Data Integration Market Report

Published Date: 31 January 2026 | Report Code: data-integration

Data Integration Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Data Integration market, offering insights into market trends, regional performance, and forecasts from 2023 to 2033, emphasizing growth opportunities and challenges in this dynamic sector.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

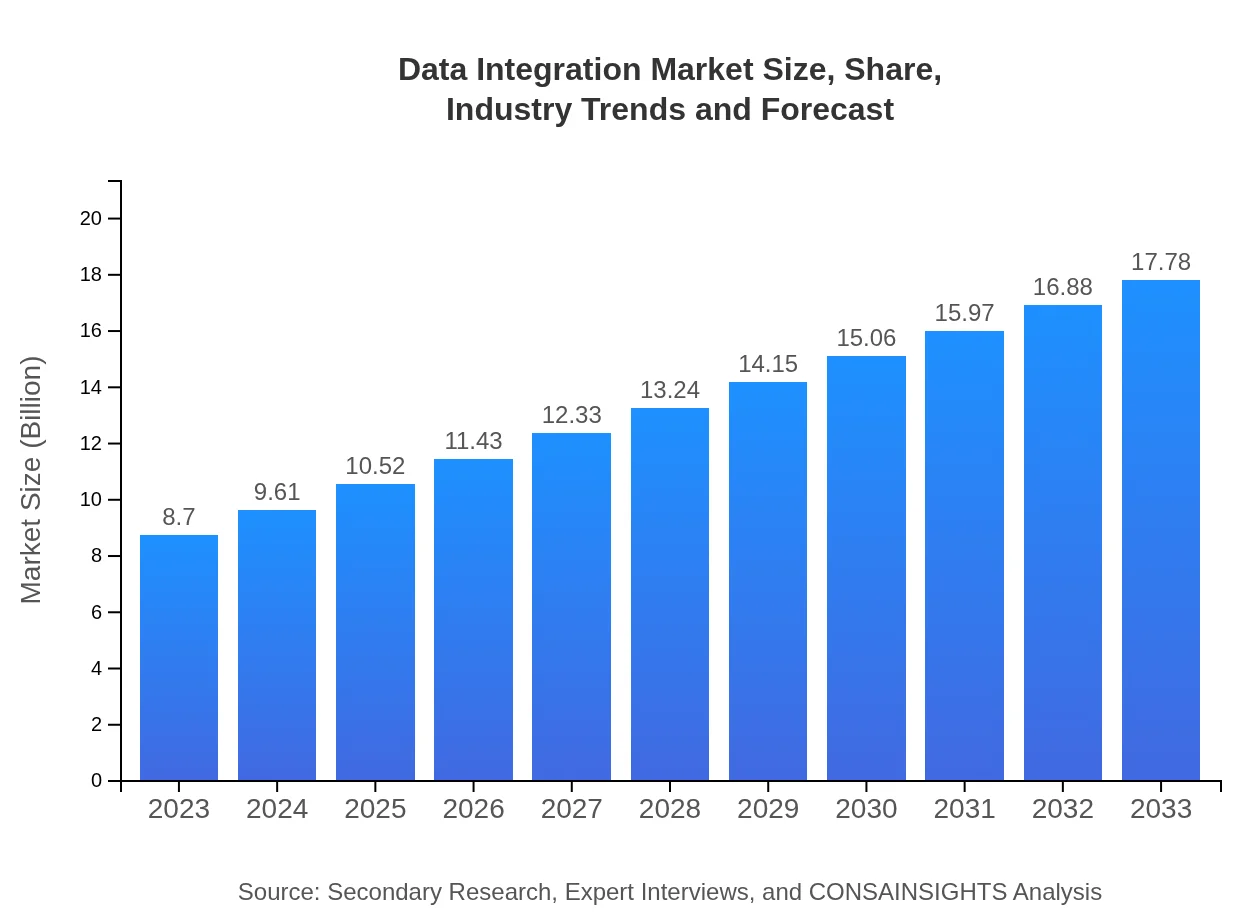

| 2023 Market Size | $8.70 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $17.78 Billion |

| Top Companies | Informatica, Talend, Microsoft, IBM, Oracle |

| Last Modified Date | 31 January 2026 |

Data Integration Market Overview

Customize Data Integration Market Report market research report

- ✔ Get in-depth analysis of Data Integration market size, growth, and forecasts.

