Defense Cyber Security Market Report

Published Date: 31 January 2026 | Report Code: defense-cyber-security

Defense Cyber Security Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Defense Cyber Security market from 2023 to 2033, offering insights into market size, trends, segmentation, and technological advancements that shape the industry landscape.

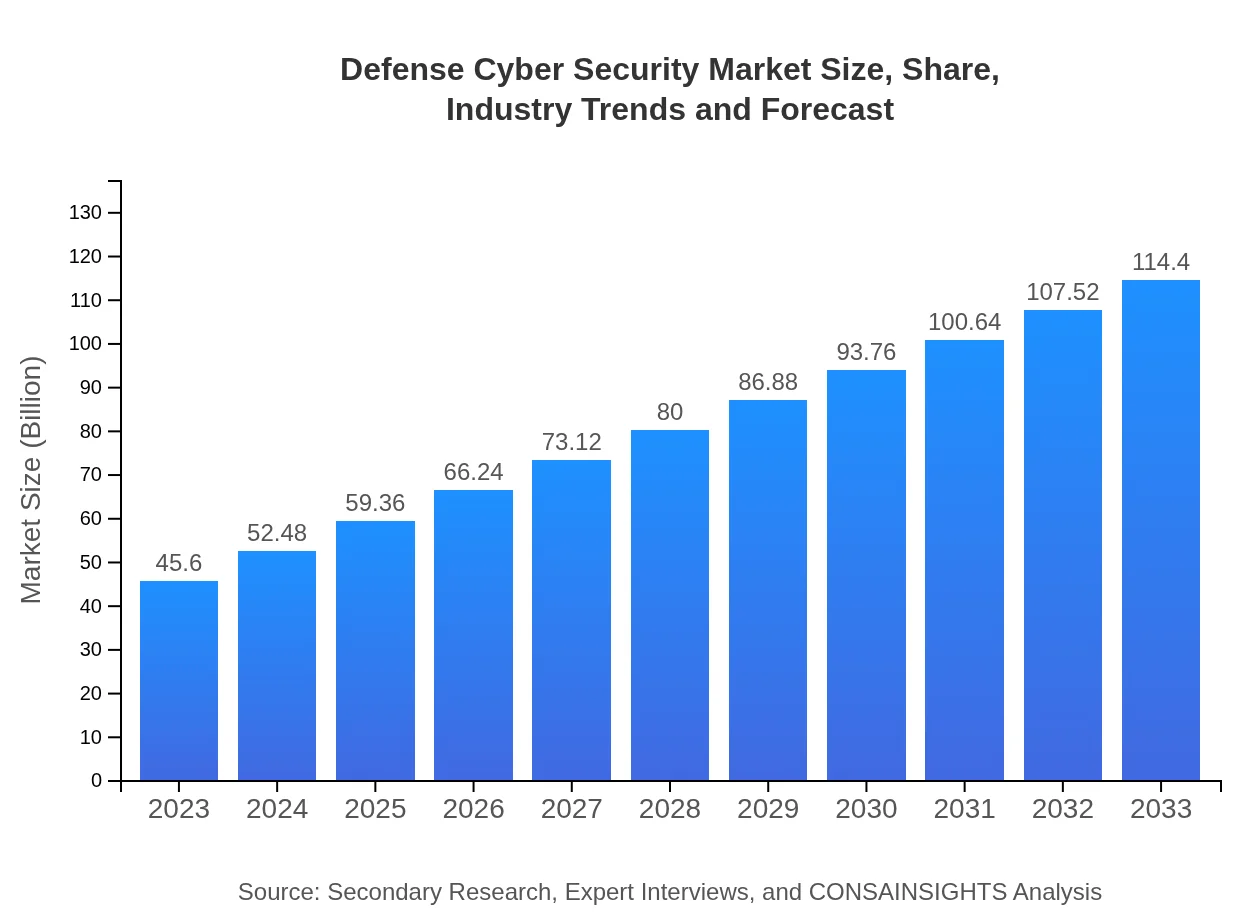

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $45.60 Billion |

| CAGR (2023-2033) | 9.3% |

| 2033 Market Size | $114.40 Billion |

| Top Companies | Northrop Grumman Corporation, Raytheon Technologies, BAE Systems, Lockheed Martin , Cisco Systems |

| Last Modified Date | 31 January 2026 |

Defense Cyber Security Market Overview

Customize Defense Cyber Security Market Report market research report

- ✔ Get in-depth analysis of Defense Cyber Security market size, growth, and forecasts.

