Dental Diagnostic And Surgical Equipment Market Report

Published Date: 31 January 2026 | Report Code: dental-diagnostic-and-surgical-equipment

Dental Diagnostic And Surgical Equipment Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a comprehensive overview of the dental diagnostic and surgical equipment industry, analyzing current trends, market size, growth prospects, and competitive landscape from 2023 to 2033.

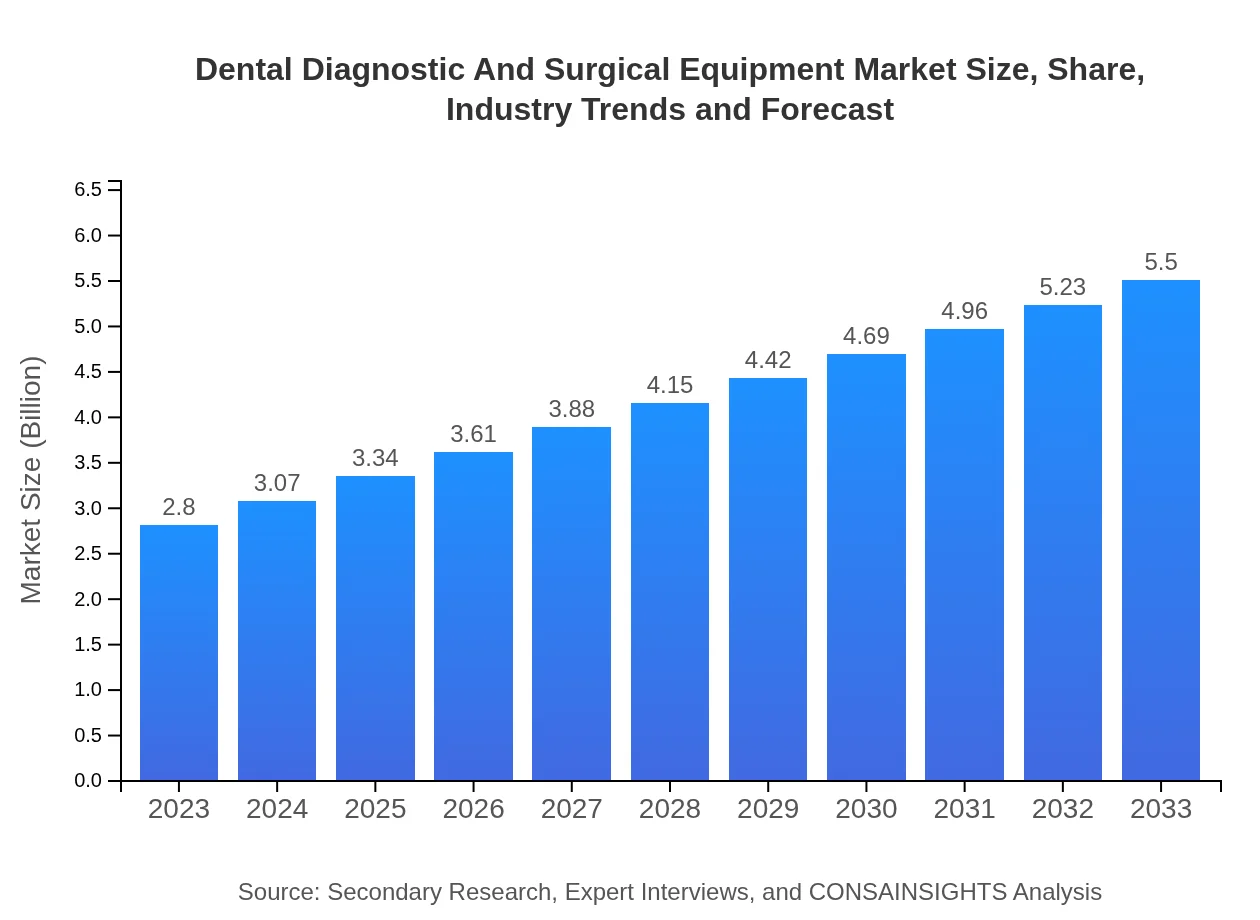

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.80 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $5.50 Billion |

| Top Companies | Dentsply Sirona, 3M, Henry Schein, Nobel Biocare |

| Last Modified Date | 31 January 2026 |

Dental Diagnostic And Surgical Equipment Market Overview

Customize Dental Diagnostic And Surgical Equipment Market Report market research report

- ✔ Get in-depth analysis of Dental Diagnostic And Surgical Equipment market size, growth, and forecasts.

