Defense Aircraft Materials Market Report

Published Date: 03 February 2026 | Report Code: defense-aircraft-materials

Defense Aircraft Materials Market Size, Share, Industry Trends and Forecast to 2033

This report presents an in-depth analysis of the Defense Aircraft Materials market, covering market size, growth rates, industry trends, and future forecasts from 2023 to 2033. Insights into segmentation, regional performance, and leading companies provide a comprehensive view of this critical industry.

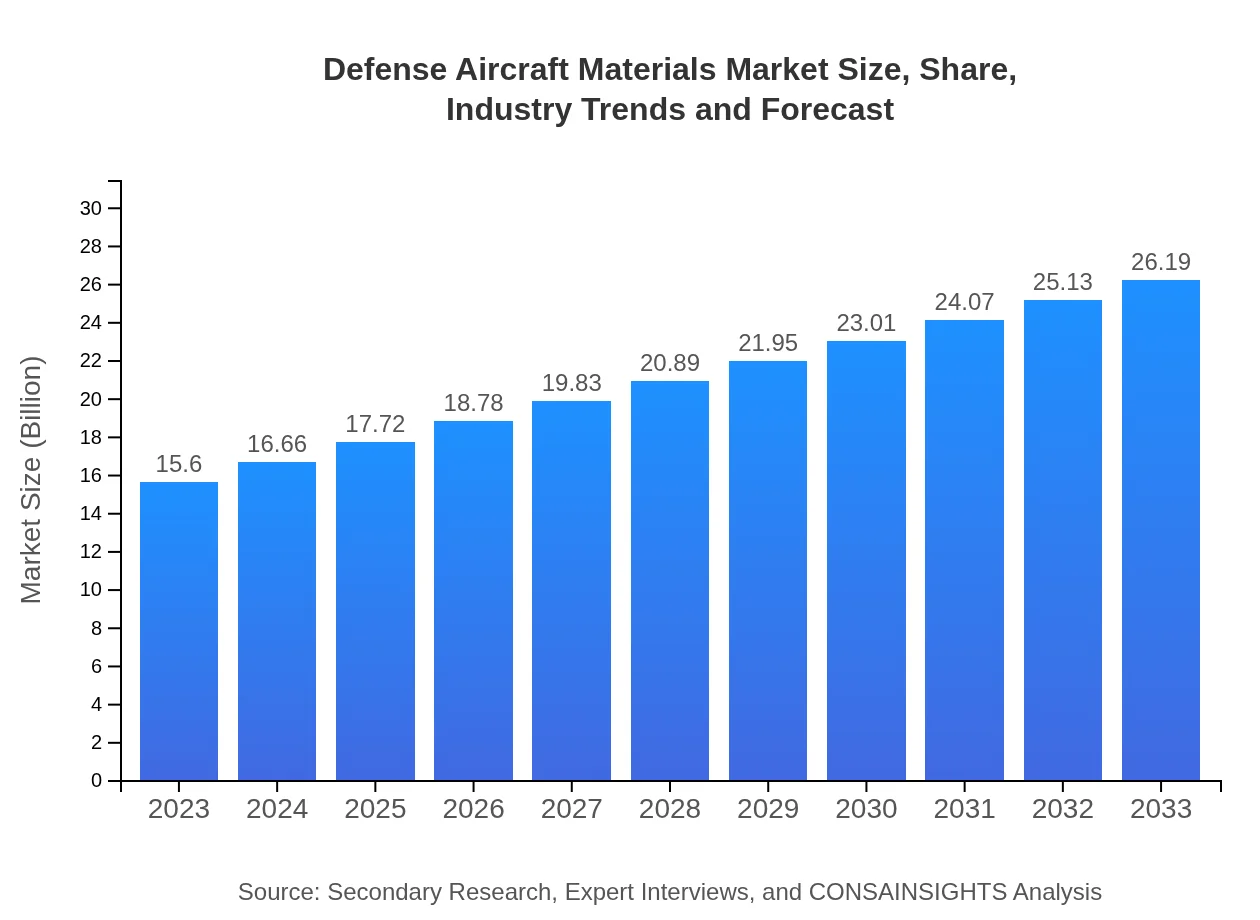

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $26.19 Billion |

| Top Companies | Boeing , Lockheed Martin, Northrop Grumman, Raytheon Technologies |

| Last Modified Date | 03 February 2026 |

Defense Aircraft Materials Market Overview

Customize Defense Aircraft Materials Market Report market research report

- ✔ Get in-depth analysis of Defense Aircraft Materials market size, growth, and forecasts.

