Data Center Rack Market Report

Published Date: 31 January 2026 | Report Code: data-center-rack

Data Center Rack Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Data Center Rack market covering current trends, regional insights, market segmentation, and the competitive landscape. It includes market forecasts from 2023 to 2033, offering valuable data for industry stakeholders.

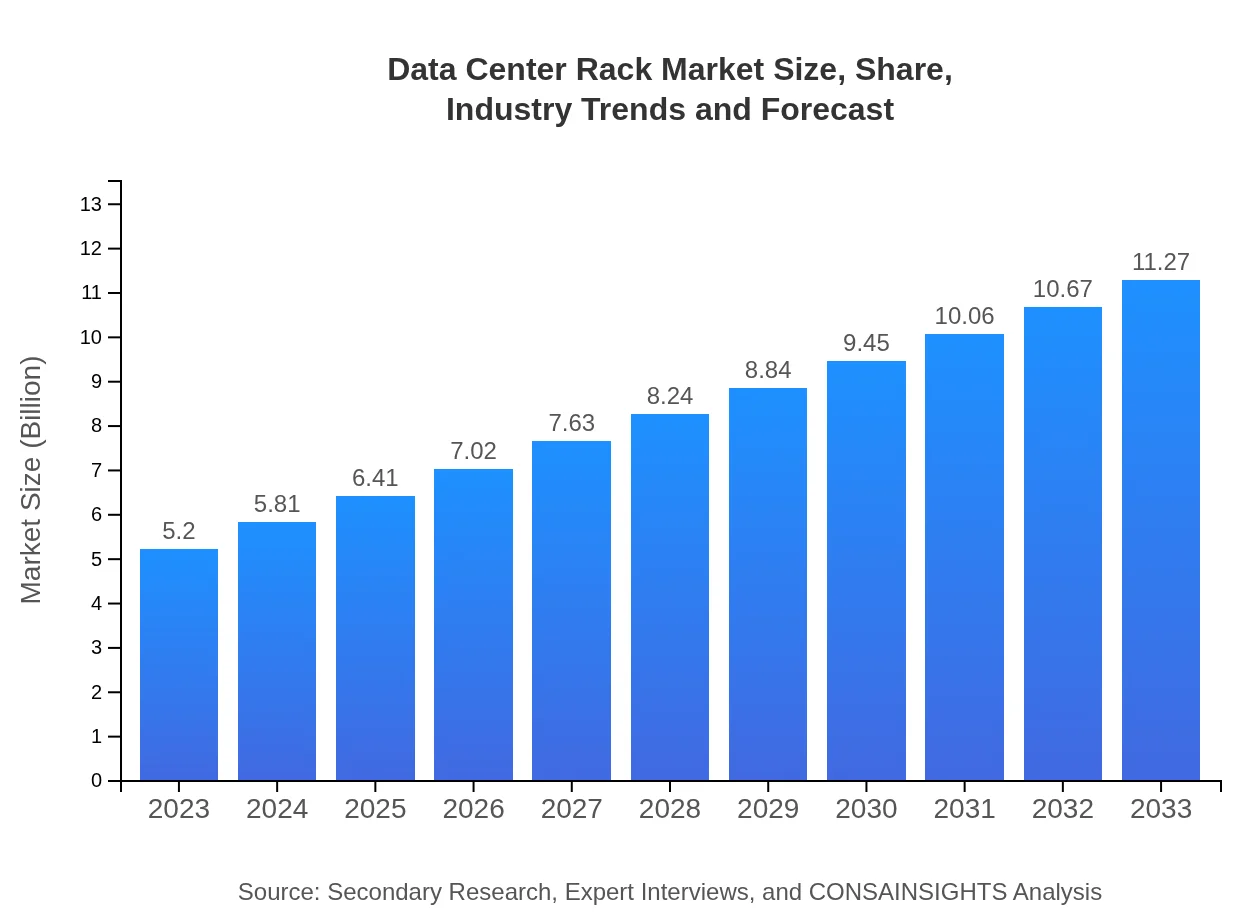

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $11.27 Billion |

| Top Companies | Schneider Electric, Vertiv, Dell Technologies, HPE (Hewlett Packard Enterprise), Cisco Systems |

| Last Modified Date | 31 January 2026 |

Data Center Rack Market Overview

Customize Data Center Rack Market Report market research report

- ✔ Get in-depth analysis of Data Center Rack market size, growth, and forecasts.

