Dental Cement Market Report

Published Date: 31 January 2026 | Report Code: dental-cement

Dental Cement Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Dental Cement market, covering market trends, size forecasts, regional insights, and key players for the period from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

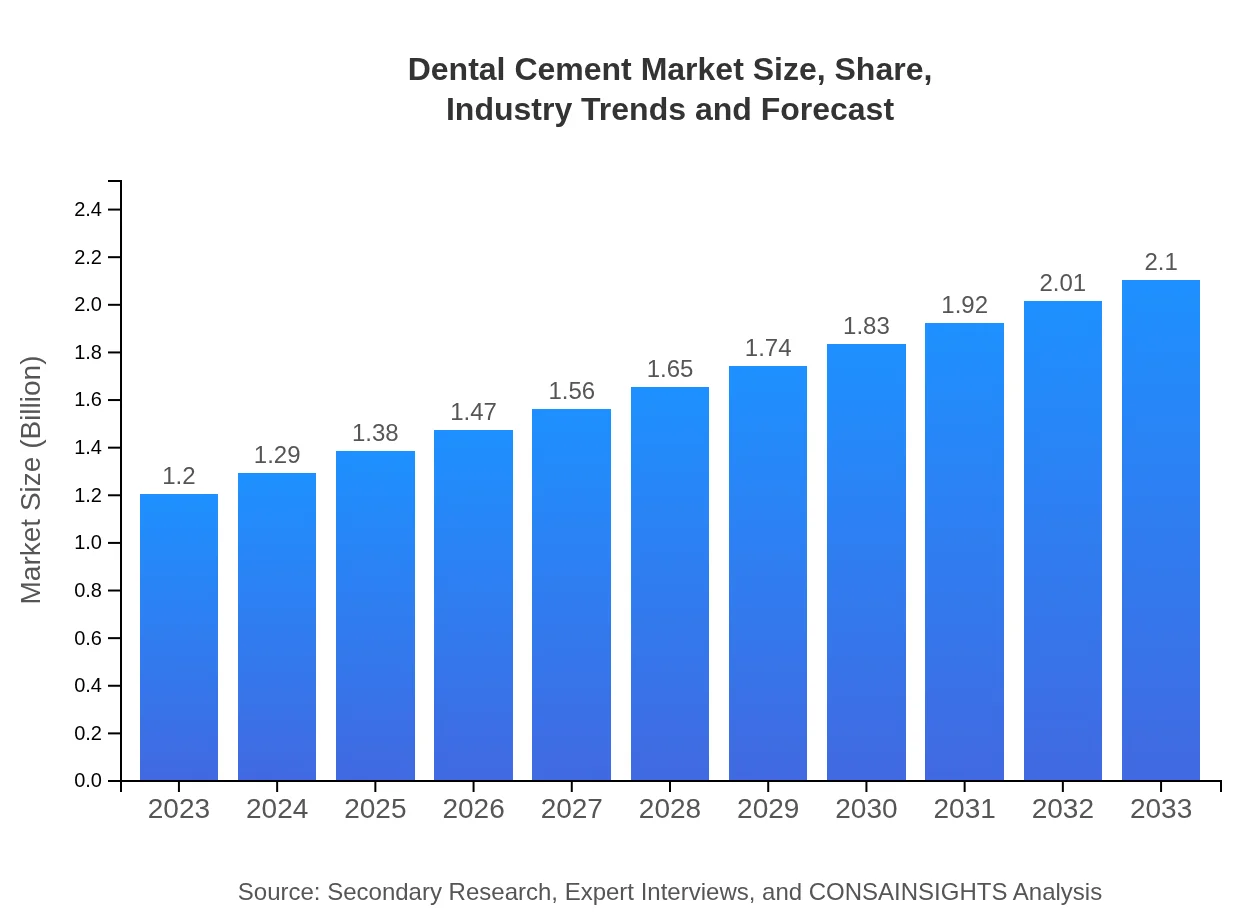

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 5.6% |

| 2033 Market Size | $2.10 Billion |

| Top Companies | 3M ESPE, IFG Dental, Kerr Corporation, Dentsply Sirona |

| Last Modified Date | 31 January 2026 |

Dental Cement Market Overview

Customize Dental Cement Market Report market research report

- ✔ Get in-depth analysis of Dental Cement market size, growth, and forecasts.