- ✔ Understand Data Integration's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Data Integration

What is the Market Size & CAGR of Data Integration market in 2023?

Data Integration Industry Analysis

Data Integration Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Data Integration Market Analysis Report by Region

Europe Data Integration Market Report:

Europe's Data Integration market is anticipated to rise from $2.44 billion in 2023 to $4.98 billion by 2033, spurred by stringent data regulations and a strong emphasis on data analytics that drive companies towards sophisticated integration solutions.Asia Pacific Data Integration Market Report:

In the Asia Pacific, the Data Integration market is expected to grow from $1.74 billion in 2023 to $3.55 billion by 2033, driven by digital transformation initiatives across various industries and the increasing utilization of cloud technologies.North America Data Integration Market Report:

North America holds a significant market share, with estimated growth from $3.04 billion in 2023 to $6.22 billion by 2033, propelled by high adoption rates in industries such as BFSI and healthcare, alongside advancements in AI and machine learning technologies.South America Data Integration Market Report:

The South American market is projected to see growth from $0.42 billion in 2023 to $0.86 billion by 2033. Factors such as advances in technology and increased investment in business analytics significantly influence this region's market dynamics.Middle East & Africa Data Integration Market Report:

The Middle East and Africa market is expected to increase from $1.06 billion in 2023 to $2.16 billion by 2033, with growing digitalization efforts and enhanced data management practices contributing to this growth.Tell us your focus area and get a customized research report.

