Dental-3d Scanners Market Report

Published Date: 31 January 2026 | Report Code: dental-3d-scanners

Dental-3d Scanners Market Size, Share, Industry Trends and Forecast to 2033

This report offers detailed insights into the dental 3D scanners market from 2023 to 2033, including market size, growth rates, segmentation, regional analysis, technology trends, and forecasts, enabling stakeholders to make informed decisions.

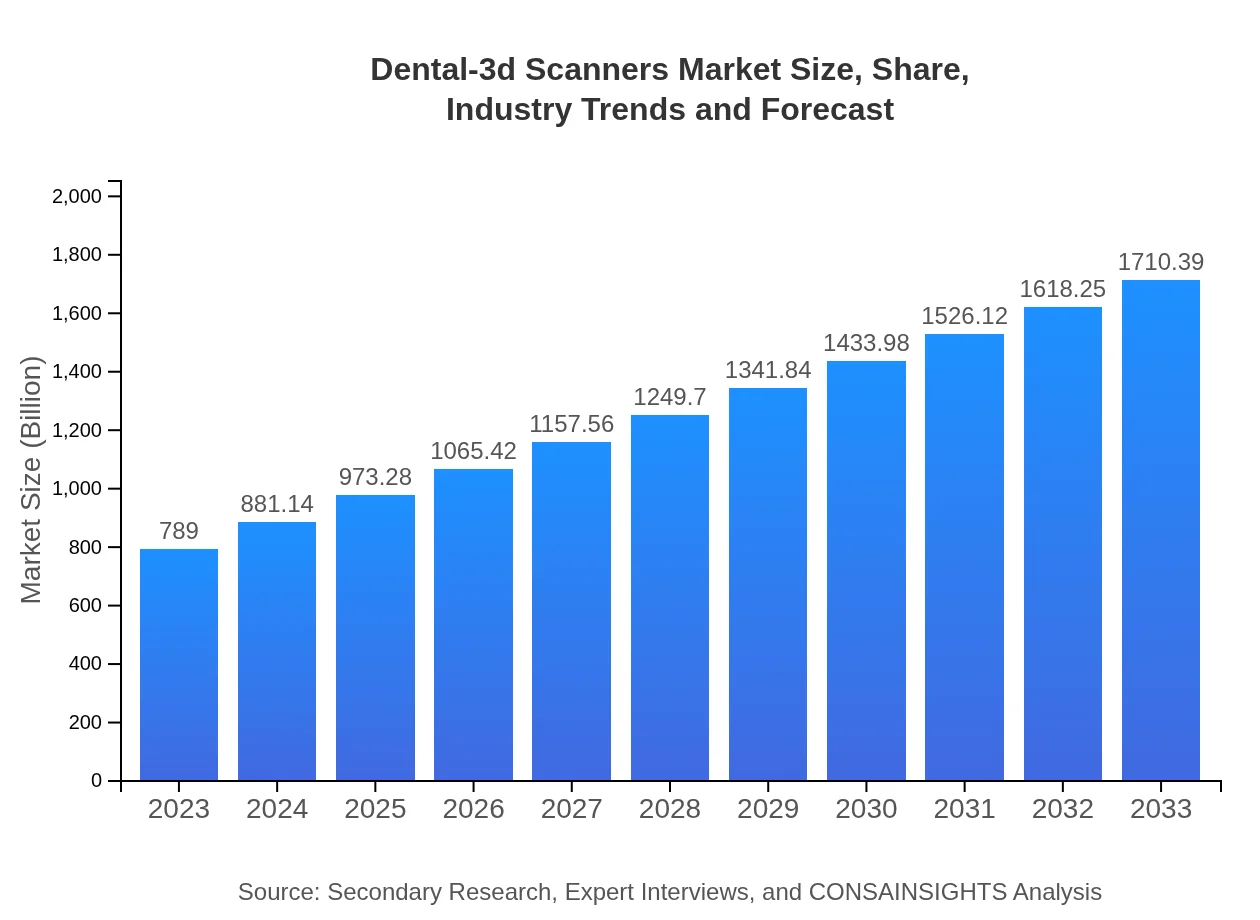

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $789.00 Million |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $1710.39 Million |

| Top Companies | 3Shape, Align Technology, DSM Dental, Planmeca, Carestream Dental |

| Last Modified Date | 31 January 2026 |

Dental-3D Scanners Market Overview

Customize Dental-3d Scanners Market Report market research report

- ✔ Get in-depth analysis of Dental-3d Scanners market size, growth, and forecasts.

