Data Center Rack Server Market Report

Published Date: 31 January 2026 | Report Code: data-center-rack-server

Data Center Rack Server Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Data Center Rack Server market, focusing on key trends, innovations, and segmentation from 2023 to 2033. It includes detailed market size, industry analysis, technology trends, and regional insights.

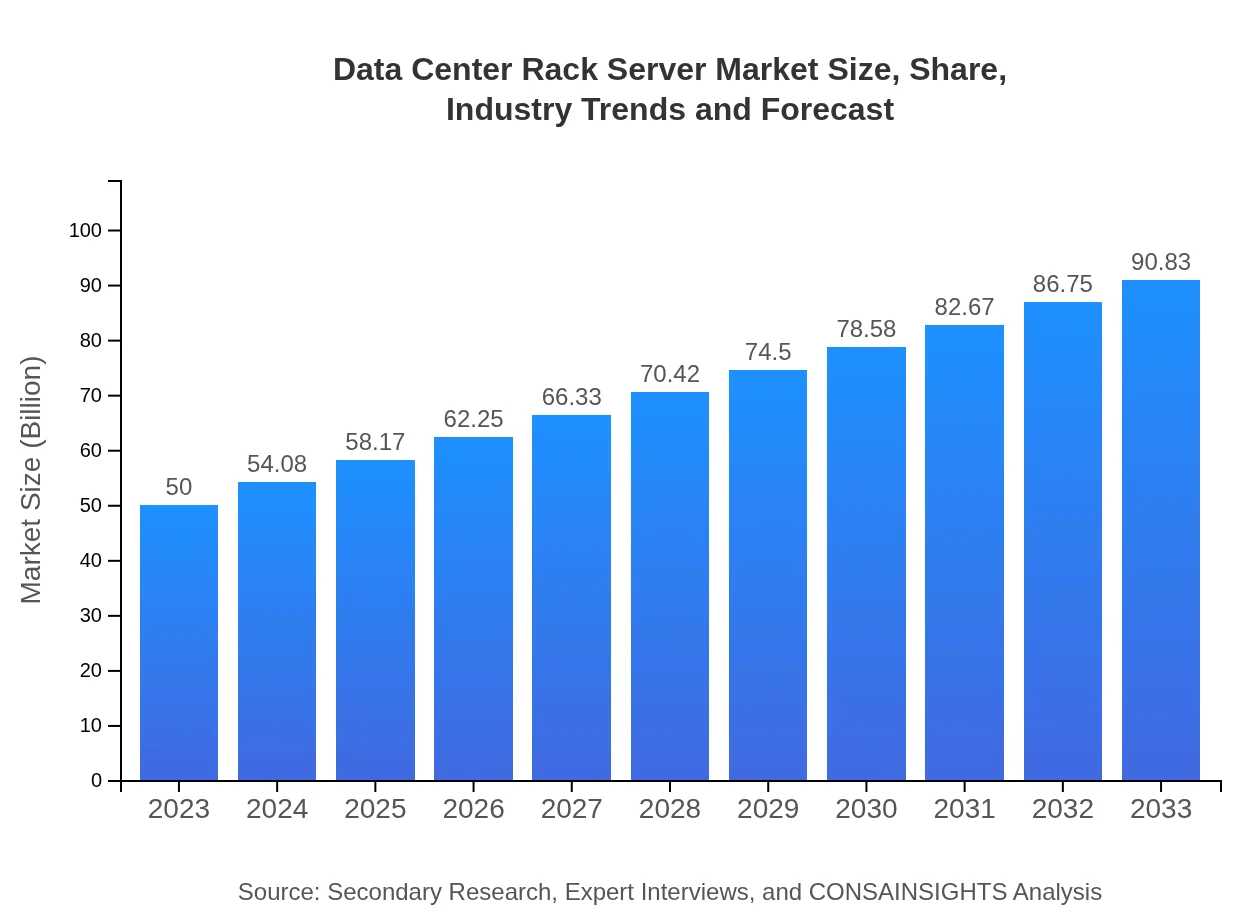

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $90.83 Billion |

| Top Companies | Dell Technologies, Hewlett Packard Enterprise (HPE), Cisco Systems, Lenovo |

| Last Modified Date | 31 January 2026 |

Data Center Rack Server Market Overview

Customize Data Center Rack Server Market Report market research report

- ✔ Get in-depth analysis of Data Center Rack Server market size, growth, and forecasts.