- ✔ Understand Data Center Rack's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Data Center Rack

What is the Market Size & CAGR of Data Center Rack market in 2023 and 2033?

Data Center Rack Industry Analysis

Data Center Rack Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Data Center Rack Market Analysis Report by Region

Europe Data Center Rack Market Report:

Europe's market is projected to expand from $1.82 billion in 2023 to $3.94 billion by 2033. Strong regulatory frameworks focusing on data security and energy efficiency policies contribute to the growth, as organizations aim to modernize their data center facilities.Asia Pacific Data Center Rack Market Report:

In the Asia Pacific region, the Data Center Rack market is expected to grow from $0.86 billion in 2023 to $1.86 billion by 2033. The rapid digitization efforts and increased investments in data center infrastructure by countries like China, India, and Japan are propelling this growth. The rise in cloud computing utilization among businesses is also a critical driver.North America Data Center Rack Market Report:

North America leads the market, with the size expected to grow from $1.75 billion in 2023 to $3.80 billion by 2033. The dominance is attributed to major players in cloud computing and IT services, which continuously invest in advanced data center technologies.South America Data Center Rack Market Report:

The South American market exhibits steady growth, projected to increase from $0.26 billion in 2023 to $0.57 billion by 2033. Key factors include growing IT infrastructure and increased adoption of user-centric technologies by local businesses, particularly in Brazil and Argentina.Middle East & Africa Data Center Rack Market Report:

The Middle East and Africa market is expected to grow from $0.51 billion in 2023 to $1.10 billion by 2033, driven by an increase in digital transformation initiatives and the expansion of telecommunication services in the region, particularly in Gulf Cooperation Council (GCC) countries.Tell us your focus area and get a customized research report.