- ✔ Understand Dental Diagnostic And Surgical Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dental Diagnostic And Surgical Equipment

What is the Market Size & CAGR of Dental Diagnostic And Surgical Equipment market in 2023?

Dental Diagnostic And Surgical Equipment Industry Analysis

Dental Diagnostic And Surgical Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dental Diagnostic And Surgical Equipment Market Analysis Report by Region

Europe Dental Diagnostic And Surgical Equipment Market Report:

Europe’s market is expected to rise from USD 1.03 billion in 2023 to USD 2.03 billion by 2033. The demand for innovative dental solutions and robust reimbursement policies contribute to this solid growth trajectory across countries like Germany, France, and the UK.Asia Pacific Dental Diagnostic And Surgical Equipment Market Report:

The Asia-Pacific region is exhibiting significant growth, with the market expected to grow from USD 0.49 billion in 2023 to USD 0.96 billion in 2033. Factors driving this growth include increasing disposable incomes, enhanced awareness about oral healthcare, and a corresponding rise in dental clinics and hospitals across countries like China and India.North America Dental Diagnostic And Surgical Equipment Market Report:

North America holds a significant share of the market, with a rise from USD 0.92 billion in 2023 to USD 1.80 billion in 2033. The region's growth is bolstered by the presence of advanced healthcare facilities, high healthcare spending, and heightened awareness regarding dental hygiene among the population.South America Dental Diagnostic And Surgical Equipment Market Report:

In South America, the market is projected to double from USD 0.18 billion in 2023 to USD 0.36 billion by 2033. This growth is fueled by urbanization, improved healthcare infrastructure, and greater access to dental services, especially in Brazil and Argentina.Middle East & Africa Dental Diagnostic And Surgical Equipment Market Report:

The Middle East and Africa region will likely see its market increase from USD 0.18 billion in 2023 to USD 0.36 billion by 2033. Increasing investments in healthcare facilities along with campaigns to improve oral health education in this region drive the market's growth.Tell us your focus area and get a customized research report.