- ✔ Understand Data Center Rack Server's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Data Center Rack Server

What is the Market Size & CAGR of Data Center Rack Server market in 2023?

Data Center Rack Server Industry Analysis

Data Center Rack Server Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Data Center Rack Server Market Analysis Report by Region

Europe Data Center Rack Server Market Report:

In Europe, the market is predicted to grow from $12.30 billion in 2023 to $22.35 billion by 2033. With stringent regulations regarding data security and increasing investments in digital transformation initiatives, the region is navigating through growth challenges and opportunities, notably in Germany and the United Kingdom.Asia Pacific Data Center Rack Server Market Report:

In the Asia-Pacific region, the market is expected to grow from $10.88 billion in 2023 to $19.76 billion by 2033. Factors driving this growth include increasing internet penetration, growing digitalization across industries, and the establishment of new data centers by tech giants. Countries like China and India are leading this expansion, impacting the market positively with rising investments.North America Data Center Rack Server Market Report:

North America holds the largest market share, with expectations of growth from $18.68 billion in 2023 to $33.93 billion by 2033. This region benefits from a well-established IT infrastructure, rapid adoption of cloud technologies, and significant investments from major companies. The U.S. leads the charge with industry giants continually innovating in data management solutions.South America Data Center Rack Server Market Report:

The South American Data Center Rack Server market is projected to increase from $2.91 billion in 2023 to $5.29 billion by 2033. The market is driven by rising cloud adoption and the increasing number of service providers focusing on expanding their infrastructure to meet the surging demand for digital services in the region.Middle East & Africa Data Center Rack Server Market Report:

The Middle East and Africa market is anticipated to expand from $5.24 billion in 2023 to $9.51 billion by 2033. Investment in IT infrastructure, driven by the increasing need for cloud and IT services, alongside the region's ambitious digitalization plans, will positively influence market dynamics.Tell us your focus area and get a customized research report.