- ✔ Understand Dental Cement's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dental Cement

What is the Market Size & CAGR of Dental Cement market in 2023?

Dental Cement Industry Analysis

Dental Cement Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dental Cement Market Analysis Report by Region

Europe Dental Cement Market Report:

The European market is anticipated to grow from USD 0.32 billion in 2023 to USD 0.57 billion in 2033. Regulatory support, high levels of dental care expenditure, and advancements in dental technologies contribute to this upward trend.Asia Pacific Dental Cement Market Report:

The Asia Pacific region is projected to grow from USD 0.25 billion in 2023 to USD 0.44 billion in 2033, driven by rising disposable incomes, increasing dental tourism, and a growing elderly population. Emerging economies like India and China are likely to see significant growth due to urbanization and improved access to dental care.North America Dental Cement Market Report:

North America remains the dominant region, growing from USD 0.39 billion in 2023 to USD 0.67 billion in 2033. High demand for advanced dental procedures and technologies, alongside a robust healthcare system, underpins this market strength.South America Dental Cement Market Report:

In South America, the market is expected to increase from USD 0.09 billion in 2023 to USD 0.15 billion by 2033. This growth is fueled by improving healthcare infrastructure, rising awareness of dental health, and a rise in disposable income.Middle East & Africa Dental Cement Market Report:

The Middle East and Africa market is projected to increase from USD 0.15 billion in 2023 to USD 0.26 billion by 2033, driven by improvements in healthcare services and growing awareness about dental health in developing countries.Tell us your focus area and get a customized research report.

