Dental Equipment Market Report

Published Date: 31 January 2026 | Report Code: dental-equipment

Dental Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Dental Equipment market, including market size, growth trends, segmentation, regional insights, and key players. Insights extend to forecasts through 2033, focusing on technological advancements and overall market dynamics.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

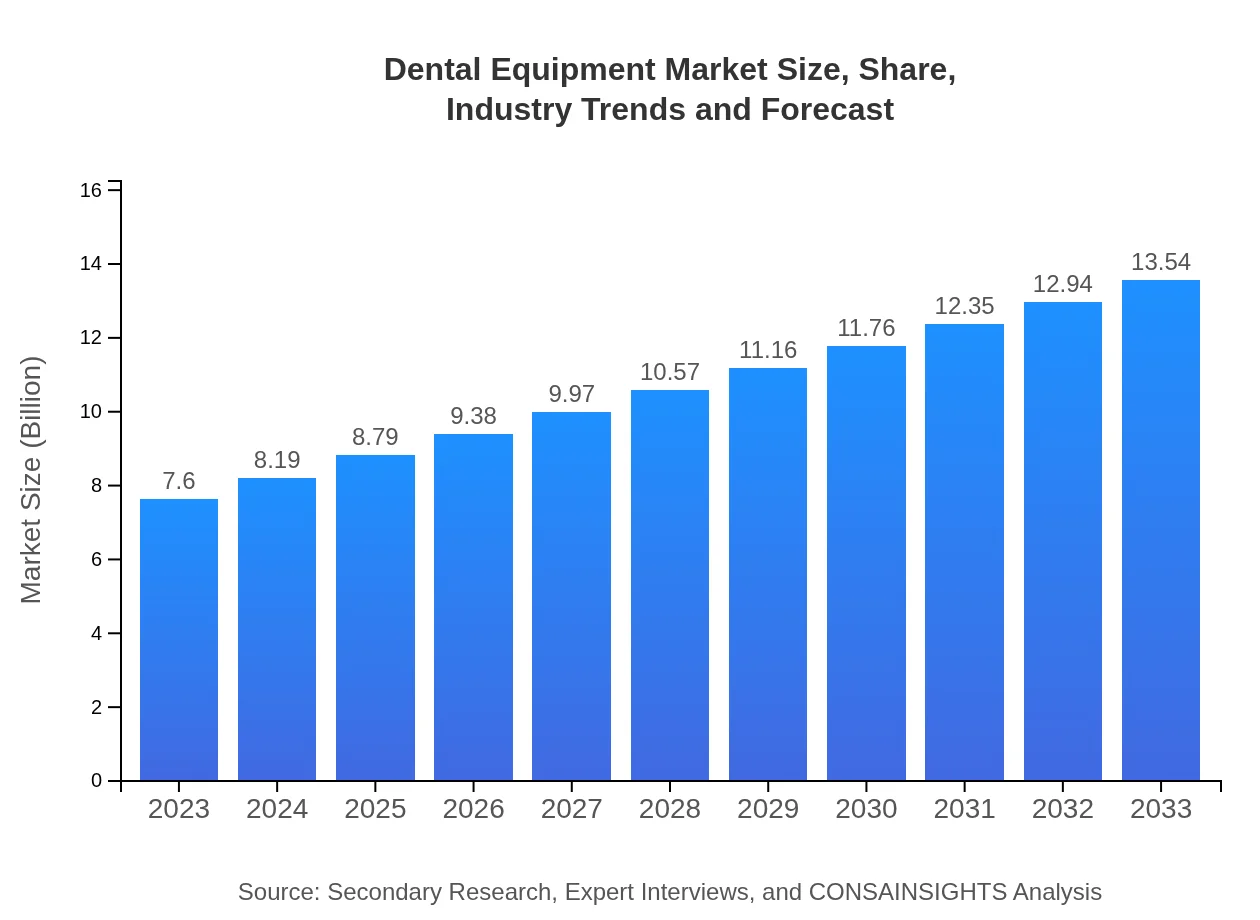

| 2023 Market Size | $7.60 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $13.54 Billion |

| Top Companies | Henry Schein, Inc., Danaher Corporation, Dentsply Sirona Inc., 3M Company, Align Technology Inc. |

| Last Modified Date | 31 January 2026 |

Dental Equipment Market Overview

Customize Dental Equipment Market Report market research report

- ✔ Get in-depth analysis of Dental Equipment market size, growth, and forecasts.