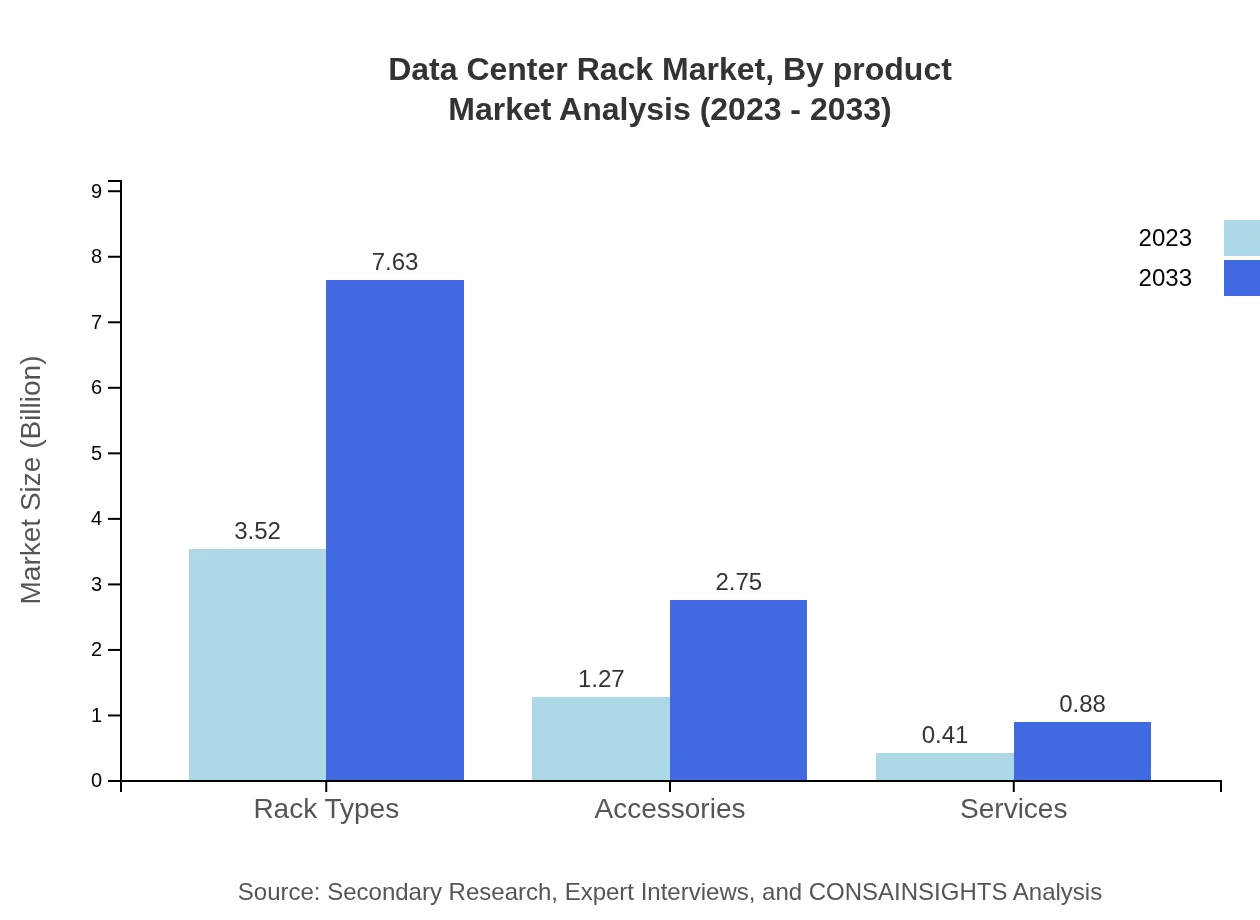

Data Center Rack Market Analysis By Product

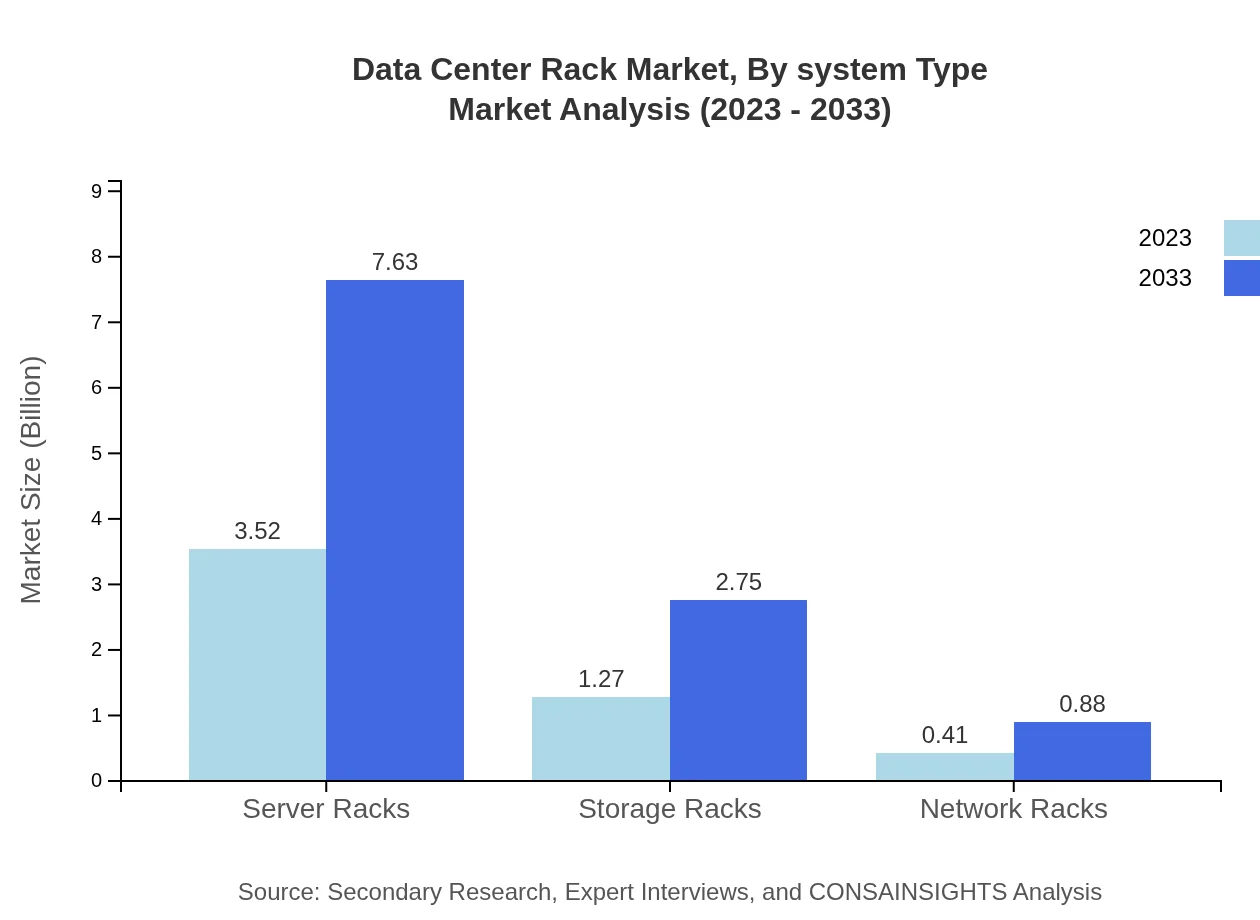

The Data Center Rack segment includes Server Racks, Storage Racks, and Network Racks. Server Racks dominate the market with a size of $3.52 billion in 2023 and projected to reach $7.63 billion by 2033. Meanwhile, Storage Racks hold a market size of $1.27 billion and will grow to $2.75 billion during the same period. Network Racks represent a smaller segment but are essential for specific data center functions.

