Dental Biomaterials Market Report

Published Date: 31 January 2026 | Report Code: dental-biomaterials

Dental Biomaterials Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the dental biomaterials market, offering insights into market size, growth forecasts, trends, and competitive landscape from 2023 to 2033.

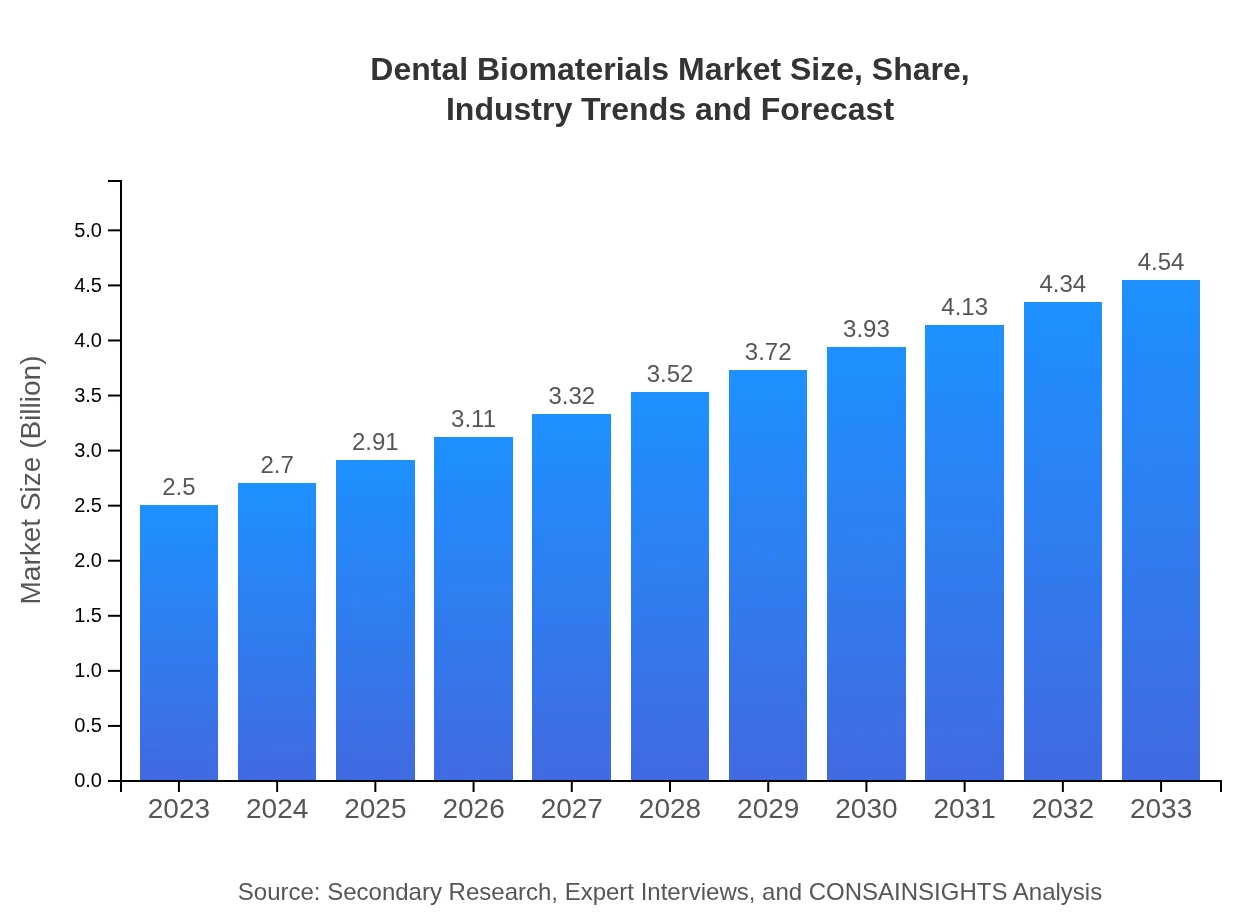

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.0% |

| 2033 Market Size | $4.54 Billion |

| Top Companies | Dentsply Sirona, Straumann Group, 3M, Kerr Corporation |

| Last Modified Date | 31 January 2026 |

Dental Biomaterials Market Overview

Customize Dental Biomaterials Market Report market research report

- ✔ Get in-depth analysis of Dental Biomaterials market size, growth, and forecasts.

