Dental-3d Printing Market Report

Published Date: 31 January 2026 | Report Code: dental-3d-printing

Dental-3d Printing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Dental 3D Printing market, including insights into market trends, growth predictions, and segmentation from 2023 to 2033, highlighting key factors shaping the industry.

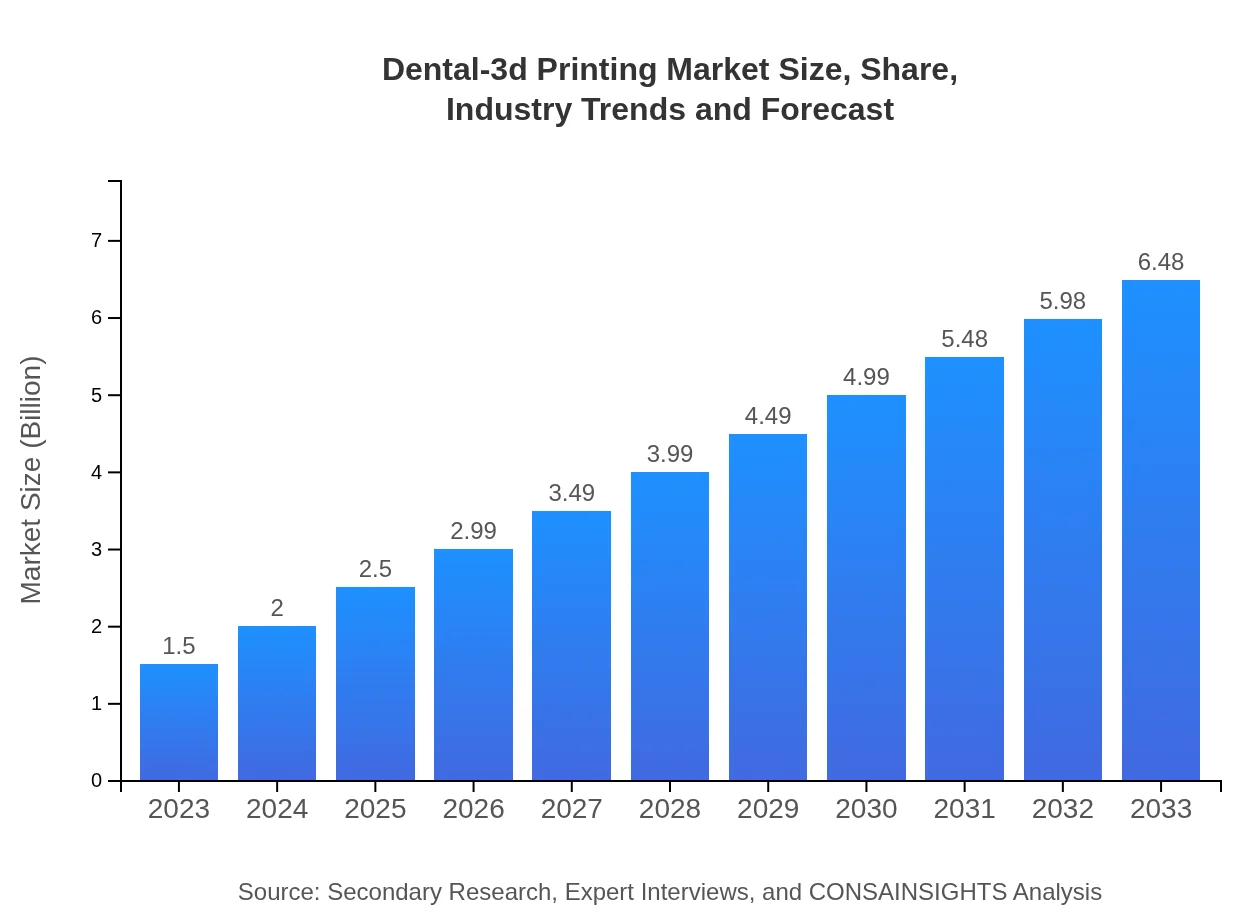

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 15% |

| 2033 Market Size | $6.48 Billion |

| Top Companies | Stratasys Ltd., 3D Systems Corporation, Align Technology, Inc., Materialise NV, Dentsply Sirona Inc. |

| Last Modified Date | 31 January 2026 |

Dental-3d Printing Market Overview

Customize Dental-3d Printing Market Report market research report

- ✔ Get in-depth analysis of Dental-3d Printing market size, growth, and forecasts.

