Data Center Ups Market Report

Published Date: 31 January 2026 | Report Code: data-center-ups

Data Center Ups Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Data Center UPS market, including detailed market size, growth forecasts from 2023 to 2033, and insights into industry trends, segmentation, and key players.

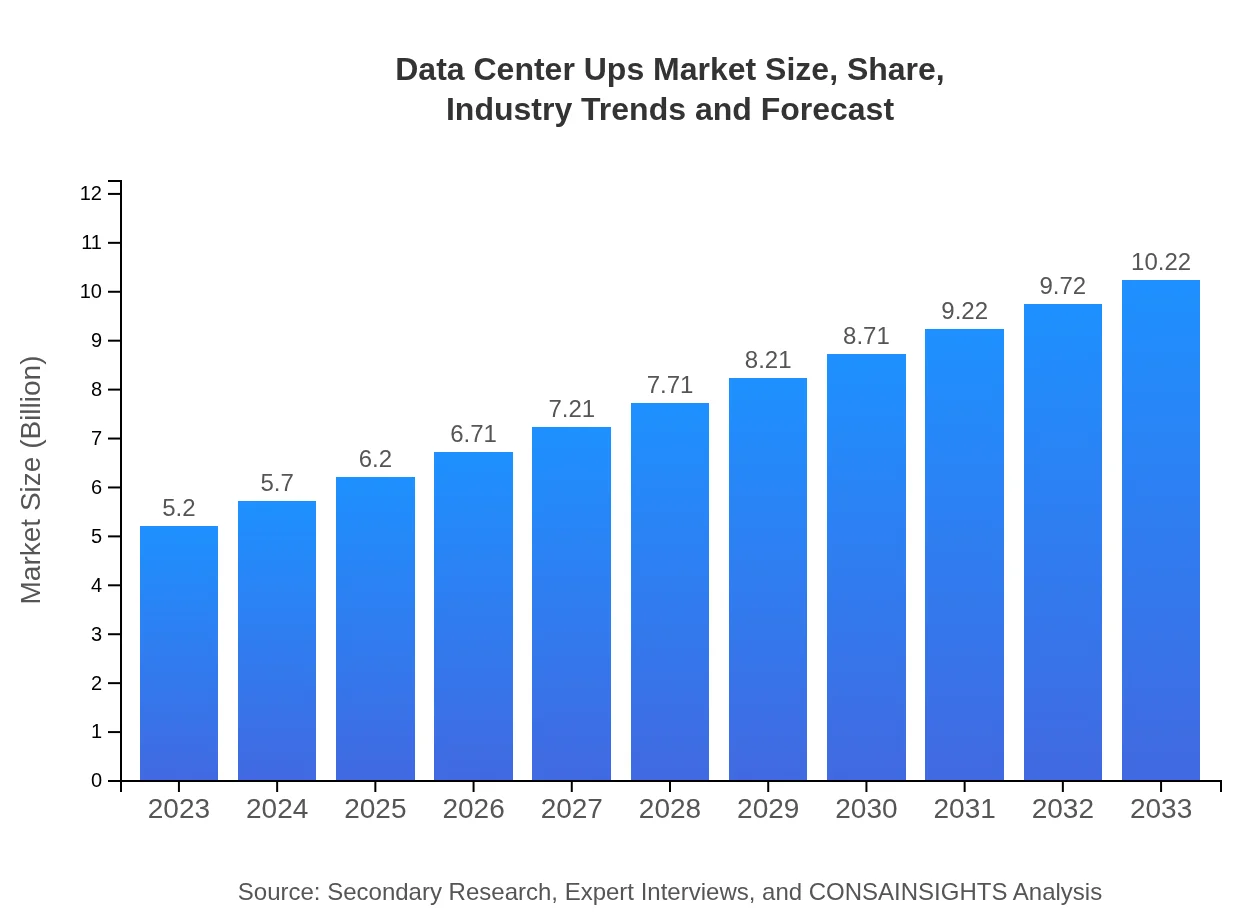

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.22 Billion |

| Top Companies | Schneider Electric, Eaton Corporation, Vertiv Co., Siemens AG, Emerson Electric Co. |

| Last Modified Date | 31 January 2026 |

Data Center Ups Market Overview

Customize Data Center Ups Market Report market research report

- ✔ Get in-depth analysis of Data Center Ups market size, growth, and forecasts.