- ✔ Understand Dental Biomaterials's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dental Biomaterials

What is the Market Size & CAGR of Dental Biomaterials market in 2023?

Dental Biomaterials Industry Analysis

Dental Biomaterials Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dental Biomaterials Market Analysis Report by Region

Europe Dental Biomaterials Market Report:

The European dental biomaterials market is projected to grow from $0.64 billion in 2023 to $1.16 billion by 2033. Factors supporting this growth include stringent regulations ensuring high product quality and an increasing geriatric population that necessitates diverse dental treatments.Asia Pacific Dental Biomaterials Market Report:

The Asia Pacific region is expected to witness significant growth in the dental biomaterials market, with the market size increasing from $0.50 billion in 2023 to $0.91 billion by 2033. This growth is driven by a rising population and an increasing number of dental health procedures, along with growing awareness of oral care products.North America Dental Biomaterials Market Report:

North America holds a prominent position in the dental biomaterials market, with an estimated market size of $0.88 billion in 2023, projected to grow to $1.60 billion by 2033. This growth is fueled by advanced healthcare infrastructure, high cosmetic dentistry spending, and a greater prevalence of dental diseases.South America Dental Biomaterials Market Report:

In South America, the dental biomaterials market size is anticipated to grow from $0.20 billion in 2023 to $0.37 billion by 2033. The increase is expected due to rising dental expenditures and expanding healthcare access among the population.Middle East & Africa Dental Biomaterials Market Report:

The Middle East and Africa dental biomaterials market is estimated to expand from $0.28 billion in 2023 to $0.51 billion by 2033. Growth in this region is driven by improving healthcare systems and increasing awareness toward dental aesthetics.Tell us your focus area and get a customized research report.