- ✔ Understand Dental-3d Printing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dental-3d Printing

What is the Market Size & CAGR of Dental-3D Printing market in 2023?

Dental-3d Printing Industry Analysis

Dental-3d Printing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dental-3d Printing Market Analysis Report by Region

Europe Dental-3d Printing Market Report:

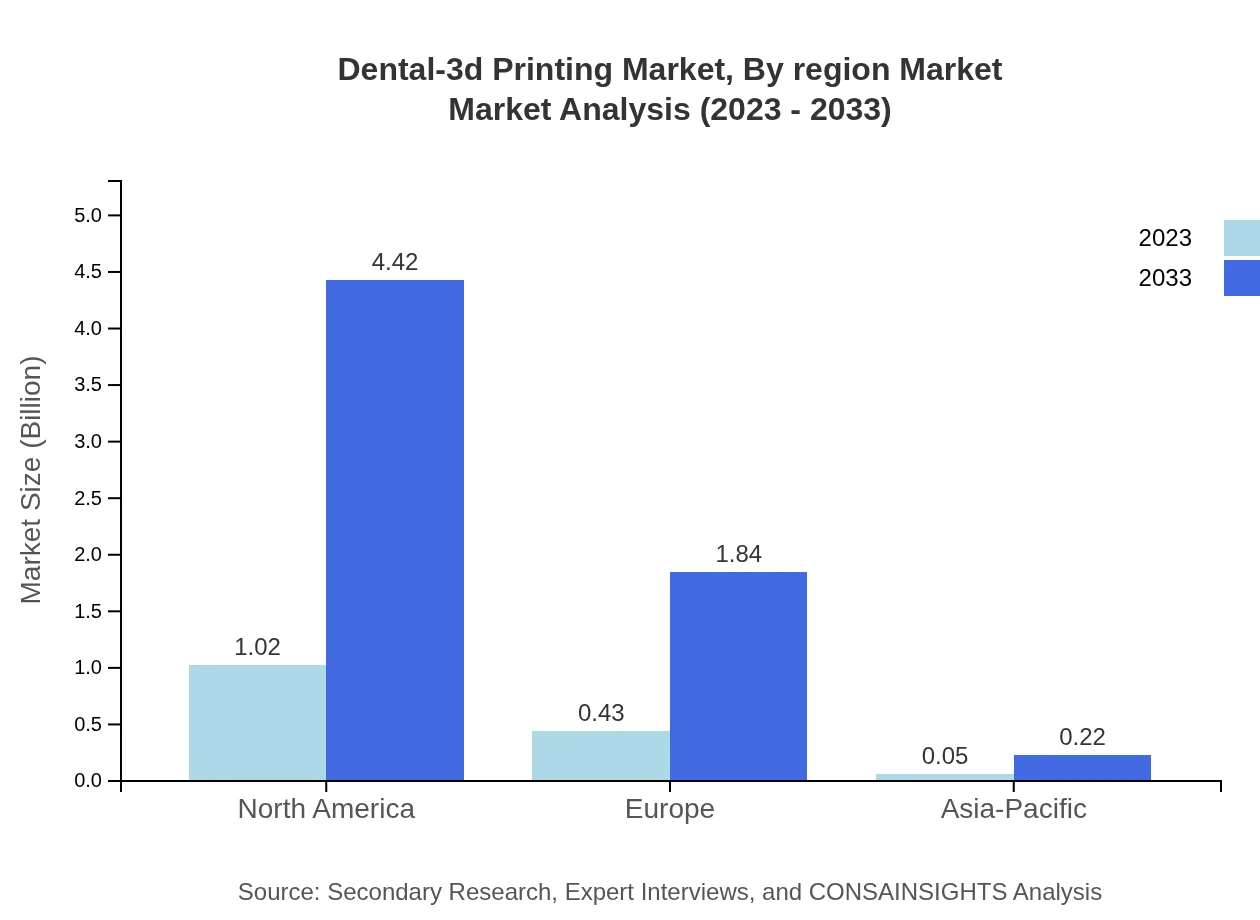

The European Dental 3D Printing market is set to grow from $0.46 billion in 2023 to $2.00 billion by 2033. Rising patient expectations for personalized care and increased technology adoption are critical growth drivers in this region.Asia Pacific Dental-3d Printing Market Report:

In 2023, the Asia Pacific Dental 3D Printing market is valued at $0.25 billion and is projected to grow to $1.09 billion by 2033, reflecting a robust CAGR. This growth is driven by increasing investments in dental health care and rising disposable incomes, which enhance access to advanced dental technologies.North America Dental-3d Printing Market Report:

With a market value of $0.58 billion in 2023, North America is expected to reach $2.50 billion by 2033. The region's leadership in dental technology innovation and a well-established dental care infrastructure are key growth factors.South America Dental-3d Printing Market Report:

The South American market, currently at $0.09 billion in 2023, is expected to reach $0.39 billion by 2033. Growth drivers in this region include improving dental care awareness and greater acceptance of advanced dental procedures among consumers.Middle East & Africa Dental-3d Printing Market Report:

The market in the Middle East and Africa, valued at $0.12 billion in 2023, is projected to grow to $0.50 billion by 2033. This growth is attributed to improving healthcare facilities and the growing prevalence of dental diseases.Tell us your focus area and get a customized research report.

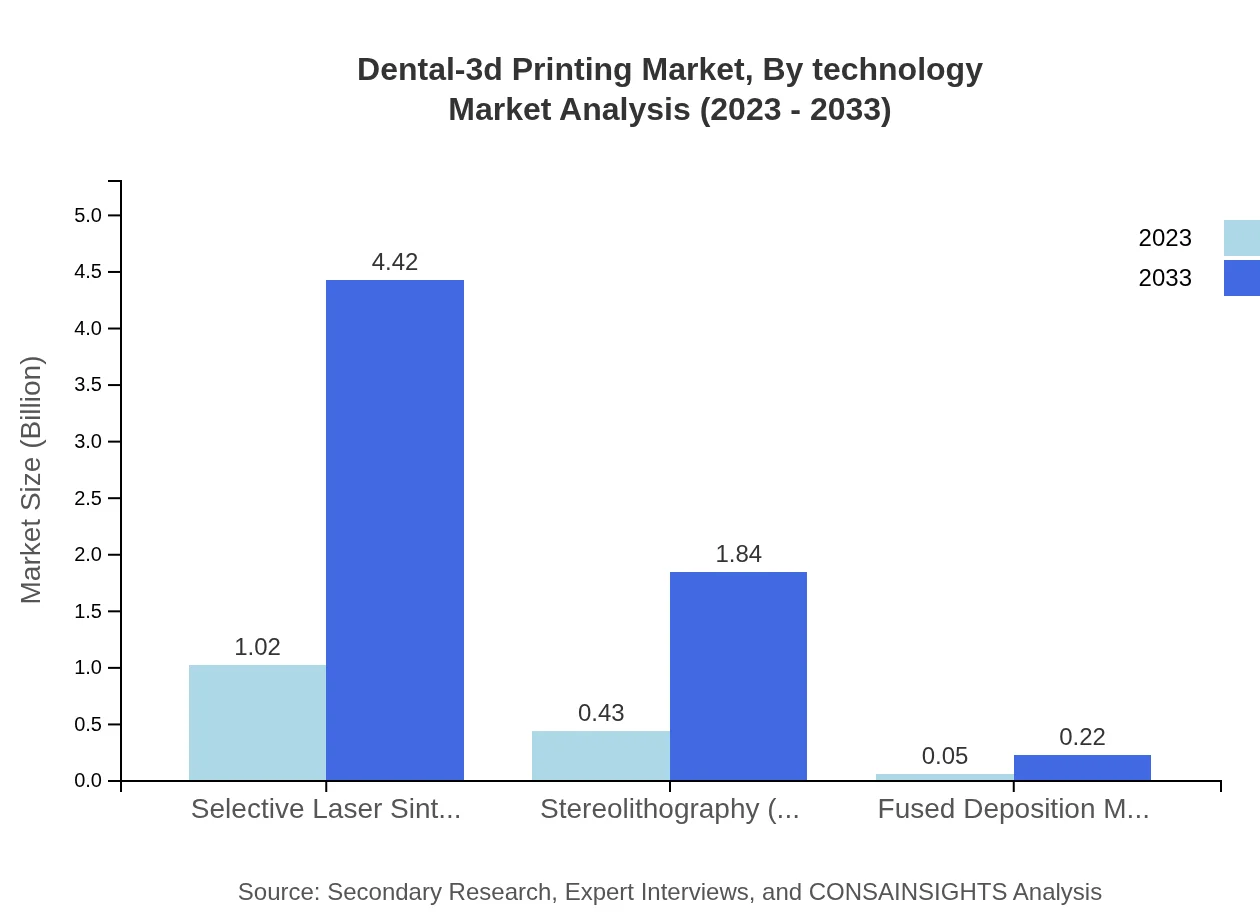

Dental-3d Printing Market Analysis By Technology

The Dental 3D Printing market, segmented by technology, reveals significant growth in Selective Laser Sintering (SLS) and Stereolithography (SLA). SLS held a market share of approximately 68.28% in 2023, growing to $4.42 billion by 2033. SLA technology, while representing 28.35% of the market share, is also witnessing increasing acceptance due to its precision in producing intricate designs. The emergence of Fused Deposition Modelling (FDM), although smaller in size, indicates an expanding interest in budget-friendly dental solutions.