- ✔ Understand Data Center Ups's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Data Center Ups

What is the Market Size & CAGR of Data Center Ups market in 2023 and 2033?

Data Center Ups Industry Analysis

Data Center Ups Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Data Center Ups Market Analysis Report by Region

Europe Data Center Ups Market Report:

Europe is experiencing a similar trend, with its UPS market size at $1.41 billion in 2023, climbing to $2.77 billion by 2033. The European commitment towards energy sustainability and green technology adoption has amplified the focus on more efficient UPS solutions, presenting significant growth opportunities.Asia Pacific Data Center Ups Market Report:

In Asia Pacific, the market is valued at $1.00 billion in 2023 and is expected to grow to $1.96 billion by 2033, signifying a strong growth trajectory. The rapidly expanding digital infrastructure, particularly in countries like China and India, coupled with increased internet penetration is driving UPS adoption. Furthermore, initiatives toward smart cities are compelling investments in reliable power solutions.North America Data Center Ups Market Report:

North America presents a robust market for Data Center UPS systems, starting at $1.99 billion in 2023 and projected to reach $3.91 billion by 2033. The region’s high concentration of data centers, coupled with stringent regulations and the commitment to advanced infrastructure resilience, positions it at the forefront of UPS investments.South America Data Center Ups Market Report:

The South American market is relatively smaller, with a valuation of $0.09 billion in 2023, increasing to $0.18 billion in 2033. The growth is primarily driven by an increasing number of small data centers and the need for backup power solutions in local markets, although slower than other regions due to economic volatility.Middle East & Africa Data Center Ups Market Report:

In the Middle East and Africa, the market is valued at $0.71 billion in 2023, growing to $1.39 billion by 2033. The region is witnessing an unprecedented digital transformation, with significant infrastructure developments, particularly in the UAE and South Africa, supporting the uptake of advanced UPS solutions.Tell us your focus area and get a customized research report.

