Dental Bone Graft Substitutes Market Report

Published Date: 31 January 2026 | Report Code: dental-bone-graft-substitutes

Dental Bone Graft Substitutes Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Dental Bone Graft Substitutes market, covering market overview, size, growth trends, regional insights, product segmentation, and forecasts from 2023 to 2033.

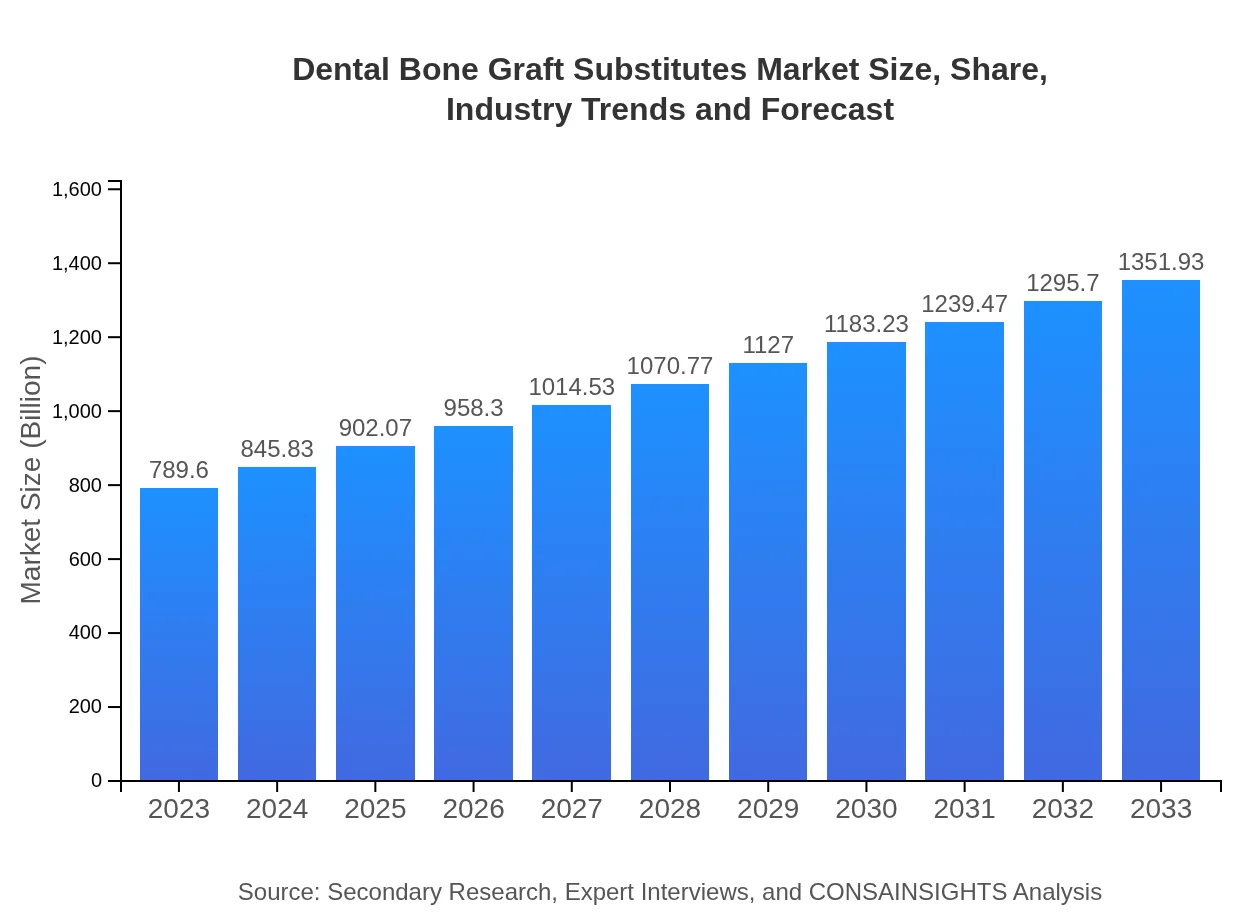

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $789.60 Million |

| CAGR (2023-2033) | 5.4% |

| 2033 Market Size | $1351.93 Million |

| Top Companies | Zimmer Biomet, Dentsply Sirona, Medtronic , Straumann, BTL Industries |

| Last Modified Date | 31 January 2026 |

Dental Bone Graft Substitutes Market Overview

Customize Dental Bone Graft Substitutes Market Report market research report

- ✔ Get in-depth analysis of Dental Bone Graft Substitutes market size, growth, and forecasts.