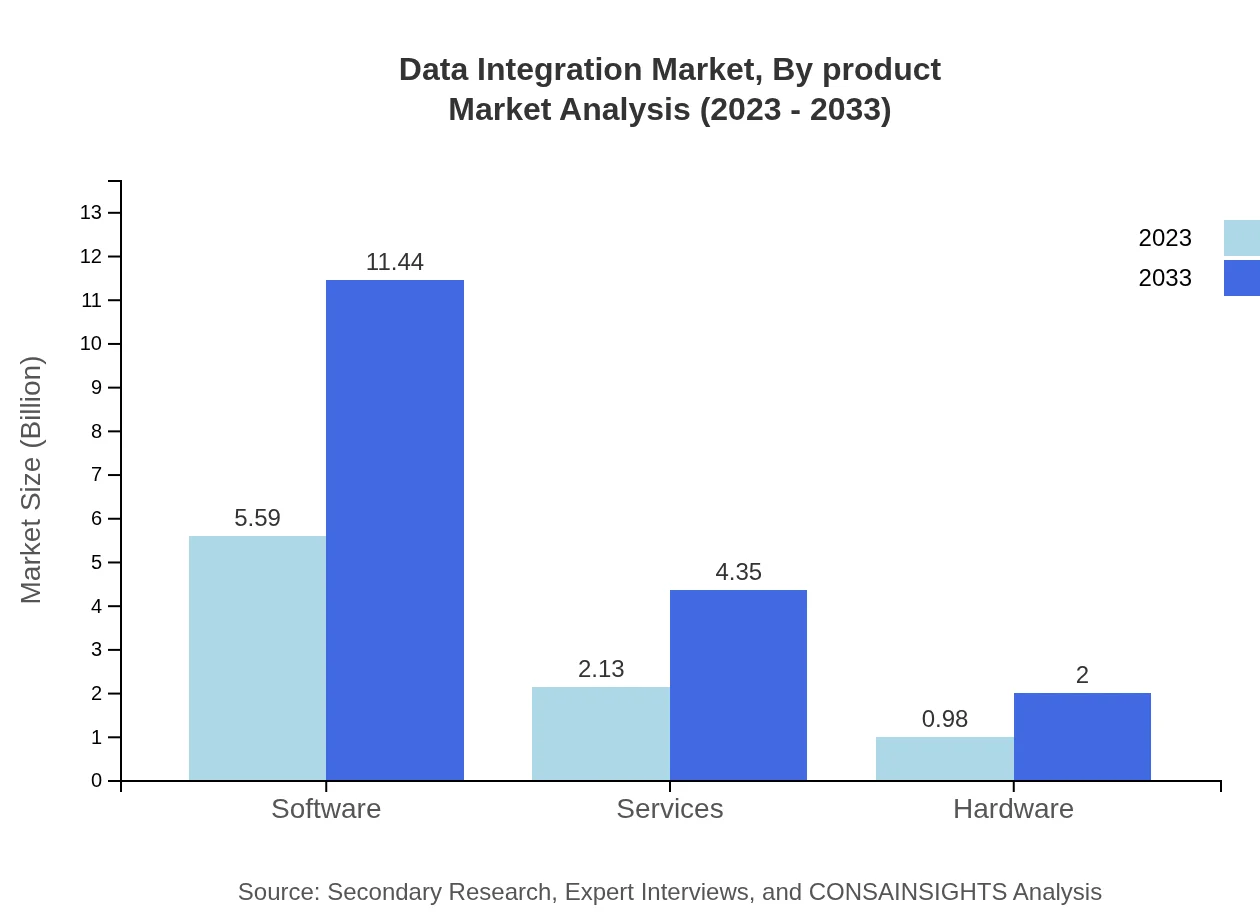

Data Integration Market Analysis By Product

In terms of product segmentation, Software dominates the market with a forecasted growth from $5.59 billion in 2023 to $11.44 billion by 2033, accounting for a significant share of 64.31%. Cloud-based Integration is driving this growth, emphasizing the shift towards flexible, scalable solutions. Services also represent a critical segment, showing growth from $2.13 billion to $4.35 billion, highlighting the importance of integration consulting and support services in enhancing client solutions.