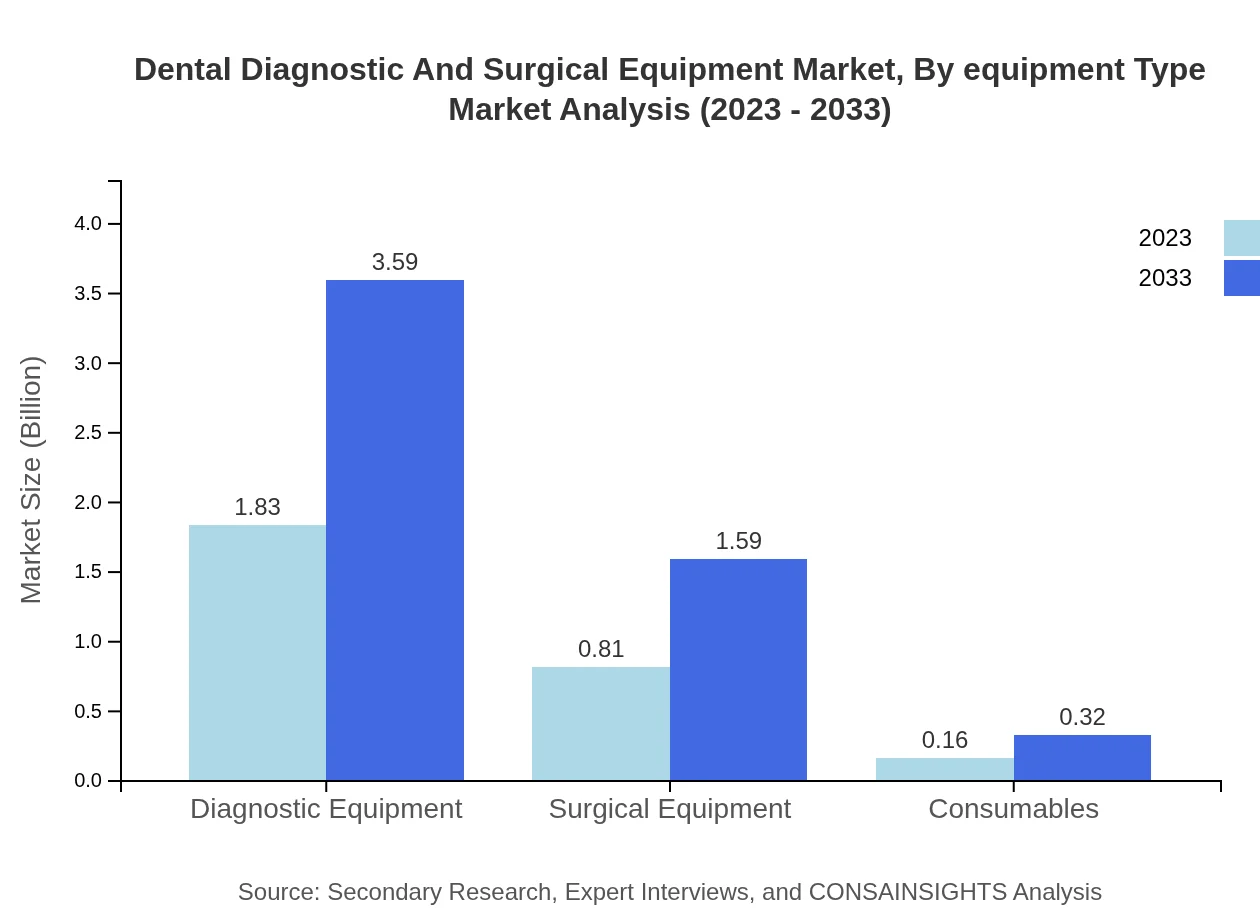

Dental Diagnostic And Surgical Equipment Market Analysis By Equipment Type

In 2023, diagnostic equipment accounted for the largest share of the market, valued at USD 1.83 billion, projected to grow to USD 3.59 billion by 2033. Surgical equipment followed, starting at USD 0.81 billion in 2023 and expected to reach USD 1.59 billion by 2033. Consumables contributed USD 0.16 billion in 2023 and are forecasted to grow significantly alongside increased demand for comprehensive dental health products.

