Data Center Rack Pdu Market Report

Published Date: 31 January 2026 | Report Code: data-center-rack-pdu

Data Center Rack Pdu Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Data Center Rack PDU market, exploring trends, growth forecasts, and competitive landscapes from 2023 to 2033. Insights include market size, segmentation by product type, application, regional analysis, and profiles of leading companies in the industry.

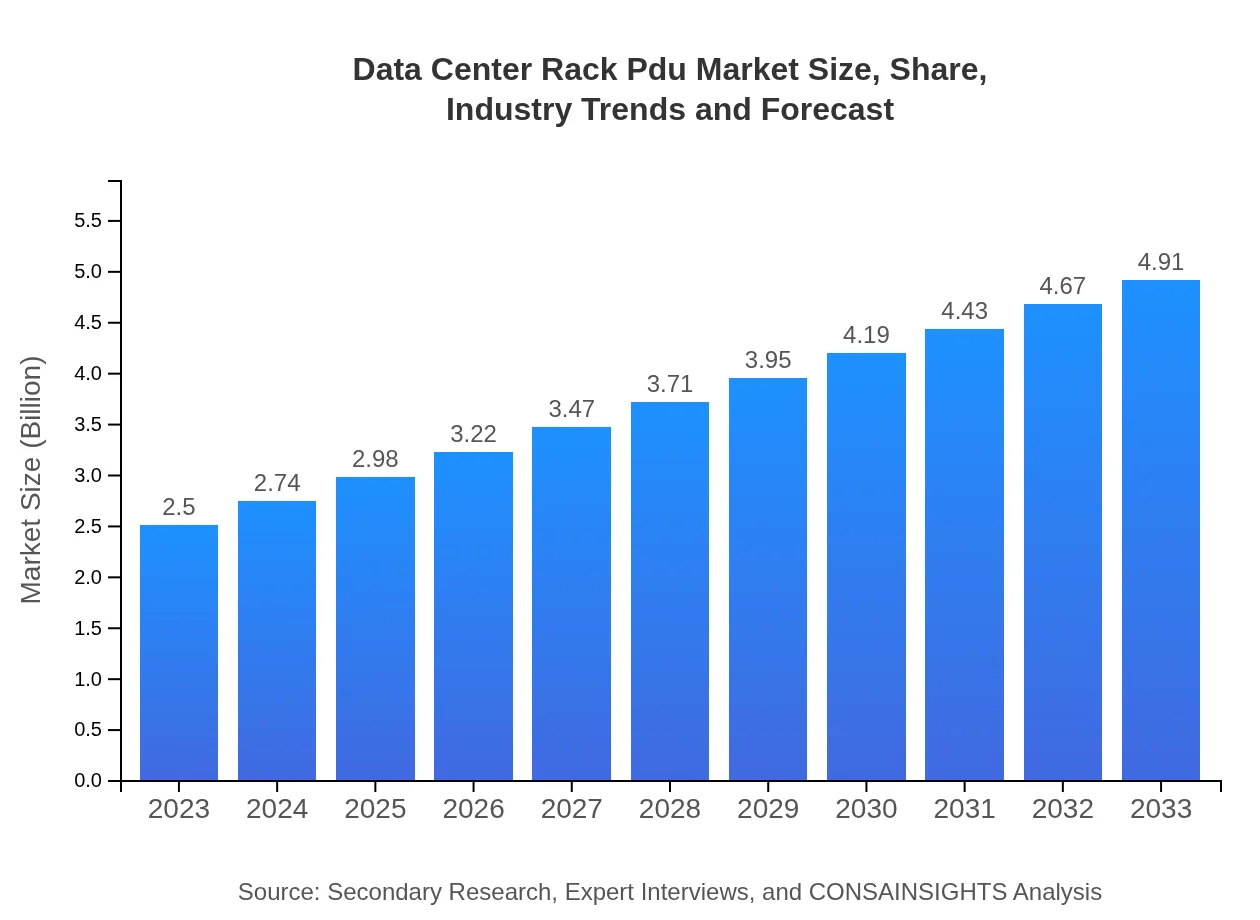

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Schneider Electric, Eaton Corporation, Vertiv Co., Cisco Systems |

| Last Modified Date | 31 January 2026 |

Data Center Rack PDU Market Overview

Customize Data Center Rack Pdu Market Report market research report

- ✔ Get in-depth analysis of Data Center Rack Pdu market size, growth, and forecasts.