- ✔ Understand Dental-3d Scanners's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dental-3d Scanners

What is the Market Size & CAGR of Dental-3D Scanners market in 2023?

Dental-3D Scanners Industry Analysis

Dental-3D Scanners Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dental-3D Scanners Market Analysis Report by Region

Europe Dental-3d Scanners Market Report:

The European market is estimated to expand from $205.85 million in 2023 to $446.24 million by 2033, driven by stringent regulations favoring the use of advanced scanners and a growing emphasis on preventive dental care.Asia Pacific Dental-3d Scanners Market Report:

In the Asia Pacific region, the dental 3D scanners market was valued at $165.22 million in 2023 and is projected to reach approximately $358.16 million by 2033. The growth is driven by increasing investments in healthcare infrastructure and a rising prevalence of dental disorders.North America Dental-3d Scanners Market Report:

North America remains the largest market, expected to grow from $262.50 million in 2023 to $569.05 million by 2033, primarily due to the increased adoption of advanced healthcare technologies and high patient expectations for precision.South America Dental-3d Scanners Market Report:

The South American market for dental 3D scanners is expected to grow from $75.82 million in 2023 to $164.37 million by 2033, fueled by an increase in dental tourism and greater availability of advanced dental care.Middle East & Africa Dental-3d Scanners Market Report:

The Middle East and Africa market is projected to grow from $79.61 million in 2023 to $172.58 million by 2033, with a growing trend in healthcare investments and the expansion of dental care services.Tell us your focus area and get a customized research report.