Data Integration Market Analysis By Technology

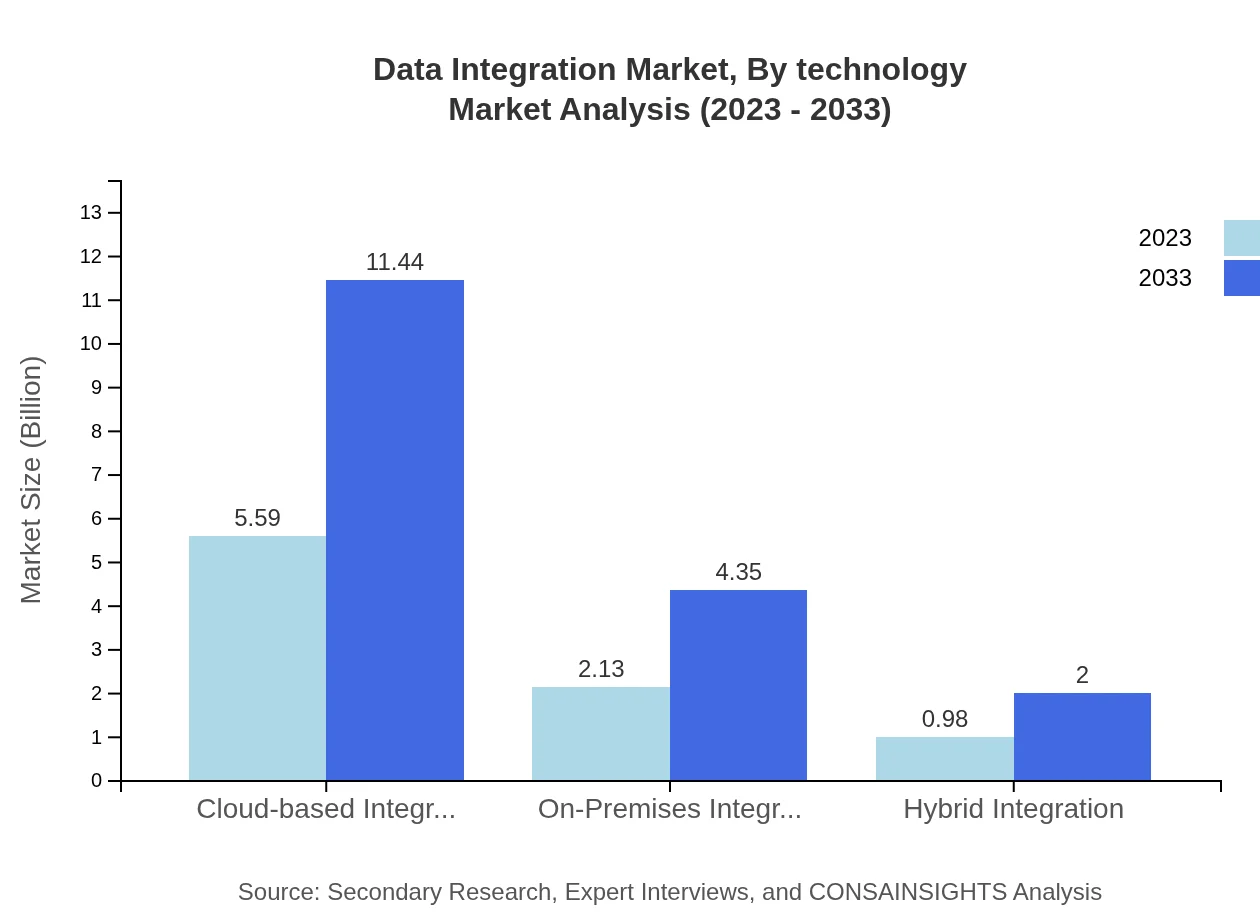

The Data Integration market's technological landscape is evolving, with significant advancements in cloud-based integration and hybrid integration modes. Cloud solutions are set to maintain their leadership, with their market size expected to grow from $5.59 billion to $11.44 billion, reflecting a strong trend toward cloud adoption. On-premises integration is also crucial, ensuring that businesses leverage existing infrastructure while integrating new technologies.