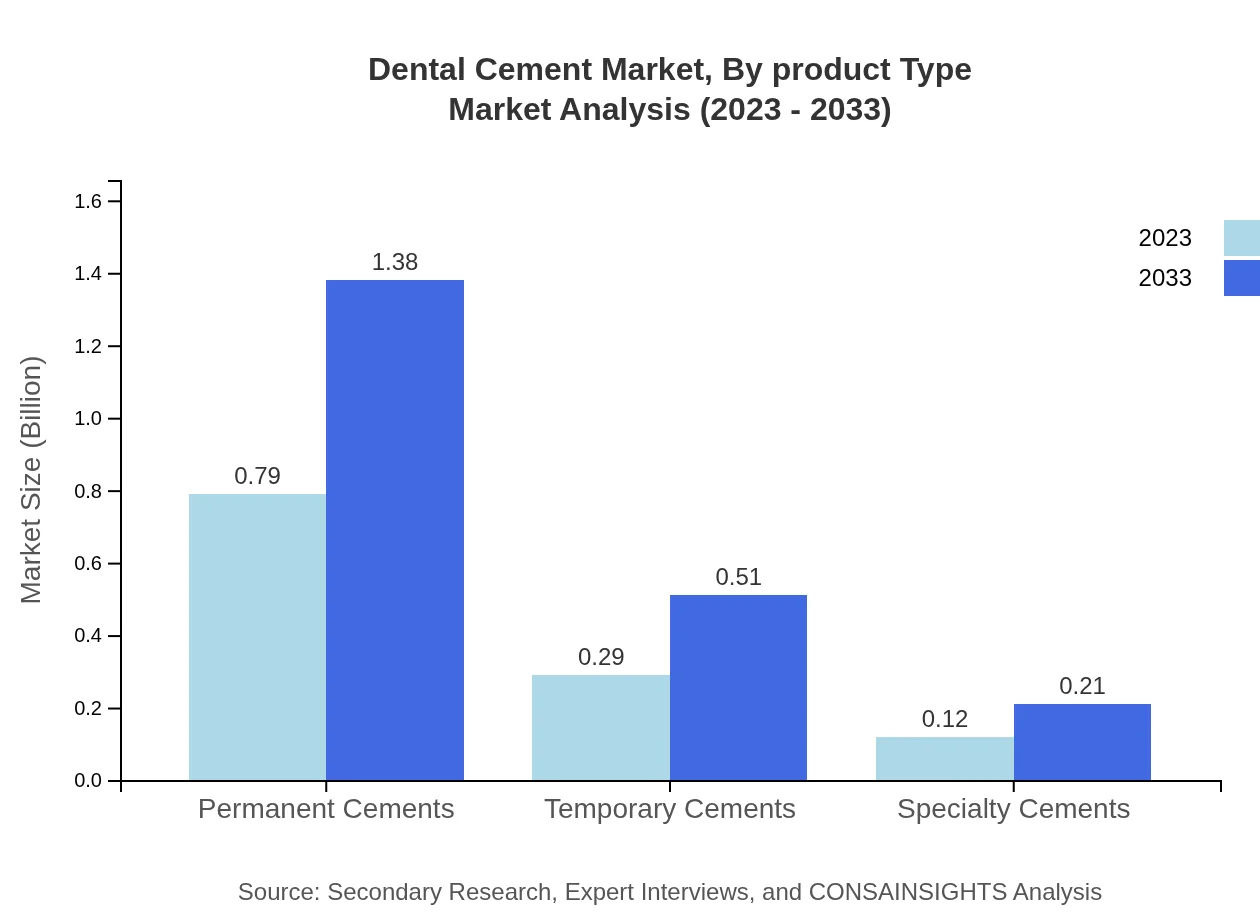

Dental Cement Market Analysis By Product Type

The Dental Cement market is segmented into several product types including permanent cements, temporary cements, bioactive materials, self-adhesive cements, smart dental cements, and specialty cements. Permanent cements hold the largest market share in both value and volume, as their durability and effectiveness in restorations make them essential in many procedures. Temporary cements are used primarily in initial stages of dental work before final restorations. Increased preference for bioactive materials due to their physiologic compatibility is gaining traction in the market.