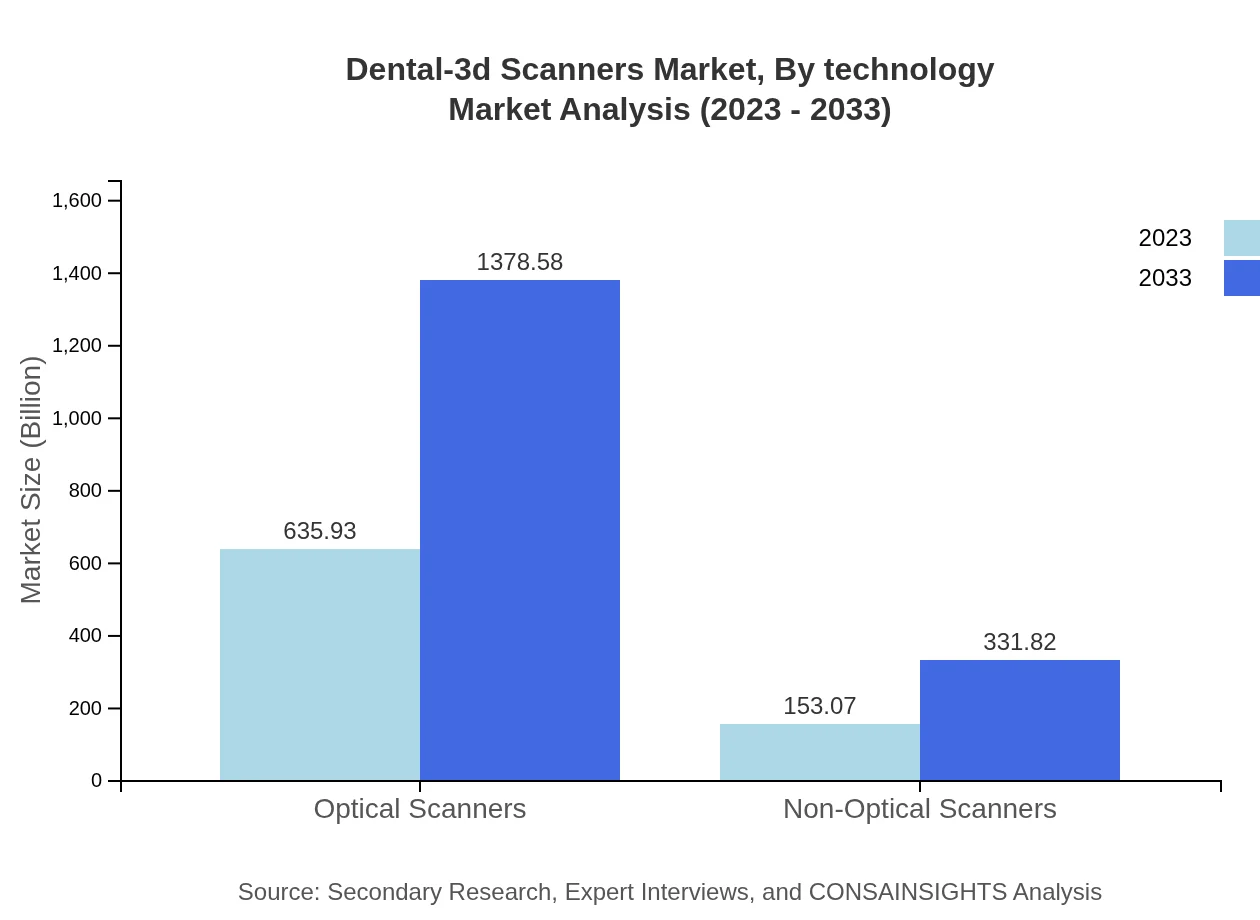

Dental-3d Scanners Market Analysis By Technology

The market is divided into Optical and Non-Optical Scanners. Optical scanners dominate with a market share of 80.6% as of 2023, valued at approximately $635.93 million and expected to reach $1378.58 million by 2033. Non-optical scanners represent 19.4%, valued at $153.07 million in 2023 and projected to rise to $331.82 million.