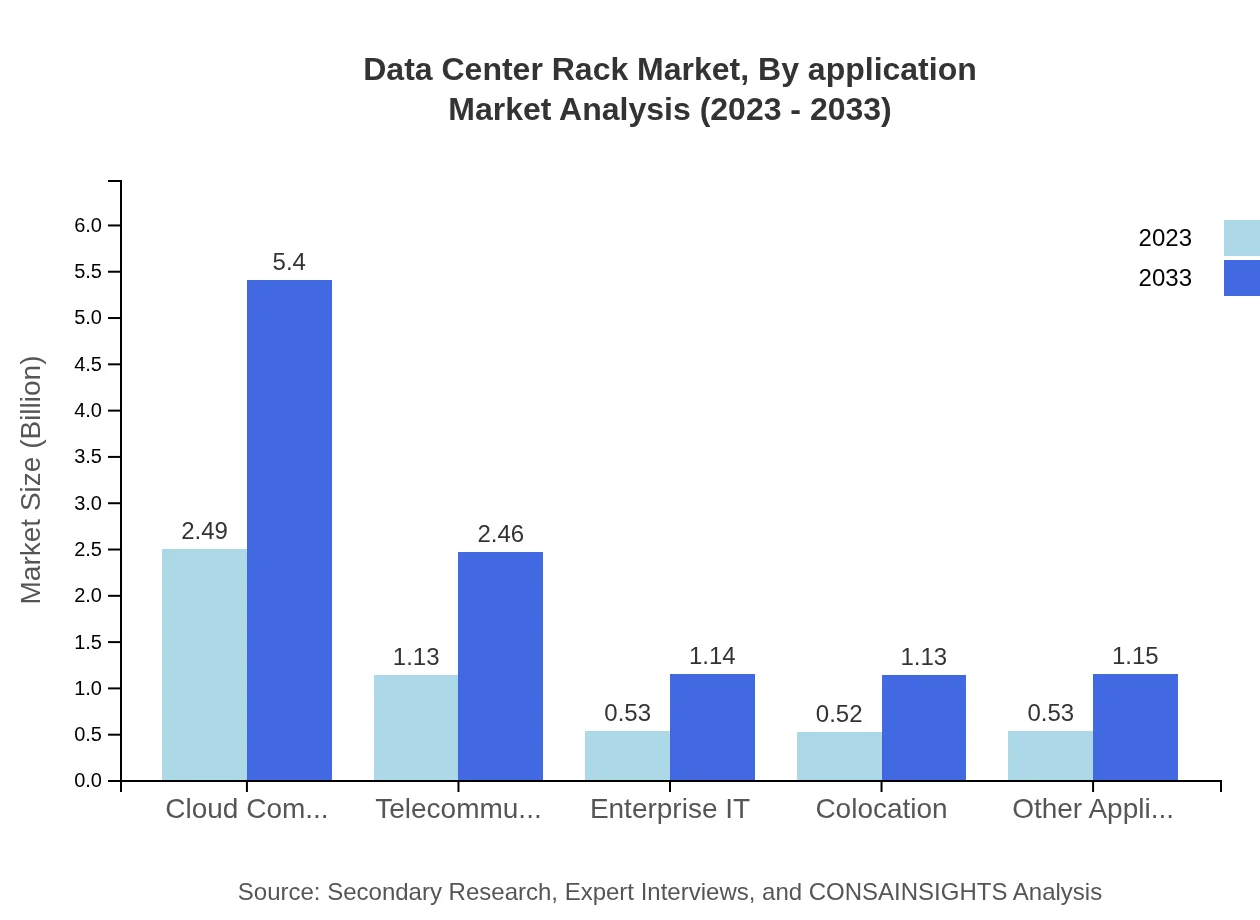

Data Center Rack Market Analysis By Application

The market is segmented based on applications including IT Companies, Telecommunications, Healthcare, Financial Institutions, and Government. IT Companies represent the largest application segment, accounting for $2.49 billion in 2023, expected to increase to $5.40 billion by 2033. Telecommunications will also grow strategically as the sector shifts towards 5G technology.

