Debt Collection Software Market Report

Published Date: 24 January 2026 | Report Code: debt-collection-software

Debt Collection Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Debt Collection Software market from 2023 to 2033, including market size, growth rates, industry trends, regional insights, and the competitive landscape.

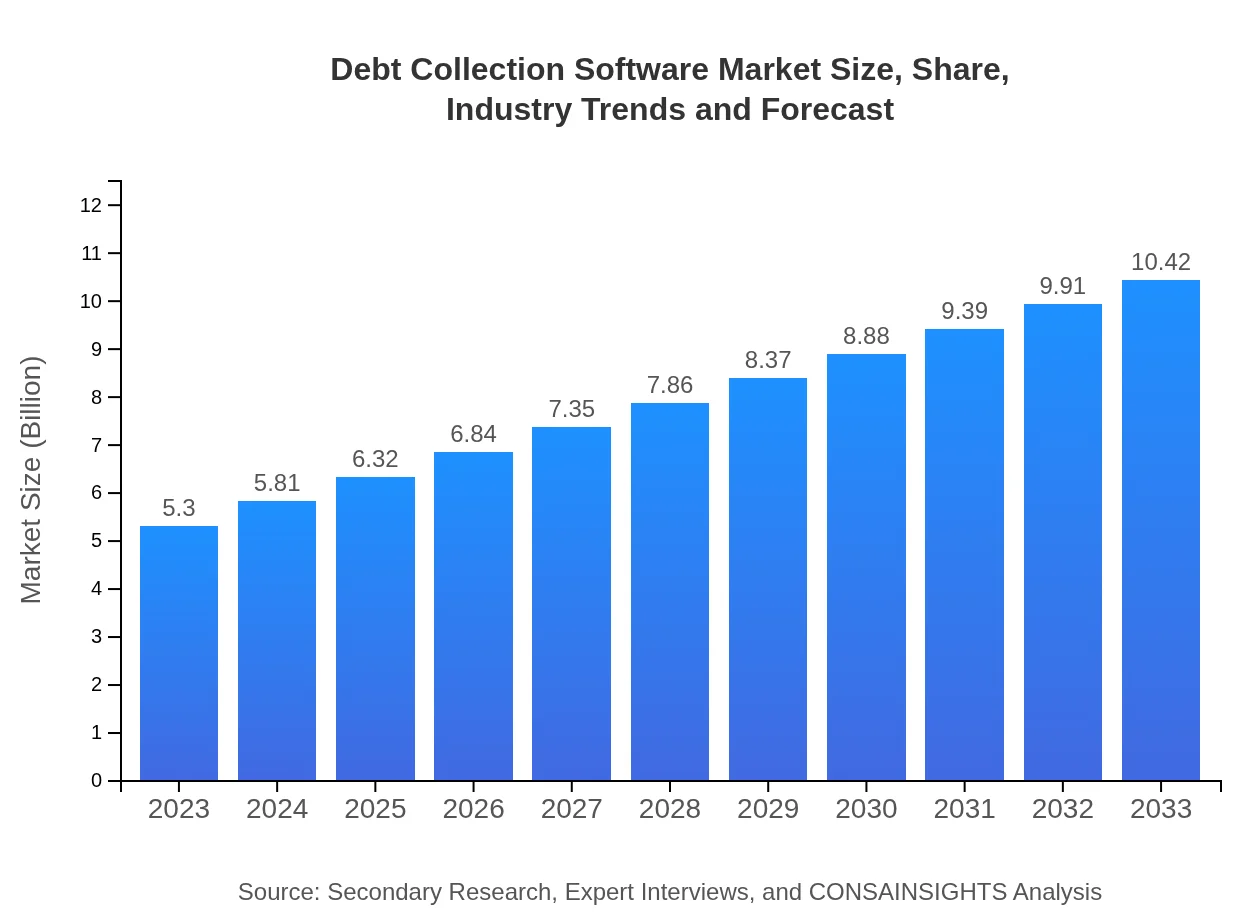

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.30 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.42 Billion |

| Top Companies | FICO, Experian, Dun & Bradstreet, CNS |

| Last Modified Date | 24 January 2026 |

Debt Collection Software Market Overview

Customize Debt Collection Software Market Report market research report

- ✔ Get in-depth analysis of Debt Collection Software market size, growth, and forecasts.