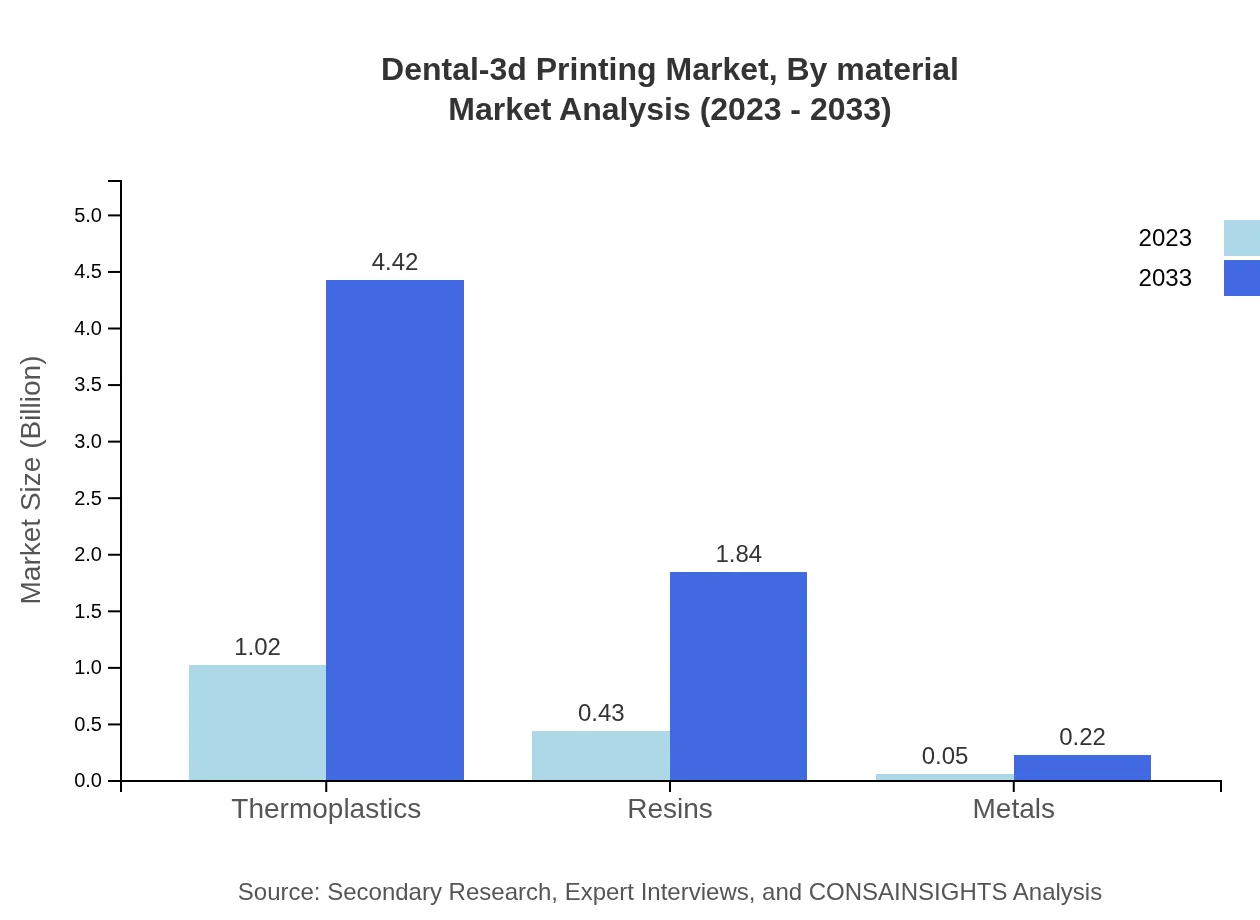

Dental-3d Printing Market Analysis By Material

Material segments include thermoplastics, resins, and metals. Thermoplastics dominated in 2023 with a market size of $1.02 billion (68.28% market share), forecasted to expand significantly. Resins, with a market size of $0.43 billion (28.35% share), are utilized extensively in prototyping and direct printing, whereas metals, valued at $0.05 billion (3.37% share), primarily serve in creating dental implants and frameworks.

