Dental Consumables Market Report

Published Date: 31 January 2026 | Report Code: dental-consumables

Dental Consumables Market Size, Share, Industry Trends and Forecast to 2033

This report provides a detailed analysis of the Dental Consumables market, offering insights into market size, trends, segmentation, and forecasts from 2023 to 2033. It aims to equip stakeholders with the necessary data for informed decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

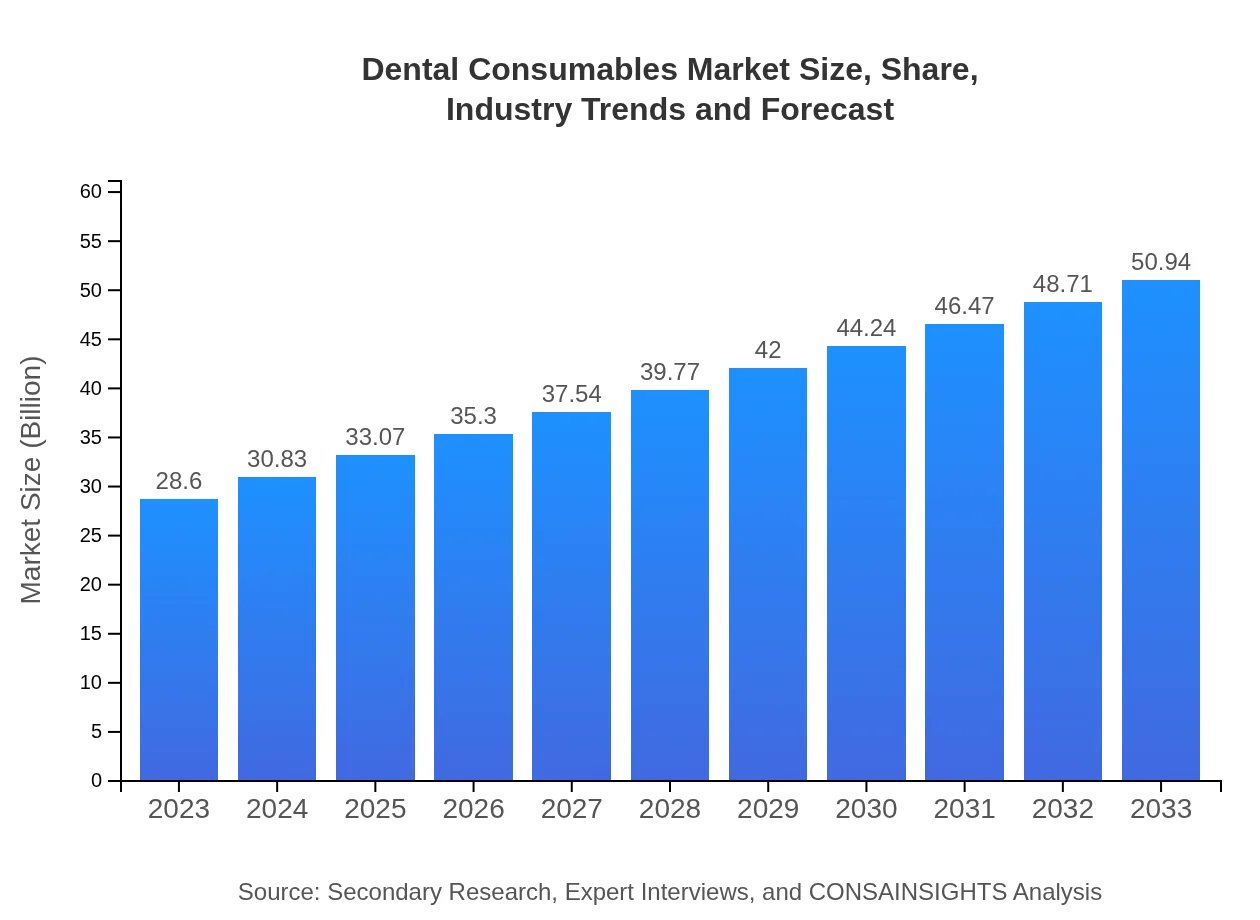

| 2023 Market Size | $28.60 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $50.94 Billion |

| Top Companies | Henry Schein, Inc., Danaher Corporation, 3M Company, Dentsply Sirona, Coltene Holding AG |

| Last Modified Date | 31 January 2026 |

Dental Consumables Market Overview

Customize Dental Consumables Market Report market research report

- ✔ Get in-depth analysis of Dental Consumables market size, growth, and forecasts.