- ✔ Understand Defense Aircraft Materials's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Defense Aircraft Materials

What is the Market Size & CAGR of Defense Aircraft Materials market in 2023?

Defense Aircraft Materials Industry Analysis

Defense Aircraft Materials Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Defense Aircraft Materials Market Analysis Report by Region

Europe Defense Aircraft Materials Market Report:

The European market is projected to grow from $5.48 billion in 2023 to $9.19 billion by 2033. European nations are focusing on defense collaborations and joint ventures, particularly in military aviation, which plays a pivotal role in transforming material requirements.Asia Pacific Defense Aircraft Materials Market Report:

In 2023, the Asia Pacific Defense Aircraft Materials market is valued at $2.68 billion and is expected to grow to $4.51 billion by 2033. Increased military spending from countries like India and China, alongside collaborative defense initiatives, will drive growth in this region.North America Defense Aircraft Materials Market Report:

North America leads the market with a value of $5.18 billion in 2023, foreseen to expand to $8.69 billion by 2033. The United States remains the largest consumer, driven by substantial investments in military modernization and aerospace capabilities.South America Defense Aircraft Materials Market Report:

The South American market stands at $0.46 billion in 2023, with forecasts projecting growth to $0.77 billion by 2033. Political instability and economic factors can impact defense spending and material procurement in this region.Middle East & Africa Defense Aircraft Materials Market Report:

In 2023, the market in the Middle East and Africa is valued at $1.80 billion, expected to escalate to $3.03 billion by 2033. Geopolitical tensions and heightened defense activities in the Middle East are catalysts for growth in this region.Tell us your focus area and get a customized research report.