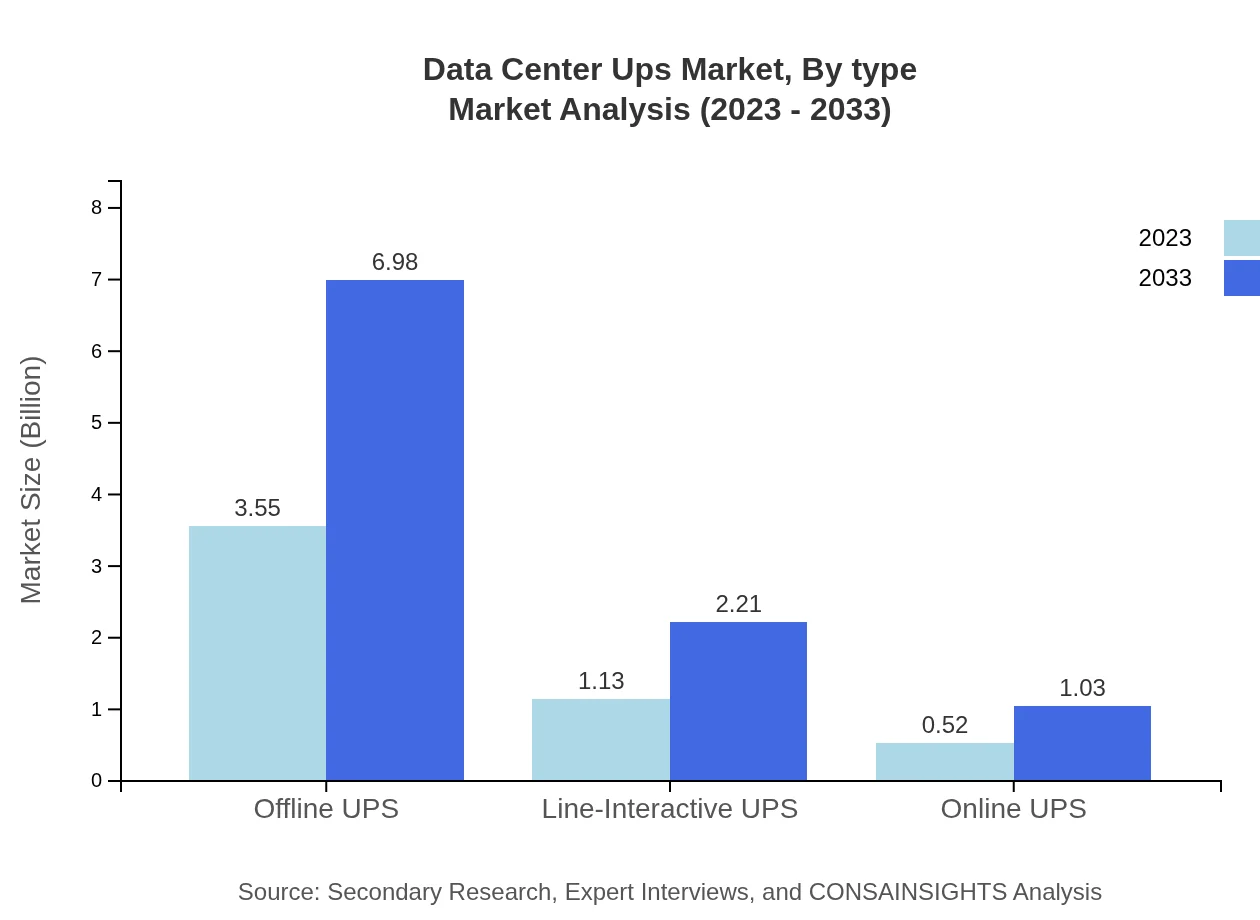

Data Center Ups Market Analysis By Type

The market can be categorized into three main types of UPS: - **Offline UPS**: Currently dominating the market, valued at $3.55 billion in 2023 and expected to grow to $6.98 billion by 2033. It represents about 68.3% market share. - **Line-Interactive UPS**: This segment is valued at $1.13 billion in 2023, growing to $2.21 billion by 2033, with a market share of 21.64%. - **Online UPS**: Valued at $0.52 billion in 2023 and projected to grow to $1.03 billion by 2033, holding a 10.06% market share.