- ✔ Understand Debt Collection Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Debt Collection Software

What is the Market Size & CAGR of Debt Collection Software market in 2023?

Debt Collection Software Industry Analysis

Debt Collection Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Debt Collection Software Market Analysis Report by Region

Europe Debt Collection Software Market Report:

Europe's Debt Collection Software market is noteworthy, starting at $1.45 billion in 2023 and forecasted to reach $2.84 billion by 2033. The stringent regulations surrounding consumer rights and data privacy are propelling companies to adopt advanced debt management solutions.Asia Pacific Debt Collection Software Market Report:

The Asia Pacific region is emerging as a key player in the Debt Collection Software market, with an estimated market size of $1.06 billion in 2023, projected to grow to $2.08 billion by 2033. Growing economies, increased consumer spending, and a rise in debt levels are driving this growth, coupled with a surge in digital payment systems that facilitate collections.North America Debt Collection Software Market Report:

North America continues to lead the market, with a size of $1.99 billion in 2023 expected to reach $3.91 billion by 2033. Strong demand from financial institutions and regulatory compliance needs are key factors driving market growth in the region.South America Debt Collection Software Market Report:

In South America, the market for Debt Collection Software is expected to increase from $0.48 billion in 2023 to $0.95 billion in 2033. This growth is supported by increased regulatory focus on collections and a transition towards adopting modern technologies in the debt recovery process.Middle East & Africa Debt Collection Software Market Report:

In the Middle East and Africa, the market is growing steadily, with a size estimated at $0.32 billion in 2023, potentially reaching $0.63 billion by 2033. Economic fluctuations and rising debt levels compel businesses to seek better debt recovery strategies facilitated by technology.Tell us your focus area and get a customized research report.