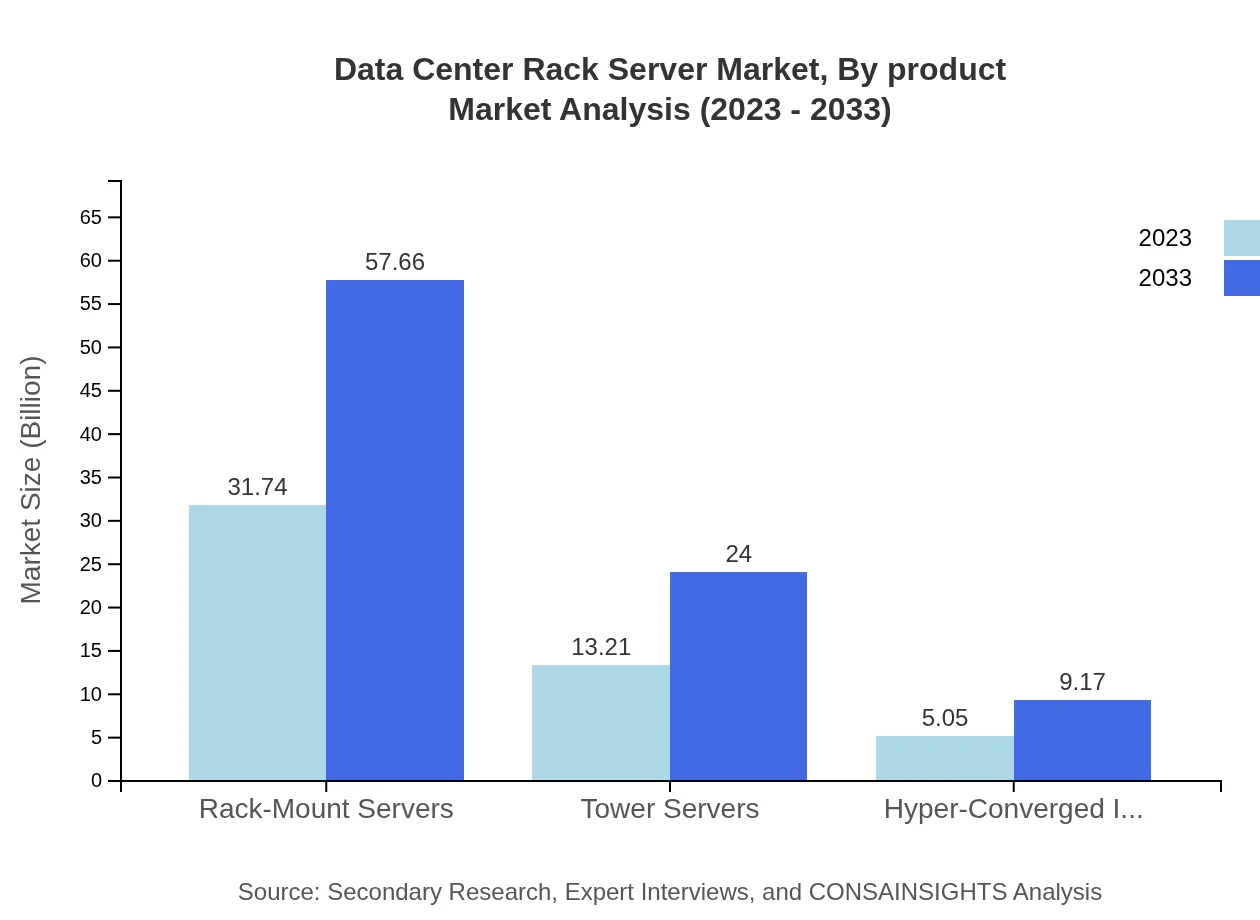

Data Center Rack Server Market Analysis By Product

The market is primarily driven by Rack-Mount Servers, which are projected to rise from $31.74 billion in 2023 to $57.66 billion by 2033, securing a market share of 63.48%. Tower Servers follow at $13.21 billion in 2023, growing to $24.00 billion, and Hyper-Converged Infrastructure at $5.05 billion expanding to $9.17 billion, each holding their respective shares.