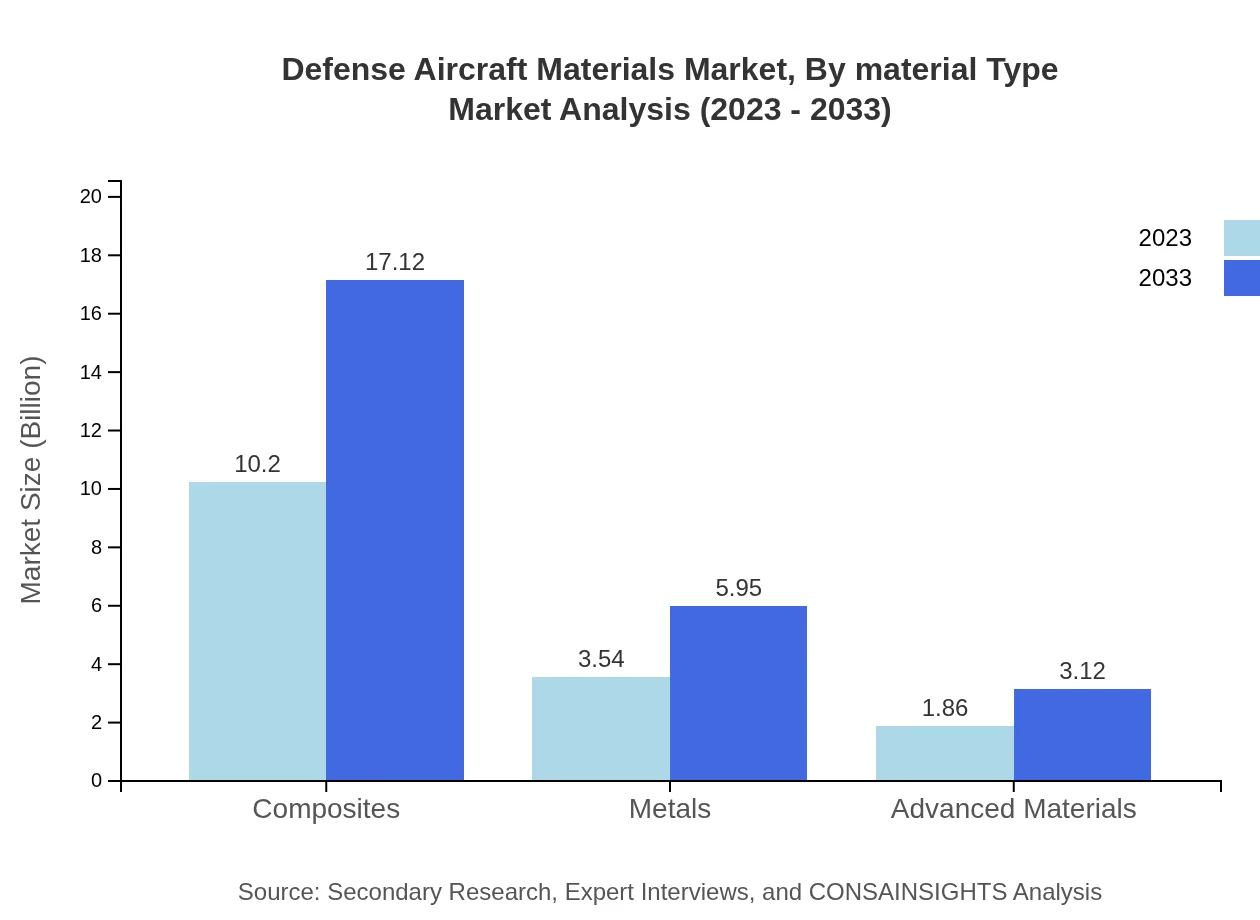

Defense Aircraft Materials Market Analysis By Material Type

The market is dominated by composites, accounting for approximately $10.2 billion in 2023 and projected to grow to $17.12 billion by 2033, maintaining a share of 65.36%. Metals hold a significant share as well, with a 22.71% market share in 2023, projected to rise from $3.54 billion in 2023 to $5.95 billion by 2033, driven by their critical application in structural components.