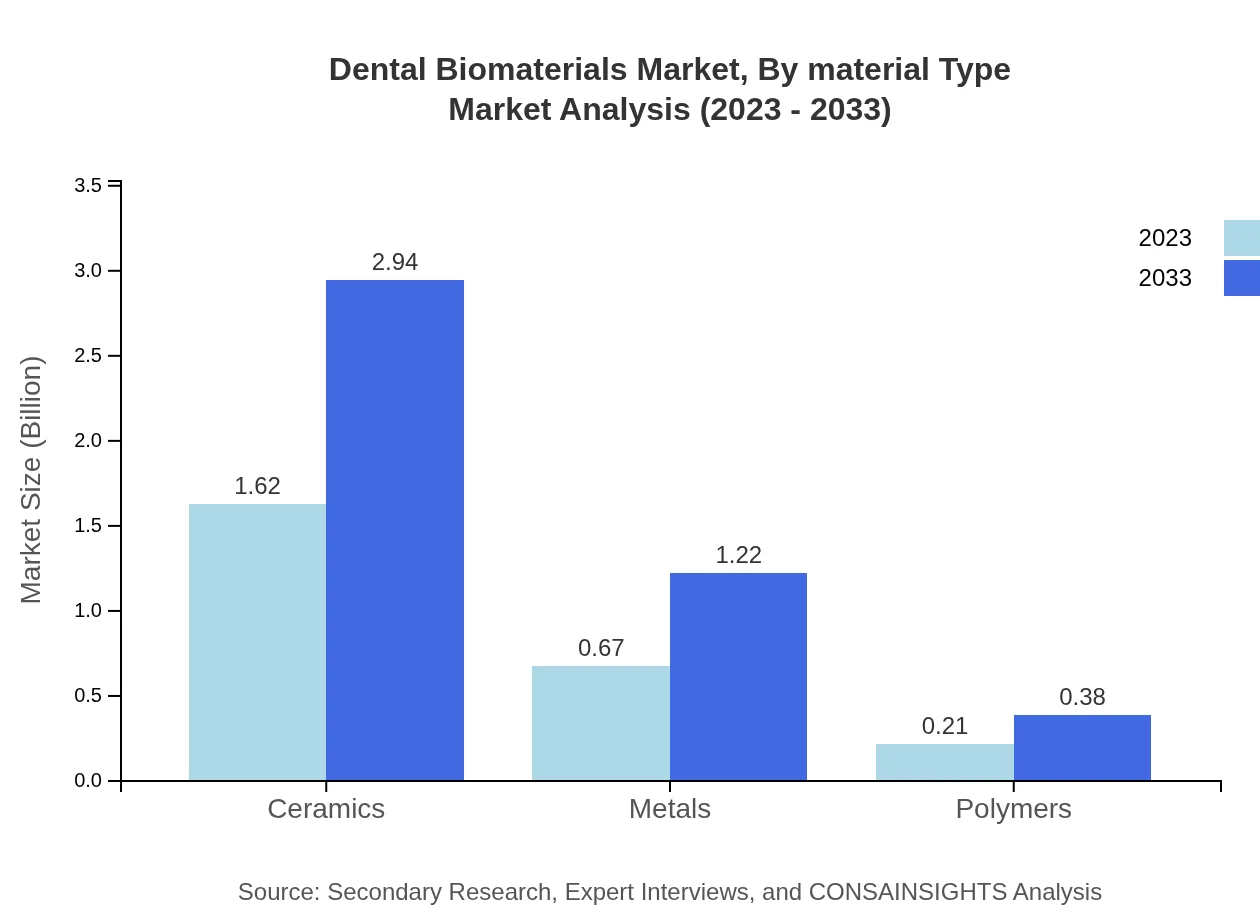

Dental Biomaterials Market Analysis By Material Type

The market for dental biomaterials is significantly impacted by material types. Ceramics uphold the largest market share at 64.65%, projected to grow from $1.62 billion in 2023 to $2.94 billion by 2033. Metals constitute 26.88% of the market, with growth from $0.67 billion to $1.22 billion in the same period. Polymers represent a smaller segment at 8.47%, expected to rise from $0.21 billion to $0.38 billion, presenting opportunities for innovation.