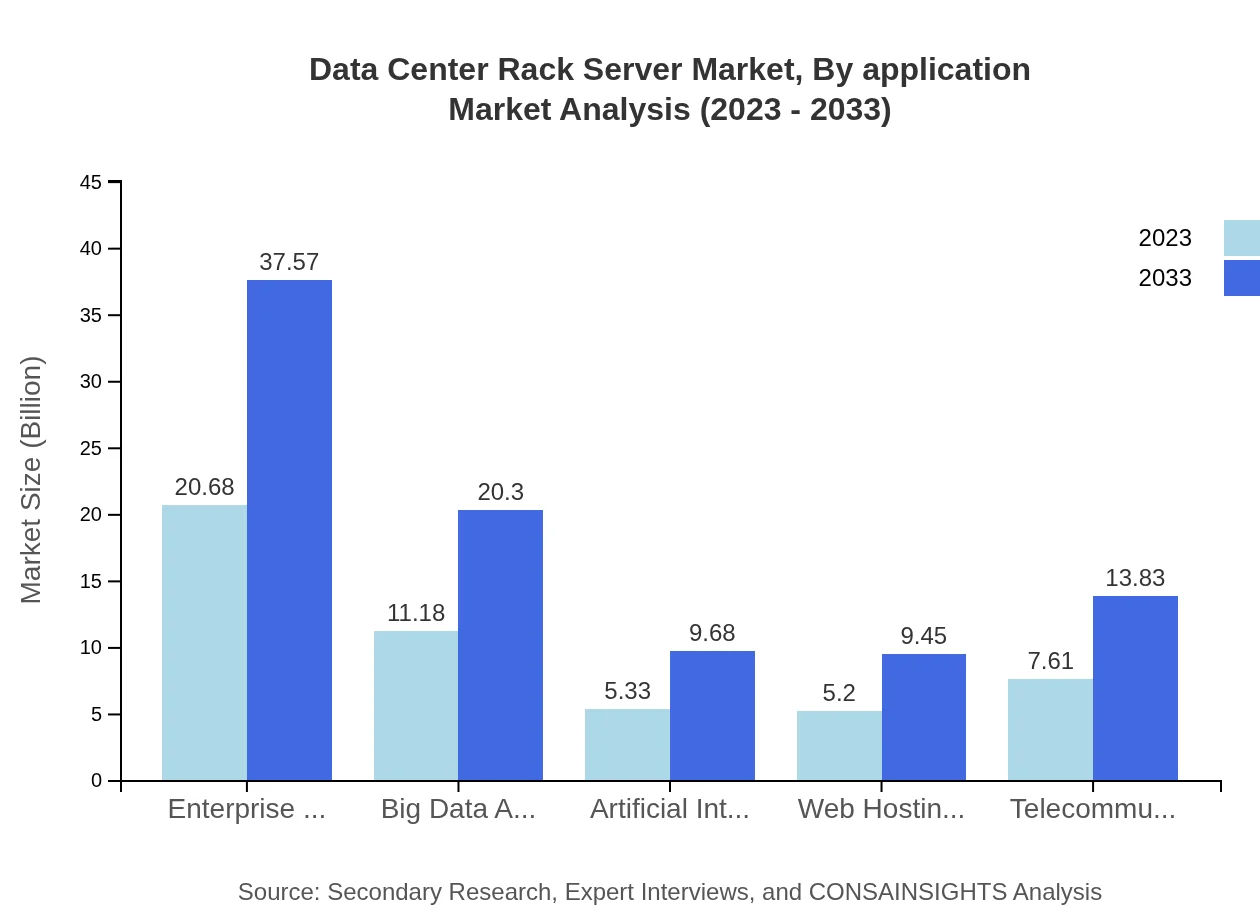

Data Center Rack Server Market Analysis By Application

Applications for Data Center Rack Servers are broad, spanning from enterprise applications to big data analytics and artificial intelligence. Enterprise applications account for a significant share, growing from $20.68 billion to $37.57 billion by 2033, while Big Data Analytics is also crucial, increasing from $11.18 billion to $20.30 billion, reflecting the demand for data-driven decision-making.