- ✔ Understand Dental Consumables's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dental Consumables

What is the Market Size & CAGR of Dental Consumables market in 2023?

Dental Consumables Industry Analysis

Dental Consumables Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dental Consumables Market Analysis Report by Region

Europe Dental Consumables Market Report:

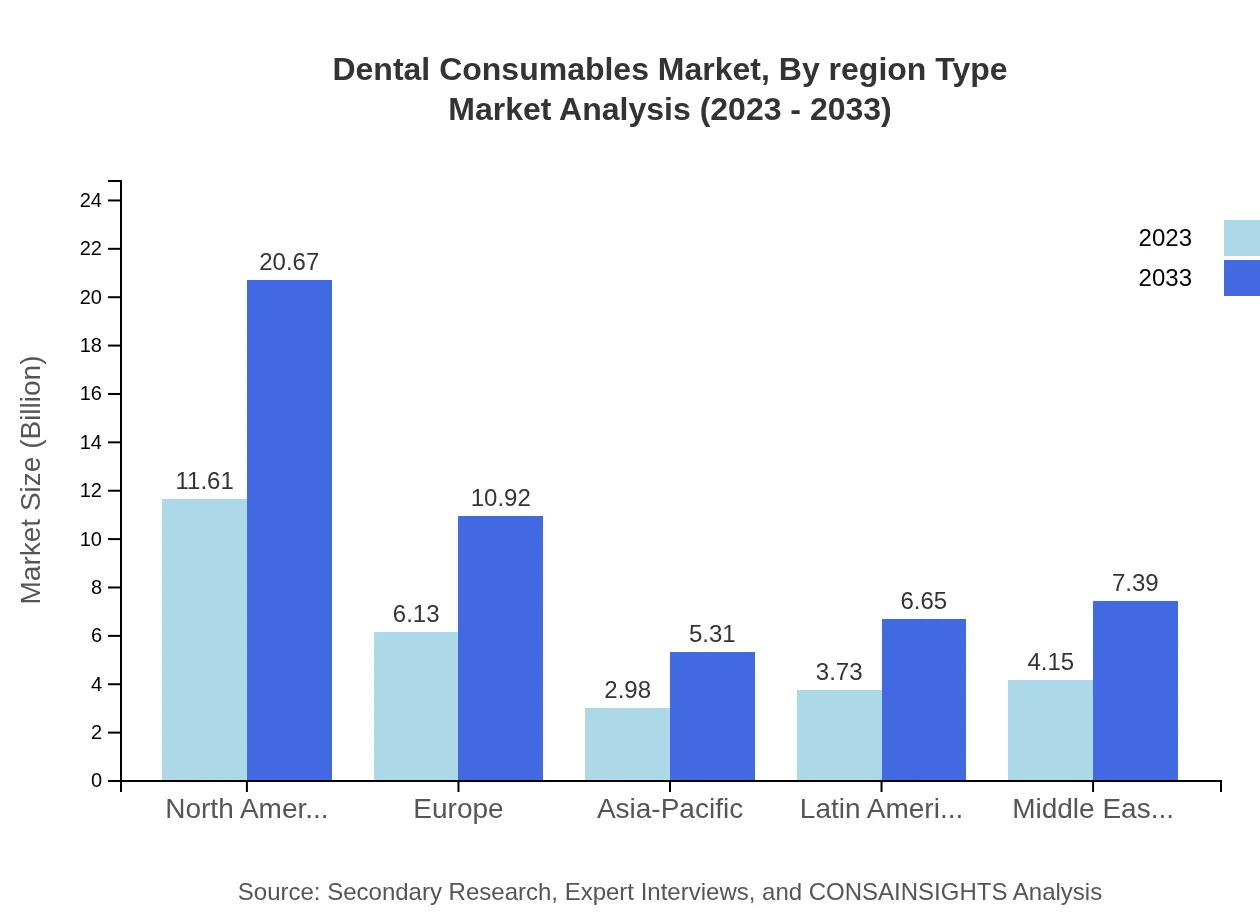

The European market for dental consumables is expected to increase from $7.48 billion in 2023 to $13.33 billion by 2033. The growth in this region is fueled by the presence of established dental infrastructure, strong awareness about oral hygiene, and a shift towards more personalized dental care experiences.Asia Pacific Dental Consumables Market Report:

The Asia Pacific region represents a significant market for dental consumables, projected to grow from $5.80 billion in 2023 to $10.33 billion by 2033. The rise is attributed to increasing dental care awareness, expanding dental tourism, and advancements in healthcare infrastructure. Emerging countries in this region are investing in improving their dental facilities, contributing to market growth.North America Dental Consumables Market Report:

North America is anticipated to dominate the dental consumables market, with values projected to rise from $10.79 billion in 2023 to $19.21 billion in 2033. Factors such as high healthcare expenditure, advanced dental technology, and a well-developed healthcare system contribute to this robust growth. A significant emphasis on preventive care and cosmetic dentistry is also notable in this region.South America Dental Consumables Market Report:

In South America, the dental consumables market is expected to grow from $1.09 billion in 2023 to $1.94 billion by 2033. This growth can be attributed to an increase in dental clinics and raising awareness around the importance of oral care, despite economic challenges within some countries in the region.Middle East & Africa Dental Consumables Market Report:

The Middle East and Africa dental consumables market is expected to grow from $3.44 billion in 2023 to $6.13 billion by 2033. The increasing healthcare initiatives and investments in dental healthcare provide a favorable environment for market expansion amidst growing populations that are becoming more conscious of oral health.Tell us your focus area and get a customized research report.