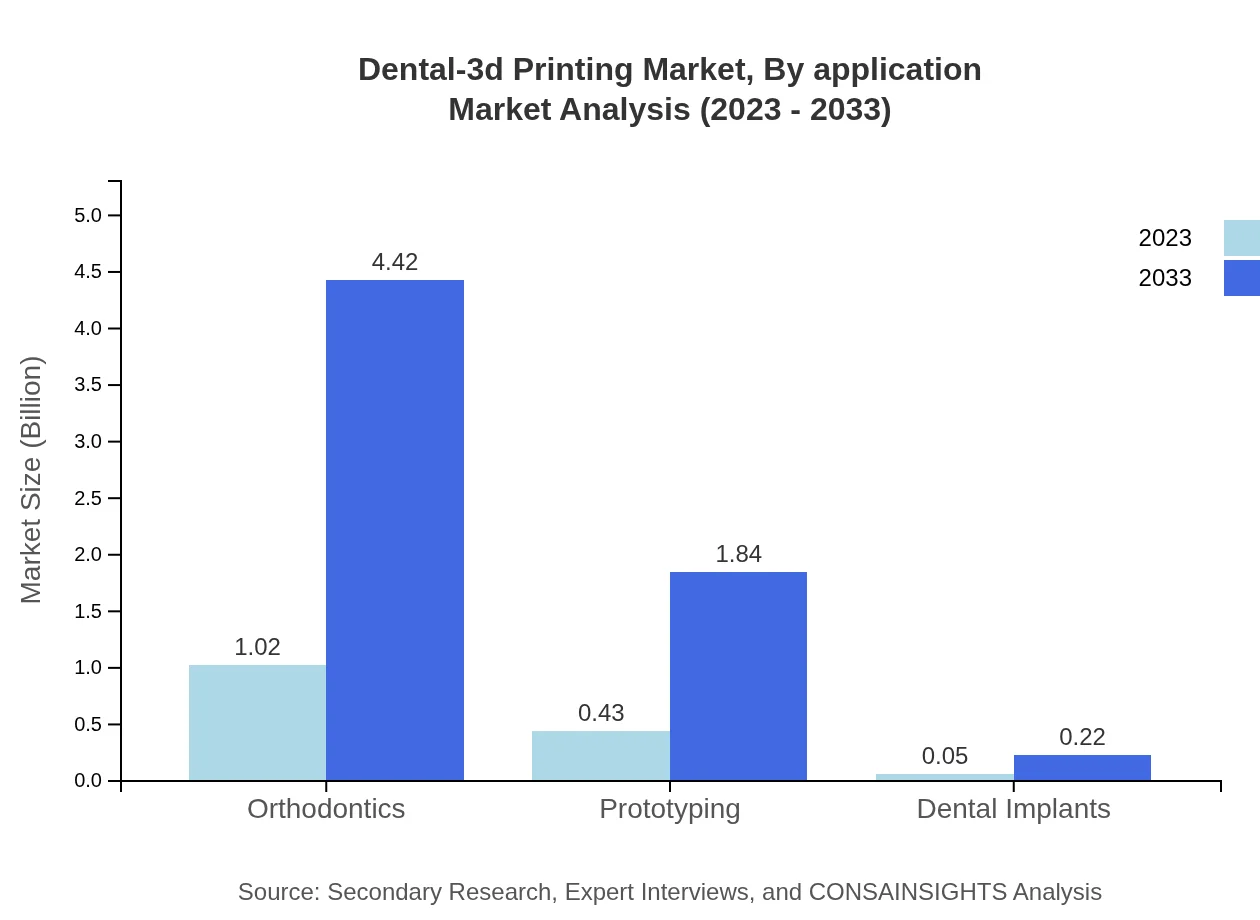

Dental-3d Printing Market Analysis By Application

The application segmentation showcases strong demand in orthodontics, contributing a market size of $1.02 billion (68.28% share) in 2023. Prototyping and dental implants also contribute, demonstrating the versatility of 3D printing. Prototyping generated $0.43 billion (28.35% share) in 2023, while dental implants remain a critical application though holding a smaller market share.