- ✔ Understand Defense Cyber Security's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Defense Cyber Security

What is the Market Size & CAGR of Defense Cyber Security market in 2033?

Defense Cyber Security Industry Analysis

Defense Cyber Security Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Defense Cyber Security Market Analysis Report by Region

Europe Defense Cyber Security Market Report:

Europe’s Defense Cyber Security market is anticipated to grow from $13.18 billion in 2023 to $33.07 billion by 2033. European governments are prioritizing cyber defense amidst increasing threats from hostile state actors. Enhanced collaboration between EU member states for cybersecurity readiness and investment in security infrastructure are essential trends to monitor.Asia Pacific Defense Cyber Security Market Report:

The Asia Pacific region witnessed significant growth in the Defense Cyber Security market, projected to reach $21.50 billion by 2033 from $8.57 billion in 2023. Countries like China and India are ramping up their investments in cybersecurity infrastructure, resulting from a rise in cyber threats and regional geopolitical tensions. Enhanced governmental policies are also driving cyber resilience initiatives across the military and financial sectors.North America Defense Cyber Security Market Report:

North America continues to lead the Defense Cyber Security market, projected to grow from $17.06 billion in 2023 to $42.81 billion by 2033. The United States, primarily, is at the forefront, investing heavily in advanced cyber defense technologies and initiatives to protect national defense agencies. Increasing defense budgets and a focus on innovative security solutions further amplify market potential in this region.South America Defense Cyber Security Market Report:

In South America, the Defense Cyber Security market is expected to grow from $1.14 billion in 2023 to $2.87 billion by 2033. The region is increasingly recognizing the importance of cybersecurity due to growing cyberattacks on governmental and critical infrastructure. Investments are likely to be focused on developing coordinated frameworks for cybersecurity response and awareness.Middle East & Africa Defense Cyber Security Market Report:

The Middle East and Africa market is projected to expand from $5.64 billion in 2023 to $14.15 billion by 2033. Countries are focusing on regulatory frameworks and national cybersecurity strategies to combat rising threats. Increased military spending on cyber capabilities reflects a growing recognition of cyber threats in the region, leading to collaborative initiatives.Tell us your focus area and get a customized research report.