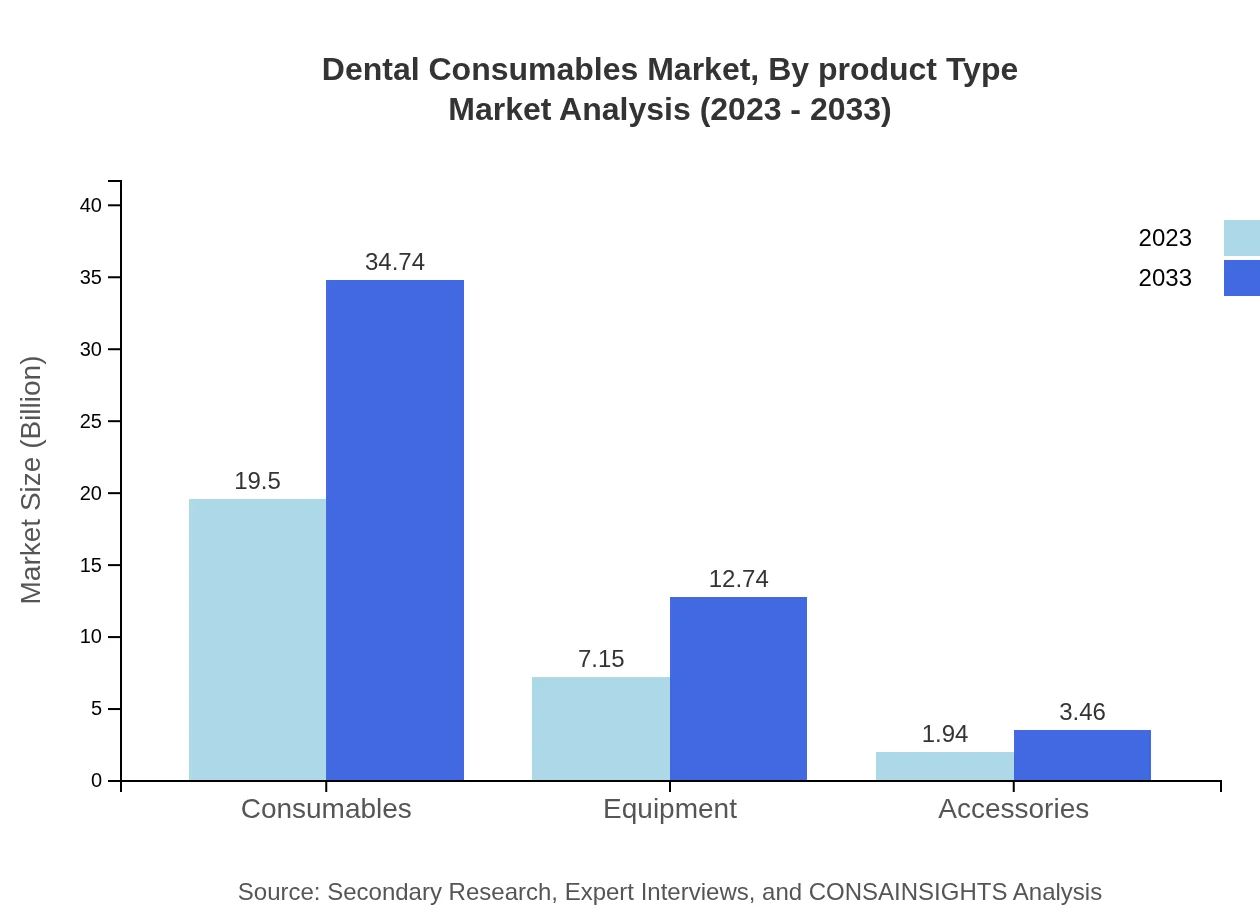

Dental Consumables Market Analysis By Product Type

The Dental Consumables market segmented by product type shows significant growth potential. In 2023, consumables account for $19.50 billion, with expectations to reach $34.74 billion by 2033, maintaining a consistent share of 68.19%. The products include preventive care, restorative materials, orthodontics, endodontics, periodontics, and more.