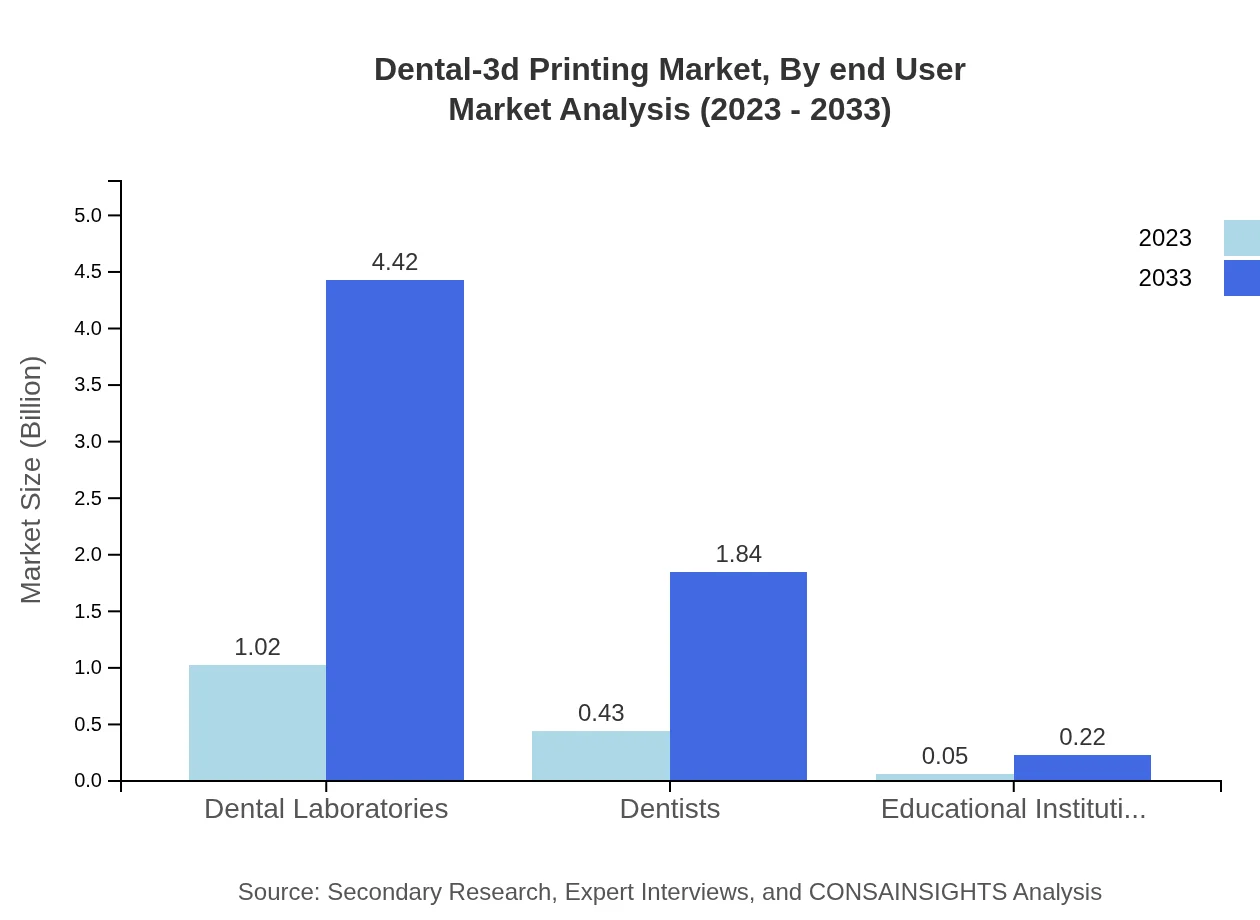

Dental-3d Printing Market Analysis By End User

End-user analysis identifies dental laboratories as significant players, capturing approximately 68.28% of the market share, valued at $1.02 billion in 2023. Dentists also represent a crucial segment with a market worth $0.43 billion (28.35% share), while educational institutions account for a smaller yet important market segment contributing $0.05 billion (3.37% share).

Dental-3d Printing Market Analysis By Region Market

Regionally, North America and Europe are the frontrunners in market size and growth, driven by advanced technology integration and well-established dental service frameworks. Asia Pacific's rapidly increasing market share highlights a shift towards more sophisticated dental care approaches, necessitating innovative technologies and practices. South America and the Middle East and Africa, while currently smaller markets, are set for considerable growth as dental health consciousness increases.

Dental-3d Printing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dental-3d Printing Industry

Stratasys Ltd.:

A global leader in 3D printing and additive manufacturing solutions, Stratasys specializes in printing technologies for dental applications, offering precision and customization.3D Systems Corporation:

3D Systems is a pioneer in 3D printing technology and serves diverse industries, including dental, providing solutions for rapid prototyping and production.Align Technology, Inc.:

Known for its innovative Invisalign products, Align Technology integrates advanced 3D printing technologies to produce dental aligners and other devices.Materialise NV:

Materialise offers a range of 3D printing services and software for the dental market, significantly improving dental workflows and patient outcomes.Dentsply Sirona Inc.:

As a global leader in dental products and technologies, Dentsply Sirona focuses on developing integrated 3D printing solutions for dental professionals.We're grateful to work with incredible clients.

FAQs

What is the market size of dental 3D printing?