- ✔ Understand Data Center Rack Pdu's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Data Center Rack Pdu

What is the Market Size & CAGR of Data Center Rack PDU market in 2023?

Data Center Rack PDU Industry Analysis

Data Center Rack PDU Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Data Center Rack PDU Market Analysis Report by Region

Europe Data Center Rack Pdu Market Report:

The European market is projected to grow from USD 0.78 billion in 2023 to USD 1.53 billion by 2033. European companies are increasingly adopting intelligent power distribution systems due to stringent energy regulations and the demand for environmentally friendly power solutions, presenting substantial growth opportunities.Asia Pacific Data Center Rack Pdu Market Report:

In the Asia Pacific region, the Data Center Rack PDU market is projected to grow from USD 0.50 billion in 2023 to USD 0.99 billion by 2033. Rapid technological adoption and expansion of IT infrastructure in countries like China and India are key drivers. The region is recognizing the importance of energy-efficient solutions as data center operations proliferate.North America Data Center Rack Pdu Market Report:

North America is at the forefront of the Data Center Rack PDU market, anticipated to rise from USD 0.84 billion in 2023 to USD 1.64 billion in 2033. The presence of major technology firms and a robust data center infrastructure contribute significantly to market expansion, alongside a heightened focus on sustainability initiatives.South America Data Center Rack Pdu Market Report:

The South America region is expected to see an increase from USD 0.09 billion in 2023 to USD 0.18 billion by 2033. With the ongoing digital transformation and investment in data centers, the PDU market is gaining traction, although more slowly compared to other regions. Energy management and power distribution efficiency are becoming focal points for enterprises.Middle East & Africa Data Center Rack Pdu Market Report:

The Middle East and Africa region’s Data Center Rack PDU market is anticipated to increase from USD 0.29 billion in 2023 to USD 0.56 billion by 2033. The advancement in data center infrastructure, particularly in the UAE and South Africa, showcases a growing demand for reliable and efficient power management solutions.Tell us your focus area and get a customized research report.