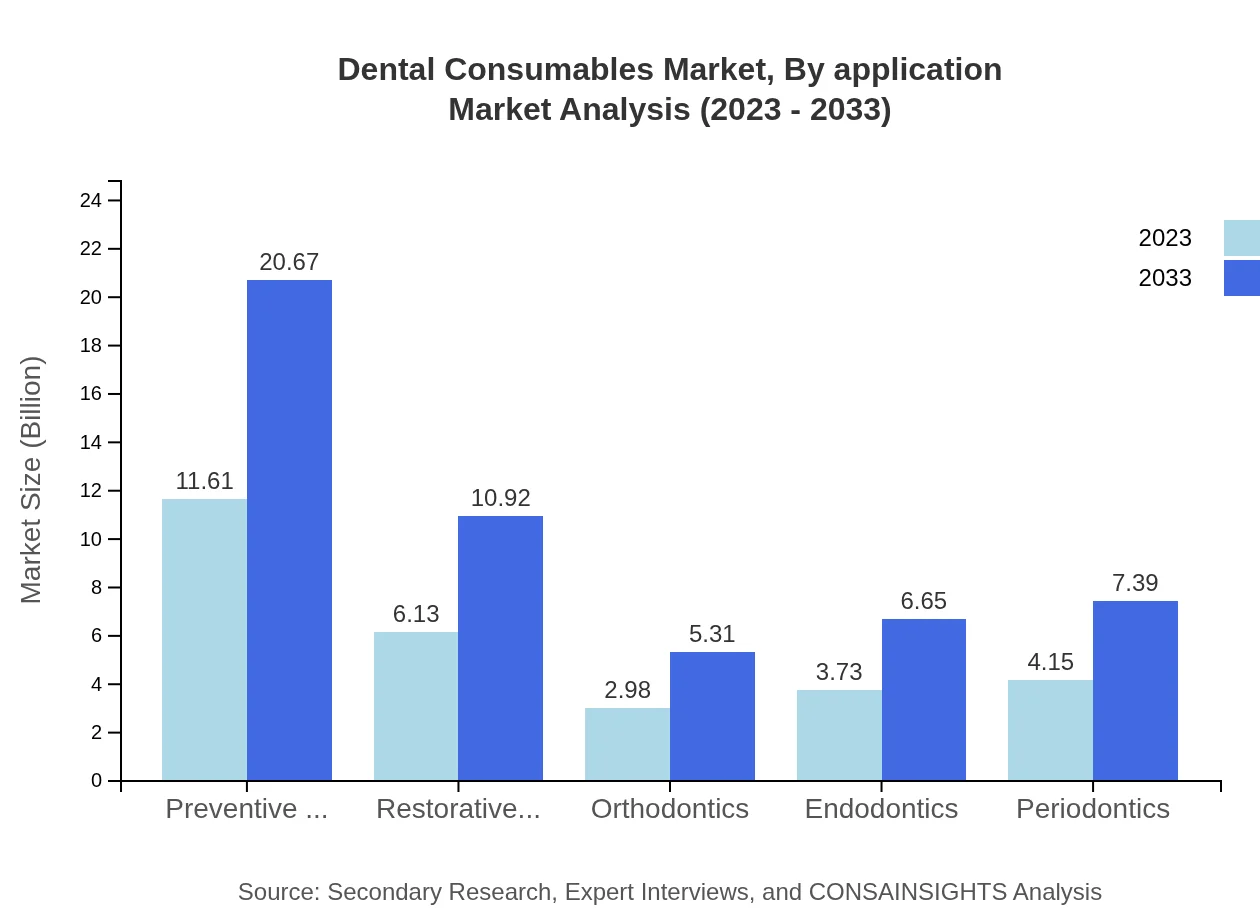

Dental Consumables Market Analysis By Application

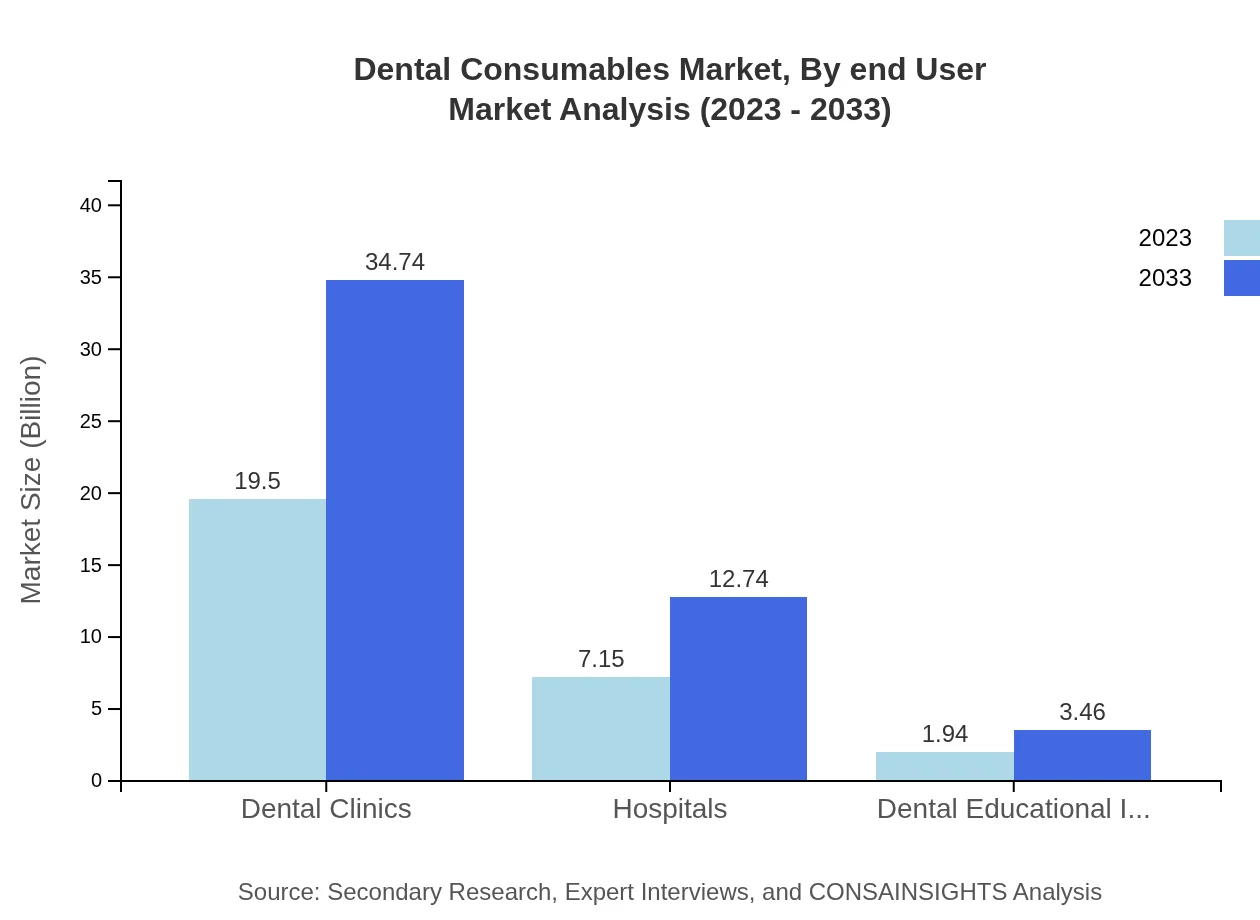

Based on application, dental clinics dominate the market with a size of $19.50 billion in 2023, growing to $34.74 billion by 2033 and maintaining a share of 68.19%. Hospitals and educational institutions also contribute significantly to the market's size and shares.