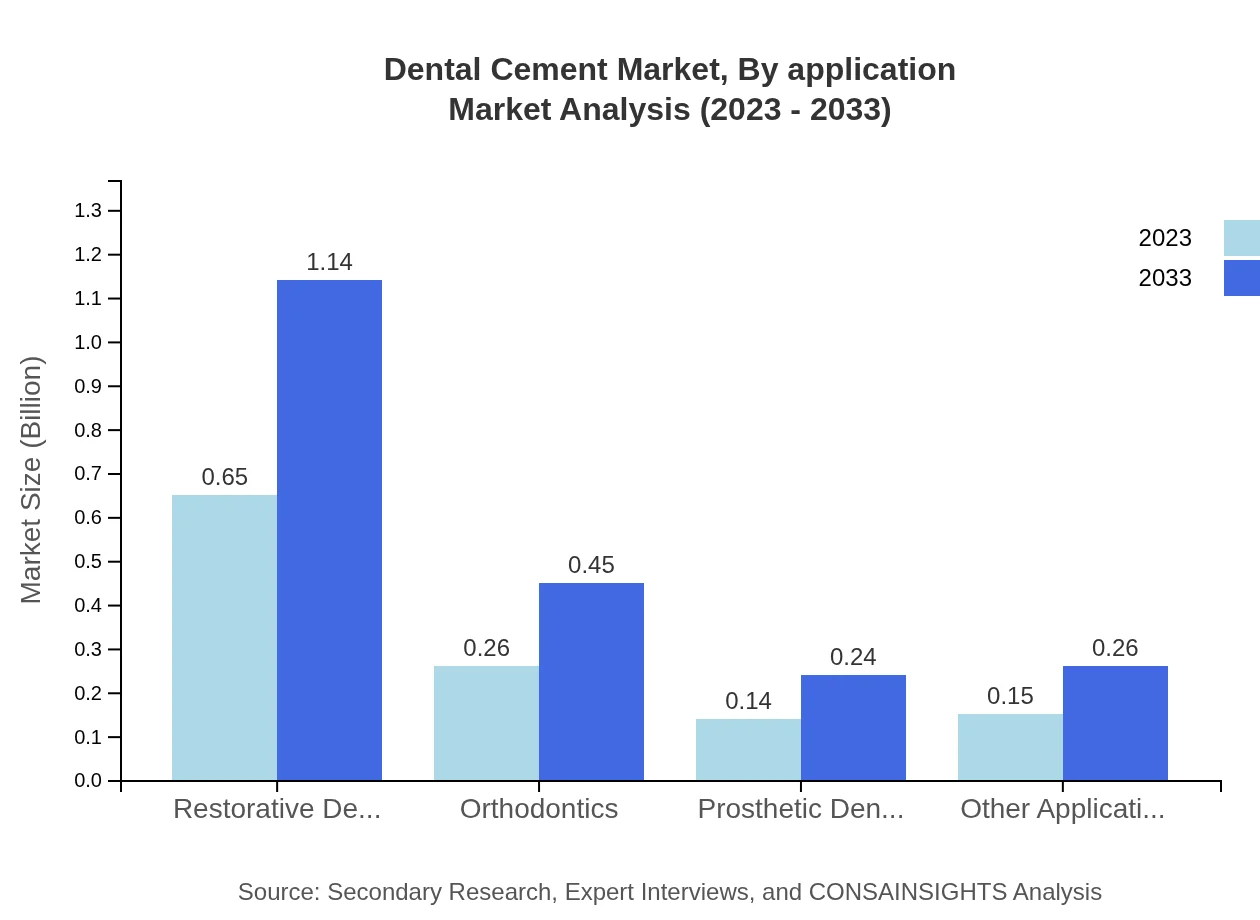

Dental Cement Market Analysis By Application

Applications in the Dental Cement market include restorative dentistry, orthodontics, prosthetic dentistry, and other applications like preventive care. Restorative dentistry is leading the market share, reflecting the high volume of procedures performed annually. Orthodontic applications are also on the rise due to increased demand for braces and aligners, contributing to the overall market growth.