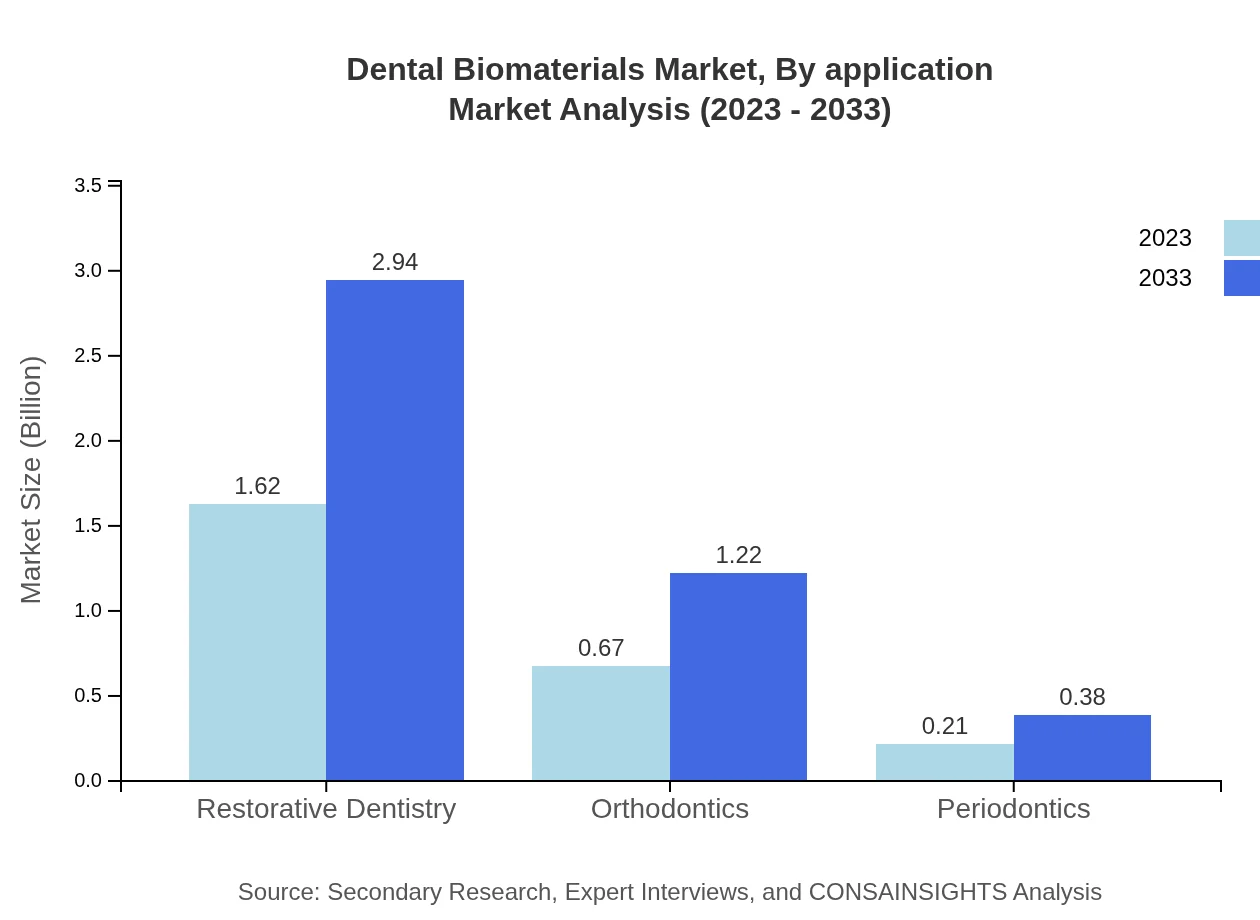

Dental Biomaterials Market Analysis By Application

Restorative dentistry dominates the application segment, capturing 64.65% of the market share, with its size projected to grow from $1.62 billion to $2.94 billion. Orthodontics and periodontics make up 26.88% and 8.47%, respectively, indicating that restorative treatments are the primary driver of revenue growth in the dental biomaterials market.