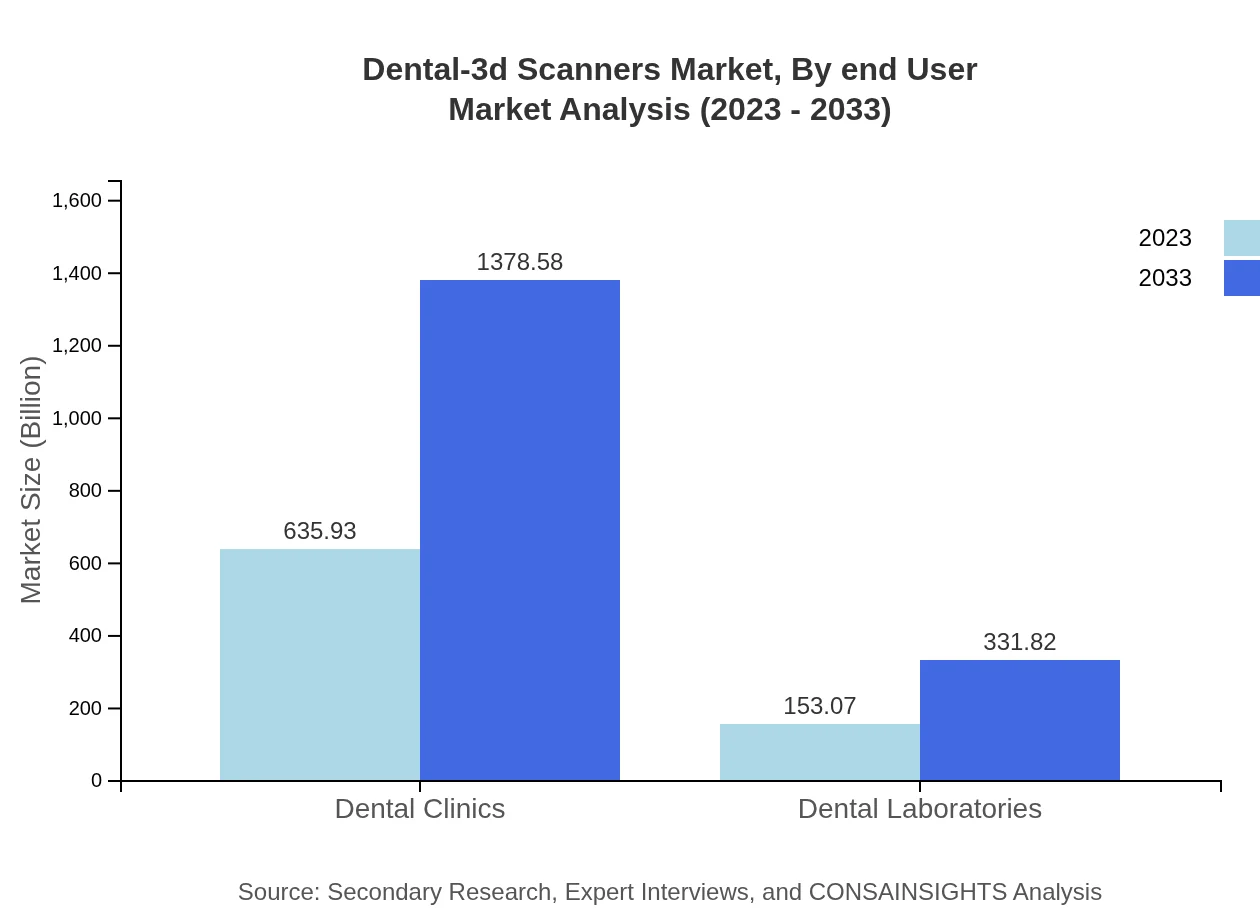

Dental-3d Scanners Market Analysis By End User

The major end-users are Dental Clinics and Dental Laboratories. Dental Clinics account for 80.6% of the market share, with revenues estimated at $635.93 million in 2023 and expected to reach $1378.58 million by 2033. Dental Laboratories hold a 19.4% share, starting at $153.07 million in 2023 and anticipated to grow to $331.82 million.