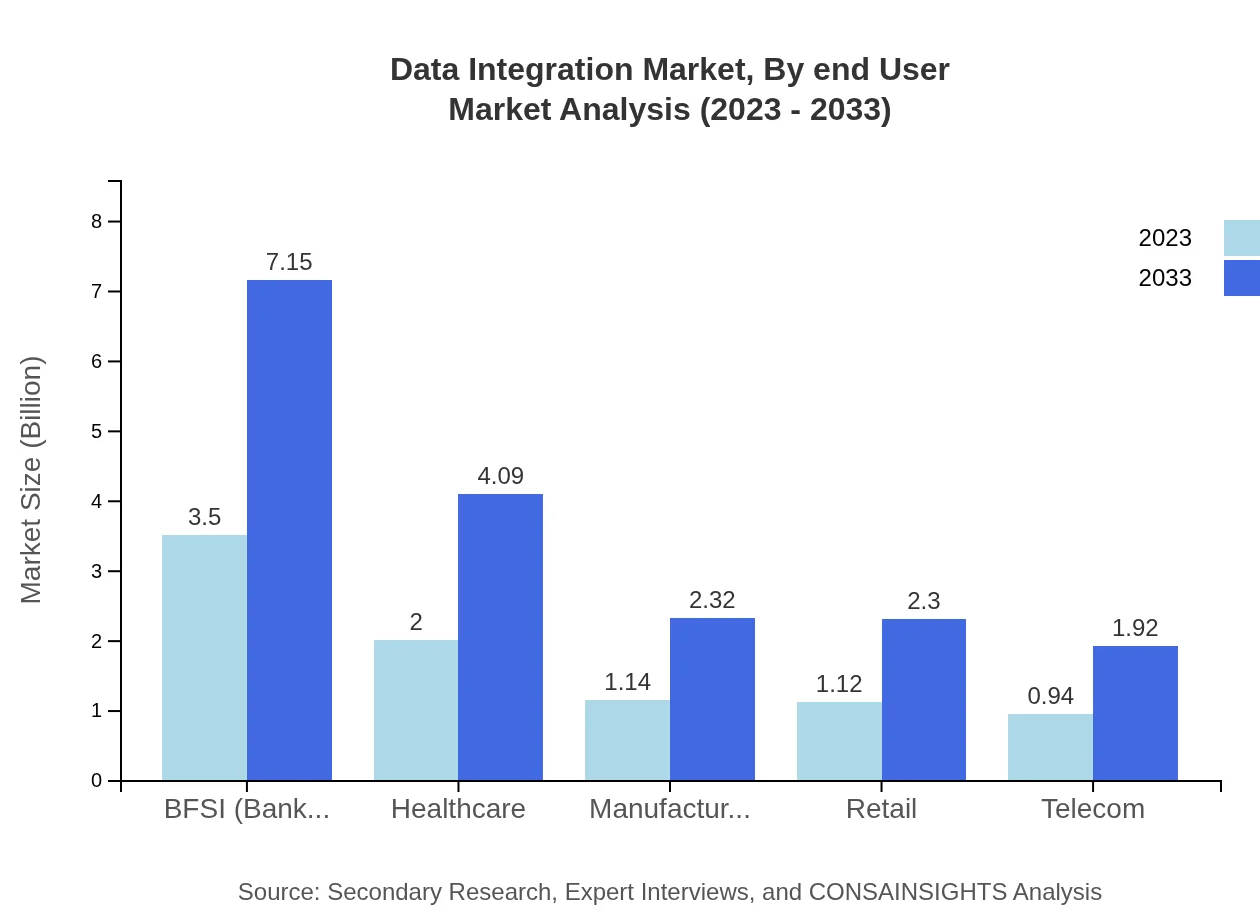

Data Integration Market Analysis By End User

Key end-user industries driving the Data Integration market are BFSI, Healthcare, and Retail. BFSI alone accounts for a market size of $3.50 billion in 2023, which expands to $7.15 billion by 2033, reflecting the sector's heightened focus on data security and operational efficiency. The Healthcare sector also shows a promising forecast, growing from $2.00 billion to $4.09 billion, underscoring the growing demand for integrated patient data solutions.