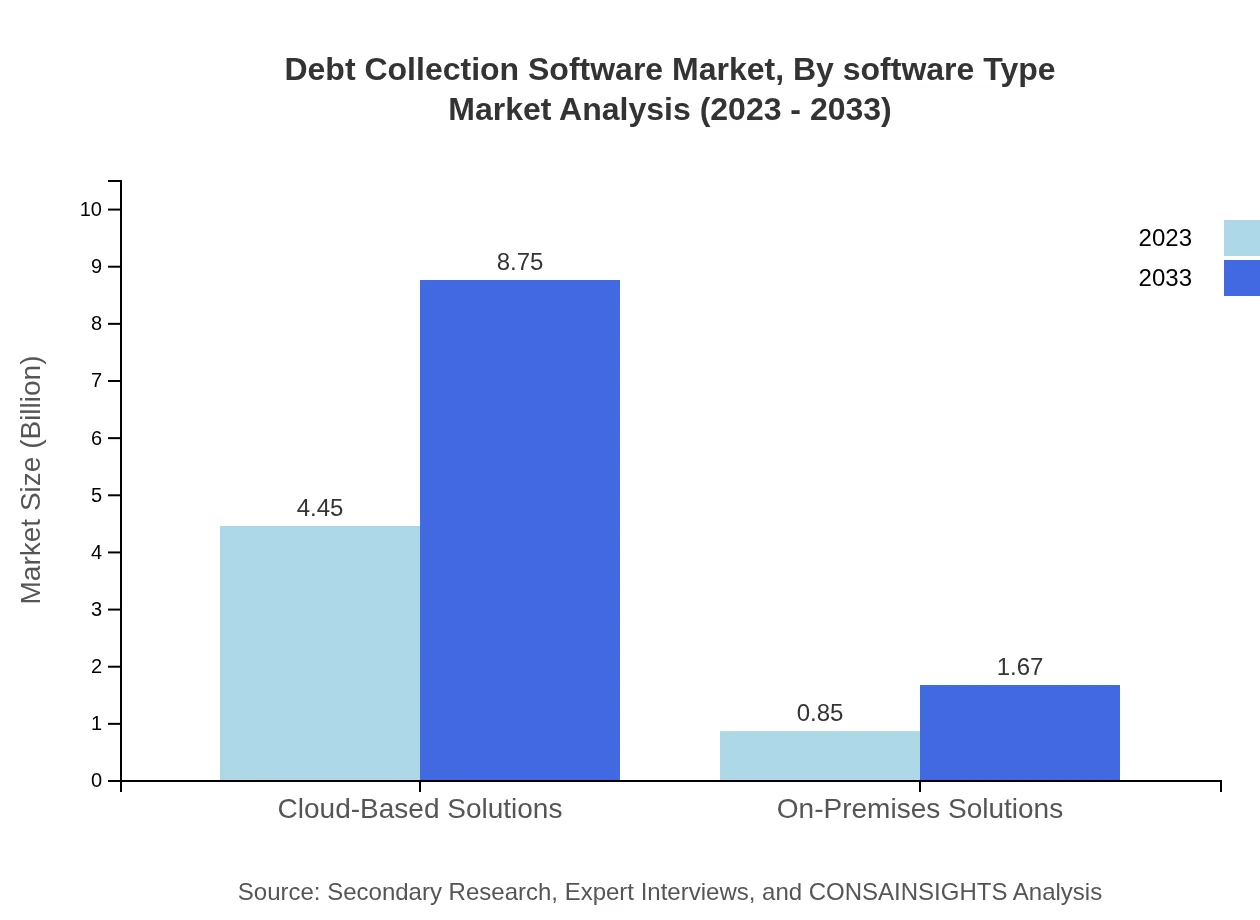

Debt Collection Software Market Analysis By Software Type

The Debt Collection Software market can be segmented based on software type. Automated collections lead the segment, with a market size projected to grow from $3.32 billion in 2023 to $6.53 billion in 2033, reflecting a share of 62.71%. Cloud-based solutions will dominate the market with an $4.45 billion size growing to $8.75 billion.