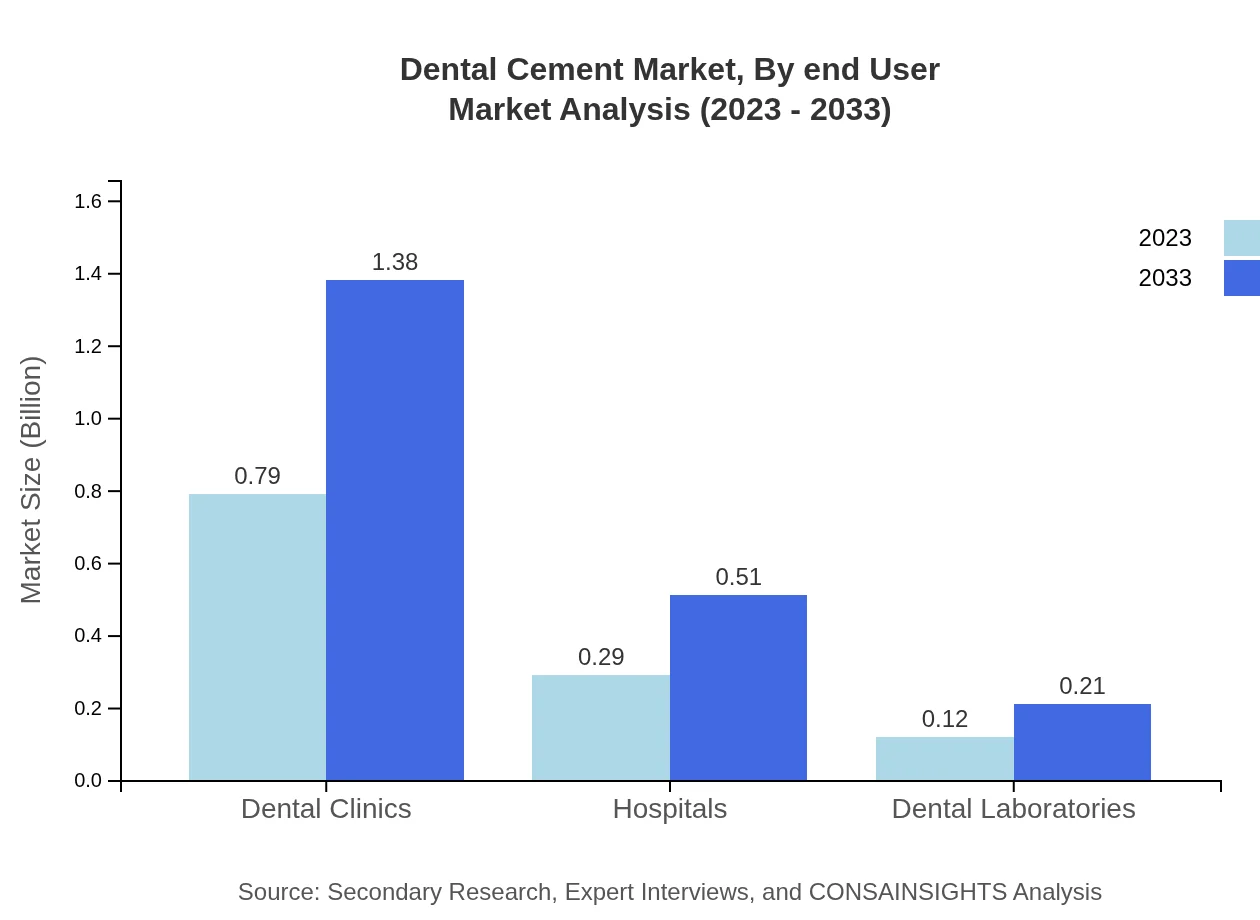

Dental Cement Market Analysis By End User

End-user segments include dental clinics, hospitals, and dental laboratories. Dental clinics dominate the market, driven by the high incidence of dental procedures and patient footfall. Hospitals also contribute significantly, especially for surgeries requiring prosthetics and restorative works. Dental laboratories continuously innovate and adopt new materials, which plays a critical role in market dynamics.