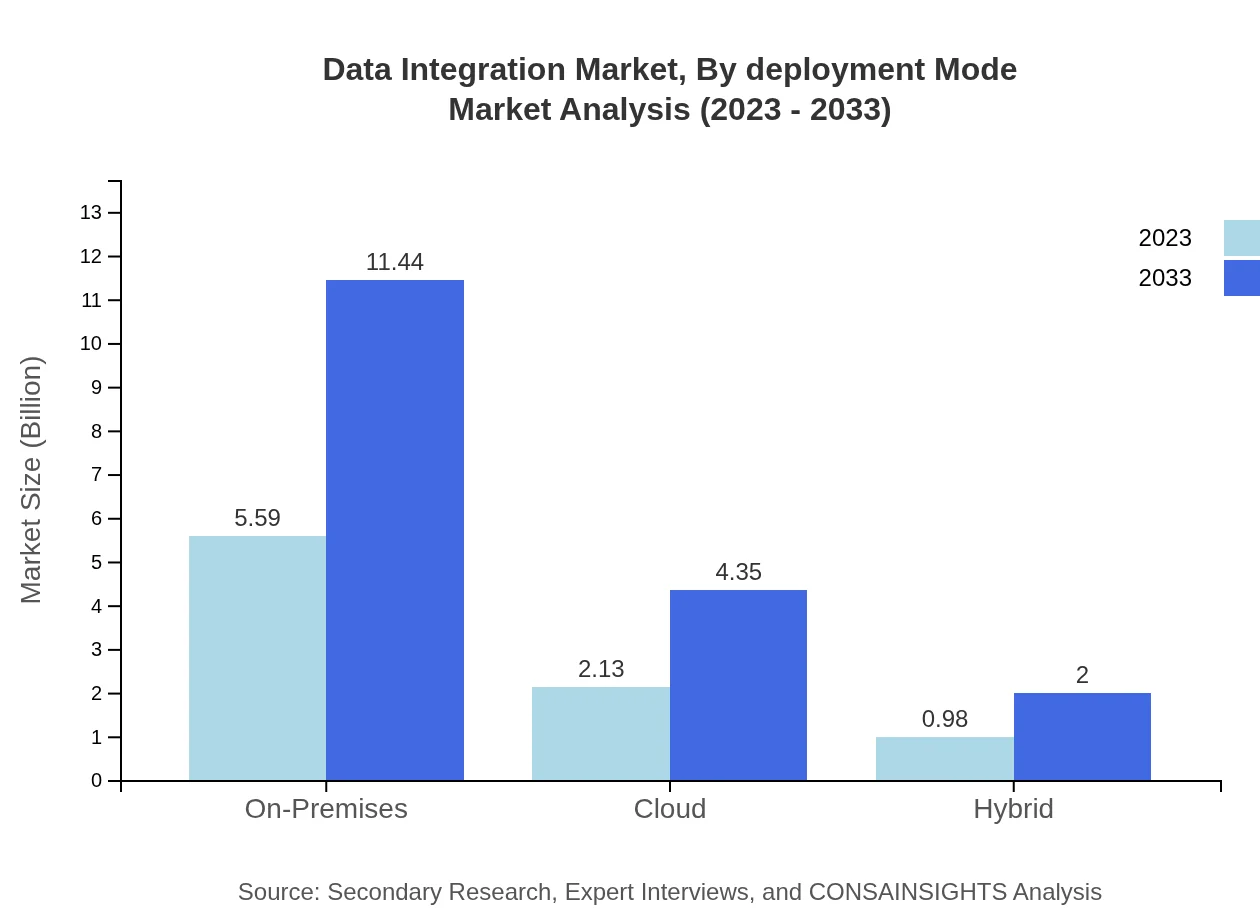

Data Integration Market Analysis By Deployment Mode

Deployment modes are witnessing a notable shift as organizations increasingly prefer cloud and hybrid integration models. The cloud deployment segment is projected to grow from $5.59 billion to $11.44 billion, emphasizing its scalability. On-premises integration remains crucial for organizations with stringent data security requirements, while hybrid integration models cater to the needs for flexibility and data security.

Data Integration Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Data Integration Industry

Informatica:

Informatica is a leader in the Data Integration industry, known for its robust cloud solutions that enhance data accessibility and governance across organizations.Talend:

Talend specializes in cloud data integration and integrity solutions, helping businesses streamline their data processes through advanced technologies.Microsoft:

Microsoft offers powerful integration tools through its Azure platform, providing enterprises with scalable solutions for managing diverse data sources.IBM:

IBM's Data Integration tools enable organizations to connect and manage data efficiently, emphasizing security and compliance across multiple industries.Oracle:

Oracle provides comprehensive integration frameworks that support complex data environments, enabling seamless data flow and analytics.We're grateful to work with incredible clients.

FAQs

What is the market size of data Integration?

The global data integration market is currently valued at $8.7 billion and is anticipated to grow at a CAGR of 7.2% over the next decade, reaching new heights by 2033.

What are the key market players or companies in this data Integration industry?

Key players in the data integration industry include leading technology firms such as Informatica, IBM, Microsoft, Oracle, and Talend, which contribute significantly to the market by offering software and services across various sectors.

What are the primary factors driving the growth in the data integration industry?

The growth in the data integration industry is driven by increasing data volumes generated from diverse sources, the need for real-time data access, and the rising adoption of cloud computing solutions, which enhance operational efficiency and decision-making.

Which region is the fastest Growing in the data Integration?

The Asia Pacific region is projected to be the fastest-growing market for data integration from 2023 to 2033, with its market size expected to increase from $1.74 billion to $3.55 billion during this period.

Does ConsaInsights provide customized market report data for the data Integration industry?

Yes, ConsaInsights offers tailored market report data specific to the data integration industry, ensuring that businesses receive insights and analyses that align with their unique operational needs and market conditions.

What deliverables can I expect from this data Integration market research project?

From the data integration market research project, you can expect comprehensive reports including market forecasts, competitive analysis, regional insights, and detailed segment analysis, along with actionable recommendations for strategic planning.

What are the market trends of data Integration?

Current market trends in data integration reflect a strong shift towards cloud-based solutions, demand for enhanced data governance, and integration of artificial intelligence to automate data processes, improving efficiency and accuracy across various sectors.