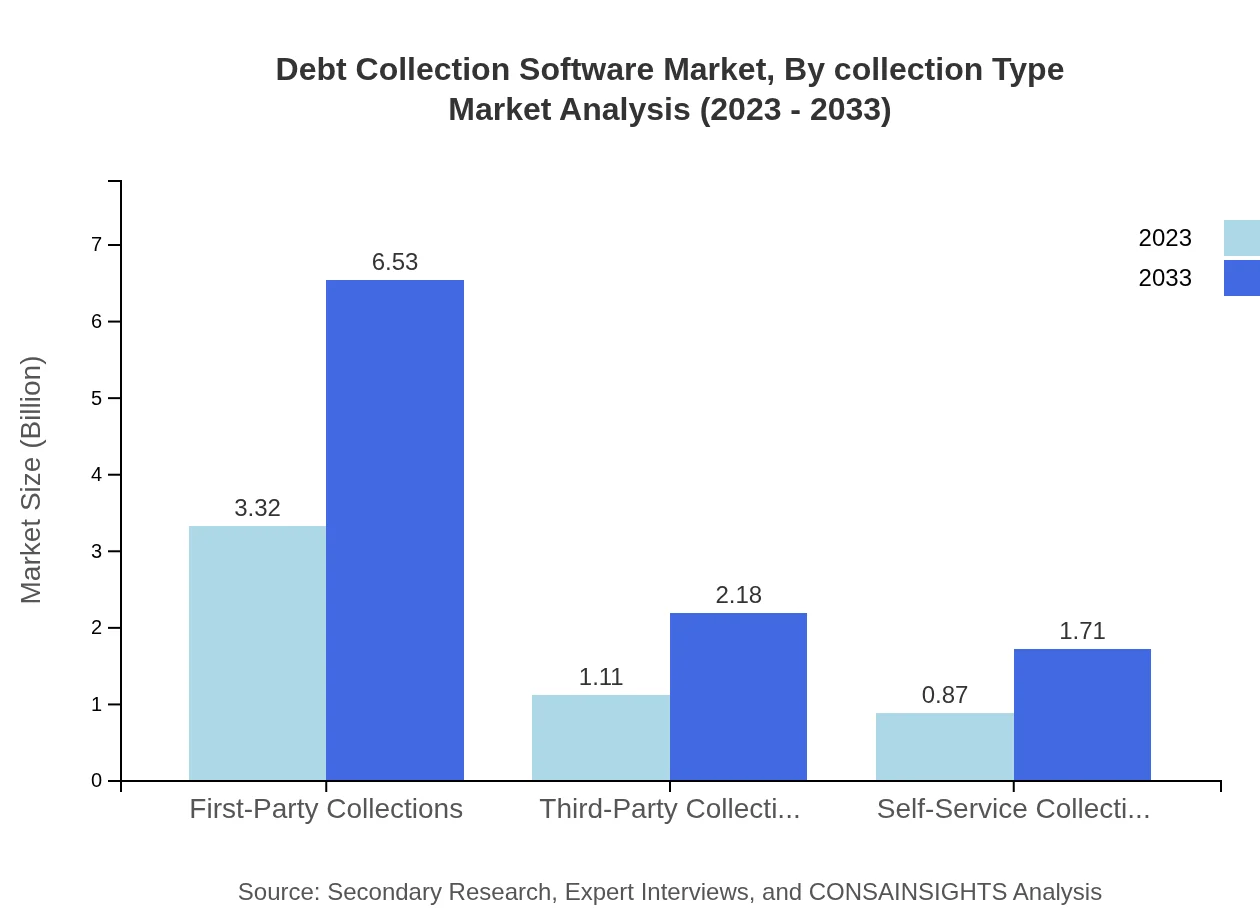

Debt Collection Software Market Analysis By Collection Type

This segment highlights the varied collection processes. First-party collections maintain strong market significance with an estimated size of $3.32 billion in 2023 to $6.53 billion by 2033. Conversely, third-party collections signify a growing dependence on outsourced agencies, projected to grow from $1.11 billion to $2.18 billion.

