Data Centre Transformers Market Report

Published Date: 31 January 2026 | Report Code: data-centre-transformers

Data Centre Transformers Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Data Centre Transformers market, highlighting key trends, insights, and predictions from 2023 to 2033. It covers market size, growth potential, segmentation, regional analysis, and profiles of leading players in the industry.

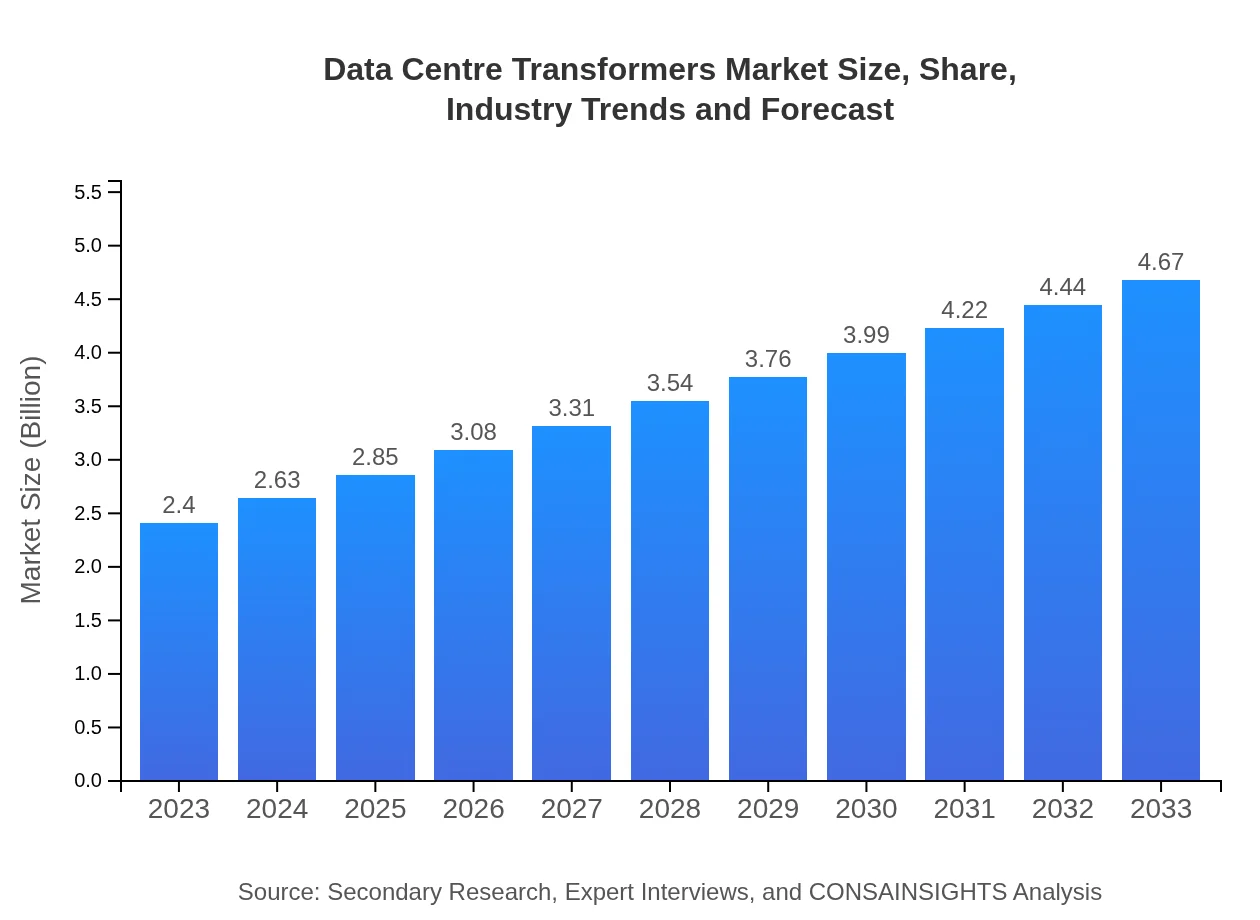

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.40 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $4.67 Billion |

| Top Companies | Schneider Electric, Siemens , General Electric, Eaton, ABB |

| Last Modified Date | 31 January 2026 |

Data Centre Transformers Market Overview

Customize Data Centre Transformers Market Report market research report

- ✔ Get in-depth analysis of Data Centre Transformers market size, growth, and forecasts.