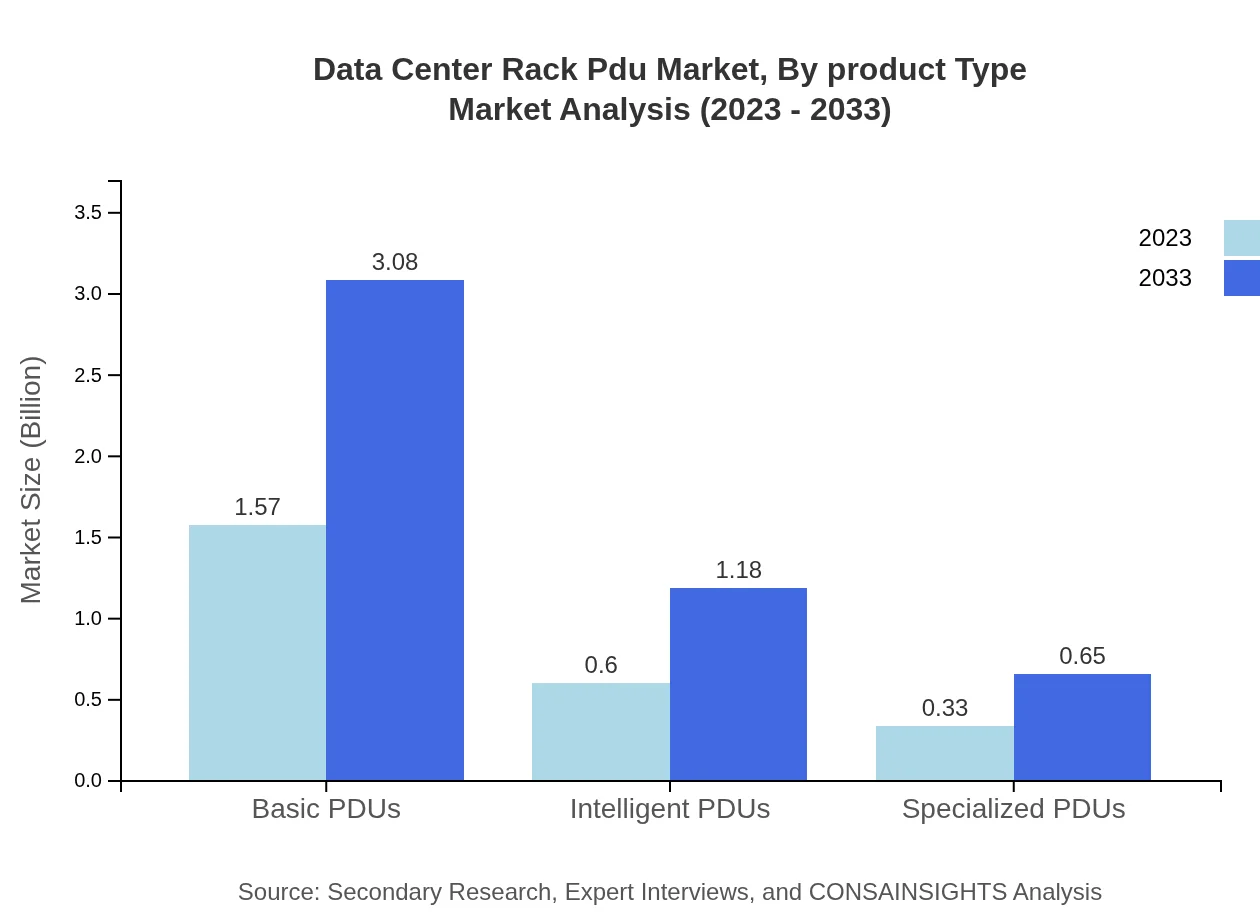

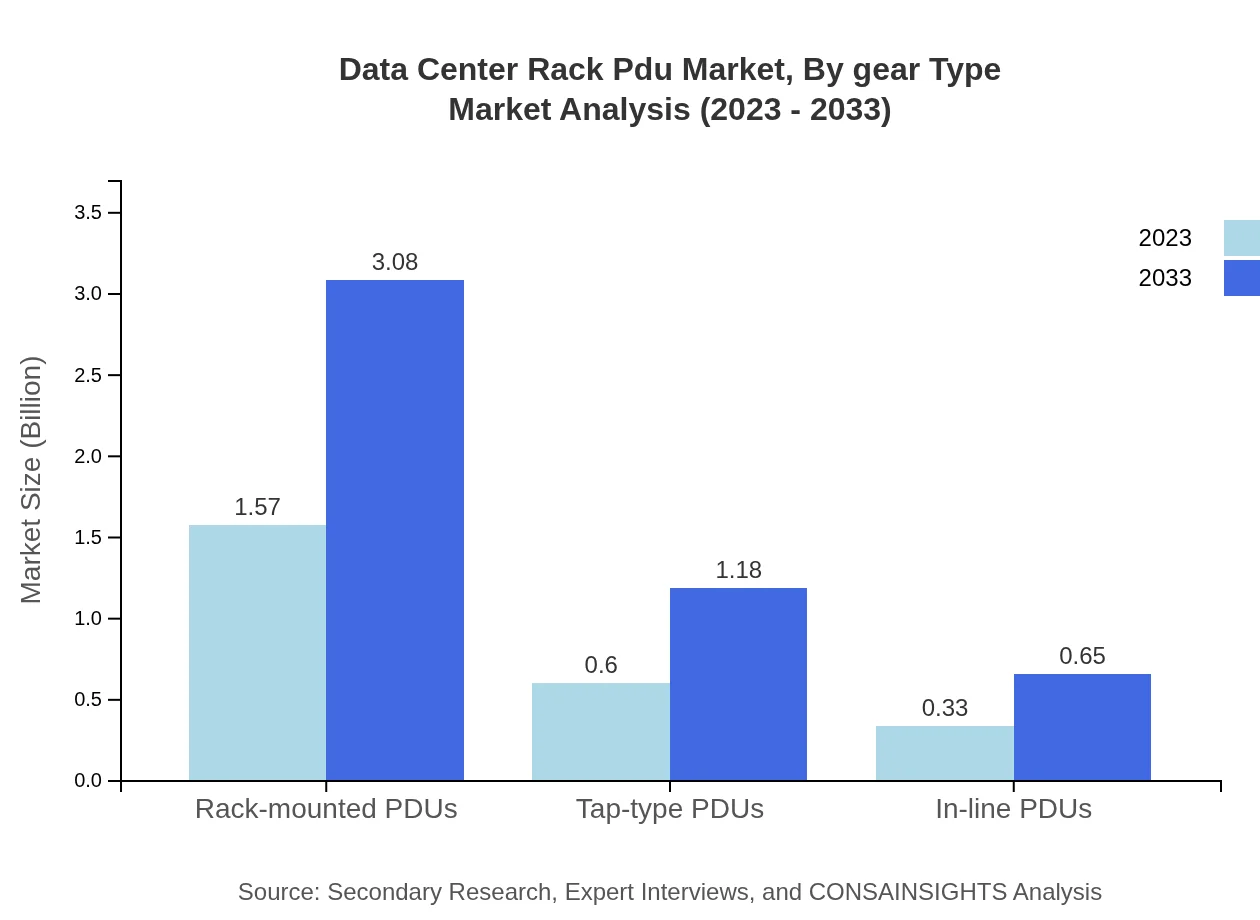

Data Center Rack Pdu Market Analysis By Product Type

The Data Center Rack PDU market is largely dominated by rack-mounted PDUs, which account for about 62.73% share in 2023, with projected growth to 3.08 billion by 2033. The intelligent PDUs hold 24.05% market share, and their growing adoption is driven by the need for real-time power monitoring. Basic PDUs continue to serve a significant role, and specialized PDUs are gaining traction for unique applications.