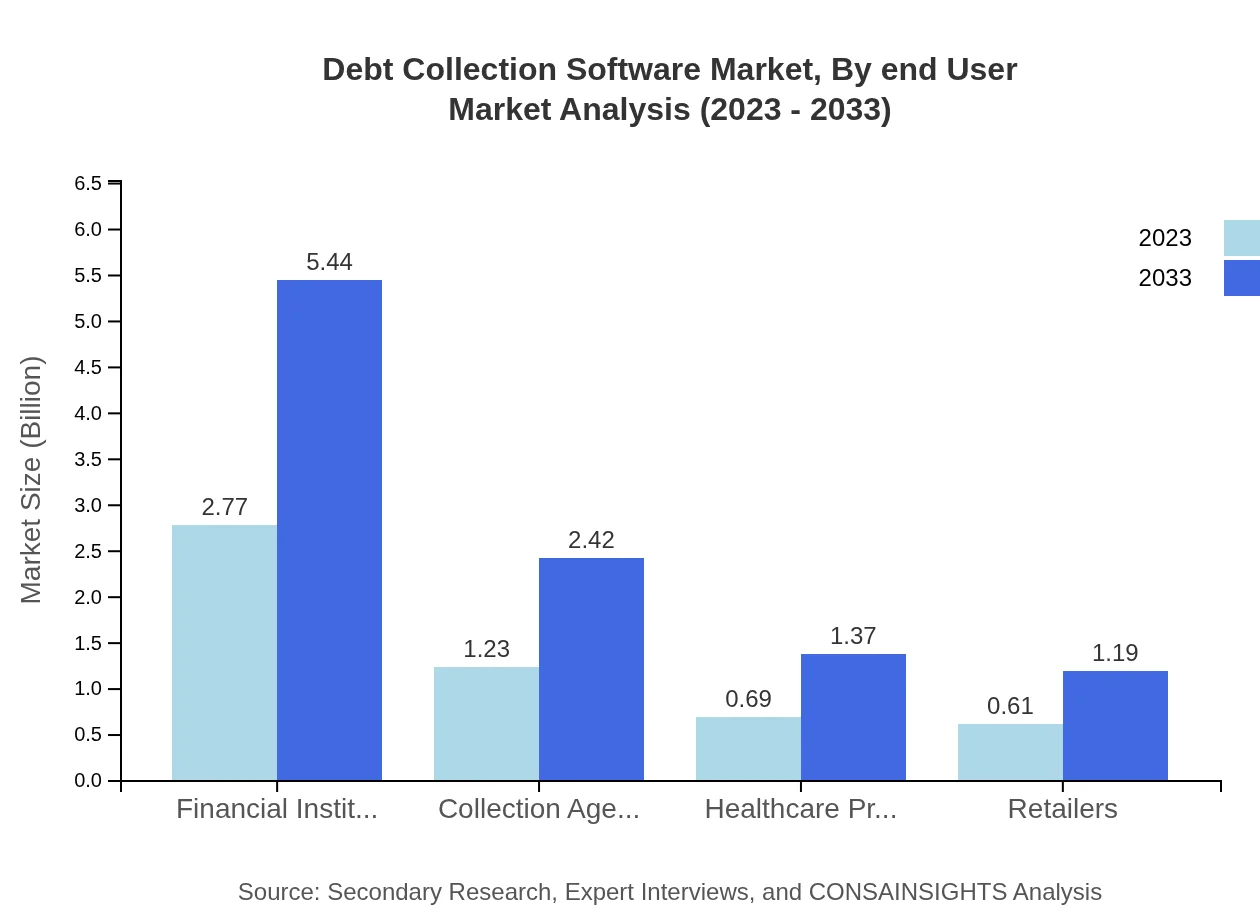

Debt Collection Software Market Analysis By End User

Financial institutions account for a significant share, projected from $2.77 billion in 2023 to $5.44 billion by 2033. Collection agencies also play a crucial role, with estimates showing growth from $1.23 billion to $2.42 billion.