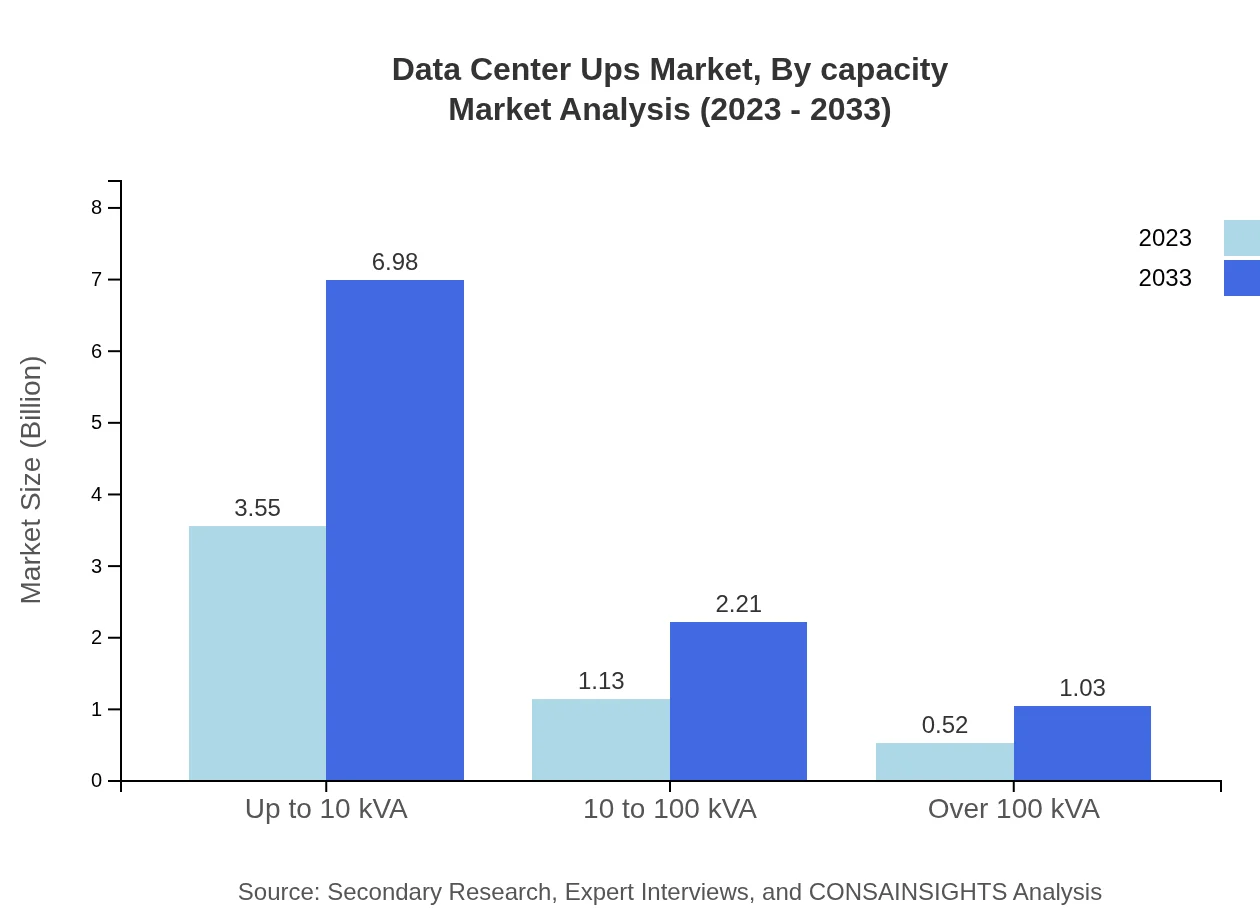

Data Center Ups Market Analysis By Capacity

Capacity segmentation indicates a clear trend in demand: - **Up to 10 kVA**: Prime segment valued at $3.55 billion in 2023, expected to double to $6.98 billion by 2033, holding 68.3% of the market share. - **10 to 100 kVA**: Starting at $1.13 billion in 2023, projected at $2.21 billion in 2033, retaining 21.64% share. - **Over 100 kVA**: This sector is gaining traction with growth from $0.52 billion in 2023 to $1.03 billion in 2033, at 10.06% market share.