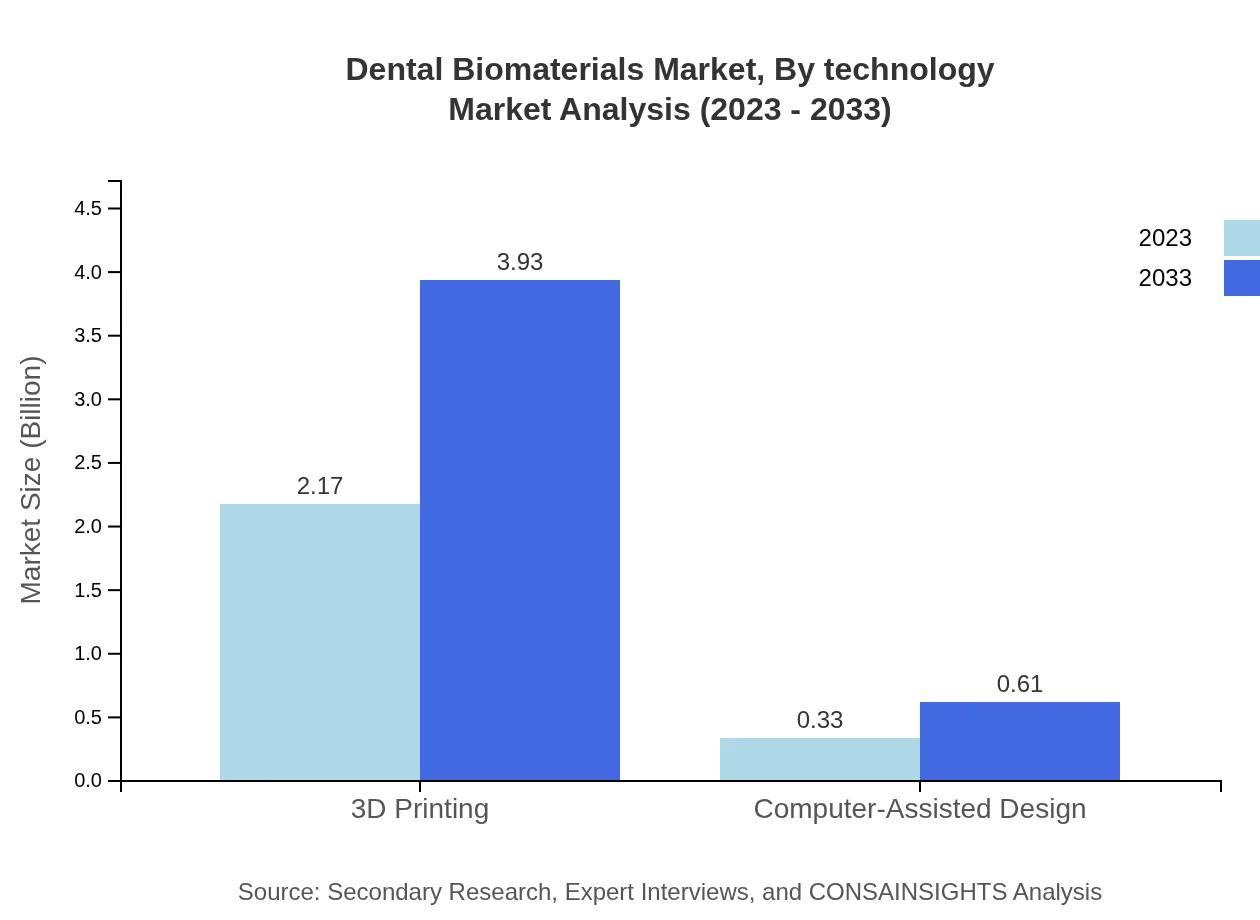

Dental Biomaterials Market Analysis By Technology

The dental biomaterials market is also segmented by technology, where 3D printing leads significantly, comprising a market share of 86.63%, with an increase from $2.17 billion in 2023 to $3.93 billion by 2033. Computer-assisted design follows with 13.37% of the market share, growing from $0.33 billion to $0.61 billion, reflecting technological advancements within the sector.