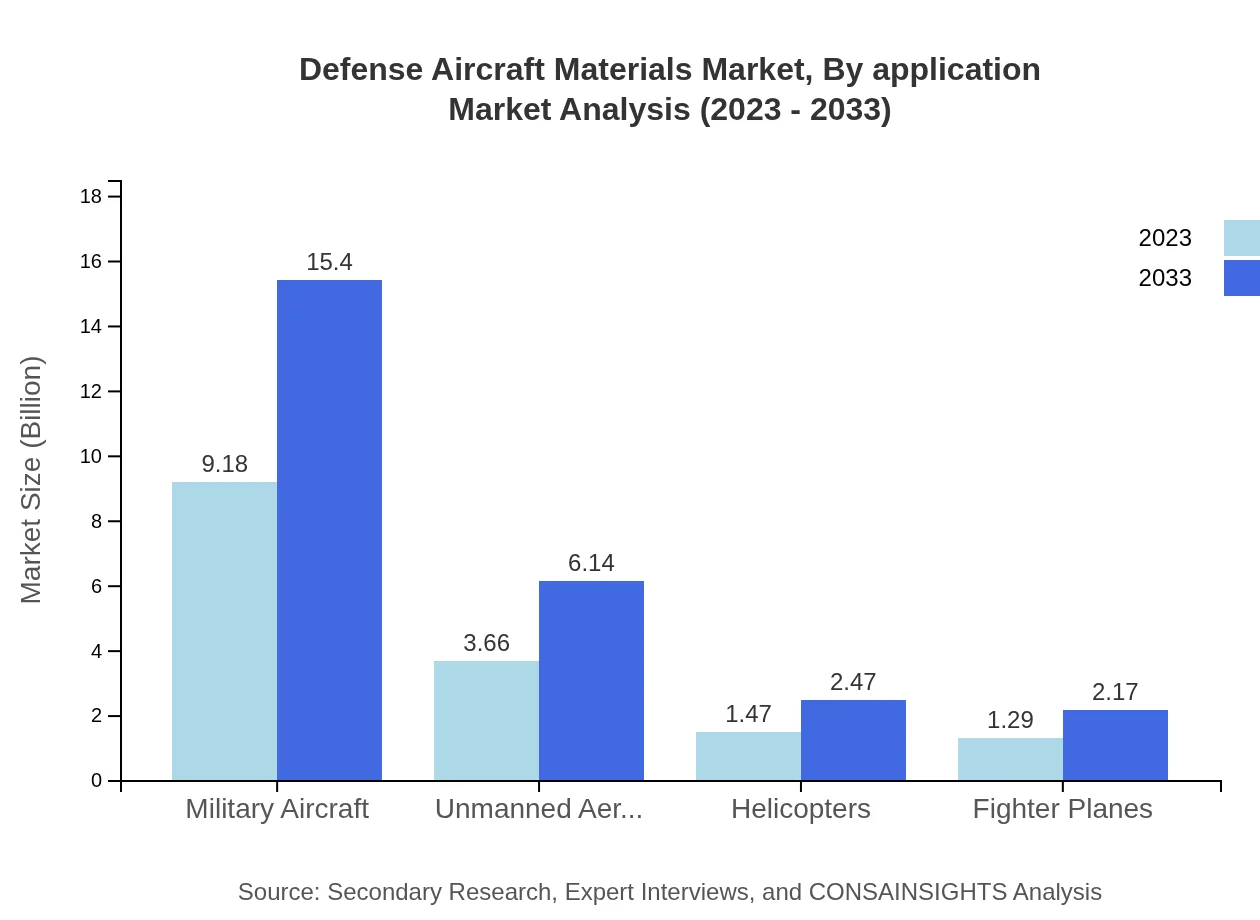

Defense Aircraft Materials Market Analysis By Application

Military aircraft lead the segment with a size of $9.18 billion in 2023, anticipated to expand to $15.40 billion by 2033, securing a market share of 58.82%. Unmanned Aerial Vehicles (UAVs) also reflect a growing demand, with a current value of $3.66 billion, expected to rise to $6.14 billion by 2033, holding a share of 23.46%.