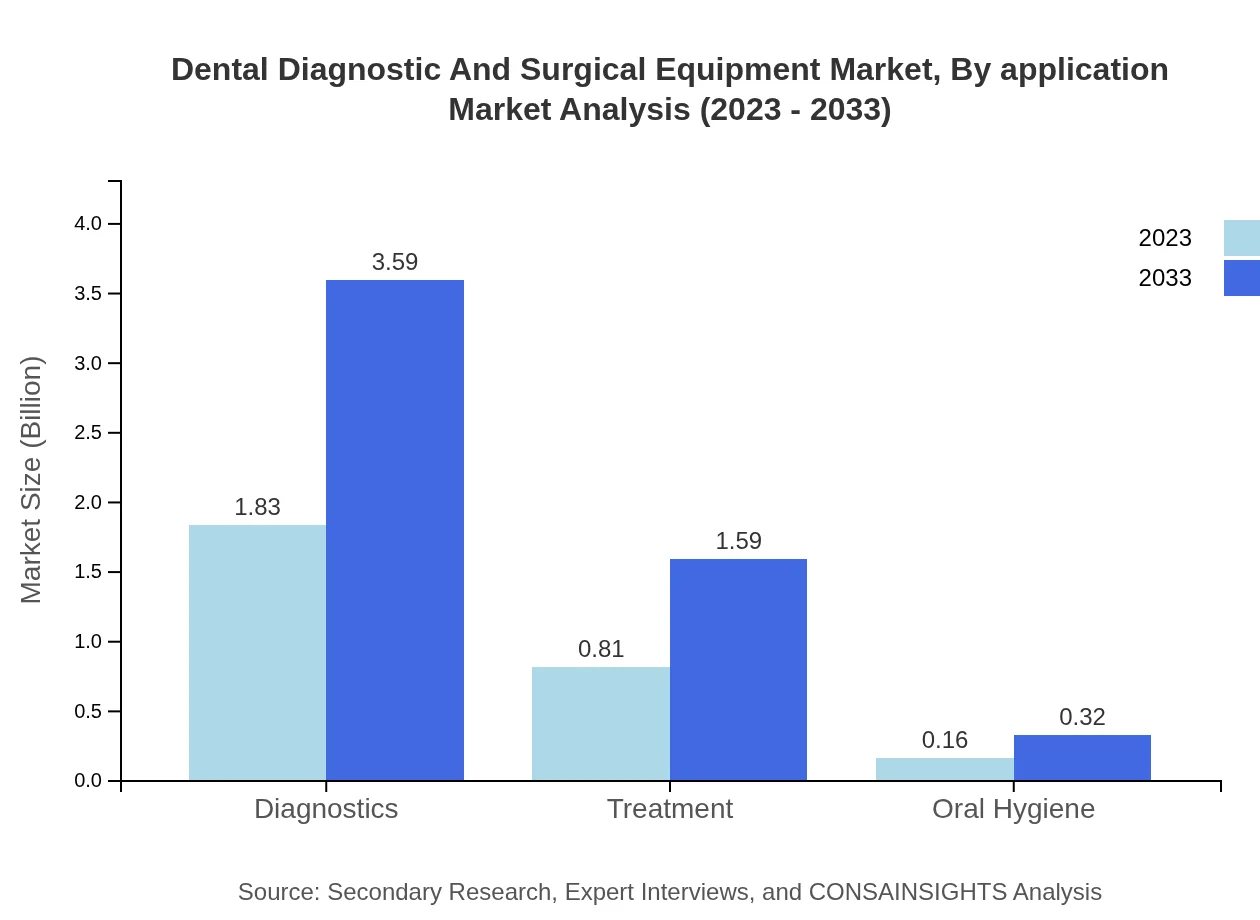

Dental Diagnostic And Surgical Equipment Market Analysis By Application

Diagnostics, leading the market with a share of USD 1.83 billion in 2023, will likely reach USD 3.59 billion by 2033. Treatment applications will also see growth from USD 0.81 billion in 2023 to USD 1.59 billion. Increased awareness about preventive care and oral hygiene will ensure a share growth for elements aimed at diagnostics and treatment going forward.