- ✔ Understand Data Centre Transformers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Data Centre Transformers

What is the Market Size & CAGR of Data Centre Transformers market in 2023?

Data Centre Transformers Industry Analysis

Data Centre Transformers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Data Centre Transformers Market Analysis Report by Region

Europe Data Centre Transformers Market Report:

The European market is forecasted to grow from $0.84 billion in 2023 to $1.63 billion in 2033. The push for sustainability and green energy policies are influencing transformer designs, leading to new opportunities for manufacturers. Countries with stringent energy norms are expected to witness increased adoption of energy-efficient solutions.Asia Pacific Data Centre Transformers Market Report:

The Asia Pacific Data Centre Transformers market is projected to grow from $0.43 billion in 2023 to $0.84 billion by 2033. Rapid urbanization, rising data consumption, and technological adoption in countries like China and India are key growth factors. Significant investments in data centre infrastructure and increasing demand for high-efficiency transformers are driving market expansion.North America Data Centre Transformers Market Report:

In North America, the Data Centre Transformers market will grow from $0.78 billion in 2023 to $1.52 billion by 2033. This region is leading in technological advancements and the adoption of cloud services. Investments in green technologies and regulatory support for energy efficiency significantly boost market prospects.South America Data Centre Transformers Market Report:

The South American market is expected to see modest growth, increasing from $0.02 billion in 2023 to $0.03 billion by 2033. Investment in IT infrastructure and the growing presence of cloud service providers are potential growth drivers, though market penetration remains slow due to economic challenges.Middle East & Africa Data Centre Transformers Market Report:

The Middle East and Africa region will experience growth from $0.33 billion in 2023 to $0.65 billion by 2033. Investments in data centre operations in the UAE and South Africa, alongside the need for reliable power solutions in expanding urban areas, are likely to drive the market.Tell us your focus area and get a customized research report.