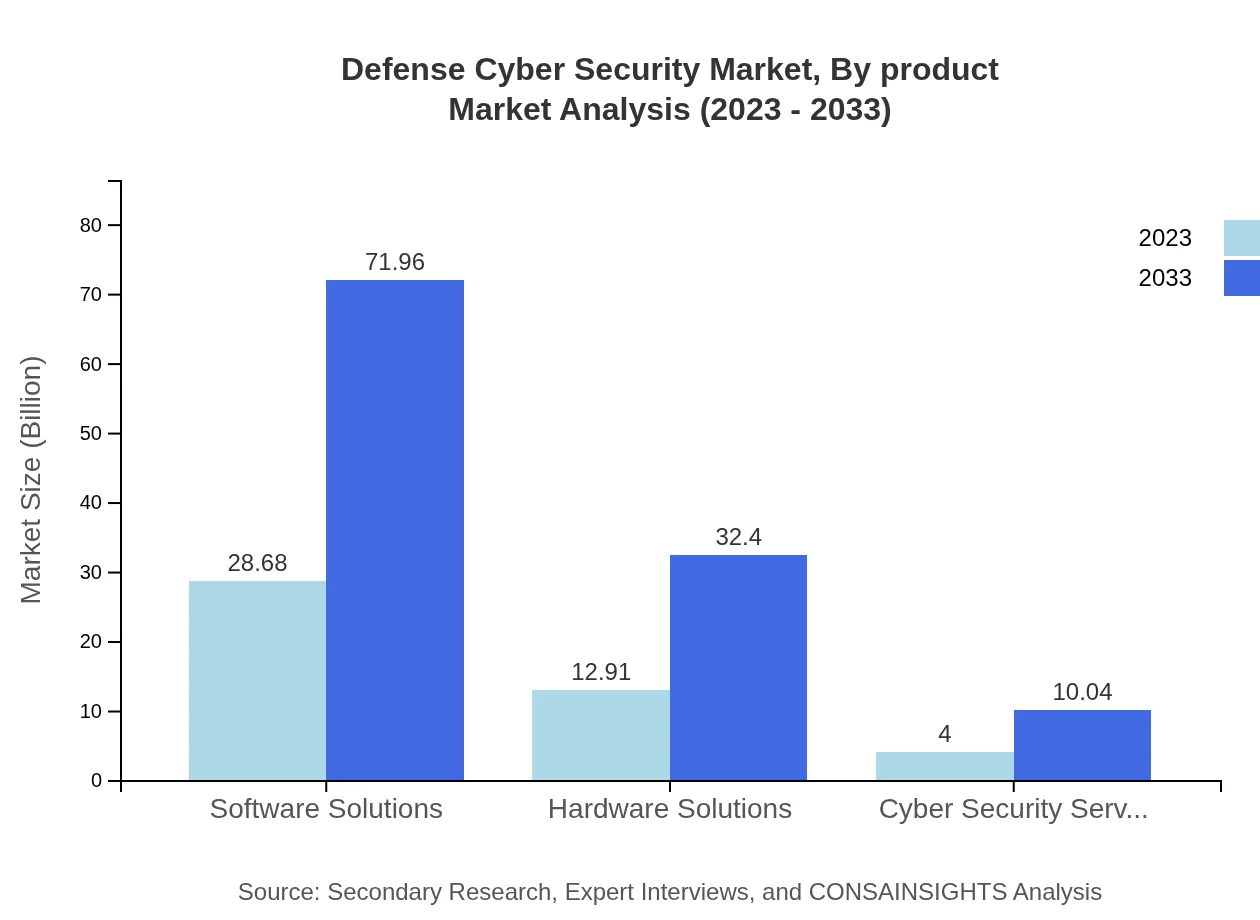

Defense Cyber Security Market Analysis By Product

In the Defense Cyber Security market, Software Solutions are leading, projected to grow from $28.68 billion in 2023 to $71.96 billion by 2033, holding a substantial 62.9% share in the market. Hardware Solutions account for $12.91 billion in 2023 with a growth projection to $32.40 billion, whilst Cyber Security Services are expected to rise from $4.00 billion to $10.04 billion during the same period. Government Agencies represent the largest end-user segment, indicating a critical focus on software and service contracts.