- ✔ Understand Dental Bone Graft Substitutes's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dental Bone Graft Substitutes

What is the Market Size & CAGR of Dental Bone Graft Substitutes market in 2023?

Dental Bone Graft Substitutes Industry Analysis

Dental Bone Graft Substitutes Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dental Bone Graft Substitutes Market Analysis Report by Region

Europe Dental Bone Graft Substitutes Market Report:

The European Dental Bone Graft Substitutes market is anticipated to grow from $200.16 million in 2023 to $342.71 million by 2033. Key drivers include heightened awareness of aesthetic dental procedures and the rise of dental tourism in regions like Eastern Europe.Asia Pacific Dental Bone Graft Substitutes Market Report:

The Asia Pacific region is expected to witness substantial growth in the Dental Bone Graft Substitutes market, with a size of $171.50 million in 2023, projected to reach $293.64 million by 2033. Factors such as increasing dental awareness, improving healthcare infrastructure, and growing accessibility to dental services are driving this growth.North America Dental Bone Graft Substitutes Market Report:

North America holds a significant share of the Dental Bone Graft Substitutes market, valued at $291.52 million in 2023 and projected to grow to $499.13 million by 2033. The region's dominance is due to high healthcare expenditure, advanced dental technology, and a growing geriatric population requiring dental intervention.South America Dental Bone Graft Substitutes Market Report:

In South America, the market for Dental Bone Graft Substitutes is growing at a steady pace, with a market size of $21.64 million in 2023, expected to increase to $37.04 million by 2033. This growth is attributed to the rising incidence of dental issues and the expanding dental restoration sectors across various countries.Middle East & Africa Dental Bone Graft Substitutes Market Report:

The Middle East and Africa market for Dental Bone Graft Substitutes is expected to expand from $104.78 million in 2023 to $179.40 million by 2033. Growth is driven by improving healthcare systems and increasing disposable income leading to higher spending on dental procedures.Tell us your focus area and get a customized research report.