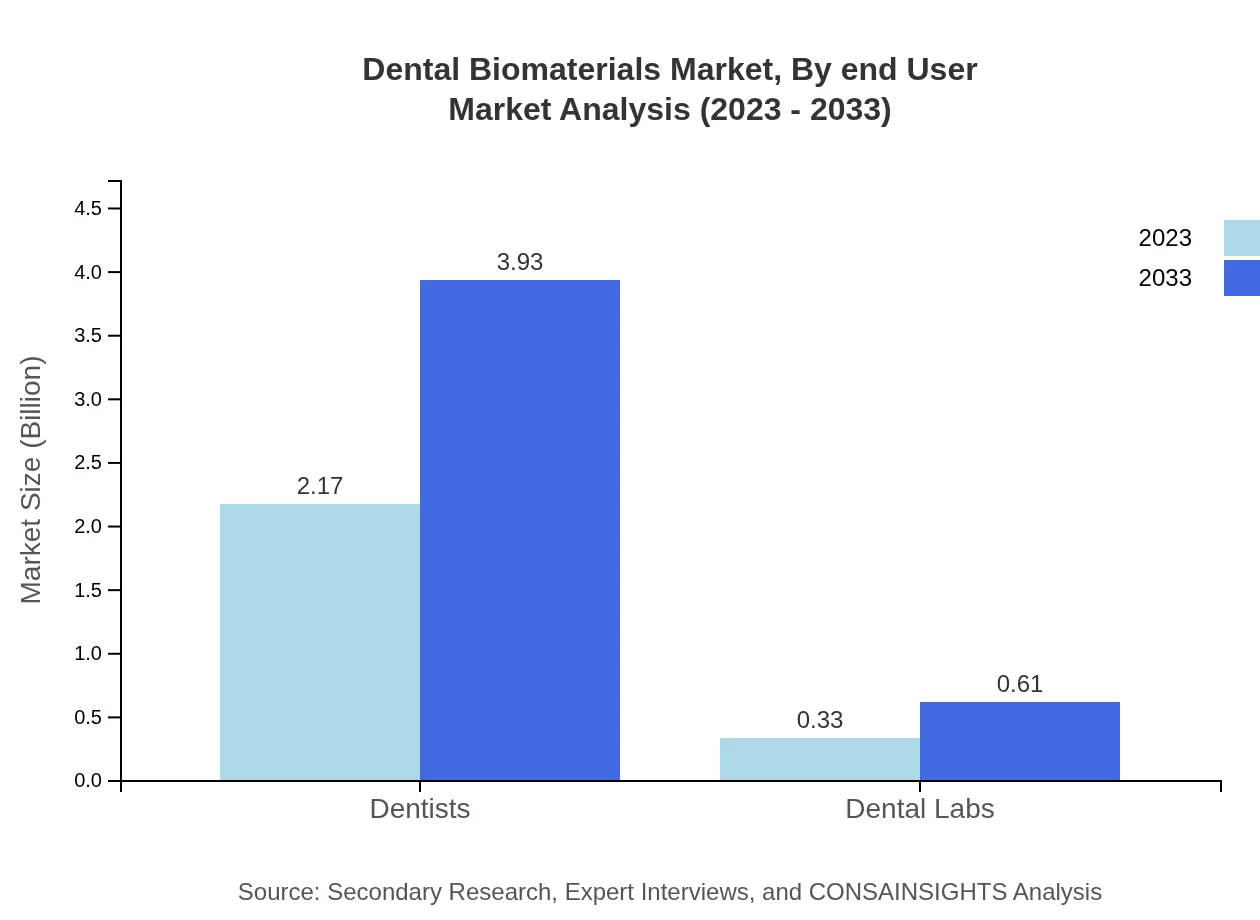

Dental Biomaterials Market Analysis By End User

The end-user segment is led by dentists, holding an 86.63% market share, projected to increase from $2.17 billion to $3.93 billion. Dental labs constitute 13.37% of the market, from $0.33 billion to $0.61 billion, demonstrating dentists as primary users of dental biomaterials in various applications.

Dental Biomaterials Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dental Biomaterials Industry

Dentsply Sirona:

Dentsply Sirona is a global leader in dental products, providing a wide range of biomaterials suitable for a variety of dental applications. Their emphasis on innovation has established them as a key player in the market.Straumann Group:

The Straumann Group specializes in dental implants and restorative products, noted for their high-quality biomaterials that cater to both surgical and aesthetic dental applications.3M:

3M operates in the dental biomaterials segment by offering a variety of dental adhesives, cements, and other restorative products that fulfill the increasing demands of dental professionals.Kerr Corporation:

Kerr Corporation focuses on restorative materials, including composites and ceramics, providing dental professionals with quality biomaterials that align with evolving standards.We're grateful to work with incredible clients.

FAQs

What is the market size of dental Biomaterials?

The global dental biomaterials market is projected to reach $2.5 billion by 2033, growing at a CAGR of 6.0%. This growth reflects increasing demand in restorative procedures and advances in materials technology.

What are the key market players or companies in this dental Biomaterials industry?

Key players in the dental biomaterials industry include major companies like Dentsply Sirona, Straumann, and 3M. These companies lead in developing innovative products to meet the evolving preferences of dental professionals.

What are the primary factors driving the growth in the dental Biomaterials industry?

Growth in the dental biomaterials sector is fueled by rising dental disorders, increased awareness of oral health, and advancements in biomaterial technologies that improve treatment outcomes and enhance patient comfort.

Which region is the fastest Growing in the dental Biomaterials?

The fastest-growing region for dental biomaterials is North America, expected to rise from $0.88 billion in 2023 to $1.60 billion by 2033. Strong demand for advanced dental solutions drives this growth.

Does ConsaInsights provide customized market report data for the dental Biomaterials industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the dental-biomaterials industry. Clients can request detailed analyses focused on particular segments, regions, or trends.

What deliverables can I expect from this dental Biomaterials market research project?

Deliverables from the dental-biomaterials market research project typically include comprehensive reports detailing market size, growth forecasts, competitor analysis, and segmented data across key demographics and regions.

What are the market trends of dental Biomaterials?

Current trends in the dental biomaterials market include a growing preference for biocompatible materials, the rise of digital dentistry techniques, and increased focus on sustainable and eco-friendly biomaterials.