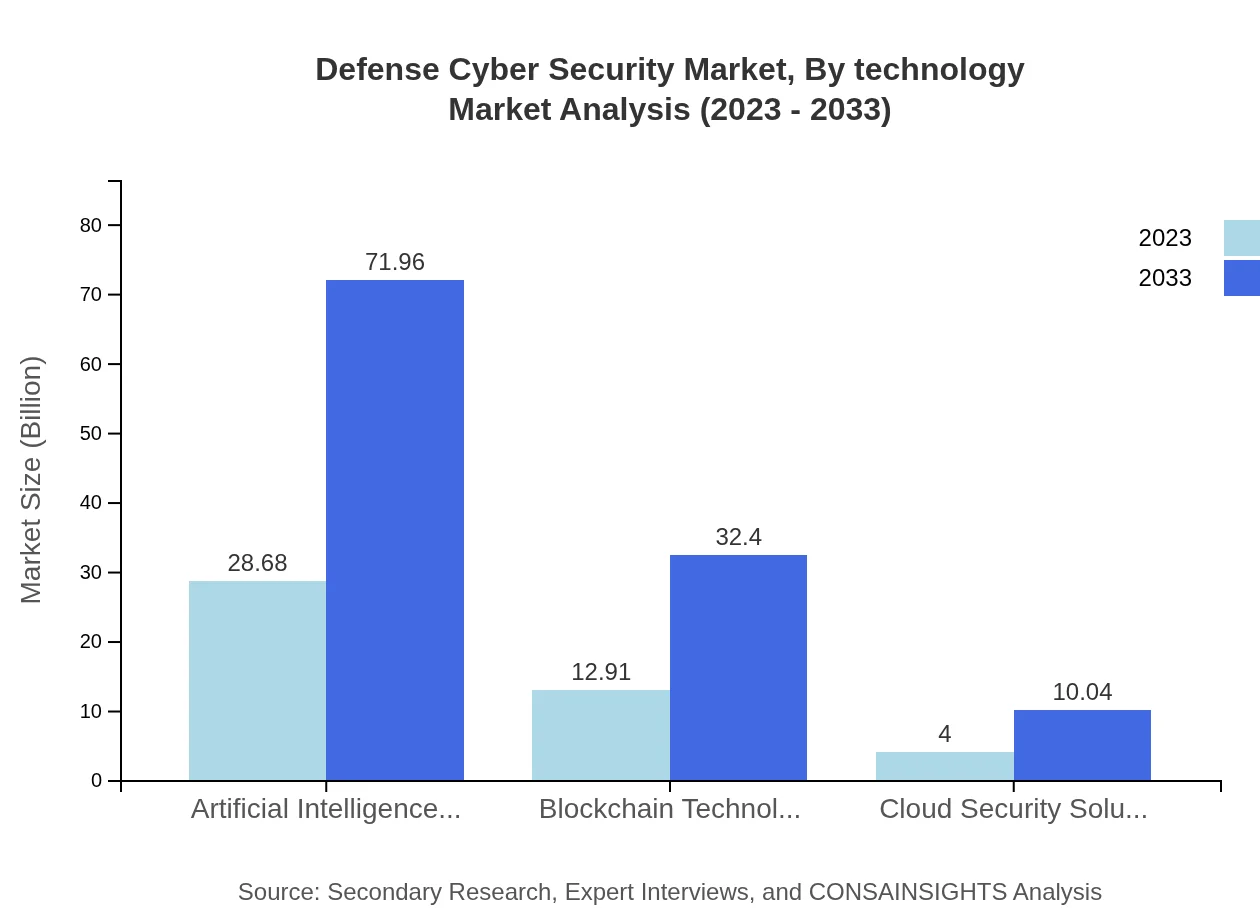

Defense Cyber Security Market Analysis By Technology

The market reflects significant technological trends that include AI and Machine Learning, projected to dominate with a market size of $28.68 billion in 2023, growing to $71.96 billion by 2033. Blockchain technology follows, growing from $12.91 billion to $32.40 billion, driven by its promise to enhance data integrity and security. Cloud Security Solutions represent an emerging market segment expected to upscale from $4.00 billion to $10.04 billion, indicating the shift towards more flexible, cloud-based security offerings.