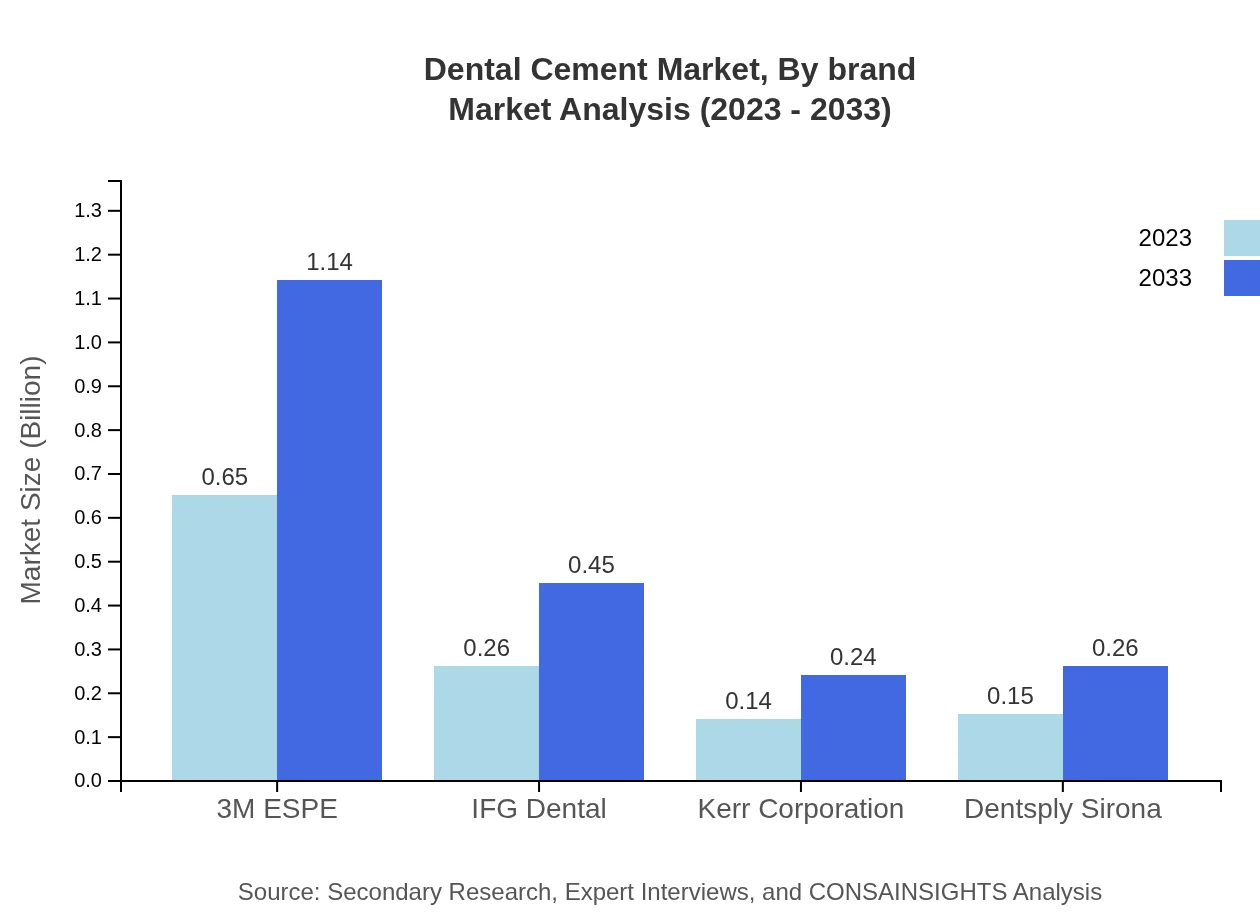

Dental Cement Market Analysis By Brand

Key brands like 3M ESPE, IFG Dental, and Kerr Corporation lead the market due to their R&D capabilities and product range. Innovations in their product portfolios and strategic marketing initiatives enhance their competitiveness and market visibility.