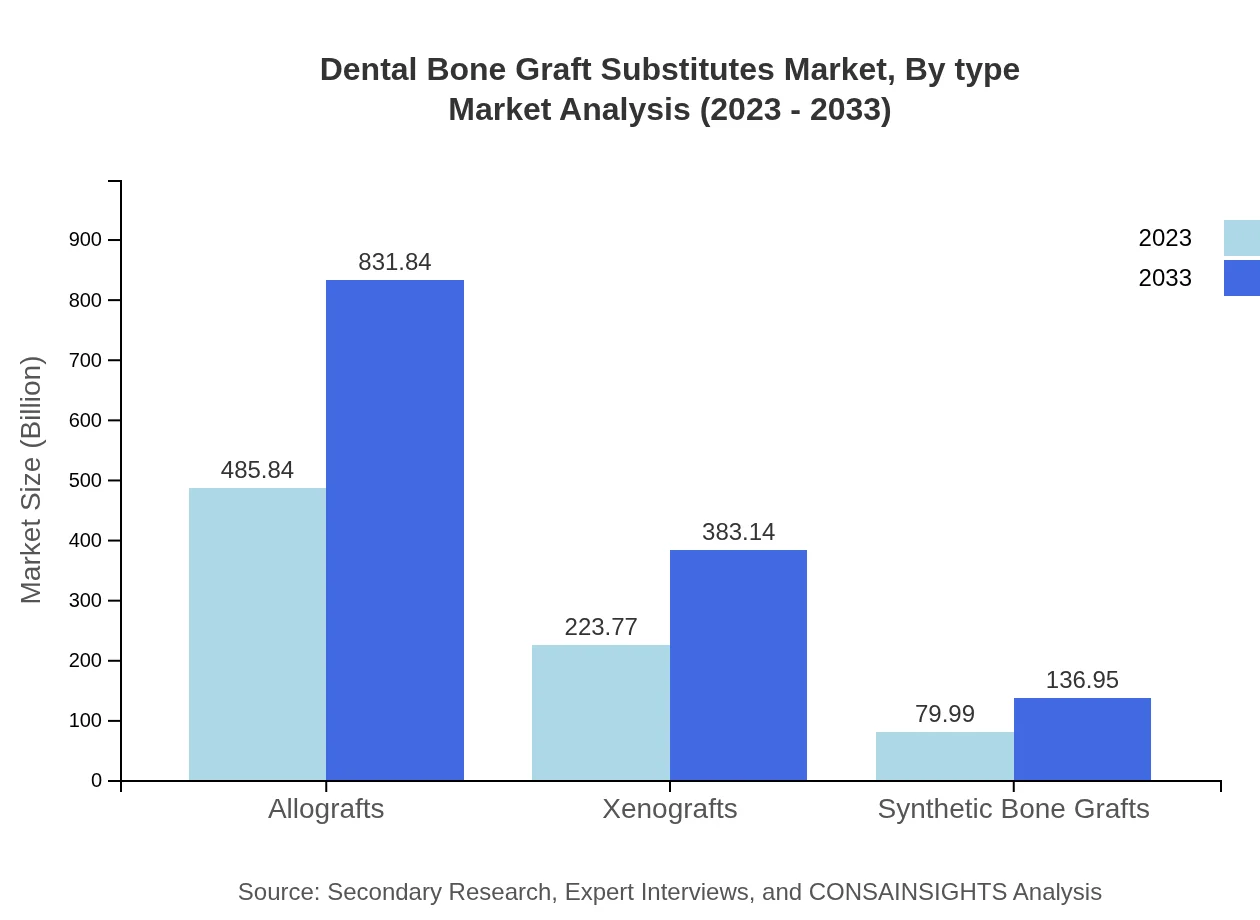

Dental Bone Graft Substitutes Market Analysis By Type

The market is segmented into allografts, xenografts, and synthetic bone grafts. In 2023, allografts dominate the market with a size of $485.84 million, expected to reach $831.84 million by 2033, accounting for 61.53% market share. Xenografts follow with a 28.34% share, starting at $223.77 million in 2023 and growing to $383.14 million by 2033. Synthetic bone grafts, although smaller at $79.99 million in 2023, are projected to grow to $136.95 million by 2033, indicating a growing acceptance of synthetic alternatives.