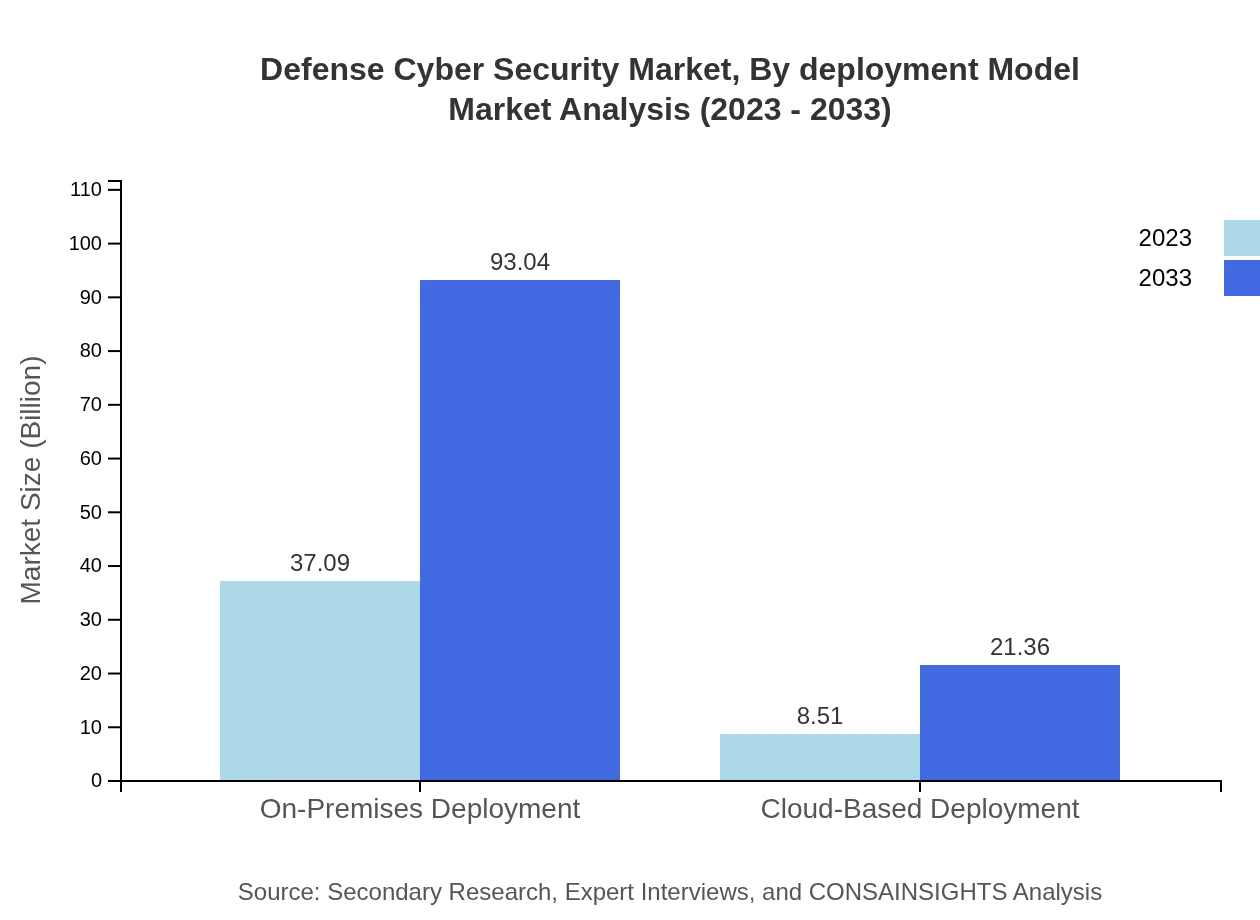

Defense Cyber Security Market Analysis By Deployment Model

On-Premises Deployment remains the most substantial segment, valuing $37.09 billion in 2023, with projections to reach $93.04 billion by 2033, claiming an 81.33% market share. Cloud-Based Deployment, while smaller, is growing rapidly, projected to scale from $8.51 billion to $21.36 billion as organizations begin adopting more cloud-specific strategies amidst growing demands for scalable solutions.