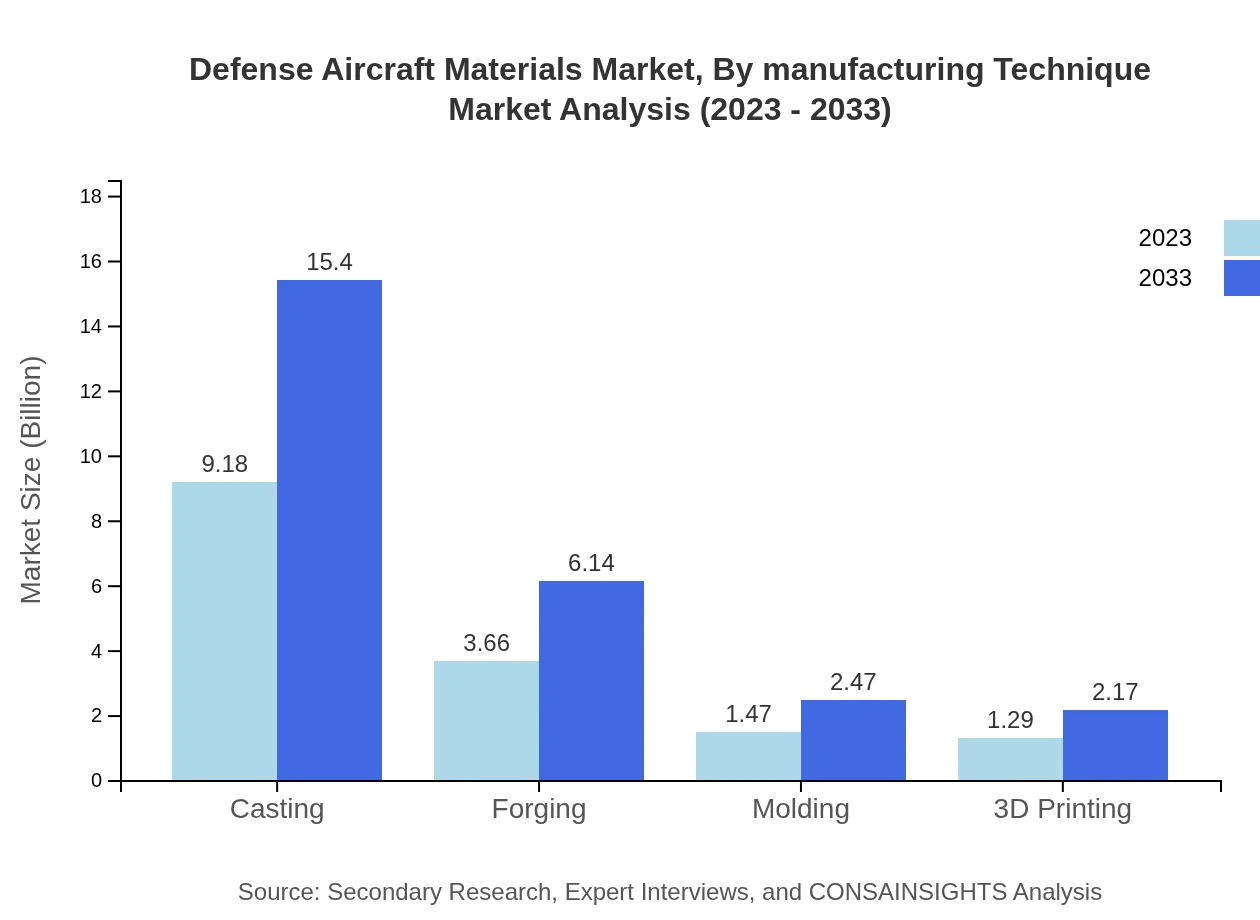

Defense Aircraft Materials Market Analysis By Manufacturing Technique

Key manufacturing techniques such as casting and forging are crucial, with casting valued at $9.18 billion in 2023, growing to $15.40 billion by 2033. Forging will also see significant growth, from $3.66 billion in 2023 to $6.14 billion by 2033, reflecting innovative advancements in manufacturing processes.