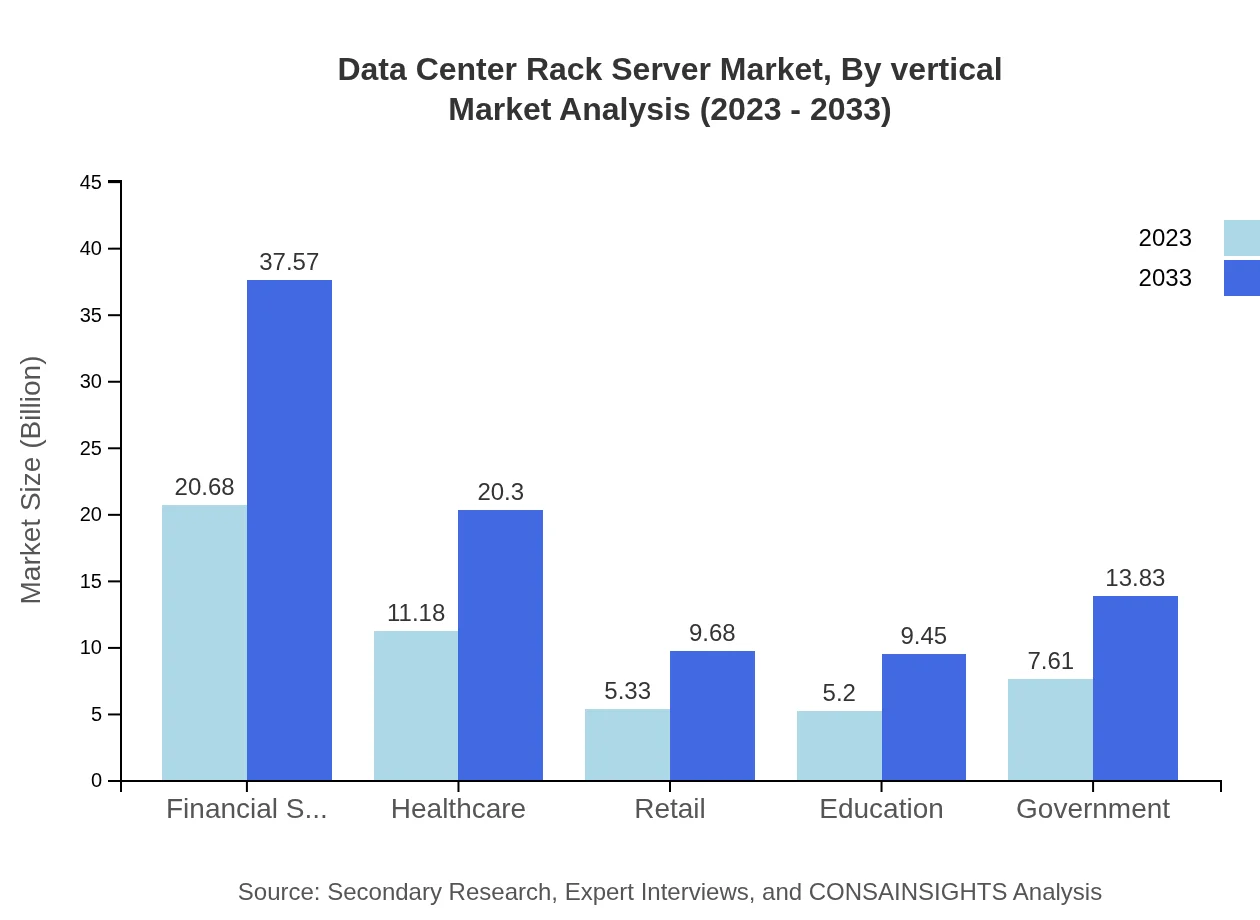

Data Center Rack Server Market Analysis By Vertical

Vertical markets such as financial services and healthcare are major contributors. Financial Services will see growth from $20.68 billion to $37.57 billion and Healthcare from $11.18 billion to $20.30 billion, highlighting the essential need for robust data solutions in these sectors.