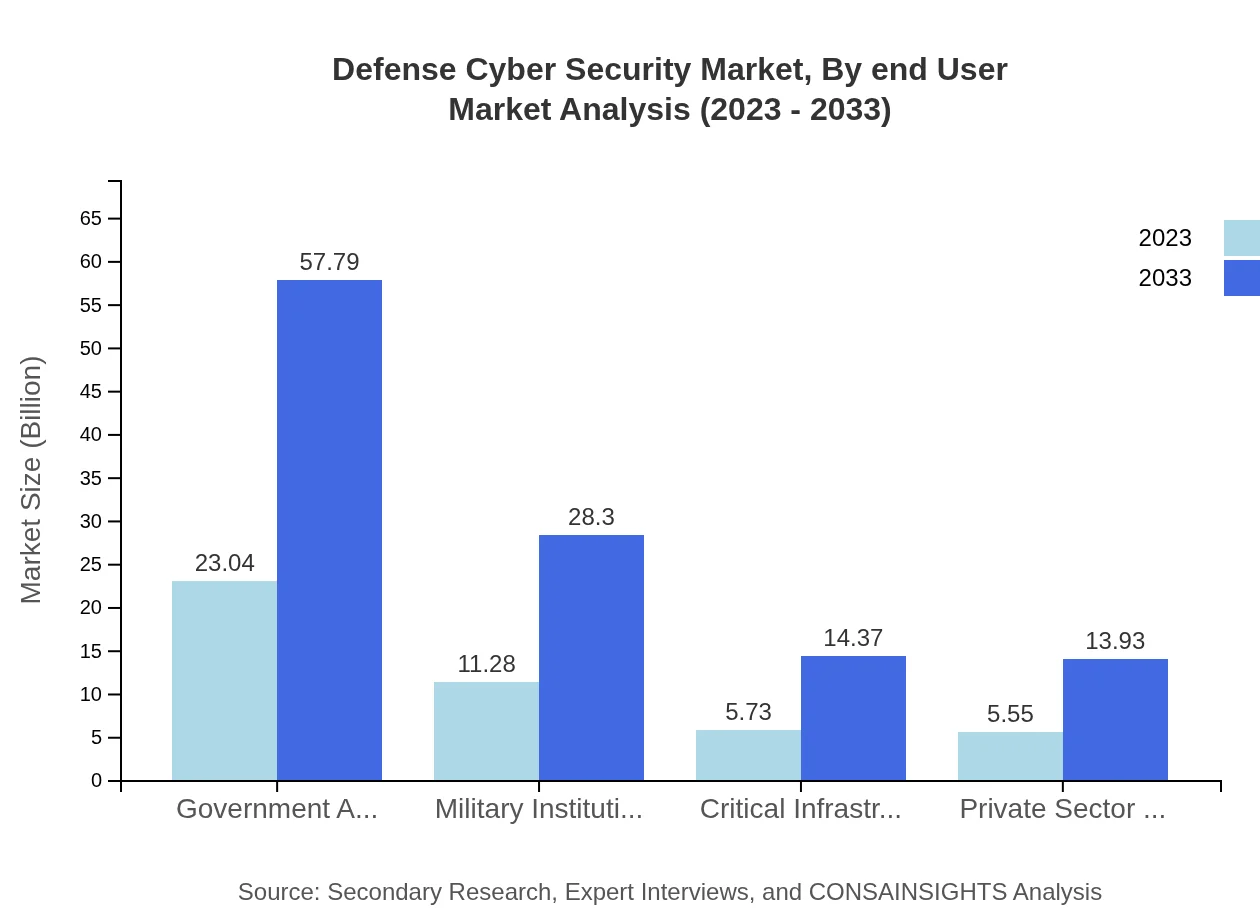

Defense Cyber Security Market Analysis By End User

The Government Agencies segment leads the Defense Cyber Security sector, estimated at $23.04 billion in 2023 and anticipated to grow to $57.79 billion by 2033, maintaining a 50.52% market share. The Military Institutions and Critical Infrastructure Industries are also key segments, with significant growth projections reflecting heightened focus on national cybersecurity efforts.