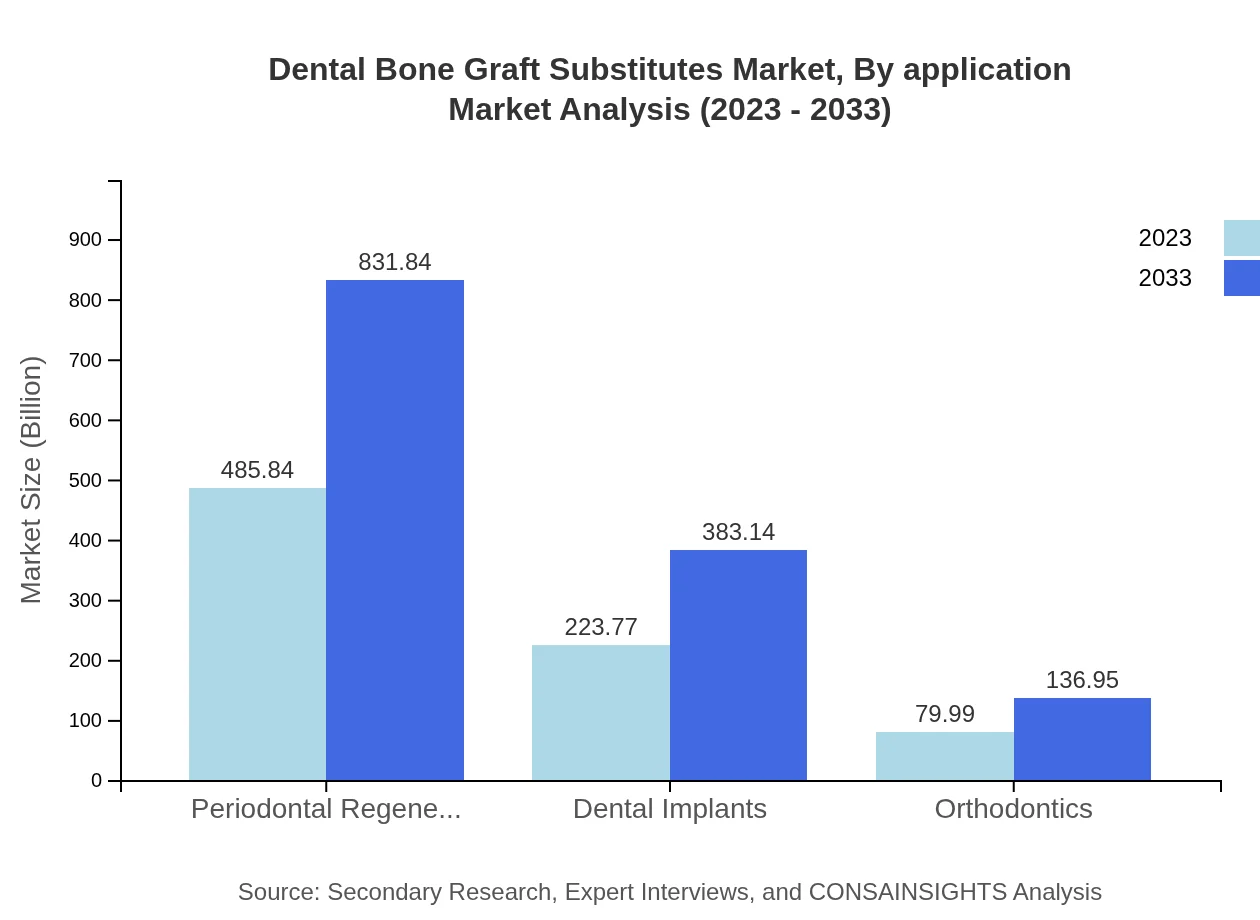

Dental Bone Graft Substitutes Market Analysis By Application

The applications of Dental Bone Graft Substitutes include periodontal regeneration, dental implants, and orthodontics. Periodontal regeneration holds the largest market share of 61.53% as of 2023, valued at $485.84 million, and is anticipated to grow substantially over the decade. Dental implants, accounting for 28.34% market share, start at $223.77 million and are expected to grow to $383.14 million by 2033, while orthodontics is projected to expand from $79.99 million to $136.95 million in the same timeframe.