- ✔ Understand Dental Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dental Equipment

What is the Market Size & CAGR of Dental Equipment market in 2023?

Dental Equipment Industry Analysis

Dental Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dental Equipment Market Analysis Report by Region

Europe Dental Equipment Market Report:

Europe's Dental Equipment market is projected to expand from $2.52 billion in 2023 to approximately $4.49 billion by 2033. The region is marked by strong regulatory frameworks promoting dental health and innovation, thus driving demand for advanced dental solutions.Asia Pacific Dental Equipment Market Report:

The Asia Pacific region showcases promising growth in the Dental Equipment market, expected to expand from $1.43 billion in 2023 to approximately $2.55 billion by 2033. Increasing disposable incomes, a rise in dental health awareness, and improving healthcare systems largely drive this growth.North America Dental Equipment Market Report:

North America leads the Dental Equipment market with an estimated value of $2.56 billion in 2023, projected to grow to about $4.55 billion by 2033. Factors such as high dental care spending, advanced healthcare infrastructure, and a strong emphasis on advanced dental technologies contribute to this trend.South America Dental Equipment Market Report:

Although smaller in scale, the South American market is gradually gaining traction, with projections indicating growth from $0.07 billion in 2023 to $0.12 billion by 2033. This growth is fueled by increased investments in healthcare and dental services.Middle East & Africa Dental Equipment Market Report:

In the Middle East and Africa, the market is expected to grow from $1.02 billion in 2023 to about $1.82 billion by 2033. The rise of dental clinics and increasing health spendings are instrumental in enhancing dental care services and equipment utilization.Tell us your focus area and get a customized research report.