The dental 3D printing market is projected to reach approximately $1.5 billion by 2033, with a CAGR of 15% from 2023 to 2033. This substantial growth indicates a rising demand for advanced dental solutions.

What are the key market players or companies in the dental 3D printing industry?

Key players in the dental 3D printing market include 3D Systems, Stratasys, Align Technology, and DENTSPLY Sirona. These companies lead in innovation and technology, propelling market growth with their unique offerings.

What are the primary factors driving the growth in the dental 3D printing industry?

The growth in the dental 3D printing market is driven by technological advancements, increasing demand for customized dental solutions, and a rising number of dental procedures. Additionally, growing awareness of 3D printing efficiency fuels this growth.

Which region is the fastest Growing in the dental 3D printing market?

The fastest-growing region in the dental 3D printing market is North America, projected to expand from $0.58 billion in 2023 to $2.50 billion by 2033, reflecting significant industry developments and investment in dental technologies.

Does ConsaInsights provide customized market report data for the dental 3D printing industry?

Yes, ConsaInsights offers customized market report data tailored specifically for the dental 3D printing industry, ensuring that clients receive insights relevant to their unique business needs and objectives.

What deliverables can I expect from this dental 3D printing market research project?

From the dental 3D printing market research project, expect detailed reports including market size analysis, growth forecasts, competitive landscape assessments, and segmented data across various regions and applications.

What are the market trends of dental 3D printing?

Trends in the dental 3D printing market include increasing adoption of digital dentistry, a shift toward personalized dental solutions, and advancements in printing technologies. Market players are also focusing on sustainability and efficiency improvements.