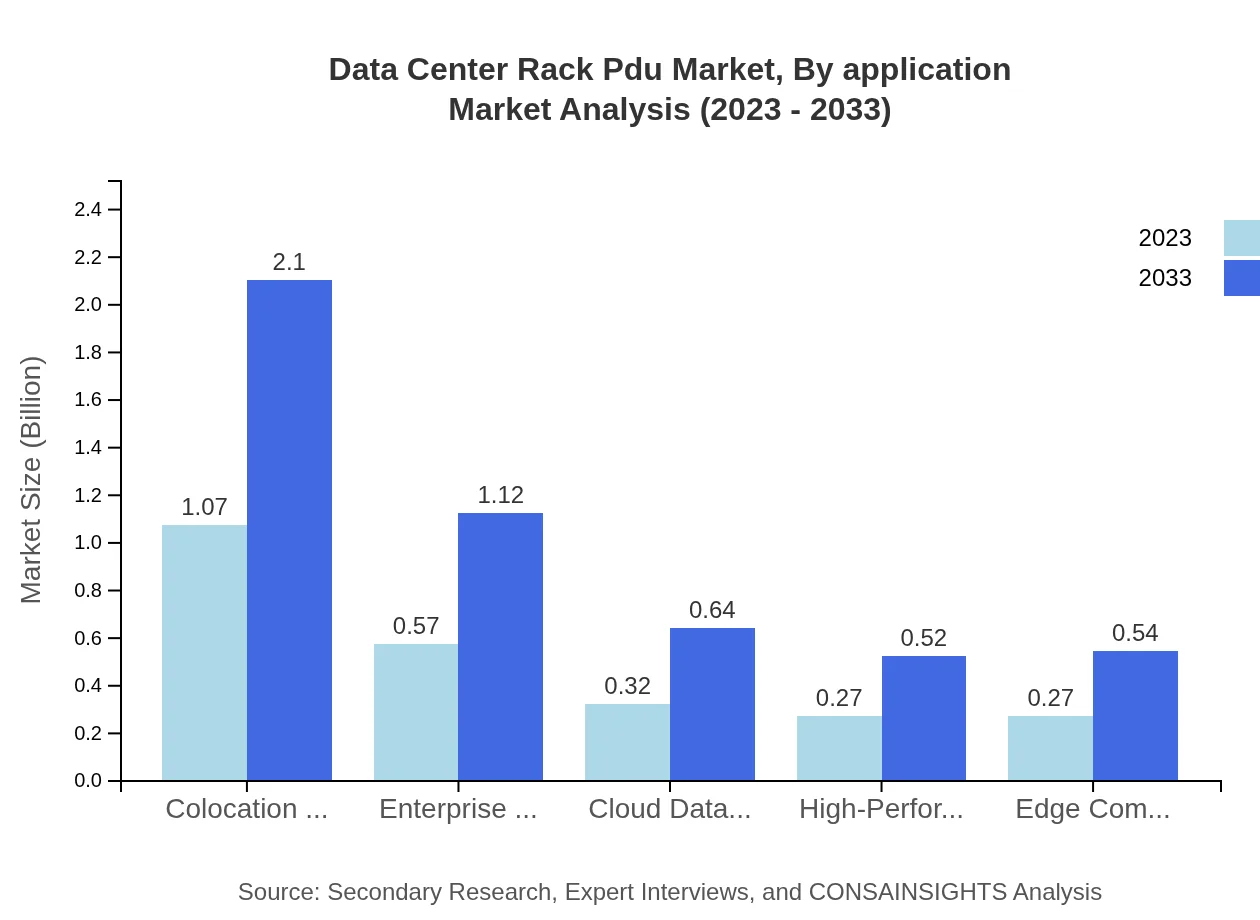

Data Center Rack Pdu Market Analysis By Application

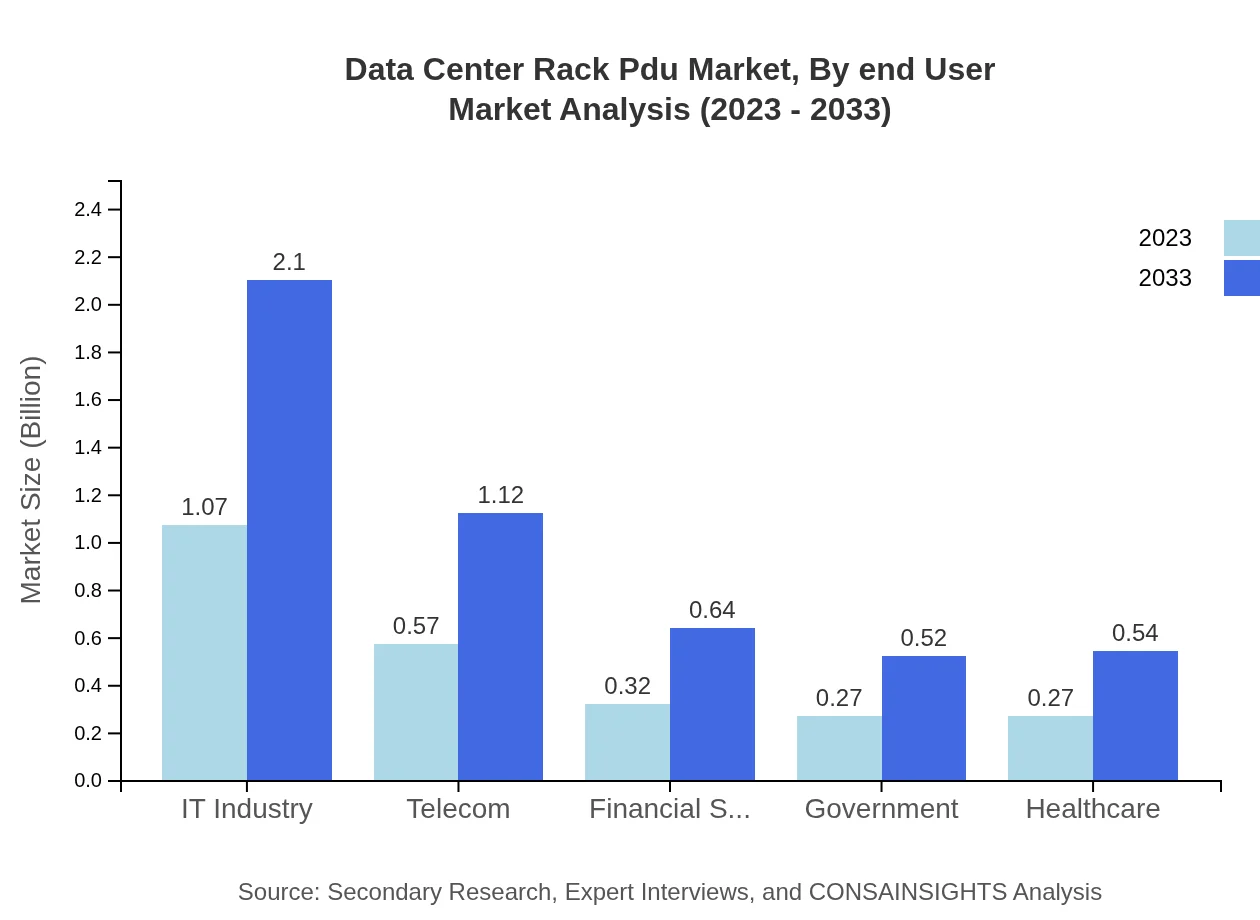

The IT industry is the largest application segment, sized at USD 1.07 billion in 2023 and expected to reach USD 2.10 billion in 2033. Telecommunications are also significant at USD 0.57 billion for 2023, reflecting an increased demand for PDU solutions to support growing network infrastructure. Financial services, healthcare, and government sectors represent additional applications where reliable power distribution is critical.

Data Center Rack Pdu Market Analysis By End User

Colocation data centers lead the market with a share of 42.65% and a size of USD 1.07 billion in 2023. They are expected to maintain this dominance as outsourcing continues. Enterprise and cloud data centers also contribute significantly, while high-performance computing and edge computing are emerging segments reflecting current technological trends.

Data Center Rack Pdu Market Analysis By Gear Type

The market is experiencing a shift towards intelligent PDUs, increasing their footprint in both share and size. Basic PDUs remain popular for straightforward applications, but intelligent systems, which connect and communicate data, are gaining importance as data centers prioritize efficiency and insight into power consumption.

Data Center Rack PDU Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Data Center Rack PDU Industry

Schneider Electric:

A leader in digital transformation and energy management, Schneider Electric offers a comprehensive portfolio of rack PDUs, known for their reliability and intelligent monitoring capabilities.Eaton Corporation:

Eaton is a power management company that develops intelligent PDUs designed for resilience in data centers, delivering advanced monitoring to enhance efficiency.Vertiv Co.:

Vertiv specializes in providing critical digital infrastructure solutions and was one of the first to invest in intelligent PDU technologies, enhancing data center operational efficiency.Cisco Systems:

Cisco integrates its data center technologies with power management solutions, providing valuable PDU offerings that cater to modern data center requirements.We're grateful to work with incredible clients.