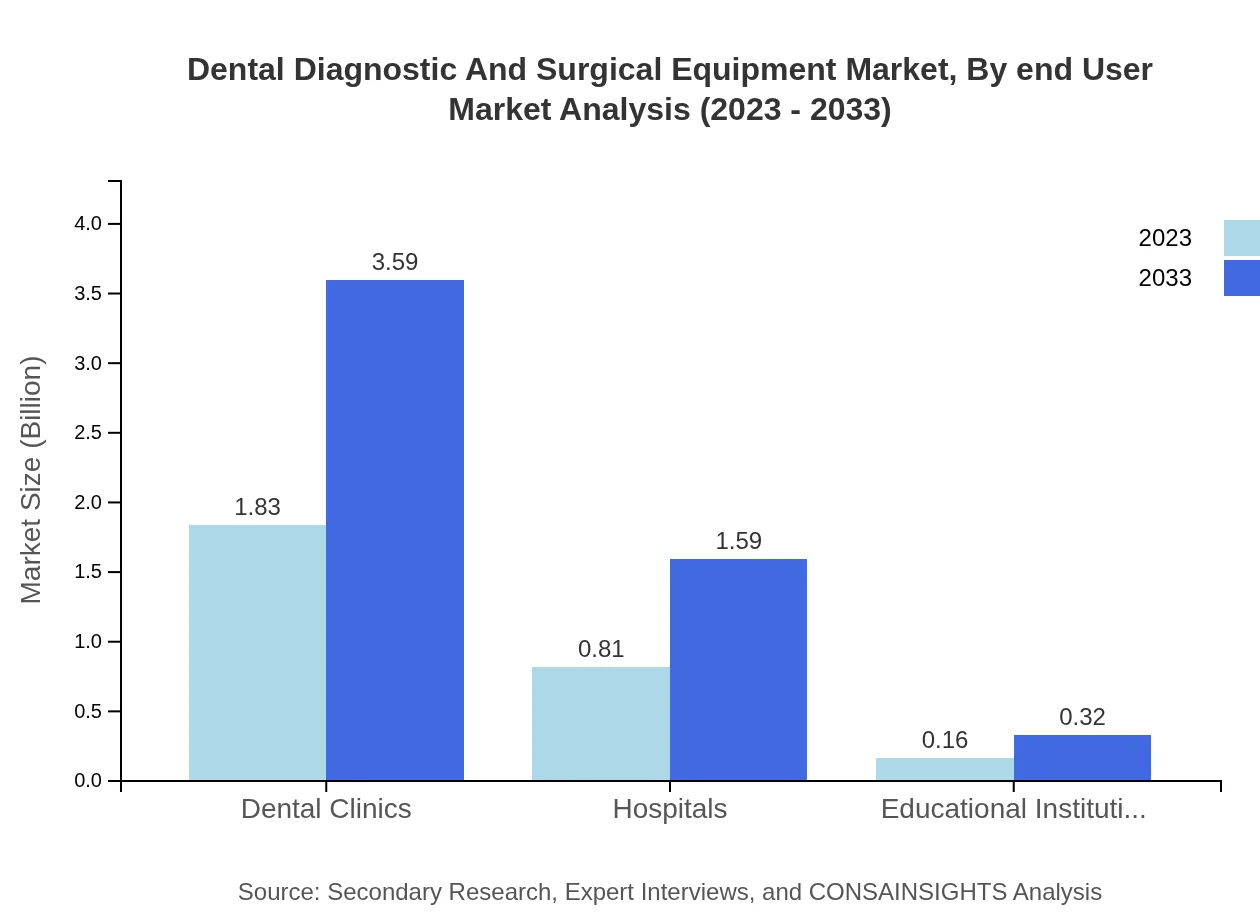

Dental Diagnostic And Surgical Equipment Market Analysis By End User

Dental clinics constitute the primary end-user segment, valued at USD 1.83 billion in 2023 with expectations of doubling by 2033. Hospitals, a secondary segment, start at USD 0.81 billion and are predicted to grow adequately, while educational institutions will also follow a positive trajectory from USD 0.16 billion in 2023 to USD 0.32 billion.