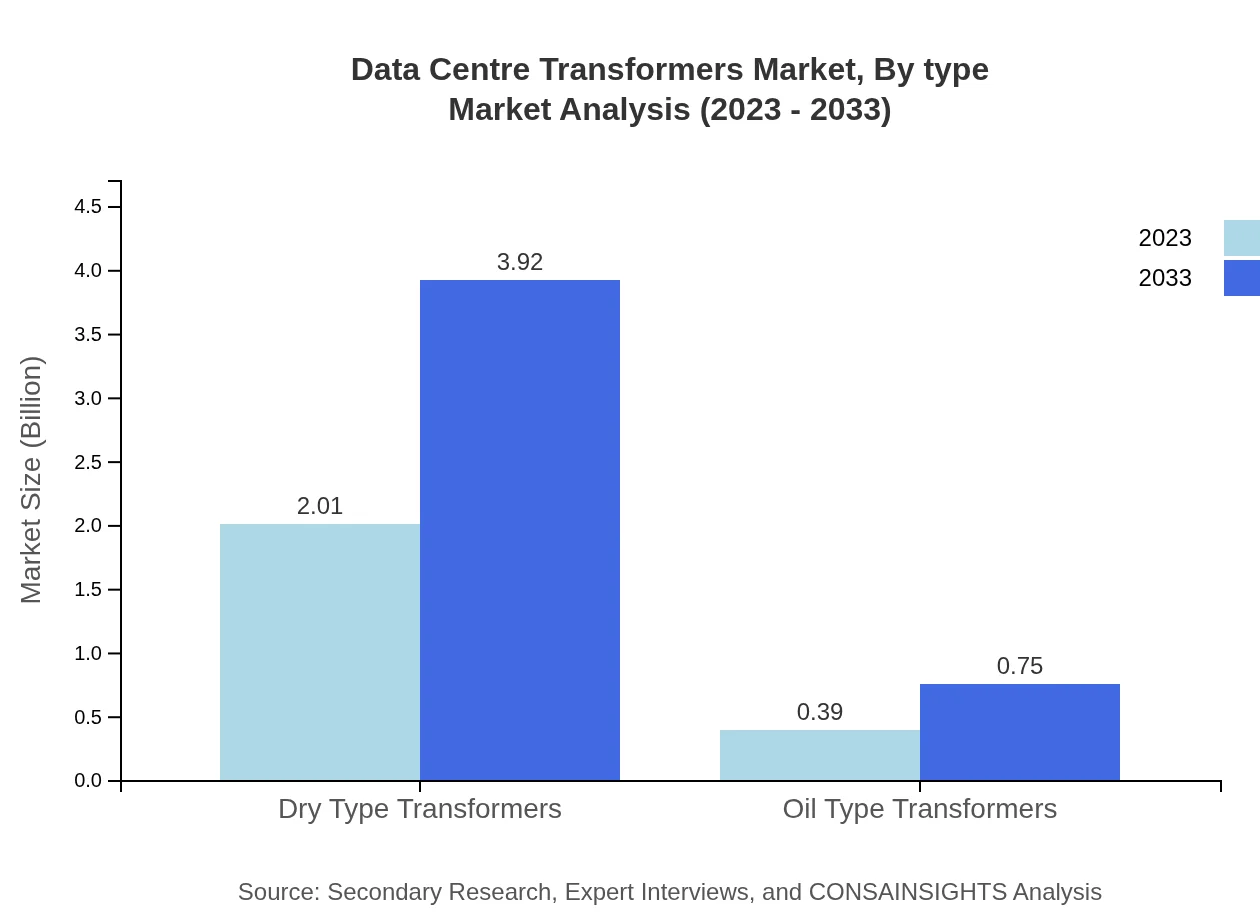

Data Centre Transformers Market Analysis By Type

The Data Centre Transformers market is analyzed based on transformer type: Dry Type Transformers and Oil Type Transformers. Dry Type Transformers dominate the market with a size of $2.01 billion in 2023, rising to $3.92 billion by 2033, capturing an 83.94% market share. Meanwhile, Oil Type Transformers, with a market size of $0.39 billion in 2023, are projected to increase to $0.75 billion by 2033, constituting 16.06% of the market.

