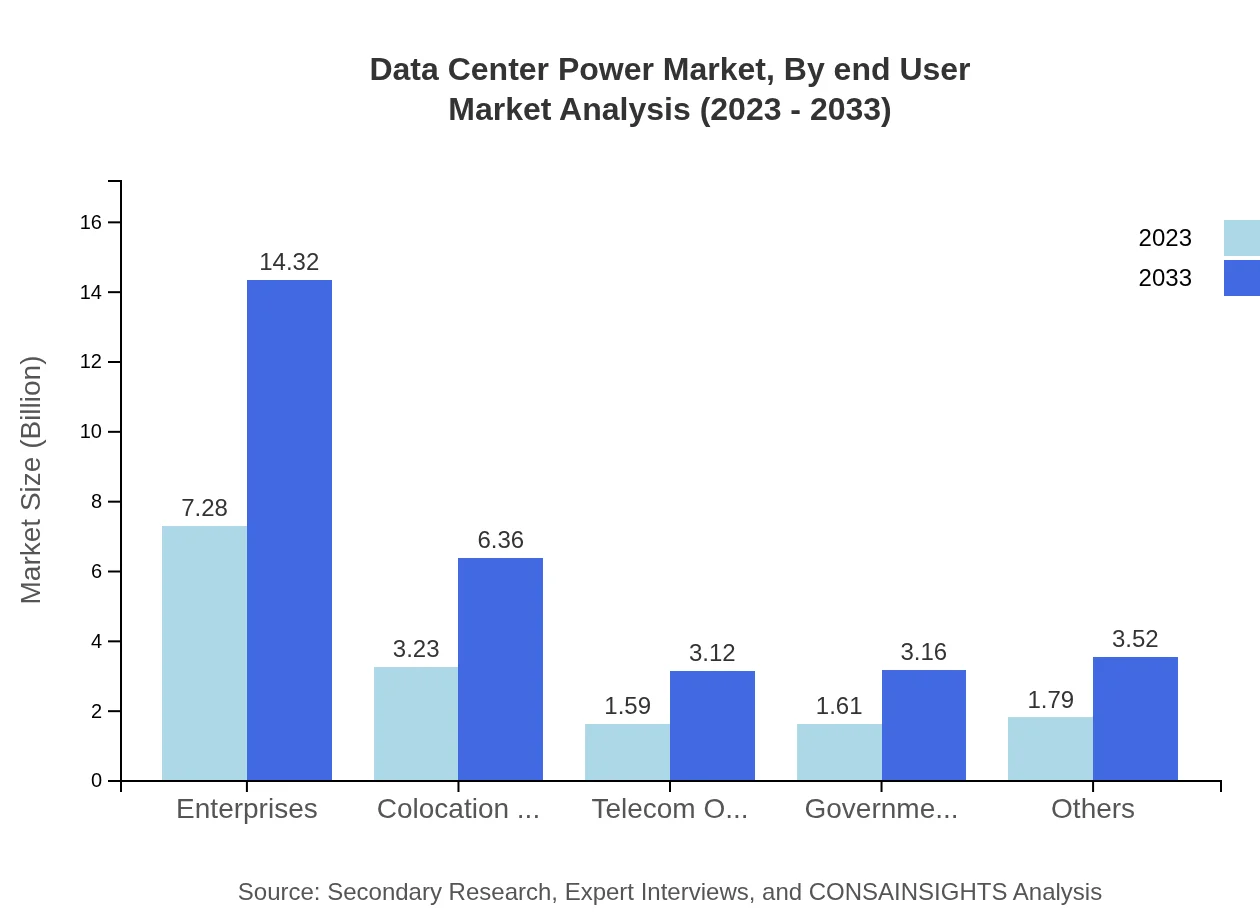

Segmented by application, the Data Center Power Market reveals enterprises as the largest contributor, with a size of $7.28 billion projected to reach $14.32 billion by 2033. Colocation providers follow closely, growing from $3.23 billion in 2023 to $6.36 billion, supported by the increasing demand for hosted solutions. Telecom Operators and Government Organizations also hold considerable market shares.