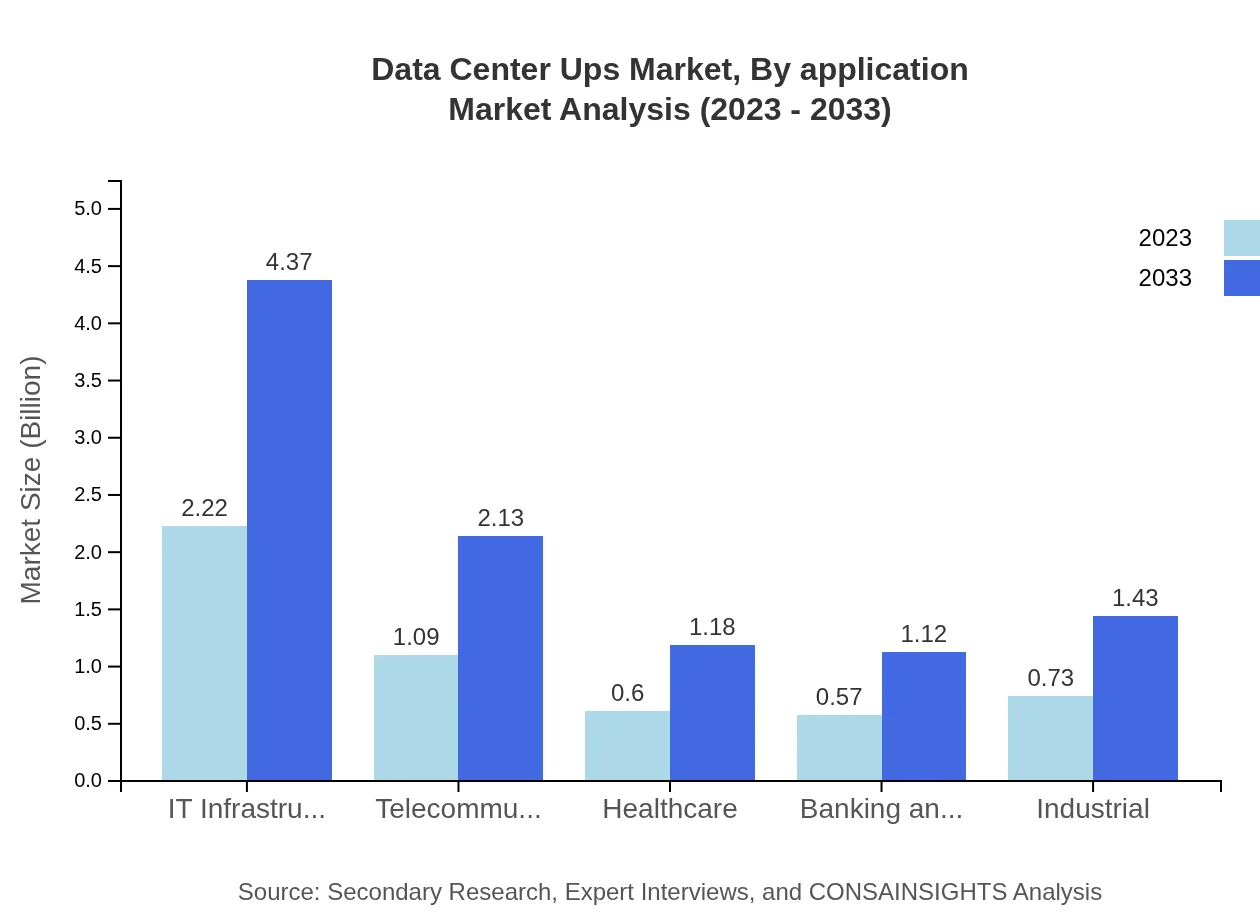

Data Center Ups Market Analysis By Application

Applications cover various essential sectors: - **IT Infrastructure**: Leading the market with $2.22 billion in 2023, set to reach $4.37 billion by 2033, constituting 42.72% of the share. - **Telecommunications**: Growing from a $1.09 billion market in 2023 to $2.13 billion by 2033, at a 20.87% share. - **Healthcare**, **Banking and Finance**, and **Industrial** sectors follow with significant contributions to the UPS market.