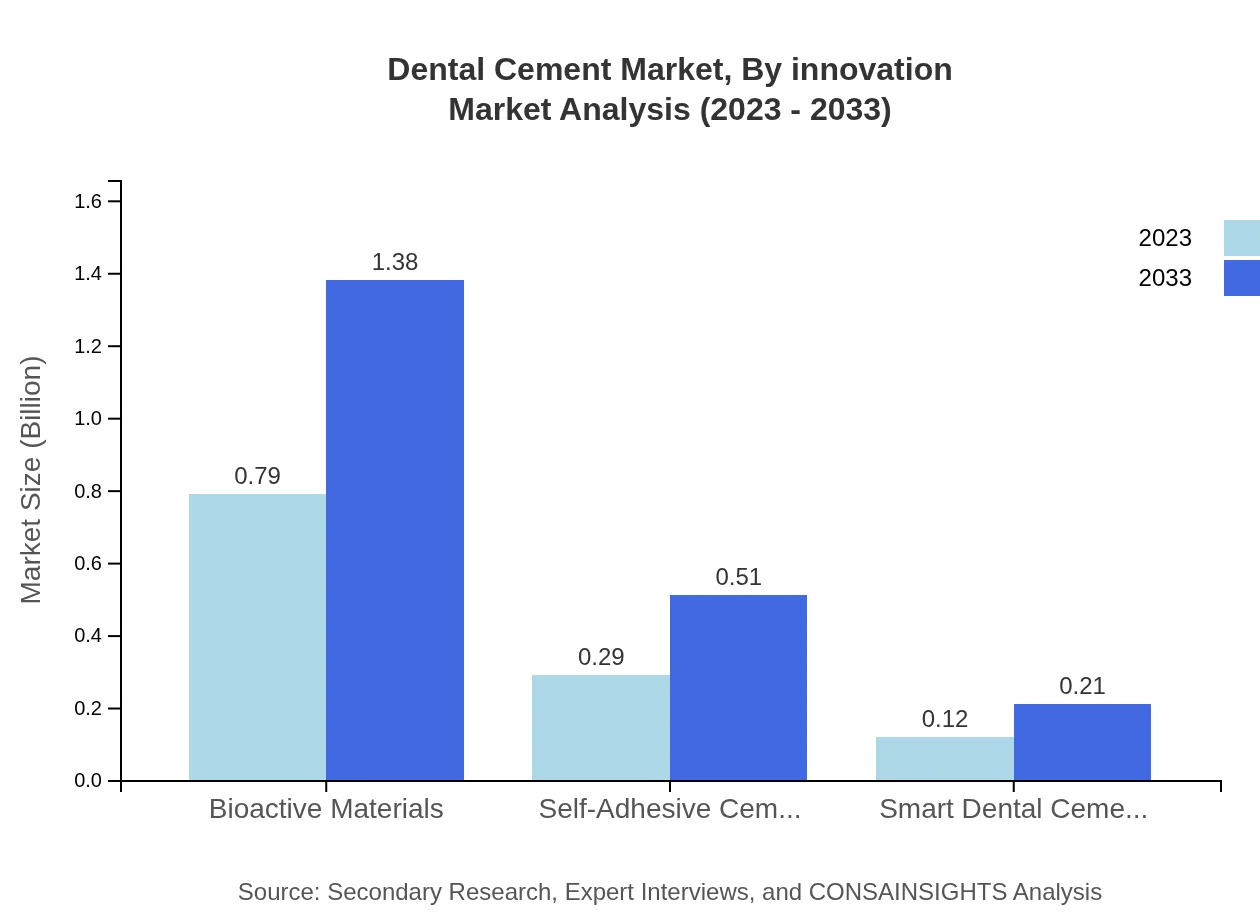

Dental Cement Market Analysis By Innovation

Innovative advancements in dental cements such as enhanced adhesion, bioactive properties, and improved material aesthetics are transforming the market. The development of digitally-assisted dentistry has opened new avenues for product innovation, enhancing effectiveness and reducing procedural times.

Dental Cement Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dental Cement Industry

3M ESPE:

A leader in dental supplies, 3M ESPE specializes in innovative dental solutions including high-quality dental cements used across various applications worldwide.IFG Dental:

Known for its reliable dental materials, IFG Dental produces a range of dental cements recognized for their effectiveness in various dental procedures.Kerr Corporation:

A significant player in the dental market, Kerr Corporation offers a variety of dental cements that cater to different dental needs and ensure high performance.Dentsply Sirona:

Dentsply Sirona is focused on product innovation, providing top-quality dental cements favored by dental professionals worldwide for their reliability.We're grateful to work with incredible clients.

FAQs

What is the market size of dental Cement?

The dental cement market is projected to reach approximately $1.2 billion by 2033, growing at a CAGR of 5.6%. This indicates a healthy growth trajectory, driven by increasing dental procedures worldwide.

What are the key market players or companies in this dental Cement industry?

Key players in the dental cement market include 3M ESPE, IFG Dental, Kerr Corporation, and Dentsply Sirona, which collectively hold significant market shares and are influential in shaping industry trends and developments.

What are the primary factors driving the growth in the dental cement industry?

The growth of the dental cement market is driven by rising dental care awareness, increasing dental health issues, technological advancements in dental materials, and the growing aging population requiring restorative dental work.

Which region is the fastest Growing in the dental cement market?

Asia Pacific is the fastest-growing region in the dental cement market, expected to expand from $0.25 billion in 2023 to $0.44 billion by 2033, showcasing a robust demand for dental services and products.

Does ConsaInsights provide customized market report data for the dental cement industry?

Yes, ConsaInsights offers customized market report data tailored for the dental cement industry, allowing clients to gain insights structured to their specific needs and strategic objectives.

What deliverables can I expect from this dental cement market research project?

Deliverables from the dental cement market research project include comprehensive market analysis reports, forecasting, key player profiles, regional insights, and detailed segment data tailored to business requirements.

What are the market trends of dental cement?

Current market trends in dental cement include an increasing preference for bioactive materials, advancements in adhesive technologies, a growing emphasis on restorative dentistry, and the rise of self-adhesive cements.