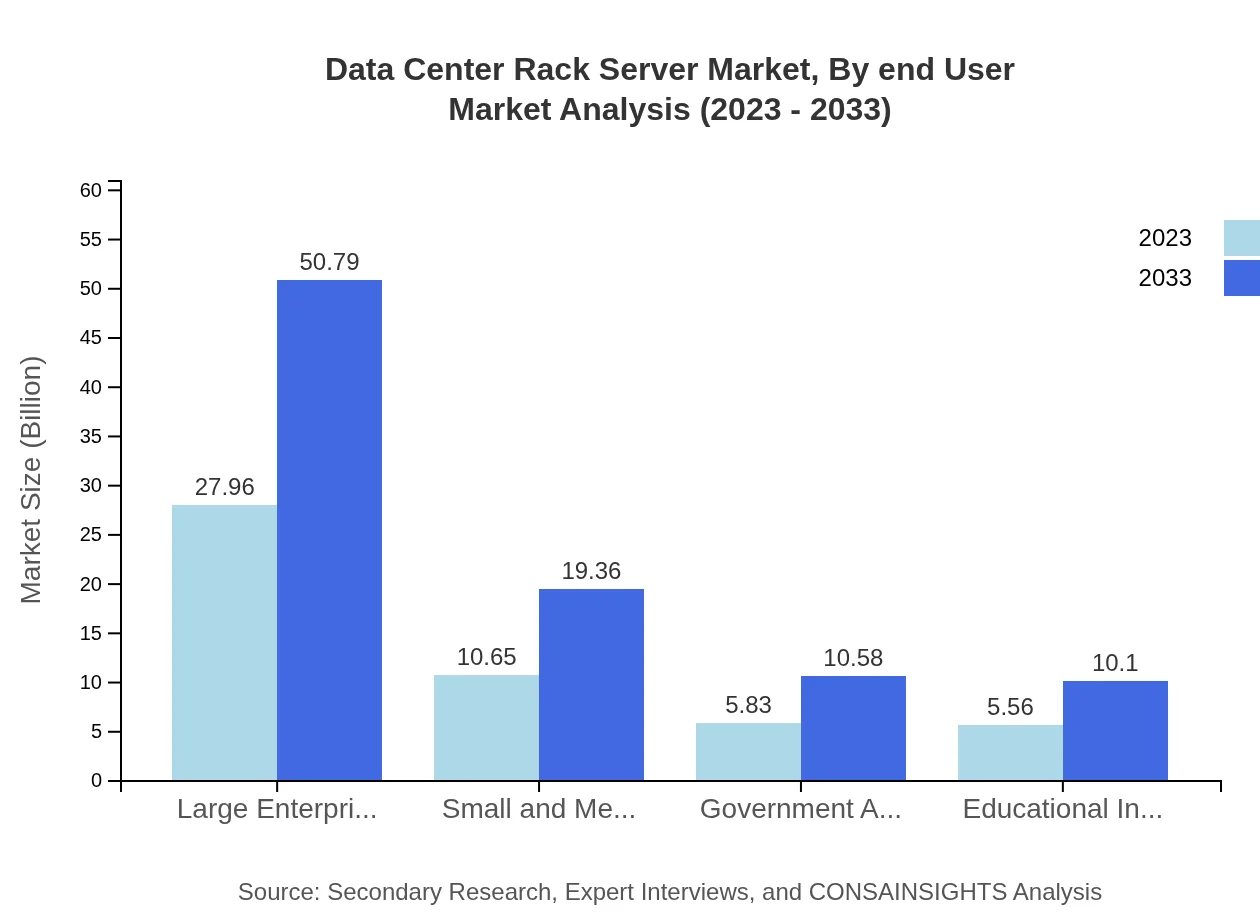

Data Center Rack Server Market Analysis By End User

The market serves a wide range of end-users, including large enterprises and small and medium-sized businesses. Large enterprises hold a significant share and are expected to grow from $27.96 billion to $50.79 billion, whereas SMBs will increase from $10.65 billion to $19.36 billion, indicating their rising technological adoption.

Data Center Rack Server Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Data Center Rack Server Industry

Dell Technologies:

Dell Technologies is a leading provider of IT solutions, offering a wide range of rack servers that cater to diverse data center needs. Their focus on innovation and customer-centric solutions positions them at the forefront of the market.Hewlett Packard Enterprise (HPE):

HPE delivers high-performance computing solutions, specializing in innovative data center technologies that enhance efficiency and scalability. Their commitment to sustainability and advanced data management strengthens their competitive advantage.Cisco Systems:

Cisco is renowned for its networking hardware and is increasingly tapping into the data center server market. They provide solutions that integrate seamlessly into existing infrastructures while ensuring high-speed connectivity.Lenovo :

Lenovo has positioned itself as a key player in the server market with its versatile rack server offerings, emphasizing reliability and cutting-edge technology.We're grateful to work with incredible clients.

FAQs

What is the market size of Data Center Rack Server?

The Data Center Rack Server market is currently valued at approximately $50 billion, with a projected compound annual growth rate (CAGR) of 6% from 2023 to 2033, indicating a steady growth trajectory in this sector.

What are the key market players or companies in the Data Center Rack Server industry?

Key market players in the Data Center Rack Server industry include major technology companies such as Dell, HP, IBM, Cisco, and Lenovo. These companies dominate the market through innovative product offerings and strong customer support services.

What are the primary factors driving the growth in the Data Center Rack Server industry?

Growth factors include the increasing demand for data storage, rising adoption of cloud computing, and the need for enhanced network performance. Additionally, advancements in server technology and the rise of big data analytics contribute significantly to market growth.

Which region is the fastest Growing in the Data Center Rack Server market?

The fastest-growing region in the Data Center Rack Server market is North America, with market size expanding from $18.68 billion in 2023 to $33.93 billion by 2033, driven by a strong demand for cutting-edge data management solutions.

Does ConsaInsights provide customized market report data for the Data Center Rack Server industry?

Yes, ConsaInsights offers customized market report data tailored to specific research needs in the Data Center Rack Server industry, ensuring comprehensive insights that align with client requirements and strategic goals.

What deliverables can I expect from this Data Center Rack Server market research project?

From the Data Center Rack Server market research project, you can expect detailed reports, market trend analysis, competitor benchmarking, segment insights, and strategic recommendations tailored to help inform business decisions.

What are the market trends of Data Center Rack Server?

Current trends in the Data Center Rack Server market include the increasing shift towards hyper-converged infrastructure, advancements in AI-driven data analytics, and a growing emphasis on energy efficiency and sustainability in server management.