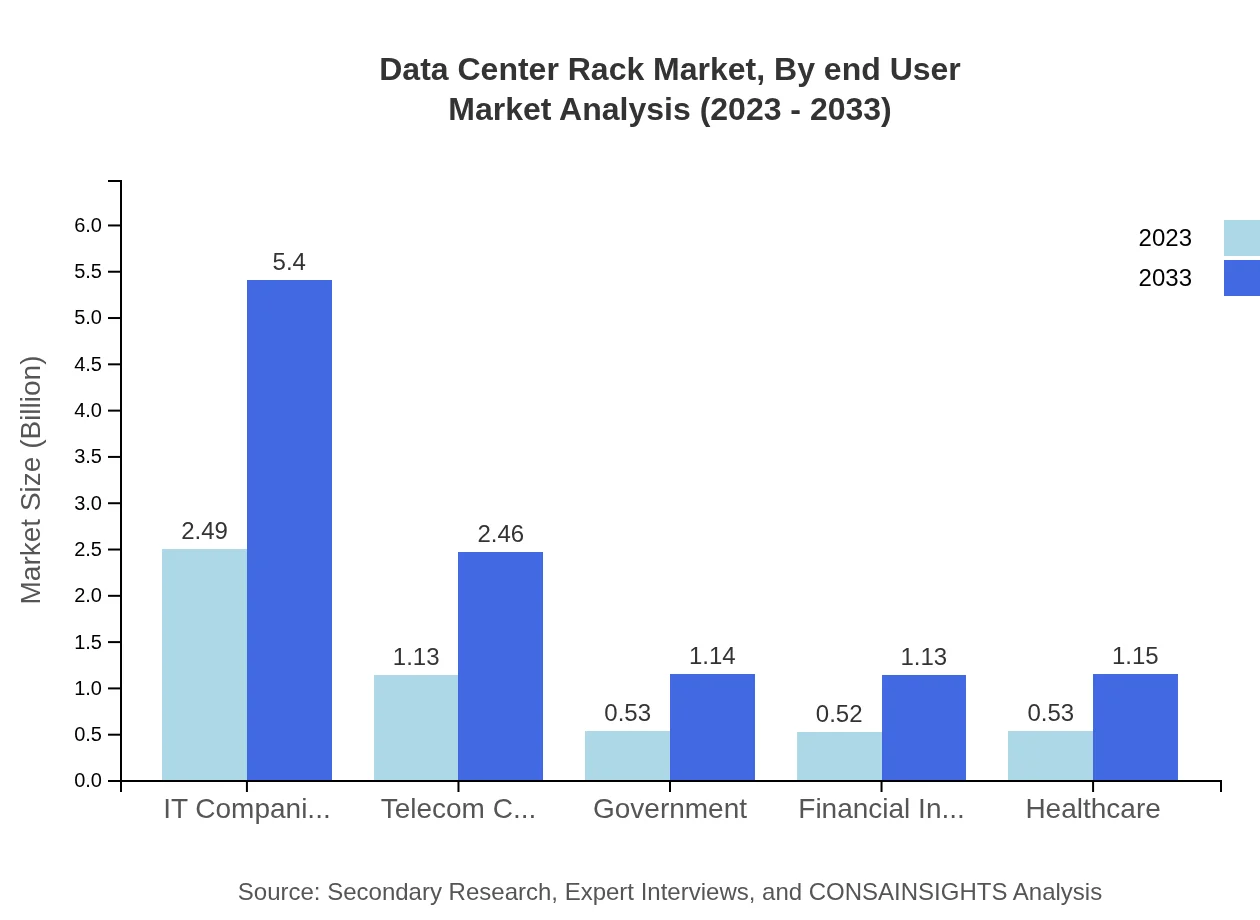

Data Center Rack Market Analysis By End User

The primary end-users of Data Center Racks include IT Companies, Telecommunications, and colocation centers. IT Companies continue to dominate the end-user demographics, signifying ongoing trends towards cloud service adoption and large-scale data processing needs. Financial Institutions and Government sectors also contribute to the significant uptake of rack solutions.