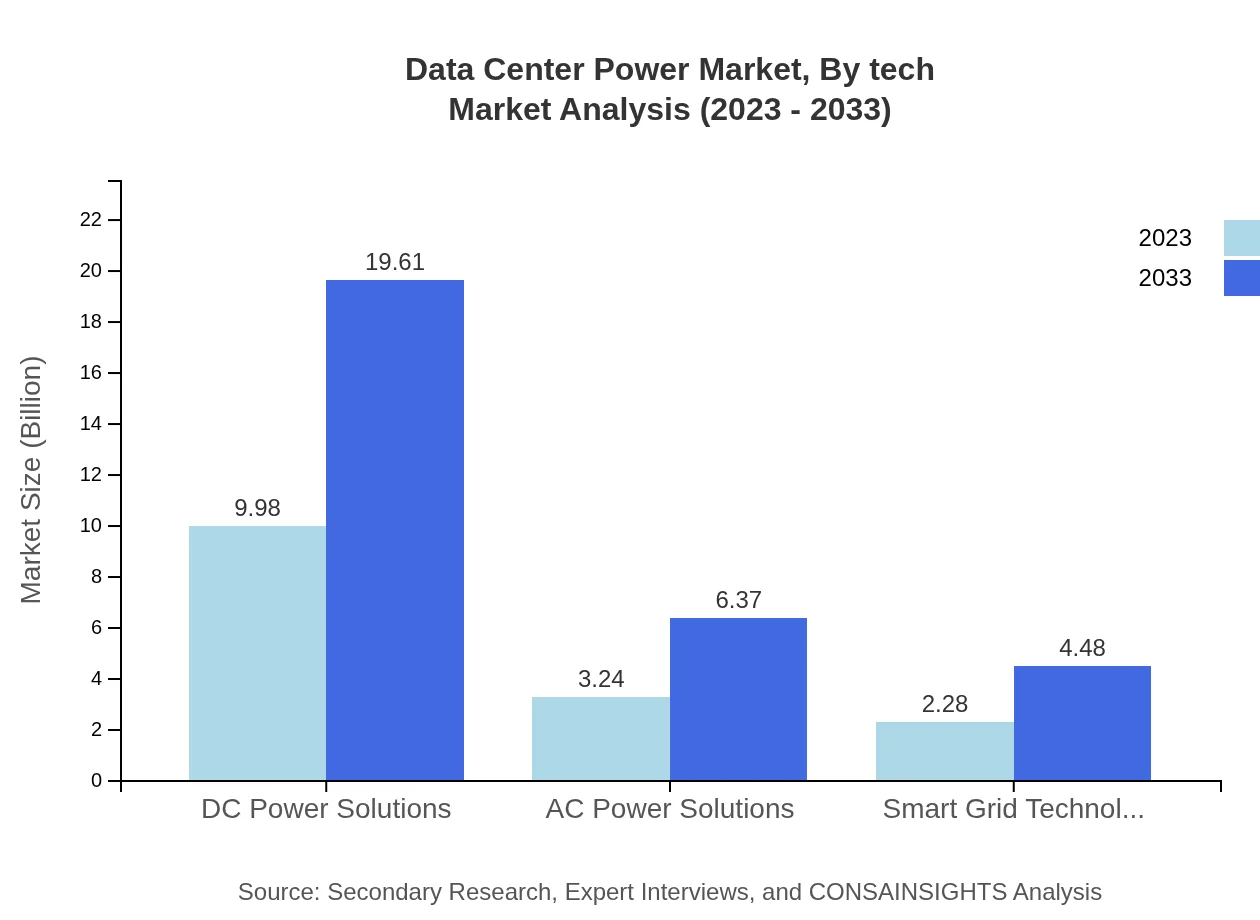

Data Center Power Market Analysis By Tech

Technological advancements and trends influencing the Data Center Power Market include enhanced UPS systems, efficient power distribution methods, and integration of renewable energy technologies. Sustainability is a foremost priority, prompting investments into non-conventional energy sources to reduce carbon footprints significantly.

Data Center Power Market Analysis By End User

In terms of end-user segments, IT Services dominate the market with a share of 47%, driven by the demand for robust computing infrastructures. Cloud Computing, Telecommunications, and other sectors significantly contribute to the market as digital services continually evolve, reinforcing the need for effective power solutions.

Data Center Power Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Data Center Power Industry

Schneider Electric:

A leader in IT infrastructure, Schneider Electric provides innovative energy management and automation solutions, ensuring reliable and sustainable power systems for data centers worldwide.Eaton Corporation:

Eaton Corp is a power management company that delivers energy-efficient solutions to manage electrical, hydraulic, and mechanical power. Their products and services are crucial for data center operations.Vertiv Holdings:

Specializing in critical digital infrastructure and continuity solutions, Vertiv offers innovative power management systems essential for maintaining uptime in data centers.Siemens AG:

Siemens is at the forefront of technology and innovation in the energy sector, providing comprehensive solutions in power distribution and management systems for data centers.We're grateful to work with incredible clients.

FAQs

What is the market size of data Center Power?

The data center power market is valued at $15.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.8%, reaching an estimated market size by 2033, awaiting further data.

What are the key market players or companies in this data Center Power industry?

Key players in the data center power industry include major companies such as Schneider Electric, Eaton Corporation, Vertiv Holdings, and Siemens. These companies are instrumental in providing innovative power solutions to enhance data center efficiency.

What are the primary factors driving the growth in the data Center Power industry?

The growth in the data-center-power industry is driven by increased demand for cloud services, the rise in data consumption, and the need for energy-efficient solutions to manage operational costs in data centers.

Which region is the fastest Growing in the data Center Power?

North America is the fastest-growing region in the data-center-power market, expected to increase from $5.62 billion in 2023 to $11.05 billion by 2033, supported by robust technological advancements and extensive data center infrastructure.

Does ConsaInsights provide customized market report data for the data Center Power industry?

Yes, Consainsights offers customized market report data tailored to the specific needs of clients in the data-center-power industry, ensuring relevant insights that align with business objectives.

What deliverables can I expect from this data Center Power market research project?

Expect comprehensive deliverables including detailed market analysis, growth forecasts, competitive landscape insights, and tailored recommendations based on your unique business requirements in the data-center-power market.

What are the market trends of data Center Power?

Key trends in the data-center-power market include a shift towards DC power solutions, increased investment in renewable energy sources, and growing emphasis on smart grid technology to enhance energy efficiency.