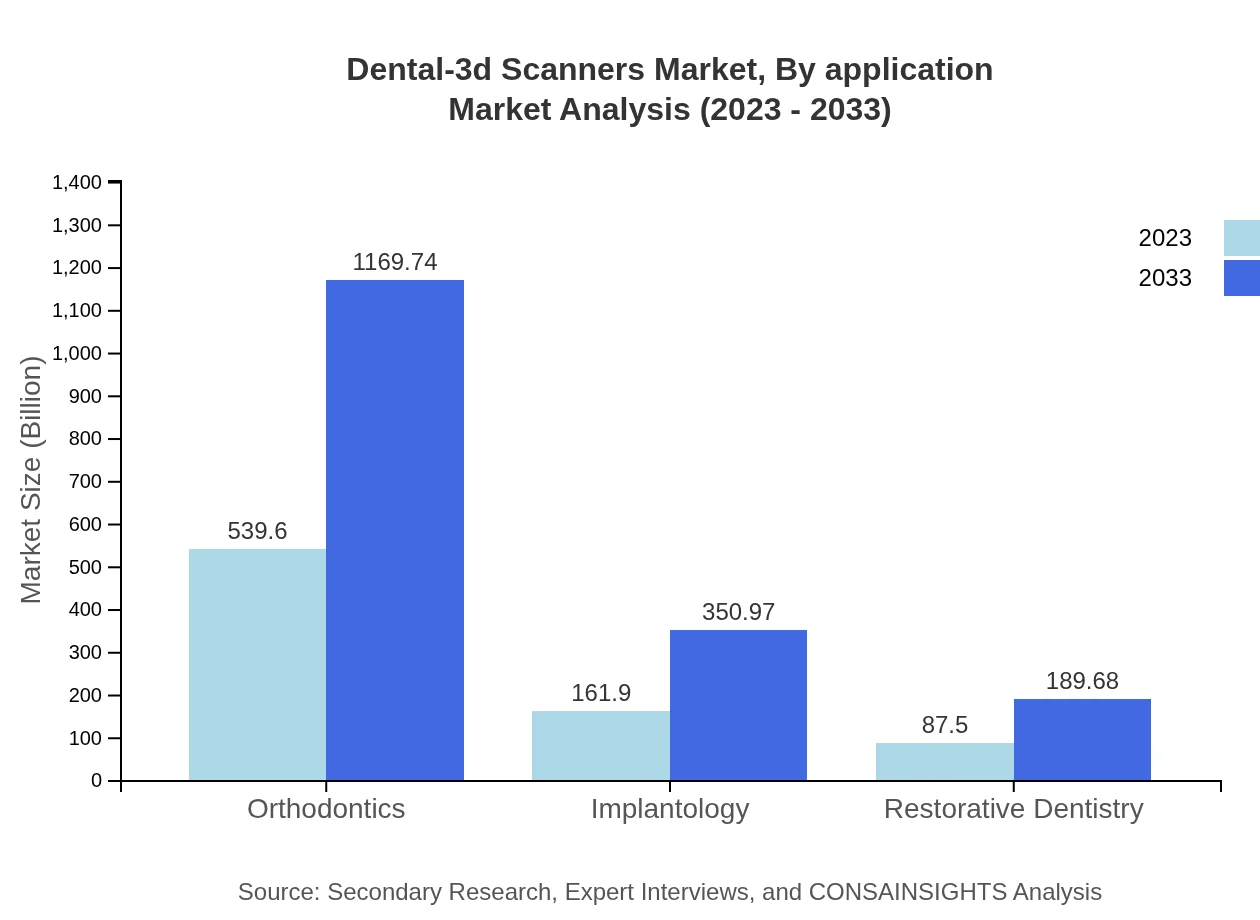

Dental-3d Scanners Market Analysis By Application

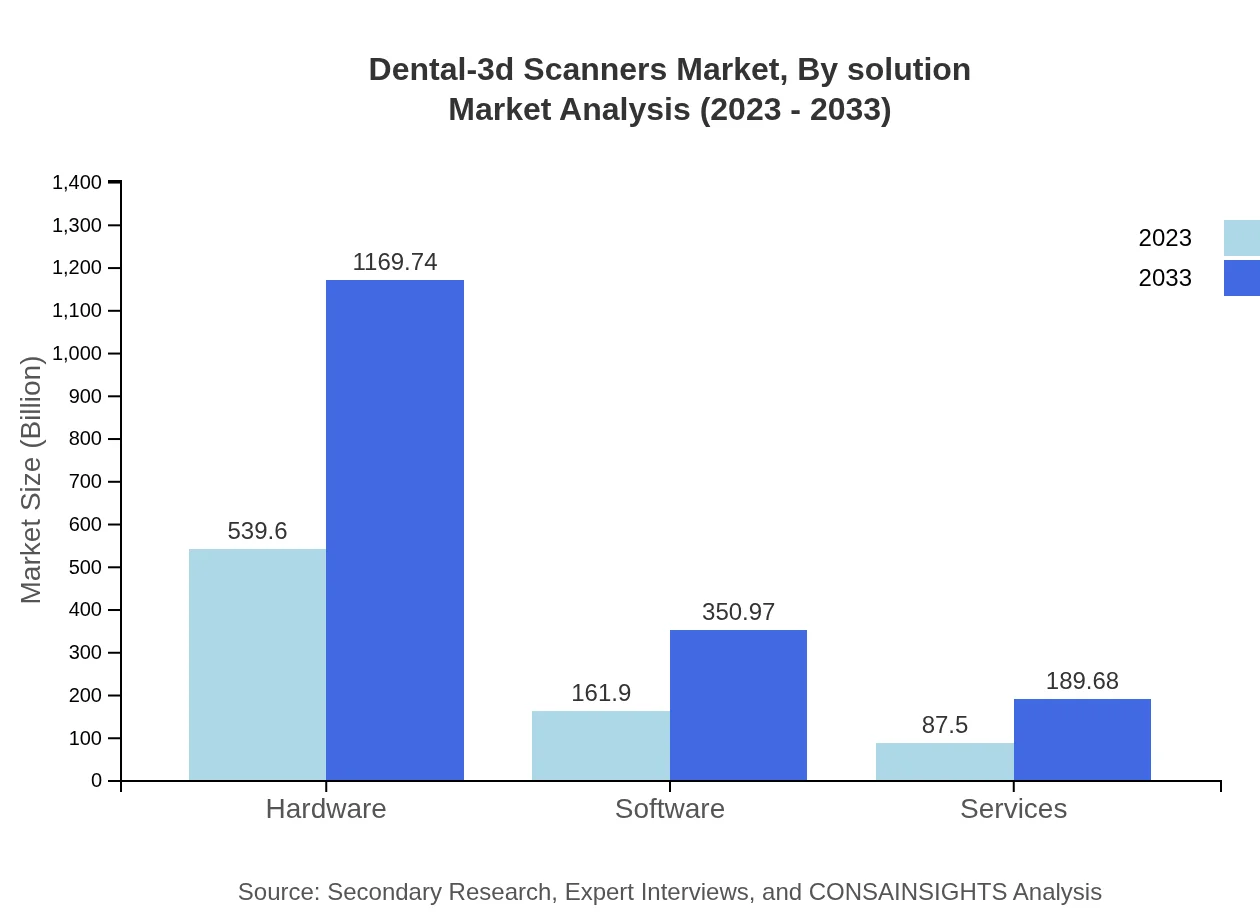

Applications include Orthodontics, Implantology, and Restorative Dentistry. Orthodontics leads with a size of $539.60 million in 2023 (projected $1169.74 million by 2033), followed by Implantology at $161.90 million (expected to reach $350.97 million), and Restorative Dentistry starting at $87.50 million, forecasted to grow to $189.68 million.