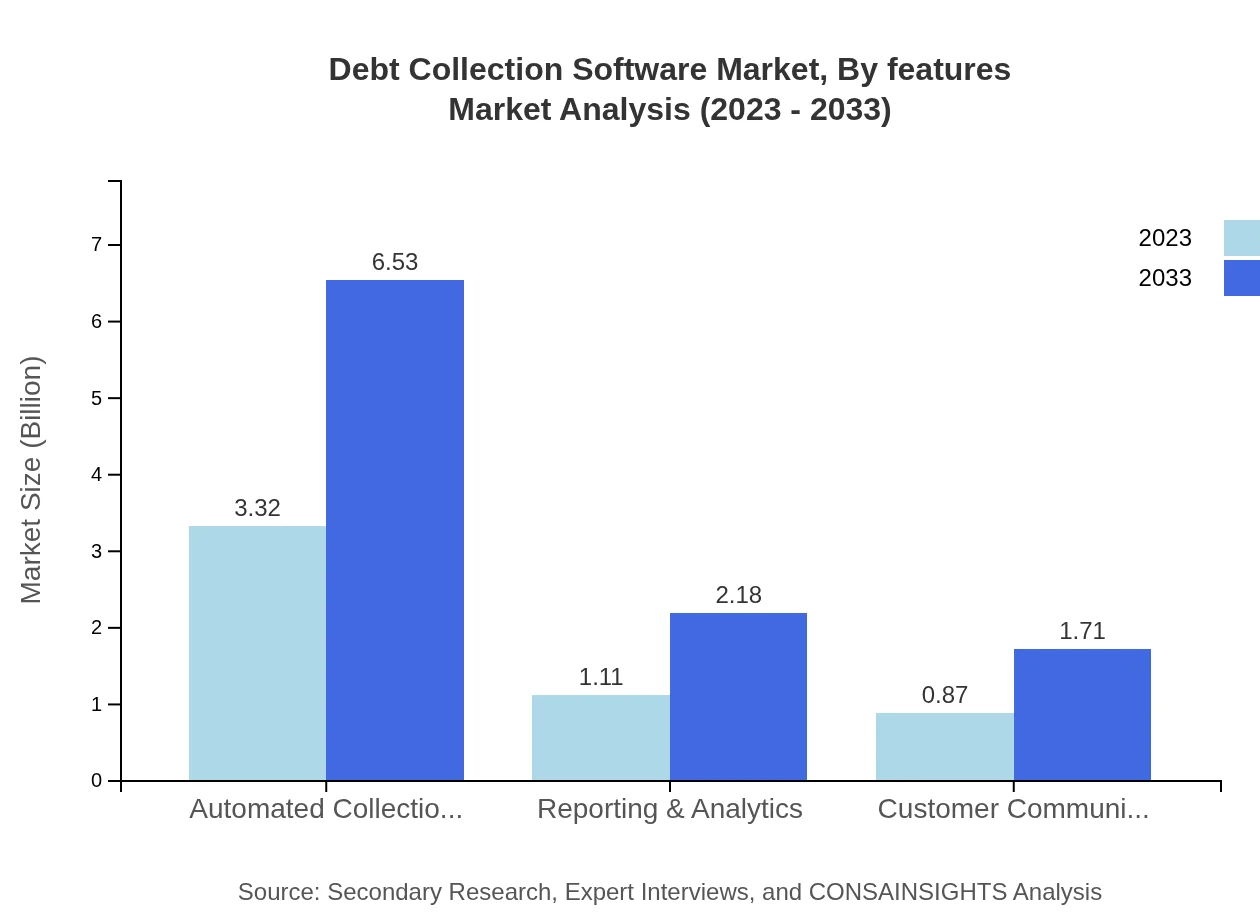

Debt Collection Software Market Analysis By Features

Reporting & Analytics tools showcase substantial growth opportunities, as their importance in decision-making processes becomes more pronounced; market size increasing from $1.11 billion to $2.18 billion. Customer Communication Tools are also significant, expected to rise from $0.87 billion to $1.71 billion by 2033.

Debt Collection Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Debt Collection Software Industry

FICO:

FICO is a global leader in analytics software and services, offering advanced debt collection solutions that improve recovery rates and compliance.Experian:

Experian provides comprehensive debt management solutions focused on data-driven performance and customer insights, helping businesses enhance collections efficiency.Dun & Bradstreet:

Dun & Bradstreet delivers leading solutions for debt management, leveraging extensive databases to facilitate effective collections strategies.CNS:

CNS specializes in cloud-based debt collection software designed to optimize the collections process for various industries.We're grateful to work with incredible clients.

FAQs

What is the market size of debt Collection Software?

The debt collection software market is valued at approximately $5.3 billion in 2023, with a projected growth at a CAGR of 6.8%, indicating significant expansion through 2033.

What are the key market players or companies in this debt Collection Software industry?

Key players in the debt collection software industry include established companies like FICO, Chetu, and Katabat. These firms lead the market with innovative solutions and extensive customer bases.

What are the primary factors driving the growth in the debt Collection Software industry?

Growth in the debt collection software market is driven by increased consumer debt levels, the adoption of cloud-based solutions, and the need for regulatory compliance. Additionally, advancements in technology boost operational efficiencies.

Which region is the fastest Growing in the debt Collection Software?

Asia Pacific is emerging as the fastest-growing region for debt collection software, with a market size expected to grow from $1.06 billion in 2023 to $2.08 billion by 2033, indicating rapid adoption of these technologies.

Does ConsaInsights provide customized market report data for the debt Collection Software industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the debt collection software industry, ensuring clients receive the most relevant insights and analysis.

What deliverables can I expect from this debt Collection Software market research project?

Deliverables from this debt collection software market research include detailed market analysis, segmented data, growth forecasts, competitive landscape, and actionable insights tailored to your strategic needs.

What are the market trends of debt Collection Software?

Key trends in the debt collection software market include a shift towards automated collections, increased reliance on cloud solutions, and heightened focus on analytics and reporting functionalities.