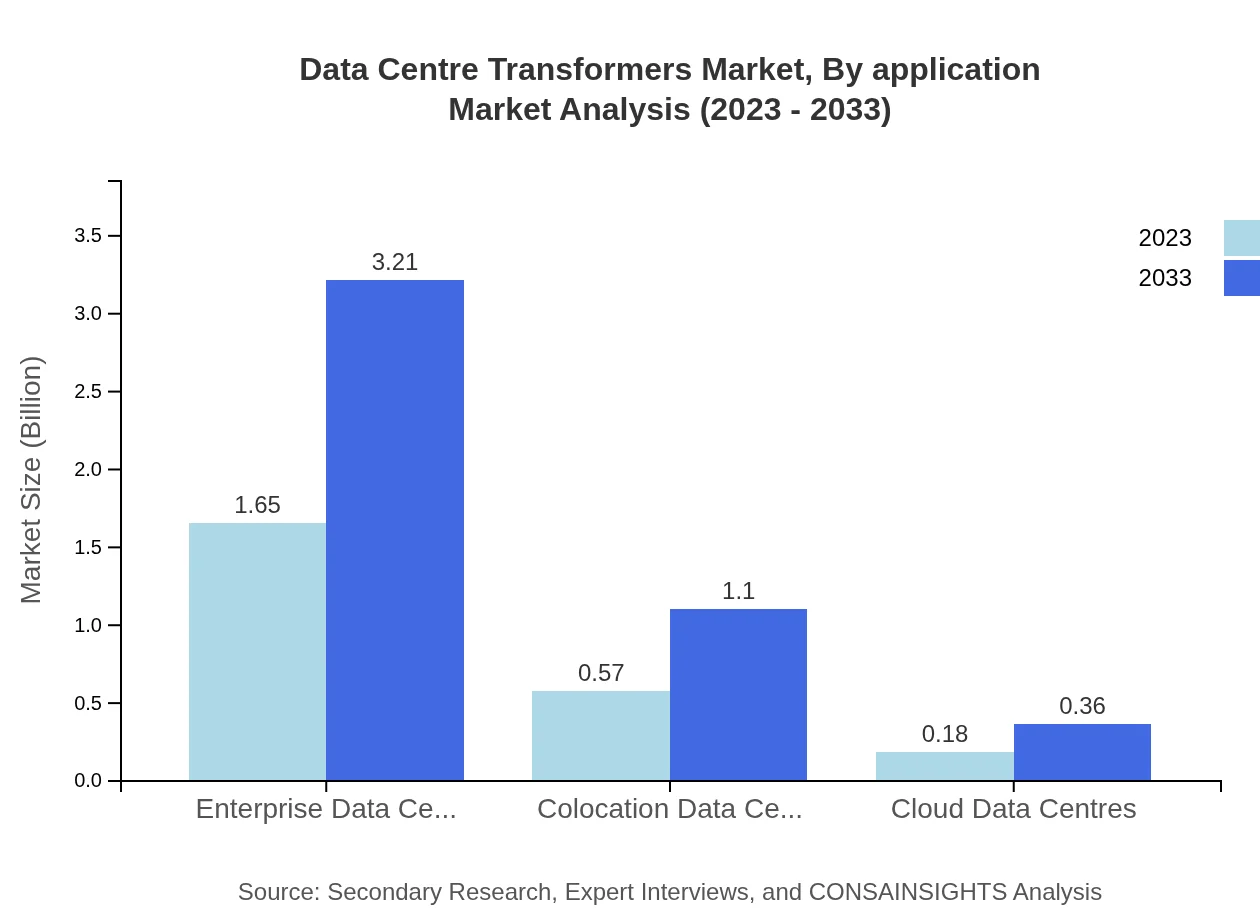

Data Centre Transformers Market Analysis By Application

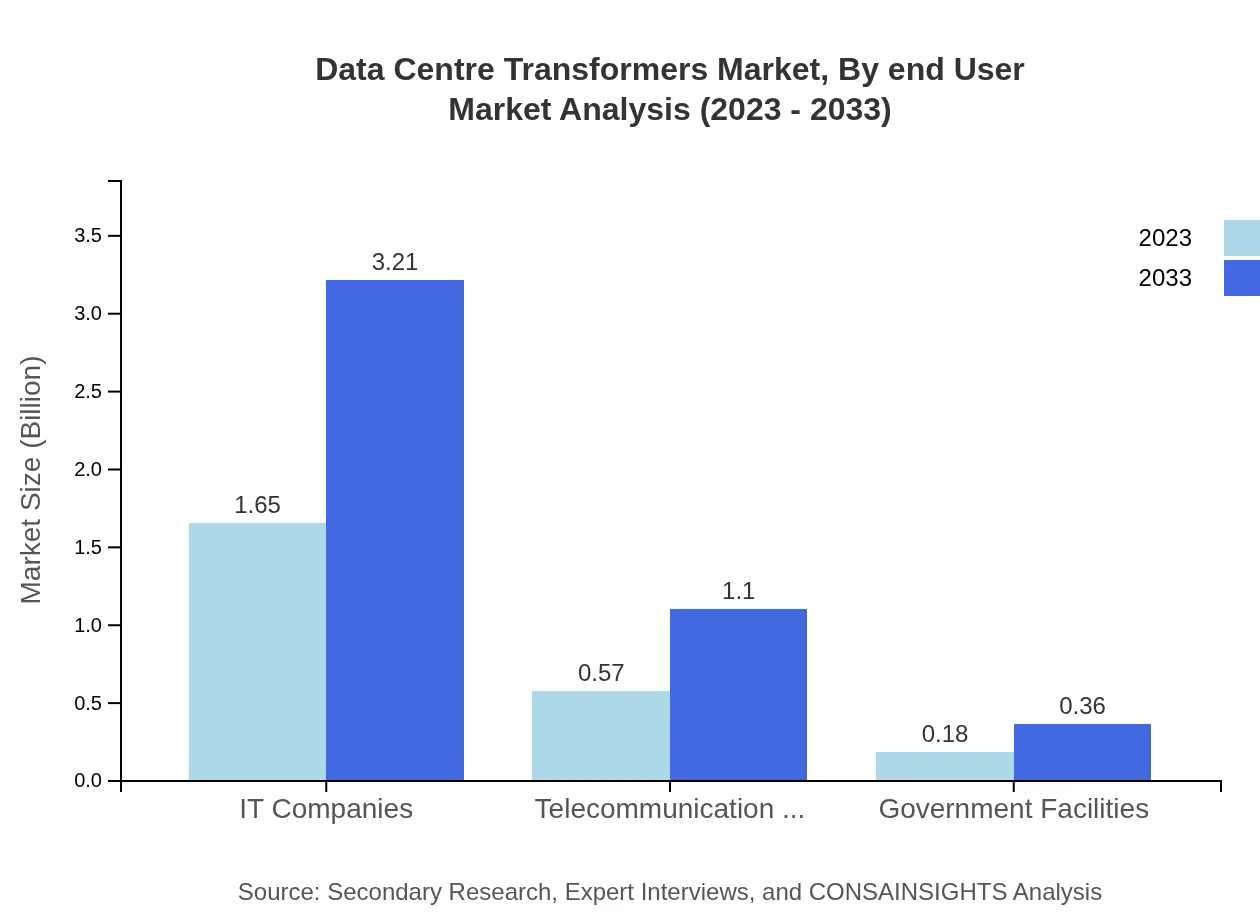

The classification by end-user reveals significant trends, with IT Companies holding a majority share of 68.74%, expected to grow from $1.65 billion to $3.21 billion during the forecast period. Telecommunication Companies constitute the second segment, growing from $0.57 billion to $1.10 billion, while other sectors such as Government Facilities and Enterprise Data Centres also represent crucial segments with meaningful growth.