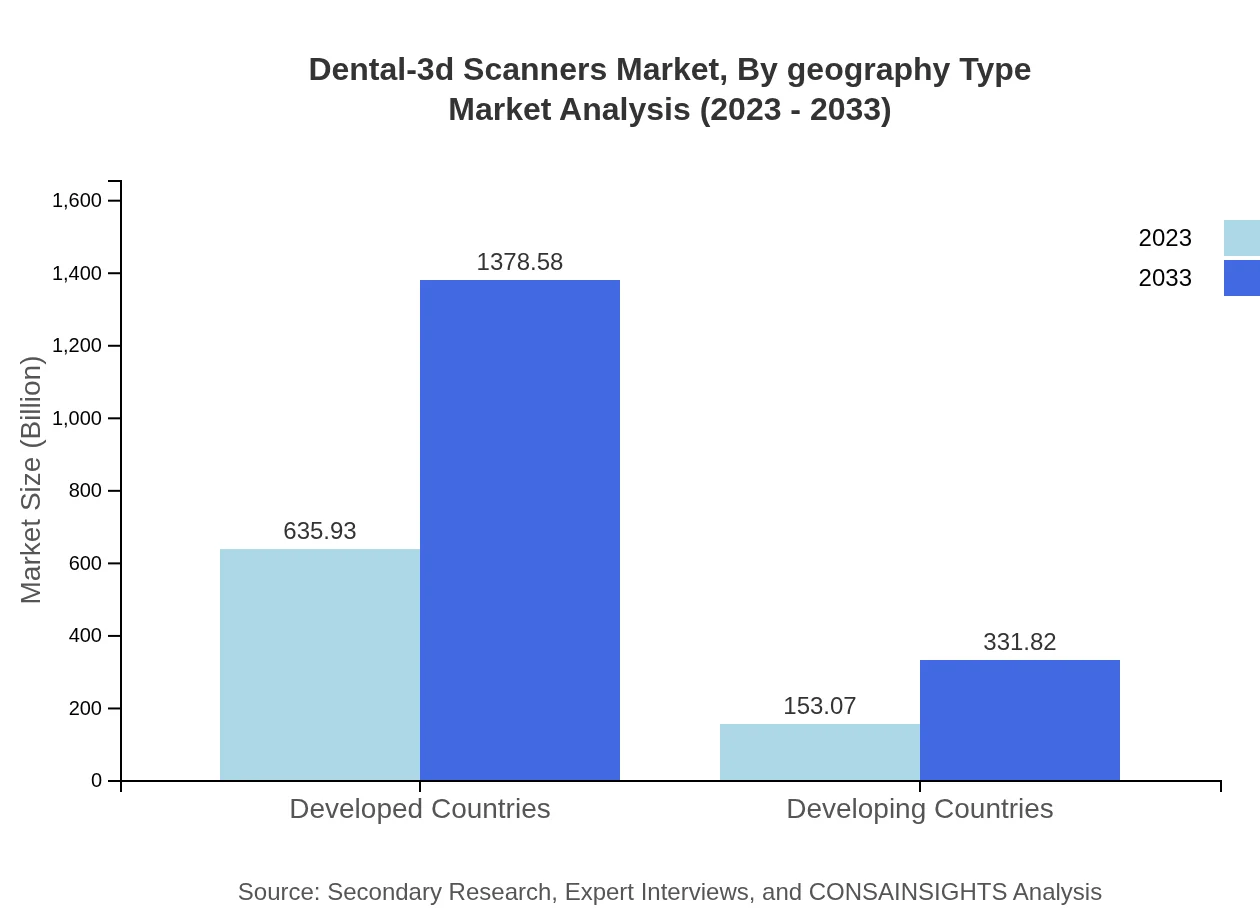

Dental-3d Scanners Market Analysis By Geography Type

The market is segmented into Developed and Developing Countries. Developed Countries dominate with a 80.6% share, projected from $635.93 million in 2023 to $1378.58 million by 2033. Developing Countries show growth potential, with a share of 19.4%, starting at $153.07 million and moving to $331.82 million.

Dental-3d Scanners Market Analysis By Solution

The solutions include Hardware, Software, and Services. Hardware holds the largest share at 68.39%, valued at $539.60 million in 2023 and forecasted at $1169.74 million by 2033. Software represents 20.52% ($161.90 million to $350.97 million), while Services account for 11.09% ($87.50 million to $189.68 million).

Dental-3D Scanners Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dental-3D Scanners Industry

3Shape:

3Shape is a leading manufacturer of dental 3D scanners and software, recognized for its high-precision technology and innovative solutions catered to dental professionals.Align Technology:

Align Technology is known for its advanced intraoral scanners and clear aligner solutions, offering tools that enhance the quality and efficiency of dental care.DSM Dental:

DSM Dental specializes in digital dental technology, emphasizing user-friendly 3D scanning solutions that help streamline dental procedures.Planmeca:

Planmeca provides comprehensive digital dentistry solutions, including high-quality 3D scanners designed to improve workflow in dental practices.Carestream Dental:

Carestream Dental offers a broad range of imaging and 3D scanning solutions for dental professionals, focusing on innovation and patient outcomes.We're grateful to work with incredible clients.

FAQs

What is the market size of dental 3D scanners?

The global dental 3D scanners market is estimated to reach approximately $789 million by 2033, growing at a CAGR of 7.8% from its current valuation. The growth signifies increased adoption and demand in the dental industry.

What are the key market players or companies in the dental 3D scanners industry?

Key players in the dental 3D scanners industry include global leaders like 3Shape, Align Technology, and Sirona Dental Systems, among others. These companies drive innovation and cater to the growing demands in the dental technology sector.

What are the primary factors driving the growth in the dental 3D scanners industry?

Growth in the dental 3D scanners market is driven by advances in dental technology, increased demand for aesthetic dentistry, and the rising prevalence of dental conditions requiring accurate and fast diagnostics.

Which region is the fastest Growing in the dental 3D scanners?

North America is the fastest-growing region in the dental 3D scanners market, with a market size of $569.05 million anticipated by 2033. This growth is attributed to high adoption rates of advanced dental technologies.

Does ConsaInsights provide customized market report data for the dental 3D scanners industry?

Yes, ConsaInsights offers customized market report data specifically for the dental 3D scanners industry, allowing clients to access tailored insights that cater to their unique needs and market queries.

What deliverables can I expect from this dental 3D scanners market research project?

From this market research project, you can expect detailed market analysis reports, insights into key trends, competitive landscapes, and forecasts, segmented by region and product type, enhancing strategic decision-making.

What are the market trends of dental 3D scanners?

Current market trends for dental 3D scanners include increasing integration of digital technologies, expansion of CAD/CAM systems, and a surge in the adoption of 3D printing technologies in dental laboratories.