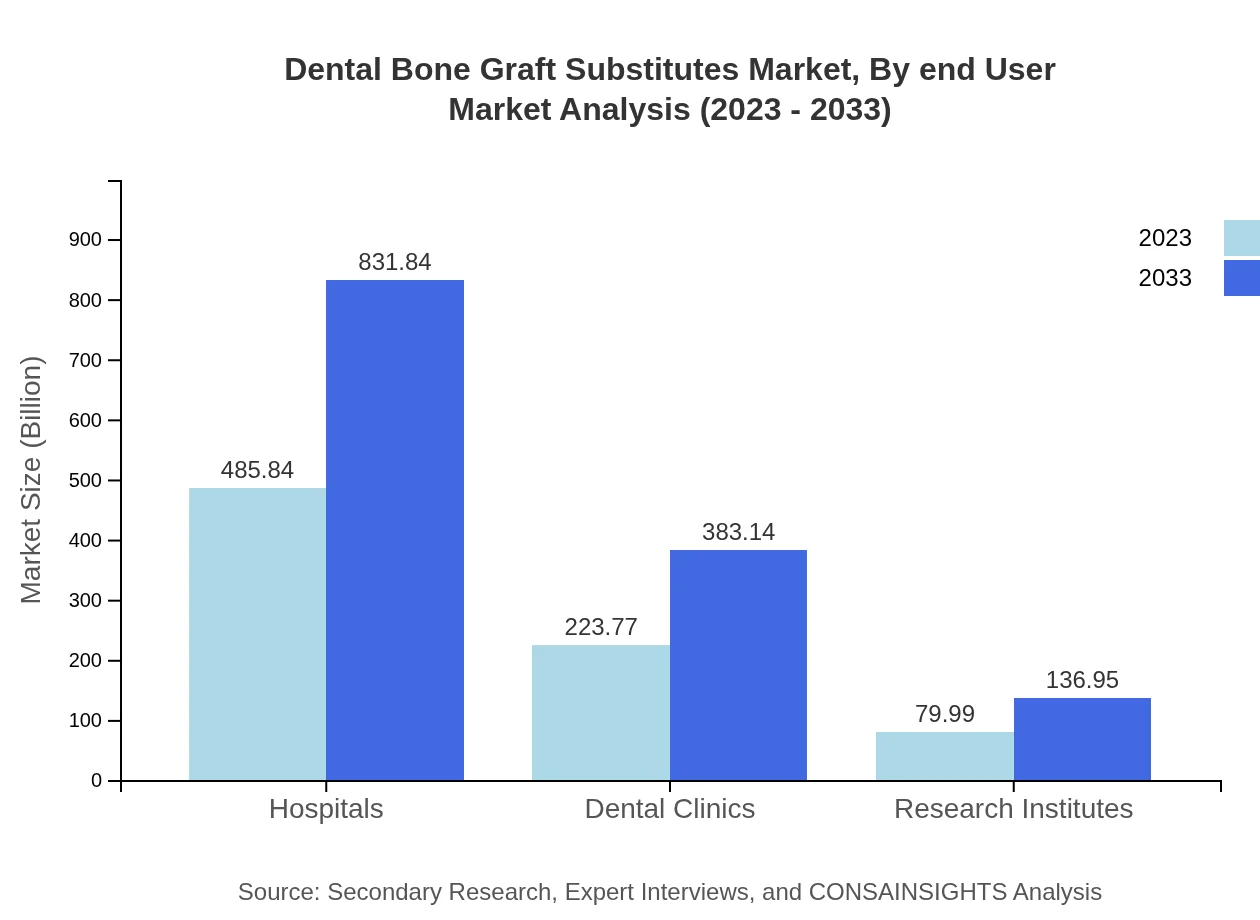

Dental Bone Graft Substitutes Market Analysis By End User

Market end-users include hospitals, dental clinics, and research institutes. Hospitals dominate the sector with a share of 61.53% in 2023, reflecting a market size of $485.84 million, forecasted to reach $831.84 million by 2033. Dental clinics, with an important 28.34% share, start at $223.77 million, while research institutes represent 10.13% of the market, initially valued at $79.99 million and expected to rise to $136.95 million.