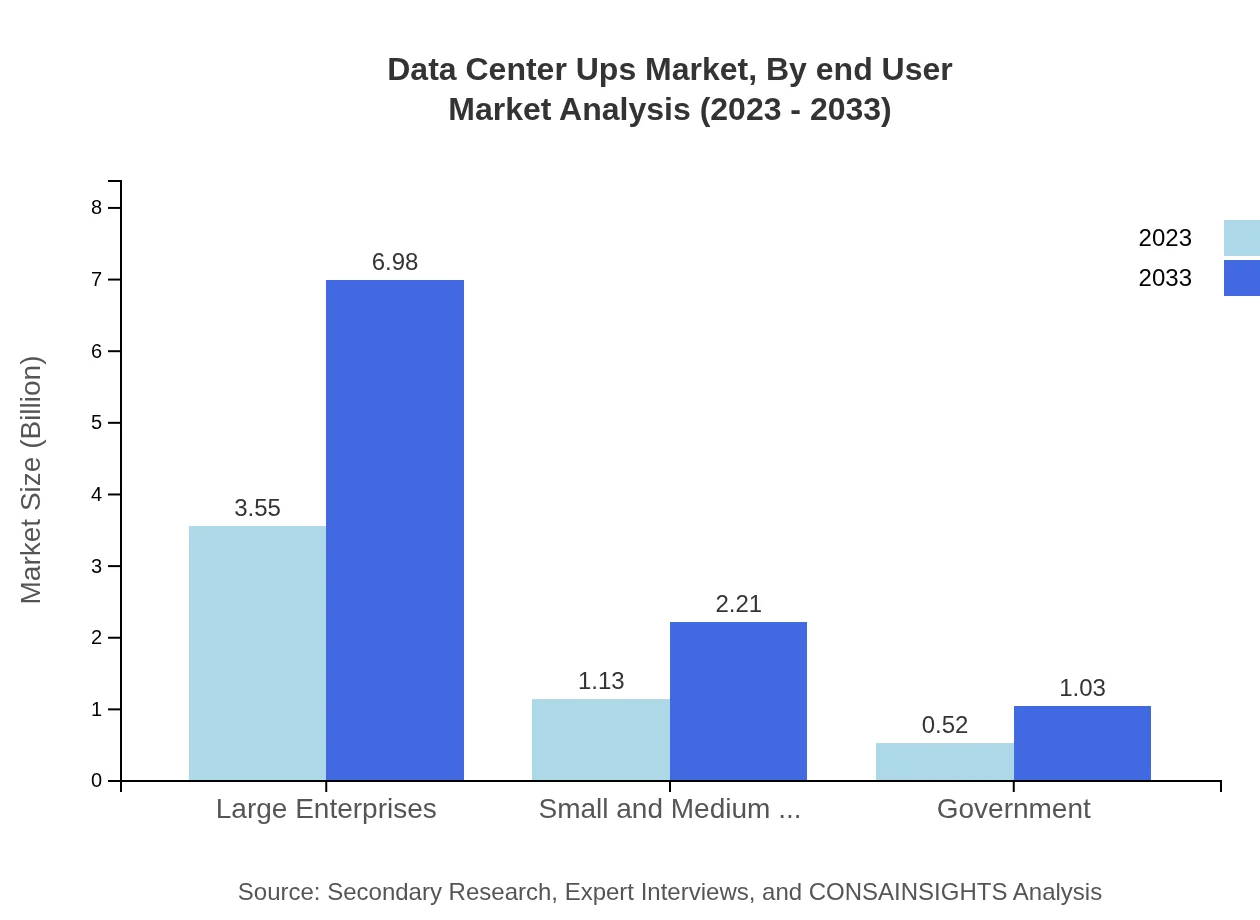

Data Center Ups Market Analysis By End User

End-user segmentation reveals substantial deployments: - **Large Enterprises**: Dominating this space with a market size of $3.55 billion in 2023 expected at $6.98 billion in 2033, maintaining a 68.3% share. - **Small and Medium Enterprises**: Projected to grow from $1.13 billion in 2023 to $2.21 billion by 2033, holding 21.64% share. - **Government sector**: Anticipated to rise from $0.52 billion in 2023 to $1.03 billion by 2033, with a 10.06% share.