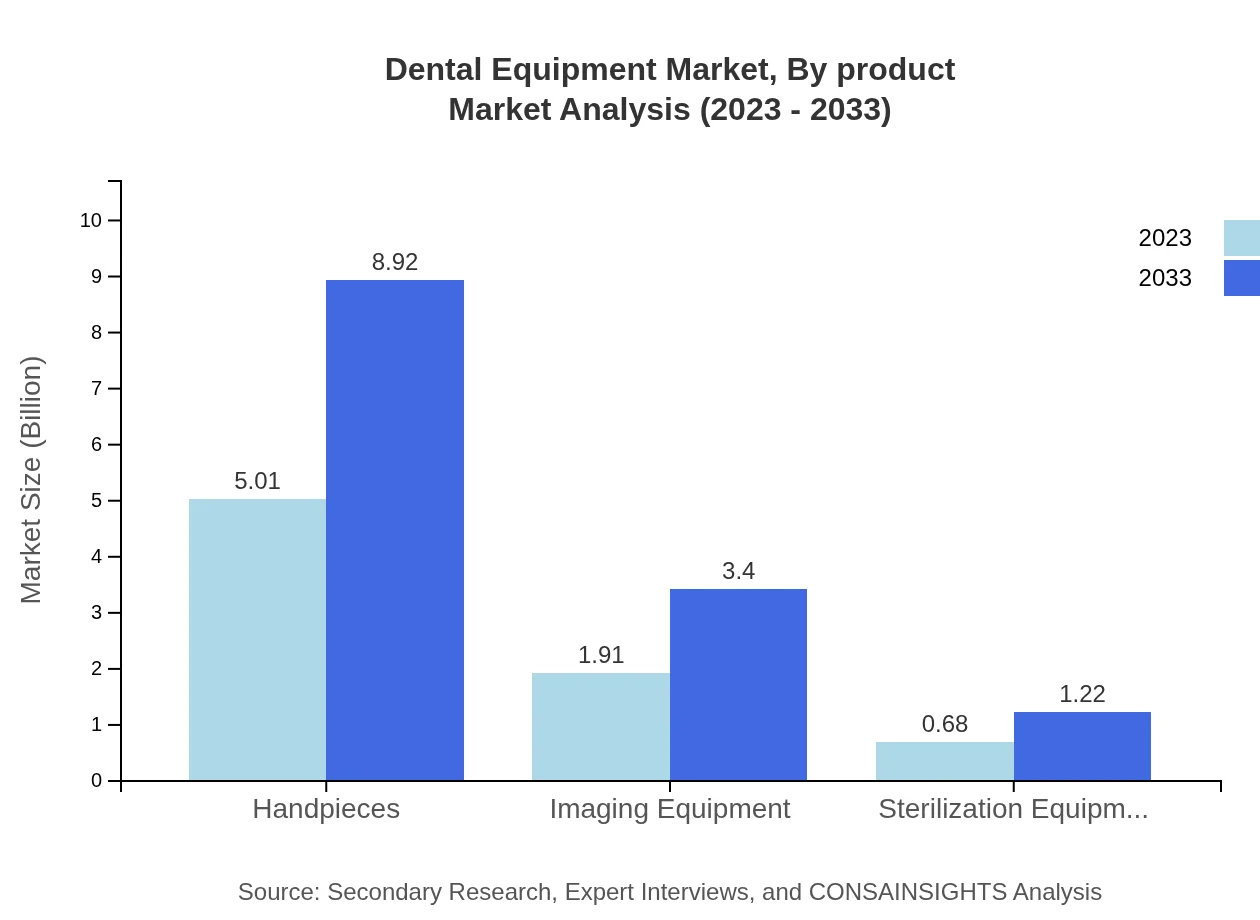

Dental Equipment Market Analysis By Product

Handpieces dominate the market, growing from $5.01 billion in 2023 to $8.92 billion by 2033, accounting for 65.87% of the market share. Imaging Equipment follows, projected to grow from $1.91 billion to $3.40 billion, representing 25.15% of the overall market share.