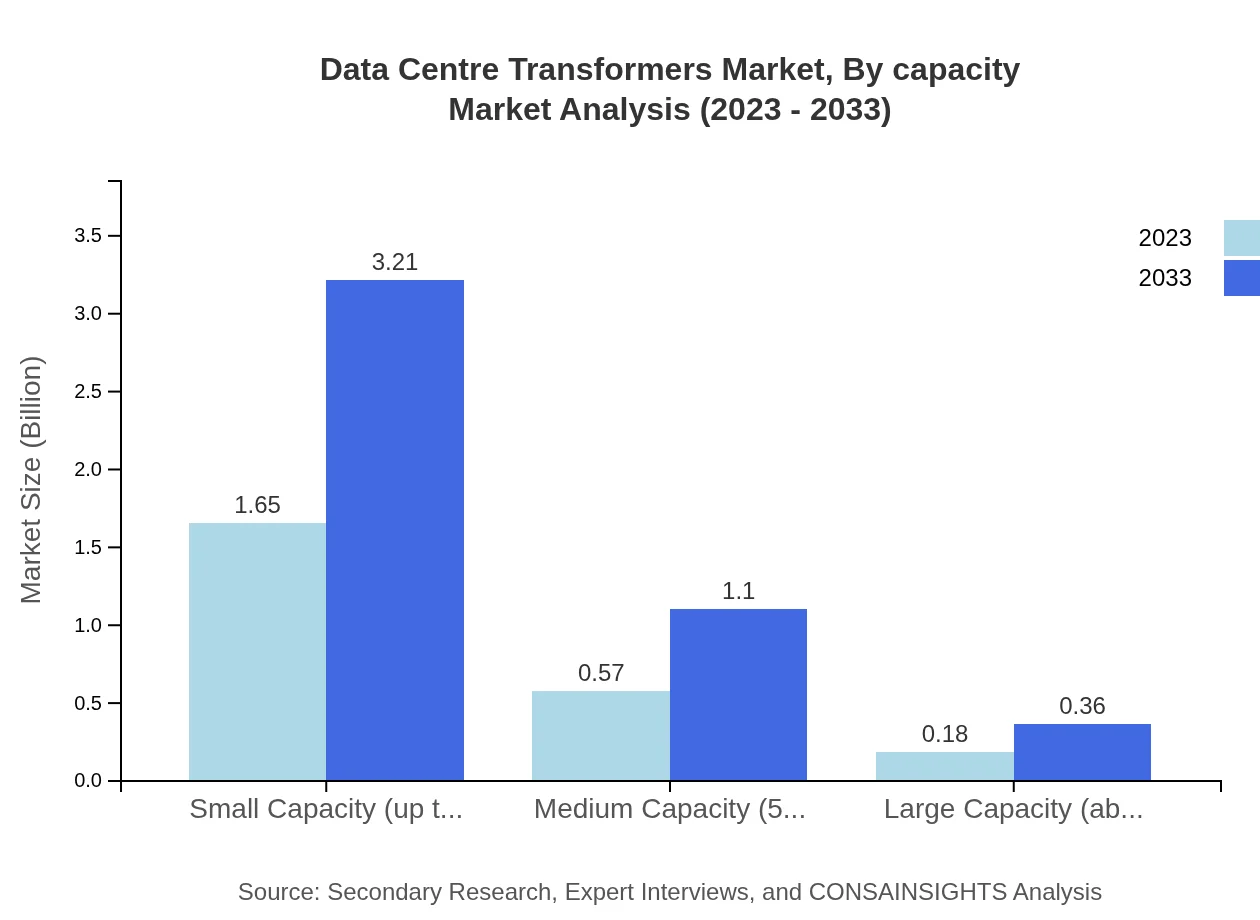

Data Centre Transformers Market Analysis By Capacity

The capacity-based segmentation has Small Capacity (up to 500 kVA) leading the market with a size of $1.65 billion in 2023, projected to grow to $3.21 billion. This segment holds a 68.74% share. The Medium Capacity (501 kVA to 2000 kVA) is also notable, with growth from $0.57 billion to $1.10 billion, while the Large Capacity (above 2000 kVA) increases from $0.18 billion to $0.36 billion.

Data Centre Transformers Market Analysis By End User

The primary end-users, including IT and Telecommunication Companies, showcase a strong focus on reliability and efficiency, driving the market. As enterprise-level systems grow, the reliance on robust electrical infrastructure grows in tandem, with enterprise and colocation data centres accounting for significant market shares.

Data Centre Transformers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Data Centre Transformers Industry

Schneider Electric:

A global specialist in energy management and automation, Schneider Electric is heavily involved in innovations for data centre solutions, providing reliable and efficient transformers.Siemens :

Siemens is a leader in electrical engineering and technology, creating cutting-edge energy solutions, including high-performance transformers for data centres.General Electric:

A top competitor in the energy sector, GE offers a range of products including transformers that are integrating advanced technologies for better efficiency.Eaton:

Eaton provides power management solutions and has a significant focus on enhancing data centre operations with state-of-the-art transformer technologies.ABB:

ABB is renowned for its innovative technologies and focuses on providing efficient transformer solutions that significantly enhance data centre operations.We're grateful to work with incredible clients.

FAQs

What is the market size of data Centre Transformers?

The global data-centre-transformers market is valued at $2.4 billion as of 2023, projected to grow at a CAGR of 6.7% through to 2033, signifying strong demand and investment in this technology.

What are the key market players or companies in this data Centre Transformers industry?

Prominent players in the data-centre-transformers industry include Schneider Electric, ABB Ltd., Siemens AG, Mitsubishi Electric Corporation, and Eaton Corporation, among others, which drive innovation and industry standards.

What are the primary factors driving the growth in the data Centre Transformers industry?

Growth drivers for the data-centre-transformers market include increasing data center demand, rising cloud computing, energy efficiency requirements, and the need for reliable power solutions to manage electronic workloads.

Which region is the fastest Growing in the data Centre Transformers?

From 2023 to 2033, North America exhibits the fastest growth in the data-centre-transformers market, projected to escalate from $0.78 billion to $1.52 billion, reflecting heightened technological investments.

Does ConsaInsights provide customized market report data for the data Centre Transformers industry?

Yes, ConsaInsights offers customizable market reports for data-centre-transformers, allowing clients to tailor insights specific to their needs, facilitating informed decision-making.

What deliverables can I expect from this data Centre Transformers market research project?

Expected deliverables include detailed market analysis, growth forecasts, competitive benchmarking, segment insights, and regional performance, providing comprehensive intelligence on data-centre-transformers.

What are the market trends of data Centre Transformers?

Key trends in the data-centre-transformers market include the shift towards renewable energy integration, the standardization of transformer types, and a focus on green technologies to improve energy efficiency.