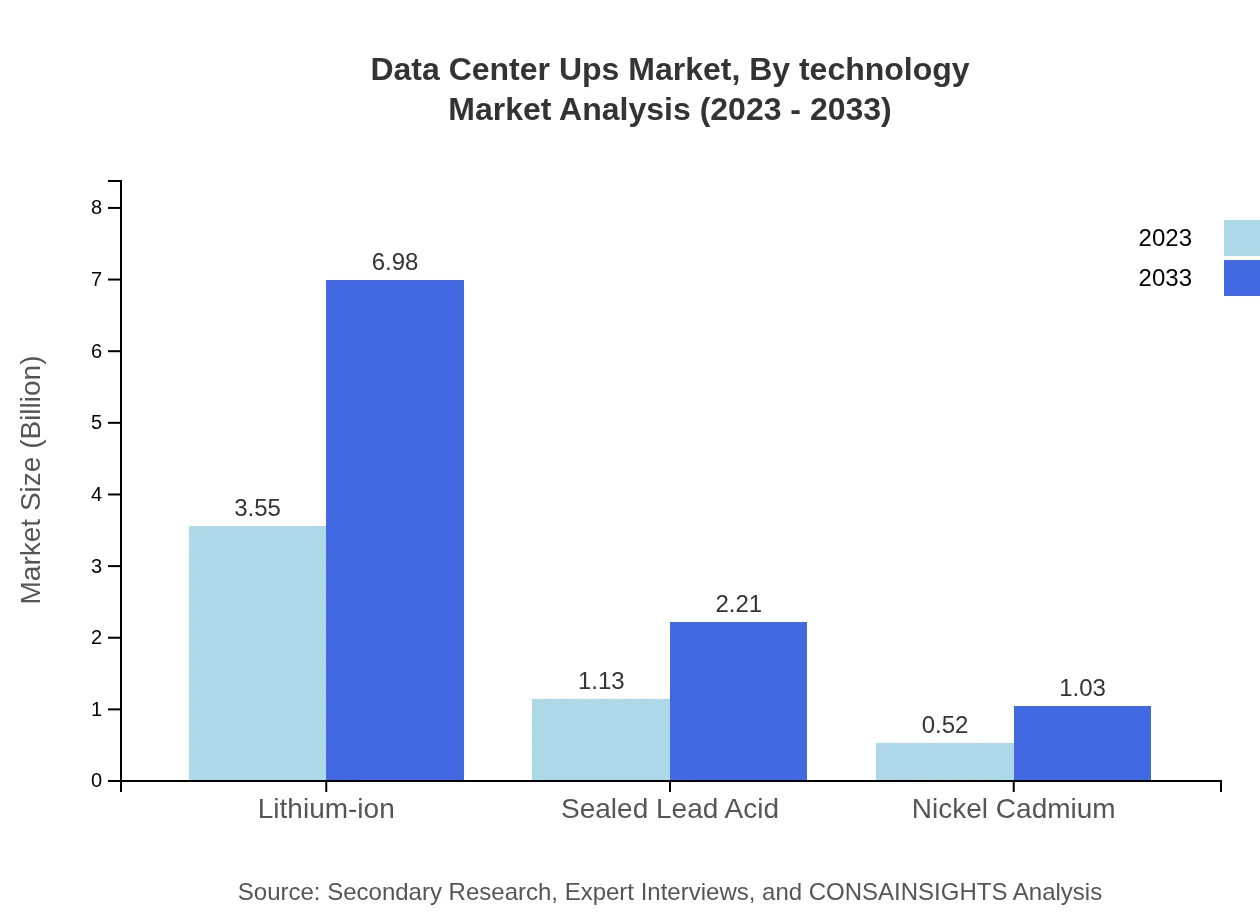

Data Center Ups Market Analysis By Technology

Technology-wise segmentation indicates: - **Lithium-ion**: Leading with a valuation of $3.55 billion in 2023, expecting $6.98 billion by 2033, gaining a significant 68.3% market share. - **Sealed Lead Acid**: Following closely at $1.13 billion in 2023 rising to $2.21 billion by 2033, holding 21.64% share. - **Nickel Cadmium**: This segment is anticipated to expand from $0.52 billion in 2023 to $1.03 billion by 2033, retaining a 10.06% share.

Data Center Ups Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Data Center Ups Industry

Schneider Electric:

A global leader in energy management and automation, Schneider Electric delivers insights and innovative UPS systems crucial for today's data centers, emphasizing sustainability.Eaton Corporation:

Eaton specializes in electrical components and power management, providing reliable UPS solutions that enhance efficiency and sustainability in data center environments.Vertiv Co.:

Vertiv provides essential digital infrastructure solutions, including UPS systems specifically designed for reliable performance in critical data environments.Siemens AG:

With a strong presence in energy solutions, Siemens offers cutting-edge UPS technologies tailored to meet the rigorous demands of data centers.Emerson Electric Co.:

Emerson specializes in automation and power solutions, including high-quality UPS products that ensure operational continuity for mission-critical applications.We're grateful to work with incredible clients.

FAQs

What is the market size of data Center Ups?

The global data center UPS market is valued at approximately $5.2 billion in 2023, with a projected CAGR of 6.8% from 2023 to 2033, indicating substantial growth driven by increasing demand for dependable power solutions.

What are the key market players or companies in this data Center Ups industry?

Key players in the data center UPS market include established companies like Schneider Electric, Eaton Corporation, Vertiv Holdings, and Mitsubishi Electric, which dominate through innovative solutions and extensive distribution networks.

What are the primary factors driving the growth in the data Center Ups industry?

The growth of the data center UPS market is primarily driven by the expansion of data centers, the rise in digitalization, increasing cloud adoption, and the need for reliable power backup solutions to prevent outages.

Which region is the fastest Growing in the data Center Ups?

The Asia Pacific region is anticipated to be the fastest-growing market for data center UPS systems, expected to increase from $1.00 billion in 2023 to $1.96 billion by 2033, fueled by rapid industrialization.

Does ConsaInsights provide customized market report data for the data Center Ups industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the data center UPS industry, allowing clients to gain insights relevant to their unique business contexts.

What deliverables can I expect from this data Center Ups market research project?

Clients can expect comprehensive deliverables including detailed reports, market size analysis, competitive landscape reviews, regional insights, and forecast data spanning growth metrics for the data center UPS industry.

What are the market trends of data Center Ups?

Key trends include the increasing adoption of lithium-ion technology, growth in green energy initiatives, and heightened focus on energy efficiency among data centers, shaping future demand for UPS systems.