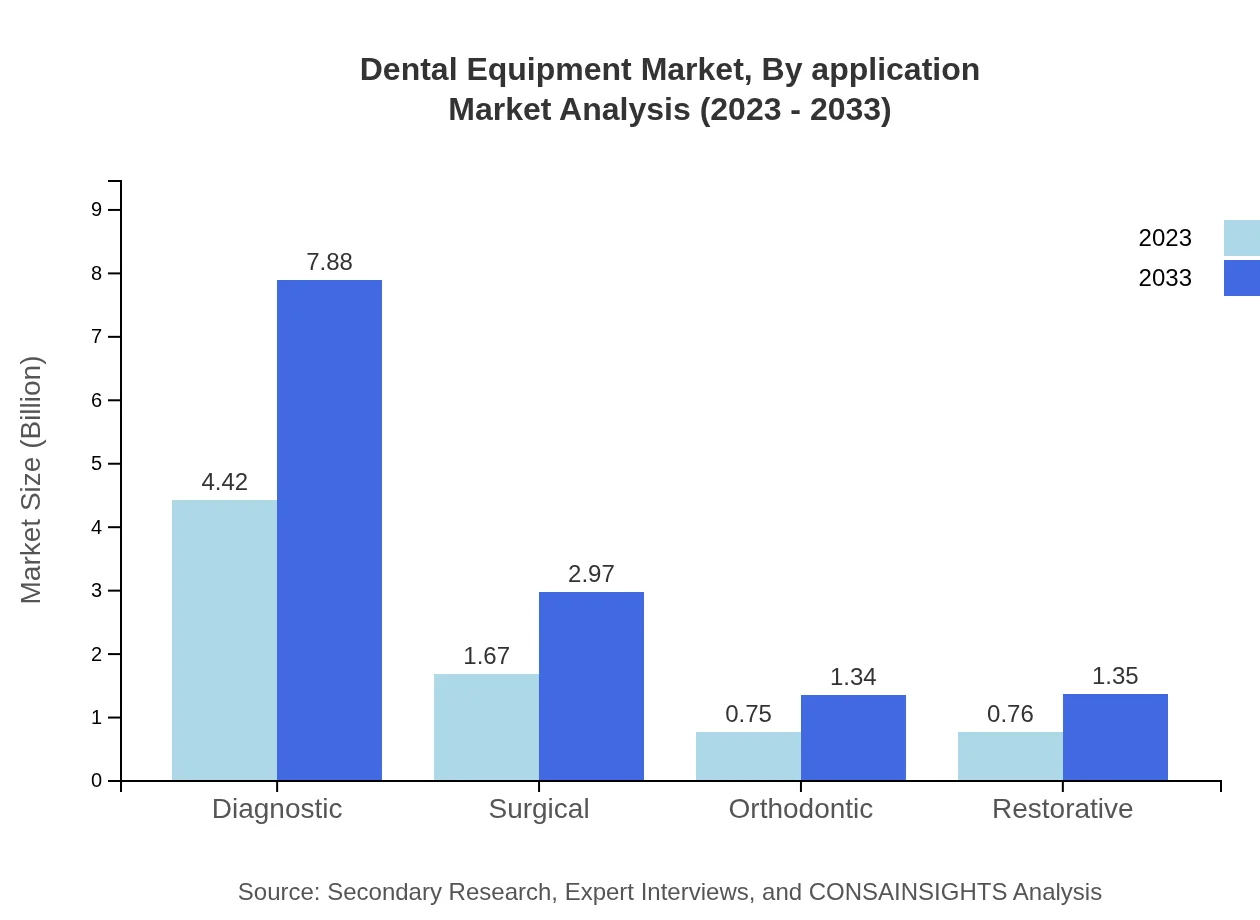

Dental Equipment Market Analysis By Application

The diagnostic application segment represents the largest share, with expected growth from $4.42 billion in 2023 to $7.88 billion by 2033. Surgical and orthodontic segments show promising growth rates as well, indicating robust demand across applications.