Data Center Rack Market Analysis By System Type

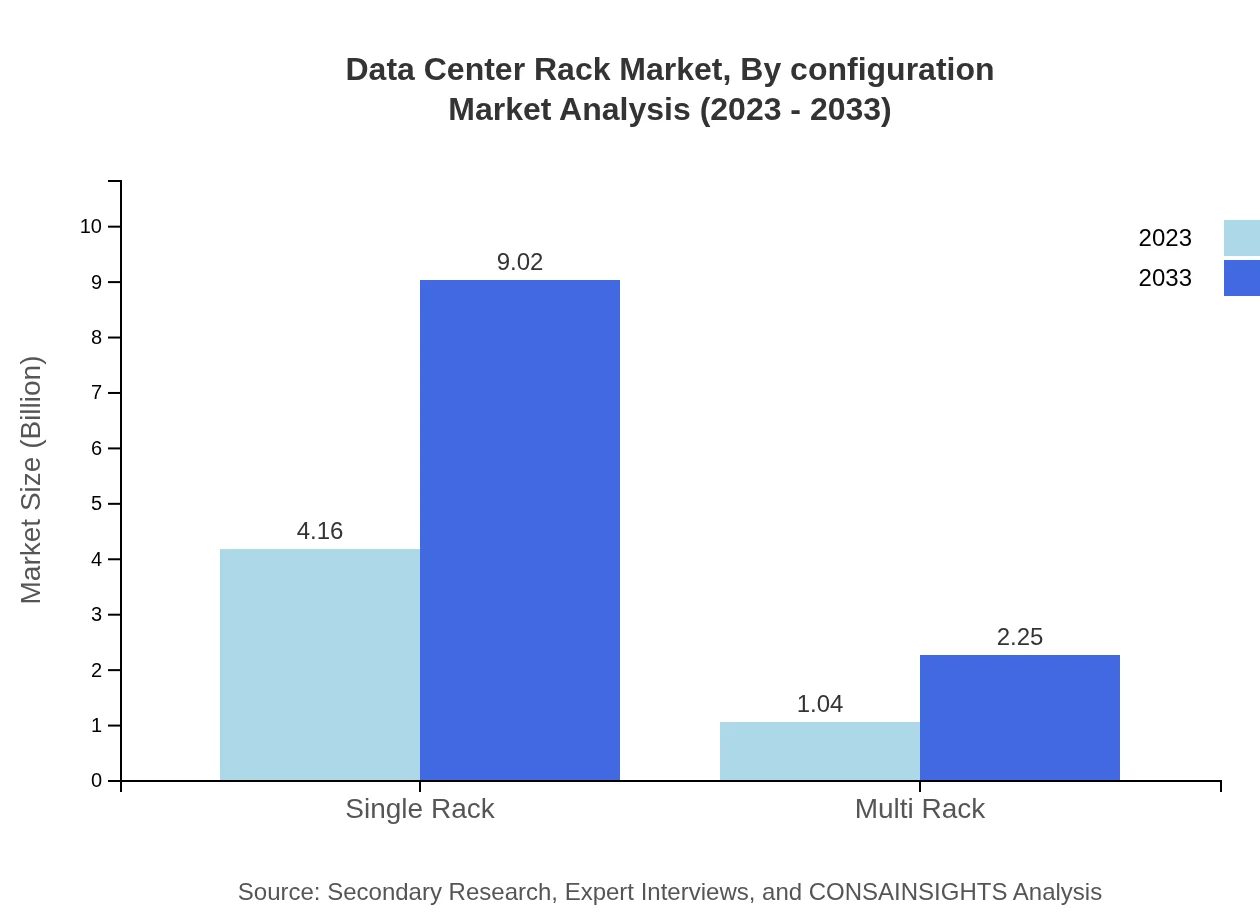

The Data Center Racks can be categorized into Single Racks and Multi Racks. Single Racks currently lead the market with a size of $4.16 billion in 2023, expected to grow to $9.02 billion by 2033, driven by their suitability for efficient single-server deployments. Meanwhile, Multi Racks represent a growing segment, reflecting the trend towards modular and scalable data center designs.

Data Center Rack Market Analysis By Configuration

Configuring racks into solutions tailored for specific workloads is essential. Vendor-led solutions and custom setups drive demand. The ability to support high-density configurations within limited spaces has emerging importance, enhancing overall data center operational efficacy. This market adaptiveness to configure racks to specific needs distinguishes competitive players.

Data Center Rack Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Data Center Rack Industry

Schneider Electric:

A global specialist in energy management and automation, Schneider Electric offers innovative solutions for data center efficiency and sustainability.Vertiv:

Vertiv provides critical digital infrastructure that enables data centers to perform at peak efficiency while ensuring uptime and reliability.Dell Technologies:

Dell offers comprehensive data center solutions including racks, servers, and storage systems tailored for mixed workloads.HPE (Hewlett Packard Enterprise):

HPE provides advanced data center solutions with a focus on hyper-converged infrastructure and integrated systems.Cisco Systems:

Cisco leads in networking and cybersecurity solutions and offers racks as essential components in data center networking architectures.We're grateful to work with incredible clients.

FAQs

What is the market size of data Center Rack?

The global data center rack market was valued at $5.2 billion in 2023 and is expected to grow at a CAGR of 7.8%, reaching significant growth by 2033.

What are the key market players or companies in this data Center Rack industry?

Key players in the data center rack industry include major companies such as Schneider Electric, Hewlett Packard Enterprise, Dell Technologies, IBM, and Emerson Network Power, which dominate the market.

What are the primary factors driving the growth in the data Center Rack industry?

The growth in the data center rack market is driven by the increasing demand for cloud services, the expansion of data centers, and the need for efficient power management and cooling solutions.

Which region is the fastest Growing in the data Center Rack?

Asia Pacific is the fastest-growing region in the data center rack market, with market size projected to grow from $0.86 billion in 2023 to $1.86 billion by 2033.

Does ConsaInsights provide customized market report data for the data Center Rack industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the data center rack industry, ensuring relevant insights for strategic decision-making.

What deliverables can I expect from this data Center Rack market research project?

Expect comprehensive deliverables, including detailed market analysis, growth forecasts, competitive landscape assessments, and actionable insights relevant to the data center rack industry.

What are the market trends of data Center Rack?

Current trends in the data center rack market include the shift toward energy-efficient designs, increased adoption of modular racks, and the growing importance of advanced cooling technologies.