FAQs

What is the market size of Data Center Rack PDU?

The global Data Center Rack PDU market is estimated to reach approximately $2.5 billion by 2033, growing at a CAGR of 6.8% from 2023 to 2033, driven by increasing demand for efficient power distribution in data centers.

What are the key market players or companies in the Data Center Rack PDU industry?

Key players in the Data Center Rack PDU industry include Schneider Electric, Vertiv, Eaton, Tripp Lite, and APC. These companies are recognized for their innovation and robust product offerings across various PDU types.

What are the primary factors driving the growth in the Data Center Rack PDU industry?

Growth drivers include the increasing data center footprint, adoption of advanced technologies like IoT and AI, and the demand for efficient power management solutions to optimize energy consumption and reduce operational costs.

Which region is the fastest Growing in the Data Center Rack PDU market?

The North American region is the fastest-growing, projected to grow from $0.84 billion in 2023 to $1.64 billion by 2033, fueled by the expansion of cloud services and data center facilities in the region.

Does Consainsights provide customized market report data for the Data Center Rack PDU industry?

Yes, Consainsights provides tailored market reports for the Data Center Rack PDU industry, enabling businesses to access specific insights according to their needs, including customized data, forecasts, and trend analyses.

What deliverables can I expect from this Data Center Rack PDU market research project?

Deliverables include detailed market reports, statistical analysis, market size forecasts, segmentation data, competitive analysis, and trend insights, providing comprehensive information for strategic decision-making.

What are the market trends of Data Center Rack PDU?

Market trends include the growing shift towards intelligent PDUs for better monitoring, increased investment in renewable energy sources, and the rise of colocation facilities, which are crucial for driving demand in the sector.