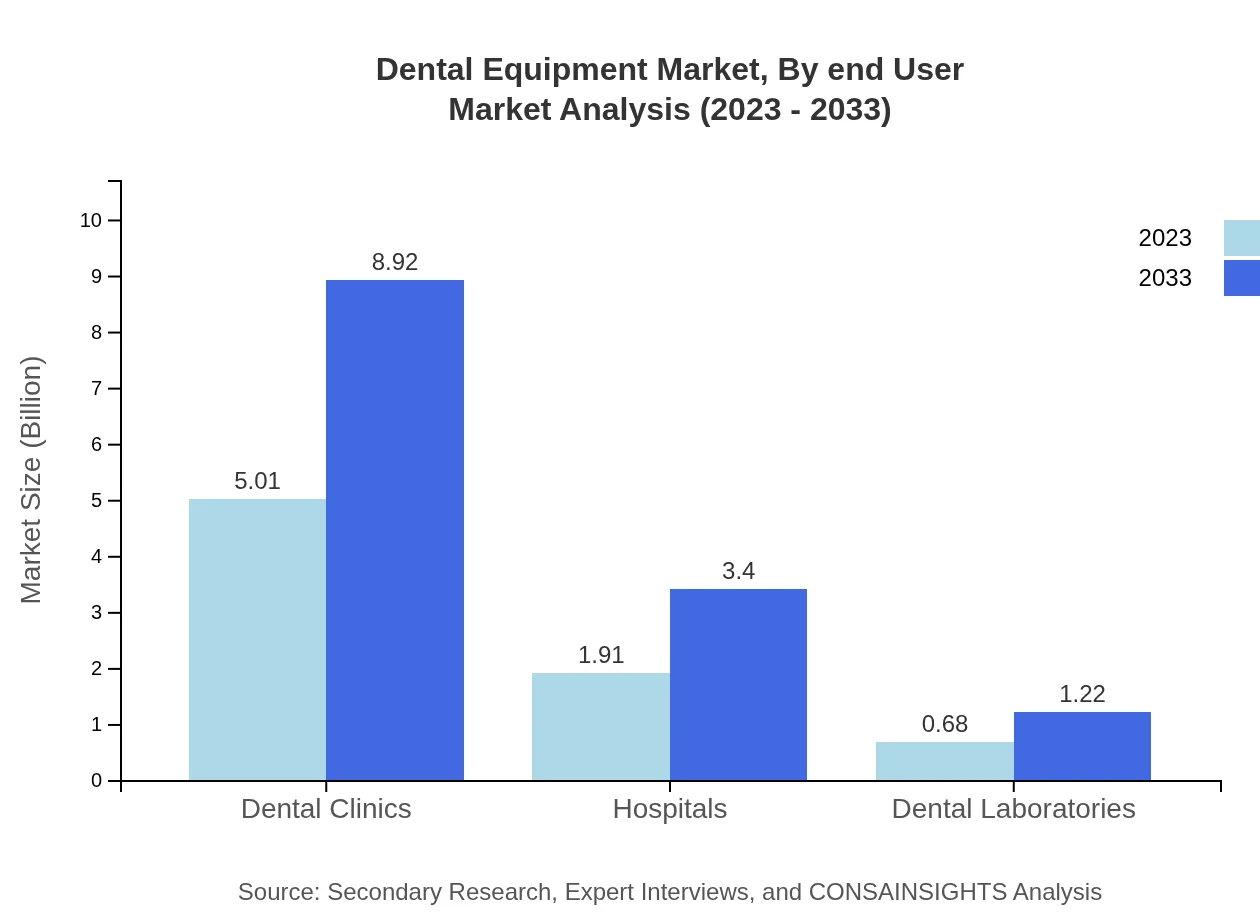

Dental Equipment Market Analysis By End User

The dental clinics segment continues to hold the largest share at 65.87%, with revenues expected to rise from $5.01 billion to $8.92 billion by 2033. Hospitals and dental laboratories are also significant contributors as they adopt advanced dental technologies.