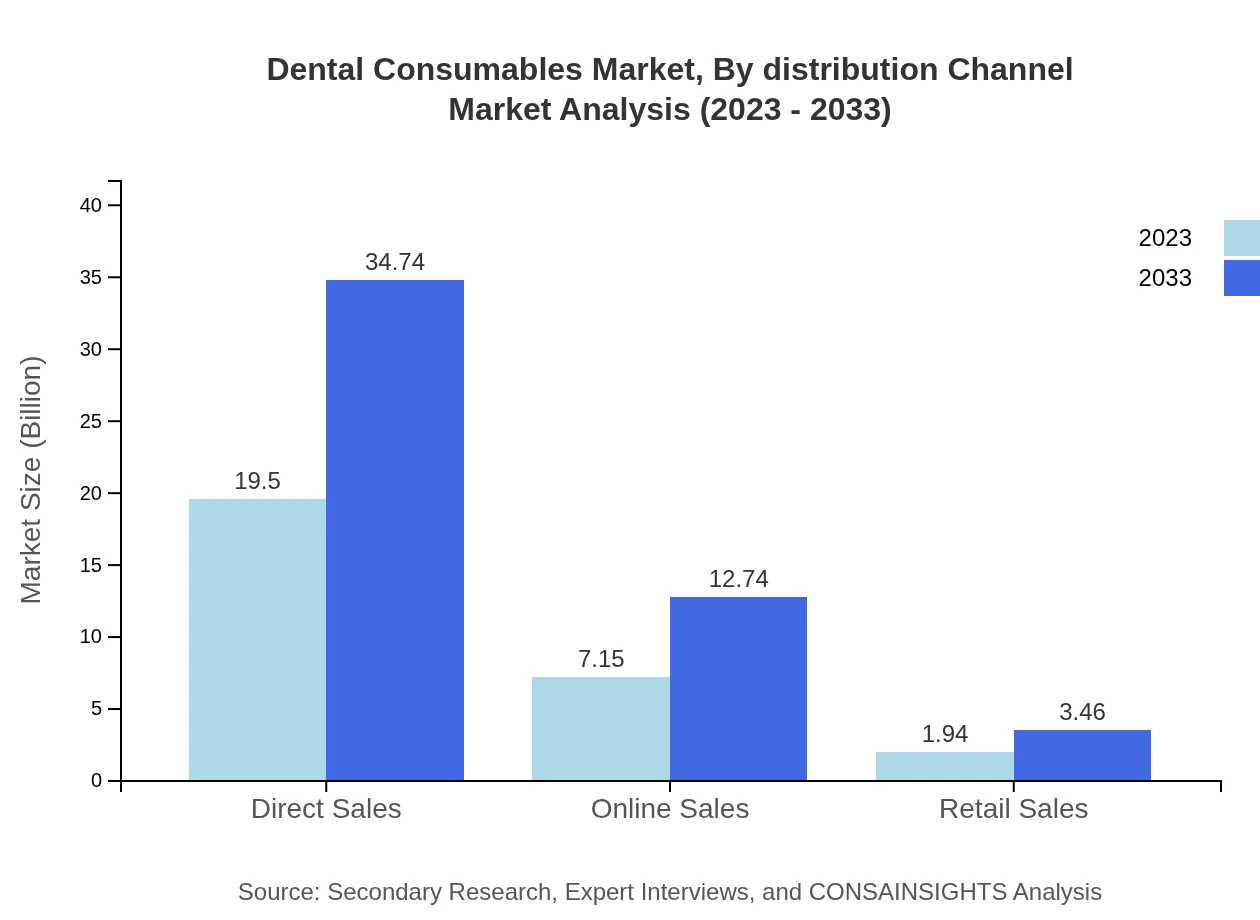

Dental Consumables Market Analysis By Distribution Channel

In distribution channels, direct sales lead with an expected growth from $19.50 billion in 2023 to $34.74 billion by 2033, representing 68.19% of market share. Online sales are gaining momentum, reflecting shifts in purchasing behavior among dental professionals.

Dental Consumables Market Analysis By End User

Identifying end-users, dental clinics play a pivotal role, holding a significant market size of $19.50 billion in 2023 to projected $34.74 billion by 2033. Hospitals and educational institutions represent other critical end-user segments supporting the industry's growth.

Dental Consumables Market Analysis By Region Type

Regionally, North America represents the largest market segment, dominated by a sophisticated healthcare system and high expenditure. Europe follows closely, while Asia Pacific is rapidly growing due to urbanization and increased awareness of oral health.

Dental Consumables Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dental Consumables Industry

Henry Schein, Inc.:

Henry Schein is a leading distributor of healthcare products and a provider of related services, including dental consumables, known for its extensive product portfolio and robust customer service.Danaher Corporation:

Danaher is known for its innovative technology in the dental space, producing a range of products and equipment focused on improving dental health and practice efficiency.3M Company:

3M is a well-established name in the dental consumables market, recognized for its high-quality dental materials and commitment to research and development.Dentsply Sirona:

Dentsply Sirona is a global leader in dental products and technologies, contributing to the market with a focus on integrated dental solutions and advanced treatments.Coltene Holding AG:

Coltene specializes in developing, manufacturing, and distributing dental consumables and is known for high-quality dental materials that enhance clinical outcomes.We're grateful to work with incredible clients.

FAQs

What is the market size of dental Consumables?

The global dental consumables market is projected to reach $28.6 billion by 2033, growing at a CAGR of 5.8% from 2023. This expansion reflects the increasing demand for advanced dental care products and services across the world.

What are the key market players or companies in this dental Consumables industry?

Key players in the dental consumables market include 3M, Dentsply Sirona, Henry Schein, and Danaher Corporation. These companies lead in innovation, product development, and market share, significantly influencing industry growth.

What are the primary factors driving the growth in the dental Consumables industry?

Growth in the dental consumables industry is driven by factors such as an increasing aging population, rising oral health awareness, advancements in dental technology, and expanding dental practices globally, which enhance the demand for consumables.

Which region is the fastest Growing in the dental Consumables?

The Asia Pacific region is the fastest-growing market for dental consumables, expected to rise from $5.80 billion in 2023 to $10.33 billion by 2033, fueled by improving healthcare infrastructure and increasing disposable incomes.

Does ConsaInsights provide customized market report data for the dental Consumables industry?

Yes, ConsaInsights offers customized market report data tailored to the dental consumables industry. Clients can request specific data and insights to cater to their strategic needs and market objectives.

What deliverables can I expect from this dental Consumables market research project?

Deliverables from the dental consumables market research project include detailed market analysis reports, segmentation data, regional insights, competitive landscape, trends, forecasts, and actionable recommendations for strategic decision-making.

What are the market trends of dental Consumables?

Current trends in the dental consumables market include increasing use of digital dentistry, growing demand for preventive care products, and a shift towards minimally invasive procedures, which are reshaping the industry's landscape.