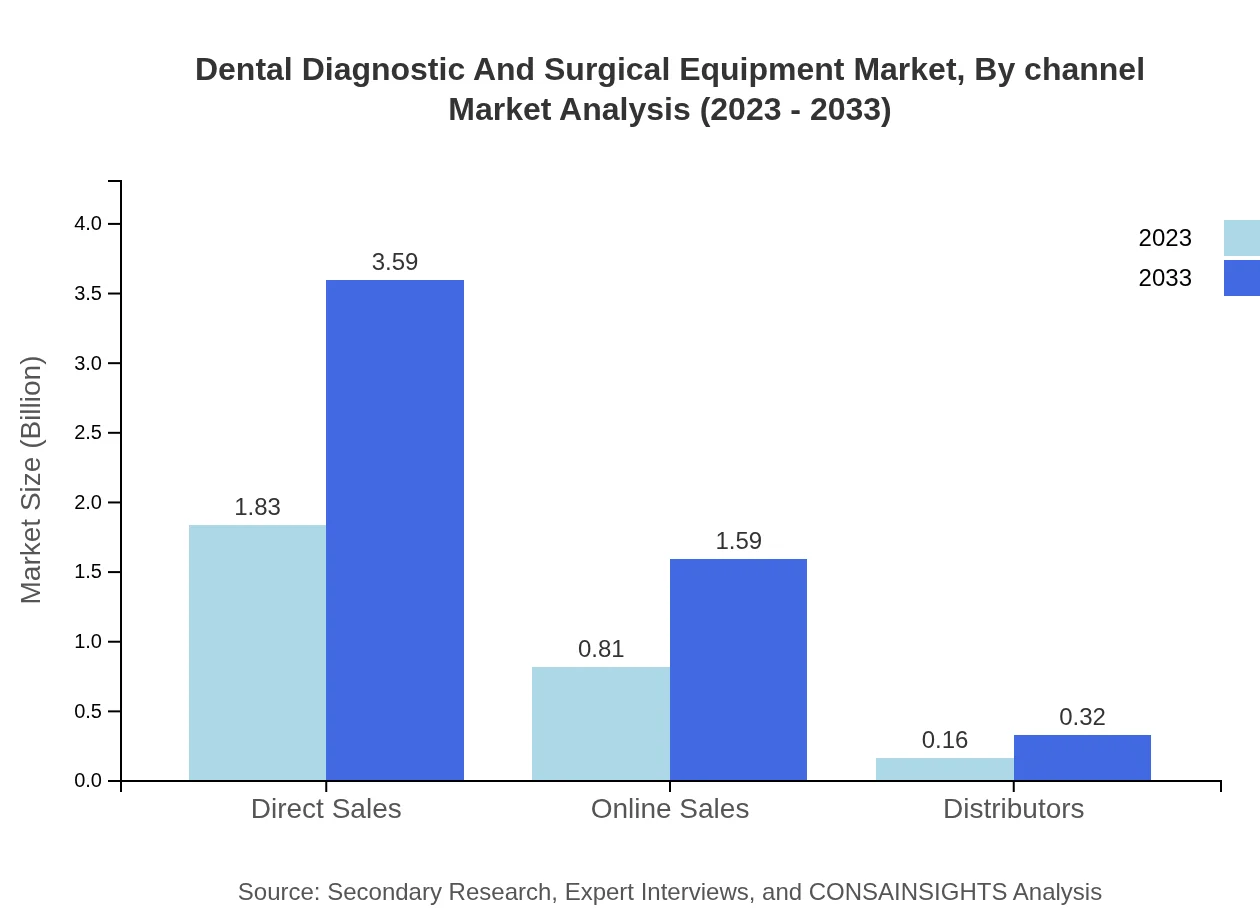

Dental Diagnostic And Surgical Equipment Market Analysis By Channel

Direct sales dominate the distribution channel, beginning at USD 1.83 billion in 2023 with expectations to reach USD 3.59 billion in 2033. Online sales, though smaller at USD 0.81 billion in 2023, show a substantial growth outlook due to the digital transformation of purchasing methods in healthcare.

Dental Diagnostic And Surgical Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dental Diagnostic And Surgical Equipment Industry

Dentsply Sirona:

Dentsply Sirona is known for its comprehensive portfolio of dental solutions, including innovative diagnostic and surgical equipment that enhances dental care standards.3M:

3M provides advanced materials and solutions that drive dental advancements, focusing on prevention and treatment with an emphasis on efficiency and quality.Henry Schein:

A leading distributor in the dental field, Henry Schein offers a wide range of dental products and equipment, ensuring accessibility to the latest technologies.Nobel Biocare:

Nobel Biocare specializes in dental implants and CAD/CAM solutions, highly regarded for their clinical performance in dental surgery.We're grateful to work with incredible clients.

FAQs

What is the market size of dental Diagnostic And Surgical Equipment?

The dental diagnostic and surgical equipment market is valued at approximately $2.8 billion in 2023, with a projected CAGR of 6.8%, indicating significant growth potential in the upcoming years.

What are the key market players or companies in this industry?

Key players in the dental diagnostic and surgical equipment industry include major firms such as Straumann, Dentsply Sirona, and Nobel Biocare, which lead the market through innovations and extensive product offerings.

What are the primary factors driving the growth in the dental Diagnostic And Surgical Equipment industry?

Growth is primarily driven by increasing dental diseases, a rising aging population, advancements in dental technology, and a growing awareness about oral hygiene among consumers globally.

Which region is the fastest Growing in the dental Diagnostic And Surgical Equipment?

The Asia Pacific region is emerging as the fastest-growing market for dental diagnostic and surgical equipment, projected to grow from $0.49 billion in 2023 to $0.96 billion by 2033, indicating a strong CAGR.

Does ConsaInsights provide customized market report data for the dental Diagnostic And Surgical Equipment industry?

Yes, ConsaInsights offers customized market research reports tailored to specific needs within the dental-diagnostic-and-surgical equipment industry, providing insights aligned with client requisites.

What deliverables can I expect from this dental Diagnostic And Surgical Equipment market research project?

Deliverables typically include comprehensive market analysis reports, data on market size and segments, competitive landscape assessments, and forecasts covering multiple years with actionable insights.

What are the market trends of dental Diagnostic And Surgical Equipment?

Market trends include a shift towards digital dentistry, increased use of smart and connected devices, greater emphasis on preventive care, and a rise in the adoption of minimally invasive surgical techniques.