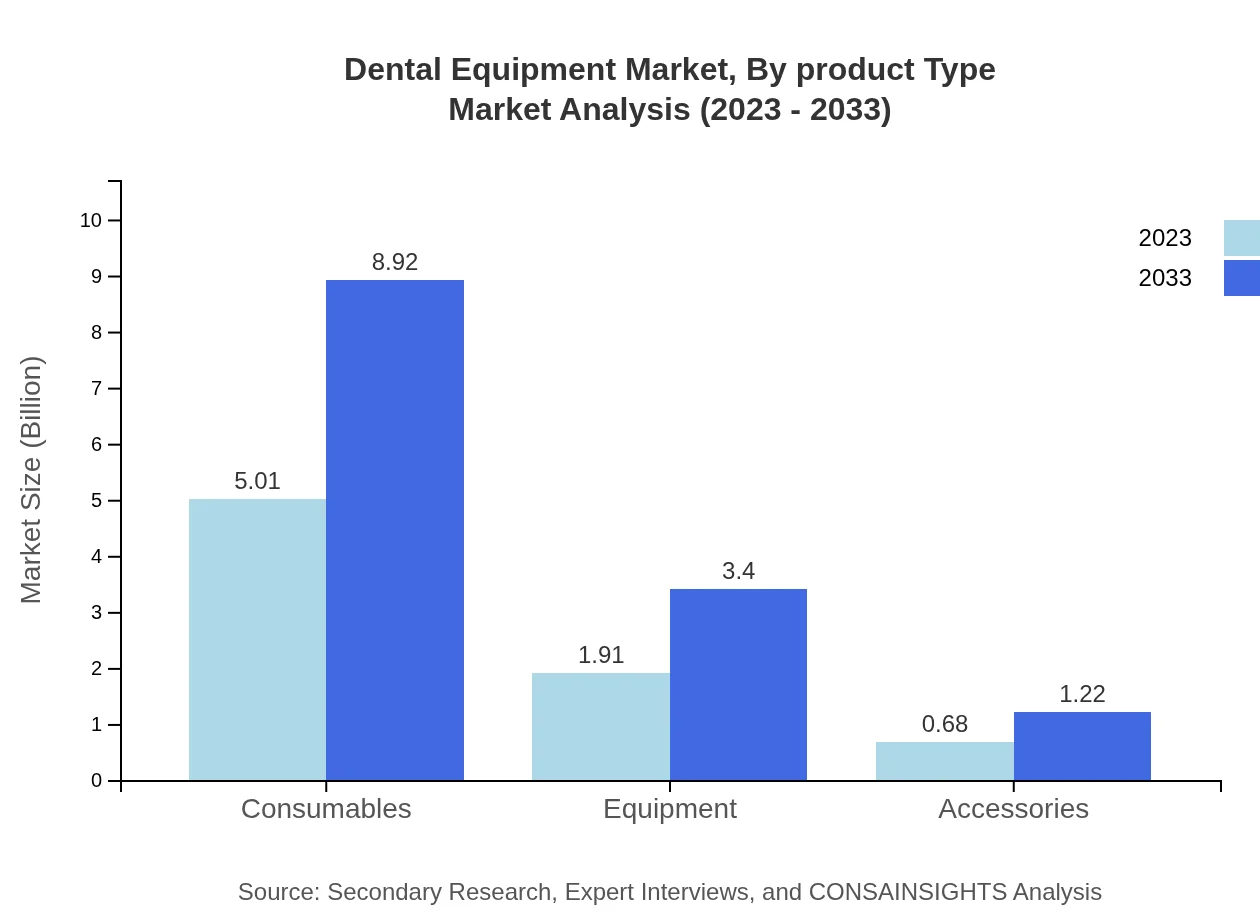

Dental Equipment Market Analysis By Product Type

Consumables represent a crucial segment in the product type classification, expected to grow from $5.01 billion to $8.92 billion by 2033, maintaining a 65.87% share. Other products such as sterilization and surgical instruments are also vital in market dynamics.

Dental Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dental Equipment Industry

Henry Schein, Inc.:

A leading distributor of dental and healthcare products, Henry Schein offers a wide range of dental equipment and technologies, supporting dental professionals with comprehensive solutions in patient care and operational efficiency.Danaher Corporation:

Danaher manufactures a diverse array of dental equipment, focusing on innovation and technology. Their brands, like KaVo Kerr and Nobel Biocare, are renowned in the dental industry for high-quality products.Dentsply Sirona Inc.:

A global leader in dental products and technologies, Dentsply Sirona specializes in developing products that enhance dental professionals' capabilities and improve patient outcomes through innovative solutions.3M Company:

3M Company is known for its diversified portfolio, including dental products and equipment that meet the evolving needs of dental practitioners and their patients, offering advanced solutions that enhance dental care.Align Technology Inc.:

A pioneer in clear aligner technology, Align Technology specializes in orthodontic solutions and digital dental treatments, setting a benchmark for innovative practices in the dental industry.We're grateful to work with incredible clients.

FAQs

What is the market size of dental Equipment?

The dental equipment market is valued at approximately $7.6 billion in 2023 and is projected to grow at a CAGR of 5.8% through 2033, indicating robust growth and expanding market potential.

What are the key market players or companies in this industry?

Leading companies in the dental equipment market include major manufacturers like Dentsply Sirona, Planmeca, and Henry Schein, offering a range of innovative dental solutions and technologies to enhance dental care.

What are the primary factors driving the growth in the dental equipment industry?

Key factors driving market growth include technological advancements, increasing dental health awareness, rising disposable income, and growth in dental tourism, leading to a higher demand for sophisticated dental equipment.

Which region is the fastest Growing in the dental equipment market?

The fastest-growing region in the dental equipment market is Asia Pacific, expected to grow from $1.43 billion in 2023 to $2.55 billion by 2033, due to increasing dental clinics and investments in healthcare infrastructure.

Does ConsaInsights provide customized market report data for the dental equipment industry?

Yes, ConsaInsights offers customized market report data for the dental equipment industry, catering to specific client needs and providing tailored insights across various parameters and segments.

What deliverables can I expect from this dental equipment market research project?

Deliverables from this market research project include comprehensive reports on market trends, segment analysis, competitive landscape, regional data, and actionable insights for strategic decision-making.

What are the market trends of dental equipment?

Current trends in the dental equipment market include increased adoption of digital dentistry, advancements in imaging technologies, rising demand for minimally invasive procedures, and a focus on ergonomic designs in dental equipment.