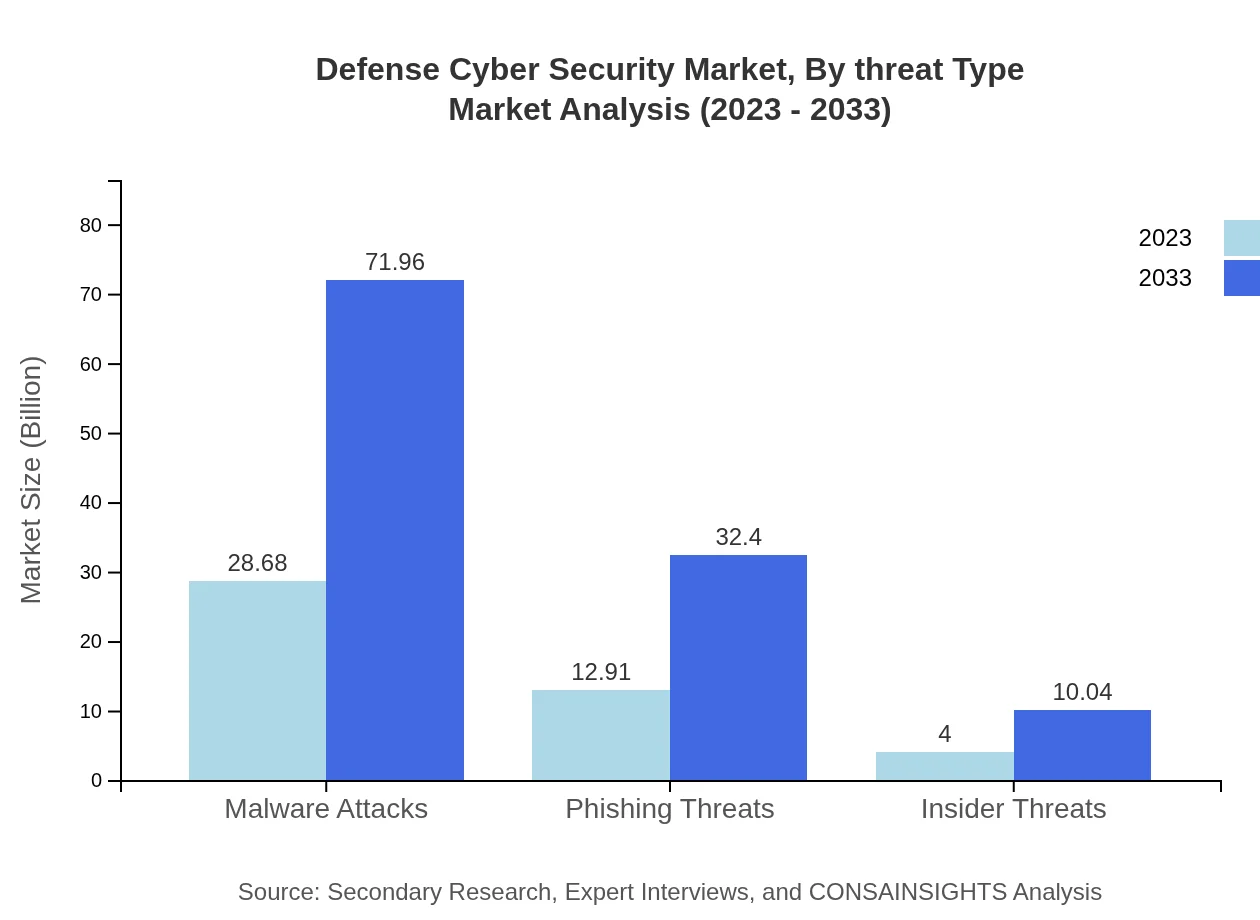

Defense Cyber Security Market Analysis By Threat Type

With malware attacks constituting a major threat, the segment is valued at $28.68 billion in 2023 and is expected to rise to $71.96 billion by 2033. Phishing threats and insider threats represent notable concerns, growing correspondingly, illustrating the urgent need for protective solutions leveraging AI and advanced analytics.

Defense Cyber Security Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Defense Cyber Security Industry

Northrop Grumman Corporation:

A leading defense contractor, Northrop Grumman provides technical innovation in the field of cybersecurity, delivering advanced systems for military and governmental use.Raytheon Technologies:

Raytheon Technologies is known for its defense and aerospace advancements, focusing on cybersecurity solutions that protect critical infrastructure and military operations.BAE Systems:

BAE Systems specializes in cybersecurity products tailored for defense applications, ensuring secure operation in complex defense environments.Lockheed Martin :

Lockheed Martin integrates cybersecurity into its mission systems to protect national security interests while advancing defense technologies.Cisco Systems:

Cisco Systems leads in networking security technology, providing frameworks that bolster cybersecurity for defense organizations globally.We're grateful to work with incredible clients.

FAQs

What is the market size of defense Cyber Security?

The global defense cyber security market is projected to reach approximately $45.6 billion by 2033, growing at a compound annual growth rate (CAGR) of 9.3%. This growth reflects the increasing demand for advanced cyber security solutions in defense systems.

What are the key market players or companies in this defense Cyber Security industry?

Key players in the defense cyber security industry include major defense contractors and tech firms specializing in cyber solutions. Companies such as Lockheed Martin, Raytheon, Northrop Grumman, and BAE Systems are prominent for their innovations and comprehensive service offerings.

What are the primary factors driving the growth in the defense cyber security industry?

The growth in the defense cyber security industry is driven by increasing cyber threats, regulatory requirements for data protection, advancements in technology, and rising government spending on national security. The need for robust cyber defense strategies is paramount.

Which region is the fastest Growing in the defense cyber security market?

North America is the fastest-growing region in the defense cyber security market, projected to grow from $17.06 billion in 2023 to $42.81 billion by 2033. Europe and Asia Pacific also show significant growth potential.

Does ConsaInsights provide customized market report data for the defense Cyber Security industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the defense cyber security industry. Clients can receive data-driven insights and detailed analyses based on their requirements.

What deliverables can I expect from this defense Cyber Security market research project?

Deliverables from the defense cyber security market research project typically include comprehensive reports, executive summaries, competitive analysis, market forecasts, and trend analyses, providing valuable insights for strategic decision-making.

What are the market trends of defense Cyber Security?

Market trends in defense cyber security include an increased focus on AI and machine learning technologies, the rise of cloud security solutions, and growing investments in private sector security. Additionally, there is a trend towards integration of advanced threat detection systems.