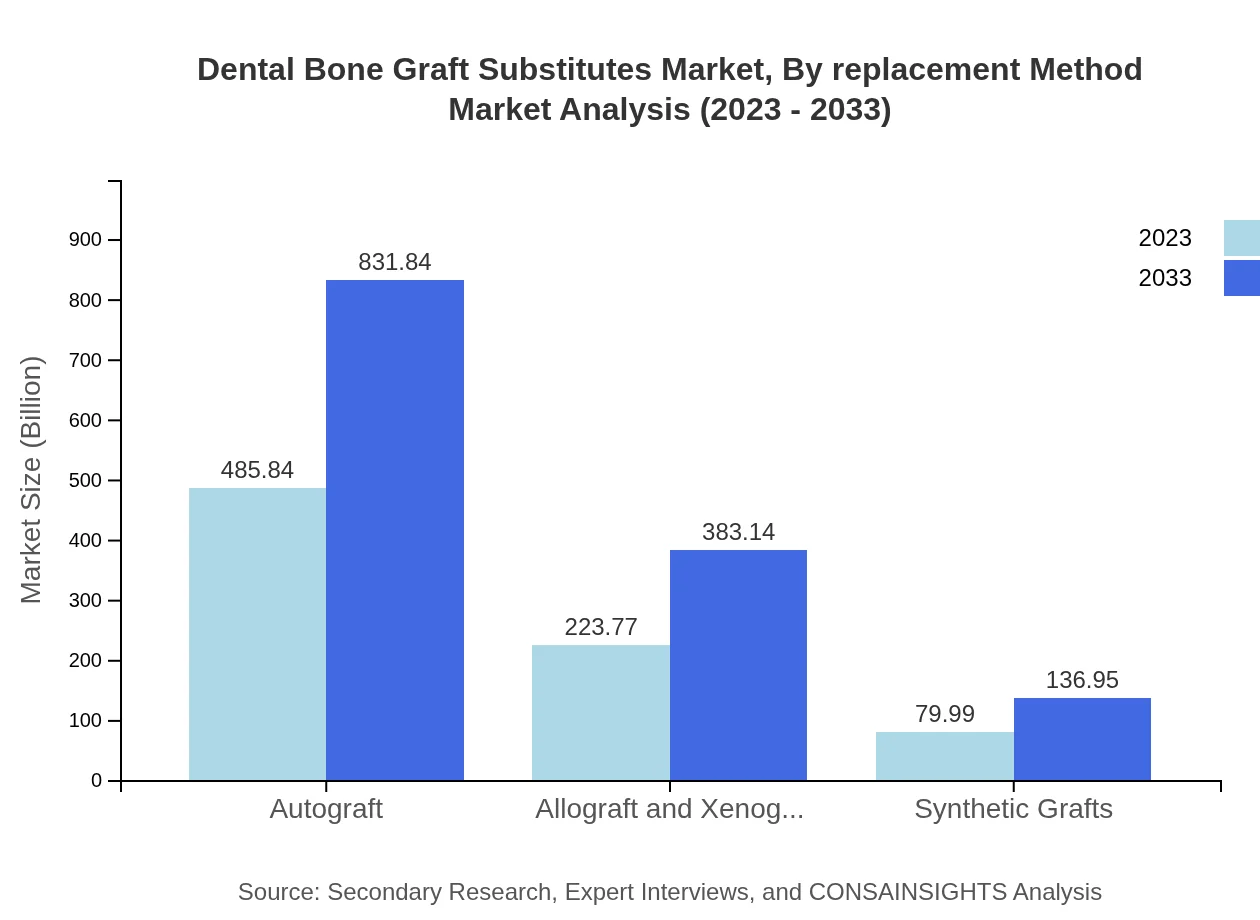

Dental Bone Graft Substitutes Market Analysis By Replacement Method

Replacement methods include autografts, allografts, and synthetic grafts. The autograft method remains popular, dominating the market at $485.84 million in 2023, with a growth forecast to $831.84 million by 2033. Allografts and xenografts, although smaller in size, are significant with respective shares of 28.34% (totaling $223.77 million) and expected growth to $383.14 million, showing the segmented nature of method preferences among dental health professionals.

Dental Bone Graft Substitutes Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dental Bone Graft Substitutes Industry

Zimmer Biomet:

Zimmer Biomet is a leading provider of dental and orthopedic products, extensively recognized for its innovative bone graft solutions, including a wide range of allografts and synthetic graft materials.Dentsply Sirona:

Dentsply Sirona is the world's largest manufacturer of professional dental products and technologies, known for its advancements in bone grafting and regenerative solutions.Medtronic :

Medtronic brings a diverse portfolio of surgical graft substitutes and biomaterial products utilized in dental surgeries, enhancing patient recovery and outcomes.Straumann:

Straumann is renowned for its high-quality dental implants and biomaterial products, including advanced grafting technologies that support dental restoration treatments.BTL Industries:

BTL Industries specializes in developing biological grafts and regenerative therapies, enhancing the efficacy of dental procedures worldwide.We're grateful to work with incredible clients.

FAQs

What is the market size of dental Bone Graft Substitutes?

The dental bone graft substitutes market is projected to reach approximately $789.6 million by 2033, growing at a CAGR of 5.4%. This growth indicates a steady demand for effective grafting solutions in dental procedures.

What are the key market players or companies in this dental Bone Graft Substitutes industry?

Key players in the dental bone graft substitutes market include major companies specializing in dental products and biotechnologies. Their continuous innovation and expansion strategies contribute significantly to the market landscape and competition.

What are the primary factors driving the growth in the dental Bone Graft Substitutes industry?

The growth of the dental bone graft substitutes market is primarily driven by the increasing prevalence of dental diseases and the growing aging population, which leads to higher demands for reconstructive procedures and dental implants.

Which region is the fastest Growing in the dental Bone Graft Substitutes?

The fastest-growing region in the dental bone graft substitutes market is North America, projected to grow from $291.52 million in 2023 to $499.13 million in 2033, influenced by advanced healthcare facilities and rising awareness among patients.

Does ConsaInsights provide customized market report data for the dental Bone Graft Substitutes industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the dental bone graft substitutes industry. Clients can access detailed insights and analyses that align with their business strategies.

What deliverables can I expect from this dental Bone Graft Substitutes market research project?

Clients can expect comprehensive deliverables from the dental bone graft substitutes market research project, including detailed reports, market forecasts, competitive analyses, and strategic recommendations based on in-depth industry evaluations.

What are the market trends of dental Bone Graft Substitutes?

Key trends in the dental bone graft substitutes market include increasing adoption of synthetic grafts and innovative biomaterials. There is also a growing emphasis on minimally invasive surgical techniques that enhance recovery times.