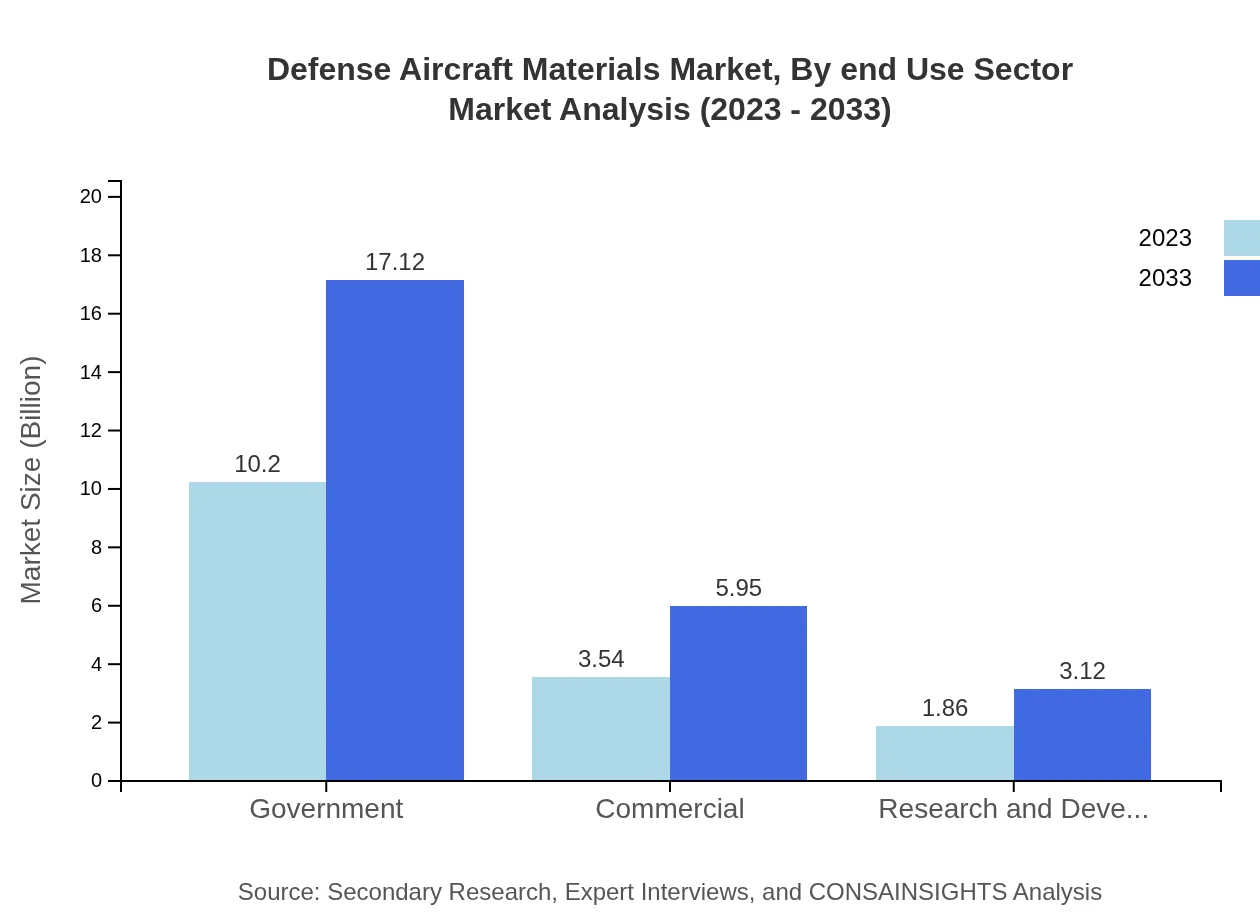

Defense Aircraft Materials Market Analysis By End Use Sector

Government sector applications dominate the market, forecasted to increase from $10.20 billion in 2023 to $17.12 billion by 2033. Commercial applications contribute significantly, expected to rise from $3.54 billion in 2023 to $5.95 billion by 2033, driven by heightened collaborations in defense and commercial sectors.

Defense Aircraft Materials Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Defense Aircraft Materials Industry

Boeing :

Boeing is a leading manufacturer of military aircraft and a key player in the defense sector, providing advanced materials and technologies for various military applications.Lockheed Martin:

Lockheed Martin is a premier aerospace and defense company, known for its innovation in aircraft design and the use of advanced materials for military operations.Northrop Grumman:

Northrop Grumman specializes in defense technology and aerospace systems, focusing on materials that enhance aircraft performance and mission capability.Raytheon Technologies:

Raytheon Technologies is a major player in the aerospace and defense sector, engaged in developing new materials that support advanced military aircraft.We're grateful to work with incredible clients.

FAQs

What is the market size of defense Aircraft Materials?

The global defense aircraft materials market is valued at approximately $15.6 billion in 2023, with a projected CAGR of 5.2% through 2033, indicating significant growth in the industry.

What are the key market players or companies in this defense Aircraft Materials industry?

Key players in the defense aircraft materials market include major manufacturers of aerospace composites, metals, and advanced materials, such as Boeing, Lockheed Martin, and Northrop Grumman, who significantly contribute to market dynamics.

What are the primary factors driving the growth in the defense aircraft materials industry?

Growth in the defense aircraft materials sector is primarily driven by increased defense spending, advancements in materials technology, and rising demand for military aircraft and unmanned aerial vehicles (UAVs) in various regions.

Which region is the fastest Growing in the defense aircraft materials?

The fastest-growing region in the defense aircraft materials market is Europe, projected to grow from $5.48 billion in 2023 to $9.19 billion by 2033, reflecting rapid advancements and defense initiatives.

Does ConsaInsights provide customized market report data for the defense aircraft materials industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the defense aircraft materials industry, allowing clients to access detailed insights catered to their strategic objectives.

What deliverables can I expect from this defense Aircraft Materials market research project?

From the defense aircraft materials market research project, clients can expect comprehensive reports, strategic insights, market forecasts, competitive analysis, and detailed segmentation data across various parameters.

What are the market trends of defense aircraft materials?

Current trends in the defense aircraft materials market include increased reliance on lightweight composites, advancements in 3D printing technology, and a growing focus on sustainable materials to enhance performance and reduce costs.